DIpil Das

What’s the Story?

Payment authorization failures are something that merchants can no longer neglect, due to the Covid-19 pandemic accelerating US consumers’ shift to e-commerce and use of credit card payments for online purchases. According to The Economist, an average of $1 in $7 is declined during payment authorization in US e-commerce—i.e., for every $700 worth of e-commerce transactions that make it to checkout, $100 is lost to payment declines—resulting in significant lost revenue for merchants.

In this report, sponsored by e-commerce solutions provider Riskified, we analyze the findings of a June 2021 Coresight Research survey of 209 senior executives at online retailers across six physical goods industries based in North America. We discuss how merchants perceive and handle payment authorization failures and present recommendations on how merchants can more effectively handle the issue moving forward, enabling them to recoup lost revenue.

Why It Matters

Payment authorization failures have a significant impact on e-commerce revenues: We estimate that the issue resulted in total lost revenue of $13.3 billion in the US in 2020, as we discuss in a later section of this report.

In addition, payment authorization failures damage the customer experience. According to Riskified, once customers experience payment declines, 28% will abandon their purchases and another 14% will opt to shop with a competitor, leading to decreased shopper loyalty and thus decreased customer lifetime value (the total revenue a business can expect from a single customer throughout the entire business relationship).

Payment authorization failures also increase the burden on customer support and increase merchants’ call-center costs, as merchants must devote more resources and time to handling related complaints, instead of other activities.

Solving for Payment Authorization Failures: In Detail

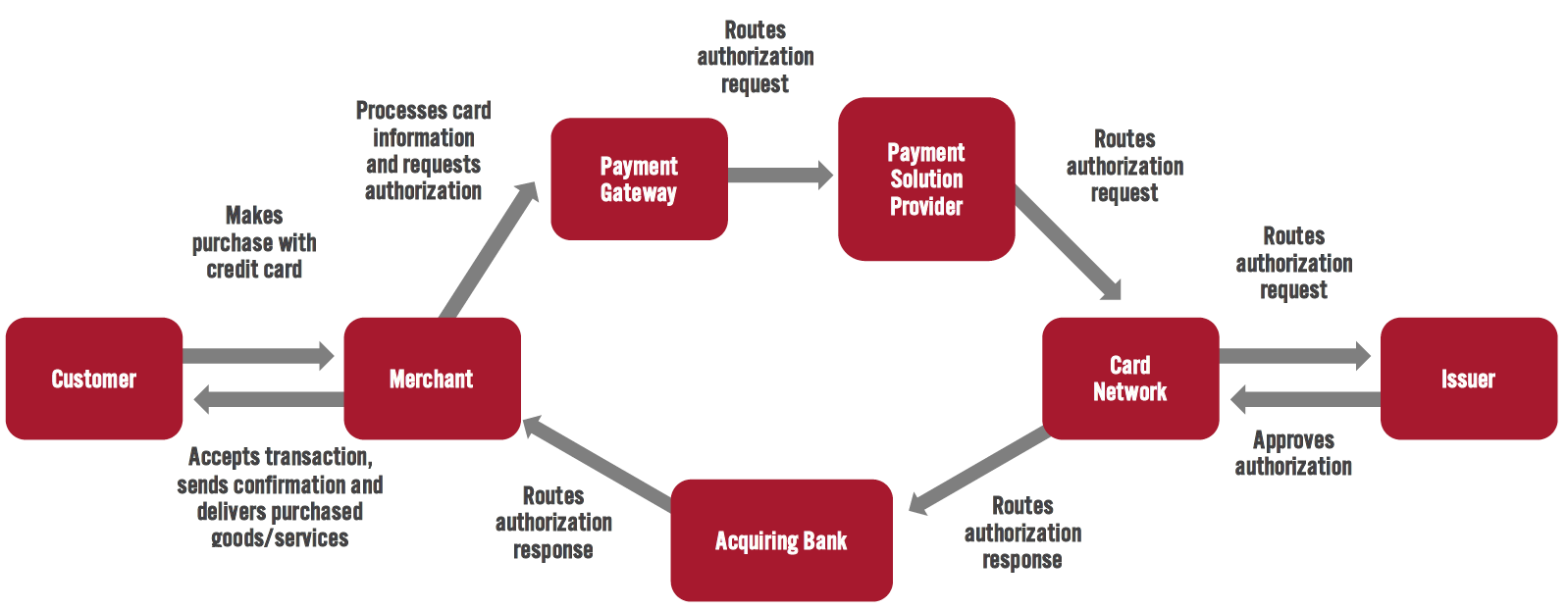

The Payment Authorization Process and Reasons for FailuresThe payment authorization process involves multiple parties:

- The customer or cardholder

- The merchant

- Payment gateway—A bridge between the merchant and banks

- Payment solution provider (PSP)—A company connected to the acquiring bank and merchant account

- Card network—An organization that facilitates payment card transactions

- Issuer—The bank that issues the cardholder’s credit card

- Acquirer—The bank that processes transactions on the merchant’s behalf and provides the merchant account

We summarize the payment authorization process in Figure 1.

