Nitheesh NH

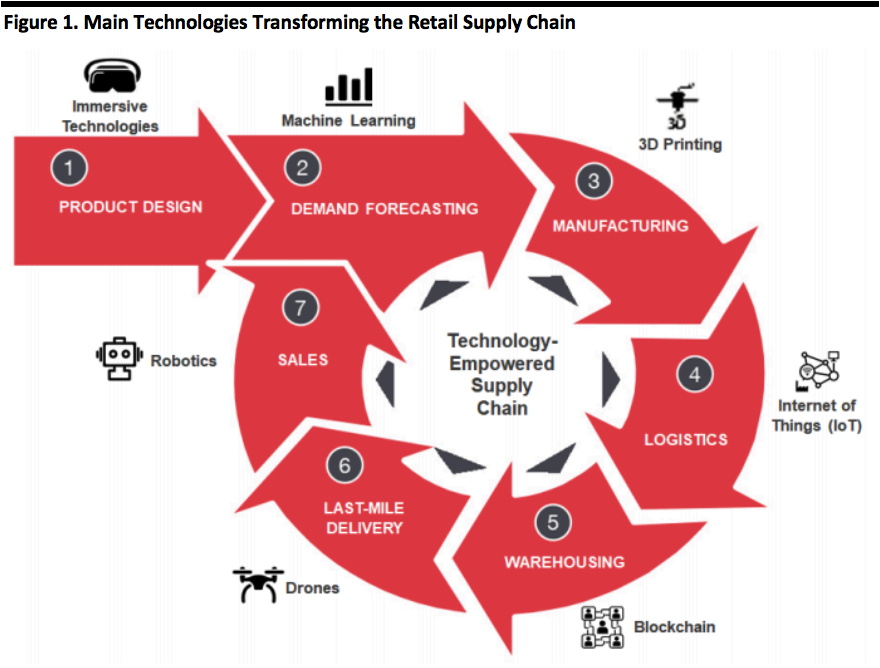

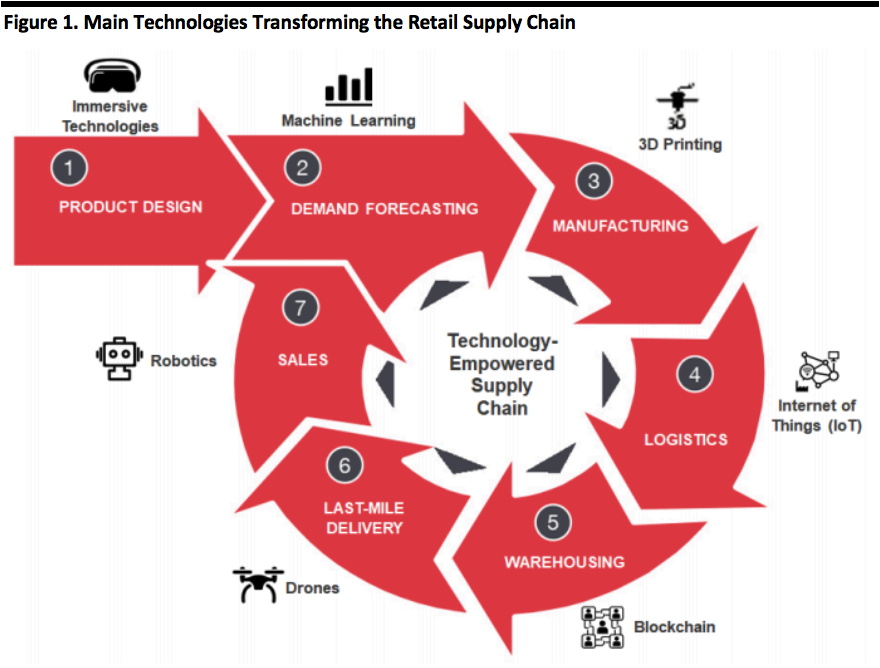

Our Supply Chain Briefing series looks at how technology is transforming the various stages of the retail supply chain. Below, we illustrate the seven major components of the retail supply chain and some of the technologies that can support processes at various stages—from product design to end consumer.

[caption id="attachment_101074" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Predicting Demand in Retail

Predictive analytics generate intelligence based on data on historical business performance and relevant external factors—such as weather, economic indicators, calendar events and seasonality. Some technology vendors help retailers forecast demand based on search behavior or trends on social media platforms.

The outputs help retailers and brands better anticipate demand, plan orders to suppliers and decide the stock levels—and to take corrective action when needed. Companies can anticipate consumer preferences and adapt marketing and promotions, pricing and product assortment accordingly.

