What’s the Story?

The US

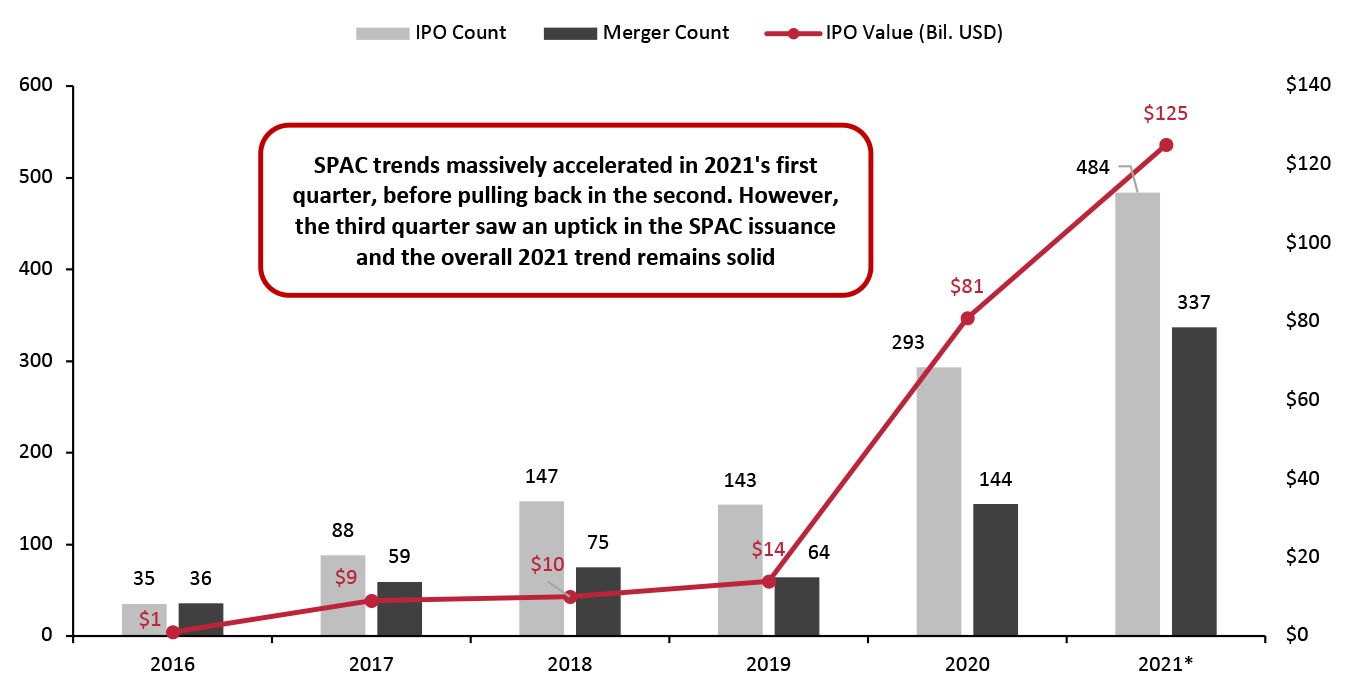

SPAC trend has remained solid in 2021, with a massive acceleration in the first quarter of 2021, followed by a strong pullback in the second quarter and a slight recovery in the third quarter. This built on robust SPAC momentum in US retail sectors in 2020, supported by expansionary monetary policies and strong equity markets.

In this report, we explore key retail sectors for recent SPAC activity, recent retail-focused SPAC merger transactions by retail category and our post-merger analysis. We also discuss retail-focused SPAC developments in the pipeline for 2022 and present our insights into the future of SPACs in retail.

Why It Matters

SPACs provide solid opportunities for brands and retailers to enter the public market and access funds for business expansion. We are seeing a substantial acceleration in SPAC trends among retailers and brands across the US.

