albert Chan

Originally inspired by surfing and skateboarding culture, streetwear has grown beyond just sports. Streetwear used to represent casual designs, oversize fit and low prices, and men were the main buyers. In recent years, women have engaged more with the category. As gender neutral becomes the new norm, especially among younger generations, street labels usually make unisex products, resulting in a tighter assortment. Adidas’s Yeezy footwear uses both sizing systems, for men and women. Reduced SKUs also help the company streamline manufacturing and inventory processes.

Historically a niche sector, streetwear usually keeps a limited supply and releases products through the “drops” model. To buy, customers often wait in line or wait to order online at a specific time. Although Nike was the first brand to do this, streetwear brought the model to another level. For major drops, people have waited outside stores all night or use specially-designed computer applications to make sure they get products online.

With carefully constructed drops, brands can control the supply to stay behind demand, leveraging consumers’ “fear of missing out” (FOMO). Instead of feeling discouraged, consumers seem to be adjusting to the drops model. Earlier this year, men’s fashion media Hypebeast released its Streetwear Impact Report, working with Strategy& (the global strategy consulting division of PwC) and found that half of consumers are willing to wait in line for a product release. [caption id="attachment_93871" align="aligncenter" width="700"] People waiting in line for Supreme

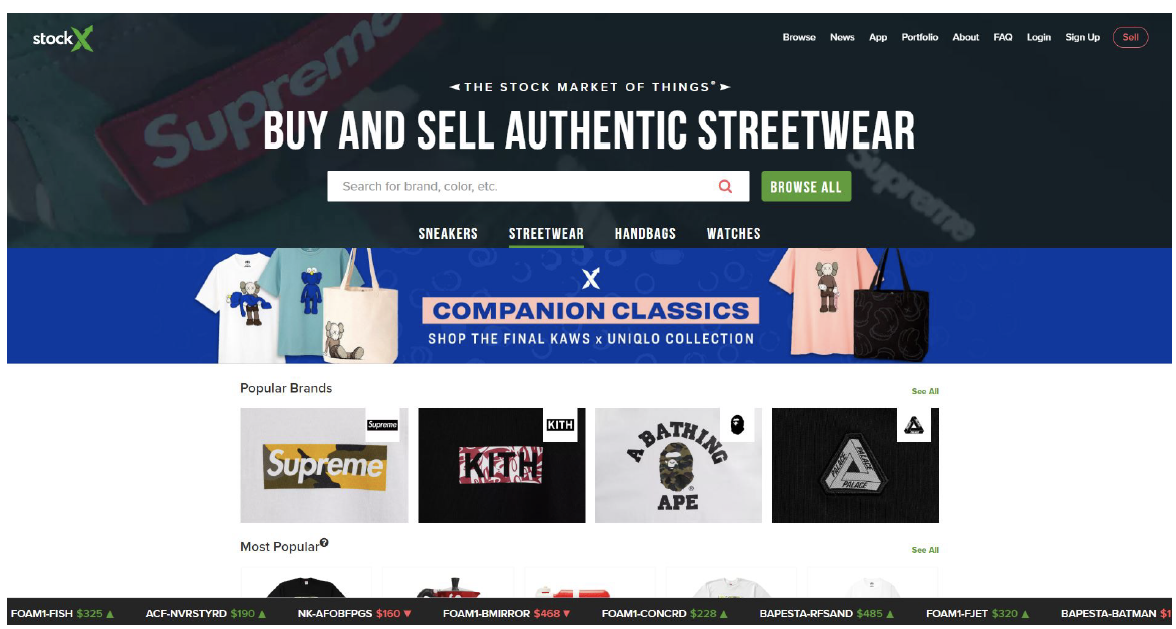

People waiting in line for SupremeSource: Hypebeast[/caption] With unmet demand, brands create scarcity for their products, which encourages consumers to purchase, whether they want to keep the products or not. Subsequently, consumers form a community to exchange and resell. The exclusivity also inflates the price in the resale market. Driven by this fanatic phenomenon, many start-ups, such as KicksOnFire, have built business tracking release calendars and facilitating after-purchase trading. Detroit-based StockX, the world’s first live auction marketplace for sneakers, raised $110 million and earned unicorn status with a $1 billion valuation in June 2019. Starting with sneakers, the company expanded to streetwear, handbags and watches. [caption id="attachment_93905" align="aligncenter" width="700"]

StockX website

StockX websiteSource: StockX[/caption]

Seeing the success of street brands using the drops model, non-streetwear brands such as Burberry are also embracing it. The Streetwear Impact Report says two-thirds of industry respondents considered drops important to their business strategy.

