Nitheesh NH

Introduction

Recent years have seen a proliferation of online subscription box service companies that focus on a variety of products including food, personal care and cosmetics, apparel and footwear, and pet toys. Online subscription box services consist of customers’ receiving products on a routine, scheduled basis—usually monthly or quarterly. Subscription box startups and newly created brands can scale operations quickly, due to growing penetration of technology and e-commerce.

Subscription box services tend to fall into two categories: 1) exploratory and 2) replenishment.

Base: 1,006 US females ages 18+

Base: 1,006 US females ages 18+

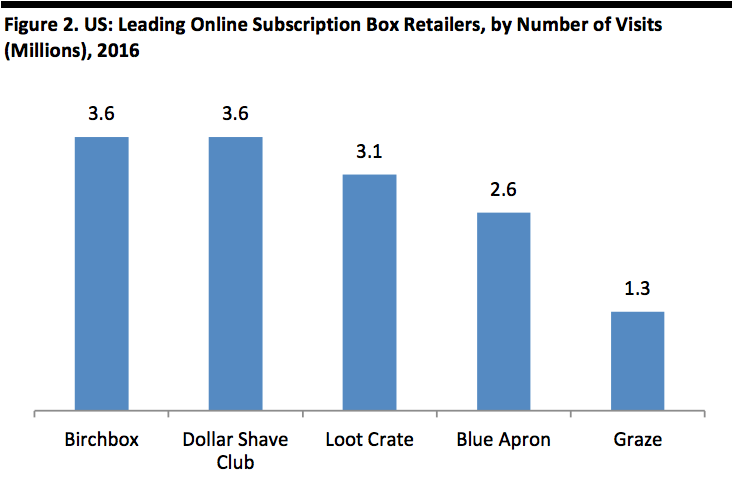

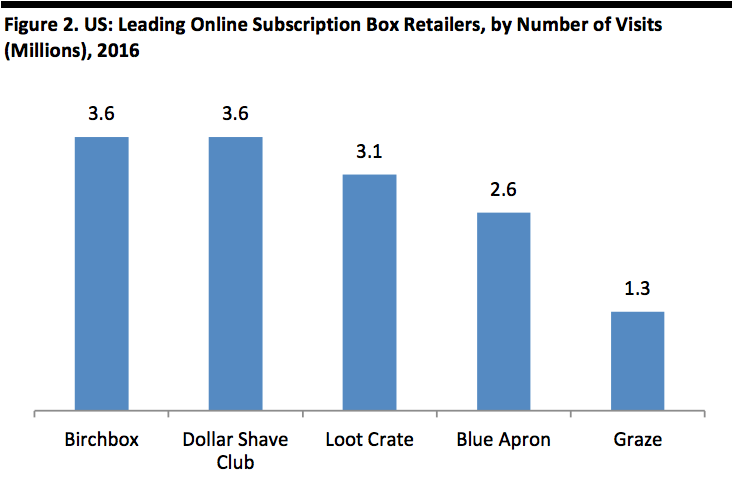

Source: Statista[/caption] Online Subscription Box Services Birchbox and Dollar Shave Club were the most-visited subscription-box sites in the US in 2016. [caption id="attachment_86475" align="aligncenter" width="720"] Source: Hitwise/Chain Store Age

