DIpil Das

Introduction

China’s booming economy and increasingly affluent younger generation presents huge opportunities for Western brands, but tapping into that potential can be daunting. There is already fierce competition, there are language and cultural barriers, differences in business culture and an opaque regulatory environment. In many cases, international brands and retailers turn to advisors with expertise in China for advice on how to approach the market and to established providers for operational support: China’s consumer market is so different that it’s unlikely companies will succeed by simply replicating what they do at home or in other export markets.

This guide aims to provide introductory information on how Western retailers can tap into the power of China’s online marketplaces to enter and expand in the fast-growing market. In particular, this guide provides an overview of e-commerce giant Alibaba’s platforms under the Tmall brand.

Enter and Expand into China Through Marketplaces

Online marketplaces that feature imported goods and international sellers are popular among consumers in China. Alibaba’s cross-border platform Tmall Global was cited as the most popular channel for buying imported products by 58.2% of the 2,253 people who responded to an iiMedia Research survey.

China’s e-commerce is also highly concentrated: Top players Tmall and JD.com accounted for 60% and 26%, respectively, of GMV in the online retail B2C market in China in the third quarter of 2018, according to insight providers China Internet Watch and Analysis. That leaves only a 14% market share split among the smaller players. This makes online marketplaces a valuable channel for international brands and retailers looking to expand into China – and the dominance of a couple of players means that working with one partner can deliver considerable market reach.

Why Alibaba?

Alibaba is the world’s largest online and mobile commerce company, with some 700 million monthly active users as of December 2018, according to the company.

Alibaba offers international brands and retailers looking to expand into China an umbrella of platforms and support services. According to the company, the biggest advantages of Alibaba include:

International brands on Tmall.com

International brands on Tmall.com

Source: Tmall.com [/caption] Tmall handles billions of transactions every month, including online shopping, digital payments, order fulfillment and a variety of daily services. This combination delivers significant insight into consumer behavior and trends in China. Tmall Global (tmall.hk) is a dedicated channel for cross-border e-commerce — i.e., it sells imported products. Tmall Global enables medium- to larger-sized international brands and retailers with existing brand awareness in China but no local operations to build virtual storefronts to sell and ship products into China. [caption id="attachment_84630" align="aligncenter" width="720"] International brands on Tmall.hk

International brands on Tmall.hk

Source: Tmall.hk [/caption] Launched in 2014, Tmall Global has grown into one of the largest and most comprehensive cross-border B2C online marketplaces targeting the China market. The platform carries more than 18,000 brands and 3,900 categories of imported goods from 75 countries and regions, according to the company. [caption id="attachment_84631" align="aligncenter" width="720"] Source: Alibaba/Coresight Research[/caption]

The advantages for international firms selling on Tmall Global include:

Source: Alibaba/Coresight Research[/caption]

The advantages for international firms selling on Tmall Global include:

