Source: Company reports

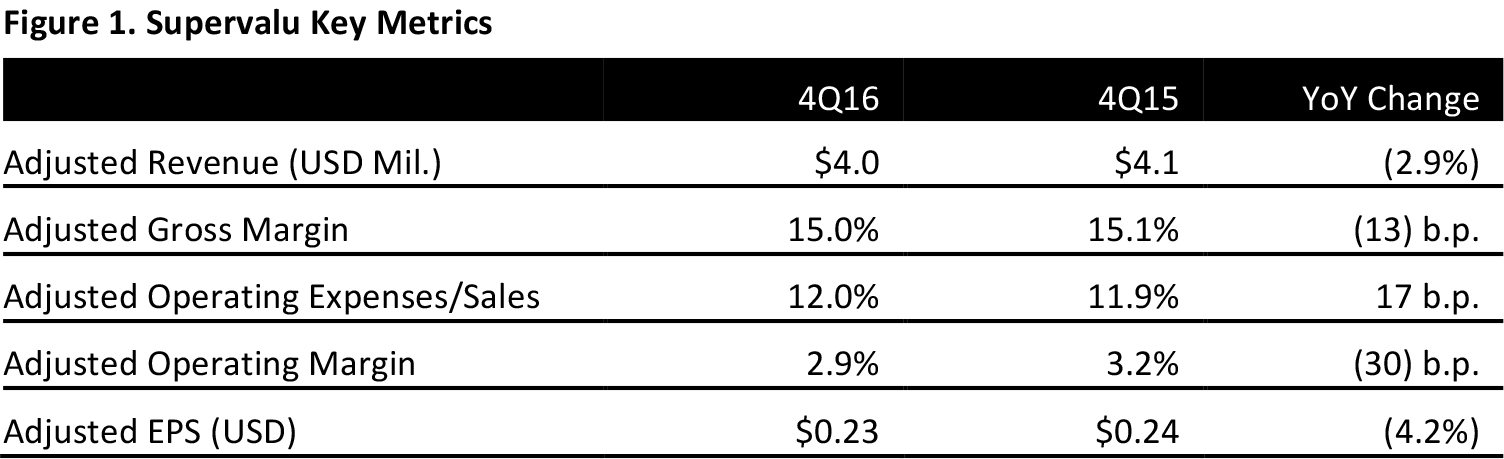

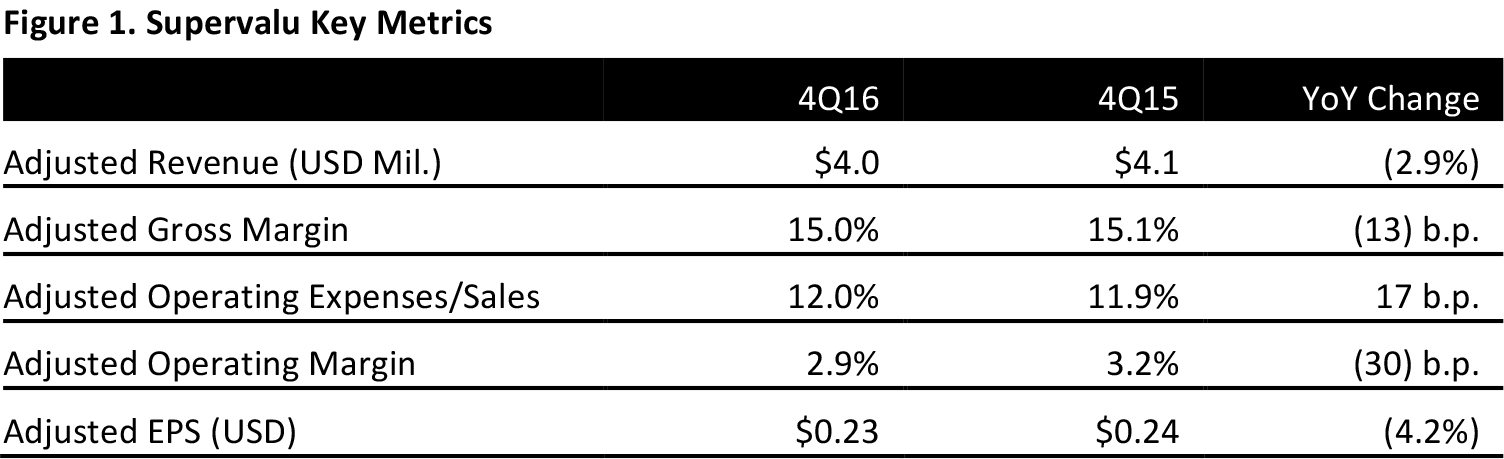

FISCAL 4Q16 RESULTS

Supervalu reported net sales of $4.0 billion, compared to $4.1 billion in the year-ago quarter and excluding the additional week in fiscal 2015, which accounted for $313 million in net sales. Comparable-store sales declined across all of the company’s divisions.

The wholesale division reported revenues (excluding the additional week in 2015) of $1.7 billion, down 4.8% year over year, owing to lost accounts and lower sales from existing customers, partially offset by increased sales from new customers. GAAP operating earnings fell to $50 million from $60 million, due to higher employee costs. The wholesale division accounted for 44% of total revenue.

Grocery discount chain, Save-A-Lot, reported adjusted revenues of $1.1 billion, down 0.8% from the year-ago quarter. The decrease was impacted by closed stores, partially offset by increased sales from new corporate and licensed stores. Save-A-Lot same store sales were down 2.2%. GAAP operating earnings were $25 million, down from $50 million a year ago, driven by higher store occupancy and employee costs.

The retail division reported revenues of $1.1 billion, down 2.6% year over year, driven by (3.9%) comps, which were partially offset by sales from new stores. GAAP operating earnings in the quarter were $30 million, down from $44 million a year ago. Higher employee costs and lower base margins hurt profitability.

Supervalu cut its selling and administrative costs by about 7%, and lower interest expense and income-tax provisions versus a year ago were a significant contributor to net earnings.

FISCAL 2016 RESULTS

Net sales in 2016 were $17.5 billion, down 2.2% from $17.9 billion in 2015. The Wholesale division’s sales were $7.9 billion, down 3.2%. Save-A-Lot reported sales of $4.6 billion which was slightly down by 0.4%. Retail sales were $4.8 billion, down 2.4%. These figures are unadjusted for the extra week in 2015. GAAP EPS from continuing operations was $0.63, compared to $0.45 in the prior year.

GUIDANCE

The decrease in same-store sales at Save-A-Lot could affect the company’s plans to spin off that business. The company in February named Mark Gross its new CEO, adding an experienced industry veteran to possibly facilitate the spin-off of its deep-discount chain. No earnings guidance was provided.