Companies Are Convinced

A 2019 survey of 450 professionals from companies across a number of US industries by trade organization MHI and Deloitte found 30% of respondents use predictive analytics technology, up from 23% in 2015. That 2019 survey found fully 90% of respondents thought predictive analytics will have an impact on the supply chain in the next 10 years—making it one of the technologies ranked highest in terms of expected impact on the supply chain in the survey.

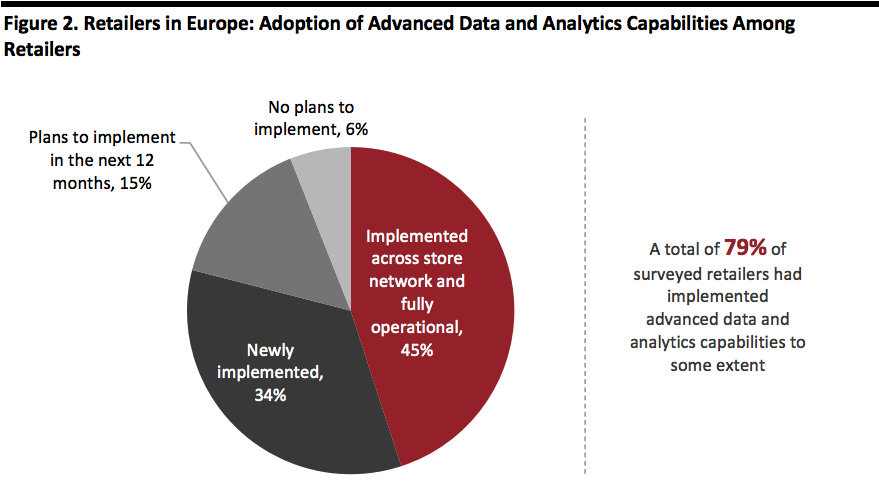

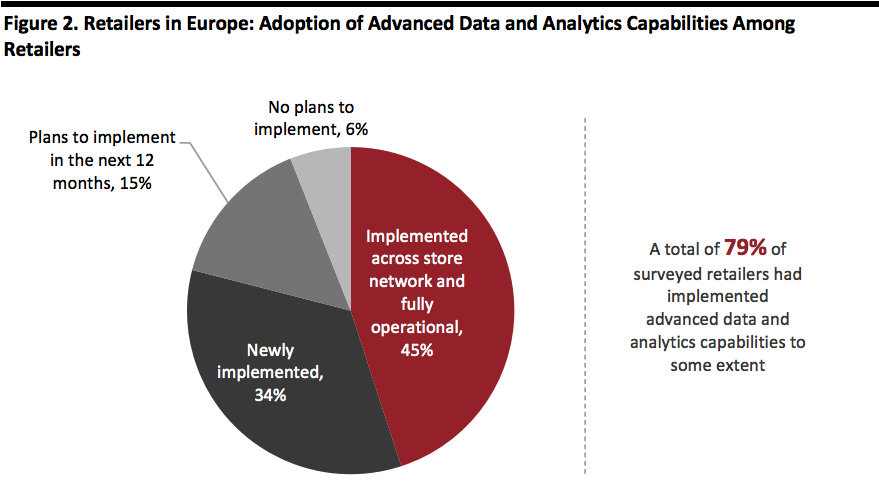

A 2019 Coresight Research and Salesforce survey of 500 retailers in Europe found close to half had fully implemented and rolled out advanced data and analytics capabilities, and that a further third had recently implemented these capabilities (see chart below). Advanced data and analytics is a broader category within which predictive analytics falls.

[caption id="attachment_101075" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Predicting Demand in Retail

Predictive analytics generate intelligence based on data on historical business performance and relevant external factors—such as weather, economic indicators, calendar events and seasonality. Some technology vendors help retailers forecast demand based on search behavior or trends on social media platforms.

The outputs help retailers and brands better anticipate demand, plan orders to suppliers and decide the stock levels—and to take corrective action when needed. Companies can anticipate consumer preferences and adapt marketing and promotions, pricing and product assortment accordingly.

Companies Are Convinced

A 2019 survey of 450 professionals from companies across a number of US industries by trade organization MHI and Deloitte found 30% of respondents use predictive analytics technology, up from 23% in 2015. That 2019 survey found fully 90% of respondents thought predictive analytics will have an impact on the supply chain in the next 10 years—making it one of the technologies ranked highest in terms of expected impact on the supply chain in the survey.