Figure 1. Process of Payment Authorization Using Credit Cards [caption id="attachment_133981" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

There are many reasons why payment authorization might fail, and certain factors increase the likelihood of failure, as we outline in Figure 2.

Source: Coresight Research[/caption]

There are many reasons why payment authorization might fail, and certain factors increase the likelihood of failure, as we outline in Figure 2.

Figure 2. Reasons Why Authorization Failures Can Occur and Factors Making Them More Likely To Occur

| Reasons Why Payment Authorization Failures Occur | Factors that Can Impact Authorization Failures |

|

|

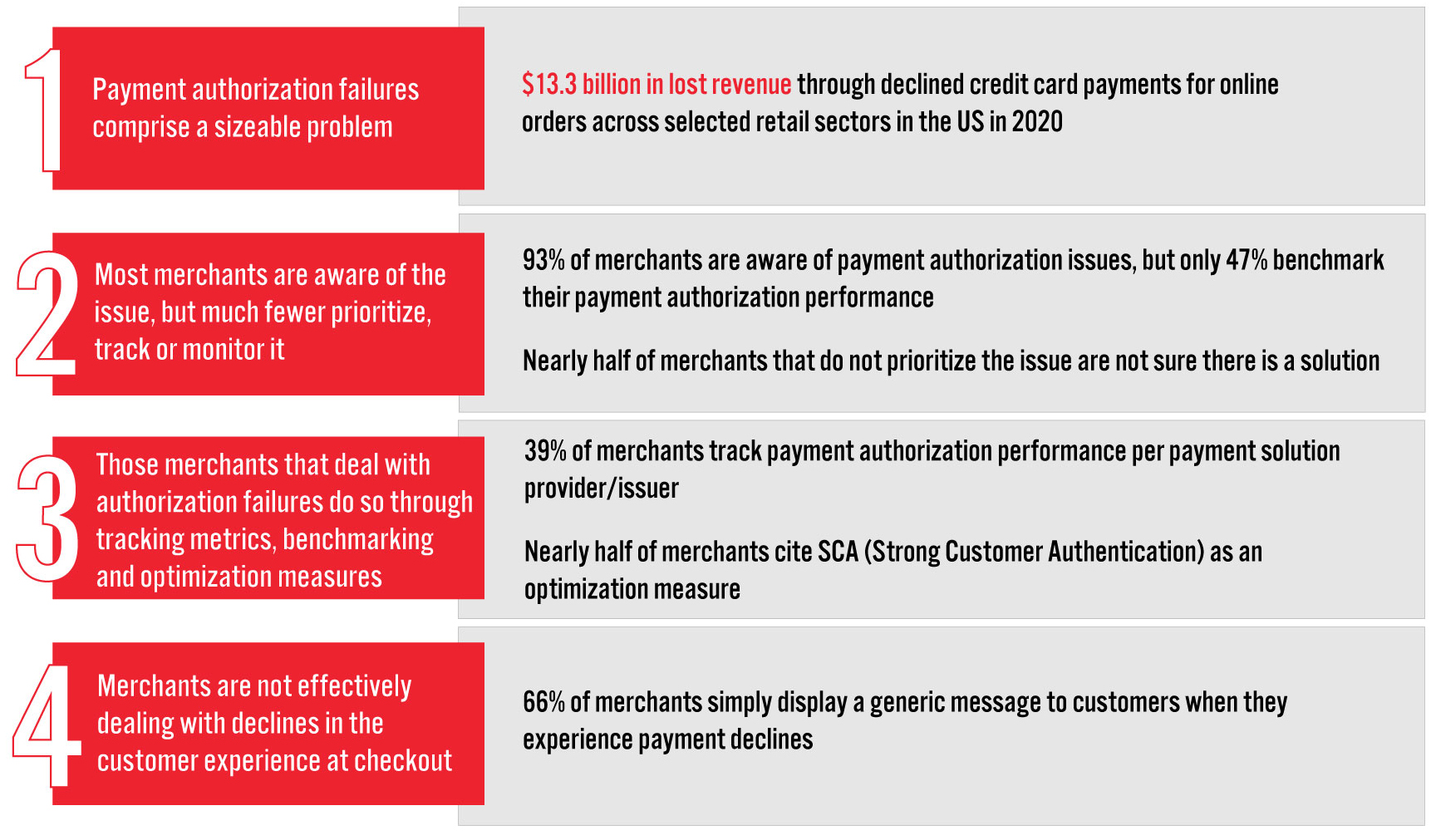

We summarize the four key insights from our survey on payment authorization failures in Figure 3 and discuss each in detail below.

