DIpil Das

Introduction

What’s the Story?

Our Supply Chain Briefing series examines issues in the retail chain and their implications on the sector. In this report, we look at the stabilization of overseas freight rates, continued challenges within the domestic US distribution chain and the broader impact of the G7 nations’ forthcoming ban on Russian gold.

Why It Matters

As a result of the pandemic, efficient supply chain planning is more important than ever, and stakeholders must remain informed of the various factors causing disruptions and the means to mitigate their impacts. Supply chains are complex due to their interconnectedness, and even minor changes and delays can have far-reaching consequences. Businesses must use the lull during off-peak seasons to overhaul or rework strategies as necessary.

Freight Rates Abate but Domestic Distribution Doubts Arise: Coresight Research Analysis

1. International Freight Rates Drop but Remain Elevated

Elevated freight rates remain one of the biggest pain points for retailers across many sectors. After breaching historic highs prior to the 2021 holiday season, global ocean shipping rates have started to drop but remain higher than pre-pandemic levels.

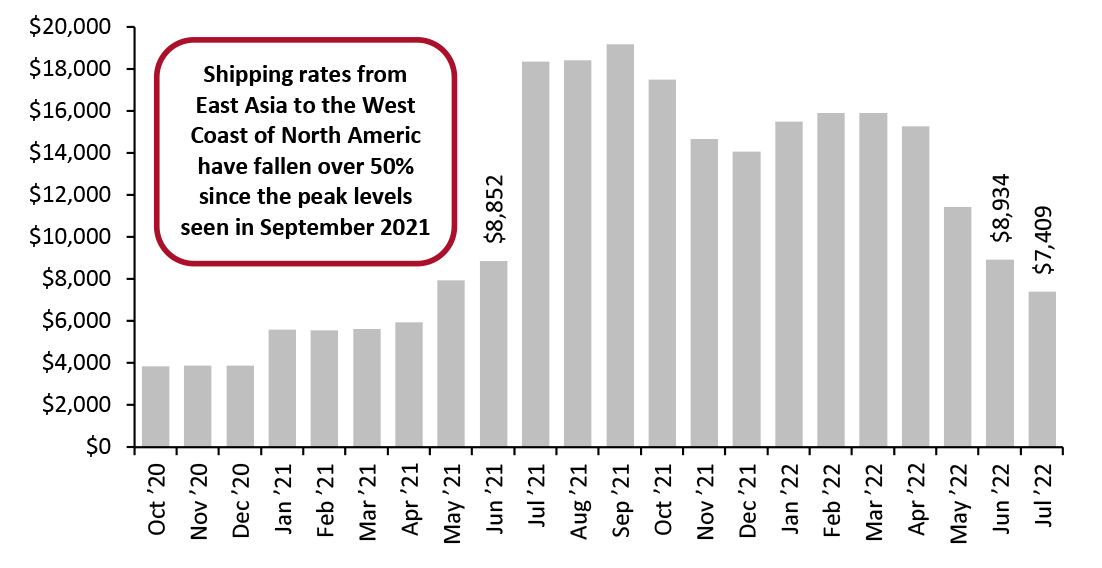

According to freight tech platform Freightos, the average rate for a 40-foot container traveling from East Asia to the West Coast of North America was $8,934 in the last full week of June 2022, close to the $8,852 level seen in June last year. In the week ended July 8, 2022, the rates continued to decline, averaging $7,409, indicating signs of a downward trend. A sustained decline as we head toward the holiday season would be a positive for the retail sector.

Figure 1. China/Eastern Asia to North American West Coast: Average Weekly Freight Rate per 40-Foot Container (USD) [caption id="attachment_152440" align="aligncenter" width="700"]

These freight rates are an average of the five business days of the last full week in each month, except for July 2022.