Collaborating with other brands is another key strategy for streetwear. Not only is it more cost efficient, it can drive media exposure before and after events, helping the brand stay relevant. Almost every established streetwear brand has worked with Nike on footwear, partly due to the more complicated techniques involved in the shoe-making process. In recent years, streetwear brands and designers have been working with heritage brands to create limited editions, Supreme and Louis Vuitton being among the most high-profile collaboration. [caption id="attachment_93904" align="aligncenter" width="700"] Supreme and Louis Vuitton collaboration

Supreme and Louis Vuitton collaborationSource: LVMH[/caption]

As streetwear continues to grow, new labels have emerged targeting the premium and luxury sectors. The Streetwear Impact Report found streetwear consumers’ monthly spending on streetwear was up to five times more than non-streetwear, and Asian consumers are the biggest spenders. While Japanese consumers have the highest average spend per item, Chinese and Korean consumers spend the most on streetwear on average per month. Brands such as Fear of God, Hood By Air and Off-White have been elevating streetwear with their unique designs and hefty price tags.

The report also pointed out that musicians are considered the most credible figures in streetwear by customers. Heavily influenced by hip pop culture, streetwear seems to be the next logical step for mainstream performers. From Pharrell Williams’ Billionaire Boys Club in 2003 to Justin Bieber’s Drew House in 2019, a number of people from the entertainment industry have tested the water in this field with their own clothing lines.

Traditional luxury brands have also seen the potential in streetwear. Givenchy was one of the first luxury brands to promote streetwear, in 2012. Shark head, Rottweiler and bird of paradise print T-shirts quickly became popular Givenchy items. The trend continued with Burberry, Gucci, Louis Vuitton and others starting to embrace the category and reimage themselves through new creative directors.

Below, we profile some notable pioneers and up-and-coming streetwear labels.

A Bathing Ape

DJ Nigo launched A Bathing Ape (Bape) in Japan in 1993 and opened its SoHo store in 2004. Bape is famous for camo print and shark hoodies, and had numerous collaborations. In 2011, the company was sold to Hong Kong fashion conglomerate I.T Group. Recently, watch maker Swatch partnered with Bape for a series of watches.

Comme des Garçons PLAY

Rei Kawakubo started Comme des Garçons five decades ago and in 2002 launched casual luxury line PLAY. Known for its heart-shaped logo with two eyes, the brand has collaborated with Nike and Louis Vuitton, among others.

Fragment Design

Unlike a traditional brand, Fragment Design is an imprint from designer Hiroshi Fujiwara. Its double lightening bolt logo has appeared on products from countless brands including Air Jordan, Louis Vuitton and Moncler.

[caption id="attachment_93906" align="aligncenter" width="700"] Fragment Design x Moncler

Fragment Design x Moncler Source: Moncler[/caption]

Mastermind Japan

Founded by designer Masaaki Homma in 1997, Mastermind Japan emphasizes exclusivity. Often the brand produces only three or fewer pieces of each size – and comes with a high price tag to go along with the limited production runs. The brand is influenced by punk and has a signature logo of skull and crossbones. Although Homma stopped producing the main collection in 2013, it continues to collaborate with other brands.

Stüssy

Shawn Stüssy founded the company in 1980s with emphasis on the skateboarding and surfing scene. Unlike other streetwear, products are fairly low cost. The classic stock T-shirt sells for $36 on the company’s official website. The brand is available in company-operated stores and retailers around the world.

Supreme

Established by James Jebbia in 1994, Supreme is influenced by skateboarding and hip-pop culture. This New York based brand is notorious for its scarcity and has a group of cult followers. Products like its Supreme red box logo T-shirt sell out online in seconds and buyers can flip hero products on re-commerce markets for a profit. Sometimes people will line up all night in front of its stores for major drops.