Figure 3. Four Key Insights into Payment Authorization Failures [caption id="attachment_133994" align="aligncenter" width="700"]

Source: Riskified/Coresight Research[/caption]

1. Payment Authorization Failures Are a Sizable Problem

Source: Riskified/Coresight Research[/caption]

1. Payment Authorization Failures Are a Sizable Problem

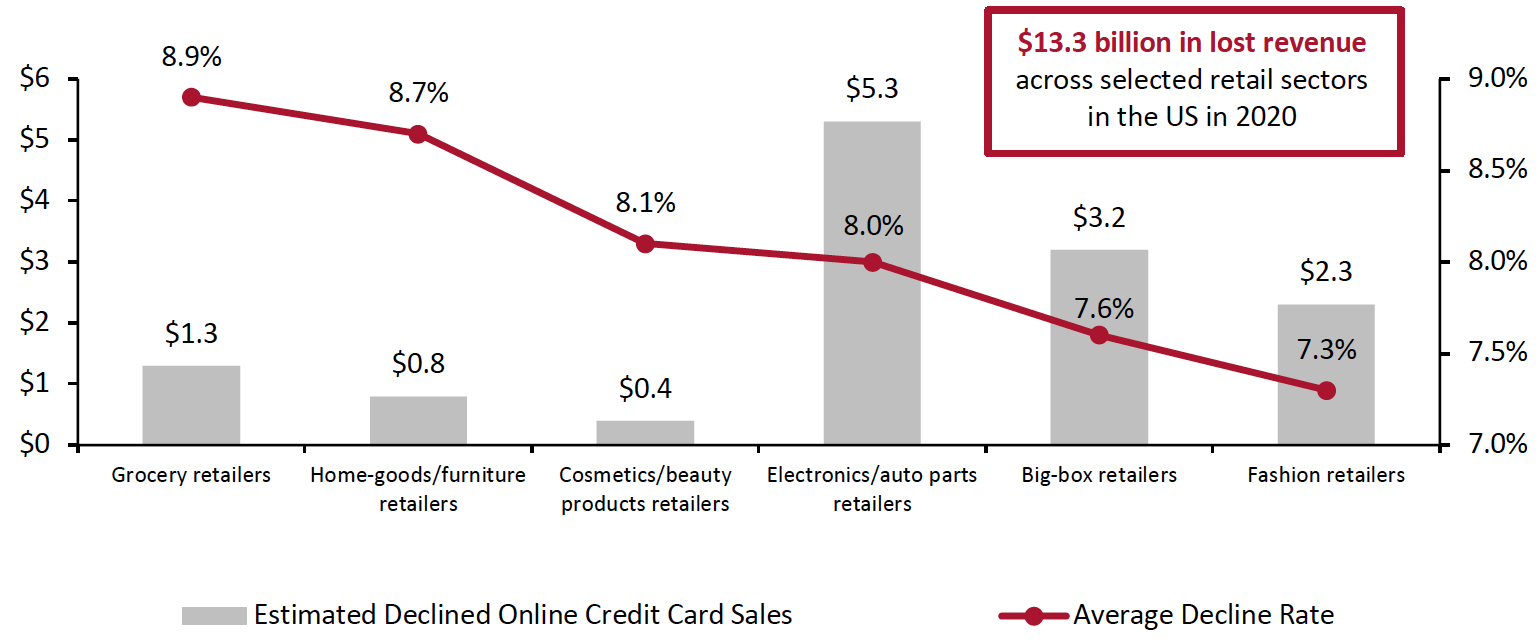

We estimate that declined online credit card sales in 2020 across six physical goods retail sectors in the US (big-box, cosmetics/beauty products, electronics/auto parts, fashion, grocery and home goods/furniture) totaled $13.3 billion—equivalent to nearly 2% of US e-commerce sales last year, according to US Census Bureau figures.

We derive our estimates for declined 2020 US online credit card sales for each retail sector through several variables:

- Estimated 2020 e-commerce market size by retail sector, from the US Census Bureau

- Percentage of US consumers using credit cards for online payments in the 12-month period of February 2020 to February 2021 (56%), according to Statista

- Average self-reported decline rate by respondents from the retail sector—calculated by dividing the number of declined transactions over the total number of transactions made

Of the six sectors, grocery retailers and home-goods/furniture retailers have relatively higher average decline rates, of 8.9% and 8.7% respectively, likely due to the pandemic-led boost in consumer spending on home products overall and grocery spending online amid lockdowns. Credit card issuers’ perception of fraudulent activities would have been influenced by resulting demand spikes and irregularities (for instance suddenly buying large amounts in multiple instances within a short time period) in cardholders’ spending patterns—particularly for the home-goods sector, which typically sees high average order values compared with other retail sectors.

An interesting finding from our survey is that the fashion sector—which usually comprises a high proportion of cross-border e-commerce sales (and therefore induces higher payment decline rates)—had a relatively lower average decline rate in 2020 than other retail sectors. This implies that fashion merchants are generally ahead of the grocery and home-goods sectors in optimizing their e-commerce capabilities, including payments. A contributing factor could also be that the fashion retailers we surveyed sell fast fashion rather than luxury fashion, which has a lower average order value and therefore a lower decline rate.

