Nitheesh NH

https://youtu.be/wlvY3pJd2Io

Introduction: No End in Sight for the Midmarket Malaise

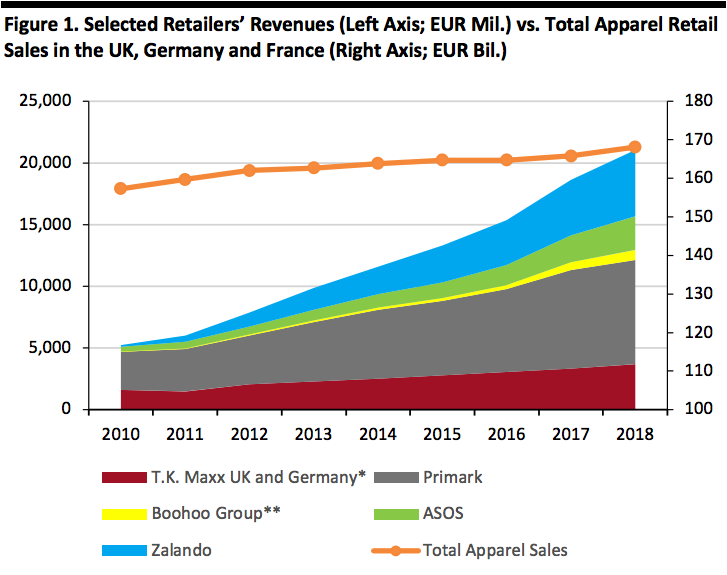

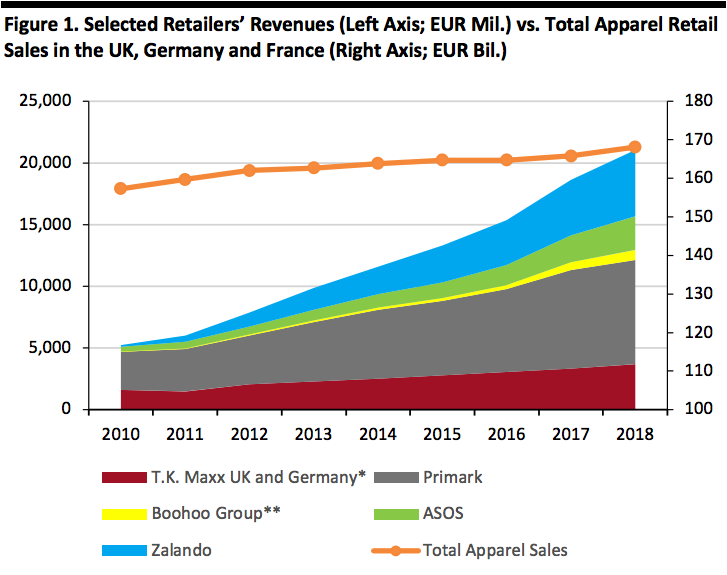

Across major European economies, floundering midmarket behemoths are finding business more challenging than ever. The explosion in choice engendered by e-commerce and high-growth store-based rivals, coupled with a fragmentation in consumer identities, tastes and shopping preferences, has left a number of apparel retailing stalwarts suffering what seems to be “death by a thousand cuts.” In the UK, names such as Marks & Spencer (M&S) and Debenhams are closing stores. In Germany, the department-store middleground has seen consolidation with the Galeria Kaufhof-Karstadt merger.

Whether brand-heavy or private label-focused, we expect middleground retailers will continue to cede share as consumers opt for three growth segments:

Companies’ revenues have been attributed to the closest calendar years. Revenues for retailers reporting in British pounds have been converted to euros at constant 2018 exchange rates. UK apparel retail sales have also been converted to euros at constant 2018 exchange rates. Revenues for some companies include non-European revenues.

Companies’ revenues have been attributed to the closest calendar years. Revenues for retailers reporting in British pounds have been converted to euros at constant 2018 exchange rates. UK apparel retail sales have also been converted to euros at constant 2018 exchange rates. Revenues for some companies include non-European revenues.

*Figures are for T.K. Maxx UK (estimated for 2018) plus TJX Deutschland (estimated for 2017 and 2018).