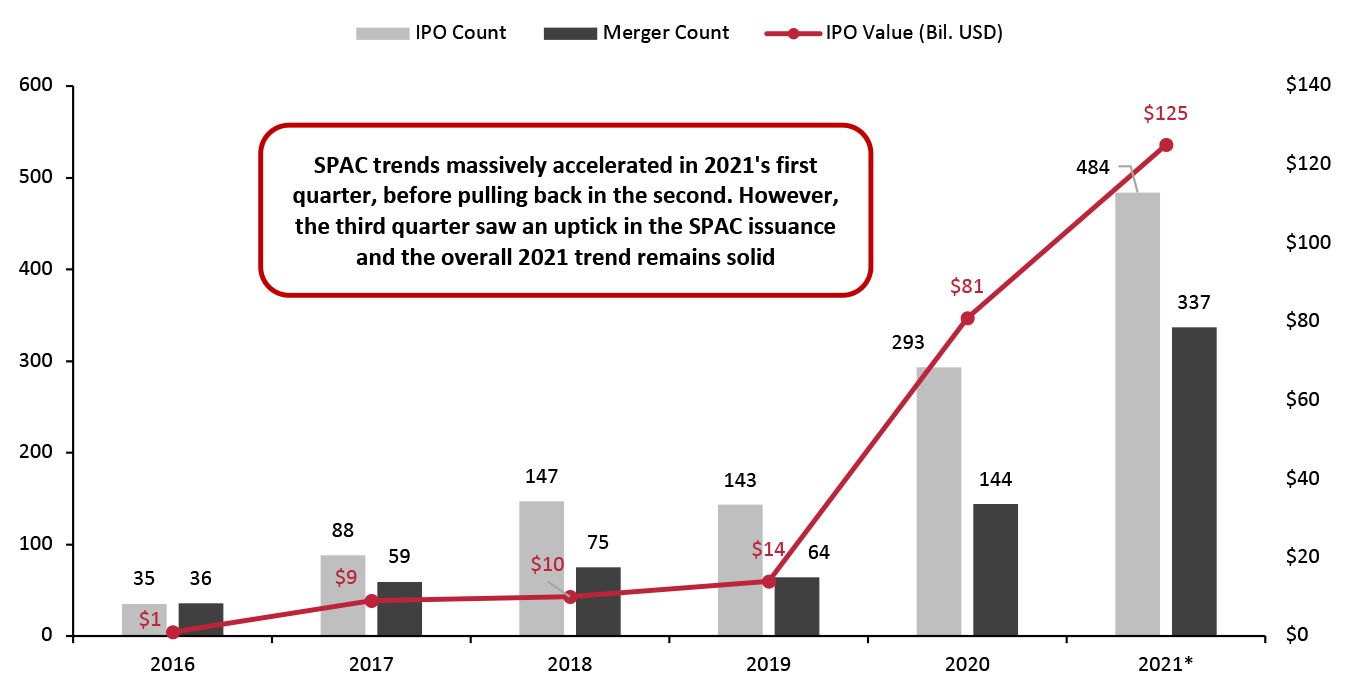

In 2016, just 35 SPACs were listed on US stock exchanges, valued at $1 billion, with this number spiking to 293 SPAC initial public offering (IPO) debuts in 2020, raising a significant $81 billion, according to S&P Capital IQ Pro.

The trend has massively accelerated in 2021—as of November 24, 2021, 484 SPACs have been listed for IPO in the US, raising $125 billion, which is 54.3% higher than the full-year tally for 2020 in terms of amount raised.

Most SPAC growth acceleration in 2021 occurred in the first quarter (ended March 31, 2021), which saw 320 SPAC IPO debuts and raised $88 billion. In contrast, the second quarter of 2021 (ended June 30, 2021) saw a 65.6% quarter-over-quarter decrease in SPAC issuance—only 110 SPAC IPO transactions took place in the second quarter, raising a total of $16 billion.

The slowdown in new SPAC issuance in the second quarter of 2021 can mainly be attributed to new guidance issued by the US Securities and Exchange Commission (SEC) in April 2021, prompting SPACs to redetermine whether warrants they offer investors are accounted on their balance sheet as equity or debt. This caused a major stalemate in the US SPAC market as companies in various stages of the SPAC process amended their financial statements. Furthermore, the new guidance has instigated substantial concerns among investors—many have likely paused their investment in SPACs until they have greater transparency on future regulations and how the new regulation will impact their investments.

Nevertheless, SPAC IPO activity picked up slightly in the third quarter (ended September 30, 2021), which saw a 13.6% quarter-over-quarter increase in SPAC issuance—125 SPAC IPO transactions took place in the quarter, raising a total of $17 billion.

For 2022, against very strong comparatives, we expect a slight pullback in the number of SPAC issuance; however, the overall trend will remain solid.

Figure 1. Gross Proceeds of US SPAC IPOs, IPO Count and Merger Count, 2016–2021 YTD*

[caption id="attachment_137862" align="aligncenter" width="699"]

*As of November 24, 2021

*As of November 24, 2021

Source: S&P Capital IQ Pro [/caption]

SPACs in US Retail: Coresight Research Analysis

The retail and consumer goods sector remains an attractive target among US SPACs. From November 1, 2020, to November 24, 2021, we saw 22 completed SPAC merger announcements in consumer discretionary and consumer staples sectors—accounting for 16% of total announced SPAC mergers during the period. This includes apparel and footwear specialty stores, automotive retailers, breweries, consumer electronics manufacturers, food retailers, furniture, home-furnishing and garden supply retailers, Internet and direct marketing retailers, packaged foods manufacturers, personal care products manufacturers, restaurants, sporting goods retailers, and software retailers, among others.

More than 75% of the 22 SPAC merger announcements in these sectors occurred from the beginning of the second quarter of 2021 to year to date (as of November 24, 2021), suggesting that SPAC trends in the retail and consumer goods sector continue to remain strong despite an overall pullback.