Figure 4. Estimated Declined Online Credit Card Sales (Left Axis; USD Bil.) and Average Decline Rate (Right Axis; %), by Retail Sector in the US, 2020

[caption id="attachment_133984" align="aligncenter" width="700"] Source: Riskified/US Census Bureau/Coresight Research[/caption]

2. Most Merchants Are Aware of the Issue, but Much Fewer Prioritize, Track or Monitor It

Source: Riskified/US Census Bureau/Coresight Research[/caption]

2. Most Merchants Are Aware of the Issue, but Much Fewer Prioritize, Track or Monitor It

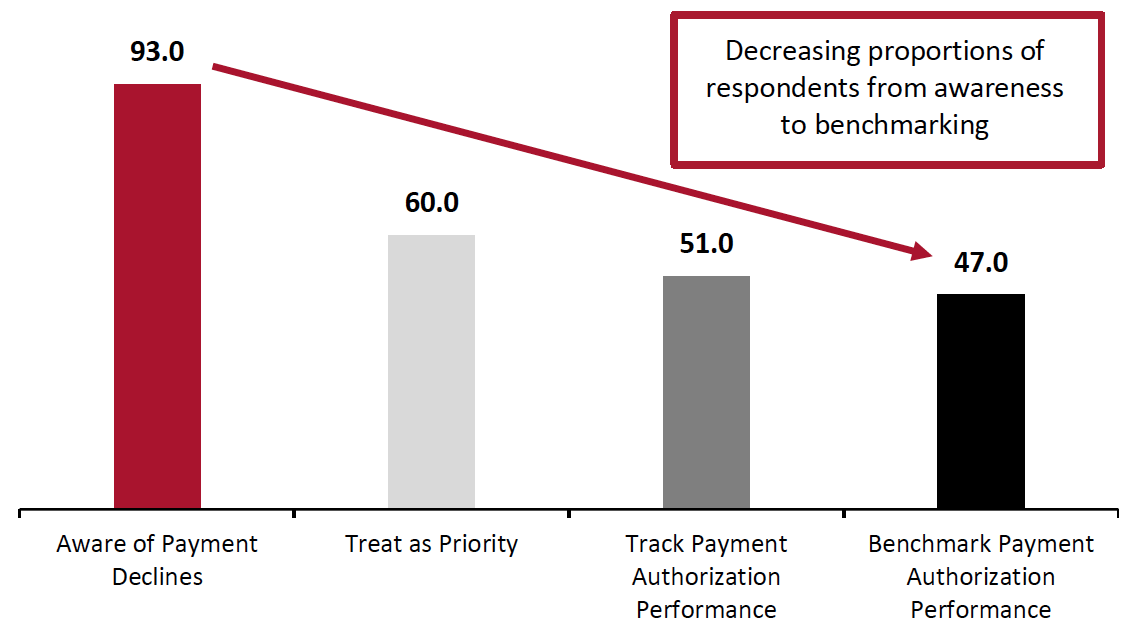

Although our survey found that nearly all merchants are aware of the issue of payment declines, only 60% are currently treating it as a priority. Furthermore, around half of respondents stated that their organizations currently track and benchmark payment authorization failures—indicating significant opportunity for merchants to improve their visibility on the issue and implement solutions to recoup lost revenue.

Figure 5. Respondents’ Awareness of, and Efforts to Track, Payment Authorization Failures and Performance (% of Respondents) [caption id="attachment_133985" align="aligncenter" width="550"]

Base: 209 senior executives in North America, surveyed in June 2021

Base: 209 senior executives in North America, surveyed in June 2021Source: Riskified/Coresight Research[/caption]

