Nitheesh NH

What’s the Story?

In our Supply Chain Briefing series, we examine key developments and challenges in the retail supply chain and their implications in the retail environment. In this report, we look at the port logjams arising from shutdowns in China and retailers’ strategies to mitigate the resulting delays. We discuss the related surge in freight and commodity prices and how this has affected consumer prices.Why It Matters

Supply chains are complex; with so many moving parts, disruptions to any stage can have a domino effect on others. Port logjams thus have far-reaching effects. A survey by the National Retail Federation (NRF) conducted in June 2021 found that 97% of US retailers have been impacted by port and shipping delays, with 70% stating that they have had to add at least two weeks to their supply chains. All retailers surveyed reported that their costs have increased, with 75% passing on some of these costs to consumers. In addition, 85% of surveyed retailers stated that they have experienced inventory shortages due to supply chain disruptions. Some retailers, unable to get products through ports, are considering air freight as an alternative—although this is expensive and not a workable option for all retailers. Likewise, sourcing products from alternative locations may generate extra costs.Port Logjams and Rising Prices: Coresight Research Analysis

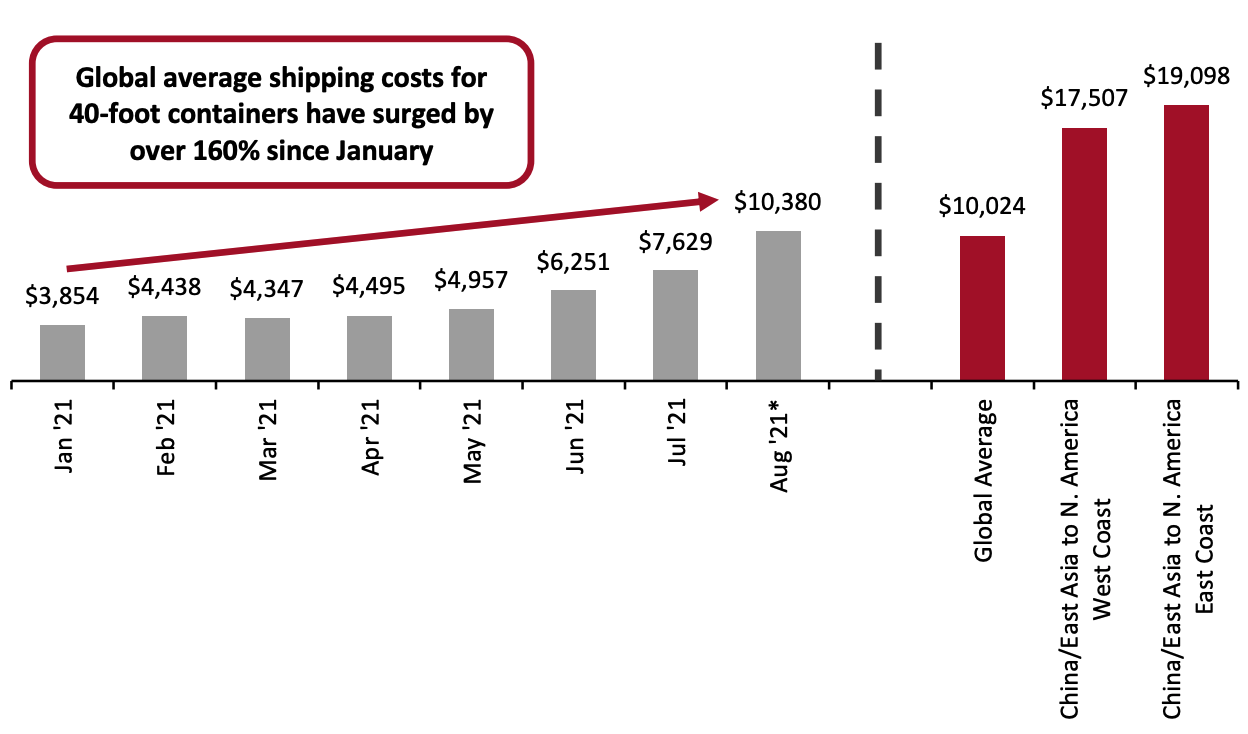

1. Port Logjams Will Result in Price and Promotion Shuffling Ahead of Holiday Season Two ports in China—Yantian in Shenzhen and Ningbo-Zhoushan—were struck by shutdowns this year due to the pandemic. The Yantian terminal in Shenzhen was shut for three weeks in June, and the Ningbo-Zhoushan port closed its Meishan terminal from August 12 due to dockworkers testing positive for Covid-19. It resumed operations after nearly two weeks, on August 25. Based on throughput in 2020, Ningbo-Zhoushan is the third-largest port worldwide, and the Yantian terminal is the fourth largest. Shutdowns in these locations have stranded hundreds of thousands of containers. As a result, manufacturers and shipping companies are turning to other ports. According to Reuters, Shanghai port had 34 vessels in anchorage on August 17, up from 27 a week prior, and there were 18 at anchorage in Xiamen, south of