Source: Hitwise/Chain Store Age

[/caption] Below, we feature some of the most popular and prominent online subscription box services. Apparel, Footwear and Accessories Rent the Runway Pure-play, online designer fashion apparel and accessories rental company Rent the Runway launched a subscription service called Unlimited in March 2017. The service charges consumers $139 for monthly rentals or $1,700 annually. The subscription provides customers with a rotating closet of rented designer pieces to women that would otherwise not be able afford them. The company was founded in 2009 and operates retail locations in Chicago, New York City, Washington, D.C., Los Angeles, San Francisco and Las Vegas. Gwynnie Bee US-based Gwynnie Bee offers online women’s plus-size fashion rentals by subscription, targeting professional women ages 28–45. Gwynnie Bee offers women’s clothing rentals in sizes 10–32 from more than 190 brands, including ASOS. Since 2012, the company has increased sales by 10%–15% annually, becoming one of the largest purchasers in plus-size fashion. By 2015, the company had shipped more than 3 million subscription boxes. Borrow For Your Bump US-based Borrow For Your Bump is an online maternity wear rental service. The company provides a onetime dress rental and/or a subscription box service for various maternity items. For US$99, renters can borrow four items for 30 days. Le Tote San Francisco-based Le Tote offers a member service option that allows customers to rent a broad selection of apparel and accessories for a monthly fee of US$59. Available brands include Nike, Lucky Brand, Vince Camuto, French Connection and Levi’s. Le Tote also offers maternity clothing and a specialized maternity subscription. Stitch Fix Stitch Fix was founded in 2012 and offers an online subscription clothing and styling service. Customers fill out style surveys and measurements, and based on algorithms the company’s fashion stylists select five items from a variety of brands to send to the customer. Customers keep what they like and return anything that doesn’t suit them. Stitch Fix employs over 2,800 stylists. Fabletics Fabletics is an activewear subscription service that sends personalized fitness outfits based on personal workout and lifestyle preferences. Members are charged $49 for a monthly subscription and have the option to skip a month. Ivory Clasp Ivory Clasp offers a subscription service for in-season, stylish handbags that retail for over $100 for just $45 per month. The service sends name-brand bags and allows the subscriber to keep the purses they receive. Customers take a style quiz. Subscribers can choose to pay $45 per month, or $45 bimonthly to receive a new bag every other month. Subscribers can get a full refund for any bag they do not like that is returned. The startup has been testing the service for a few months, with over 300 active users, and has hit $10,000 in monthly recurring revenue. LSwop LSwop (Luxury Swop) is an online, pure-play luxury sneaker rental service for men. The company operates on a monthly subscription business model, and sneakers can be rented for one to four days. Customers can rent one pair a month for US$150, two pairs for US$250 and three pairs for US$350. LSwop offers luxury sneakers from Tom Ford, Christian Louboutin, Balmain, Givenchy and Rick Owens, among others, which are typically priced at $800–$1,000. According to the company’s founder, no sneakers are rented out more than two times, and subscribers can purchase sneakers at a discounted price. This fall, the company set up a temporary pop-up store in Soho in New York. Briefd A number of online underwear subscription services have sprung up in the UK, the US and Australia. The subscriber pays a fixed monthly fee and receives one to three pairs of underwear a month; subscription tiers are based on brand, quality and the required number of items. Some startups specialize in plus sizes or sizes outside of standard sizing. Several of the startups have raised investment funding of over US$10 billion each. One such UK online underwear subscription service for men is called Briefd. The company has a two-tier subscription service consisting of one pair of underwear shipped per month for £17.99, or a higher-end pair for £23.99 per month. Brands include Armani, Hugo Boss, Calvin Klein, Ralph Lauren, Tommy Hilfiger, French Connection and Diesel, among others. Some other underwear subscription startups include Related Garments, MeUndies and Nice Laundry. Beauty and Personal Care Subscription services in the beauty and personal care categories span functional purchase categories, such as razor blades, and categories where shoppers want to