1. Key Retail Sectors Witnessing SPAC Activity

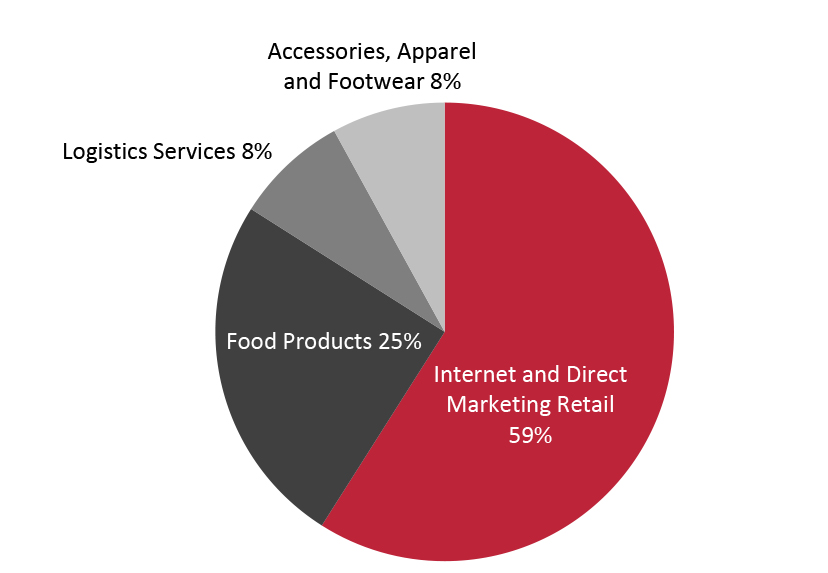

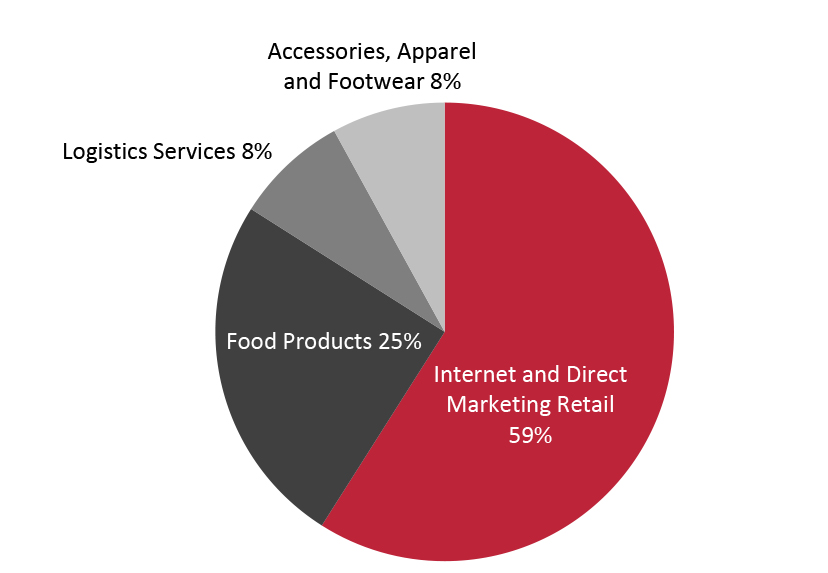

Between November 1, 2020, and November 24, 2021, the Internet and direct marketing retail category (comprising e-commerce platforms, technology vendors and payments platforms) witnessed the highest number of SPAC merger announcements—accounting for 59% of total SPAC merger announcements in the retail sector.

Food products saw the second-highest number of SPAC merger announcements, accounting for 25% of retail SPAC merger agreements. Combined, these two industries contributed more than 80% of SPAC merger agreements (both in terms of count and valuation) in the retail sector during the period, according to Coresight Research analysis of S&P Capital IQ Pro data. Other retail sectors that witnessed notable SPAC merger transactions during the period include apparel and footwear, and logistics services.

Figure 2. US: Retail-Focused SPAC Merger Transactions by Target Industry, Nov 1, 2020–Nov 24, 2021

[caption id="attachment_137863" align="aligncenter" width="699"]

Note: Figure 2 excludes SPAC mergers in automotive retail, software retail, restaurants and breweries sectors, which were part of total 22 SPAC merger announcements in consumer discretionary and consumer staples sectors mentioned above.

Note: Figure 2 excludes SPAC mergers in automotive retail, software retail, restaurants and breweries sectors, which were part of total 22 SPAC merger announcements in consumer discretionary and consumer staples sectors mentioned above.

Source: S&P Capital IQ Pro/Coresight Research [/caption]

2. Recent Retail-Focused SPAC Merger Transactions

We provide examples of six retail-focused SPAC merger deals in the past year, from November 1, 2020, to November 24, 2021, by retail sector. We selected three companies in Internet and direct marketing retail and one each from the food products, apparel and footwear, and logistics services sectors, based on the highest market capitalizations.

Internet and Direct Marketing Retailers

Bark, parent company of a monthly dog products and services subscription provider BarkBox, announced in June 2021 that it had completed its

previously reported merger with Northern Star Acquisition Corp. The combined company is named “The Original Bark Company,” and its stock and warrants commenced trading on the NYSE (New York Stock Exchange) on June 2, 2021.

In connection with the merger, Bark received $427 million in cash proceeds, which the company aims to use to grow its food, health and home product lines, fuel the growth of its toy and treat subscription services, boost cross-selling opportunities and expand customer reach, both in the US and internationally.

Bark’s CEO Manish Joneja said, “The closing of our merger with Northern Star provides us with the platform to bring our renowned BarkBox and Super Chewer toy and treat subscription lines to even more customers while scaling our newer, high-potential BARK Eats, BARK Bright and BARK Home initiatives. By building deep, personalized relationships with dogs and their parents, we believe BARK will continue to gain meaningful market share and grow to be synonymous with all things dogs worldwide.”

