Nitheesh NH

What’s the Story?

Stitch Fix, which is part of the Coresight 100 (our focus list of retailers, brand owners and real estate firms, spanning the US, Europe and Asia), has expanded from a startup to a multibillion-dollar public retail company within just 10 years of its incorporation in 2011. The company’s meteoric rise has not just disrupted the traditional apparel retail market but also apparel e-commerce. We believe that apparel retailers around the world can take learnings from Stitch Fix to bolster their own businesses. In this report, we review Stitch Fix’s business model in detail, highlighting the company’s major growth strategies and revenue drivers.Stitch Fix: In Detail

OverviewFigure 1. Company Overview: Stitch Fix [wpdatatable id=1220]

*For the trailing 12 months ended May 1, 2021 Source: Company reports

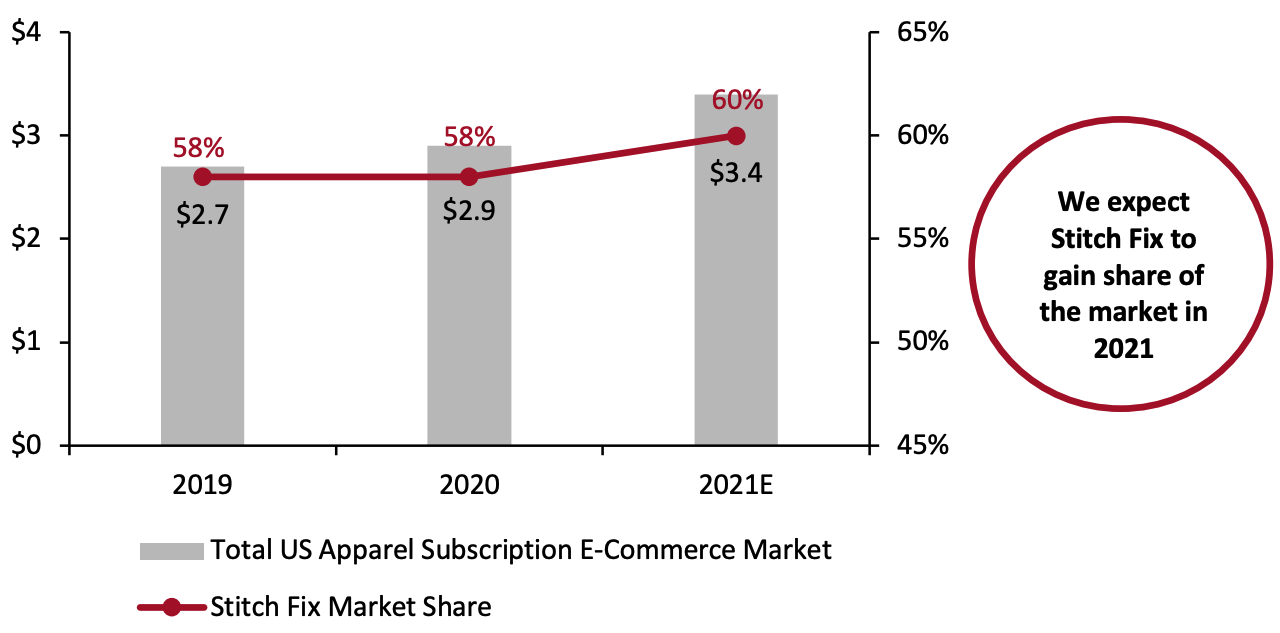

Market Positioning Stitch Fix originated as an apparel subscription company and has since expanded its addressable market by opening up a “direct buy” feature to non-subscription clients on August 9, 2021 (which we discuss in further detail later in this report). At present, Stitch Fix generates a large majority of its revenues from its apparel subscription service and holds a very dominant position in the relatively new US apparel subscription e-commerce market, which comprises about 1% of the total US apparel and footwear market, we estimate. In fiscal 2020 (ended August 1, 2020), Stitch Fix’s share of the US apparel subscription e-commerce market stood at 58%, unchanged from fiscal 2019, Coresight Research estimates. In the total US apparel and footwear market, Stich Fix held about 0.5% share in fiscal 2020, slightly up from 0.4% in fiscal 2019. Coresight Research estimates that Stitch Fix will see year-over-year sales growth of nearly 22% (US only) in fiscal 2021, ending July 31, 2021—outpacing the 17% sales growth of the total US apparel subscription e-commerce market, of which we estimate Stitch Fix holds a 60% share this year. The company’s strong sales growth will be driven by an acceleration in year-over-year growth of its active client base as well as increased spend from its newest client cohorts as they mature on the company’s platform. With the reopening of its warehouses amid the easing of pandemic-related restrictions and a strong pickup in consumer demand, Stitch Fix has seen a rebound in sales, even outperforming pre-pandemic levels in the third quarter of fiscal 2021 (ended May 1, 2021), when sales grew 44% year over year and 31% on a two-year basis (versus the corresponding quarter in 2019).Figure 2. US Apparel Subscription E-Commerce Market Size (Left Axis; USD Bil.) and Stitch Fix’s Share of the Total Market (Right Axis; %) [caption id="attachment_132008" align="aligncenter" width="700"]