discover new products, such as cosmetics. Birchbox New York-based Birchbox pioneered the first subscription box service when it launched one for beauty products in 2010. The company offers subscriptions for weekly and monthly deliveries of up-and-coming beauty products and cosmetics shipped in attractive boxes decorated with flowers, bright neons and abstract designs. Birchbox is reportedly profitable. Honest Company Honest Company, cofounded by actress Jessica Alba, sells healthy and natural consumer goods such as disposable baby diapers, household cleaners, personal-care and beauty products. The company distributes through brick-and-mortar retailers including Target and Whole Foods, but many consumers purchase through monthly subscription services. Scent Trunk Scent Trunk, a US e-commerce fragrance company, offers customized scents based on personal preferences and sells them through a subscription model. Scent Trunk sends customers a sampling kit or scent test that contains six core scents, representing different fragrance types. Customers fill out an online form about the scent test, and then the company creates a custom-blended fragrance using raw ingredients sourced from small-batch producers. The perfumes are dispersed in 5 ml bottles and shipped every month for $11.95. The company stated that it targets millennials. Ipsy Ipsy charges members $10 per month for a delivery of five product samples, which are reportedly provided free to the company by beauty brands. Dollar Shave Club Founded in 2011, male grooming products firm Dollar Shave Club offers a monthly subscription of shaving products and accessories. Razor subscriptions options are offered for $1, $6 and $9 monthly. Dollar Shave Club had 3 million subscribers and revenues of $160 million in 2016. Unilever purchased the company in July 2016 for $1 billion, marking unicorn valuation. The company estimated that it would reach sales of $200 million in 2016. Dollar Shave Club developed customer recognition through entertaining and humorous online advertisements through social media. Harry’s After Dollar Shave Club, Harry’s is one of the largest online sellers of shaving products for men. It was founded in 2011 and offers customized subscription plans based on needed frequency and desired products. In 2013, Harry’s opened a barber shop and store in New York to promote the brand offline. Harry’s had over 2 million customers, according to a Business Insider report published in July 2016. Jewelry Rocksbox Rocksbox offers three jewelry pieces at a time, and free shipping and returns for $21 per month on a try-before-you-buy model; if the subscriber decides to keep an item, the $21 is applied toward the purchase. The site carries more than 30 designers such as House of Harlow 1960, Kendra Scott, Loren Hope and Sophie Harper. The company uses technology for greater personalization and expects to triple business in 2017. Flowers bloomon Amsterdam-based bloomon offers a flower-subscription service that delivers in Holland as well as the UK, Belgium, Denmark and Germany. The company collaborates with over 400 growers, designs in-season bouquets and delivers within 24 hours of order placement. The founder stated that there is potential for expansion, as the customers the company delivers to are buying more flowers so the company is growing the market itself. Food A number of subscription service companies are catering to demands for healthy eating and convenience. Graze Graze offers healthy snack discovery boxes, with regular deliveries of new flavors and a selection of over 100 different snack choices. Snacks are handpicked based on personal preferences. Freshology US-based Freshology offers a customized, gourmet meal program, with low-carb and gluten-free options, using seasonal, locally-sourced ingredients and all-natural hand-crafted meals. Meals are delivered twice weekly. Detox Kitchen UK-based Detox Kitchen was founded in 2012 and offers a healthy and tasty meal delivery service. The company is expected to grow by 50% year over year to £4.5 million in 2017, according to news website Independent. Subscribers can select from five different packages, including one for vegans, starting at £28.90 daily and one called “active protein” for £39.95 daily. Blue Apron New York subscription service Blue Apron offers weekly meal kits, ingredients and recipes for make-at-home meals. Blue Apron completed an IPO in June 2017, valuing the company at about $1.9 billion. The company had sales of $795 million in 2016. Industry Ramifications Subscription box services generally bring an opportunity to smaller, unestablished merchants to promote their brands and services at lower costs.