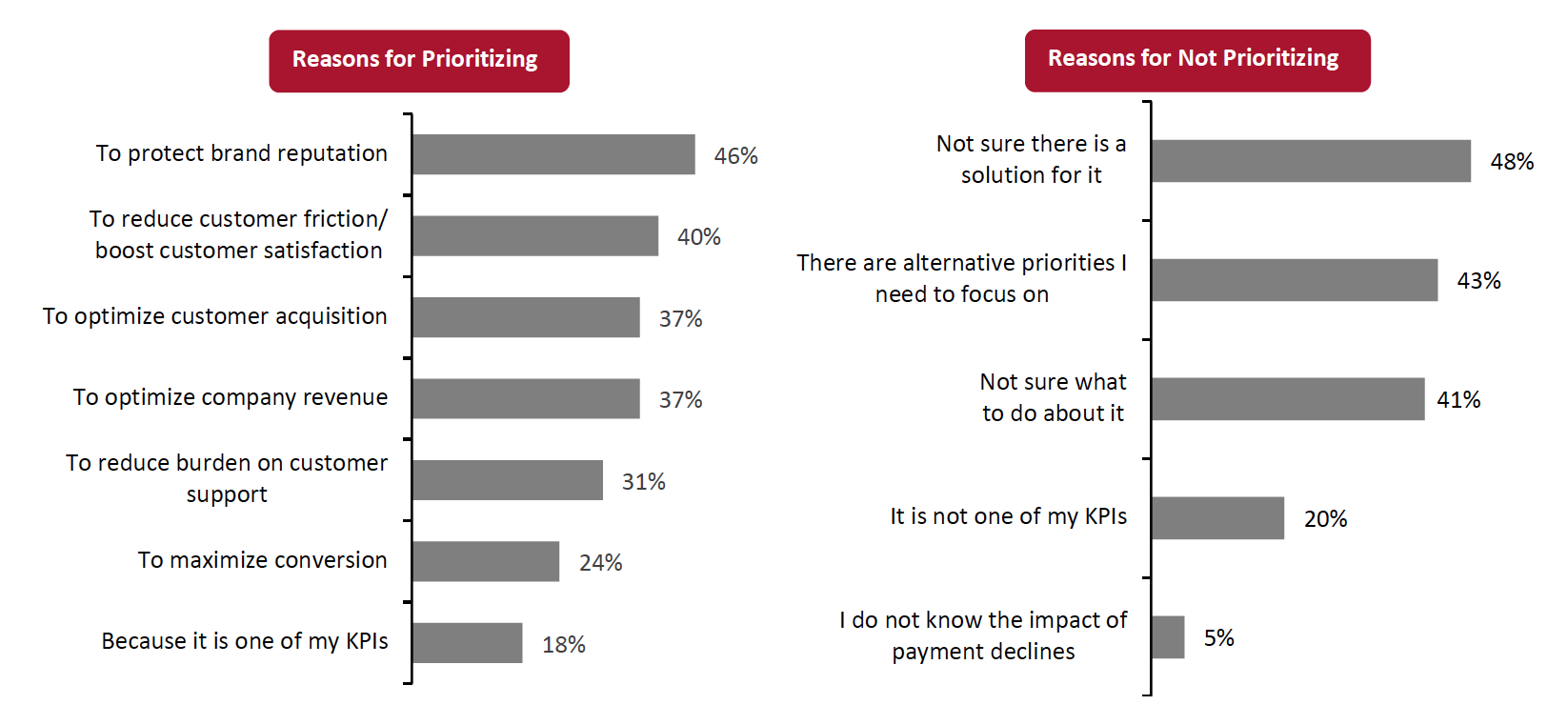

Our survey found that branding and customer satisfaction concerns—such as reducing customer friction—are motivations for merchants choosing to prioritize the payment authorization issue. However, notably, of the merchants that do not prioritize the issue, nearly half are not sure there is a solution, and 41% are not sure what to do about it (see Figure 6).

Figure 6. Reasons Merchants Prioritize or Do Not Prioritize Payment Authorization Issue (% of Respondents)

[caption id="attachment_133986" align="aligncenter" width="700"] Base (prioritizing): 125 senior executives in North America, surveyed in June 2021

Base (prioritizing): 125 senior executives in North America, surveyed in June 2021Base (not prioritizing): 61 senior executives in North America, surveyed in June 2021

Source: Riskified/Coresight Research[/caption]

Overall, our findings suggest that while merchants are generally aware of the issue of payment authorization failures, they are not doing enough in terms of tracking and benchmarking the problem. Taking into account that payment authorization failures can damage brand reputation and customer loyalty, it is important that merchants place a high priority on this issue, and at the same time strengthen their efforts in tracking and benchmarking payment authorization performance.

3. Merchants that Deal with Authorization Failures Do So Through Tracking Metrics, Benchmarking and Optimization Measures- Tracking Metrics