Ningbo, on August 17, versus four early in the prior week. This could lead to clogging and delays spreading to those ports, as well as increased costs due to redirecting ships and reorganizing logistics. According to global eBooking platform Freightos, end-to-end shipping times in August 2021 were 15% higher than in May and 46% higher year over year, for small and medium-sized importers sending “less than a container load” (LCL) shipments from China to the US. Pre-pandemic shipping times for the East Asia–US route were around 20 days port to port, and 45–60 days door to door. Artificial intelligence (AI)-driven supply chain tech company Impact Analytics has identified a four-to-six-week delay in retailers getting products onto shelves, which has led to retailers rethinking their pricing and product mix. Retailers are already impacted significantly by these delays. Qurate Retail Group (owner of HSN and QVC) said on its second-quarter earnings call on August 6, 2021, that 30% of its Today’s Special Value products (products it offers at a discounted price each day) were affected due to supply issues during the quarter. The company said that high demand in the electronics and home categories, combined with semiconductor chip shortages, has left them unable to source adequate quantities of key items or provide attractive offers. Other retailers must, we reason, be facing the same challenges and will be forced to adjust prices and reshuffle promotions based on available inventory during the holiday season. 2. Freight Prices Continue To Surge Global shipping prices continue to surge: In early January 2021, a 40-foot container cost an average of $3,854 to ship globally, according to the Freightos Baltic Index. In the week ended August 20, 2021, the average cost had surged to over $10,000. Prices are much higher for the key routes from China or East Asia, where many factories are located, to importers in North America—at around $17,000–$19,000 (see Figure 1).Figure 1. Average Weekly Container Prices: Globally, in the First Week of Each Month, 2021 (Left) and for Selected Routes in the Week Ended August 20, 2021 (Right) [caption id="attachment_132064" align="aligncenter" width="700"]

*For August, we have provided the average weekly prices for the first week of August and the fourth week of August (latest).