- Exploratory: This type of subscription service allows shoppers to try new products, selecting items on their behalf such as healthy, non-gluten snacks or samples of new-to-market cosmetics. Some subscription box services are about curating a variety of products across different product categories.

- Replenishment: This service offers replenishment boxes for regularly used, routine products such as men’s shaving items. Many subscriptions are specifically tailored to the personal tastes of subscribers. Some subscription box services are backed by celebrities and magazines such as Allure and Men’s Health.

- Mysubscriptionaddiction.com has over 1 million visitors monthly and counted 998 new subscription boxes in 2016, up from 284 new ones in 2013.

- Monthly visits to top subscription box service sites increased by 3,000%, between 2013 and 2016, according to audience data tracking firm Hitwise.

- According to UPS, 23% of online shoppers have signed up for a subscription box service to receive a predetermined set of products and 10% have signed up for a curated service, where products are selected on a personalized basis. The survey was conducted in January and February 2016 on participants that had shopped online in the previous three months.

- There is even a website platform to sell or swap unused or unwanted products from subscription boxes called The Aftermarket. It was set up by the founders of subscription box directory website Find Subscription Boxes.

- Online subscription startups usually offer a point of product differentiation from mass-market rivals, and serve particular customer needs such as vegan or handmade cosmetics.

- Subscription boxes curate and cater products to personal preferences, and often provide personalization and customization options.

- Automating recurring shipments for recurring purchases offers shoppers the convenience of not having to visit stores for mundane repeat-purchase items. This can be particularly appealing for consumers who lead busy lives or parents of young children, as well as some elderly people.

- Subscriptions offer increased variety and constant, rotating newness as well as the thrill of discovery; moreover, deliveries are usually packaged in attractive boxes and appealing packaging, which enhances the feeling of “unwrapping” a treat.

- These services save consumers time, because they no longer need to browse and try products on at brick-and-mortar stores. Subscription boxes provide discovery in a convenient and time-efficient manner.

- Subscription boxes are also popular gift ideas, especially around the holiday season.

- Subscription services can gain a customer following quickly and cheaply through the use of social media.

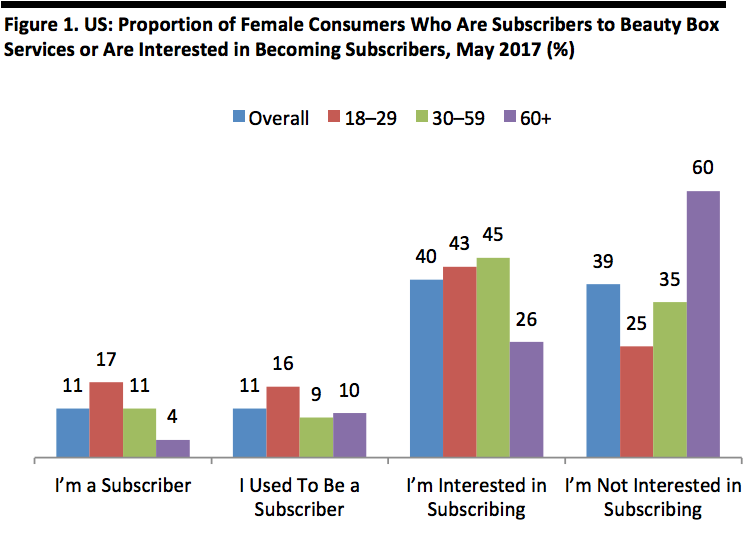

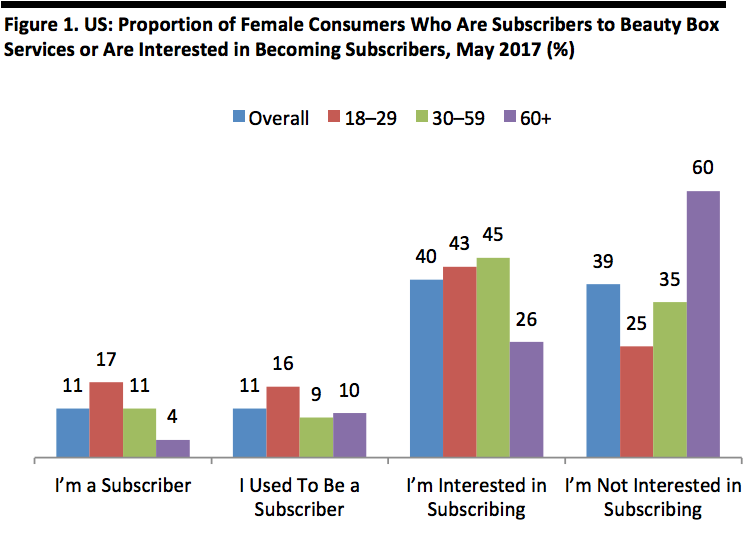

- Subscription services are more popular with millennials. According to a survey by shopping-center operator Westfield, almost half of 25–34-year-olds in the UK and the US would be interested in a monthly rental subscription plan for clothes. As we chart below, around one in ten US women have a subscription to a beauty box scheme, and membership tends to be higher among younger age groups.