These freight rates are an average of the five business days of the last full week in each month, except for July 2022. Source: FBX.com [/caption]

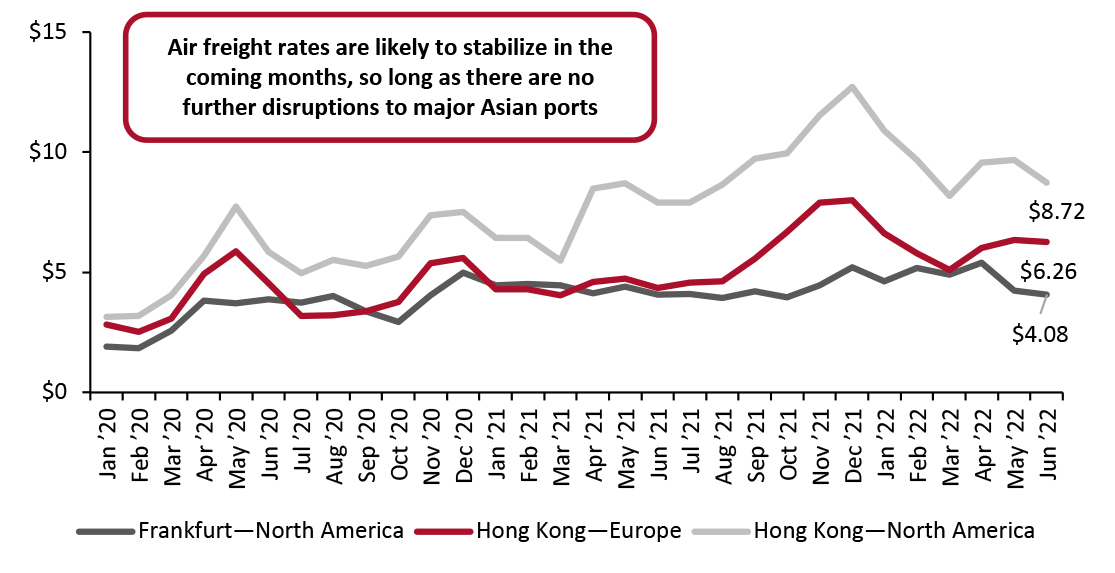

Air freight rates have seen a slight upward trend since March 2022, especially on routes out of Hong Kong. However, as various cities in China lifted lockdowns gradually through June and businesses and shipping returned to normalcy, these rates are likely to stabilize in the coming months as long as there are no further disruptions to major Asian ports.

As of July 13, 2022, residents in the southern Chinese port of Guangzhou and nine of Shanghai’s 16 districts will be subjected to a mass testing campaign. Wugang, a city in Hunan province that houses one of the largest steel mills in the country, and Lanzhou, the capital city of Gansu province with a population of 4.4 million, are in full lockdown since July 12 and 13, respectively. It remains to be seen in the coming weeks whether other major cities in China will impose strict lockdowns similar to the ones seen earlier this year.

Figure 2. Average Air Freight Rates on Major Global Routes (USD per Kilogram) [caption id="attachment_152441" align="aligncenter" width="701"]

Source: Air Cargo News/Baltic Exchange/TAC Index[/caption]

Source: Air Cargo News/Baltic Exchange/TAC Index[/caption]

Air freight has cost several retailers dearly in recent quarters. Below, we present selected commentary from various major apparel retailers that resorted to air freight for the quick movement of goods from source countries.

- Abercrombie & Fitch: The retailer stated during its June 2022 analyst day that it typically uses air freight for 15% of its shipments; however, in the fall, the company had to double that due to lockdowns in Vietnam delaying shipments. The delays added some $50 million of pressure to its gross margin—split between the second half of its fiscal 2021 and the first quarter of 2022—but the retailer has reverted to the usual 15% since the second quarter of 2022. For the rest of 2022, Abercrombie & Fitch expects a total freight and raw material cost increase of $300 million above pre-pandemic levels.

- Crocs: During two separate investor conferences in March and June this year, Crocs stated that it expects to incur $75 million in air freight costs in the first half of this year, primarily due to lockdowns in Vietnam last year. It said it expects the air freight costs to be nonrecurring and termed it “expensive” and “not (its) normal practice.”

