DIpil Das

What’s the Story?

In our new Supply Chain Briefing series, we examine key developments and challenges in the retail supply chain and their implications in the retail environment. To kick off the series, we examine issues that have impacted the supply chain so far in 2021—namely, shortages of semiconductor chips, paperboard and packaging materials, as well as port blockages and shutdowns.Why It Matters

A product’s retail price is the composition of the various costs of manufacturing and delivery. Typically, brands and retailers can absorb small increases in costs to keep selling prices stable, but continually rising costs and substantial increases in input material and transport prices will materially impact selling prices.Chips, Ships and Paperboard: In Detail

Chip Shortages Impact Consumer-Electronics Prices Semiconductor chips are used in numerous electronic devices, from intelligent systems in vehicles to everyday consumer electronics, such as laptops, microwave ovens and TVs. Earlier this year, many automobile manufacturers reported hold-ups in production due to inadequate stock. Chip shortages and the resulting price increase have begun to effect consumer electronics’ selling prices as well as retailers’ capacity to restock. The following retailers and electronics manufacturers have discussed the impact of semiconductor chip shortages on earnings calls this year:- ASUS: On its March 2021 earnings call, electronics manufacturer ASUS stated that it “will see price hikes further upstream” due to supply shortages.

- Costco:On its third-quarter earnings call in late May 2021, warehouse club retailer Costco remarked that “chip shortages are impacting many items from an inflation standpoint, some items more than others.”

- Dell: On its first-quarter earnings call held in May 2021, technology and computer manufacturer Dell stated that its semiconductor chip supply has not kept up with demand. It expects component costs to remain inflationary in the ongoing quarter and possibly the second half of the year, resulting in “price increases in certain components.”

- HP: At an industry conference held on June 17, 2021,HP’s CEO Enrique Lores stated that the current industry estimate for the number of PCs being bought over 2021 is 40% higher than initial predictions. He said that this heightened demand for PCs (among other electronics) is driving constraints in the supply of components containing semiconductor chips. Lores believes the impacts of this shortage will continue through 2021 and will be felt through the initial months of 2022.

- Taiwan Semiconductor Manufacturing Company (TSMC): On its second-quarter earnings call held in July 2021, TSMC, one of the largest chipmakers in the world, stated that it expects“capacity to remain tight throughout the year and into 2022 fueled by strong demand for [its] industry-leading advanced and special technologies.”

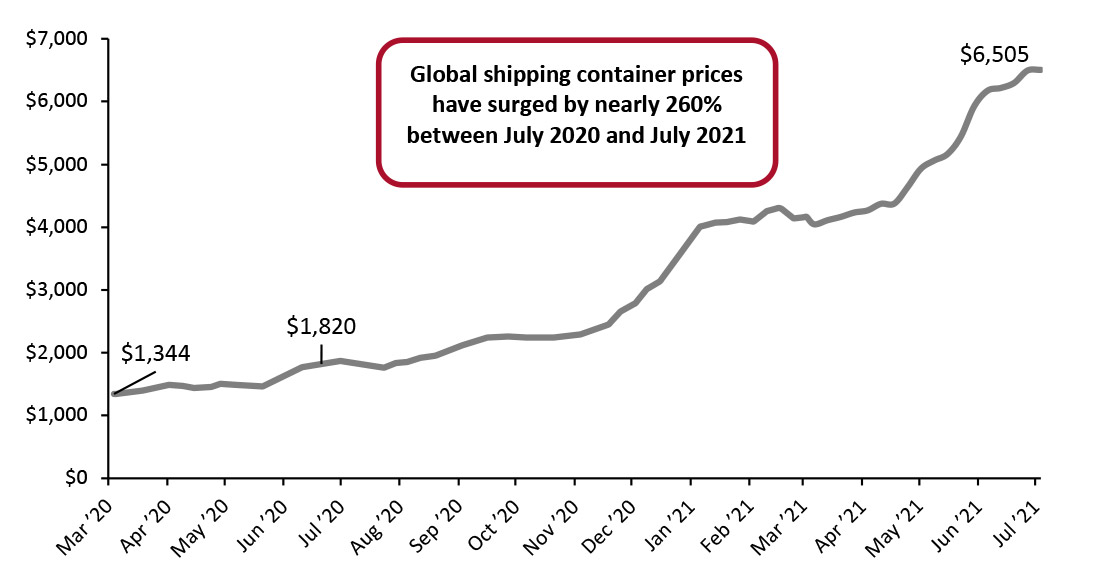

Figure 1. Freightos Baltic Index: Global Container Freight Index [caption id="attachment_130539" align="aligncenter" width="726"]

Source: Freightos Baltic Index [/caption]

Packaging Material Prices Driven Up by E-Commerce Demand

Elevated levels of e-commerce have led to increased demand for packaging materials such as cardboard boxes. According to the Fibre Box Association, US manufacturing of corrugated product—used for delivery boxes and crates—rose by 3.4% in 2020.