**2018 data are trailing-12-month data, as of August 31, 2018.

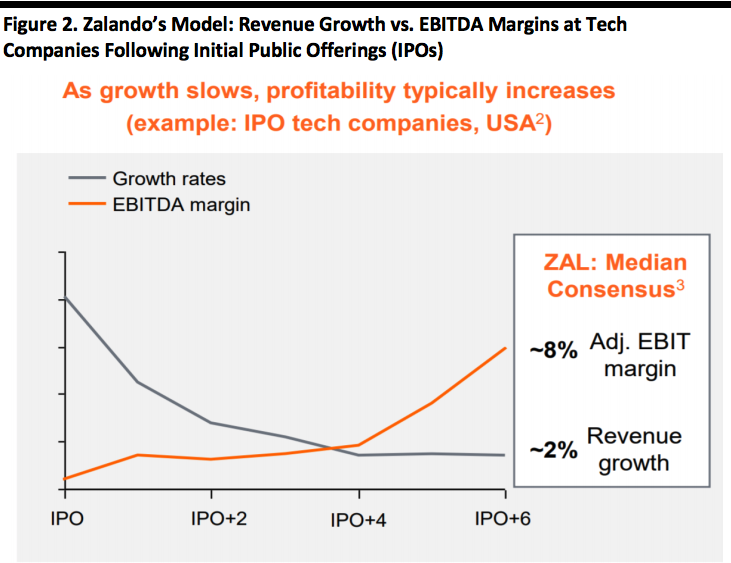

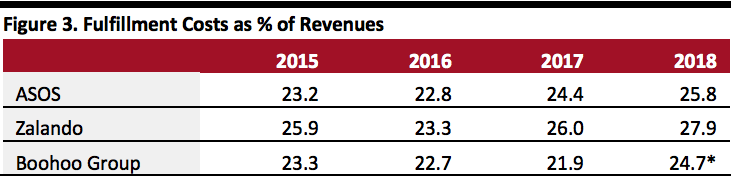

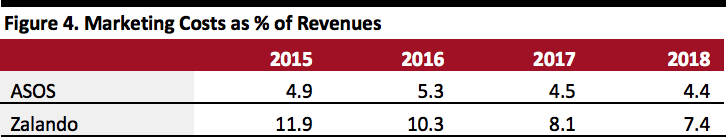

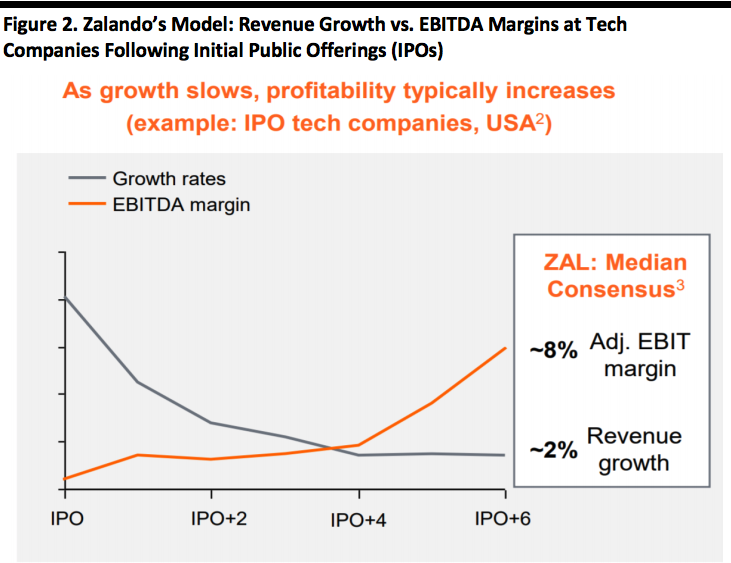

Source: Company reports/S&P Capital IQ/Euromonitor International/Coresight Research[/caption] Not All Discounters are Equal The successes of Primark, Boohoo Group and T.K. Maxx have been built on raising standards in discount retail. We believe Primark’s glossy flagship stores and product mix, combining fast fashion with apparel staples, have drawn shoppers from midmarket rivals. Online, Boohoo Group has built a similarly compelling product offering. These retailers and T.K. Maxx have almost certainly consolidated the value segment, and this means the strength of these retailers does not reflect the overall discount segment. Longstanding value players in European markets have seen mixed performance as competition has intensified: Germany: Kik, Takko and NKD are legacy value retailers. According to Euromonitor International data, Kik grew its revenues by a CAGR of 4.9% in the eight years ended 2018. Takko grew revenues at an average annual pace of 1.0% over the same period while NKD saw a revenue CAGR of (1.9)% over the same eight years. UK: In April 2018, value retailer Select launched a company voluntary arrangement that sought rent reductions of up to 75%. Blue Inc, with 31 stores, entered administration in December 2018, after launching a CVA in 2017. Not strictly discount but a lower-price retailer, New Look announced in November 2018 that it would close 85 stores. The privately owned company reported that comparable sales fell 3.7% for the 26 weeks ended September 22, 2018, following a UK comp decline of 11.7% in the year ended March 24. New Look subsequently reported a 0.9% increase in UK comparable sales for the third quarter of its fiscal 2019. France: Difficulties in lower-price French apparel retail have been epitomized by troubles at debt-laden Vivarte and its closure of a host of stores at price-competitive chain La Halle since 2015. Pure Plays’ Strong Revenue Growth is Balanced by Challenges in Fulfillment Costs Zalando is Europe’s biggest Internet-only apparel retailer and, according to management, that makes it the continent’s biggest distributor of a number of major apparel brands. At Zalando’s 2019 Capital Markets Day, management outlined new financial ambitions. By 2023/24, Zalando aims to report revenues of €13 billion, from €5.4 billion in 2018, a revenue CAGR of 15-20%. And it aims to grow GMV from €6.6 billion in 2018 to €20 billion by 2023/24, a CAGR of 20-25%. Long term, Zalando expects to report a group adjusted EBIT margin of 10-13%, supported by higher margins of 20-25% in its expanding Partner Program. However, management cautioned this target model is several years away: According to Co-CEO Rubin Ritter, 2019-21 