- Lululemon: In June 2022, the athletic clothing brand reported a first-quarter 2022 gross margin decrease of 320 basis points year over year, driven down by a depleted product margin and high freight costs. The company stated that its product margin decreased by 370 basis points due to a jump of 340 basis points in air freight costs—much higher than the 300 basis points the company had previously guided. In the second quarter, Lululemon expects gross margin to be down 200 points year over year, with an approximately 150-basis-point impact from air freight, while, for the full year, it expects air freight expense to be up by about 30 points. Management told analysts, in response to a query on the 30-point increase for the full year, that as the company completes a full year of air freight, it “expects to have a leverage point as it laps the high-water line in Q4 of last year.”

- VF Corporation: The apparel company incurred $160 million in air freight costs in its fiscal 2022 due to shutdowns in Vietnam, prompting it to use faster means of transport to get goods in time to the US and other markets. In the current fiscal year, the company does not expect to rely on air freight as much as it has altered its sourcing strategy, instead sourcing closer to markets.

2. Distributing Goods Through Domestic US Networks Remains a Challenge

While some international supply chain factors are easing, challenges in the domestic US supply chain appear to be mounting. The US rail network is an essential cog in the domestic supply wheel as it keeps goods moving from ports to their destinations. However, in recent months, the network has been experiencing congestion.

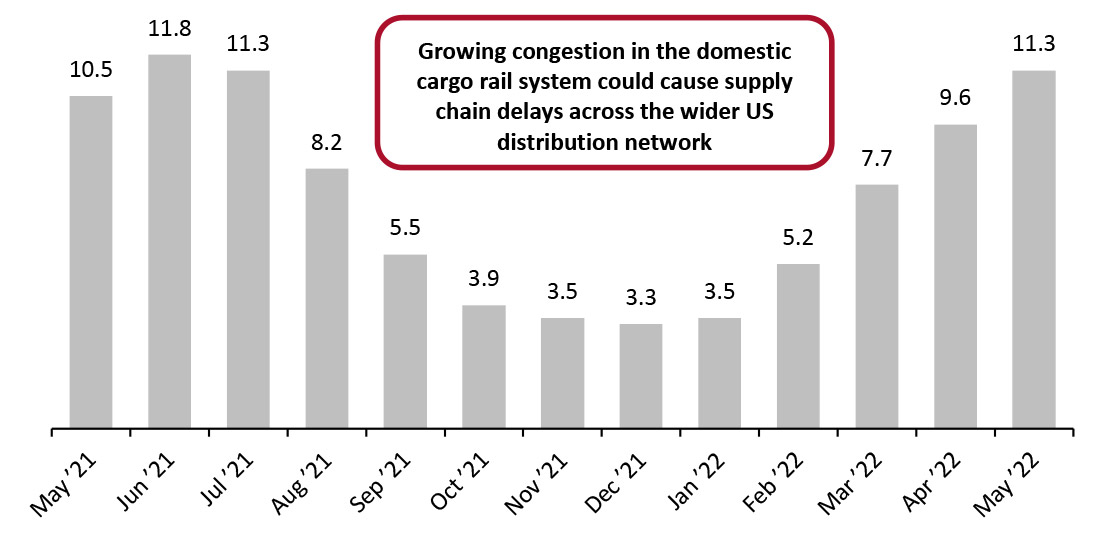

In May, containers meant for rail cargo remained on terminals for an average of 11.3 days, up from April’s 9.6 days, according to the Pacific Merchant Shipping Association (PMSA). The usual pre-pandemic dwell time was two to three days, stated Jessica Alvarenga, Manager of Government Affairs at PMSA, in the association’s latest press release.

Figure 3. Container Dwell Times for US Rail Cargo (Days) [caption id="attachment_152413" align="aligncenter" width="700"]

Source: PMSA[/caption]

Source: PMSA[/caption]

