DIpil Das

What’s the Story?

Our Supply Chain Briefing series examines issues in the retail chain and implications to the sector. In this report, we look how retailers—including Costco, Home Depot and Walmart—are chartering ships to move goods primarily from Asia, where they are produced, to their consumer markets. We also examine the impact of extended hours at major US ports of Los Angeles and Long Beach on easing congestion, as well as proposed escalating fees. Lastly, we analyze major carriers’ attempts to automate operations to build capacity amid labor shortages.Why It Matters

Supply chain complexities tend to compound at each stage from production to processing to delivery, thus increasing their vulnerabilities as well as the risks involved. As retailers are unable to secure lower shipping rates, chartering ships seems economical when transporting large amounts of cargo. Smaller businesses that cannot afford to charter ships or those with fewer options available will risk delayed shipment. Other supply chain players, such as port operators and carriers, are taking steps to ease disruptions. However, the cost of delayed shipping has begun to weigh on the consumer and the larger industry. In addition, pressures for brands, retailers and other stakeholders have been compounded by the unavailability of labor to manage surge in purchases and shipments across the supply chain. Automating operations at scale may be a helpful solution to easing some of staffing crunches.How Are Retailers and Ports Addressing Disruptions? Coresight Research Analysis

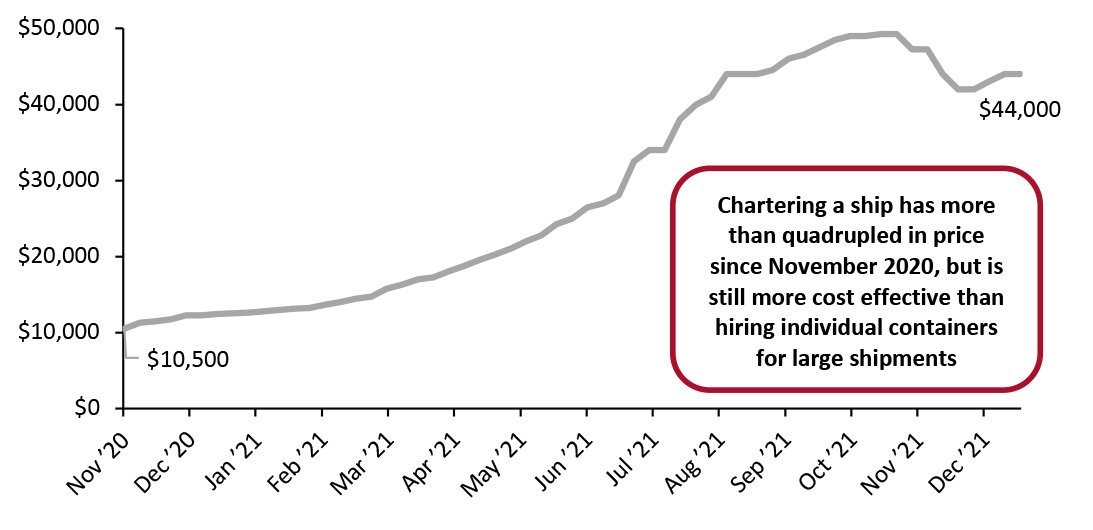

1. High Shipping Rates: Retailers Charter Ships Retailers including Costco, Home Depot, Target and Walmart have announced that they are chartering ships to circumvent some pandemic-related shipping disruptions. Shipping rates reached astronomically high levels earlier this year and, while container freight prices have fallen in recent months, they are still much higher than before the pandemic. As of December 20, 2021, shipping a 20-foot container from Shanghai to the port of Los Angeles cost $13,475, according to shipping container company Freightos—whereas chartering a vessel that can accommodate 1,700 20-foot containers costs $44,000 per day, as of the week ended December 17, 2021, based on six-month charter rates from ship broker Harper Petersen. Therefore, chartering a vessel for large shipments seems more cost effective. Shipping 1,700 20-foot containers on separate ships, or a single ship without chartering a vessel, would cost approximately $23 million based on the individual container-shipping rates (though in reality, a single shipper is likely to get a discount for booking many container spots). However, a vessel that can hold 1,700 containers will cost around $880,000 for a port-to-port trip of 20 days, or about $1.8 million for 40 days—even if the ship must wait for 20 days after arriving at port to secure a spot and unload the shipment and despite ship charter rates reaching significantly high levels compared to a year ago.Figure 1. Ship Charter Rates for 1,700-Container Vessels (USD per Day) [caption id="attachment_138445" align="aligncenter" width="700"]

Source: Harper Petersen[/caption]

A dedicated vessel means retailers can consolidate shipments, avoid stopping at multiple ports and even circumvent congested routes. However, small and medium-sized retailers, who do not ship large enough amounts of cargo, will need to bear the brunt of high shipping costs and delays until the disruptions subside.