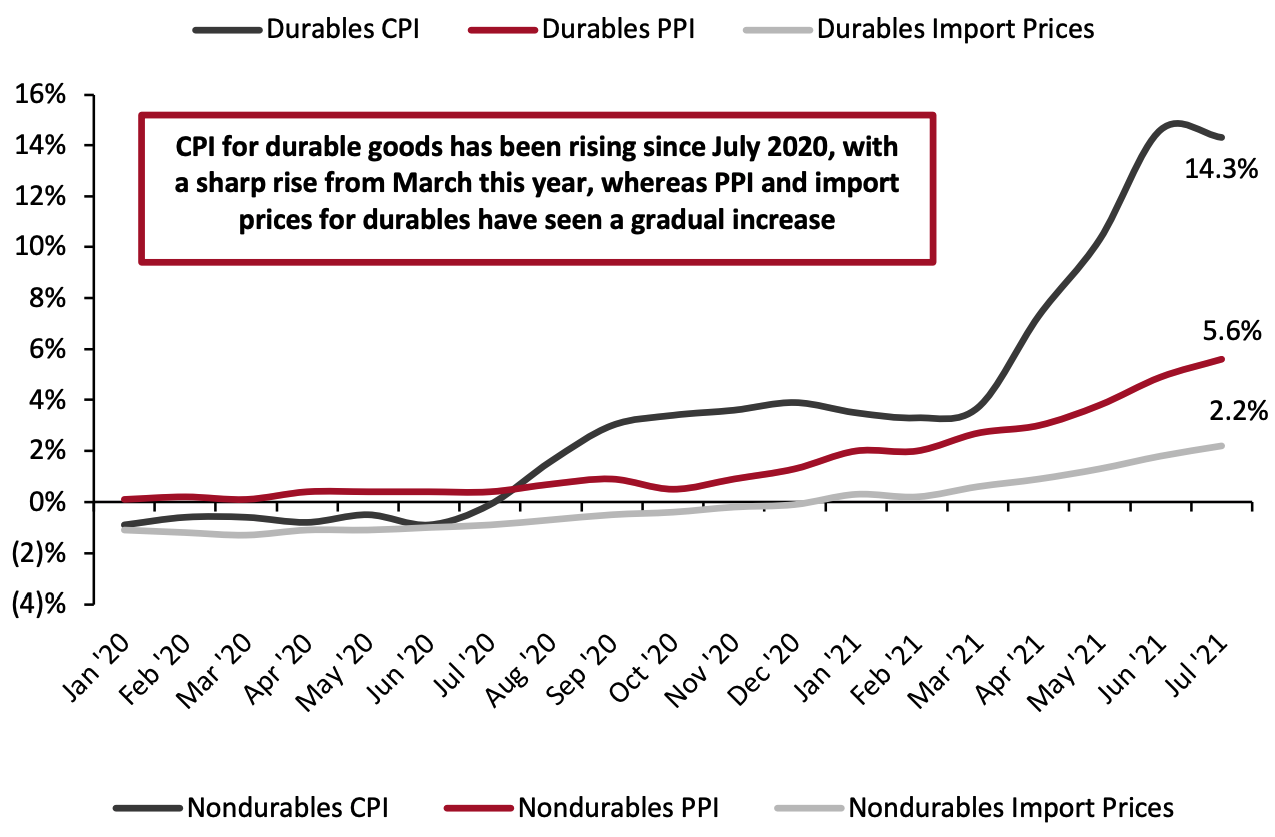

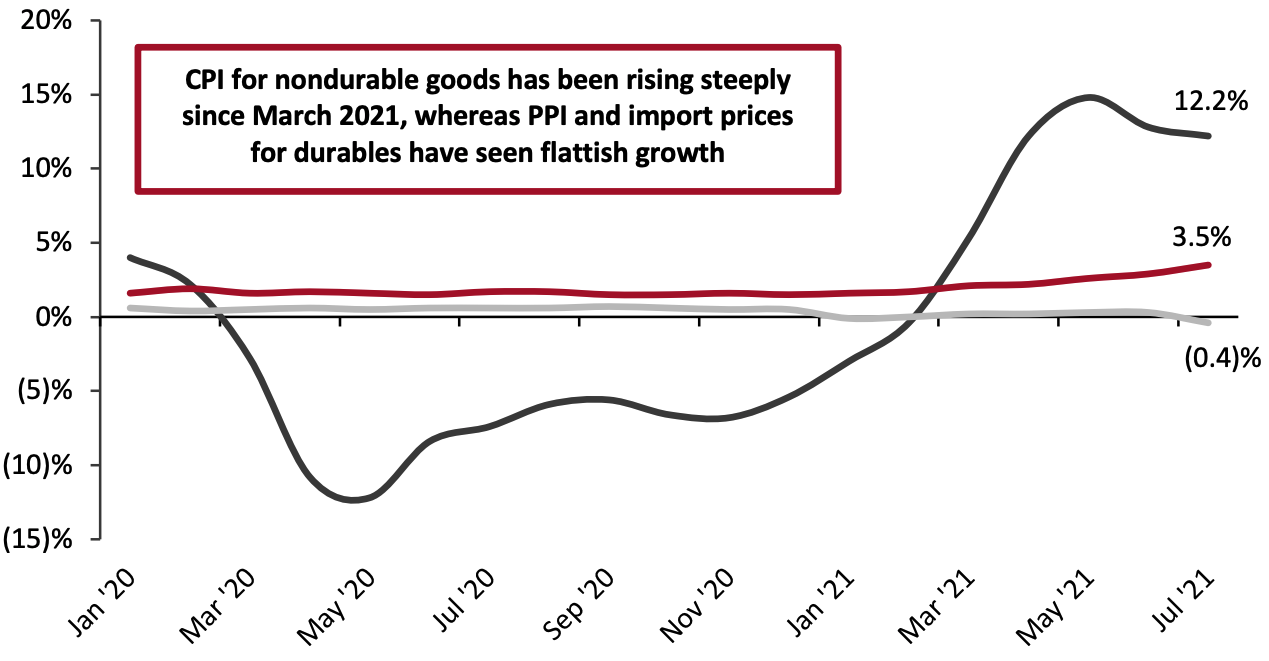

*For August, we have provided the average weekly prices for the first week of August and the fourth week of August (latest).Source: Freightos Baltic Index[/caption] Ongoing logjams and delayed clearing of cargo in situ will lead to further price rises. Some retailers are now stockpiling shipping capacity by booking up containers, further inflating prices. Others, including Home Depot and Walmart, have responded to surging prices and diminished capacity by chartering their own ships. However, according to Freightos, this strategy does not address the underlying problem, since it does not guarantee speedy processing at origin and destination ports—the real points of congestion. 3. Retailers Are Passing On Costs to Consumers Durables and nondurables have seen a sharp surge in year-over-year consumer price inflation (CPI) since March 2021, while producer prices (for domestically produced goods) and imports have seen steadier rises. CPI includes imports, although the increase in PPI and import prices is not proportionate to the increase in CPI. The stark disparity in the indices is explained by the fact that CPI reflects the selling prices of the finished products which include domestic operating costs such as in transport and marketing, whereas the PPI and import prices include the prices of raw materials or the parts that make the finished product. Retailers are able to absorb some cost rises, but the huge scale of pandemic-driven increases in shipping costs means that retailers will have little choice but to pass costs on to consumers through increased sales prices. Rising input costs and corresponding increases in consumer prices will result in lower disposable income for consumers. We may also see the effects of retailers trying to absorb a portion of these costs by cutting expenditure elsewhere, such as on marketing or staff.

Figure 2. US: Consumer, Producer and Import Price Inflation for Durable and Nondurable Consumer Goods (%)

[caption id="attachment_132066" align="aligncenter" width="700"]

[caption id="attachment_132066" align="aligncenter" width="700"] PPI and import prices are for end-use or final demand. CPI for nondurables excludes food and beverages, and PPI for nondurables excludes food and energy.