Total market size as estimated by Coresight ResearchStitch Fix’s fiscal year ends on July 31; Stitch Fix’s market share for each calendar year as estimated by Coresight Research

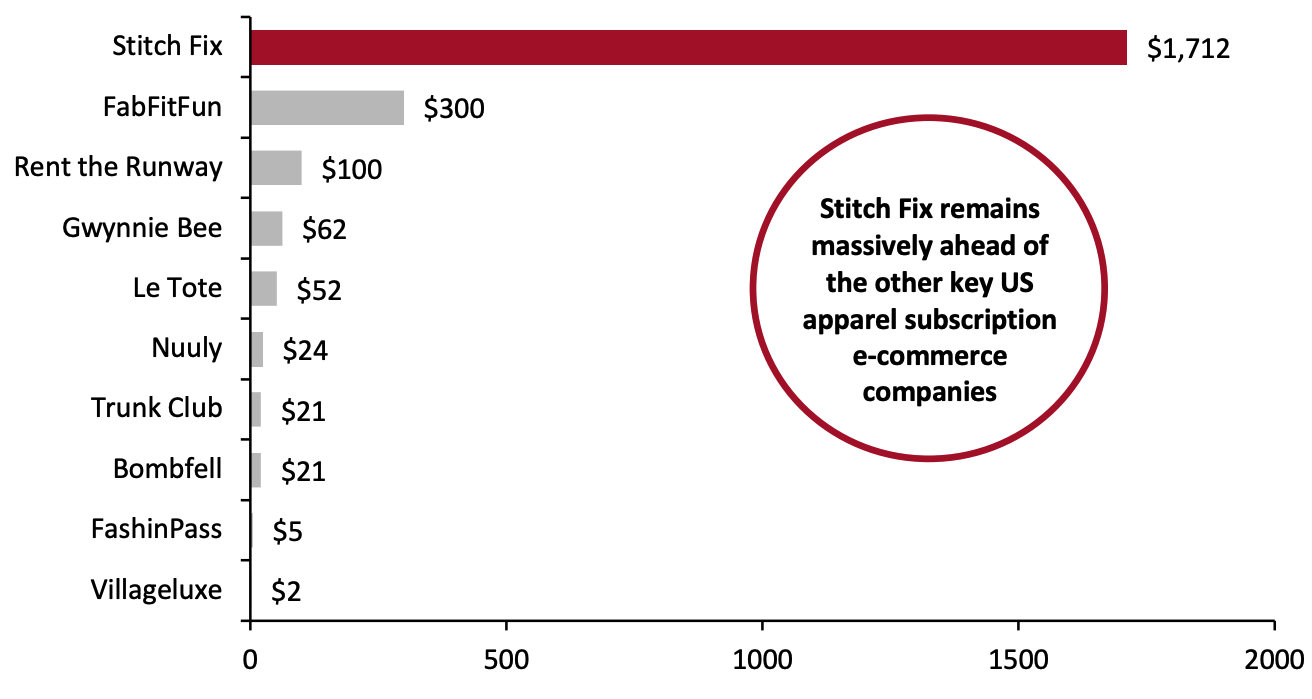

Total market size as estimated by Coresight ResearchStitch Fix’s fiscal year ends on July 31; Stitch Fix’s market share for each calendar year as estimated by Coresight ResearchSource: Company reports/Coresight Research[/caption] In the US apparel subscription e-commerce space, other major companies include FabFitFun, Rent the Runway, Gwynnie Bee, Le Tote, Bombfell, Nuuly (offered by Urban Outfitters) and Trunk Club (offered by Nordstrom). Although these apparel subscription companies are aggressively expanding their business operations, they remain very small (in terms of sales) compared to Stitch Fix (see Figure 3).

