*Estimated

Source: Company reports

4Q15 RESULTS

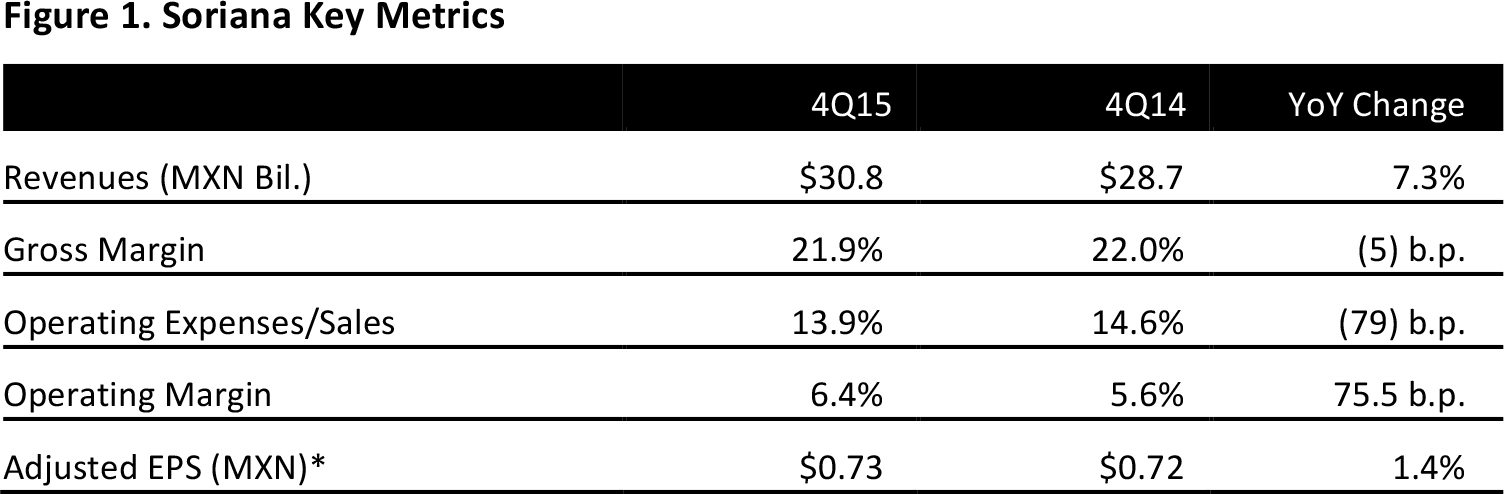

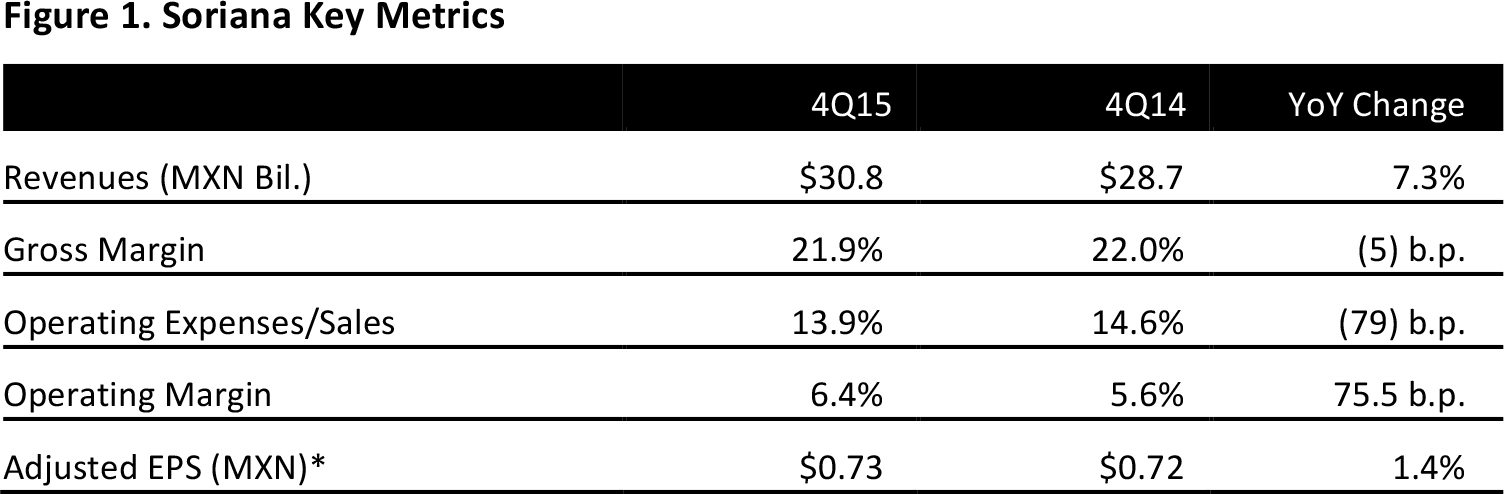

Soriana’s 4Q15 total revenues hit MXN$30.8 billion, up 7.3% from MXN$28.7 billion in 4Q14, which the company’s management deemed an outstanding improvement.

Comps in Mexico were up 6.2% for the quarter, a significant improvement over 4Q14’s comp decrease of 1.6%. For the full year, comps were up 5.6%. The company noted that it had made significant efforts to provide attractive offers and promotions to customers. Along with new and more efficient self-service options, these resulted in increases in average units per transaction and customer traffic.

Bloomberg calculates EPS of MXN$0.73, based upon 1.8 billion shares and the reported MXN$1.3 billion in net income. This is roughly flat with the company’s 4Q14 reported EPS of MXN$0.72.

On January 8, 2016, Soriana successfully completed a bid to take over Controladora Comercial Mexicana, acquiring 96% of the capital stock in circulation. The acquisition gave Soriana control over 143 Comercial Mexicana stores in the first days of 2016 for MXN$17.11 billion.

2015 RESULTS

Revenues in 2015 were MXN$109.38 billion, up 6.9% from MXN$101.83 billion in 2014.

The previous year’s same-store sales were negative for all four quarters, so the improvement in 2015 comps to 5.6% was significant, and was mostly due to Soriana’s new operating and commercial model.

Bloomberg calculates 2015 EPS of $2.07. This would be an increase of only MXN$0.01 year over year, attributable in part to the additional interest expense of the MXN$17 billion acquisition of Comercial Mexicana in the last days of 2015.

GUIDANCE

Soriana expects continued and more significant growth in 2016. The new stores opened in 2015 represent new sales floor space of 39,337 square meters (423,420 square feet) for the company. The 2016 consensus estimate calls for EPS of MXN$2.28, or an increase of MXN$0.21 per share and 10.3% year over year, versus the MXN$0.01 increase per share seen in 2015.

Despite wide income disparities between Mexican consumers and unfavorable international monetary policies, Mexico expects its economy to grow moderately in 2016. Consumer confidence continues to be strong due to the labor market and low inflation rates. Bloomberg calculates that its revenue will increase by nearly MXN$35 billion. The current consensus estimate calls for MXN$145.4 in 2016, up 32.9% year over year.