In June 2021, US-based online bulk grocery retailer Giddy (which operates under the name Boxed) signed a deal with SPAC Seven Oaks Acquisition Corp to enter the US public market. The deal valued the combined company at $900 million and it is expected to complete in the fourth quarter of fiscal 2021.

The combined company will be led by Giddy’s current CEO Chieh Huang, while Gary Matthews, CEO of Seven Oaks Acquisition, will serve as Chairman. Giddy expects the deal to provide up to $334 million in cash proceeds, including $120 million in private placement financing.

Giddy capitalizes on artificial intelligence (AI) and robotics to offer a curated experience for households and businesses buying consumables in bulk. Giddy expects its revenue to grow 40% year over year in its fiscal 2022, ended December 31, 2022.

In June 2021, Germany-based online sporting goods retailer Signa Sports entered into a business combination agreement with the US SPAC Yucaipa Acquisition Corp to enter the US public market. The deal valued the combined company at $3.2 billion and is expected to complete by the end of fiscal 2021.

As part of the agreement, Signa Sports will also acquire its UK-based online rival Wiggle. Financial terms of the deal were not disclosed. For fiscal 2021, ended September 30, 2021, Signa Sports and Wiggle forecast that they generated $1.6 billion in combined net revenue.

Signa Sports expects the deal to provide $645 million in gross proceeds, comprising $345 million in cash and $300 million in private investment in public equity. The company will use the money to bolster its product line and boost international expansion. CEO of Signa Sports Stephan Zoll stated in the merger announcement that “becoming a listed company allows us to continue capturing market share in Europe and to accelerate our US and international expansion, while scaling our platform solutions.”

Food Product Retailers

In July 2021, snack food company Stryve reported the completion of its previously announced merger with SPAC Andina Acquisition Corp. The new entity, which is named Stryve Foods, was valued at $170 million and began trading on Nasdaq on July 21, 2021. The transaction included a private placement of $53.4 million, with $42.5 million of stock, payable in cash.

For fiscal 2021, ending December 31, 2021, the company expects its sales to double to $51 million as it enhances its e-commerce business, expands sales by its existing brands and add more stores to its 20,000 existing locations. Stryve reported a revenue CAGR of 63% between 2018 and 2020.

In a joint statement, the company’s Co-CEOs Joe Oblas and Jaxie Alt stated, “As Stryve begins this new chapter as a public company, we are more eager than ever to deepen our penetration within existing channels, expand our SKUs on the shelf and build upon our already-strong e-commerce momentum. As our revenues continue to grow, Stryve’s investments in people, infrastructure and vertical integration will pay significant dividends for the business.”

Apparel and Footwear Companies

In July 2021, Italy-based luxury apparel brand Zegna, owned by luxury group Ermenegildo Zegna, announced a business combination agreement with US SPAC Investindustrial Acquisition Corp to enter the US public market. The merger deal valued the combined company at $3.2 billion and the transaction is expected to complete by the end of fiscal 2021. The deal is one of the biggest global SPAC merger transactions in the apparel/luxury space to date.

Under the terms of the merger agreement, Zegna will sell a proportion of its holdings and retain a 62% stake in the combined company—with a market capitalization of $2.5 billion. Zegna stated that it expects the deal to provide $880 million in cash proceeds, which will support its expansion plans in the US and China. Commenting on the merger announcement, Zegna’s CEO Gildo Zegna said, “We could have remained private for another 100 years, but the timing was perfect, and luxury has become very challenging.” He also stated that the Zegna family “will remain at the company’s helm following the transaction’s completion, and will continue to invest in creativity, innovation, talent, and technology in order to sustain Zegna’s leadership position in the global luxury market.”

Going forward, we are interested to see whether Zegna will have other M&A aspirations, given its continued efforts to take ownership over its supply chain and the overall consolidation taking place in the global apparel and footwear industry. In June 2021, Zegna partnered with fellow Italian luxury fashion brand Prada to acquire a controlling stake in Italy-based cashmere producer Filati Biagioli. The acquisition deal falls in line with the trend for luxury brands, including Gucci and Kering, to bring suppliers in house to gain increased control over production.

With apparel brands and retailers experiencing a

substantial recovery and the ongoing trend of consolidation taking place globally in the industry, we expect to see more SPACs targeting this sector for M&A in 2022. For instance, on June 21, 2021, former Coach Inc.’s CEO Lew Frankfort and former Tapestry’s CEO Jide Zeitlin filed with the SEC to form a SPAC named Bleuacacia—intended primarily for acquiring apparel companies targeting Millennials and Gen Z. Frankfort and Zeitlin expect the SPAC to raise up to $300 million through an IPO. In its registration statement with the SEC, Bleuacacia stated, “Well managed brands can realize tremendous growth over the next decade. As such, this is an exciting time to pursue acquisitions of globally relevant, premium and consumer-facing brands that have a powerful emotional engagement with millennial and Gen-Z consumers.”

Logistics Service Providers

- JHD Holdings(Cayman) Limited

In February 2021, China-based online and offline merchant enablement services platform JHD Holdings (Cayman) Limited entered into an agreement with US SPAC East Stone Acquisition to enter the US public market at a valuation of $1 billion. The SPAC merger deal is expected to complete by the end of 2021.

