Stitch Fix

Sector: Online apparel retailers

Countries of operation: The UK and the US

Key product categories: Accessories, apparel and footwear

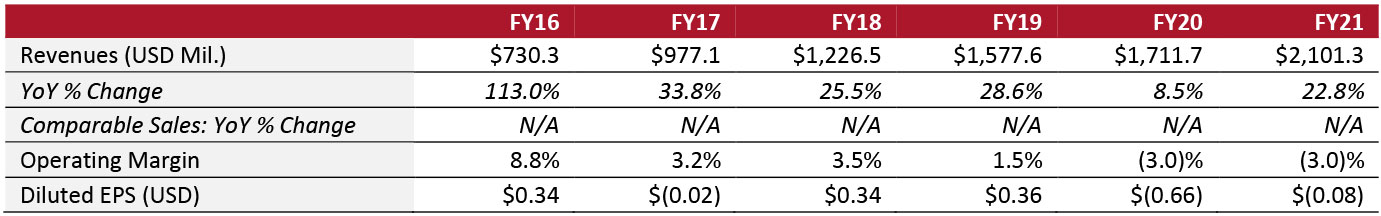

Annual Metrics

[caption id="attachment_138583" align="aligncenter" width="697"]

Fiscal year ends on August 1 of the same calendar year

Fiscal year ends on August 1 of the same calendar year[/caption]

Summary

Founded in 2011 and headquartered in San Francisco, California, Stitch Fix is an online personal styling service that operates in the US and UK—launching in the latter in May 2019. Combining recommendation algorithms, data science and human judgement, Stitch Fix stylists select and ship personalized accessories, apparel and shoes to clients’ homes. Clients can choose recurring automatic shipments or on-demand delivery. After receiving the package, they can purchase items they want to keep and return the rest. Stitch Fix charges a styling fee, but it is credited toward merchandise purchased. In September 2021, the company also introduced direct-buy functionality, allowing clients to purchase individual items without the styling fee. As of September 21, 2021, Stitch Fix had 4.2 million active clients.

Company Analysis

Coresight Research insight: Stitch Fix’s “try before you buy” personalized styling service model, combining data science and human judgement, differentiates it within the highly competitive US apparel market. We think that it has a competitive edge with a loyal customer base, bolstered by its data systems—the majority of its data is sourced directly from clients and its business model relies on deep learning built over time. Its model particularly appeals to customers seeking wardrobe styling assistance and helps the company to better curate products that are aligned with demand.

However, with increasing market competition—including other retail subscription models and resale alternatives—we believe adding new options into Stitch Fix’s model will help widen its appeal. Consequently, we view its decisions to add new functionality and flexibility over the past year favorably. In September 2021, it launched “Stitch Fix Freestyle” (earlier known as “direct buy”), which requires less commitment and subsequently we believe it could become a growth driver for its active clients base during the economic downturn.

Additionally, in May 2021, the company expanded the rollout of its Fix Preview feature across the US and UK, which allows customers to view the item selection before they are sent to provide feedback. The company stated that about three-quarters of its clients have opted to use the option as of June 7, 2021, and expects its broader expansion to improve client conversion and retention rates, as well as increase average order values. In its fourth-quarter earnings call (held in September 2021), the company reported that Freestyle and Fix Preview features are seeing promising results in product categories such as accessories, dresses, footwear, loungewear and outerwear—which represent a $90 billion opportunity in the US. Finally, in March 2021, Stitch Fix launched “Shop by Category” for existing clients. Management stated that following the initiative’s launch, the company saw a significant increase in client engagement and average weekly units ordered per client.

| Tailwinds |

Headwinds |

- Opportunities for growth from consumers’ increased usage of e-commerce due to the pandemic

- Opportunities for sustained expansion outside of the US market

- Opportunities to expand growth in categories such as menswear, kids’ and plus-size apparel

- Deep competence in data science

- The recent launch of “Stitch Fix Freestyle” requires less commitment from customers—and could drive the company’s client base

|

- Heightened competition from similar services offered by retailers such as e-commerce giant Amazon

- Elevated marketing, operating and shipping expenses may weigh on its operating margin

|

Strategy

In its annual report published in September 2021, Stitch Fix outlined the following key focus areas to meet customers’ expectations and futureproof the group:

1. Expand relationships with existing clients

- Introduce new merchandise offerings across multiple price points and broaden brand partnerships in existing product categories

- Develop new products under its “Exclusive Brands” banner to target specific client needs

- Launch new functionalities to provide clients with more convenience and flexibility

- Continue investing in its data science capabilities to better predict clients’ preferences and deliver a personalized customer experience

- Improve efficiency in inventory management and fulfillment

2. Acquire new customers

- Invest in marketing strategies including referrals programs, organic word of mouth, television advertising campaigns, search engine optimization and other methods of discovery

- Improve its offerings’ diversity by broadening its brand partnerships and expanding into new geographies, price points and product types

3. Expand its addressable market

- Expand into new markets and new product categories within personal styling services

- Continue investments in technology infrastructure

- Develop new concepts and business models

Company Developments

| Date |

Development |

| October 8, 2021 |

Stitch Fix launches its first Elevate collection, which promotes diversity and inclusivity by supporting entrepreneurs and designers of color. The Elevate collection features six Black-owned men’s and women’s accessories and apparel brands, including Busayo and Diarrablu. |

| September 21, 2021 |

Stitch Fix launches “Stitch Fix Freestyle,” allowing customers to purchase items directly from the company without ordering a Fix first. |

| April 13, 2021 |

Stitch Fix announces that President Elizabeth Spaulding will become CEO of the company, effective August 1, 2021, while current CEO and Founder Katrina Lake will transition to the role of Executive Chairperson on the same date. |

| March 23, 2021 |

Stitch Fix announces that Sharon Chiarella has been appointed Chief Product Officer. Chiarella joins Stitch Fix from Amazon, where she worked for 13 years across various roles, most recently as Vice President of Community Shopping. |

| December 7, 2020 |

Stitch Fix announces that Dan Jedda has been appointed as CFO. |

| October 22, 2020 |

Stitch Fix adds Neal Mohan, Chief Product Officer, YouTube, and SVP, Google, to its Board of Directors. |

| April 9, 2020 |

Stitch Fix issues a business update in response to Covid-19, withdrawing its business outlook for its third quarter and fiscal year 2020. |

| March 20, 2020 |

Stitch Fix temporarily closes two of its distribution centers in California and Pennsylvania as a result of public health orders. |

| March 9, 2020 |

Stitch Fix reports that quarterly sales fell below consensus for its second quarter of fiscal year 2020 and announces a bleak full-year outlook. |

| December 9, 2019 |

Stitch Fix names Elizabeth Spaulding, who previously headed Bain & Company’s digital practice, as President. |

| September 7, 2019 |

Stitch Fix collaborates with Rebecca Minkoff to launch a capsule collection on its platform, offering designer clothing in extended sizes. |

| August 30, 2019 |

Stitch Fix acquires digital wardrobe platform Finery. |

Management Team

- Elizabeth Spaulding—CEO

- Dan Jedda—CFO

- Sharon Chiarella—Chief Product Officer

- Scott Darling—Chief Legal Officer

- Minesh Shah—Chief Operations Officer

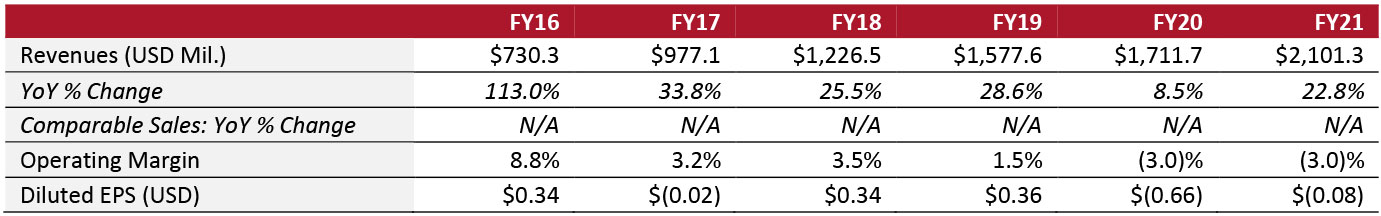

Source: Company reports/S&P Capital IQ

Fiscal year ends on August 1 of the same calendar year[/caption]

Summary

Founded in 2011 and headquartered in San Francisco, California, Stitch Fix is an online personal styling service that operates in the US and UK—launching in the latter in May 2019. Combining recommendation algorithms, data science and human judgement, Stitch Fix stylists select and ship personalized accessories, apparel and shoes to clients’ homes. Clients can choose recurring automatic shipments or on-demand delivery. After receiving the package, they can purchase items they want to keep and return the rest. Stitch Fix charges a styling fee, but it is credited toward merchandise purchased. In September 2021, the company also introduced direct-buy functionality, allowing clients to purchase individual items without the styling fee. As of September 21, 2021, Stitch Fix had 4.2 million active clients.