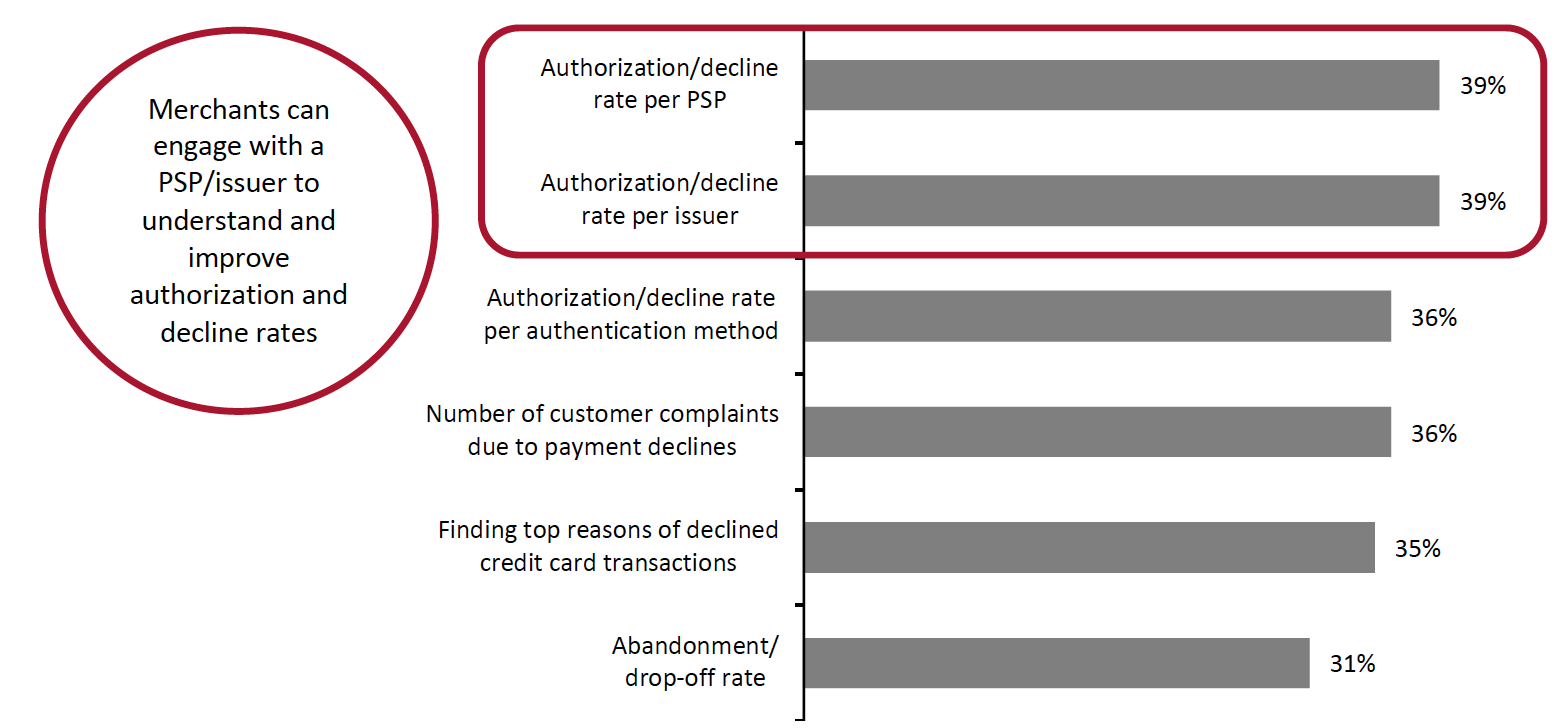

Authorization and decline rates—the ratio of the number of authorized or declined transactions to the total number of transactions made—are commonly used metrics among merchants that track payment authorization performance. Our survey found that, combined, authorization and decline rates by payment solution provider (PSP) and by issuer comprise the most cited metrics that merchants use for tracking (39% of merchants do each). These were followed by authorization and decline rates by authentication method and the number of customer complaints due to payment declines (see Figure 7).

Tracking authorization and decline rates by PSP/issuer is important as it enables merchants to investigate payment data and engage with a PSP/issuer when the decline rate is particularly high (or authorization rate particularly low) to gain a better understanding of root causes and consider necessary actions for improvement.

However, merchants must not ignore customer satisfaction-related metrics such as the number of complaints due to payment declines. As we highlighted earlier, such complaints can burden customer support teams, and negative customer experiences would likely lead to decreased customer lifetime value for merchants. Prioritizing the issue of payment authorization failures is therefore one way in which merchants can prevent the loss of customer lifetime value while boosting operational productivity by reducing the burden on customer support (the latter was cited as a reason to prioritize the issue by 31% of merchants that prioritize payment authorization failures).

Figure 7. Merchants That Track Payment Authorization Performance: Tracking Metrics They Use (% of Respondents)

[caption id="attachment_133987" align="aligncenter" width="700"] Base: 107 senior executives in North America that track payment authorization performance, surveyed in June 2021

Base: 107 senior executives in North America that track payment authorization performance, surveyed in June 2021Source: Riskified/Coresight Research[/caption]

We also found that among those that track payment authorization performance, 58% do so through multiple departments. Although this may be beneficial in providing different viewpoints and suggestions to optimize payment authorization performance, it could explain why payment authorization failures are not prioritized: The issue may get lost across teams. Furthermore, our survey found that 34% of all merchants optimize payment authorization performance through regular meetings or discussions between different company departments (see Figure 8 in the later section). Merchants can set up a payment committee drawn from different departments across an organization to ensure a proactive focus on payments with the right expertise and experience to manage payments effectively.

- Benchmarking

In terms of what merchants use for benchmarking their payment authorization performance, most respondents cited benchmarking against industry competitors (52%), followed by different product categories within a company (44%) and against a single industry benchmark (39%). Comparing authorization rates with peers can certainly be instrumental in helping merchants remain competitive in their respective industry, but it is worth noting that it would be difficult for merchants to obtain industry benchmarks without the help of third-party solutions providers.

