DIpil Das

What’s the Story?

In our Supply Chain Briefing series, we examine key developments and challenges in the retail supply chain and their implications in the retail environment. In this report, we delve into Hurricane Ida’s impact on trade in the Gulf Coast, how Covid-19 outbreaks and subsequent strict regulations in China and Southeast Asia are contributing to increased congestion, and the most recent developments in US domestic product shortages.Why It Matters

Supply chains are complex: products go through several stages of the chain before reaching the end consumer—from production to processing to delivery. With so many moving parts, disruptions at any stage can have a domino effect. The pandemic has caused supply chain issues to come into focus. They were discussed in two-thirds of the 7,000 company earnings calls held globally in July—up 59% year over year, according to S&P Global. Furthermore, a survey by the National Retail Federation (NRF) conducted in June 2021 found that 97% of US retailers have been impacted by port and shipping delays, with 70% stating that they have had to add at least two weeks to their supply chains.Hurricanes, Covid-19 Restrictions and Component Shortages: Coresight Research Analysis

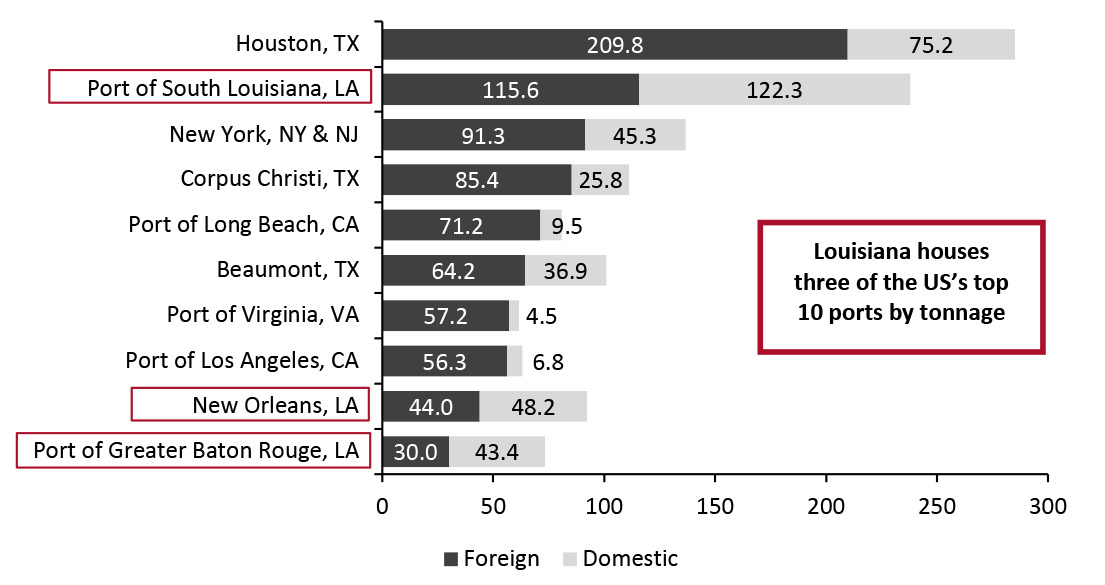

Hurricane Ida Disrupts Louisiana Ports In recent months, a series of natural disasters on the US’s East Coast have undermined domestic production and ports. Hurricane Ida hit Louisiana on August 26, sweeping across the country through to early September, causing flooding and power outages. We anticipate that the hurricane will cause substantial delays in the import and export of goods from Louisiana and impact various petrochemical companies—which are essential in the creation of packaging materials. Hurricane Ida is predicted to cause $25 billion worth of insured damages in Louisiana, a state essential to the country’s supply chain, housing three of the US’s top 10 ports by tonnage. The hardest-hit areas in the state may be without power for three weeks from September 6, according to energy company Entergy Louisiana. The storm swept through one of the US’s largest oil and chemical hubs, which is located in the state and accounts for nearly one-fifth of the country’s refining capacity, according to the United States Energy Information Administration. Based on the impact of Winter Storm Uri—which hit the US in February, shutting down foam-packaging plants and causing a 4.8% year-over-year rise in foam prices by July, according to YCharts—we expect that Hurricane Ida will worsen the foam shortage, and its knock-on effects will impact various industries, including furniture and bedding. Currently, many petrochemical plants essential to the production of foam remain closed. Additionally, Hurricane Ida forced many ports in Louisiana and Mississippi to close, which we anticipate will drive up transport costs and worsen product shortages. In Louisiana, we expect that the state’s top import categories will be affected, including coffee (accounting for 7.9% of imports by volume, according to S&P Global Market Intelligence), furniture and automotive products. Overall imports had already declined 20.7% year over year in the second quarter of 2021 and by 24.9% in July, according to a report by S&P Global Market Intelligence. Coffee imports grew 4.2% year over year in the second quarter of 2021, but declined by 22.0% year over year in July; automotive products followed a similar trajectory, growing 39.8% year over year in the second quarter but falling 17.3% in July. We expect that Hurricane Ida will cause the decline in imports to continue and lead to increased products shortages. In Mississippi, the ports Bienville, Biloxi, Gulfport and Pascagoula were forced to close, which has increased congestion along the US Gulf Coast and caused a spike in US Atlantic coast-bound gasoline shipments.Figure 1. Leading Ports in the US by Tonnage, 2019 (Mil. Tons) [caption id="attachment_133056" align="aligncenter" width="725"]