Company Analysis

Coresight Research insight: Stitch Fix’s “try before you buy” personalized styling service model, combining data science and human judgement, differentiates it within the highly competitive US apparel market. We think that it has a competitive edge with a loyal customer base, bolstered by its data systems—the majority of its data is sourced directly from clients and its business model relies on deep learning built over time. Its model particularly appeals to customers seeking wardrobe styling assistance and helps the company to better curate products that are aligned with demand.

However, with increasing market competition—including other retail subscription models and resale alternatives—we believe adding new options into Stitch Fix’s model will help widen its appeal. Consequently, we view its decisions to add new functionality and flexibility over the past year favorably. In September 2021, it launched “Stitch Fix Freestyle” (earlier known as “direct buy”), which requires less commitment and subsequently we believe it could become a growth driver for its active clients base during the economic downturn.

Additionally, in May 2021, the company expanded the rollout of its Fix Preview feature across the US and UK, which allows customers to view the item selection before they are sent to provide feedback. The company stated that about three-quarters of its clients have opted to use the option as of June 7, 2021, and expects its broader expansion to improve client conversion and retention rates, as well as increase average order values. In its fourth-quarter earnings call (held in September 2021), the company reported that Freestyle and Fix Preview features are seeing promising results in product categories such as accessories, dresses, footwear, loungewear and outerwear—which represent a $90 billion opportunity in the US. Finally, in March 2021, Stitch Fix launched “Shop by Category” for existing clients. Management stated that following the initiative’s launch, the company saw a significant increase in client engagement and average weekly units ordered per client.

Fiscal year ends on August 1 of the same calendar year[/caption]

Summary

Founded in 2011 and headquartered in San Francisco, California, Stitch Fix is an online personal styling service that operates in the US and UK—launching in the latter in May 2019. Combining recommendation algorithms, data science and human judgement, Stitch Fix stylists select and ship personalized accessories, apparel and shoes to clients’ homes. Clients can choose recurring automatic shipments or on-demand delivery. After receiving the package, they can purchase items they want to keep and return the rest. Stitch Fix charges a styling fee, but it is credited toward merchandise purchased. In September 2021, the company also introduced direct-buy functionality, allowing clients to purchase individual items without the styling fee. As of September 21, 2021, Stitch Fix had 4.2 million active clients.

Company Analysis

Coresight Research insight: Stitch Fix’s “try before you buy” personalized styling service model, combining data science and human judgement, differentiates it within the highly competitive US apparel market. We think that it has a competitive edge with a loyal customer base, bolstered by its data systems—the majority of its data is sourced directly from clients and its business model relies on deep learning built over time. Its model particularly appeals to customers seeking wardrobe styling assistance and helps the company to better curate products that are aligned with demand.

However, with increasing market competition—including other retail subscription models and resale alternatives—we believe adding new options into Stitch Fix’s model will help widen its appeal. Consequently, we view its decisions to add new functionality and flexibility over the past year favorably. In September 2021, it launched “Stitch Fix Freestyle” (earlier known as “direct buy”), which requires less commitment and subsequently we believe it could become a growth driver for its active clients base during the economic downturn.

Additionally, in May 2021, the company expanded the rollout of its Fix Preview feature across the US and UK, which allows customers to view the item selection before they are sent to provide feedback. The company stated that about three-quarters of its clients have opted to use the option as of June 7, 2021, and expects its broader expansion to improve client conversion and retention rates, as well as increase average order values. In its fourth-quarter earnings call (held in September 2021), the company reported that Freestyle and Fix Preview features are seeing promising results in product categories such as accessories, dresses, footwear, loungewear and outerwear—which represent a $90 billion opportunity in the US. Finally, in March 2021, Stitch Fix launched “Shop by Category” for existing clients. Management stated that following the initiative’s launch, the company saw a significant increase in client engagement and average weekly units ordered per client.