Paper and cardboard manufacturers have also been ramping up production but have had to increase selling prices as demand remains higher than supply. The resulting inflation in packaging material prices has also been impacted by rising wood pulp prices, shortages in shipping containers and rising freight prices.

On its first-quarter earnings call held on April 29, 2021, International Paper, a large manufacturer of paper and packaging materials, remarked that higher sales prices in industrial packaging and other business divisions helped drive sales during the quarter. CEO Mark Sutton told analysts that the company’s containerboard and corrugated box inventory was “lower than [the company] likes it to be.” CFO Timothy Nicholls stated thatInternational Paper is attempting to restore inventory levels and thinks the impact of shortages will be eased in the second half of the year. However, Nicholls said that it will “take a long time to recover,” as these products’ supply chains are long.

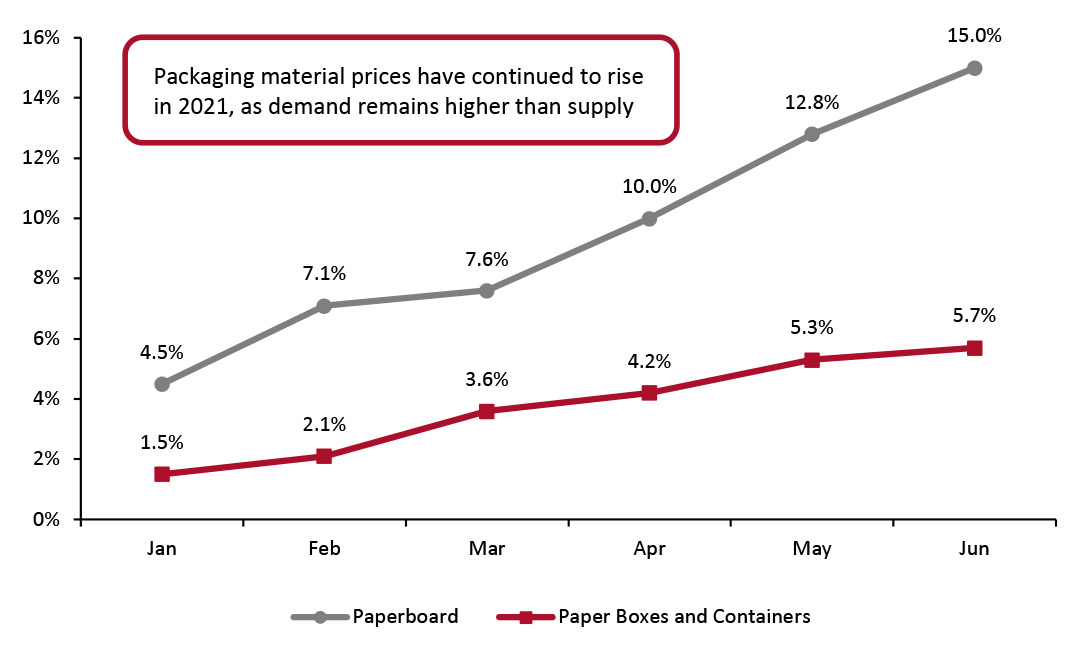

The latest Producer Price Index (PPI) data from the US Bureau of Labor Statistics (BLS) indicates that in June 2021 paperboard prices were up 15.0% year over year, rising from 12.8% growth in May. Paper boxes and container prices were up 5.7% year over year, from 5.3% in May.

Source: Freightos Baltic Index [/caption]

Packaging Material Prices Driven Up by E-Commerce Demand

Elevated levels of e-commerce have led to increased demand for packaging materials such as cardboard boxes. According to the Fibre Box Association, US manufacturing of corrugated product—used for delivery boxes and crates—rose by 3.4% in 2020.

Paper and cardboard manufacturers have also been ramping up production but have had to increase selling prices as demand remains higher than supply. The resulting inflation in packaging material prices has also been impacted by rising wood pulp prices, shortages in shipping containers and rising freight prices.

On its first-quarter earnings call held on April 29, 2021, International Paper, a large manufacturer of paper and packaging materials, remarked that higher sales prices in industrial packaging and other business divisions helped drive sales during the quarter. CEO Mark Sutton told analysts that the company’s containerboard and corrugated box inventory was “lower than [the company] likes it to be.” CFO Timothy Nicholls stated thatInternational Paper is attempting to restore inventory levels and thinks the impact of shortages will be eased in the second half of the year. However, Nicholls said that it will “take a long time to recover,” as these products’ supply chains are long.

The latest Producer Price Index (PPI) data from the US Bureau of Labor Statistics (BLS) indicates that in June 2021 paperboard prices were up 15.0% year over year, rising from 12.8% growth in May. Paper boxes and container prices were up 5.7% year over year, from 5.3% in May.

Figure 2. US PPI: Paperboard, and Paper Boxes and Containers, 2021 (YoY % Change) [caption id="attachment_130540" align="aligncenter" width="725"]

Source: BLS [/caption]

Source: BLS [/caption]