DIpil Das

[caption id="attachment_85554" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

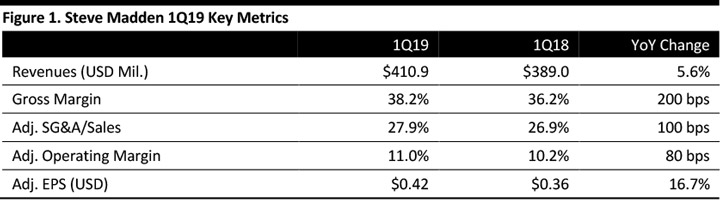

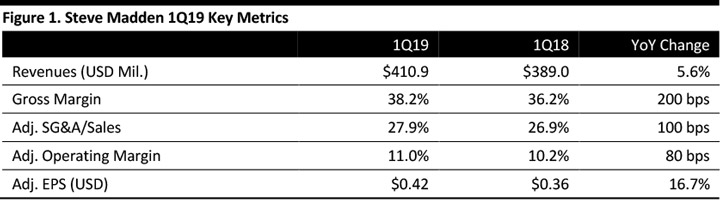

Steve Madden 1Q19 sales rose 5.6% to $410.9 million, beating the $404.3 million consensus estimate. Net sales for the wholesale business grew 5.1% to $348.1 million, driven by strong results in accessories, up 27.5% to $71.5 million. The company experienced modest growth in wholesale footwear, up 0.6% to $276.6 million; however, US wholesale footwear, including Steve Madden brand and the core Steve Madden women’s business, grew double digits. This strength, along with the addition of Anne Klein, offset the impact of not recognizing sales to Payless ShoeSource, which voluntarily filed for bankruptcy in February 2019 and is closing all stores in North America this May.

Sneakers continue to enjoy strong sales momentum with “dad sneakers” (chunky designs with oversized soles) selling well, along with joggers, slip-ons, sandals, platforms and wedges. Rhinestones, vinyls and animal print continue to perform well for the Steve Madden brand portfolio and as a result, they are seeing reorders.

The adjusted gross margin rose 200 bps to 38.2%. Wholesale gross margin increased 190 bps to 34.5% driven by improvement in wholesale footwear. Sales mix hurt the margin on wholesale accessories reflecting lower margin Anne Klein handbags.

Same-store sales rose 6.3% driven by strong performance in e-commerce: Brick-and-mortar comps were negative. The late Easter negatively impacted comps around 170 bps and management sees a 130-bps benefit to comps due to the late Easter in 2Q.

The retail gross margin expanded 180 bps to 58.5% as the result of improved e-commerce gross margin.

The adjusted operating margin expanded 80 bps to 11.0% of sales.

Adjusted EPS increased 16.7% to $0.42, ahead of the $0.37 consensus estimate.

The company has 225 company-operated retail locations, including seven Internet stores and 33 overseas concessions.

Outlook

The company raised its guidance for 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Steve Madden 1Q19 sales rose 5.6% to $410.9 million, beating the $404.3 million consensus estimate. Net sales for the wholesale business grew 5.1% to $348.1 million, driven by strong results in accessories, up 27.5% to $71.5 million. The company experienced modest growth in wholesale footwear, up 0.6% to $276.6 million; however, US wholesale footwear, including Steve Madden brand and the core Steve Madden women’s business, grew double digits. This strength, along with the addition of Anne Klein, offset the impact of not recognizing sales to Payless ShoeSource, which voluntarily filed for bankruptcy in February 2019 and is closing all stores in North America this May.

Sneakers continue to enjoy strong sales momentum with “dad sneakers” (chunky designs with oversized soles) selling well, along with joggers, slip-ons, sandals, platforms and wedges. Rhinestones, vinyls and animal print continue to perform well for the Steve Madden brand portfolio and as a result, they are seeing reorders.

The adjusted gross margin rose 200 bps to 38.2%. Wholesale gross margin increased 190 bps to 34.5% driven by improvement in wholesale footwear. Sales mix hurt the margin on wholesale accessories reflecting lower margin Anne Klein handbags.

Same-store sales rose 6.3% driven by strong performance in e-commerce: Brick-and-mortar comps were negative. The late Easter negatively impacted comps around 170 bps and management sees a 130-bps benefit to comps due to the late Easter in 2Q.