Source: US Army Corps of Engineers [/caption]

Retailers Turn to Air Freight To Avoid Port Congestion—but Face Rising Fees and Restrictions

Southeast Asia accounts for a large percentage of imports to the US: Nearly 40% of the volume of goods imported into the US by sea from July 2020–21 came from Vietnam, according to S&P Global. As companies have shifted manufacturing into lower-cost areas, imports from Thailand and Vietnam have risen by 15.9% year over year and 31.7% year over year, respectively. However, the Delta variant has spread quickly in Southeast Asia, with several major apparel brands shutting factories in Vietnam during August 2021, contributing to congestion and rising fees at both ports and airports, as retailers struggle to produce and ship their products.

Increased Inventory Pressures and Shipping Costs at Ports in Southeast Asia

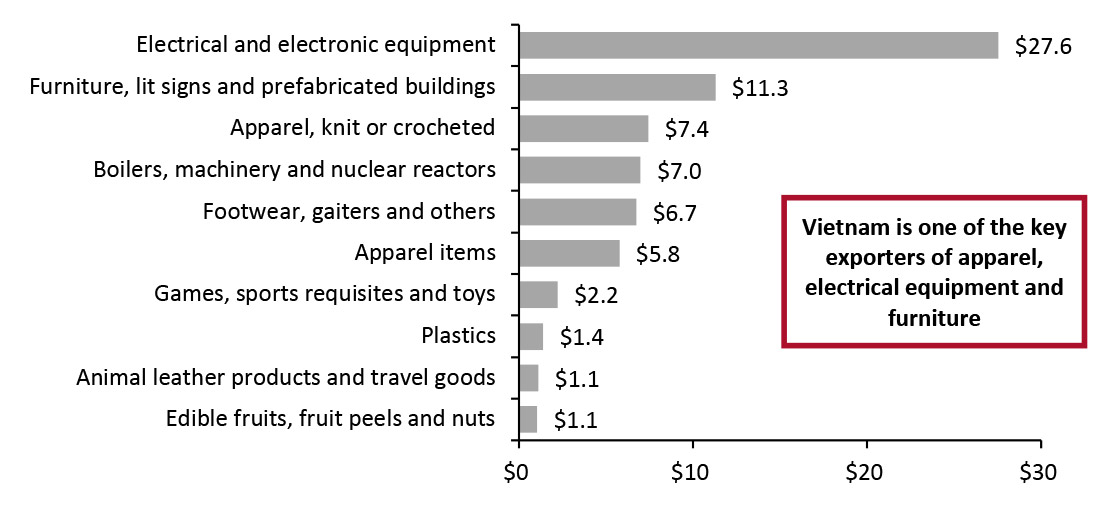

Vietnam, the second largest exporter to the US after China, is still in lockdown, further delaying shipments as we approach the holiday season. The country is one of the key exporters of apparel, electrical equipment and furniture, according to the UN Comtrade database, which will only exacerbate inventory pressures as retailers stock up ahead of the intense holiday season.

Source: US Army Corps of Engineers [/caption]

Retailers Turn to Air Freight To Avoid Port Congestion—but Face Rising Fees and Restrictions

Southeast Asia accounts for a large percentage of imports to the US: Nearly 40% of the volume of goods imported into the US by sea from July 2020–21 came from Vietnam, according to S&P Global. As companies have shifted manufacturing into lower-cost areas, imports from Thailand and Vietnam have risen by 15.9% year over year and 31.7% year over year, respectively. However, the Delta variant has spread quickly in Southeast Asia, with several major apparel brands shutting factories in Vietnam during August 2021, contributing to congestion and rising fees at both ports and airports, as retailers struggle to produce and ship their products.

