albert Chan

[caption id="attachment_78308" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

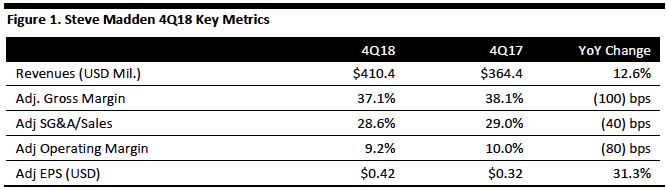

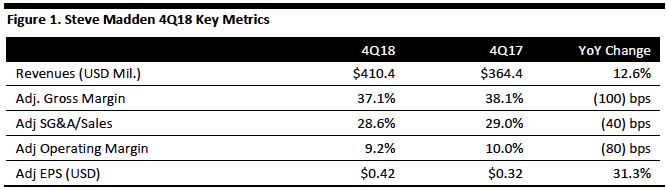

Steve Madden 4Q sales rose 12.6% to $410.4 million, beating the $401.5 million consensus estimate, driven by a 14.1% increase in wholesale revenues to $317.4 million and a 7.9% increase in retail sales to $93 million. Same store sales rose 4%, reflecting a 30% increase in SteveMadden.com sales growth.

Adjusted operating profit contracted 80 bps to 9.2% of sales on a 90-bps gross margin contraction in the wholesale segment reflecting mix shift, the 10% tariff on handbags and other accessories made in China implemented September 24, 2018, and increased ocean freight costs as demand spiked in efforts to bring in goods prior to the new year and avoid a potential 25% tariff. Retail gross margin expanded 20 bps to 61%. Operating expenses declined 40 bps to 28.6% of sales.

By moving production out of China primarily to Cambodia for categories impacted by the tariff and working with Chinese manufacturers for price concessions for the remaining 50% of product still manufactured in China, the company mitigated the vast majority of the 10% tariff and looking forward, believes it will be immaterial at the 10% level this year. (Cambodia now the source of nearly half of Steve Madden handbag production, up from about 16% a year ago)

By division, Steve Madden women’s US wholesale footwear net sales rose mid-single digit; at the Steven division, net sales rose mid-teens. Madden NYC, the new exclusive brand for Kohls, is building momentum as the company roles out selected women’s styles to all Kohl’s doors and men’s in 50 Kohl’s doors this spring. Internationally, the Madden brand is strong too, with international sales up 22% in Canada and Mexico (company-owned markets) and up 40%+ in joint venture and distributor markets of Europe, the Middle East, India and Italy. Sales of Blondo (waterproof footwear) sales rose 50%. Anne Klein (a licensed brand) began shipping in the fall and is on target for $80-90 million in sales for the first 12 months (fall 2018/spring 2019). Wholesale accessories revenues rose 17% on an improved product assortment; Steve Madden handbags were up nearly 20%.

At yearend, the company formed a JV with a key distributor in Israel, Inner Jeans. Steve Madden owns 51% and Inner Jeans 49%. The joint venture currently has 14 Steve Madden stores and 50 doors of wholesale distribution. The company expects to add another 10 stores in the next three years and to significantly expand the wholesale business.

Adjusted EPS increased 31.3% to $0.42, ahead of the $0.38 consensus estimate.

Inventories increased $27.1 million, or 24.4%, to $137.2 million on a year-over-year basis.

Excluding the new businesses of Anne Klein and the Israel JV, inventory rose 17%, mostly related to the accessories division as the company tried to import goods before tariffs went into effect. The early Chinese New Year (11 days earlier than last year) resulted in more inventory on hand and in transit at 2018-yearend in accessories and shoes.

Payless ShoeSource filed for Chapter 11 on February 18, 2019, approximately 18 months after emerging from its prior bankruptcy. Payless has been a meaningful private label customer for Steve Madden since the company's acquisition of Topline in 2011. Approximately $105 million in sales were made to Payless in 2018. CEO Ed Rosenfeld said on the investor call that of consumers who shopped at Payless in 2018, nearly half also purchased footwear at Walmart and approximately 20% purchased footwear at Target, two retailers with which Steve Madden has significant private label relationships.

Outlook

The company provided initial guidance for 2019.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Steve Madden 4Q sales rose 12.6% to $410.4 million, beating the $401.5 million consensus estimate, driven by a 14.1% increase in wholesale revenues to $317.4 million and a 7.9% increase in retail sales to $93 million. Same store sales rose 4%, reflecting a 30% increase in SteveMadden.com sales growth.

Adjusted operating profit contracted 80 bps to 9.2% of sales on a 90-bps gross margin contraction in the wholesale segment reflecting mix shift, the 10% tariff on handbags and other accessories made in China implemented September 24, 2018, and increased ocean freight costs as demand spiked in efforts to bring in goods prior to the new year and avoid a potential 25% tariff. Retail gross margin expanded 20 bps to 61%. Operating expenses declined 40 bps to 28.6% of sales.