Figure 3. Total Annual Sales of Selected Apparel Subscription E-Commerce Businesses* (USD. Mil) [caption id="attachment_132009" align="aligncenter" width="700"]

*As of their latest fiscal years

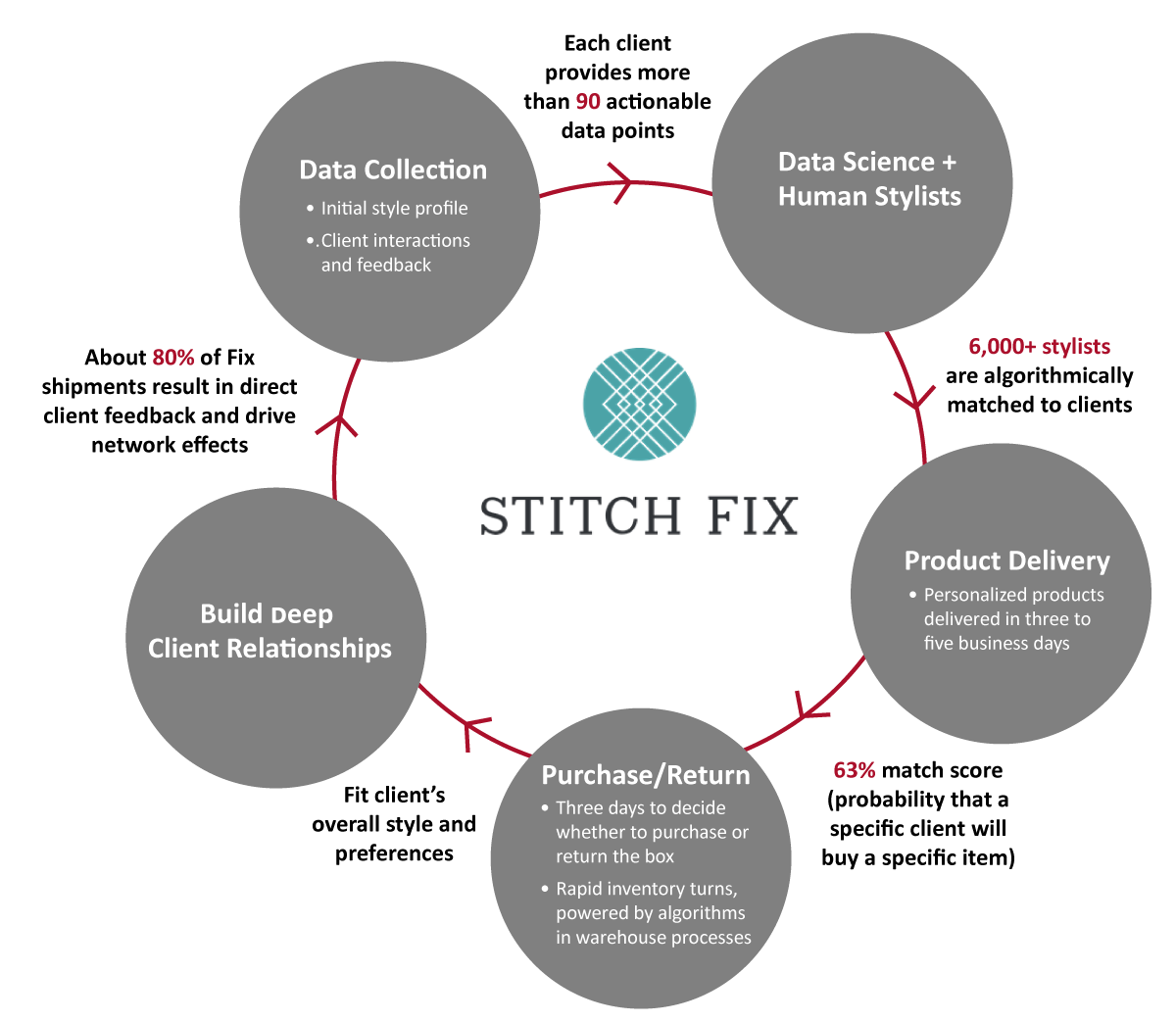

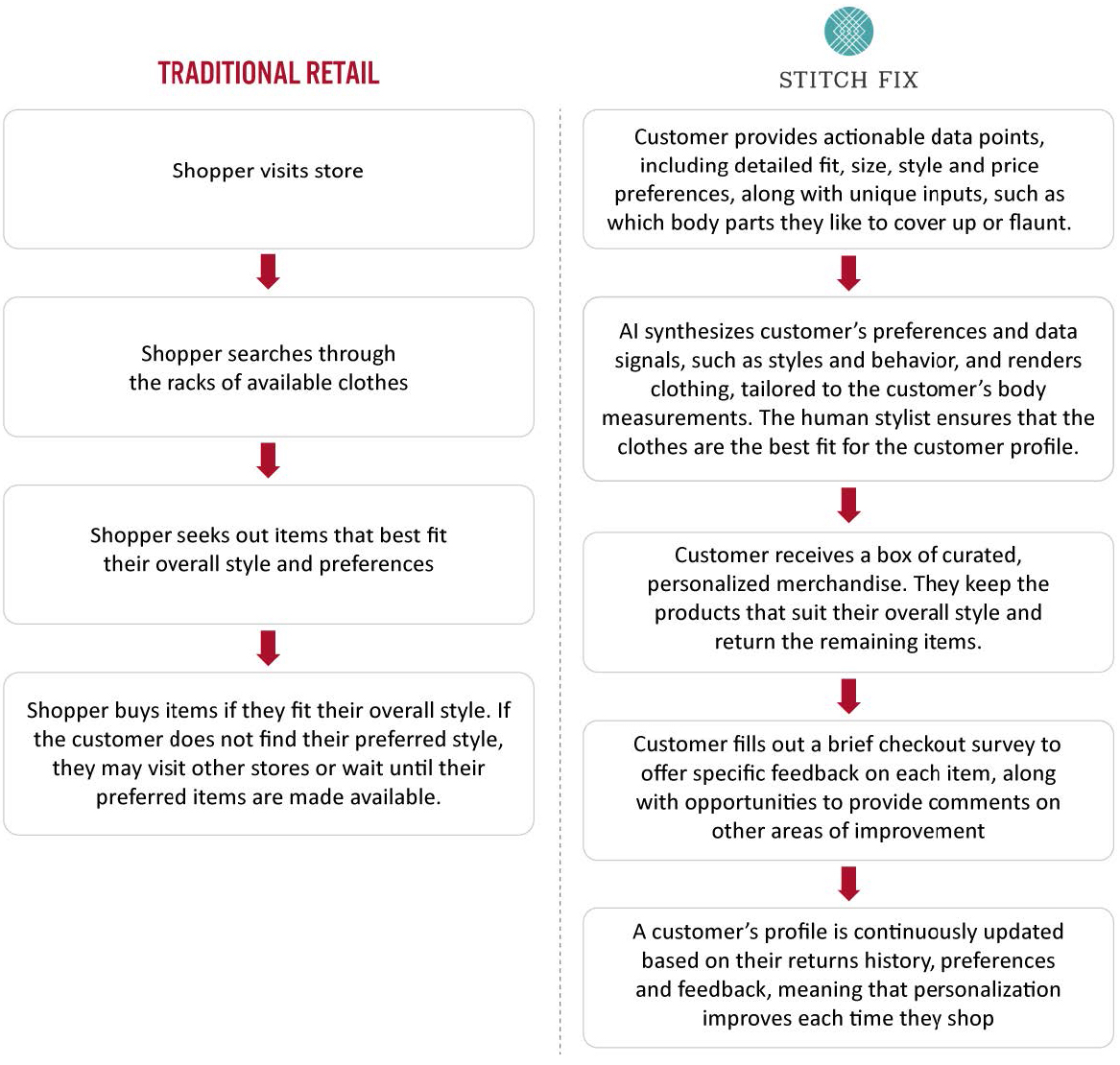

*As of their latest fiscal yearsSource: Company reports/dun&bradsheet/Jilt/Los Angeles Business Journal/RocketReach/WWD[/caption] Business Model Stitch Fix’s “try before you buy” business model relies on algorithms and data science, complemented by human judgment, with the aim of providing a personalized experience to its customers. We summarize the business model in Figure 4 and discuss it in further detail below.

Figure 4. Stitch Fix: Business Model [caption id="attachment_132050" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

The company’s primary offering is “Fix,” a branded box that contains a curated collection of accessories, clothing and footwear personally selected by the company’s stylist for each client. The box is delivered for the client to try on the items in the comfort of their own home. For each Fix, the client pays a styling fee that is credited toward the merchandise purchased.

Customer data is integral to Stitch Fix’s personalization strategy, which it gathers from two primary sources:

Source: Company reports/Coresight Research[/caption]

The company’s primary offering is “Fix,” a branded box that contains a curated collection of accessories, clothing and footwear personally selected by the company’s stylist for each client. The box is delivered for the client to try on the items in the comfort of their own home. For each Fix, the client pays a styling fee that is credited toward the merchandise purchased.