Increased Inventory Pressures and Shipping Costs at Ports in Southeast Asia

Vietnam, the second largest exporter to the US after China, is still in lockdown, further delaying shipments as we approach the holiday season. The country is one of the key exporters of apparel, electrical equipment and furniture, according to the UN Comtrade database, which will only exacerbate inventory pressures as retailers stock up ahead of the intense holiday season.

Figure 2. US Top Imports from Vietnam in 2020 (USD Bil.) [caption id="attachment_133057" align="aligncenter" width="726"]

Source: United Nations Comtrade Database[/caption]

London-based maritime research consultancy Drewry’s World Container Index shows that the composite cost of shipping a 40-foot container on eight major East–West routes hit $9,613 in the week ended August 19, up 360% year over year. The largest price jump in container shipping was along the route from Shanghai to Rotterdam, the Netherlands, where the price of a 40-foot container soared 659%, reaching $13,698. Container shipping prices on routes from Shanghai to Los Angeles and New York have also increased. Congestion in China’s ports is especially high given the country’s strict containment measures under its “zero-tolerance” Covid-19 policy. The country is still reeling from shutdowns at its shipping terminals, leading to continued bottlenecks: In August, Ningbo terminal closed, following the closure of Yantian in June, a port 50 miles north of Hong Kong.

Retailers Turning to Air Freight Face Difficulties

Increased shipping prices have caused retailers to turn air freight—although this method is not cheap and still comes with the risk of potential outbreaks in airports. In China, airport closures and strict Covid-19 regulations continue to cause freight supply crunches.

Shanghai Pudong International Airport is the second-largest airport in China and third largest cargo airport in the world. Freighters from the airport were suspended in August 2021, after the Shanghai Health Commission reported five Covid-19 cases among its cargo workers. Before the closure, the airport was only operating at 33% capacity due to China’s quarantine measures. Now reopen, fares at the airport are up 30% since the closure, according to SEKO Logistics—which could bring forward the October “super-peak” season.

According to air cargo pricing provider TAC Index, August airfreight rates across the country are 30% above last year and about 60% higher than in 2019. As of August 16, it costs $8.10 per kilogram, almost 6% up month over month. On the same date, transport and third-party logistics provider C.H. Robinson stated in a freight market update that the Asia-to-North America airfreight market is in “critical” status after seeing a fall in capacity, while spot rates are trending up.

Stimulus-Fueled Demand and Chip Shortage Surprise Car Retailers

Continued supply chain disruptions have occurred while consumer demand is very high, primarily spurred by government stimulus payments: the rapid return of consumer spending shattered demand forecasts for 2020. According to Coresight Research, the US government will have issued $1.66 trillion in direct payments to consumers between March 2020 and the end of 2021 as part of its stimulus initiative.

Car sales in the US tumbled 40% in 2020 shortly after the pandemic hit—however, demand returned much faster than expected, causing both soaring prices and depleted inventories. Cars’ average transaction price surged to $42,736 in July 2021, up by $402 from June, and since the beginning of the pandemic, prices have risen by $3,000 on average.

The increase in car prices has also been impacted by the ongoing shortage of semiconductors—which are increasingly used in car manufacturing, as electronic parts currently comprise about 40% of a vehicle’s value. Globally, this shortage is expected to cost automotive industries $110 billion in revenue in 2021, according to consulting firm AlixPartners. The shortage began as auto plants shut down: semiconductor orders declined, leading chip manufacturers to divert supply toward the high demand for consumer electronics—subsequently worsening the chip shortage for auto plants when high demand returned, subverting retailers’ predictions. Consumer electronics companies such as ASUS, Dell and HP had already been discussing the semiconductor chip shortage in earnings calls, as discussed in an earlier report in the series.

In response to the shortage, Toyota cut global production by 40% in August 2021, losing up to 170,000 vehicles through September 2021, according to the company. While the firm had been less susceptible to the shortage than its Japanese peers such as Mazda, Nissan and Subaru, it has been impacted by the increasing number of chip factory closures, particularly in Malaysia.

We have tracked retail and supply chain companies to keep pace of categories that are reporting shortages, as shown in Figure 3 below.

