One-click physical “Buy” buttons allow users to seamlessly restock household essentials, and Amazon Dash first started offering these buttons in April 2015. Now, Israel-based startup

Kwik is challenging Amazon Dash by allowing consumers to automatically reorder items from more of the brands they love with just the press of a button. Although Kwik’s concept may sound similar to Amazon Dash, Kwik is opening the market to a much wider range of brands and consumers.

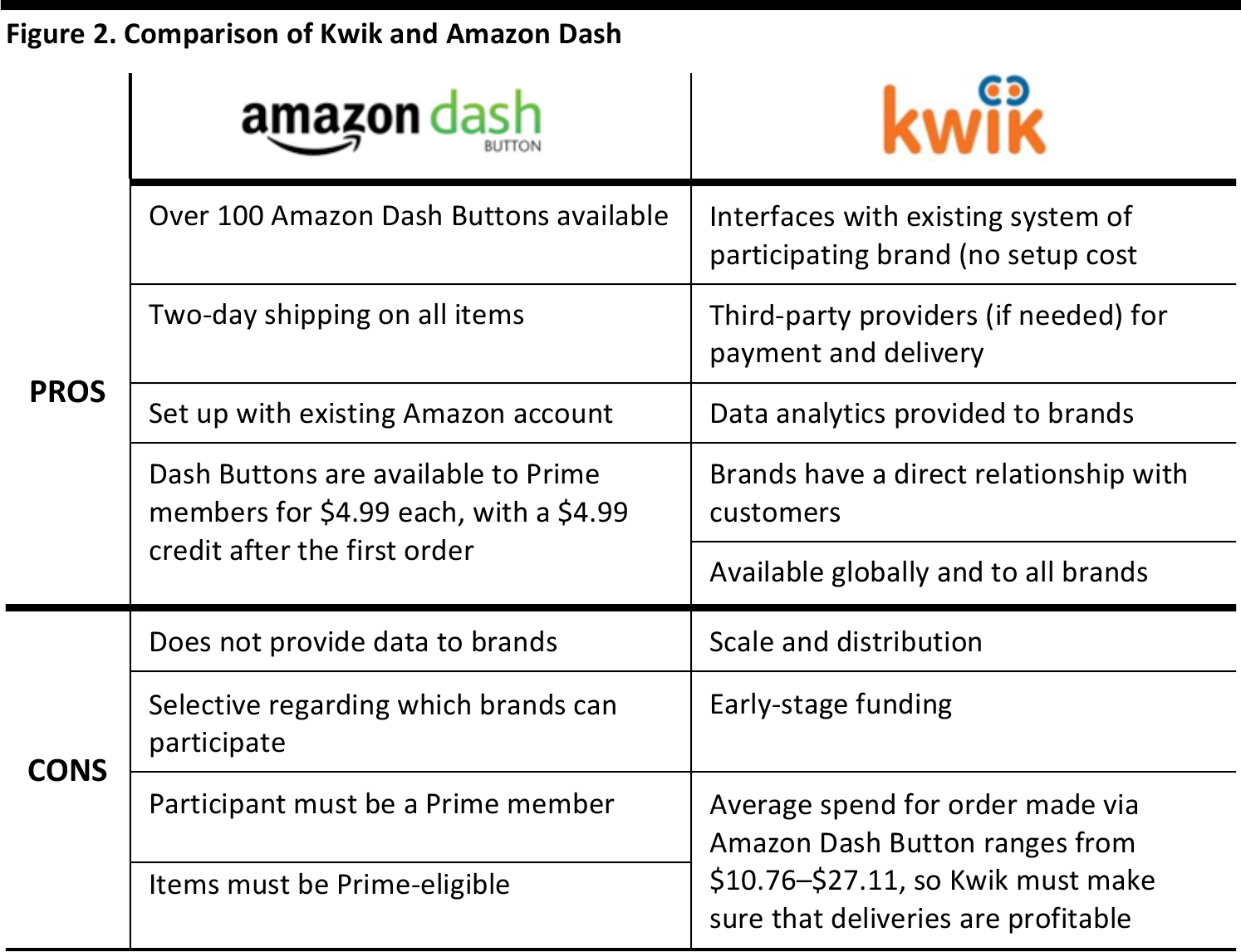

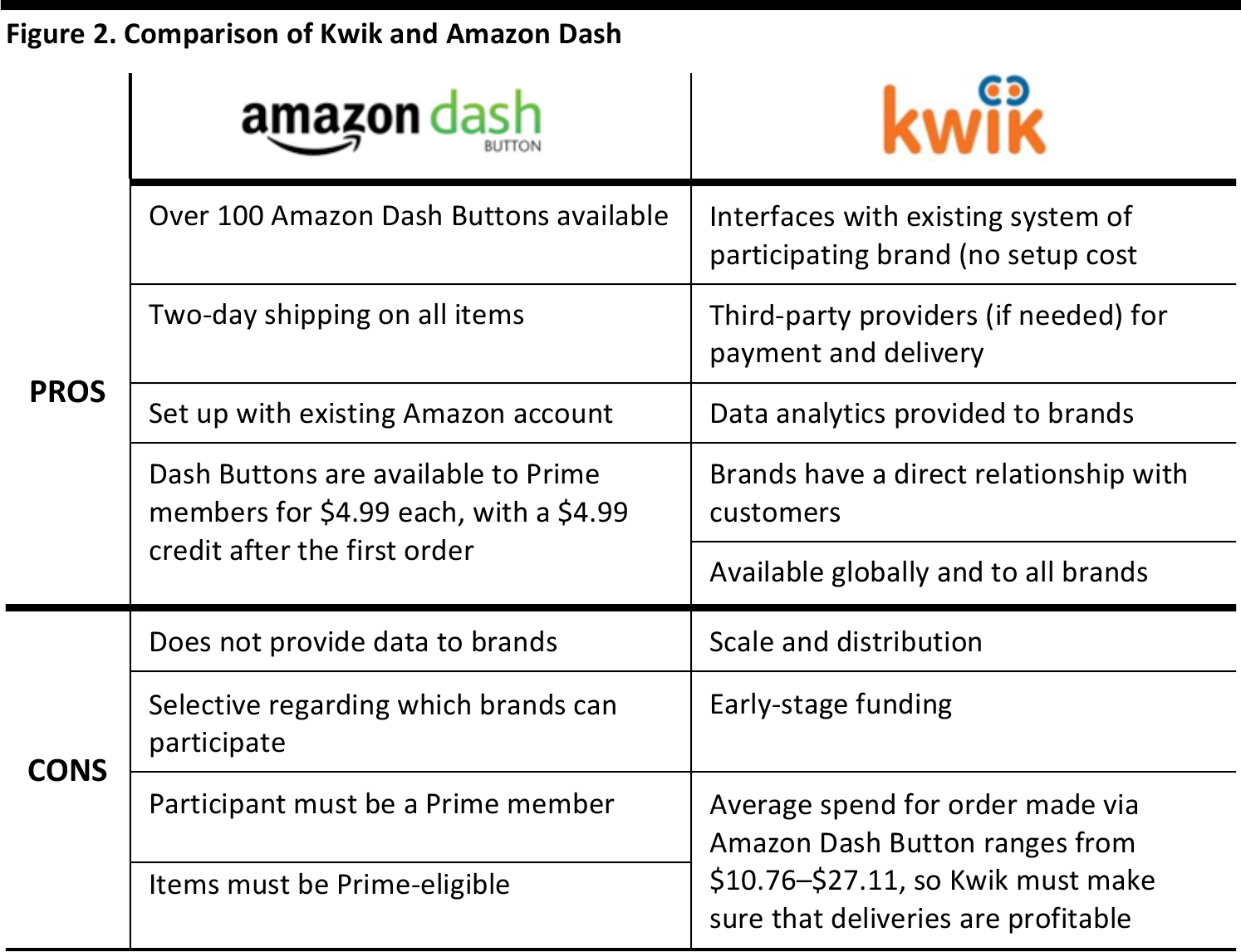

Unlike Amazon Dash, Kwik is an open IoT platform that will soon be available to all brands across the globe. Brands and suppliers can connect their current order system to the Kwik platform by way of easy-to-implement APIs. Thus, they can get up and running on Kwik with no setup cost and no change to their existing system. This enables businesses to maintain direct contact with customers, a significant advantage that Amazon Dash does not offer. Kwik’s IoT platform also provides a dashboard that gathers customer data, including total clicks, orders and conversion rates. Brands are offered a direct channel to their customers as well as the opportunity to collect real-time data about those customers’ buying habits.