Customer data is integral to Stitch Fix’s personalization strategy, which it gathers from two primary sources:

- Initial style profiles—Each Fix client provides more than 90 actionable data points, including detailed fit, size, style and price preferences, along with unique inputs such as how often the shopper dresses for special occasions or which body parts they like to cover up or flaunt.

- Client interactions and feedback—Stitch Fix’s Style Shuffle, an interactive mobile and web-based offering that encourages clients to rate merchandise, provides meaningful data to bolster the company’s understanding of customers’ tastes and preferences.

- Auto-ship—Every two to three weeks, monthly, bi-monthly or quarterly

- On demand— The client need to book each Fix individually any time they want one

Figure 5. Customer Journey Map: Traditional Retail Versus Stitch Fix [caption id="attachment_132011" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

How Is Stitch Fix Evolving Its Offerings?

Stitch Fix is evolving its offerings to attract new clients, convert prospective clients and reactivate lapsed clients through a “direct buy” option and its Fix Preview feature, which we discuss below.

Direct Buy

Stitch Fix first launched its direct-buy option in late 2019, enabling the sale of individual items without charging a styling fee. On August 9, 2021, the company opened up the direct-buy offering to non-subscription clients, which is expected to accelerate top-line and client growth, and expand its total addressable market to multiple times larger than the Fix offering alone, as stated by the company in June 2021 in its earnings call for the third quarter of fiscal 2021.

In March 2021, the company expanded the direct-buy function to include a “Shop by Category” filter, which leverages customer-style data to create a highly personalized direct-buy shopping feed. In the June earnings call, company management said that following the launch of Shop by Category, Stitch Fix saw a significant increase in client engagement and average weekly units ordered per client.

Overall, we are seeing growing consumer interest in direct-buy services via subscription platforms: A Coresight Research survey of US consumers conducted on June 21, 2021, found that 34.2% of respondents had purchased apparel this way in the past 12 months, and 74.5% of those said they prefer direct buy over the subscription offering.

Fix Preview

In August 2020, Stitch Fix began testing its Fix Preview feature across the UK and had introduced it to 50% of its UK clients by December 2020. The feature allows shoppers to preview the items that will be in their box and make changes before the box ships—giving the customer a chance to engage with a stylist and have more control over the products they receive.

While launching the Fix Preview feature, Stitch Fix conducted a survey of its prospective clients and found that about 45% of respondents would order a Fix if they could preview what they might receive through the company’s stylist-based experience.

In its earnings call for the second quarter of fiscal 2021, held in March 2021, the company noted that the results from the Fix Preview launch were highly encouraging, with about 75% of the clients opting to use the feature. Stitch Fix sees higher item-keep rates and satisfaction through Fix Preview, resulting in improved client retention and a 10% increase in average order value. In addition to these advantages, we believe that higher item-keep rates—and thus reduced returns—will help the company to substantially reduce its overall shipping costs and lessen Stitch Fix’s impact on the environment.

During its third quarter of fiscal 2021, ended May 1, 2021, Stitch Fix expanded the rollout of the Fix Preview feature to 100% of the company’s UK clients. Furthermore, as of the end of May 2021, the company rolled the feature to more than half of its US clients and plans to further expand the rollout in the region. In its latest earnings call, Stitch Fix noted that about three-quarters of its clients in the US and the UK have opted to use Fix Preview as of June 7, 2021.