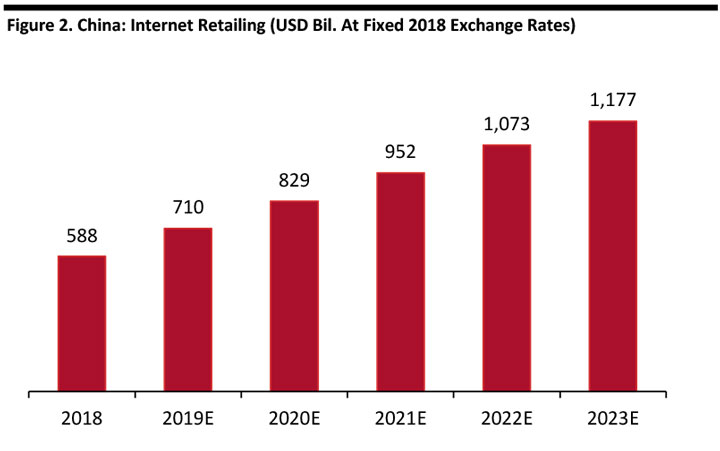

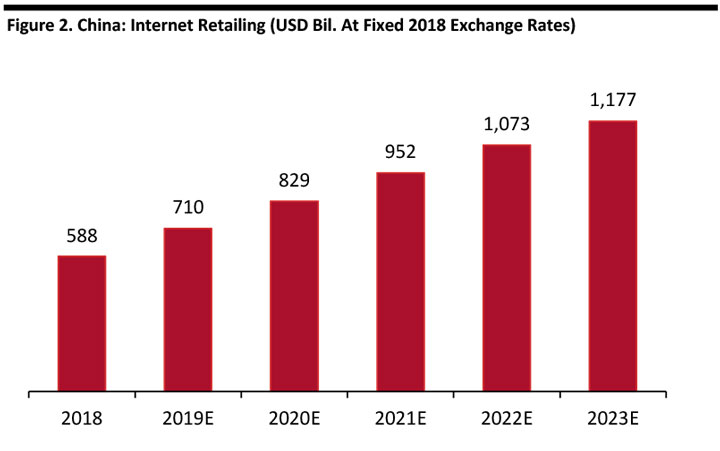

Source: Euromonitor International [/caption]

Chinese demand for imported international brands has created a huge, high-growth market for imports sold online. eMarketer estimates the market grew by 27.6% in 2017 (latest) and forecasts a 15.3% year-over-year rise in cross-border e-commerce sales for 2018.

A number of factors are boosting consumer demand for imported goods, including:

Source: Euromonitor International [/caption]

Chinese demand for imported international brands has created a huge, high-growth market for imports sold online. eMarketer estimates the market grew by 27.6% in 2017 (latest) and forecasts a 15.3% year-over-year rise in cross-border e-commerce sales for 2018.

A number of factors are boosting consumer demand for imported goods, including:

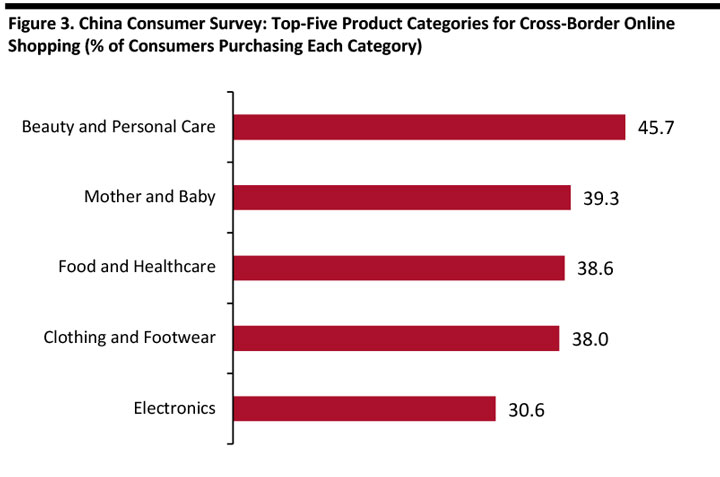

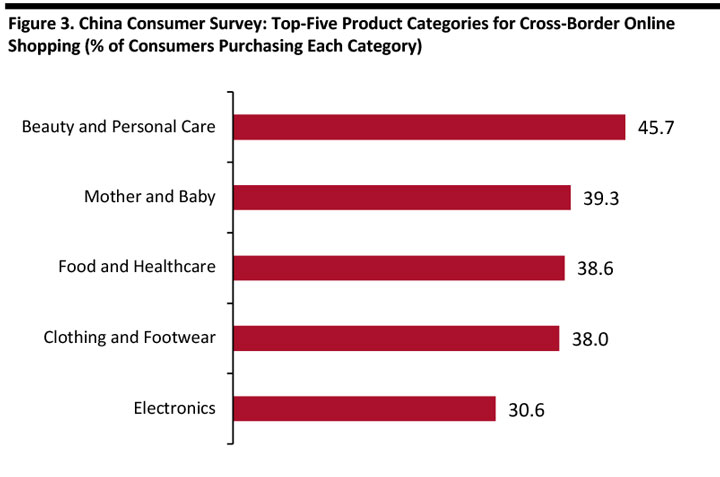

Base: 1,596 Chinese Internet users, surveyed in 2016.

Base: 1,596 Chinese Internet users, surveyed in 2016.

Source: iResearch [/caption] Conclusion Tmall platforms offer Western companies a valuable channel to access consumers in China, with different options depending on level of presence in the market, such as Tmall or Tmall Global (depending on whether they have operations in China or not), and to smaller firms through TOF and TDI. China is a large, fast growing and fast-changing consumer market that largely works with unique dynamics compared to other markets. International brands and retailers looking to succeed in this complex environment can benefit from partnering with an established player with deep knowledge of the local market and extensive local operational capabilities.