Under the Amazon Dash model, brands must be accepted by Amazon and only Prime-eligible items can be purchased. Also, Dash is a closed system offered only to Amazon Prime users in the US, and it does not release customer data to participating brands.

Although Kwik buttons have yet to be released on the market, the company has carried out successful tests. For example, it tested with Domino’s Israel and found that 72% of the customers who used the Kwik button to order pizza attached an additional item to their order.

The company was founded by Ofer Klein and Shlomi Atias in 2013. Kwik employs approximately 23 employees in Tel Aviv and Palo Alto, and has raised $120,000 as of December 2015.

Kwik is an end-to-end IoT platform, linking customer orders from the button directly to a brand’s existing infrastructure. There are three simple steps brands take in order to integrate their systems with Kwik:

- Determine which products customers will be able to order and define how the button will be branded.

- Connect the current order system to Kwik’s platform using Kwik’s APIs.

- Link the existing payment and delivery process, if available, or connect to third-party providers via Kwik’s cloud services.

Customers connect the Kwik button to their wi-fi network, enter their details into the companion app, and then select which items they will reorder using the button.

Business Model

Like Amazon, Kwik intends to take a percentage of each order. The company plans to sell the buttons at cost to its partners. This year is a proof-of-concept year for the startup. CEO and Co-Founder Ofer Klein said that the company estimates it will have 100,000 live users by the end of 2016 and generate $1.7 million in revenue.

Kwik enables businesses that lack shipping and payment solutions to tap into the reorder marketplace. The company says it connects with existing ordering networks to build a network of delivery and payment providers for brands that do not have preexisting systems. The company will connect brands to third-party providers via its cloud service. In those cases, Kwik will also earn an e-commerce service fee.

Kwik’s value proposition is that it:

- Creates a direct link between brand and customer

- Boosts order frequency and raises awareness

- Increases customer loyalty and engagement

- Collects customer data for analysis and insights

Kwik has already signed with five brands: Huggies, Domino’s, Strauss Water, SodaStream and Eden. These companies have ordered a combined 4,200 buttons and “the pipeline in the US and Europe is exceeding 35,000 buttons in the next three to five months,” according to Klein.

Source: Company reports

Kwik vs. Amazon Dash

One of the biggest differences between Kwik and Amazon Dash is that Kwik provides data analytics to participating brands via an online dashboard that monitors key performance indicators, including total clicks, orders and conversion rate. The dashboard gives brands the ability to slice the data by product, category and geography.

Amazon is selective regarding which brands can participate in the Dash program, although it has recently expanded its offering to include more brands. The buttons that were initially available were mostly for common household items, such as diapers, garbage bags and detergent. The latest expansion brings the Dash Buttons to even more retail categories, including food and drink brands such as Slim Jim and Starbucks, and there are now more than 100 Amazon Dash Buttons available.

Source: Fung Global Retail & Technology

Amazon Dash Button Market

Digital commerce research firm Slice Intelligence analyzed daily Dash Button use by 4 million online shoppers, and found that fewer than 50% of the people who had bought a Dash Button before Amazon expanded the assortment on March 31 had ever actually made an order using one. However, according to Amazon, in the past three months, Dash Button orders have grown by more than 75%, and customers are using the buttons more than once a minute. According to Slice, the buttons are being purchased by only a very small subgroup of the online shopping population.

Among customers who have made a purchase of the brand from a Dash Button, the average spend per order has varied between $10.76, and $27.11, and Bounty has seen the highest average spend among participating brands. On average, Dash Button users order items about once every two months. With the introduction of more brands, the buttons may be adopted by a larger set of Amazon customers.

�

One-click physical “Buy” buttons allow users to seamlessly restock household essentials, and Amazon Dash first started offering these buttons in April 2015. Now, Israel-based startup Kwik is challenging Amazon Dash by allowing consumers to automatically reorder items from more of the brands they love with just the press of a button. Although Kwik’s concept may sound similar to Amazon Dash, Kwik is opening the market to a much wider range of brands and consumers.