Financial and Client Metrics

Revenue Growth, Operating Margin and Marketing Cost Ratio

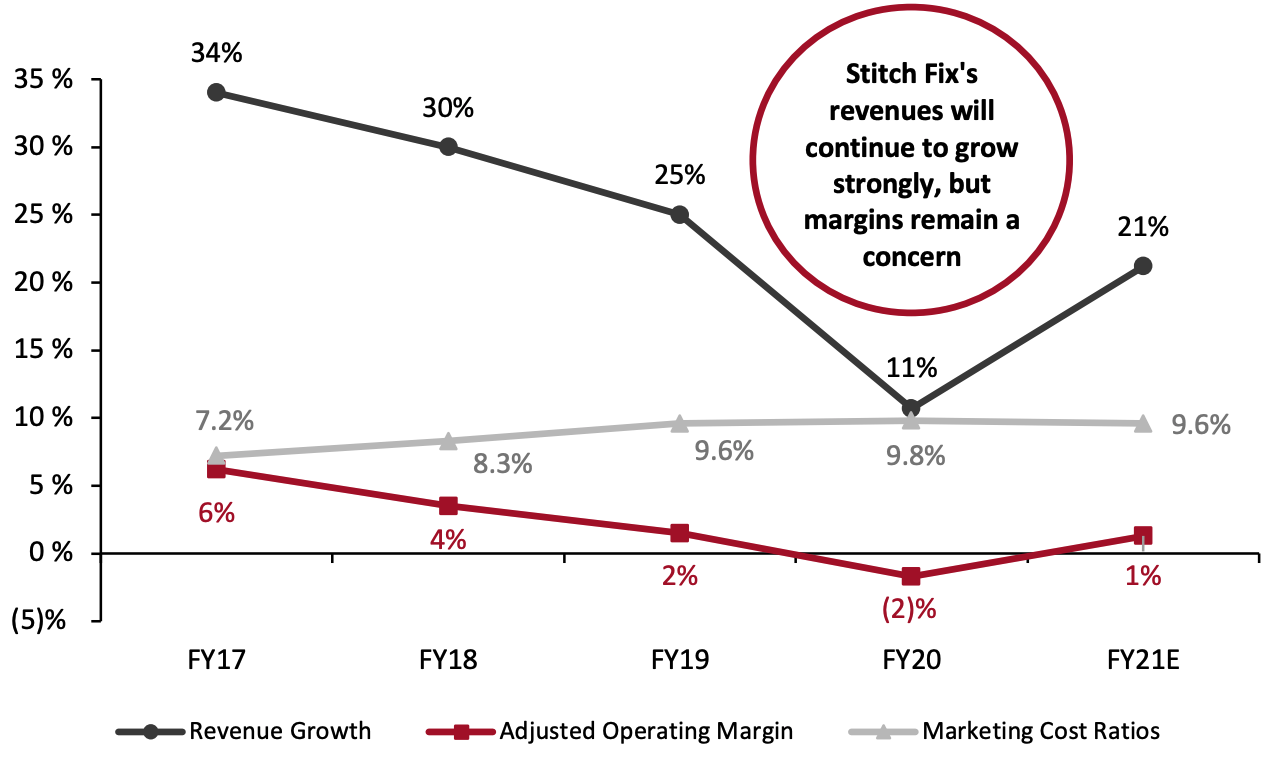

In fiscal 2020, the company saw year-over-year revenue growth decelerate to 10.7% (adjusting for the impact of the extra week in fiscal 2019), which was still very strong in the context of the pandemic. For fiscal 2021, Stitch Fix expects revenue growth of 20.9%–21.5% year over year, driven primarily by its growing base of active clients (which we discuss further later in this report).

However, despite strong revenue growth, Stitch Fix’s adjusted operating margin had been slim even before the pandemic and then turned negative in fiscal 2020. While we believe Stitch Fix’s overall consumer demand remains intact, certain factors are likely to weigh on margins in fiscal 2021—namely, increasing marketing costs, shipping expenses (higher rates with carriers) and inventory reserves, as well as a slow rebound in the men’s business.

In the past three fiscal years, Stitch Fix has seen increasing marketing cost ratios (marketing costs as a percentage of revenues). For fiscal 2021 ended July 31, 2021 (yet to be reported), we expect the company’s marketing cost ratio to marginally contract, mainly due to Stitch Fix pulling back on advertising spend in the second quarter, particularly during the holiday season, to reduce its client-acquisition costs. However, in the next couple of years, we expect the company’s marketing expenses to increase substantially, which will lead to a slight expansion in marketing cost ratio. While this will weigh on the company’s margins, we believe it is prudent on Stitch Fix’s part to continue spending on advertising in the near future to gain share of the total US apparel market when most traditional apparel retailers face traffic headwinds.

Source: Coresight Research[/caption]

How Is Stitch Fix Evolving Its Offerings?

Stitch Fix is evolving its offerings to attract new clients, convert prospective clients and reactivate lapsed clients through a “direct buy” option and its Fix Preview feature, which we discuss below.

Direct Buy

Stitch Fix first launched its direct-buy option in late 2019, enabling the sale of individual items without charging a styling fee. On August 9, 2021, the company opened up the direct-buy offering to non-subscription clients, which is expected to accelerate top-line and client growth, and expand its total addressable market to multiple times larger than the Fix offering alone, as stated by the company in June 2021 in its earnings call for the third quarter of fiscal 2021.