The retail gross margin expanded 180 bps to 58.5% as the result of improved e-commerce gross margin.

The adjusted operating margin expanded 80 bps to 11.0% of sales.

Adjusted EPS increased 16.7% to $0.42, ahead of the $0.37 consensus estimate.

The company has 225 company-operated retail locations, including seven Internet stores and 33 overseas concessions.

Outlook

The company raised its guidance for 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Steve Madden 1Q19 sales rose 5.6% to $410.9 million, beating the $404.3 million consensus estimate. Net sales for the wholesale business grew 5.1% to $348.1 million, driven by strong results in accessories, up 27.5% to $71.5 million. The company experienced modest growth in wholesale footwear, up 0.6% to $276.6 million; however, US wholesale footwear, including Steve Madden brand and the core Steve Madden women’s business, grew double digits. This strength, along with the addition of Anne Klein, offset the impact of not recognizing sales to Payless ShoeSource, which voluntarily filed for bankruptcy in February 2019 and is closing all stores in North America this May.

Sneakers continue to enjoy strong sales momentum with “dad sneakers” (chunky designs with oversized soles) selling well, along with joggers, slip-ons, sandals, platforms and wedges. Rhinestones, vinyls and animal print continue to perform well for the Steve Madden brand portfolio and as a result, they are seeing reorders.

The adjusted gross margin rose 200 bps to 38.2%. Wholesale gross margin increased 190 bps to 34.5% driven by improvement in wholesale footwear. Sales mix hurt the margin on wholesale accessories reflecting lower margin Anne Klein handbags.

Same-store sales rose 6.3% driven by strong performance in e-commerce: Brick-and-mortar comps were negative. The late Easter negatively impacted comps around 170 bps and management sees a 130-bps benefit to comps due to the late Easter in 2Q.

The retail gross margin expanded 180 bps to 58.5% as the result of improved e-commerce gross margin.

The adjusted operating margin expanded 80 bps to 11.0% of sales.

Adjusted EPS increased 16.7% to $0.42, ahead of the $0.37 consensus estimate.

The company has 225 company-operated retail locations, including seven Internet stores and 33 overseas concessions.

Outlook

The company raised its guidance for 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Steve Madden 1Q19 sales rose 5.6% to $410.9 million, beating the $404.3 million consensus estimate. Net sales for the wholesale business grew 5.1% to $348.1 million, driven by strong results in accessories, up 27.5% to $71.5 million. The company experienced modest growth in wholesale footwear, up 0.6% to $276.6 million; however, US wholesale footwear, including Steve Madden brand and the core Steve Madden women’s business, grew double digits. This strength, along with the addition of Anne Klein, offset the impact of not recognizing sales to Payless ShoeSource, which voluntarily filed for bankruptcy in February 2019 and is closing all stores in North America this May.

Sneakers continue to enjoy strong sales momentum with “dad sneakers” (chunky designs with oversized soles) selling well, along with joggers, slip-ons, sandals, platforms and wedges. Rhinestones, vinyls and animal print continue to perform well for the Steve Madden brand portfolio and as a result, they are seeing reorders.

The adjusted gross margin rose 200 bps to 38.2%. Wholesale gross margin increased 190 bps to 34.5% driven by improvement in wholesale footwear. Sales mix hurt the margin on wholesale accessories reflecting lower margin Anne Klein handbags.

Same-store sales rose 6.3% driven by strong performance in e-commerce: Brick-and-mortar comps were negative. The late Easter negatively impacted comps around 170 bps and management sees a 130-bps benefit to comps due to the late Easter in 2Q.

The retail gross margin expanded 180 bps to 58.5% as the result of improved e-commerce gross margin.

The adjusted operating margin expanded 80 bps to 11.0% of sales.

Adjusted EPS increased 16.7% to $0.42, ahead of the $0.37 consensus estimate.

The company has 225 company-operated retail locations, including seven Internet stores and 33 overseas concessions.

Outlook

The company raised its guidance for 2019:

- The company expects net sales will increase 5-7% over 2018, up from the previous 4-6% guidance.

- The company guided for adjusted EPS of $1.76-1.84, up from prior guidance of $1.70-1.78.