JHD offers a full suite of services and technologies—spanning fintech/payment capability, point-of-sale (POS) and supply chain and logistics—to 90,000 independent retailers in China. JHD primarily targets independent retailers in low-tier cities and emerging areas in China, which represent a population of approximately 550 million people that spend more than $900 billion annually on food and household items, according to the company.

Commenting on the merger announcement, JHD’s Chairman Alan Clingman stated, “In 2016 we started Ji Hui Duo [JHD] with the mission of building a technology-driven platform and the accompanying service infrastructure to support financial inclusion in the world’s largest emerging market. We believe the highly fragmented, lower-tier economy of China represents one of the biggest potential growth stories of this decade and we are in the middle of it.”

Our

SPAC Think Tank report discussed the formation of a SPAC named Simon Property Group Acquisition Holdings by leading US mall operator Simon Property Group. The SPAC is intended primarily for acquiring growing retail and tech companies that investors want to take public.

Currently, Simon Property Group Acquisition Holdings is in talks with a US-based commercial property security software company Kastle Systems to take the latter public, as cited in Bloomberg on August 10, 2021 (see report appendix for further details of retail-focused active and pre-IPO SPACs). Kastle Systems provides an operating system to facilitate various property management functions, including self-service kiosks, video surveillance and visitor access, among others. The merger discussions are ongoing, and a deal has not yet been officially announced.

3. Post-Merger Analysis

Overall US SPAC Performance

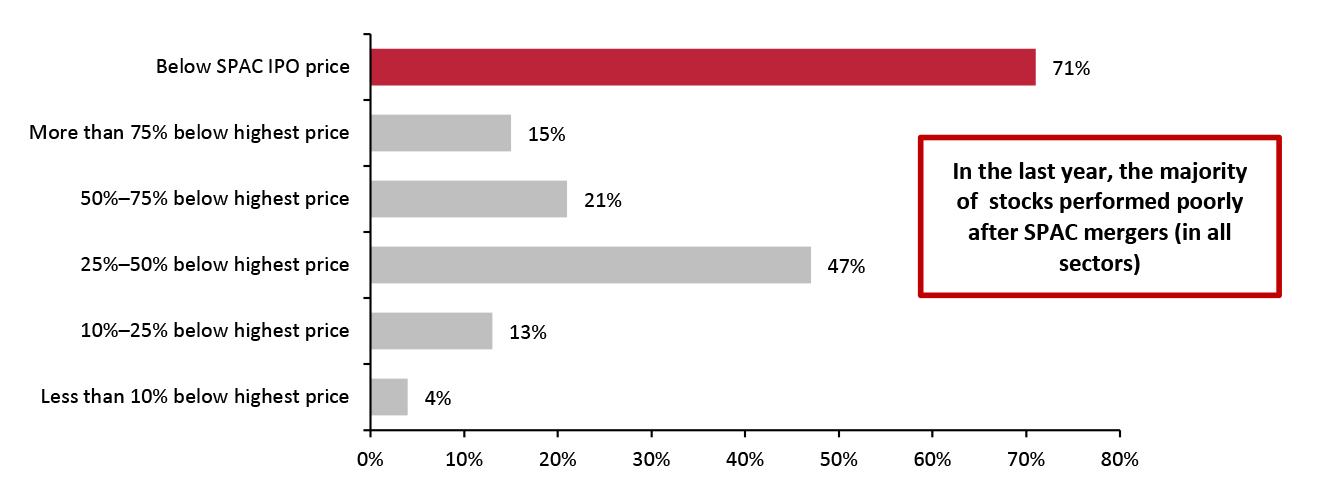

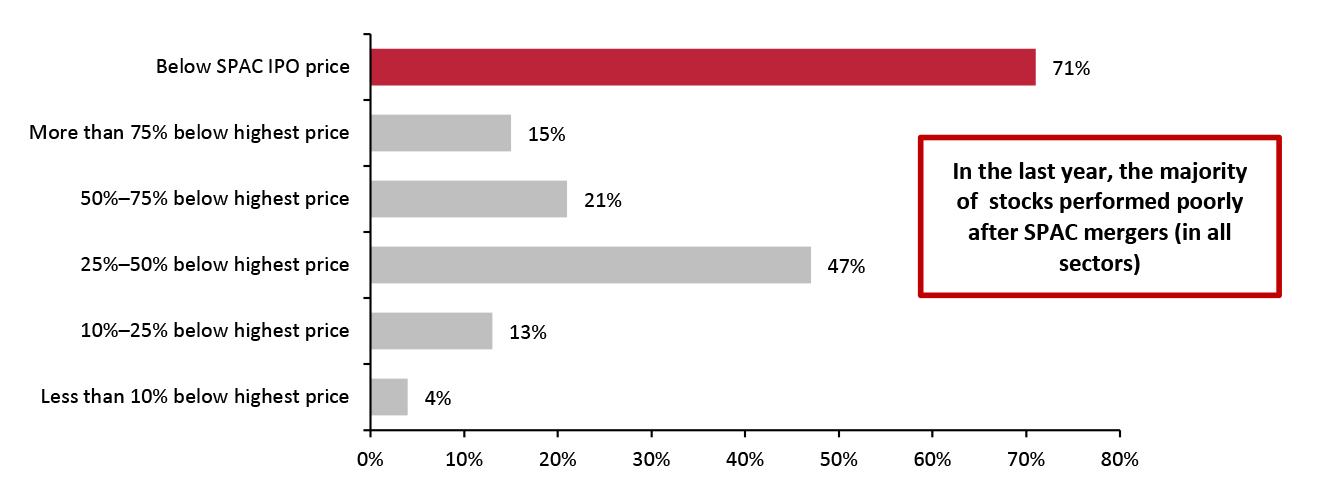

Aftermarket performance—the variation in price of the company’s stock up to one year after the SPAC merger—is a useful metric to gauge the success of a SPAC.