Unlike Amazon Dash, Kwik is an open IoT platform that will soon be available to all brands across the globe. Brands and suppliers can connect their current order system to the Kwik platform by way of easy-to-implement APIs. Thus, they can get up and running on Kwik with no setup cost and no change to their existing system. This enables businesses to maintain direct contact with customers, a significant advantage that Amazon Dash does not offer. Kwik’s IoT platform also provides a dashboard that gathers customer data, including total clicks, orders and conversion rates. Brands are offered a direct channel to their customers as well as the opportunity to collect real-time data about those customers’ buying habits.

Under the Amazon Dash model, brands must be accepted by Amazon and only Prime-eligible items can be purchased. Also, Dash is a closed system offered only to Amazon Prime users in the US, and it does not release customer data to participating brands.

Although Kwik buttons have yet to be released on the market, the company has carried out successful tests. For example, it tested with Domino’s Israel and found that 72% of the customers who used the Kwik button to order pizza attached an additional item to their order.

The company was founded by Ofer Klein and Shlomi Atias in 2013. Kwik employs approximately 23 employees in Tel Aviv and Palo Alto, and has raised $120,000 as of December 2015.

One-click physical “Buy” buttons allow users to seamlessly restock household essentials, and Amazon Dash first started offering these buttons in April 2015. Now, Israel-based startup Kwik is challenging Amazon Dash by allowing consumers to automatically reorder items from more of the brands they love with just the press of a button. Although Kwik’s concept may sound similar to Amazon Dash, Kwik is opening the market to a much wider range of brands and consumers.

Unlike Amazon Dash, Kwik is an open IoT platform that will soon be available to all brands across the globe. Brands and suppliers can connect their current order system to the Kwik platform by way of easy-to-implement APIs. Thus, they can get up and running on Kwik with no setup cost and no change to their existing system. This enables businesses to maintain direct contact with customers, a significant advantage that Amazon Dash does not offer. Kwik’s IoT platform also provides a dashboard that gathers customer data, including total clicks, orders and conversion rates. Brands are offered a direct channel to their customers as well as the opportunity to collect real-time data about those customers’ buying habits.

Under the Amazon Dash model, brands must be accepted by Amazon and only Prime-eligible items can be purchased. Also, Dash is a closed system offered only to Amazon Prime users in the US, and it does not release customer data to participating brands.

Although Kwik buttons have yet to be released on the market, the company has carried out successful tests. For example, it tested with Domino’s Israel and found that 72% of the customers who used the Kwik button to order pizza attached an additional item to their order.

The company was founded by Ofer Klein and Shlomi Atias in 2013. Kwik employs approximately 23 employees in Tel Aviv and Palo Alto, and has raised $120,000 as of December 2015.

Kwik is an end-to-end IoT platform, linking customer orders from the button directly to a brand’s existing infrastructure. There are three simple steps brands take in order to integrate their systems with Kwik:

Kwik is an end-to-end IoT platform, linking customer orders from the button directly to a brand’s existing infrastructure. There are three simple steps brands take in order to integrate their systems with Kwik:

One of the biggest differences between Kwik and Amazon Dash is that Kwik provides data analytics to participating brands via an online dashboard that monitors key performance indicators, including total clicks, orders and conversion rate. The dashboard gives brands the ability to slice the data by product, category and geography.

Amazon is selective regarding which brands can participate in the Dash program, although it has recently expanded its offering to include more brands. The buttons that were initially available were mostly for common household items, such as diapers, garbage bags and detergent. The latest expansion brings the Dash Buttons to even more retail categories, including food and drink brands such as Slim Jim and Starbucks, and there are now more than 100 Amazon Dash Buttons available.

One of the biggest differences between Kwik and Amazon Dash is that Kwik provides data analytics to participating brands via an online dashboard that monitors key performance indicators, including total clicks, orders and conversion rate. The dashboard gives brands the ability to slice the data by product, category and geography.

Amazon is selective regarding which brands can participate in the Dash program, although it has recently expanded its offering to include more brands. The buttons that were initially available were mostly for common household items, such as diapers, garbage bags and detergent. The latest expansion brings the Dash Buttons to even more retail categories, including food and drink brands such as Slim Jim and Starbucks, and there are now more than 100 Amazon Dash Buttons available.