DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

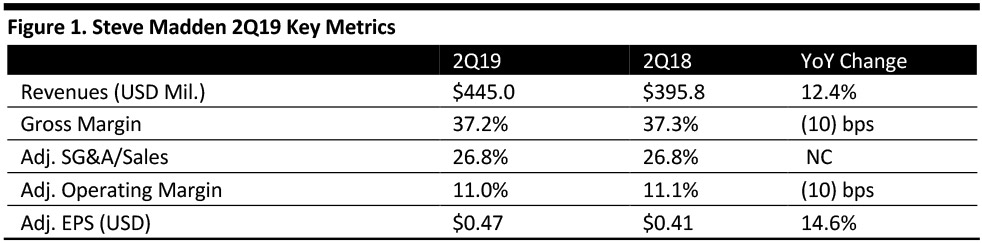

Steve Madden 2Q sales rose 12.4% to $445 million, beating the $421 million consensus estimate. Net sales for the wholesale business grew 13.1% to $363.5 million, driven by strong results in footwear and accessories, up 13.5% and 11.5%, respectively. In wholesale footwear, the Steve Madden brand, the addition of Anne Klein and private label business more than offset the loss of Payless ShoeSource revenues (which voluntarily filed for bankruptcy in February 2019 and shuttered its North American stores in the past few months).

The core Steve Madden women's US wholesale footwear business increased at a double-digit pace for the third consecutive quarter and wholesale accessories achieved its fourth consecutive quarter of double-digit growth as Steve Madden Handbags and private label drove momentum. Sneakers continue to enjoy strong sales momentum with “dad sneakers” (chunky designs with oversized soles) selling well.

Adjusted gross margin declined 10 bps to 37.2%. Wholesale gross margin increased 70 bps to 32.1% driven by improvements in wholesale footwear. The sales mix hurt the margin on wholesale accessories, reflecting lower margin Anne Klein handbags.

Same-store sales rose 6.2% driven by strong performance in e-commerce: Brick-and-mortar comps were negative.

Retail gross margin contracted 320 bps to 59.7% primarily as the result of the winding down of the company’s China joint venture, related inventory liquidation and markdowns as well as aggressive liquidation of slow-moving inventory in North American retail. China remains a significant opportunity and Steven Madden is in discussions to form a new JV with a strong partner focusing on e-commerce and hopes to announce a new partnership in the coming months.

Adjusted operating profit declined 10 bps to 11.0% of sales.

Adjusted EPS increased 14.6% to $0.47, ahead of the $0.43 consensus estimate.

Update on Tariff Impact

The tariff on List 3 products (which includes handbags and accessories that Steve Madden produces) was at 10% until May 10, a level at which the company was able to mitigate most of the negative impact by moving production out of China (primarily to Cambodia) and receiving price concessions from factories in China. In May, the tariff on List 3 products rose to 25%, where it remains today.

Steve Madden has requested additional price concessions from factories in China and is also looking to raise prices by low single-digits. In its wholesale accessories business, Steve Madden expects to continue to see gross margin contraction of 250 to 300 bps in 3Q and 4Q, primarily related to the tariff. If the 25% tariff remains, the company will consider further price increases. The company doesn’t believe it can mitigate the entire impact and estimates a negative $0.05 per share impact related to the tariff.

If tariffs were applied to footwear, the company would use the same levers to mitigate the impact: move production out of China, look for price concessions from factories on that production that remains in China and raise selling prices for wholesalers and consumers. The company has already started moving production out of China and is sourcing some of its fall Steve Madden branded products in Mexico.

The company has 224 company-operated retail locations, including six online stores and 31 overseas concessions.

Outlook

The company reiterated guidance for 2019:

- The company maintains its expectation that net sales will increase 5-7% over 2018.

- The company maintains its adjusted diluted 2019 EPS guidance of $1.78-1.86 despite an estimated incremental headwind of $0.05 per share related to May’s tariff increase on List 3 products from 10% to 25%.