would be a period of transition, the subsequent years would see growth rates moderate and margins increase, and it would hit its target model only in the years after that. The promise of future margin expansion comes as Zalando continues to focus on sales growth in the near term. At the company’s 2018 Capital Markets Day, SVP of Finance and Indirect Procurement Birgit Haderer noted the company had analyzed the margin development of tech companies after they had gone public and found that those firms generally went from high revenue growth at a lower margin, to strong growth and solid profitability, to slower revenue growth at a stronger margin. Zalando is in the second of those three phases, Haderer remarked. The company expects to see strong growth and solid profitability in the coming years. [caption id="attachment_81504" align="aligncenter" width="580"] (2) US tech companies with IPO 2010-2013 and IPO size >$150m (sample size 36).

(2) US tech companies with IPO 2010-2013 and IPO size >$150m (sample size 36).

(3) Consensus terminal revenue growth and margin assumptions.

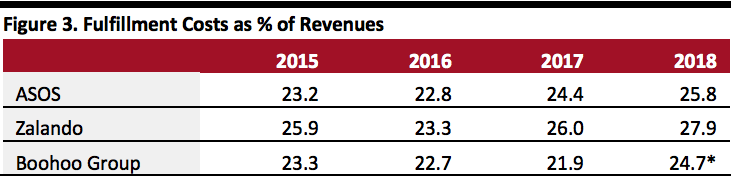

Source: Company reports[/caption] Zalando’s third-party marketplace, called Partner Program, is likely to prove a bulwark to margins in the coming years: The company is growing this segment’s share of sales, with the ambition of it accounting for 40% of GMV in 2023/24, up from 10% in 2018. Across e-commerce, third-party marketplaces tend to be more profitable than direct retailing models. Selling services to retailers should support margin expansion, too. Zalando wants to convert more Partner Program retailers to Zalando Fulfilment Solutions (ZFS), under which Zalando holds and ships stock on behalf of the brand. Further, Zalando hopes to grow these brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business. At the same time, Zalando and other Internet-only retailers are seeing fulfillment costs spiral: As they seek to overcome longstanding delivery hurdles and offer greater convenience, fulfillment costs as a share of revenues are climbing rapidly. The variable costs associated with fulfillment mean pure-play retailers do not enjoy economies of scale and a leveraging of their cost base even as revenues grow rapidly. With consumer expectations constantly rising, we see few opportunities to reverse this increase in fulfillment costs. This is pressuring some Internet-only retailers to diversify into services, though others do not yet appear to have a clear plan for mitigating such rising costs. As we show below, after a slide in fulfillment cost ratios in 2016 for ASOS and Zalando (or 2016 and 2017 for Boohoo Group), the trend has been upward. [caption id="attachment_81505" align="aligncenter" width="580"] Data are attributed to the closest calendar years: ASOS’s fiscal year ends in August, Boohoo Group’s ends in February and Zalando’s ends in December.