PPI and import prices are for end-use or final demand. CPI for nondurables excludes food and beverages, and PPI for nondurables excludes food and energy.Source: BLS/Coresight Research[/caption] According to Coresight Research analysis, the US government has paid out close to $1.7 trillion to consumers through stimulus checks, Child Tax Credit, food stamps and unemployment benefits, enabling consumers to cope with some inflation; for the time being, many consumers may not have significantly lower disposable income. Impact Analytics’ CEO, Prashant Agrawal, believes there are opportunities for retailers among the current supply chain challenges, and advises retailers to reset their pricing and promotion strategies now, as the demand and supply equation is favorable to them. Consumer demand is still strong, and many consumers have a build-up of unspent income; the present scenario presents a chance for retailers to reduce promotions and sharpen their pricing, enabling them to ride out the current disruption and profit once it has passed.

What We Think

As the threat of the Covid-19 Delta variant persists, supply chains continue to be strained and any closure of major ports has a cascading effect across other regions and aspects of the supply chain. Implications for Brands/Retailers- Companies that continue to incur rising input costs and pass them on to customers may see those customers eventually spending less as the increases erode their disposable income. Consumers may view the current time of rising prices as the most optimal to stock up in fear of future price rises, leading to further stockouts and supply crunches.

- Conversely, retailers that can are confident in continued consumer demand may be able to raise their prices now to offset their increased costs and enjoy greater margins once the disruption fades and supply costs return to normal.

- Real estate firms with properties near ports may be in demand, to store inventory that cannot board ships or vehicles for transport.

- Brands and retailers may seek out technology that helps increase visibility and predictability of disruptions. They may also seek ways to manage inventory in the most cost-effective manner and look toward technological platforms that can help with this effort.