The majority of companies discussed above witnessed negative price performance after they entered into SPAC merger deals in the past year, according to Coresight Research analysis of S&P Capital IQ Pro data. From November 1, 2020, to November 24, 2021, 71% of stocks (all sectors) traded below the SPAC IPO price after entering into merger deals, as shown in Figure 3.

Figure 3. US: Post-Merger SPAC Performance for All Sectors, November 1, 2020–November 24, 2021

[caption id="attachment_137864" align="aligncenter" width="699"]

Source: S&P Capital IQ Pro/Coresight Research

Source: S&P Capital IQ Pro/Coresight Research[/caption]

We believe the negative aftermarket performance of SPACs is driven by the following key factors:

- Increasing regulatory concerns: SPACs are increasingly attracting attention from regulators, such as the SEC. As we mentioned earlier, on April 12, 2021, the SEC issued new guidance for accounting for warrants issued as part of a SPAC IPO. Warrants are financial instruments that grant the holder (in this case, institutional investors) the right to acquire a particular stock (in this case, stock of the new company formed after the merger of the target company with the SPAC) at a predetermined price within a specified time period. On exercise of such warrants, fresh shares are supplied by the issuing company (the new company that is formed after the merger of the target company with the SPAC).

Historically, SPACs accounted for warrants as equity on their balance sheets; however, if the SEC’s April guidelines are converted into law, SPACS may have to account them as liabilities. Classifying warrants as liabilities would require that SPACs perform quarterly valuations of warrants as debt—compared to the previous one-time equity valuation—which would be expensive and time-consuming. Furthermore, the changes in accounting could substantially impact the debt-to-equity ratios of SPACs and in some cases, would require the restatement of prior financial statements.

We believe this is causing substantial concern among both investors and target companies—and a significant number of investors have likely paused their investment in SPACs until they have further clarity on the future laws and how it will affect their investments.

- Liquidity-driven sell-offs: A large proportion of SPAC investors’ portfolios is held as capital in trust in an escrow account while an acquisition is sought. Therefore, if SPAC investors want to invest in new SPACs or traditional IPOs, they need to sell existing SPAC positions in their portfolios. With many SPAC sponsors struggling to find suitable targets amid the highly competitive SPAC markets in the past year, many investors are squaring off positions in their existing portfolios to enter into new SPACs or traditional IPOs. This is further driving selling pressure, resulting in a liquidity-driven sell-off trend.

- Saturation of the SPAC market: As discussed earlier in the report, US SPAC issuance witnessed a strong pullback in the second quarter of 2021—which was inevitable considering the saturation of the market after a spike in 2020 and the first quarter of 2021. Although the third quarter of 2021 saw a slight quarter-over-quarter improvement, SPAC issuance remains substantially lower than the first quarter. We believe that the excess of supply over demand is considerably impacting the price performance of SPACs.

Retail-Focused US SPAC Performance

Although retail-focused post-merger SPAC performance has been negative, it has substantially outperformed the overall SPAC market. Between August 1, 2020, and November 24, 2021, retail-focused SPACs witnessed an average price decline of 15.1% for post-merger deals versus the 71.0% decline reported by the overall SPAC market.

We believe that the outperformance of retail-focused SPACs is due to the growing attractiveness of retail companies, particularly Internet and direct marketing retailers, as M&A targets among US SPACs. Overall, the US retail sector witnessed a strong recovery in 2021, with Internet and direct marketing retailers maintaining strong growth momentum. While the overall SPAC market saw a pullback in the second quarter of 2021, the majority of retail-focused SPAC merger announcements have taken place from the beginning of the second quarter to date (as of November 24, 2021).

In Figure 4, we present retail-focused post-merger SPAC performance for transactions that took place from November 1, 2020, to November 24, 2021.

Figure 4. Retail-Focused Post-Merger US SPAC Performance, November 1, 2020–November 24, 2021

[wpdatatable id=1534 table_view=regular]

Note: The table excludes SPAC mergers in automotive retail, software retail, restaurants and breweries sector, which were part of the 22 total SPAC mergers in the consumer discretionary and consumer staples sectors discussed earlier in the report