Data are attributed to the closest calendar years: ASOS’s fiscal year ends in August, Boohoo Group’s ends in February and Zalando’s ends in December.

*Boohoo 2018 data are for the first-half ended August 31, 2018.

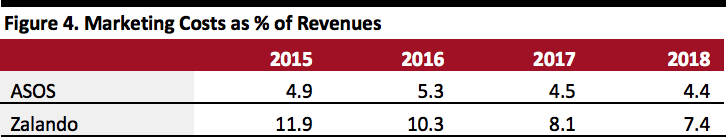

Source: Company reports/Coresight Research[/caption] No data for Boohoo Group.

No data for Boohoo Group.

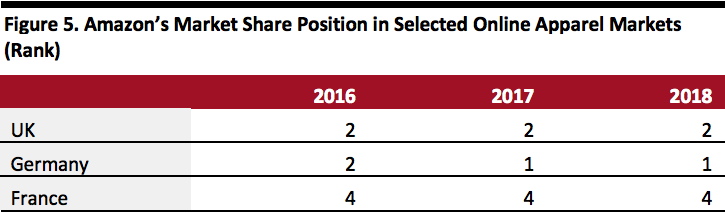

Source: Company reports/Coresight Research[/caption] Amazon Making Inroads in Europe Amazon is targeting the apparel market on both sides of the Atlantic. The company has launched a number of apparel private labels for the UK market. The Find brand has been Amazon’s most high-profile apparel private label launch in the UK, but the company has introduced other brands such as Aurique, Hem & Seam, Hikaro, Iris & Lilly and Meraki, according to TJI, a company that tracks Amazon’s brands. Euromonitor International estimates that: Source: Euromonitor International/Coresight Research[/caption]

Buoyant Sportswear Demand Provides a Supporting Boost for Online Multibrand Platforms

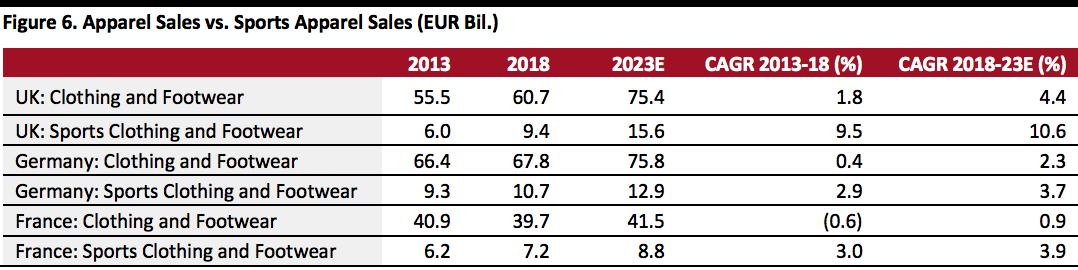

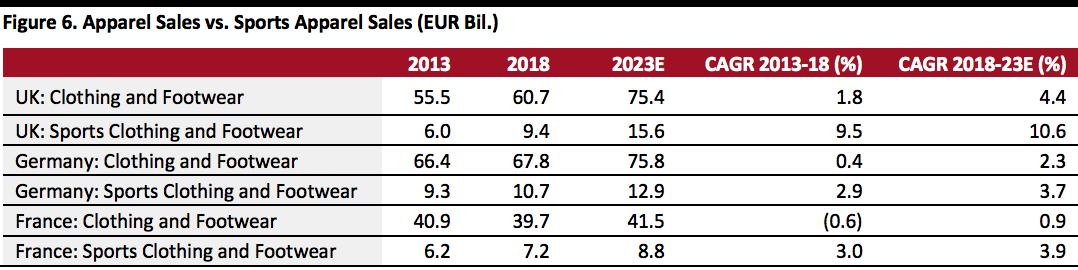

In the UK, Germany and France, shoppers have been switching more and more of their apparel budgets to sportswear, and Euromonitor International forecasts this trend will continue over the five years through 2023.

In the UK, for example, Euromonitor estimates that sportswear grew at an average annual rate five times that of the total clothing and footwear market between 2013 and 2018.