Big-box retailers stockpiled to prepare for the holiday surge; however, smaller and specialty retailers have tended to maintain leaner inventories. As we move past the holiday season, the start-of-year lull may give shippers and ports a chance to clear backlogs and prepare for Spring.

2. Port Congestion: Extended Pickup Hours and Escalating Fines

In September, the ports of Los Angeles and Long Beach, two of the busiest in the US, announced expanded night and weekend opening hours to allow trucks to pick up and return containers over a longer duration. Port managers hoped to ease congestion, which exists in part due to a shortage of dockworkers and drivers, alongside increased imports slowing down regular movement of freight. The trial has shown some progress, according to both ports—however, there are still several challenges that need to be addressed. In November, Executive Director of the Port of Los Angeles Gene Seroka stated that the ports have been struggling to fulfill the new hours primarily due to worker shortages.

All stakeholders involved in port operations—port authorities, transport companies, carriers, importers and exporters, among others—need to harmonize their schedules. “It’s an effort to try to get this entire orchestra of supply chain players to get on the same calendar,” Seroka stated. Even if they can, the ports need to hire additional labor to work these extended hours—however, the supply chain job market was already constrained before the announcement of extended hours and ports have struggled.

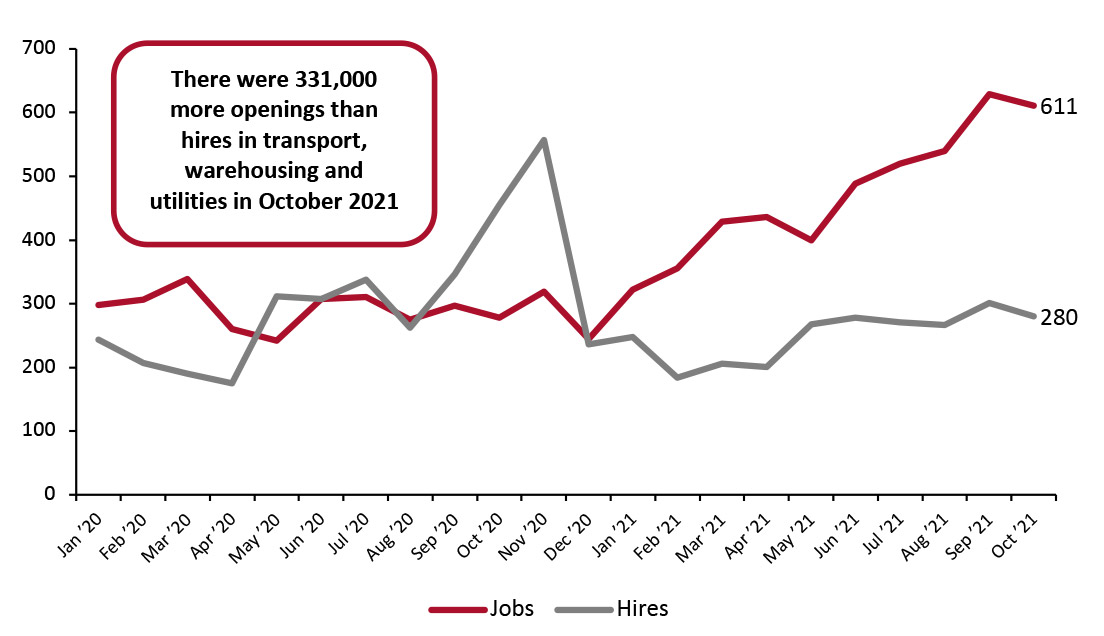

Job openings within transportation, warehousing and utilities in the US have begun to increase since January this year, while new hires in the same sector have not kept pace. Since December 2020, the gap between hires and jobs available has been widening—as of October 2021, there were 331,000 more jobs than hires.

Source: Harper Petersen[/caption]

A dedicated vessel means retailers can consolidate shipments, avoid stopping at multiple ports and even circumvent congested routes. However, small and medium-sized retailers, who do not ship large enough amounts of cargo, will need to bear the brunt of high shipping costs and delays until the disruptions subside.

Big-box retailers stockpiled to prepare for the holiday surge; however, smaller and specialty retailers have tended to maintain leaner inventories. As we move past the holiday season, the start-of-year lull may give shippers and ports a chance to clear backlogs and prepare for Spring.

