Source: Company reports/Fung Global Retail & Technology

2Q17 RESULTS

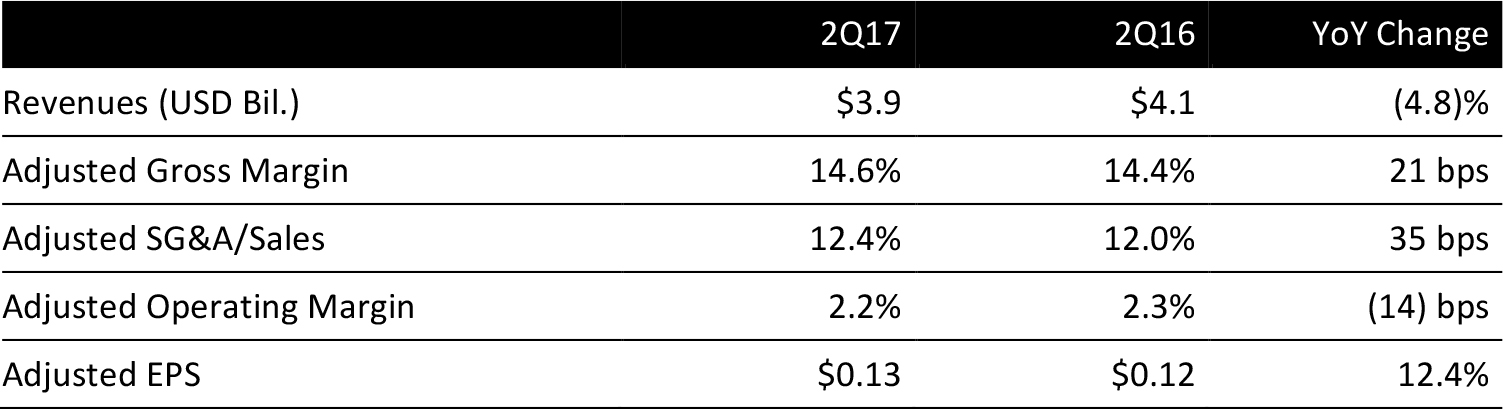

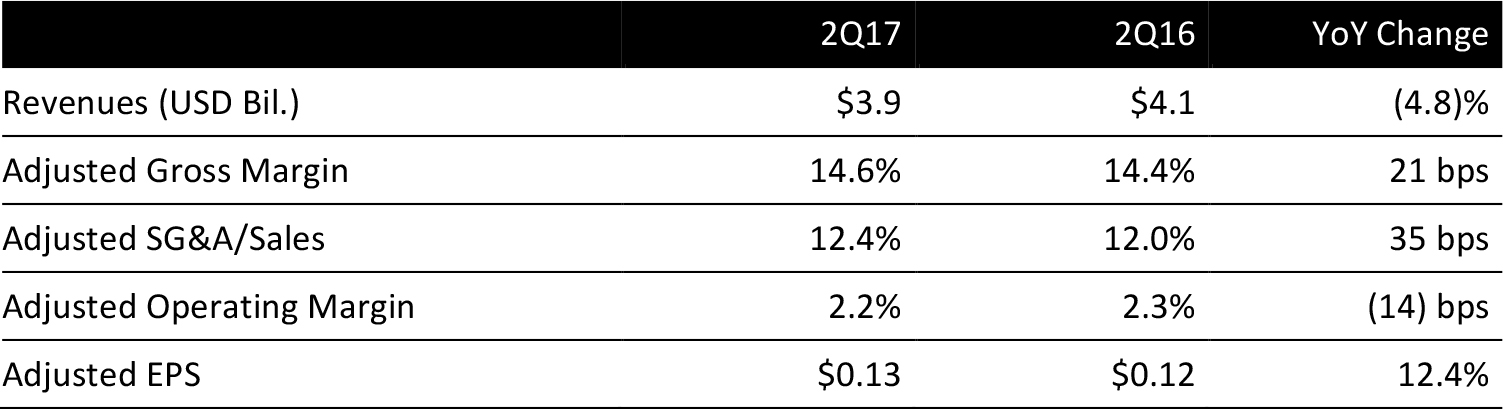

Supervalu reported fiscal 2Q17 revenues of $3.87 billion, down 4.8% year over year and slightly below the $3.95 billion consensus estimate. Same-store sales were negative for the Wholesale segment, the Retail segment, at Save-A-Lot and for corporate stores within the Save-A-Lot network. Fees from transition service agreements were down year over year.

Adjusted EPS was $0.13, ahead of the $0.10 consensus estimate and up 12.4% year over year; the figure excludes $6 million of after-tax costs for severance and the separation of Save-A-Lot. GAAP EPS from continuing operations was $0.10.

By Segment

- Wholesale net sales were $1.7 billion, down 5.5% year over year. The decrease was due to stores no longer supplied by the company, and was partially offset by higher sales to new stores.

- Save-A-Lot sales were $1.1 billion, down 2.8% year over year, driven by a 5.2% decline in same-store sales that was partially offset by new corporate and licensed stores.

- Retail sales were $1.0 billion, down 5.4% year over year, driven by a 5.9% decline in same-store sales that was partially offset by the addition of new stores.

- Corporate fees amounted to $41 million, compared with $48 million in the year-ago quarter.

SALE OF SAVE-A-LOT

On October 17, Supervalu announced the signing of an agreement to sell Save-A-Lot to an affiliate of Onex Corporation for $1.365 billion in cash. The two companies will enter into a five-year professional services agreement, and the deal is expected to close by January 31, 2017. Supervalu plans to use at least $750 million of the proceeds to prepay a portion of its outstanding loan balance, with the remainder earmarked for improvements to its capital structure and for corporate and growth initiatives.

OUTLOOK

On September 8, the company reduced its full-year outlook for adjusted EBITDA to 5.0% below last year’s figure. The revision was based on the Wholesale segment’s positive contribution, which was offset by softer performance in the Retail and Save-A-Lot segments in the second quarter.

Adjusted EBITDA was $771 million in fiscal year 2016.

Consensus estimates prior to the earnings report called for $17.3 billion in full-year revenue and EPS of $0.63.