[caption id="attachment_81508" align="alignnone" width="700"]

Source: Euromonitor International/Coresight Research[/caption]

Buoyant Sportswear Demand Provides a Supporting Boost for Online Multibrand Platforms

In the UK, Germany and France, shoppers have been switching more and more of their apparel budgets to sportswear, and Euromonitor International forecasts this trend will continue over the five years through 2023.

In the UK, for example, Euromonitor estimates that sportswear grew at an average annual rate five times that of the total clothing and footwear market between 2013 and 2018.

[caption id="attachment_81508" align="alignnone" width="700"] UK data converted to euros at fixed 2018 exchange rates.

UK data converted to euros at fixed 2018 exchange rates.

Source: Euromonitor International/Coresight Research [/caption] Management commentary from major sportswear brands provide further evidence of the buoyancy of Europe’s sportswear markets, although Adidas saw sales decline due to company-specific factors. Base: 4,000+ respondents, interviewed May 2018–January 2019

Base: 4,000+ respondents, interviewed May 2018–January 2019

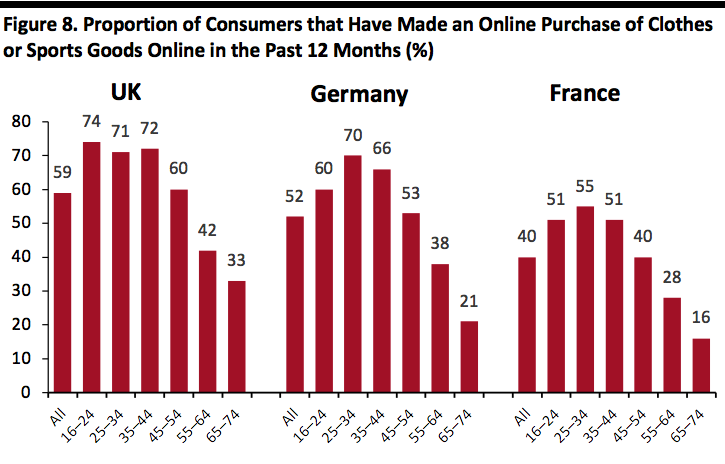

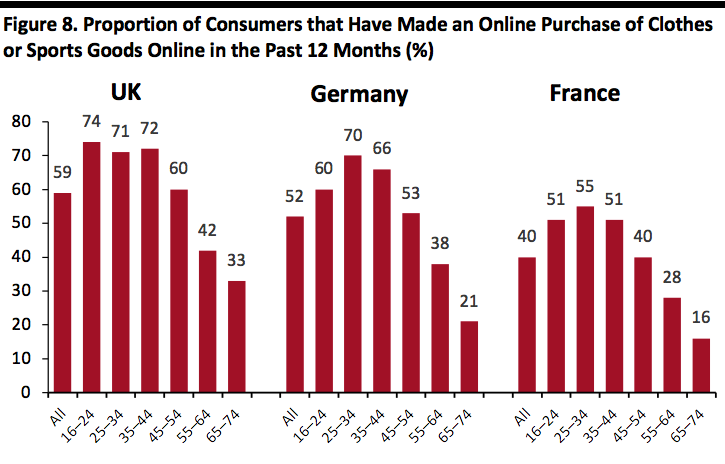

Source: YouGov[/caption] Millennials drive demand for fashion e-commerce, too, with shopping online for clothes tending to peak in the 24-34 age group. As this generation builds careers and family lives, time pressures are likely to sustain their demand for e-commerce. [caption id="attachment_81518" align="aligncenter" width="580"] No data available for respondents ages 75+

No data available for respondents ages 75+

Source: Eurostat[/caption] Key Insights Selected high-growth value players, such as Primark and Boohoo Group, appear to be consolidating the discount segment, impacting some legacy discount players. Even as Internet pure-play retailers scale rapidly, they are seeing fulfillment cost ratios increase. Given ever-rising consumer expectations, this is pushing some Internet-only retailers to find ways to mitigate the costs of fulfillment. However, such strategies are not universal, raising questions over how some e-commerce pure plays will offset further increases in such costs. More positively for Internet retailers, we think strong consumer demand for brand-heavy sports is likely to support growth at multibrand e-commerce platforms.

- High-quality, low-price private-label retailers such as Primark and Boohoo.com, and brand-heavy off-pricers such as K. Maxx (owned by the TJX Companies) in the discount segment.

- Internet-only retailers bidding to capture greater share in apparel — notably multibrand apparel specialists ASOS, Zalando and Amazon.