- Choosing from a variety of Tmall platforms, based on strategic priorities.

- Access to the huge pool of active users.

- Access to support through Alibaba’s divisions, including payments (Alipay), marketing solutions (Alimama) and logistics (Cainiao).

- Teams in the US and in China that can advise on operational aspects of cross-border e-commerce and selling into China.

International brands on Tmall.com

International brands on Tmall.com Source: Tmall.com [/caption] Tmall handles billions of transactions every month, including online shopping, digital payments, order fulfillment and a variety of daily services. This combination delivers significant insight into consumer behavior and trends in China. Tmall Global (tmall.hk) is a dedicated channel for cross-border e-commerce — i.e., it sells imported products. Tmall Global enables medium- to larger-sized international brands and retailers with existing brand awareness in China but no local operations to build virtual storefronts to sell and ship products into China. [caption id="attachment_84630" align="aligncenter" width="720"]

International brands on Tmall.hk

International brands on Tmall.hk Source: Tmall.hk [/caption] Launched in 2014, Tmall Global has grown into one of the largest and most comprehensive cross-border B2C online marketplaces targeting the China market. The platform carries more than 18,000 brands and 3,900 categories of imported goods from 75 countries and regions, according to the company. [caption id="attachment_84631" align="aligncenter" width="720"]

Source: Alibaba/Coresight Research[/caption]

The advantages for international firms selling on Tmall Global include:

Source: Alibaba/Coresight Research[/caption]

The advantages for international firms selling on Tmall Global include:

- Selling into China without the need to set up a Chinese entity.

- Quickly reach the massive Tmall customer base.

- International shipments are simplified as Tmall fulfills orders to China internationally (from warehouses outside China).

- Alibaba’s logistics network, which cuts fulfillment time.

- Alibaba’s payment methods (Alipay) – one of the most popular payment methods in China.

- No need to set up a local bank account, enabling the vendor to get paid in the preferred currency into a bank account outside China (e.g. in USD in a US bank account).

- Tmall Overseas Fulfillment (TOF): Enables brands to enter China without committing to a large initial investment. With TOF, Alibaba handles operations such as marketing and fulfillment, while products are stored in overseas warehouses by the brand. Products listed through TOF are displayed on a multi-brand store on Tmall Global and operated by Tmall itself.

- Tmall Direct Imports (TDI): A direct sales channel under Tmall Global which enables brands with a level of recognition in China — but not established in the market enough to feature directly on Tmall Global — to list products on a Tmall Global Direct Import storefront on Tmall Global marketplace.

Source: Euromonitor International [/caption]

Chinese demand for imported international brands has created a huge, high-growth market for imports sold online. eMarketer estimates the market grew by 27.6% in 2017 (latest) and forecasts a 15.3% year-over-year rise in cross-border e-commerce sales for 2018.

A number of factors are boosting consumer demand for imported goods, including:

Source: Euromonitor International [/caption]

Chinese demand for imported international brands has created a huge, high-growth market for imports sold online. eMarketer estimates the market grew by 27.6% in 2017 (latest) and forecasts a 15.3% year-over-year rise in cross-border e-commerce sales for 2018.

A number of factors are boosting consumer demand for imported goods, including:

- Government initiatives, including cross-border e-commerce pilot zones in cities such as Hangzhou and Shanghai.

- Often lower prices for Western brands online.

- Increasing disposable incomes and lrising iving standards in China.

- The perception of overseas brands being higher quality.

Base: 1,596 Chinese Internet users, surveyed in 2016.

Base: 1,596 Chinese Internet users, surveyed in 2016.Source: iResearch [/caption] Conclusion Tmall platforms offer Western companies a valuable channel to access consumers in China, with different options depending on level of presence in the market, such as Tmall or Tmall Global (depending on whether they have operations in China or not), and to smaller firms through TOF and TDI. China is a large, fast growing and fast-changing consumer market that largely works with unique dynamics compared to other markets. International brands and retailers looking to succeed in this complex environment can benefit from partnering with an established player with deep knowledge of the local market and extensive local operational capabilities.