Base: 1,006 US females ages 18+

Base: 1,006 US females ages 18+Source: Statista[/caption] Online Subscription Box Services Birchbox and Dollar Shave Club were the most-visited subscription-box sites in the US in 2016. [caption id="attachment_86475" align="aligncenter" width="720"]

Source: Hitwise/Chain Store Age

Source: Hitwise/Chain Store Age[/caption] Below, we feature some of the most popular and prominent online subscription box services. Apparel, Footwear and Accessories Rent the Runway Pure-play, online designer fashion apparel and accessories rental company Rent the Runway launched a subscription service called Unlimited in March 2017. The service charges consumers $139 for monthly rentals or $1,700 annually. The subscription provides customers with a rotating closet of rented designer pieces to women that would otherwise not be able afford them. The company was founded in 2009 and operates retail locations in Chicago, New York City, Washington, D.C., Los Angeles, San Francisco and Las Vegas. Gwynnie Bee US-based Gwynnie Bee offers online women’s plus-size fashion rentals by subscription, targeting professional women ages 28–45. Gwynnie Bee offers women’s clothing rentals in sizes 10–32 from more than 190 brands, including ASOS. Since 2012, the company has increased sales by 10%–15% annually, becoming one of the largest purchasers in plus-size fashion. By 2015, the company had shipped more than 3 million subscription boxes. Borrow For Your Bump US-based Borrow For Your Bump is an online maternity wear rental service. The company provides a onetime dress rental and/or a subscription box service for various maternity items. For US$99, renters can borrow four items for 30 days. Le Tote San Francisco-based Le Tote offers a member service option that allows customers to rent a broad selection of apparel and accessories for a monthly fee of US$59. Available brands include Nike, Lucky Brand, Vince Camuto, French Connection and Levi’s. Le Tote also offers maternity clothing and a specialized maternity subscription. Stitch Fix Stitch Fix was founded in 2012 and offers an online subscription clothing and styling service. Customers fill out style surveys and measurements, and based on algorithms the company’s fashion stylists select five items from a variety of brands to send to the customer. Customers keep what they like and return anything that doesn’t suit them. Stitch Fix employs over 2,800 stylists. Fabletics Fabletics is an activewear subscription service that sends personalized fitness outfits based on personal workout and lifestyle preferences. Members are charged $49 for a monthly subscription and have the option to skip a month. Ivory Clasp Ivory Clasp offers a subscription service for in-season, stylish handbags that retail for over $100 for just $45 per month. The service sends name-brand bags and allows the subscriber to keep the purses they receive. Customers take a style quiz. Subscribers can choose to pay $45 per month, or $45 bimonthly to receive a new bag every other month. Subscribers can get a full refund for any bag they do not like that is returned. The startup has been testing the service for a few months, with over 300 active users, and has hit $10,000 in monthly recurring revenue. LSwop LSwop (Luxury Swop) is an online, pure-play luxury sneaker rental service for men. The company operates on a monthly subscription business model, and sneakers can be rented for one to four days. Customers can rent one pair a month for US$150, two pairs for US$250 and three pairs for US$350. LSwop offers luxury sneakers from Tom Ford, Christian Louboutin, Balmain, Givenchy and Rick Owens, among others, which are typically priced at $800–$1,000. According to the company’s founder, no sneakers are rented out more than two times, and subscribers can purchase sneakers at a discounted price. This fall, the company set up a temporary pop-up store in Soho in New York. Briefd A number of online underwear subscription services have sprung up in the UK, the US and Australia. The subscriber pays a fixed monthly fee and receives one to three pairs of underwear a month; subscription tiers are based on brand, quality and the required number of items. Some startups specialize in plus sizes or sizes outside of standard sizing. Several of the startups have raised investment funding of over US$10 billion each. One such UK online underwear subscription service for men is called Briefd. The company has a two-tier subscription service consisting of one pair of underwear shipped per month for £17.99, or a higher-end pair for £23.99 per month. Brands include Armani, Hugo Boss, Calvin Klein, Ralph Lauren, Tommy Hilfiger, French Connection and Diesel, among others. Some other underwear subscription startups include Related Garments, MeUndies and Nice Laundry. Beauty and Personal Care Subscription