- Sportswear brands, which are increasingly selling directly to consumers through their own brick-and-mortar stores, their own websites and platforms such as Zalando.

Companies’ revenues have been attributed to the closest calendar years. Revenues for retailers reporting in British pounds have been converted to euros at constant 2018 exchange rates. UK apparel retail sales have also been converted to euros at constant 2018 exchange rates. Revenues for some companies include non-European revenues.

Companies’ revenues have been attributed to the closest calendar years. Revenues for retailers reporting in British pounds have been converted to euros at constant 2018 exchange rates. UK apparel retail sales have also been converted to euros at constant 2018 exchange rates. Revenues for some companies include non-European revenues. *Figures are for T.K. Maxx UK (estimated for 2018) plus TJX Deutschland (estimated for 2017 and 2018).

**2018 data are trailing-12-month data, as of August 31, 2018.

Source: Company reports/S&P Capital IQ/Euromonitor International/Coresight Research[/caption] Not All Discounters are Equal The successes of Primark, Boohoo Group and T.K. Maxx have been built on raising standards in discount retail. We believe Primark’s glossy flagship stores and product mix, combining fast fashion with apparel staples, have drawn shoppers from midmarket rivals. Online, Boohoo Group has built a similarly compelling product offering. These retailers and T.K. Maxx have almost certainly consolidated the value segment, and this means the strength of these retailers does not reflect the overall discount segment. Longstanding value players in European markets have seen mixed performance as competition has intensified: Germany: Kik, Takko and NKD are legacy value retailers. According to Euromonitor International data, Kik grew its revenues by a CAGR of 4.9% in the eight years ended 2018. Takko grew revenues at an average annual pace of 1.0% over the same period while NKD saw a revenue CAGR of (1.9)% over the same eight years. UK: In April 2018, value retailer Select launched a company voluntary arrangement that sought rent reductions of up to 75%. Blue Inc, with 31 stores, entered administration in December 2018, after launching a CVA in 2017. Not strictly discount but a lower-price retailer, New Look announced in November 2018 that it would close 85 stores. The privately owned company reported that comparable sales fell 3.7% for the 26 weeks ended September 22, 2018, following a UK comp decline of 11.7% in the year ended March 24. New Look subsequently reported a 0.9% increase in UK comparable sales for the third quarter of its fiscal 2019. France: Difficulties in lower-price French apparel retail have been epitomized by troubles at debt-laden Vivarte and its closure of a host of stores at price-competitive chain La Halle since 2015. Pure Plays’ Strong Revenue Growth is Balanced by Challenges in Fulfillment Costs Zalando is Europe’s biggest Internet-only apparel retailer and, according to management, that makes it the continent’s biggest distributor of a number of major apparel brands. At Zalando’s 2019 Capital Markets Day, management outlined new financial ambitions. By 2023/24, Zalando aims to report revenues of €13 billion, from €5.4 billion in 2018, a revenue CAGR of 15-20%. And it aims to grow GMV from €6.6 billion in 2018 to €20 billion by 2023/24, a CAGR of 20-25%. Long term, Zalando expects to report a group adjusted EBIT margin of 10-13%, supported by higher margins of 20-25% in its expanding Partner Program. However, management cautioned this target model is several years away: According to Co-CEO Rubin Ritter, 2019-21 would be a period of transition, the subsequent years would see growth rates moderate and margins increase, and it would hit its target model only in the years after that. The promise of future margin expansion comes as Zalando continues to focus on sales growth in the near term. At the company’s 2018 Capital Markets Day, SVP of Finance and Indirect Procurement Birgit Haderer noted the company had analyzed the margin development of tech companies after they had gone public and found that those firms generally went from high revenue growth at a lower margin, to strong growth and solid profitability, to slower revenue growth at a stronger margin. Zalando is in the second of those three phases, Haderer remarked. The company expects to see strong growth and solid profitability in the coming years. [caption id="attachment_81504" align="aligncenter" width="580"]

(2) US tech companies with IPO 2010-2013 and IPO size >$150m (sample size 36).

(2) US tech companies with IPO 2010-2013 and IPO size >$150m (sample size 36).(3) Consensus terminal revenue growth and margin assumptions.