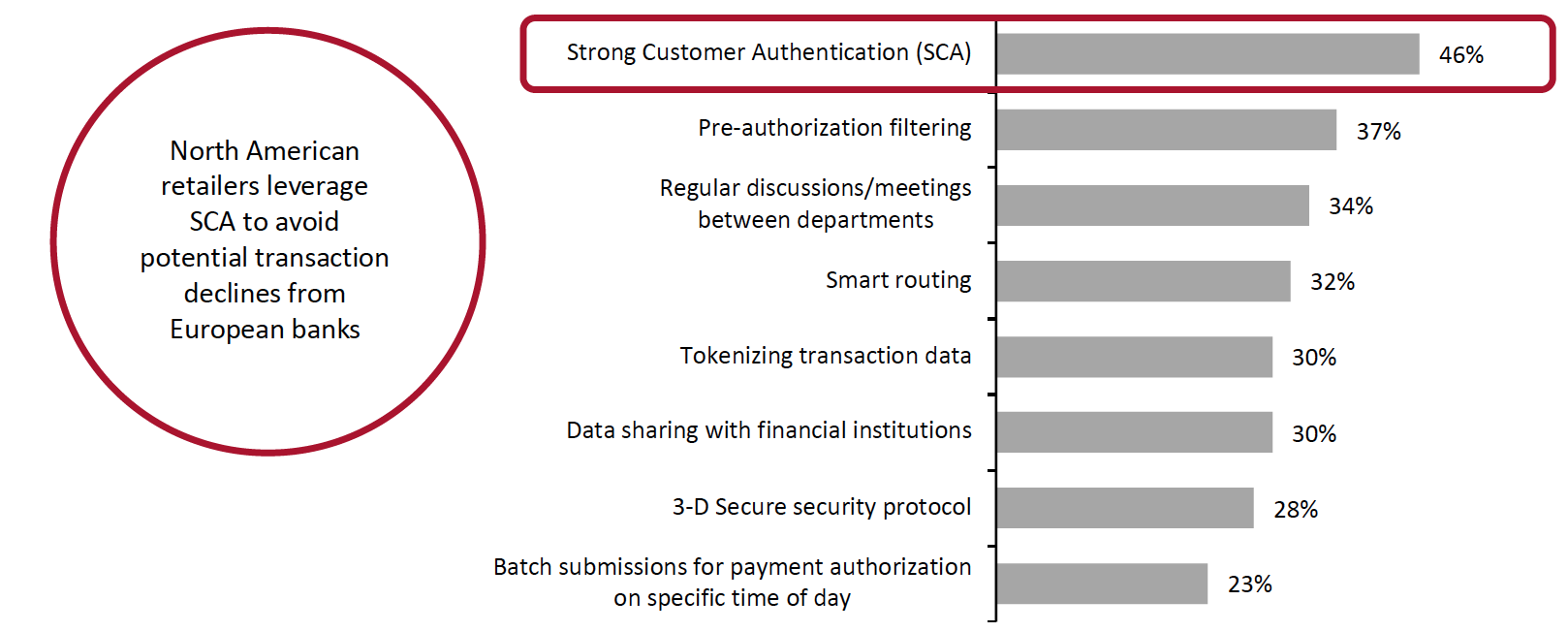

- Optimization Measures

According to our survey findings, some merchants are already taking measures to optimize their payment authorization performance. Nearly half of all respondents (46%) cited Strong Customer Authentication (SCA) as a measure for optimizing payment authorization performance—SCA is a European regulation designed to prevent online transaction fraud by mandating banks to require extra user authentication before authorizing payments. This suggests that US-based businesses are choosing to update their current authentication process to avoid potential transaction declines from European banks, or simply to minimize the impact of fraud attempts on their businesses.

While many North American retailers leverage SCA to avoid potential transaction declines from European banks, there are multiple reasons why SCA is not a sufficient solution in coping with payment authorization failures:

- SCA focuses on fraud and ID verification and only addresses wrongfully declined orders due to lapses in authentication; it does not account for wrongful declines caused by technical outages or the time financial institutions need to assess cardholders' ability to afford an order.

- SCA adds friction for consumers and increases the likelihood of abandoned shopping carts.

- SCA overlooks a key segment of customers with payments declined due to insufficient funds in their account.

- Even with SCA, the profile of merchants may still be considered high risk.

- In the long run, SCA does not necessarily improve payment authorization rates as fraudsters know how to circumvent it.

