Source: Company reports

2Q16 RESULTS

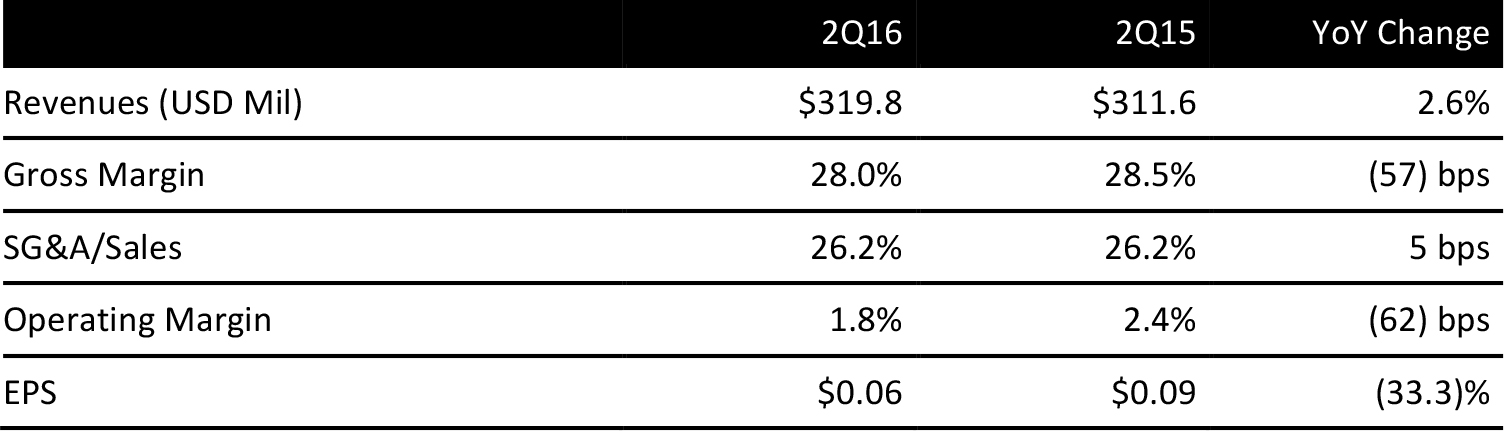

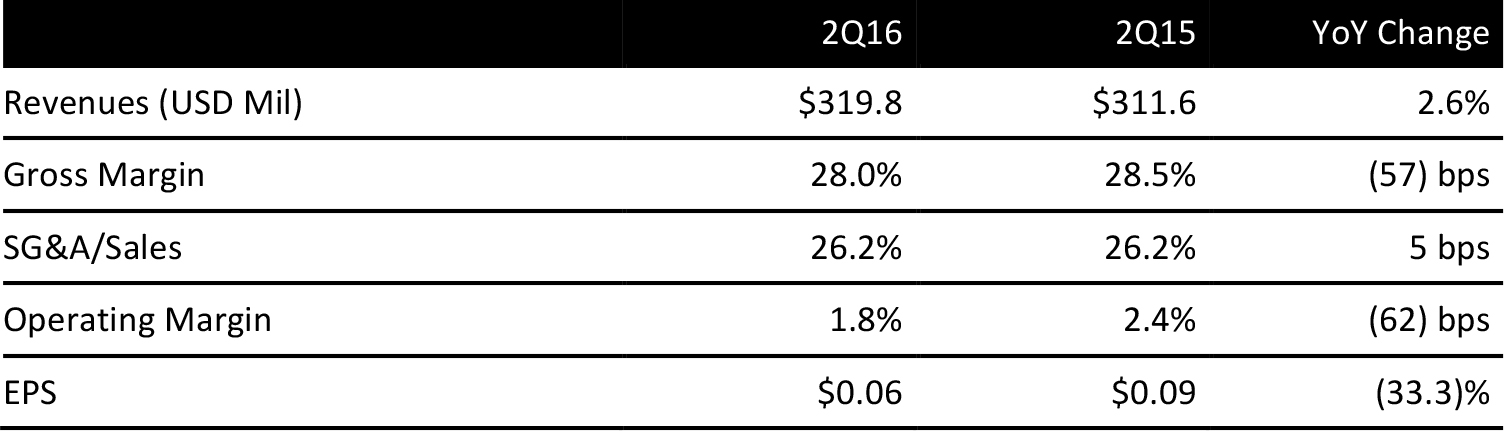

Stein Mart reported total revenues of $319.8 million, up 2.6% compared to the second quarter of 2015. Same-store sales decreased by 1.4%, however. The increase in sales was attributed to new store openings, an effective seasonal markdown strategy and controlled expenses. The company reported, although traffic was down, units per transactions are improving.

Stein Mart reported E-commerce sales for the quarter grew by 20% and helped to lift the comparative store sale results by 30 basis points. The online business represented 1.8% of total quarter revenues.

Strong categories compared to the first quarter were Men’s, Accessories and Ladies. The most challenging category in the quarter was Home, not in linens but in other areas. The company seeks to improve the Home category for the third and fourth quarters.

Average inventories per store were down by 4% from last year. Inventories at the end of the second quarter were $280 million compared to $277 million last year.

The gross margin was 28% compared to 28.5% in the year-ago quarter. The decrease was due to higher markdowns and higher occupancy costs.

Stein Mart’s selling, general and administrative expense (SG&A) costs as a percentage of total sales remained 26.2%. SG&A increased by $2.3 million. This was primarily due to higher operating expenses at the new stores which were offset by higher income from the company’s credit card program.

Capital expenditures are expected to total $33 million in 2016, which is an increase of 3.1% compared to $32 million in 2015 due to tenant improvement allowances.

Stein Mart increased penetration of its credit card program. It was 16% through the first half of 2016, a 12.8% increase from the first half of 2015.

Real Estate Activity

Stein Mart had 283 stores at the end of the second quarter compared to 269 at the end of the second quarter last year. The company plans to open eight new stores this fall, relocate 2 stores and close one store. The net total for 2016 will be 13 new stores and 290 total stores. Stein Mart operates stores in 31 states.

Merchandising and Marketing Initiatives

Stein Mart plans to implement a merchandising and marketing initiative in the third quarter. This includes a rollout of revitalized merchandise assortments, a Fabulous Finds program to fulfill the “treasure hunter” in its customers, and the “A List” program which will appeal to existing loyal customers. Additionally, the company seeks to attract a new customer demographic and is aggressively growing its activewear business. There will be a modern assortment of activewear in approximately 60 stores, approximately 20% of all Stein Mart stores. The activewear line will be introduced with a national television spot, and will be supported with direct mail, email and an active online presence.

Social Media

Stein Mart is shifting marketing from newspaper to digital, social and broadcast. The company has increased the number of television spots from 1 to 2 per month for the third quarter to attract new customers and draw existing customers to the brand and specific events.

2016 OUTLOOK

Management decreased its guidance for fiscal year 2016 and forecasts SG&A costs will come in $10 million lower at $360 million compared to $370 million previously forecasted. Stein Mart maintained its guidance that new stores will increase sales an estimated 4% above comparable store sales for the year. The company also continues to expect gross profit will be 50 basis points higher than 2015.