Source: Company reports[/caption] Zalando’s third-party marketplace, called Partner Program, is likely to prove a bulwark to margins in the coming years: The company is growing this segment’s share of sales, with the ambition of it accounting for 40% of GMV in 2023/24, up from 10% in 2018. Across e-commerce, third-party marketplaces tend to be more profitable than direct retailing models. Selling services to retailers should support margin expansion, too. Zalando wants to convert more Partner Program retailers to Zalando Fulfilment Solutions (ZFS), under which Zalando holds and ships stock on behalf of the brand. Further, Zalando hopes to grow these brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business. At the same time, Zalando and other Internet-only retailers are seeing fulfillment costs spiral: As they seek to overcome longstanding delivery hurdles and offer greater convenience, fulfillment costs as a share of revenues are climbing rapidly. The variable costs associated with fulfillment mean pure-play retailers do not enjoy economies of scale and a leveraging of their cost base even as revenues grow rapidly. With consumer expectations constantly rising, we see few opportunities to reverse this increase in fulfillment costs. This is pressuring some Internet-only retailers to diversify into services, though others do not yet appear to have a clear plan for mitigating such rising costs. As we show below, after a slide in fulfillment cost ratios in 2016 for ASOS and Zalando (or 2016 and 2017 for Boohoo Group), the trend has been upward. [caption id="attachment_81505" align="aligncenter" width="580"]

Data are attributed to the closest calendar years: ASOS’s fiscal year ends in August, Boohoo Group’s ends in February and Zalando’s ends in December.

Data are attributed to the closest calendar years: ASOS’s fiscal year ends in August, Boohoo Group’s ends in February and Zalando’s ends in December.*Boohoo 2018 data are for the first-half ended August 31, 2018.

Source: Company reports/Coresight Research[/caption]

- In the year ended August 31, 2018, ASOS management pointed to an “increased mix into more expensive propositions and territories, partly offset by improved standard delivery rates.” It also noted “higher transitional costs” as it increases its supply chain capacity.

- In its third quarter ended October 31, 2018, Zalando management reported that higher logistics costs came “as Zalando is building up a diverse logistics network and continues to invest in the customer and brand propositions.” Management cited the ramp up of new fulfillment and investments in enhancements such as same-day delivery. However, the company also noted a shift of some expenses from administrative expenses to selling and distribution costs, though this was partly offset by a shift of share-based compensation expenses.

- Compounding fulfillment costs for Zalando was a 5.4% decrease in average basket size in 2018. However, ASOS grew its average basket size by 1.1% in FY18 and Boohoo (brand) grew its by 1.6% in the six months ended August 31, 2018.

- To tackle the challenge of serving small basket sizes, Zalando trialed minimum order values in Italy and more recently rolled this out to Spain, the UK and Ireland. Zalando continues to offer free delivery with no minimum purchase value in Germany.

No data for Boohoo Group.

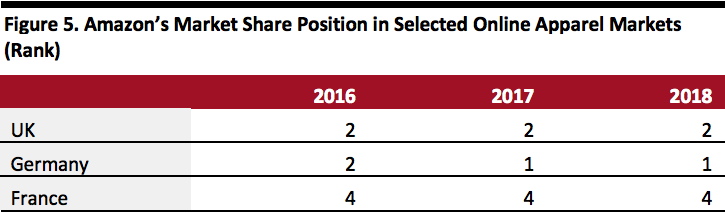

No data for Boohoo Group.Source: Company reports/Coresight Research[/caption] Amazon Making Inroads in Europe Amazon is targeting the apparel market on both sides of the Atlantic. The company has launched a number of apparel private labels for the UK market. The Find brand has been Amazon’s most high-profile apparel private label launch in the UK, but the company has introduced other brands such as Aurique, Hem & Seam, Hikaro, Iris & Lilly and Meraki, according to TJI, a company that tracks Amazon’s brands. Euromonitor International estimates that:

- Amazon is #2 in online apparel in the UK, behind Next, which is a predominantly private label retailer, suggesting that Amazon is #1 among the multibrand players.

- In Germany, Amazon captured the #1 spot in online apparel from Otto Group in 2017.

Source: Euromonitor International/Coresight Research[/caption]

Buoyant Sportswear Demand Provides a Supporting Boost for Online Multibrand Platforms

In the UK, Germany and France, shoppers have been switching more and more of their apparel budgets to sportswear, and Euromonitor International forecasts this trend will continue over the five years through 2023.

In the UK, for example, Euromonitor estimates that sportswear grew at an average annual rate five times that of the total clothing and footwear market between 2013 and 2018.