In March 2021, the company expanded the direct-buy function to include a “Shop by Category” filter, which leverages customer-style data to create a highly personalized direct-buy shopping feed. In the June earnings call, company management said that following the launch of Shop by Category, Stitch Fix saw a significant increase in client engagement and average weekly units ordered per client.

Overall, we are seeing growing consumer interest in direct-buy services via subscription platforms: A Coresight Research survey of US consumers conducted on June 21, 2021, found that 34.2% of respondents had purchased apparel this way in the past 12 months, and 74.5% of those said they prefer direct buy over the subscription offering.

Fix Preview

In August 2020, Stitch Fix began testing its Fix Preview feature across the UK and had introduced it to 50% of its UK clients by December 2020. The feature allows shoppers to preview the items that will be in their box and make changes before the box ships—giving the customer a chance to engage with a stylist and have more control over the products they receive.

While launching the Fix Preview feature, Stitch Fix conducted a survey of its prospective clients and found that about 45% of respondents would order a Fix if they could preview what they might receive through the company’s stylist-based experience.

In its earnings call for the second quarter of fiscal 2021, held in March 2021, the company noted that the results from the Fix Preview launch were highly encouraging, with about 75% of the clients opting to use the feature. Stitch Fix sees higher item-keep rates and satisfaction through Fix Preview, resulting in improved client retention and a 10% increase in average order value. In addition to these advantages, we believe that higher item-keep rates—and thus reduced returns—will help the company to substantially reduce its overall shipping costs and lessen Stitch Fix’s impact on the environment.

During its third quarter of fiscal 2021, ended May 1, 2021, Stitch Fix expanded the rollout of the Fix Preview feature to 100% of the company’s UK clients. Furthermore, as of the end of May 2021, the company rolled the feature to more than half of its US clients and plans to further expand the rollout in the region. In its latest earnings call, Stitch Fix noted that about three-quarters of its clients in the US and the UK have opted to use Fix Preview as of June 7, 2021.

Financial and Client Metrics

Revenue Growth, Operating Margin and Marketing Cost Ratio

In fiscal 2020, the company saw year-over-year revenue growth decelerate to 10.7% (adjusting for the impact of the extra week in fiscal 2019), which was still very strong in the context of the pandemic. For fiscal 2021, Stitch Fix expects revenue growth of 20.9%–21.5% year over year, driven primarily by its growing base of active clients (which we discuss further later in this report).

However, despite strong revenue growth, Stitch Fix’s adjusted operating margin had been slim even before the pandemic and then turned negative in fiscal 2020. While we believe Stitch Fix’s overall consumer demand remains intact, certain factors are likely to weigh on margins in fiscal 2021—namely, increasing marketing costs, shipping expenses (higher rates with carriers) and inventory reserves, as well as a slow rebound in the men’s business.

In the past three fiscal years, Stitch Fix has seen increasing marketing cost ratios (marketing costs as a percentage of revenues). For fiscal 2021 ended July 31, 2021 (yet to be reported), we expect the company’s marketing cost ratio to marginally contract, mainly due to Stitch Fix pulling back on advertising spend in the second quarter, particularly during the holiday season, to reduce its client-acquisition costs. However, in the next couple of years, we expect the company’s marketing expenses to increase substantially, which will lead to a slight expansion in marketing cost ratio. While this will weigh on the company’s margins, we believe it is prudent on Stitch Fix’s part to continue spending on advertising in the near future to gain share of the total US apparel market when most traditional apparel retailers face traffic headwinds.

Figure 6. Stitch Fix: Revenue Growth (YoY %)*, Adjusted Operating Margin (%) and Marketing Cost Ratio** (%) [caption id="attachment_132012" align="aligncenter" width="700"]

*For fiscal 2020, revenue growth number has been adjusted for the impact of the extra week in fiscal 2019