By moving production out of China primarily to Cambodia for categories impacted by the tariff and working with Chinese manufacturers for price concessions for the remaining 50% of product still manufactured in China, the company mitigated the vast majority of the 10% tariff and looking forward, believes it will be immaterial at the 10% level this year. (Cambodia now the source of nearly half of Steve Madden handbag production, up from about 16% a year ago)

By division, Steve Madden women’s US wholesale footwear net sales rose mid-single digit; at the Steven division, net sales rose mid-teens. Madden NYC, the new exclusive brand for Kohls, is building momentum as the company roles out selected women’s styles to all Kohl’s doors and men’s in 50 Kohl’s doors this spring. Internationally, the Madden brand is strong too, with international sales up 22% in Canada and Mexico (company-owned markets) and up 40%+ in joint venture and distributor markets of Europe, the Middle East, India and Italy. Sales of Blondo (waterproof footwear) sales rose 50%. Anne Klein (a licensed brand) began shipping in the fall and is on target for $80-90 million in sales for the first 12 months (fall 2018/spring 2019). Wholesale accessories revenues rose 17% on an improved product assortment; Steve Madden handbags were up nearly 20%.

At yearend, the company formed a JV with a key distributor in Israel, Inner Jeans. Steve Madden owns 51% and Inner Jeans 49%. The joint venture currently has 14 Steve Madden stores and 50 doors of wholesale distribution. The company expects to add another 10 stores in the next three years and to significantly expand the wholesale business.

Adjusted EPS increased 31.3% to $0.42, ahead of the $0.38 consensus estimate.

Inventories increased $27.1 million, or 24.4%, to $137.2 million on a year-over-year basis.

Excluding the new businesses of Anne Klein and the Israel JV, inventory rose 17%, mostly related to the accessories division as the company tried to import goods before tariffs went into effect. The early Chinese New Year (11 days earlier than last year) resulted in more inventory on hand and in transit at 2018-yearend in accessories and shoes.

Payless ShoeSource filed for Chapter 11 on February 18, 2019, approximately 18 months after emerging from its prior bankruptcy. Payless has been a meaningful private label customer for Steve Madden since the company's acquisition of Topline in 2011. Approximately $105 million in sales were made to Payless in 2018. CEO Ed Rosenfeld said on the investor call that of consumers who shopped at Payless in 2018, nearly half also purchased footwear at Walmart and approximately 20% purchased footwear at Target, two retailers with which Steve Madden has significant private label relationships.

Outlook

The company provided initial guidance for 2019.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Steve Madden 4Q sales rose 12.6% to $410.4 million, beating the $401.5 million consensus estimate, driven by a 14.1% increase in wholesale revenues to $317.4 million and a 7.9% increase in retail sales to $93 million. Same store sales rose 4%, reflecting a 30% increase in SteveMadden.com sales growth.

Adjusted operating profit contracted 80 bps to 9.2% of sales on a 90-bps gross margin contraction in the wholesale segment reflecting mix shift, the 10% tariff on handbags and other accessories made in China implemented September 24, 2018, and increased ocean freight costs as demand spiked in efforts to bring in goods prior to the new year and avoid a potential 25% tariff. Retail gross margin expanded 20 bps to 61%. Operating expenses declined 40 bps to 28.6% of sales.

By moving production out of China primarily to Cambodia for categories impacted by the tariff and working with Chinese manufacturers for price concessions for the remaining 50% of product still manufactured in China, the company mitigated the vast majority of the 10% tariff and looking forward, believes it will be immaterial at the 10% level this year. (Cambodia now the source of nearly half of Steve Madden handbag production, up from about 16% a year ago)

By division, Steve Madden women’s US wholesale footwear net sales rose mid-single digit; at the Steven division, net sales rose mid-teens. Madden NYC, the new exclusive brand for Kohls, is building momentum as the company roles out selected women’s styles to all Kohl’s doors and men’s in 50 Kohl’s doors this spring. Internationally, the Madden brand is strong too, with international sales up 22% in Canada and Mexico (company-owned markets) and up 40%+ in joint venture and distributor markets of Europe, the Middle East, India and Italy. Sales of Blondo (waterproof footwear) sales rose 50%. Anne Klein (a licensed brand) began shipping in the fall and is on target for $80-90 million in sales for the first 12 months (fall 2018/spring 2019). Wholesale accessories revenues rose 17% on an improved product assortment; Steve Madden handbags were up nearly 20%.

At yearend, the company formed a JV with a key distributor in Israel, Inner Jeans. Steve Madden owns 51% and Inner Jeans 49%. The joint venture currently has 14 Steve Madden stores and 50 doors of wholesale distribution. The company expects to add another 10 stores in the next three years and to significantly expand the wholesale business.

