DIpil Das

Introduction

What’s the Story? Our Supply Chain Briefing series examines issues in the retail chain and implications to the sector. In this report, we discuss the global impacts of the Russia-Ukraine war on supply chains, including a tighter freight market, a jump in oil prices and rising commodity prices. We also present FedEx’s new shipping container service designed to help ease US port congestion, plus other steps that supply chain stakeholders are taking to reduce or avoid future bottlenecks at US ports. Why It Matters Disruption in just one area of the supply chain can compound and ripple throughout the entire process due to the complexity and intertwinement of each stage. The pandemic brought supply chain planning under significant scrutiny—stakeholders must stay on top of the various factors causing disruptions and the means to mitigate their impacts. As the effects of Omicron subside for many retail supply chains and businesses’ recovery pick up pace, the Russia-Ukraine war has thrown a wrench in supply chains the world over. Some businesses will need to go back to the drawing board and rework their already revamped supply chain policies considering the latest developments.Air Freight Market To Brace for Impact of Russia-Ukraine Conflict as Oil and Commodity Prices Soar: Coresight Research Analysis

1. Sanctions on Airspace and Grounded Fleets Impacts Global Air Freight Rates Russia’s invasion of Ukraine on February 24 sparked a flurry of sanctions and other moves from countries and businesses across the world. Countries in the European Union (EU) were among the first to bar Russian airplanes from entering their airspace. In retaliation, Russia closed its airspace to 36 countries, including all 27 EU nations and the UK and Canada, on February 28 this year. The US government’s announcement followed days later, implementing a ban on Russian aircrafts—commercial and civil (including passenger, cargo and chartered flights) entering US airspace from March 2, 2022. The ban includes flights owned or operated “by, for, or for the benefit of, a person who is a citizen of Russia,” which has several implications to businesses, including retailers that use air freight for shipments due to longer flight routes and reduced capacity.- For example, German airline Lufthansa Cargo used to fly over Russia to Asian destinations but has since had to re-route to take longer courses to avoid Russia, requiring additional fuel. This supplementary fuel accounts for 10% of the flight’s maximum allowable carrying capacity. As such, the company expects a 10% loss in shipping capacity between Asia and Europe for its operations as well as for the industry, according to CEO Dorothea von Boxberg.

- For passenger flights, other airlines have also commented on longer flying times due to detours: Virgin Atlantic flight times between the UK and India may increase by anywhere from 15 minutes to one hour, while Finnair flights between Bangkok and Helsinki may be longer by about three hours, according to FlightRadar24 data charted by Reuters. Delta Air Lines, the third-largest passenger airline globally (by passenger traffic) in 2020 according to International Air Transport Association (IATA) data, announced on February 25, 2022, that it has suspended its partnership with Aeroflot, Russia’s largest airline, which ranked 17th worldwide by passenger traffic in 2020.

- Current airspace sanctions include a ban on Russian all-cargo carrier AirBridgeCargo Airlines, which ranked 16th in worldwide cargo traffic in 2020, according to IATA data.

- Reduced passenger and cargo flight capacity will likely drive up supply chain prices in the near term, and at least until sanctions are lifted. The belly hold area in passenger flights is sometimes used to carry cargo, so a reduction in passenger flights implies a further squeeze on cargo capacity.