2. Port Congestion: Extended Pickup Hours and Escalating Fines

In September, the ports of Los Angeles and Long Beach, two of the busiest in the US, announced expanded night and weekend opening hours to allow trucks to pick up and return containers over a longer duration. Port managers hoped to ease congestion, which exists in part due to a shortage of dockworkers and drivers, alongside increased imports slowing down regular movement of freight. The trial has shown some progress, according to both ports—however, there are still several challenges that need to be addressed. In November, Executive Director of the Port of Los Angeles Gene Seroka stated that the ports have been struggling to fulfill the new hours primarily due to worker shortages.

All stakeholders involved in port operations—port authorities, transport companies, carriers, importers and exporters, among others—need to harmonize their schedules. “It’s an effort to try to get this entire orchestra of supply chain players to get on the same calendar,” Seroka stated. Even if they can, the ports need to hire additional labor to work these extended hours—however, the supply chain job market was already constrained before the announcement of extended hours and ports have struggled.

Job openings within transportation, warehousing and utilities in the US have begun to increase since January this year, while new hires in the same sector have not kept pace. Since December 2020, the gap between hires and jobs available has been widening—as of October 2021, there were 331,000 more jobs than hires.

Figure 2. US: Job Openings and Hires in Transportation, Warehousing and Utilities (Thous.) [caption id="attachment_138446" align="aligncenter" width="700"]

Data are not seasonally adjusted

Data are not seasonally adjusted Source: BLS [/caption] On October 25, 2021, Los Angeles and Long Beach ports announced an escalating fee as another measure to combat delays—charging $100 per container left at the ports on the first day, $200 on the second day, and so on. However, these fees, called “container dwell fees,” remain on hold until December 27, 2021—when the ports will make a new joint announcement on whether they will be introduced—as lingering containers at both ports have reduced by 46% since the initial announcement. The US is not the only country to experience a truck driver shortage. Felixstowe, the largest container port in the UK, has been experiencing a large backlog of ships hailing from Asia in part due to a truck driver shortage. Additionally, congestion at major ports along popular shipping routes can cause backlogs at other ports. If a ship originating in Shanghai has to stop in Europe or the UK and has to wait due to a backlog before continuing to US, it may be delayed arriving at its final destination. 2. Labor Shortage: Automatic Logistics Operations As hiring labor becomes increasingly challenging, exacerbated by holiday hiring, logistics operators and delivery companies are investing in automation initiatives to meet the challenge. Courier service DHL is now using smart logistics provider Geekplus’ goods-to-person package in its fashion e-commerce facilities. A robot moves inventory shelves and pallets to the picking station, eliminating the need for workers to walk around warehouses. Automated picking improves efficiency by two to three times compared to manual picking, according to Geekplus. DHL plans to spend $300 million over the next five years to grow its real estate in the US by 70%, automate 19 distribution centers and improve its IT systems. FedEx has partnered with truck manufacturer PACCAR and autonomous driving technology provider Aurora to launch a commercial autonomous trucking pilot in Texas. Beginning in September 21, the companies have been trialing an autonomous truck that moves FedEx shipments between Dallas and Houston. While the truck largely drives itself, it currently has a driver present—who only intervenes if necessary. Aurora hopes that the trucks will work fully autonomously from 2023, without a safety driver. Though carriers are working to automate operations, it will take some time before supply chain operations are adequately automated and staffed to see a meaningful impact.

What We Think

As companies employ various alternatives to curb delays and rising costs for 2022, they will need to be flexible to alter various aspects of their supply chain based on how these disruptions materialize over the next month. Our analysis indicates that there is likely to be ongoing disruption in the supply chain into early to mid-2022 at least—or until the threat of Covid-19 has substantially reduced, and retailers, shippers and other supply chain stakeholders have cleared their backlogs. Implications for Brands/Retailers- Companies should continue to overhaul their sourcing strategies and make their supply chain more flexible. As the pandemic has exposed vulnerabilities in a long supply chain, they should look to suppliers in the domestic market that can help meet increases in demand quickly.

- Real estate firms with properties near ports will continue to be in demand, to store inventory that cannot be transported or loaded to ships in time.

- As ports, transport firms and businesses seek solutions for ongoing supply chain challenges, technology providers should develop applications that not only help increase visibility but also promote coordination between supply chain stakeholders.

- Typically, supply chain technology helps businesses achieve efficiency. Technologies that offer better coordination along the supply chain, such as matching ships and trucks offloading loaded containers with empty ones, or identifying areas for automation, will help reduce some of the ongoing disruptions.