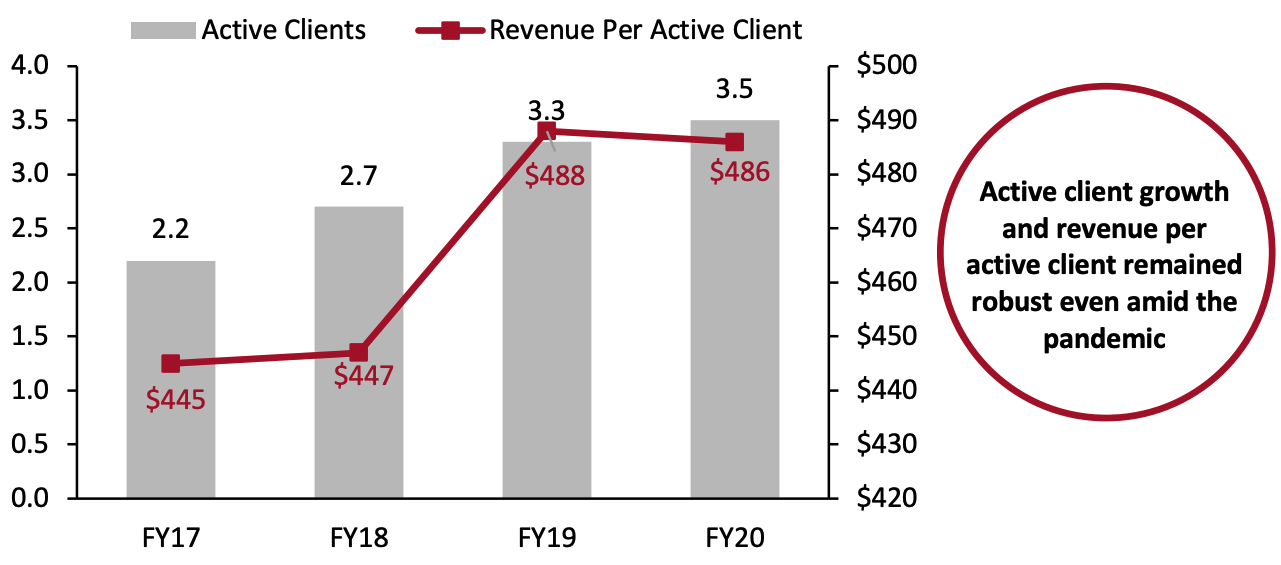

*For fiscal 2020, revenue growth number has been adjusted for the impact of the extra week in fiscal 2019**Fiscal 2021 estimates: marketing cost ratio is Coresight Research’s estimate, while revenue growth and adjusted operating margin are mid-points of the company’s estimates Source: Company reports/Coresight Research[/caption] Active Clients and Revenues Per Active Clients Since its incorporation, Stitch Fix has been aggressively acquiring clients, with revenue per active client growing consistently. Even during the pandemic, the company managed to expand its active client base: In fiscal 2020, the company’s active clients increased by 200,000, or 6%, to 3.5 million, with revenue per active client remaining solid at $486, compared to $488 in fiscal 2019. For fiscal 2021, Stitch Fix expects year-over-year growth acceleration in both its active client base and revenue per client.

Figure 7. Stitch Fix: Number of Active Clients (Mil.; Left Axis) and Revenue Per Active Client (USD; Right Axis) [caption id="attachment_132013" align="aligncenter" width="700"]

Fiscal year ends on August 30

Fiscal year ends on August 30Source: Company reports[/caption] Recent Key Developments Below, we outline major developments at Stitch Fix since the incorporation of the company in 2011.

Figure 8. Stitch Fix: Recent Developments [wpdatatable id=1221]

Source: Company reports/S&P Capital IQ

What We Think

Stitch Fix’s “try before you buy” personalized styling-service model utilizing data science and human judgment differentiates the company within the highly competitive US apparel market. We see Stitch Fix having a strong competitive edge with its loyal customers—the company sources the majority of its actionable data directly from its clients, with its business model relying on deep learnings built over time. We believe that the company’s business model is particularly appealing to customers seeking wardrobe styling assistance, with Stitch Fix curating offerings that are aligned with clients’ preferences. With increasing market competition, including the rise of other retail subscription companies and resale fashion alternatives, such as The RealReal, we believe adding new options into Stitch Fix’s model will help the company to widen its appeal: Stitch Fix’s new “direct buy” and “Fix Preview” functionalities have the potential to become long-term drivers of growth for the company’s active client base. Implications for Brands/Retailers- Instead of relying on one source of consumer data, retailers and brand owners should collect, sort and analyze a variety of data from several sources, such as through initial client profiling and subsequent interactions and feedback, to understand customer psychology well and offer a unique experience to them.

- Combining AI with human judgment can help brand owners and retailers to upend the customers’ traditional retail clothing experience through effective personalization of the offerings.

- Automation at scale is key to sustainable personalization in apparel retail. Retailers and brands should strategically decide various aspects of businesses that can be automated, such as inventory ordering or warehouse functions.

- Retailers and brand owners should regularly evolve their offerings to attract new clients and convert prospective clients.