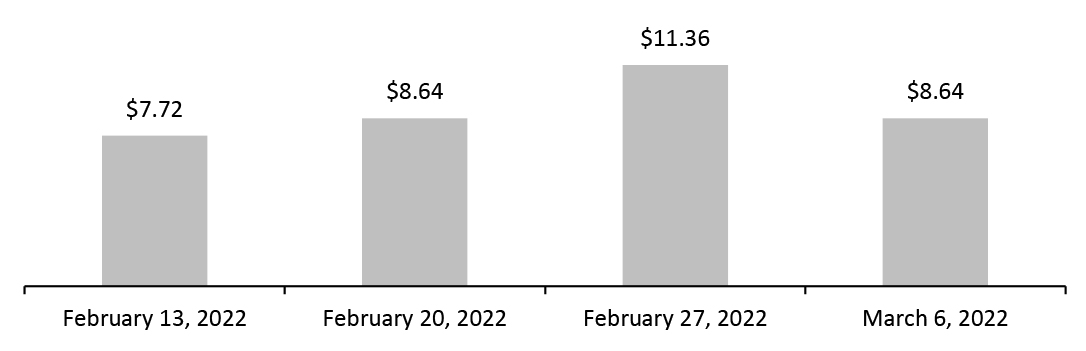

Figure 1. China to Europe: Average Weekly Air Cargo Prices per Kilogram [caption id="attachment_143027" align="aligncenter" width="700"]

Source: Freightos[/caption]

2. Impact of War Yet To Be Reflected in Ocean Freight

While there are likely to be several implications for ocean shipping of the war in Ukraine, we expect the impact to be delayed. Among several factors, this is due to capacity from air freight shortages being reallocated to ocean freight. We can also attribute this to re-routing of trade routes via the Black Sea, which is bordered by Russia, Ukraine and four other countries. Although the route is also not a major trade route for container shipping, various container lines have already announced that their carriers will use alternative routes to avoid passing through the Black Sea.

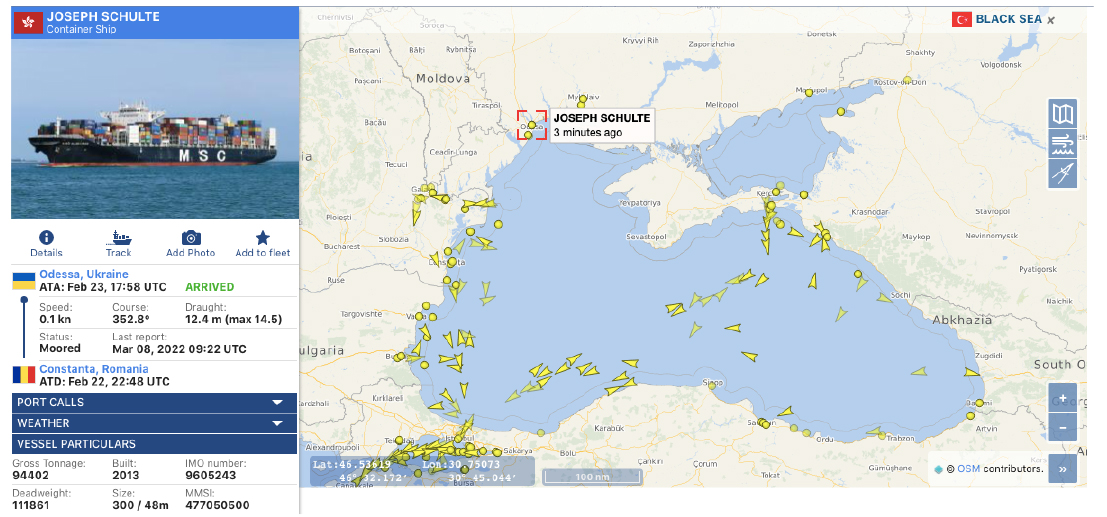

As of March 8, 2022, there is one container ship at the Ukrainian port of Odessa, which is named Joseph Schulte and operated by China’s state-run shipping firm Cosco. A cargo vessel named Bach, operated by private shipping company Borealis Maritime was at the port at the time of invasion; however, its current status is unclear. A third container vessel, Hansa Limburg, which is operated by German shipping company Hapag-Lloyd managed to get safe passage out of the Black Sea following the invasion.

Container vessels rarely go from an origin to a single destination; they tend to have multiple stops along the way, offloading and loading various quantities of cargo. If there are subsequent delays from re-routing or using alternative routes to pick up and deliver such cargo, it could impact deliveries and pickups later down the line. This comes just as global shipping routes are finally unclogging and returning to some semblance of order and ocean freight rates seem to be stabilizing. Nevertheless, we think the impact of re-routing ships that typically use Black Sea routes will be felt in due course.