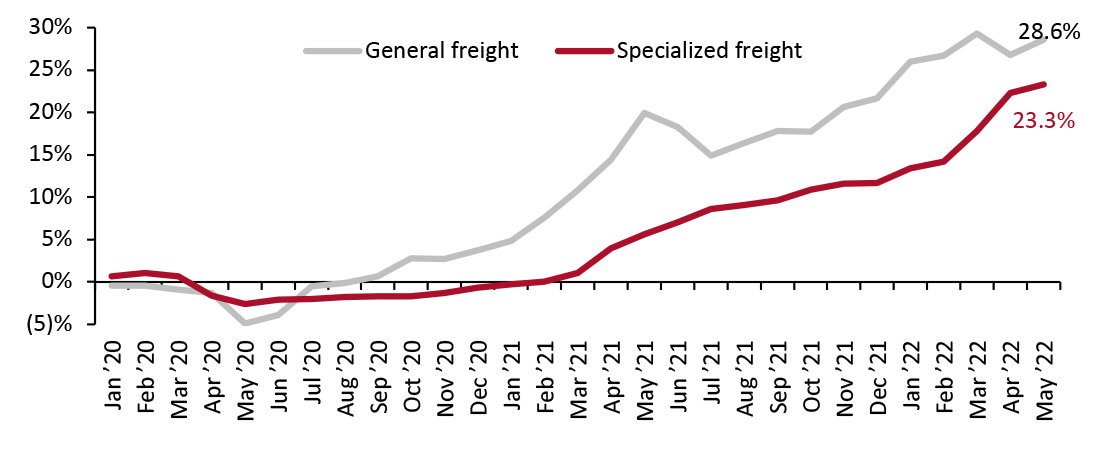

Truck freight rates have seen steep inflation since early 2021 and remain at elevated levels, according to the producer price index (PPI) for general freight and specialized freight trucking by the Bureau of Labor Statistics (BLS). Part of this inflation is likely driven by the sharp rise in fuel costs as the supply of trucks does not match the demand to move goods. Earlier this year, the US also faced congestion at ports and a truck driver shortage, both of which compounded problems in the truck freight supply chain.

Rising rail dwell times and truck freight prices could amplify inland distribution challenges for US retailers.

Figure 4. PPI for Trucking: General Freight and Specialized Freight (YoY % Change) [caption id="attachment_152414" align="aligncenter" width="700"]

Source: BLS[/caption]

Source: BLS[/caption]

3. G7 Nations Ban Russian Gold

The Russia-Ukraine war prompted various sanctions from countries worldwide, with the latest coming from the G7, which consists of Canada, France, Germany, Italy, Japan, the UK and the US. The group announced on June 28, 2022, that they will all begin implanting bans on the import of Russian gold, hoping to deter Russia from continuing the war. In addition to the diplomatic repercussions of the move, we think it will also affect the global supply of gold and the wider jewelry industry.

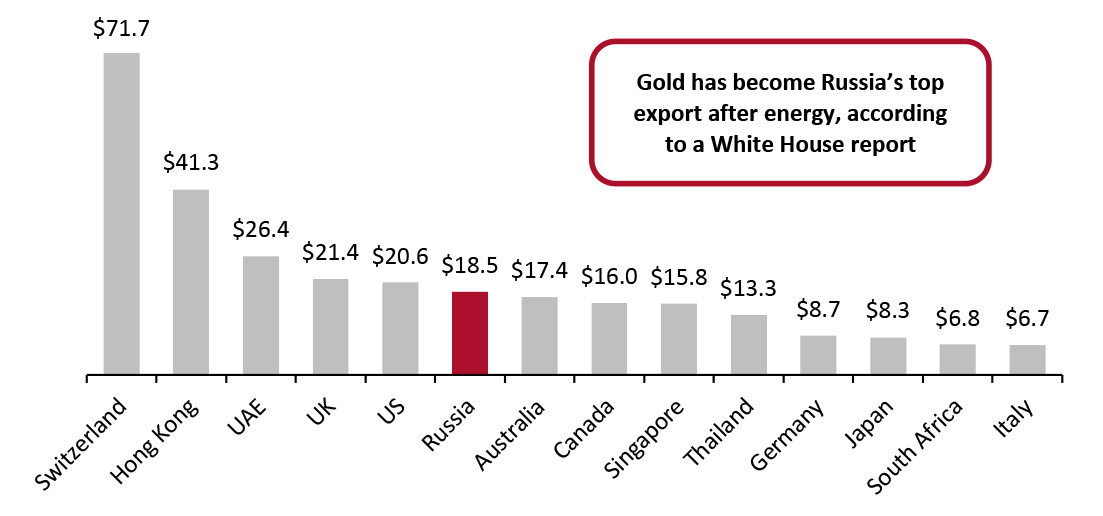

According to US intelligence agency CIA’s World Factbook and multilateral agency International Trade Center, Russia exported $18.5 billion worth of gold in 2020 and is the world’s sixth-largest exporter of gold. The top buyers of Russian gold imports are India, Kazakhstan, Switzerland, Turkey and the UK, according to data distribution platform Observatory of Economic Complexity (OEC). However, online newspaper Euronews reported that 90% of Russian gold exports were consigned to G7 nations.