Adjusted EPS increased 31.3% to $0.42, ahead of the $0.38 consensus estimate.

Inventories increased $27.1 million, or 24.4%, to $137.2 million on a year-over-year basis.

Excluding the new businesses of Anne Klein and the Israel JV, inventory rose 17%, mostly related to the accessories division as the company tried to import goods before tariffs went into effect. The early Chinese New Year (11 days earlier than last year) resulted in more inventory on hand and in transit at 2018-yearend in accessories and shoes.

Payless ShoeSource filed for Chapter 11 on February 18, 2019, approximately 18 months after emerging from its prior bankruptcy. Payless has been a meaningful private label customer for Steve Madden since the company's acquisition of Topline in 2011. Approximately $105 million in sales were made to Payless in 2018. CEO Ed Rosenfeld said on the investor call that of consumers who shopped at Payless in 2018, nearly half also purchased footwear at Walmart and approximately 20% purchased footwear at Target, two retailers with which Steve Madden has significant private label relationships.

Outlook

The company provided initial guidance for 2019.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Steve Madden 4Q sales rose 12.6% to $410.4 million, beating the $401.5 million consensus estimate, driven by a 14.1% increase in wholesale revenues to $317.4 million and a 7.9% increase in retail sales to $93 million. Same store sales rose 4%, reflecting a 30% increase in SteveMadden.com sales growth.

Adjusted operating profit contracted 80 bps to 9.2% of sales on a 90-bps gross margin contraction in the wholesale segment reflecting mix shift, the 10% tariff on handbags and other accessories made in China implemented September 24, 2018, and increased ocean freight costs as demand spiked in efforts to bring in goods prior to the new year and avoid a potential 25% tariff. Retail gross margin expanded 20 bps to 61%. Operating expenses declined 40 bps to 28.6% of sales.

By moving production out of China primarily to Cambodia for categories impacted by the tariff and working with Chinese manufacturers for price concessions for the remaining 50% of product still manufactured in China, the company mitigated the vast majority of the 10% tariff and looking forward, believes it will be immaterial at the 10% level this year. (Cambodia now the source of nearly half of Steve Madden handbag production, up from about 16% a year ago)

By division, Steve Madden women’s US wholesale footwear net sales rose mid-single digit; at the Steven division, net sales rose mid-teens. Madden NYC, the new exclusive brand for Kohls, is building momentum as the company roles out selected women’s styles to all Kohl’s doors and men’s in 50 Kohl’s doors this spring. Internationally, the Madden brand is strong too, with international sales up 22% in Canada and Mexico (company-owned markets) and up 40%+ in joint venture and distributor markets of Europe, the Middle East, India and Italy. Sales of Blondo (waterproof footwear) sales rose 50%. Anne Klein (a licensed brand) began shipping in the fall and is on target for $80-90 million in sales for the first 12 months (fall 2018/spring 2019). Wholesale accessories revenues rose 17% on an improved product assortment; Steve Madden handbags were up nearly 20%.

At yearend, the company formed a JV with a key distributor in Israel, Inner Jeans. Steve Madden owns 51% and Inner Jeans 49%. The joint venture currently has 14 Steve Madden stores and 50 doors of wholesale distribution. The company expects to add another 10 stores in the next three years and to significantly expand the wholesale business.

Adjusted EPS increased 31.3% to $0.42, ahead of the $0.38 consensus estimate.

Inventories increased $27.1 million, or 24.4%, to $137.2 million on a year-over-year basis.

Excluding the new businesses of Anne Klein and the Israel JV, inventory rose 17%, mostly related to the accessories division as the company tried to import goods before tariffs went into effect. The early Chinese New Year (11 days earlier than last year) resulted in more inventory on hand and in transit at 2018-yearend in accessories and shoes.

Payless ShoeSource filed for Chapter 11 on February 18, 2019, approximately 18 months after emerging from its prior bankruptcy. Payless has been a meaningful private label customer for Steve Madden since the company's acquisition of Topline in 2011. Approximately $105 million in sales were made to Payless in 2018. CEO Ed Rosenfeld said on the investor call that of consumers who shopped at Payless in 2018, nearly half also purchased footwear at Walmart and approximately 20% purchased footwear at Target, two retailers with which Steve Madden has significant private label relationships.

Outlook

The company provided initial guidance for 2019.

- The company expects net sales will increase 4% to 6% over net sales in 2018.

- 2019 adjusted EPS guidance is $1.78-1.83 versus adjusted EPS of $1.83. Guidance includes $0.21 in expected impact from Payless ShoeSource bankruptcy ($0.16) and a higher tax rate ($0.05).

- Growing the international business is a top priority in 2019 and beyond.