services in the beauty and personal care categories span functional purchase categories, such as razor blades, and categories where shoppers want to discover new products, such as cosmetics. Birchbox New York-based Birchbox pioneered the first subscription box service when it launched one for beauty products in 2010. The company offers subscriptions for weekly and monthly deliveries of up-and-coming beauty products and cosmetics shipped in attractive boxes decorated with flowers, bright neons and abstract designs. Birchbox is reportedly profitable. Honest Company Honest Company, cofounded by actress Jessica Alba, sells healthy and natural consumer goods such as disposable baby diapers, household cleaners, personal-care and beauty products. The company distributes through brick-and-mortar retailers including Target and Whole Foods, but many consumers purchase through monthly subscription services. Scent Trunk Scent Trunk, a US e-commerce fragrance company, offers customized scents based on personal preferences and sells them through a subscription model. Scent Trunk sends customers a sampling kit or scent test that contains six core scents, representing different fragrance types. Customers fill out an online form about the scent test, and then the company creates a custom-blended fragrance using raw ingredients sourced from small-batch producers. The perfumes are dispersed in 5 ml bottles and shipped every month for $11.95. The company stated that it targets millennials. Ipsy Ipsy charges members $10 per month for a delivery of five product samples, which are reportedly provided free to the company by beauty brands. Dollar Shave Club Founded in 2011, male grooming products firm Dollar Shave Club offers a monthly subscription of shaving products and accessories. Razor subscriptions options are offered for $1, $6 and $9 monthly. Dollar Shave Club had 3 million subscribers and revenues of $160 million in 2016. Unilever purchased the company in July 2016 for $1 billion, marking unicorn valuation. The company estimated that it would reach sales of $200 million in 2016. Dollar Shave Club developed customer recognition through entertaining and humorous online advertisements through social media. Harry’s After Dollar Shave Club, Harry’s is one of the largest online sellers of shaving products for men. It was founded in 2011 and offers customized subscription plans based on needed frequency and desired products. In 2013, Harry’s opened a barber shop and store in New York to promote the brand offline. Harry’s had over 2 million customers, according to a Business Insider report published in July 2016. Jewelry Rocksbox Rocksbox offers three jewelry pieces at a time, and free shipping and returns for $21 per month on a try-before-you-buy model; if the subscriber decides to keep an item, the $21 is applied toward the purchase. The site carries more than 30 designers such as House of Harlow 1960, Kendra Scott, Loren Hope and Sophie Harper. The company uses technology for greater personalization and expects to triple business in 2017. Flowers bloomon Amsterdam-based bloomon offers a flower-subscription service that delivers in Holland as well as the UK, Belgium, Denmark and Germany. The company collaborates with over 400 growers, designs in-season bouquets and delivers within 24 hours of order placement. The founder stated that there is potential for expansion, as the customers the company delivers to are buying more flowers so the company is growing the market itself. Food A number of subscription service companies are catering to demands for healthy eating and convenience. Graze Graze offers healthy snack discovery boxes, with regular deliveries of new flavors and a selection of over 100 different snack choices. Snacks are handpicked based on personal preferences. Freshology US-based Freshology offers a customized, gourmet meal program, with low-carb and gluten-free options, using seasonal, locally-sourced ingredients and all-natural hand-crafted meals. Meals are delivered twice weekly. Detox Kitchen UK-based Detox Kitchen was founded in 2012 and offers a healthy and tasty meal delivery service. The company is expected to grow by 50% year over year to £4.5 million in 2017, according to news website Independent. Subscribers can select from five different packages, including one for vegans, starting at £28.90 daily and one called “active protein” for £39.95 daily. Blue Apron New York subscription service Blue Apron offers weekly meal kits, ingredients and recipes for make-at-home meals. Blue Apron completed an IPO in June 2017, valuing the company at about $1.9 billion. The company had sales of $795 million in 2016. Industry Ramifications Subscription box services generally bring an opportunity to smaller, unestablished merchants to promote their brands and services at lower costs.