[caption id="attachment_81508" align="alignnone" width="700"]

Source: Euromonitor International/Coresight Research[/caption]

Buoyant Sportswear Demand Provides a Supporting Boost for Online Multibrand Platforms

In the UK, Germany and France, shoppers have been switching more and more of their apparel budgets to sportswear, and Euromonitor International forecasts this trend will continue over the five years through 2023.

In the UK, for example, Euromonitor estimates that sportswear grew at an average annual rate five times that of the total clothing and footwear market between 2013 and 2018.

[caption id="attachment_81508" align="alignnone" width="700"] UK data converted to euros at fixed 2018 exchange rates.

UK data converted to euros at fixed 2018 exchange rates. Source: Euromonitor International/Coresight Research [/caption] Management commentary from major sportswear brands provide further evidence of the buoyancy of Europe’s sportswear markets, although Adidas saw sales decline due to company-specific factors.

- Nike: In Nike’s first quarter of fiscal 2019 (ended August 31, 2018), the company grew Europe, Middle East and Africa (EMEA) revenues by 9% at constant currencies. In the second quarter (ended November 30, 2018), EMEA revenues were up 14% at constant currencies with management pointing to “extraordinary momentum” in the region and “great momentum” within Europe specifically. In both quarters, Nike noted that five of its “key global cities” are in the EMEA region.

- Adidas: In the company’s third-quarter 2018 earnings call, CEO Kasper Bo Rorsted noted that Adidas continued to see challenges in Western Europe, with the region’s 1% revenue decline (at constant currencies) weighing on the company’s top line. Comparable sales growth in total and at Adidas’s concept stores softened in the third quarter. However, management said they did not think there had been a slowdown in the European sneaker market during the period, and attributed the slowdown to product and marketing missteps.

- Lululemon: In the first and second quarters of 2018, Lululemon noted double-digit comparable sales growth in Europe. In the third quarter, the company grew total Europe revenues by more than 50%. In the first three quarters of 2018, Lululemon launched stores in Berlin, Frankfurt, Stockholm and Guildford (UK), and a shop-in-shop in Le Bon Marché in Paris.

- We believe that brand-heavy sportswear is more likely to sell on specification and less on cut than many other types of apparel. Many shoppers will buy items such as sweatshirts, joggers and sneakers for the logos and styles. We think that fit (traditionally a challenge for e-commerce) is a lower priority in sportswear than it is in non-sportswear categories such as shirts, suits and dresses in which tailoring and fit are meaningful contributors to the purchase decision.

- Supporting this view is our research on Amazon in the US. Our found that sportswear was among the most-purchased apparel categories on Amazon, and that Nike, Under Armour and Adidas were the most-purchased brands on the site, by number of shoppers. Moreover, our September 2018 analysis of clothing listings on Amazon.com in the US confirmed that activewear is one of the most-listed clothing categories on the site.

- Platforms such as Zalando offer a wide range of competitively priced major sportswear products that only the brands’ own sites can match. Physical stores, including traditional sports stores, cannot compete with this breadth of choice. Moreover, Zalando has collaborated on exclusive ranges with sportswear and streetwear brands such as Puma and Vans, and it signed Adidas as one of the first brands on its Partner Program marketplace. In 2017, Amazon signed a deal to sell Nike on its site.

Base: 4,000+ respondents, interviewed May 2018–January 2019

Base: 4,000+ respondents, interviewed May 2018–January 2019Source: YouGov[/caption] Millennials drive demand for fashion e-commerce, too, with shopping online for clothes tending to peak in the 24-34 age group. As this generation builds careers and family lives, time pressures are likely to sustain their demand for e-commerce. [caption id="attachment_81518" align="aligncenter" width="580"]

No data available for respondents ages 75+

No data available for respondents ages 75+Source: Eurostat[/caption] Key Insights Selected high-growth value players, such as Primark and Boohoo Group, appear to be consolidating the discount segment, impacting some legacy discount players. Even as Internet pure-play retailers scale rapidly, they are seeing fulfillment cost ratios increase. Given ever-rising consumer expectations, this is pushing some Internet-only retailers to find ways to mitigate the costs of fulfillment. However, such strategies are not universal, raising questions over how some e-commerce pure plays will offset further increases in such costs. More positively for Internet retailers, we think strong consumer demand for brand-heavy sports is likely to support growth at multibrand e-commerce platforms.