Source: United Nations Comtrade Database[/caption]

London-based maritime research consultancy Drewry’s World Container Index shows that the composite cost of shipping a 40-foot container on eight major East–West routes hit $9,613 in the week ended August 19, up 360% year over year. The largest price jump in container shipping was along the route from Shanghai to Rotterdam, the Netherlands, where the price of a 40-foot container soared 659%, reaching $13,698. Container shipping prices on routes from Shanghai to Los Angeles and New York have also increased. Congestion in China’s ports is especially high given the country’s strict containment measures under its “zero-tolerance” Covid-19 policy. The country is still reeling from shutdowns at its shipping terminals, leading to continued bottlenecks: In August, Ningbo terminal closed, following the closure of Yantian in June, a port 50 miles north of Hong Kong.

Retailers Turning to Air Freight Face Difficulties

Increased shipping prices have caused retailers to turn air freight—although this method is not cheap and still comes with the risk of potential outbreaks in airports. In China, airport closures and strict Covid-19 regulations continue to cause freight supply crunches.

Shanghai Pudong International Airport is the second-largest airport in China and third largest cargo airport in the world. Freighters from the airport were suspended in August 2021, after the Shanghai Health Commission reported five Covid-19 cases among its cargo workers. Before the closure, the airport was only operating at 33% capacity due to China’s quarantine measures. Now reopen, fares at the airport are up 30% since the closure, according to SEKO Logistics—which could bring forward the October “super-peak” season.

According to air cargo pricing provider TAC Index, August airfreight rates across the country are 30% above last year and about 60% higher than in 2019. As of August 16, it costs $8.10 per kilogram, almost 6% up month over month. On the same date, transport and third-party logistics provider C.H. Robinson stated in a freight market update that the Asia-to-North America airfreight market is in “critical” status after seeing a fall in capacity, while spot rates are trending up.

Stimulus-Fueled Demand and Chip Shortage Surprise Car Retailers

Continued supply chain disruptions have occurred while consumer demand is very high, primarily spurred by government stimulus payments: the rapid return of consumer spending shattered demand forecasts for 2020. According to Coresight Research, the US government will have issued $1.66 trillion in direct payments to consumers between March 2020 and the end of 2021 as part of its stimulus initiative.

Car sales in the US tumbled 40% in 2020 shortly after the pandemic hit—however, demand returned much faster than expected, causing both soaring prices and depleted inventories. Cars’ average transaction price surged to $42,736 in July 2021, up by $402 from June, and since the beginning of the pandemic, prices have risen by $3,000 on average.

The increase in car prices has also been impacted by the ongoing shortage of semiconductors—which are increasingly used in car manufacturing, as electronic parts currently comprise about 40% of a vehicle’s value. Globally, this shortage is expected to cost automotive industries $110 billion in revenue in 2021, according to consulting firm AlixPartners. The shortage began as auto plants shut down: semiconductor orders declined, leading chip manufacturers to divert supply toward the high demand for consumer electronics—subsequently worsening the chip shortage for auto plants when high demand returned, subverting retailers’ predictions. Consumer electronics companies such as ASUS, Dell and HP had already been discussing the semiconductor chip shortage in earnings calls, as discussed in an earlier report in the series.

In response to the shortage, Toyota cut global production by 40% in August 2021, losing up to 170,000 vehicles through September 2021, according to the company. While the firm had been less susceptible to the shortage than its Japanese peers such as Mazda, Nissan and Subaru, it has been impacted by the increasing number of chip factory closures, particularly in Malaysia.

We have tracked retail and supply chain companies to keep pace of categories that are reporting shortages, as shown in Figure 3 below.

Figure 3. Tracked Consumer Goods Shortages [wpdatatable id=1273 table_view=regular]

Source: Company reports/Coresight Research

What We Think

This holiday season, we expect that inventories will be stretched thin and that consumers will feel inflationary pressures—due to supply chain issues including insufficient components and natural-disaster related import and export problems. Implications for Retailers- In the short term, we expect a series of both intermediary and consumer goods to be in short supply, which will result in elevated costs. Therefore, we advise retailers to re-evaluate their product pricing and promotion strategies, especially for the upcoming holiday season. Companies must pull levers such as promotional events and discrete price cuts to underscore reputations for value for money.

- In the long term, retailers should consider strengthening and diversifying their supply chain. They should factor in the high costs of transport and possible delays, particularly if a significant portion of their supply chain is in Southeast Asia.