Source: S&P Capital IQ Pro/Coresight Research

4. Future Prospects

Active and Pre-IPO SPACs by Retail Industry

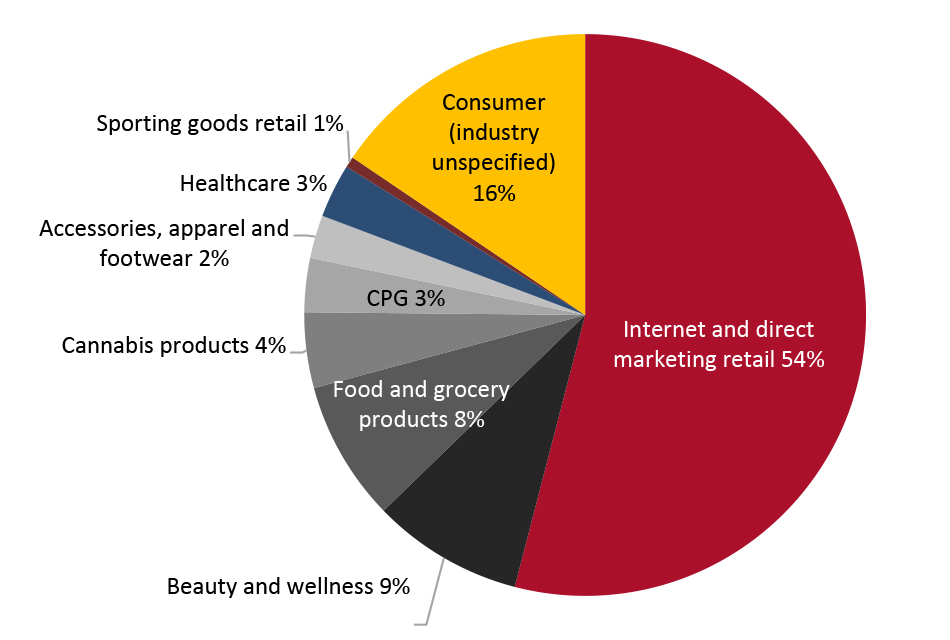

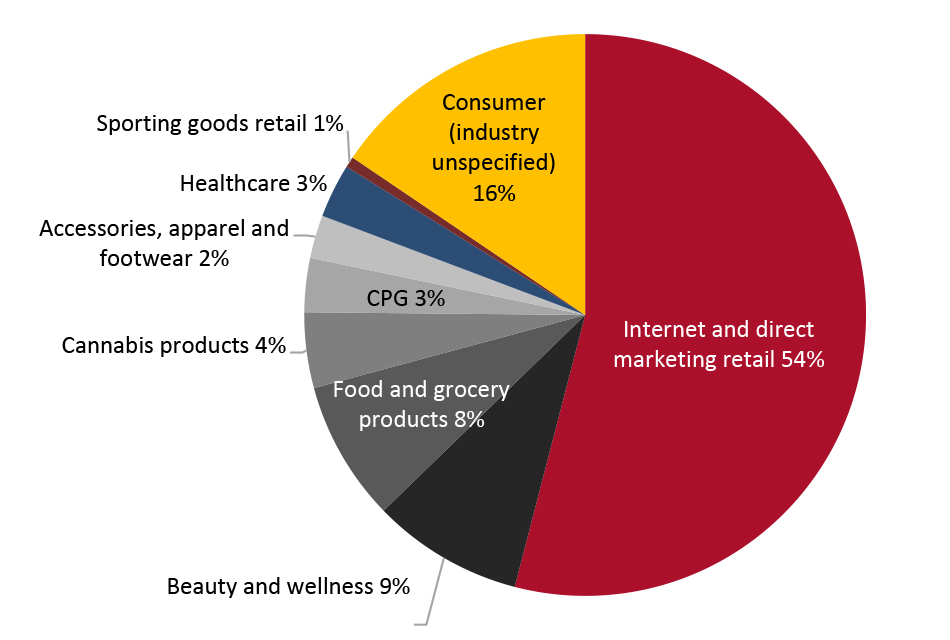

Even as overall SPAC IPO issuance slowed in the second quarter before recovering slightly in the third quarter, we believe that the attractiveness of retail companies as M&A targets remains intact. There is a significant amount of capital dedicated to searching for business acquisitions in the retail and consumer goods sector.

As of November 24, 2021, 161 US active and pre-IPO SPACs are looking for merger deals in retail-focused sectors, according to Coresight Research analysis of SPAC Track data. Nearly 54% of these 161 SPACs are looking for mergers in the Internet and direct marketing retail industry. The other major target retail industries include beauty and wellness, and food and grocery products. Please see the Appendix for a full list of the 161 active and pre-IPO SPACs focused on retail and consumer goods.

Figure 5. Retail and Consumer Goods-focused Active and Pre-IPO SPACs by Industry, as of November 24, 2021

[caption id="attachment_137865" align="aligncenter" width="700"]

Source: SPAC Track/Coresight Research

Source: SPAC Track/Coresight Research[/caption]

Retail-Focus SPAC Trends for 2022 and Beyond

While the strong pullback in the SPAC market in the second quarter of 2021 has led to some pain for investors who bought at over-inflated levels, it was inevitable given the saturation of the market. Even as the SPAC market is consolidating, we believe that the overall SPAC in retail trends remains strong—as indicated by the uptick in SPAC issuance in the third quarter.

Below, we present our key insights into the outlook for SPAC merger deals in 2022 and beyond.

Current volatility in the US equity market environment favors the SPAC market over traditional IPOs. Unlike traditional IPOs, SPACs allow private retailers and brand owners to negotiate their own fixed valuations with SPAC sponsors, which will continue to be a key temptation for retail companies looking to go public via the model in 2022 and beyond.