[caption id="attachment_143028" align="aligncenter" width="700"]

Source: Freightos[/caption]

2. Impact of War Yet To Be Reflected in Ocean Freight

While there are likely to be several implications for ocean shipping of the war in Ukraine, we expect the impact to be delayed. Among several factors, this is due to capacity from air freight shortages being reallocated to ocean freight. We can also attribute this to re-routing of trade routes via the Black Sea, which is bordered by Russia, Ukraine and four other countries. Although the route is also not a major trade route for container shipping, various container lines have already announced that their carriers will use alternative routes to avoid passing through the Black Sea.

As of March 8, 2022, there is one container ship at the Ukrainian port of Odessa, which is named Joseph Schulte and operated by China’s state-run shipping firm Cosco. A cargo vessel named Bach, operated by private shipping company Borealis Maritime was at the port at the time of invasion; however, its current status is unclear. A third container vessel, Hansa Limburg, which is operated by German shipping company Hapag-Lloyd managed to get safe passage out of the Black Sea following the invasion.

Container vessels rarely go from an origin to a single destination; they tend to have multiple stops along the way, offloading and loading various quantities of cargo. If there are subsequent delays from re-routing or using alternative routes to pick up and deliver such cargo, it could impact deliveries and pickups later down the line. This comes just as global shipping routes are finally unclogging and returning to some semblance of order and ocean freight rates seem to be stabilizing. Nevertheless, we think the impact of re-routing ships that typically use Black Sea routes will be felt in due course.

[caption id="attachment_143028" align="aligncenter" width="700"] Container vessel Joseph Schulte and its position at Odessa, Ukraine, and other cargo ships in the Black Sea, as of March 8, 2022

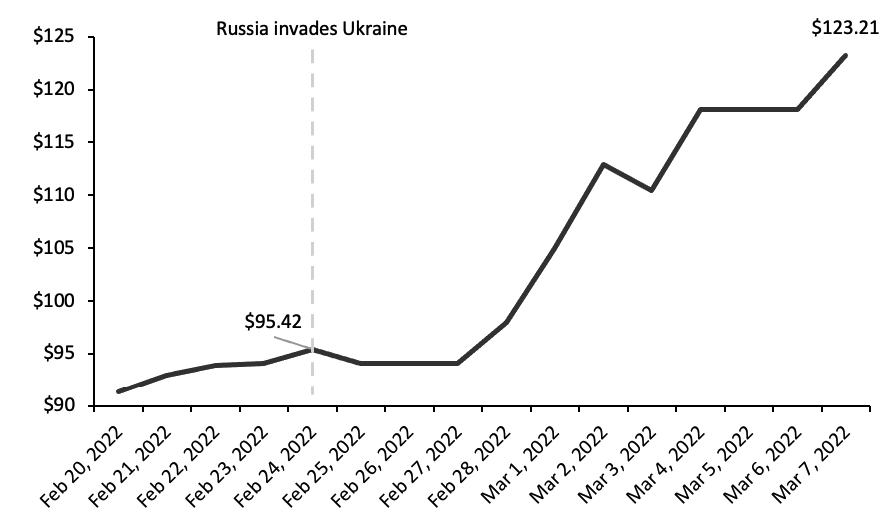

Container vessel Joseph Schulte and its position at Odessa, Ukraine, and other cargo ships in the Black Sea, as of March 8, 2022 Source: Vesselfinder.com [/caption] 3. Oil Prices Breach $100 Mark—Threatening Further Inflation Brent Crude oil, the global benchmark for two-thirds of oil pricing, has seen rising rates since Russia’s invasion of Ukraine with a jump of 30% since, taking the barrel price to $123.21 as of March 7, 2022. The last time oil prices crossed $100 per barrel was in 2014. The increase in oil prices will have major cross-industry repercussions. Generally, a $10 rise in the price of a barrel of oil leads to a 0.2 percentage-point increase in inflation and a 0.1 percentage-point hit to growth, according to US Federal Reserve Chair Jerome Powell.