A 2019 Coresight Research and Salesforce survey of 500 retailers in Europe found close to half had fully implemented and rolled out advanced data and analytics capabilities, and that a further third had recently implemented these capabilities (see chart below). Advanced data and analytics is a broader category within which predictive analytics falls.

[caption id="attachment_101075" align="aligncenter" width="700"] Base: 500 retail executives based in the Netherlands, Germany, France, the UK, Spain, Italy, Denmark, Sweden and Norway, surveyed in August 2019

Base: 500 retail executives based in the Netherlands, Germany, France, the UK, Spain, Italy, Denmark, Sweden and Norway, surveyed in August 2019

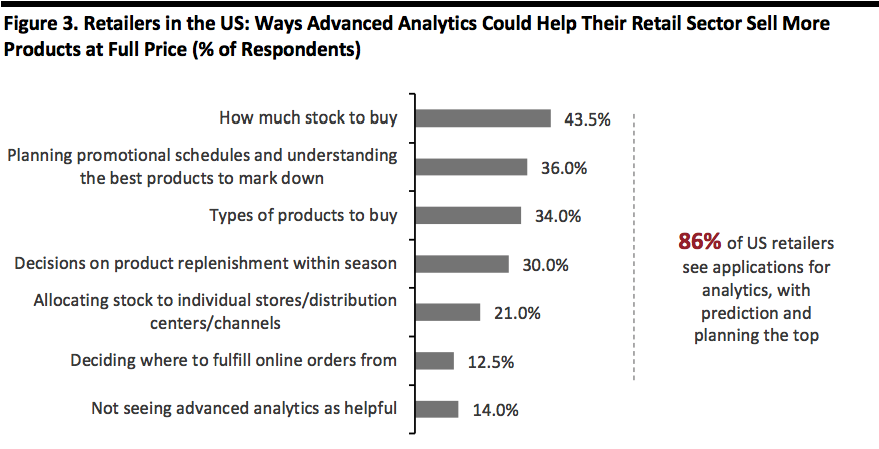

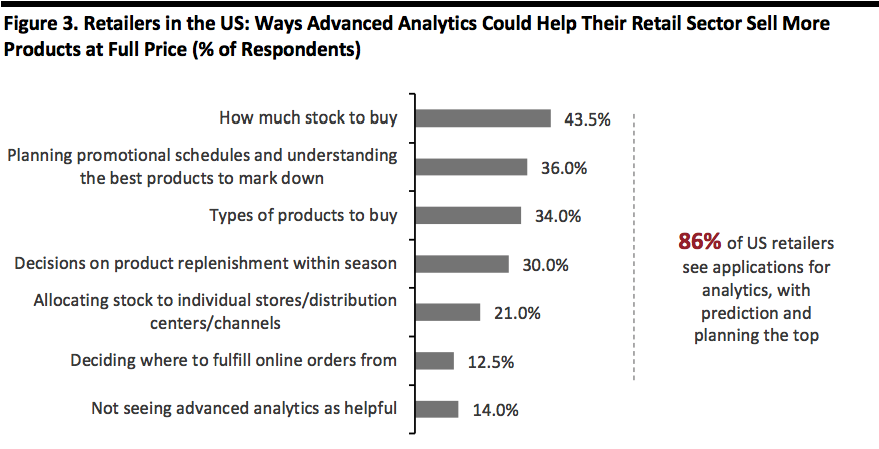

Source: Salesforce/Coresight Research[/caption] A 2018 Coresight Research survey asked US retailers how they thought advanced analytics could help their retail sector sell more products at full price. Fully 86% saw a use case for advanced analytics, with predictive support in terms of planning stock, promotions and products the top drivers for adoption. [caption id="attachment_101076" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options

Base: 200 decision makers in US retail companies, surveyed in October 2018

Source: Celect/Coresight Research[/caption] The demand for predictive capabilities is reflected in NIKE’s 2019 acquisition of predictive analytics firm Celect. The company’s platform generates insights that allow retailers to optimize inventory, including through “hyper-local” demand predictions. Eric Sprunk, NIKE Chief Operating Officer, explained “As demand for our product grows, we must be insight-driven, data-optimized and hyper-focused on consumer behavior.” As we outlined in our July 2019 Coresight Matrix, the vendor landscape for inventory optimization software includes tech giants such as IBM, Infor, Microsoft, NCR, Oracle, SAP and SAS, and a mix of innovators. And as we discussed in our recent Retail-Tech Landscape, disruptors and innovators in demand forecasting include names such as Adeptmind, Breinify, Everywear, Gfaive, Heuritech and LoyaltyLab. Key Insights The days of retailers basing operational decisions on gut instinct or making those decisions reactively look to be coming to a close. As longstanding retailers and brands seek to compete with newer rivals on a data-driven basis, we expect to see more legacy companies partner with established technology vendors and disruptors, or build in-house capabilities through the acquisition of predictive analytics specialist firms.

