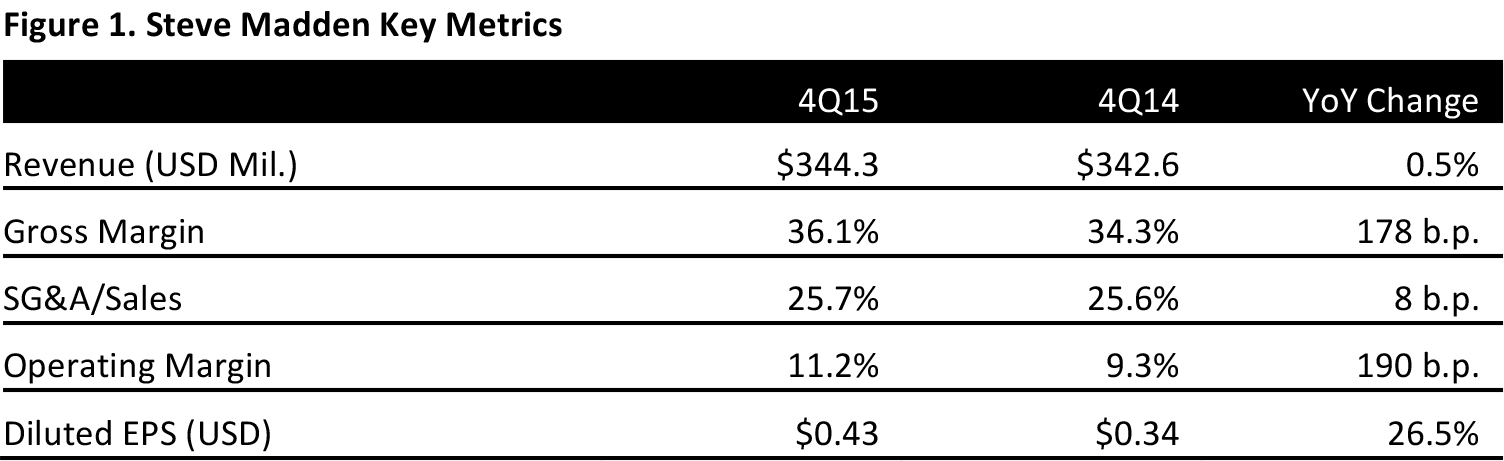

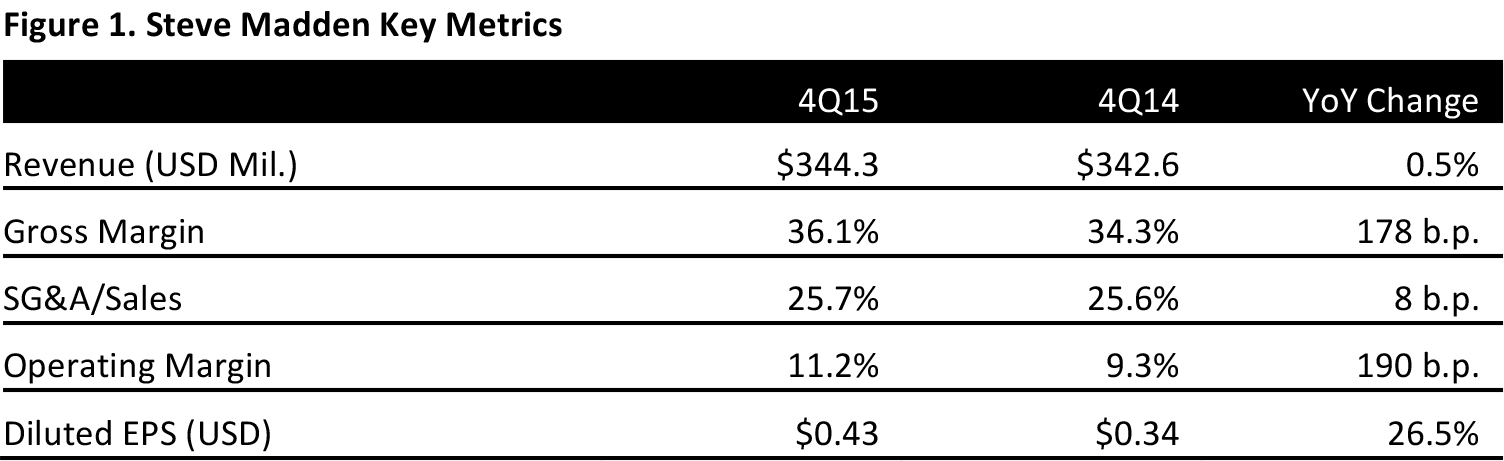

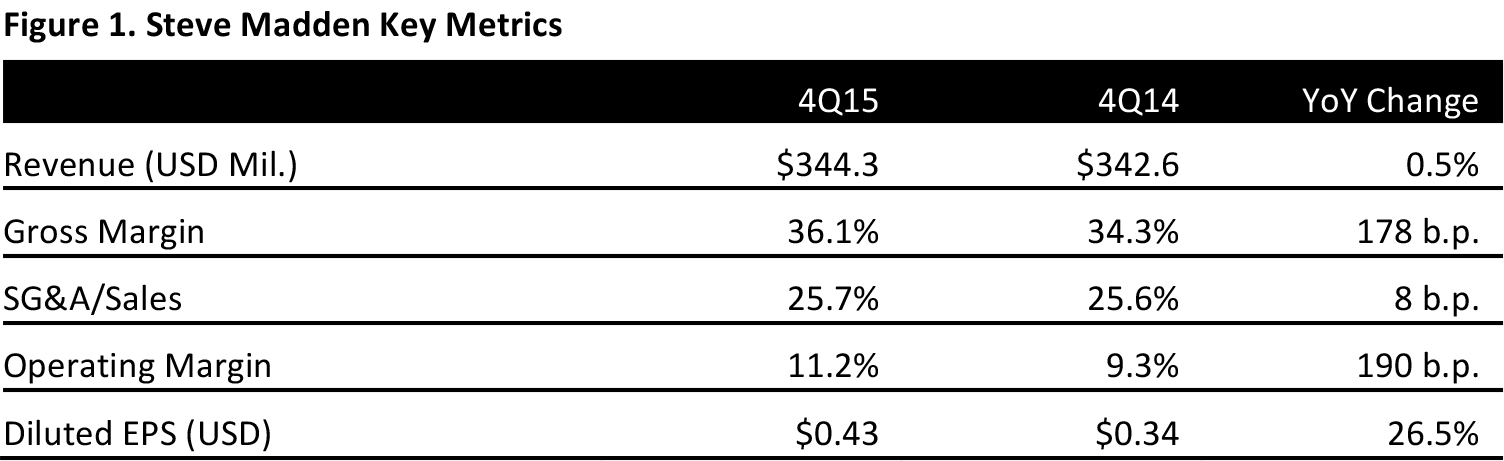

Source: Company reports

Steve Madden reported solid 4Q15 results despite unfavorable weather and a heavily promotional retail environment: sales totaled $344.3 million, up 0.5% from the year-ago quarter.

The retail segment recorded 4Q net sales of $79.3 million, up 8.9% year over year. The increase reflects a 6.1% comparable same-store sales gain, which was driven by better fashion footwear trends, stronger product assortment and improvement in conversion rates.

The wholesale division, which accounts for more than 70% of the retailer’s sales, reported a 4Q sales decline of 1.8%, to $265.0 million, partially offsetting retail gains. The decrease reflects headwinds from a heavily promotional retail environment and a challenging landscape for seasonal products such as boots and cold weather accessories. Wholesale gross margin increased by 130 basis points year over year, reflecting the improvement in both the wholesale footwear and accessories segments.

FY15 RESULTS

For FY15, Steve Madden’s total sales increased by 5.3%, to $1.4 billion. Wholesale net sales grew by 3.3%, to $1.2 billion; retail net sales increased by 15.9%, to $240.3 million; and retail comps rose by 11.2%. Diluted EPS was $1.85, compared to $1.76 in 2014. The figure was at the low end of the company’s guidance of $1.85–$1.95.

GUIDANCE

For FY16, Steve Madden expects diluted EPS in the range of $1.93–$2.03, short of the consensus estimate of $2.10. The company expects total sales to increase by approximately 2%–4%, or to $1.43–$1.46 billion, compared to the consensus estimate of $1.46 billion.