Figure 2. Brent Crude Oil Historical Prices [caption id="attachment_143030" align="aligncenter" width="700"]

Source: Intercontinental Exchange/S&P Capital IQ[/caption]

Russia is the world’s third-largest oil producer (including crude oil, all other petroleum liquids and biofuels), according to 2020 data from the US Energy Information Administration (EIA). uncertainty around global sanctions on Russian energy supply is fueling oil price rises.

On March 8, 2022, the US government announced a ban on Russian oil imports. In 2021, Russian crude oil accounted for a relatively minor 3% of US crude oil imports and only 1% of total crude oil processed by US refineries, according to the American Fuel and Petrochemical Manufacturers trade association. Due to geographical challenges, the US West Coast in particular is dependent on light sweet crude oil imported from several countries, including Russia.

Aside from US sanctions, if other countries take similar steps, a ban on Russian oil imports would equate to a reduction in global supply by the 11% it accounts for, according to the EIA.

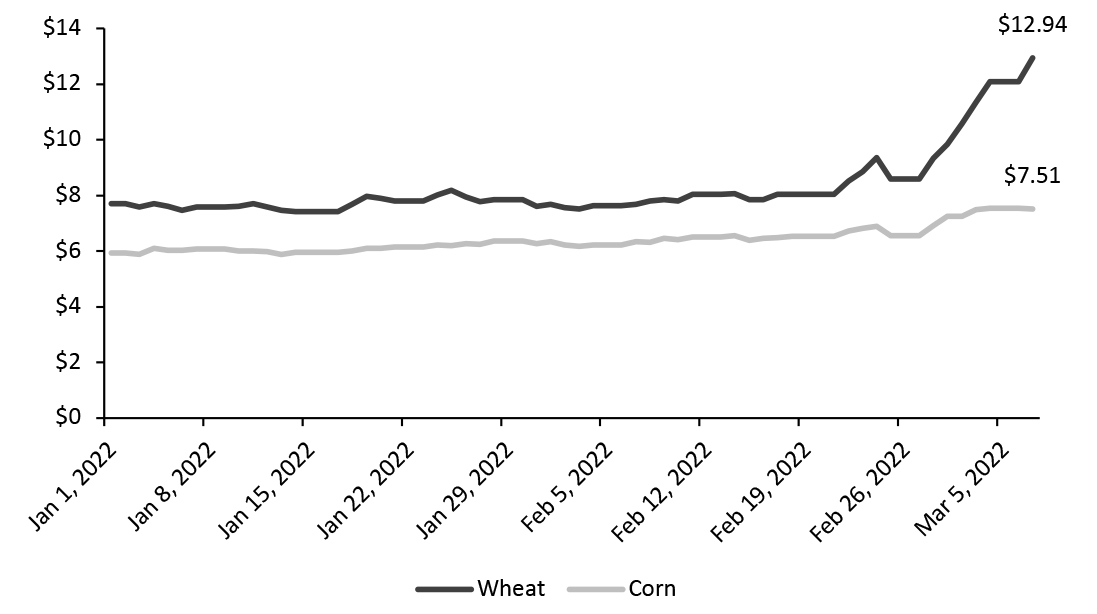

The conflict is also impacting other exports beyond oil. Ukraine is a major global exporter of wheat, corn and other grains. In 2021, it accounted for 11.5% of global wheat exports and 17.2% of global corn exports, according to the US Department of Agriculture. The war has diminished its harvest this year, sending international grain markets to a 14-year high.

As of March 7, 2022, wheat prices closed at $12.94 per bushel and corn at $7.51 per bushel, on the Chicago Board of Trade (CBOT). Wheat prices are up 68% and corn prices are up 27% from their prices at the start of the year.

Source: Intercontinental Exchange/S&P Capital IQ[/caption]

Russia is the world’s third-largest oil producer (including crude oil, all other petroleum liquids and biofuels), according to 2020 data from the US Energy Information Administration (EIA). uncertainty around global sanctions on Russian energy supply is fueling oil price rises.

On March 8, 2022, the US government announced a ban on Russian oil imports. In 2021, Russian crude oil accounted for a relatively minor 3% of US crude oil imports and only 1% of total crude oil processed by US refineries, according to the American Fuel and Petrochemical Manufacturers trade association. Due to geographical challenges, the US West Coast in particular is dependent on light sweet crude oil imported from several countries, including Russia.