- Continuation of speculative investments and growing interest from the private-equity market

We expect entrepreneurial speculative firms to continue to invest in SPAC formations to capitalize on volatile capital markets to make a short-term profit—although this may come at the cost of small individual investors.

Moreover, we are seeing growing SPAC interest from private equity firms. The reverse merger structure of SPACs enables deals with a more modest outlay compared to the cost of traditional acquisition and investment. A private equity firm sponsoring a SPAC typically acquires 2%–3% of the shares offered in a SPAC public listing, meaning they gain access to a large stake in a target company business with less upfront investment than in a traditional IPO.

Even if US equity markets witness some disturbance, SPACs and private equity firms will still aim to buy targets at lower valuations and have sufficient cash to do so in case the opportunity arises.

- Forward-looking disclosure requirements and increased speed compared to traditional IPOs

Unlike the traditional IPO pathway, SPACs require target companies to provide forward-looking projections and disclosures as part of negotiations—which is attractive to investors, particularly amid current uncertainties.

Furthermore, SPAC IPOs typically list target companies within a much shorter timeframe versus traditional IPOs. Private retailers and brand owners looking to enter the public market quickly will most likely prefer SPACs to traditional IPOs.

- Low-interest rates and strong equity market

The US Federal Reserve System continues to keep interest rates low, facilitating a low opportunity cost for investment in SPACs. Combined with strong equity performance, SPACs are an attractive investment option.

However, the potential threat of inflation may impact the economic outlook and force the US Federal Reserve System to raise interest rates, which would push up the cost of merger deal financing.

What We Think

With the sequential improvement in SPAC issuance in the third quarter of 2021, following the strong pullback in the second quarter, we believe that the SPAC market will continue to offer

strong opportunities for retailers and brand owners to use forward-looking projections to access capital.

We expect that the future SPAC growth will be driven by a continuation in low interest rates and ongoing strong equity market momentum. However, key concerns to watch include the impact for financial statements of the SEC’s new regulations on warrants and assessing the credibility and efficiency of SPAC sponsors.

With a robust pipeline of retail-focused active and pre-IPO SPACs in the US as of November 24, 2021 (see the Appendix for the full list), we are likely to see a notable number of SPAC negotiations in the retail sector over the next two years. We anticipate that private equity firms will be a significant catalyst for retail-focused SPACs in future, given their access to expansive networks and financial resources, alongside industry and negotiation expertise, enabling them to sponsor multiple SPACs at once.

Implications for Brands/Retailers

- For brand owners and retailers, due diligence on their SPAC sponsor is essential, and should aim to identify experienced and reputable management that have a high probability of merger deal success.

- Private brand owners and retailers looking to enter the public market via SPACs should ensure that they are well informed ahead of negotiating their fixed valuation with sponsors—retailers should analyze the impact in the context of the full transaction, as well as the uses and sources of financing.

- Brand owners and retailers should ensure that the key attributes and objectives of internal controls are revised to address the financial reporting and tax implications of the SEC’s new regulations on warrants issued by SPACs.

- As a SPAC transaction requires public disclosure of forward-looking projections, there is an opportunity for retailers to tell a more in-depth story in terms of their investment thesis.

Appendix: SPACs in Retail

Appendix Figure 1. US: Active and Pre-IPO SPACs Targeting Retail Industries, as of November 24, 2021

[wpdatatable id=1535 table_view=regular]

Green indicates definitive agreements/in talks with target companies

Source: SPAC Track

*As of November 24, 2021

*As of November 24, 2021  Note: Figure 2 excludes SPAC mergers in automotive retail, software retail, restaurants and breweries sectors, which were part of total 22 SPAC merger announcements in consumer discretionary and consumer staples sectors mentioned above.

Note: Figure 2 excludes SPAC mergers in automotive retail, software retail, restaurants and breweries sectors, which were part of total 22 SPAC merger announcements in consumer discretionary and consumer staples sectors mentioned above.  Source: S&P Capital IQ Pro/Coresight Research[/caption]

We believe the negative aftermarket performance of SPACs is driven by the following key factors:

Source: S&P Capital IQ Pro/Coresight Research[/caption]

We believe the negative aftermarket performance of SPACs is driven by the following key factors:

Source: SPAC Track/Coresight Research[/caption]

Retail-Focus SPAC Trends for 2022 and Beyond

While the strong pullback in the SPAC market in the second quarter of 2021 has led to some pain for investors who bought at over-inflated levels, it was inevitable given the saturation of the market. Even as the SPAC market is consolidating, we believe that the overall SPAC in retail trends remains strong—as indicated by the uptick in SPAC issuance in the third quarter.

Below, we present our key insights into the outlook for SPAC merger deals in 2022 and beyond.

Source: SPAC Track/Coresight Research[/caption]

Retail-Focus SPAC Trends for 2022 and Beyond

While the strong pullback in the SPAC market in the second quarter of 2021 has led to some pain for investors who bought at over-inflated levels, it was inevitable given the saturation of the market. Even as the SPAC market is consolidating, we believe that the overall SPAC in retail trends remains strong—as indicated by the uptick in SPAC issuance in the third quarter.

Below, we present our key insights into the outlook for SPAC merger deals in 2022 and beyond.