Source: Coresight Research[/caption]

Predicting Demand in Retail

Predictive analytics generate intelligence based on data on historical business performance and relevant external factors—such as weather, economic indicators, calendar events and seasonality. Some technology vendors help retailers forecast demand based on search behavior or trends on social media platforms.

The outputs help retailers and brands better anticipate demand, plan orders to suppliers and decide the stock levels—and to take corrective action when needed. Companies can anticipate consumer preferences and adapt marketing and promotions, pricing and product assortment accordingly.

Companies Are Convinced

A 2019 survey of 450 professionals from companies across a number of US industries by trade organization MHI and Deloitte found 30% of respondents use predictive analytics technology, up from 23% in 2015. That 2019 survey found fully 90% of respondents thought predictive analytics will have an impact on the supply chain in the next 10 years—making it one of the technologies ranked highest in terms of expected impact on the supply chain in the survey.

A 2019 Coresight Research and Salesforce survey of 500 retailers in Europe found close to half had fully implemented and rolled out advanced data and analytics capabilities, and that a further third had recently implemented these capabilities (see chart below). Advanced data and analytics is a broader category within which predictive analytics falls.

[caption id="attachment_101075" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Predicting Demand in Retail

Predictive analytics generate intelligence based on data on historical business performance and relevant external factors—such as weather, economic indicators, calendar events and seasonality. Some technology vendors help retailers forecast demand based on search behavior or trends on social media platforms.

The outputs help retailers and brands better anticipate demand, plan orders to suppliers and decide the stock levels—and to take corrective action when needed. Companies can anticipate consumer preferences and adapt marketing and promotions, pricing and product assortment accordingly.

Companies Are Convinced

A 2019 survey of 450 professionals from companies across a number of US industries by trade organization MHI and Deloitte found 30% of respondents use predictive analytics technology, up from 23% in 2015. That 2019 survey found fully 90% of respondents thought predictive analytics will have an impact on the supply chain in the next 10 years—making it one of the technologies ranked highest in terms of expected impact on the supply chain in the survey.

A 2019 Coresight Research and Salesforce survey of 500 retailers in Europe found close to half had fully implemented and rolled out advanced data and analytics capabilities, and that a further third had recently implemented these capabilities (see chart below). Advanced data and analytics is a broader category within which predictive analytics falls.

[caption id="attachment_101075" align="aligncenter" width="700"] Base: 500 retail executives based in the Netherlands, Germany, France, the UK, Spain, Italy, Denmark, Sweden and Norway, surveyed in August 2019

Base: 500 retail executives based in the Netherlands, Germany, France, the UK, Spain, Italy, Denmark, Sweden and Norway, surveyed in August 2019Source: Salesforce/Coresight Research[/caption] A 2018 Coresight Research survey asked US retailers how they thought advanced analytics could help their retail sector sell more products at full price. Fully 86% saw a use case for advanced analytics, with predictive support in terms of planning stock, promotions and products the top drivers for adoption. [caption id="attachment_101076" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 200 decision makers in US retail companies, surveyed in October 2018

Source: Celect/Coresight Research[/caption] The demand for predictive capabilities is reflected in NIKE’s 2019 acquisition of predictive analytics firm Celect. The company’s platform generates insights that allow retailers to optimize inventory, including through “hyper-local” demand predictions. Eric Sprunk, NIKE Chief Operating Officer, explained “As demand for our product grows, we must be insight-driven, data-optimized and hyper-focused on consumer behavior.” As we outlined in our July 2019 Coresight Matrix, the vendor landscape for inventory optimization software includes tech giants such as IBM, Infor, Microsoft, NCR, Oracle, SAP and SAS, and a mix of innovators. And as we discussed in our recent Retail-Tech Landscape, disruptors and innovators in demand forecasting include names such as Adeptmind, Breinify, Everywear, Gfaive, Heuritech and LoyaltyLab. Key Insights The days of retailers basing operational decisions on gut instinct or making those decisions reactively look to be coming to a close. As longstanding retailers and brands seek to compete with newer rivals on a data-driven basis, we expect to see more legacy companies partner with established technology vendors and disruptors, or build in-house capabilities through the acquisition of predictive analytics specialist firms.