Aside from US sanctions, if other countries take similar steps, a ban on Russian oil imports would equate to a reduction in global supply by the 11% it accounts for, according to the EIA.

The conflict is also impacting other exports beyond oil. Ukraine is a major global exporter of wheat, corn and other grains. In 2021, it accounted for 11.5% of global wheat exports and 17.2% of global corn exports, according to the US Department of Agriculture. The war has diminished its harvest this year, sending international grain markets to a 14-year high.

As of March 7, 2022, wheat prices closed at $12.94 per bushel and corn at $7.51 per bushel, on the Chicago Board of Trade (CBOT). Wheat prices are up 68% and corn prices are up 27% from their prices at the start of the year.

Figure 3. CBOT Wheat and Corn Future Contract Prices, per Bushel [caption id="attachment_143031" align="aligncenter" width="700"]

Source: CBOT/S&P Capital IQ[/caption]

As commodity trading involves speculation on future prices, uncertainty amid the continuing war is weighing heavily on the global commodity market, supply and demand forces, and, ultimately, inflation.

Russia is also a major global supplier of aluminum, which is used to make soda cans and food tins, as well as potash, a compound used to make fertilizer. Sanctioning exports of these may have repercussions on food manufacturing and farming respectively, with these hits eventually trickling down to consumers.

4. FedEx Begins Congestion Bypass Service

Carrier giant and major supply chain stakeholder FedEx is doing its bit to help ease some of the bottlenecks choking the US supply chain. FedEx launched a service in January to offer empty space on its 53-foot containers imported from China to shippers that wish to avoid congestion. FedEx typically imports the containers for use in its domestic less-than-truckload (LTL) or small-sized shipping loads division named FedEx Freight.

FedEx will also take the imports from a chartered ship in its fleet into Port Hueneme, California, to avoid the bottlenecks at the larger ports of Los Angeles and Long Beach. This will cut transit times by 20 days, according to FedEx CEO Udo Lange. The company has been trialing this with one ship per month for three months as January this year.

Source: CBOT/S&P Capital IQ[/caption]

As commodity trading involves speculation on future prices, uncertainty amid the continuing war is weighing heavily on the global commodity market, supply and demand forces, and, ultimately, inflation.

Russia is also a major global supplier of aluminum, which is used to make soda cans and food tins, as well as potash, a compound used to make fertilizer. Sanctioning exports of these may have repercussions on food manufacturing and farming respectively, with these hits eventually trickling down to consumers.

4. FedEx Begins Congestion Bypass Service

Carrier giant and major supply chain stakeholder FedEx is doing its bit to help ease some of the bottlenecks choking the US supply chain. FedEx launched a service in January to offer empty space on its 53-foot containers imported from China to shippers that wish to avoid congestion. FedEx typically imports the containers for use in its domestic less-than-truckload (LTL) or small-sized shipping loads division named FedEx Freight.

FedEx will also take the imports from a chartered ship in its fleet into Port Hueneme, California, to avoid the bottlenecks at the larger ports of Los Angeles and Long Beach. This will cut transit times by 20 days, according to FedEx CEO Udo Lange. The company has been trialing this with one ship per month for three months as January this year.

What We Think

Just as the global supply chain was recovering from the ravages of the pandemic, albeit coping with high costs and inflation, it has been hit by the effects of the Russia-Ukraine war, making future recovery doubly challenging. Implications for Brands/Retailers- A tighter air cargo market will particularly impact UK and European retailers that rely on airfreight for quick delivery of goods. UK retailers ASOS and Boohoo already incurred high costs in 2021 due to elevated freight rates, and a tighter air freight market may pressure their margins further.

- High oil prices will translate to high fuel costs for air freight and ocean shipping; while there is isolated volatility in airfreight rates already, the current stability in ocean freight rates may be short lived.

- High oil and commodity prices will affect several sectors, including consumer packaged goods (CPG) companies, food manufacturers and producers, farmers, and food retailers.