- Subscription services can increase the market for certain product categories and increase customer bases by introducing people to new products that they would otherwise have to buy in larger quantities at more expensive prices, especially for cosmetics. Sampling is an effective vehicle to drive purchase.

- Subscription boxes can be paired with temporary pop-up stores and social media influencers such as bloggers and vloggers to promote the services by leveraging their large follower bases on Instagram, Twitter or Facebook.

- Retailers such as Nordstrom, Sephora, Target and Walmart have launched their own subscription and sample boxes. Walmart’s beauty products sample box arrives quarterly and costs just $5. Target uses printed coupons inside its beauty, baby and wellness boxes to drive consumers to stores. Sephora’s beauty boxes contain a card that incentivize subscribers to receive rewards program points in-store.

- In January 2017, Amazon launched an $18 Amazon Prime Surprise Sweets box that includes four to five gourmet candies and cookies, and ships boxes as frequently as every two days.

- Unilever acquired Dollar Shave Club, a men’s razor subscription e-commerce business that has a strong millennial customer base. In 2015, Dollar Shave Club’s market share of the US shaving market was 5% (according to Forbes) and Unilever purchased the company for $1 billion, marking unicorn valuation. Unilever was also holding discussions to acquire Honest Company, an online retailer and subscription service provider of natural consumer products.

- In order to address the threat from Dollar Shave Club and Harry’s, P&G-owned Gillette has also developed its own shaving products subscription service and is testing one for laundry detergent.

- Australian cosmetics and makeup company E.l.f. offers its own subscription and sample boxes.

- One-third of subscription subscribers surveyed by Mysubscriptionaddiction.com had cancelled at least as many subscriptions as they joined in 2016.

- According to UPS, 53% of routine subscription subscribers have cancelled their subscriptions and 61% have cancelled a curated subscription service. The survey was conducted in January and February 2016 on participants that had shopped online in the previous three months. Top reasons for service cancellations included cost, unappealing products, boredom of service and competitive offerings, in order of importance.

- Many subscription companies have shut down, including Beachmint, which focused on celebrity-curated products.

- Even behemoth subscription company Dollar Shave Club was not profitable at the time of its acquisition by Unilever in July 2016, but estimated it could reach profitability by the end of 2016.

- Blue Apron completed an IPO in June 2017 and had to lower the original offer share price from a range of $15–$17 to $10. Investor concerns included mounting costs to attract new customers, subscriber churn and profitability issues. Although the company’s revenues have been growing, losses have been increasing each year since inception. Marketing costs as a percentage of revenue have increased in the last few years. In the first quarter of 2017, marketing costs increased to 25% of revenues, up from 15% a year earlier.

- Subscription services are becoming ubiquitous and appeal especially to millennials.

- Subscription-based retail is often niche, product specific and represents a point of differentiation.

- The boom in e-commerce and the subscription model has put competitive pressure on established retailers, as online subscription services pose at least some competitive threat.

- Customers need to receive value from month to month with the subscription boxes. Subscription service products need to be relevant to the customer, otherwise customer retention will be limited.