Figure 5. 2020: Top Gold-Exporting Countries (USD Bil.) [caption id="attachment_152415" align="aligncenter" width="699"]

Source: CIA’s The World Factbook/International Trade Centre[/caption]

Source: CIA’s The World Factbook/International Trade Centre[/caption]

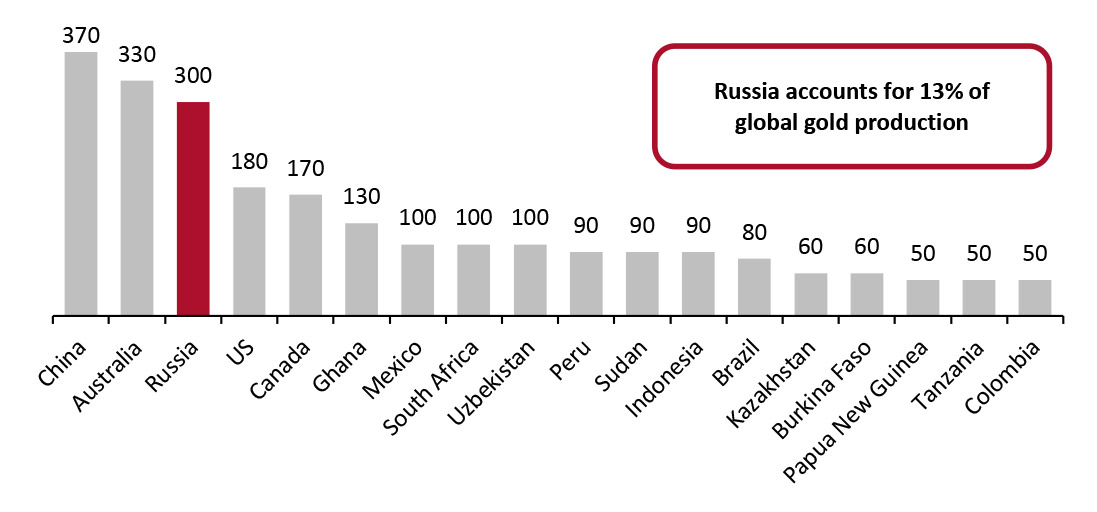

Russia is also one of the biggest producers of gold in the world. In 2021, Russia produced 300 metric tons, accounting for 13% of global gold production, according to the US Geological Survey. Therefore, as the worldwide gold supply falls, there could be an increase in global gold prices, which would impact the jewelry and luxury sectors.

Figure 6. 2021: Top Gold-Producing Countries (Metric Tons) [caption id="attachment_152416" align="aligncenter" width="701"]

Source: US Geological Survey[/caption]

Source: US Geological Survey[/caption]

What We Think

While some disruptions along global supply chains appear to be easing, such as stabilizing international freight rates, there are growing challenges on the domestic front, including rail cargo network congestion and truck freight inflation. At the same time, international diplomatic moves are yet again threatening a domino effect on a commodity—gold—mirroring the impact of sanctions on Russian oil.

Implications for Brands/Retailers

- Businesses must use this period of stabilization in international factors, as well as the lull before the holiday season, to reassess strategies, pull forward receipts if required and change their sourcing and transport mixes.

- Businesses should also consider upgrading technologies that improve visibility and efficiency, or implement technologies that they may not have explored, such as artificial intelligence.

Implications for Technology Vendors

- Vendors that can help improve visibility over the supply chain and predict instances and impacts of anomalies will be helpful to retailers in 2022 and beyond.