The label has collaborated with brands and artists including Nike, Louis Vuitton and KAWS. In October 2017, private equity firm the Carlyle Group acquired around 50% of the company for $500 million.

Newcomers

A-Cold-Wall* A-Cold-Wall* was founded in 2015 by designer Samuel Ross, who won the BFC/GQ Designer Menswear Fund Award this year. This premium street brand is a curation of British culture inspired products, designed and produced in the UK.Last year, the company released a special collaboration with Nike Air Force 1. Diesel also announced that its Red Tag project will work with the label in June 2019.

Anti-Social Social Club

Created by former Stüssy employee Neek Lurk in 2015, the brand shares a similar strategy with Supreme: small quantity at low cost. The $36 iconic logo T-shirt, along with other merchandise, is sold out online.

Despite its youth, the brand has been actively collaborating with brands such as Bape, Comme des Garçons, Playboy etc.

Brain Dead

Based in Los Angeles, unlike a traditional brand with one creative director, Brain Dead is a creative collective of global designers and artists, influenced by underground subculture.

The company first collaborated with Converse to release limited edition sneakers last year, followed by another drop in February 2019.

Cactus Plant Flea Market

Unlike other streetwear brands that keep a high profile and active social media accounts, Cactus Plant Flea Market is quite obscure and leaves a very limited digital footprint – and seems to be trying to keep its profile low. Even who is behind it is unclear: Reports on the Internet tie the brand to rapper Pharrell Williams’ assistant. Its Instagram account shows only 13 photos – but had 137,000 followers as of June 2019. There is no official brand story or creator, but Pharrell has endorsed the brand.In April 2019, rapper Kid Cudi partnered with the brand to release a capsule collection at Coachella. The collection was available online for four days and 20 hours on April 20 (to mark 4.20, a slang for cannabis). The next month, Kid Cudi dropped another collection with the label, also available for only four days and 20 hours. The brand also collaborated with Nike Air VaporMax in May.

Fear of God

Founded by Jerry Lorenzo in 2013, Fear of God is a luxury streetwear brand based in Los Angeles. The clothing tends to follow a bagged, over-sized style. The brand has collaborated with Nike multiple times on footwear since inception. Currently, the label does not have its own store.

Hood By Air

Shayne Oliver launched the label back in 2006 as high fashion streetwear. However, the brand took a hiatus when the designer left to lead Helmut Lang in 2017, but relaunched in 2019. The brand has no stores.

KITH

Started by Ronnie Fieg in New York in 2011, KITH collaborated with brands and eventually built its own clothing line. The company has been exploring different formats and business opportunities, opening two shop-in-shops at Bergdorf Goodman and Hirshleifers, and launching a line of cereal bars called KITH Treats.

Off-White

Created by Virgil Abloh in Milan in 2012, Off-White was not the designer’s first attempt at streetwear. Abloh’s first effort was called Pyrex Vision, but it was not well received following a collaboration with Ralph Lauren, so he abandoned the label and launched Off-White.

The label has worked with various brands, retailers and even museums. This year, the brand created a new color for Nike Air Force One in collaboration with the Museum of Contemporary Art in Chicago. Categories have expanded beyond clothing and footwear: Last year, Off-White collaborated with Rimowa to create transparent polycarbonate carry-on luggage.

[caption id="attachment_93866" align="aligncenter" width="700"] Off-White spring summer 2020 collection and Virgil Abloh

Off-White spring summer 2020 collection and Virgil Abloh Source: Off-White[/caption]

Palace

Established by Lev Tanju in 2009, Palace is a British skateboard culture inspired streetwear. Like Supreme, the label utilizes a drop model and usually releases new items on the website on Friday. In 2015, the brand opened its first store in London Soho, and opened another in New York’s SoHo two years later.Vetements

Vetements is founded by designer Demna Gvasalia using a collection of designs from his friends in 2014. This French-based premium brand focusses on urban streetwear and does not follow the traditional fashion season.

In 2015, Gvasalia was appointed creative director of Balenciaga.