Figure 8. Optimization Measures Merchants Take to Optimize Payment Authorization Performance (% of Respondents)

[caption id="attachment_133988" align="aligncenter" width="700"] Base: 209 senior executives in North America, surveyed in June 2021

Base: 209 senior executives in North America, surveyed in June 2021Source: Riskified/Coresight Research[/caption] 4. Merchants Are Not Effectively Dealing with Declines in the Customer Experience at Checkout

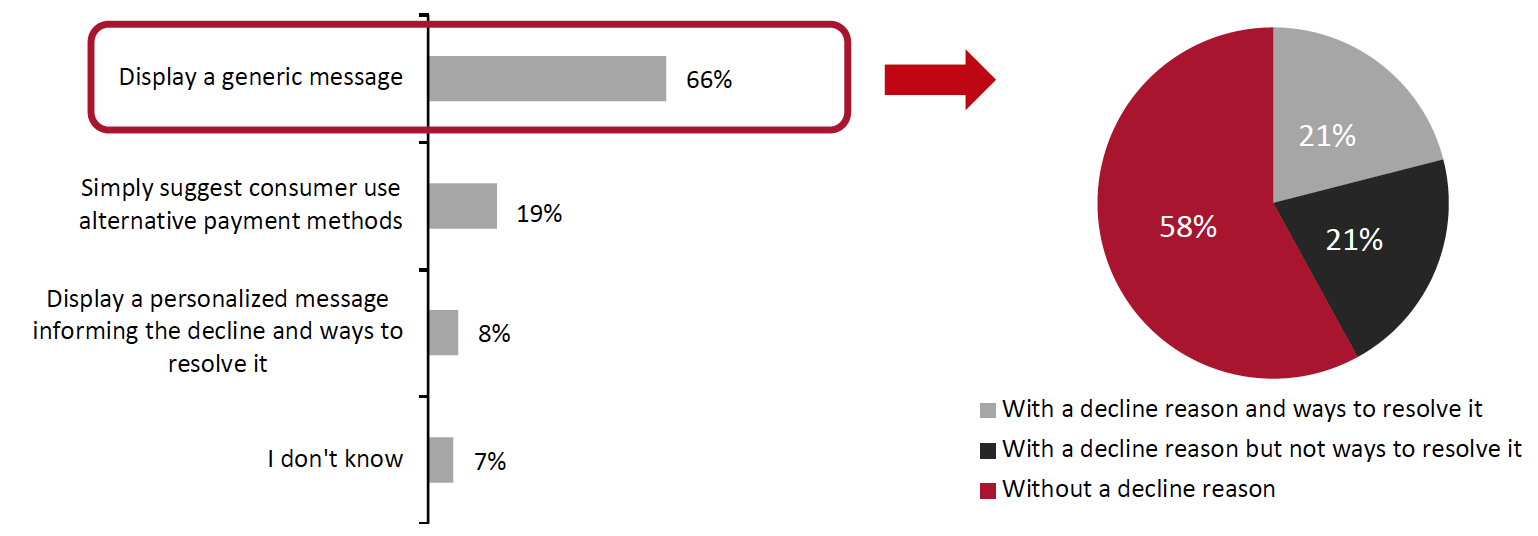

Card issuers rarely provide merchants with detailed reasons for payment declines due to fraud prevention concerns, but this does not justify poor customer communication, which can negatively impact customer experience. Our survey found that the majority of merchants (66%) simply display a generic message to customers at the checkout page when they experience payment declines, and 58% of those displaying a generic message do so without providing a reason for the decline.

To improve their communication with customers, merchants should collaborate with card issuers to solve challenges around data visibility. They should also improve their messaging around a payment being declined by disclosing the reason and prompting shoppers to complete the transaction via a different payment method.

Figure 9. How Merchants Usually Deal with Payment Declines at Checkout (% of Respondents)

[caption id="attachment_133989" align="aligncenter" width="700"] Base: 209 senior executives in North America, surveyed in June 2021

Base: 209 senior executives in North America, surveyed in June 2021Source: Riskified/Coresight Research[/caption] The Path Forward: How Merchants Can Better Handle Payment Authorization Failures

Leveraging the help of PSPs is one way that merchants can better track and benchmark their payment authorization performance and better handle consumer communication around payment declines. Such collaboration can help merchants save time and costs associated with equipping their internal teams to handle payment authorization failures themselves.

However, leveraging PSPs is not an all-encompassing solution. PSPs differ in their payment authorization performance, and they may not all possess the latest technologies that facilitate merchants to resolve payment authorization failures. PSPs aim to prevent and pre-empt authorization failures, without having the capability to offer recourse when the payment decline still occurs.

Below, we discuss the benefits to merchants of using a third-party solution that proactively tackles payment authorization failures as they happen at checkout—Riskified’s Deco.

Riskified

Riskified is an e-commerce solutions provider that empowers businesses to realize the full potential of e-commerce through making it safe, accessible and frictionless. Riskified’s e-commerce risk-management platform, based on machine learning (ML), accurately identifies the individuals behind the online interactions and delivers revenue-critical decisions to merchants. Apart from mitigating card-not-present (CNP) fraud, Riskified also protects customers from malicious account-takeover attacks, combats payment failures at checkout, helps merchants block abuse while upholding consumer-friendly policies, and more. In May 2021, Riskified announced the launch of the latest version of Deco.

Riskified’s Deco

- An Overview

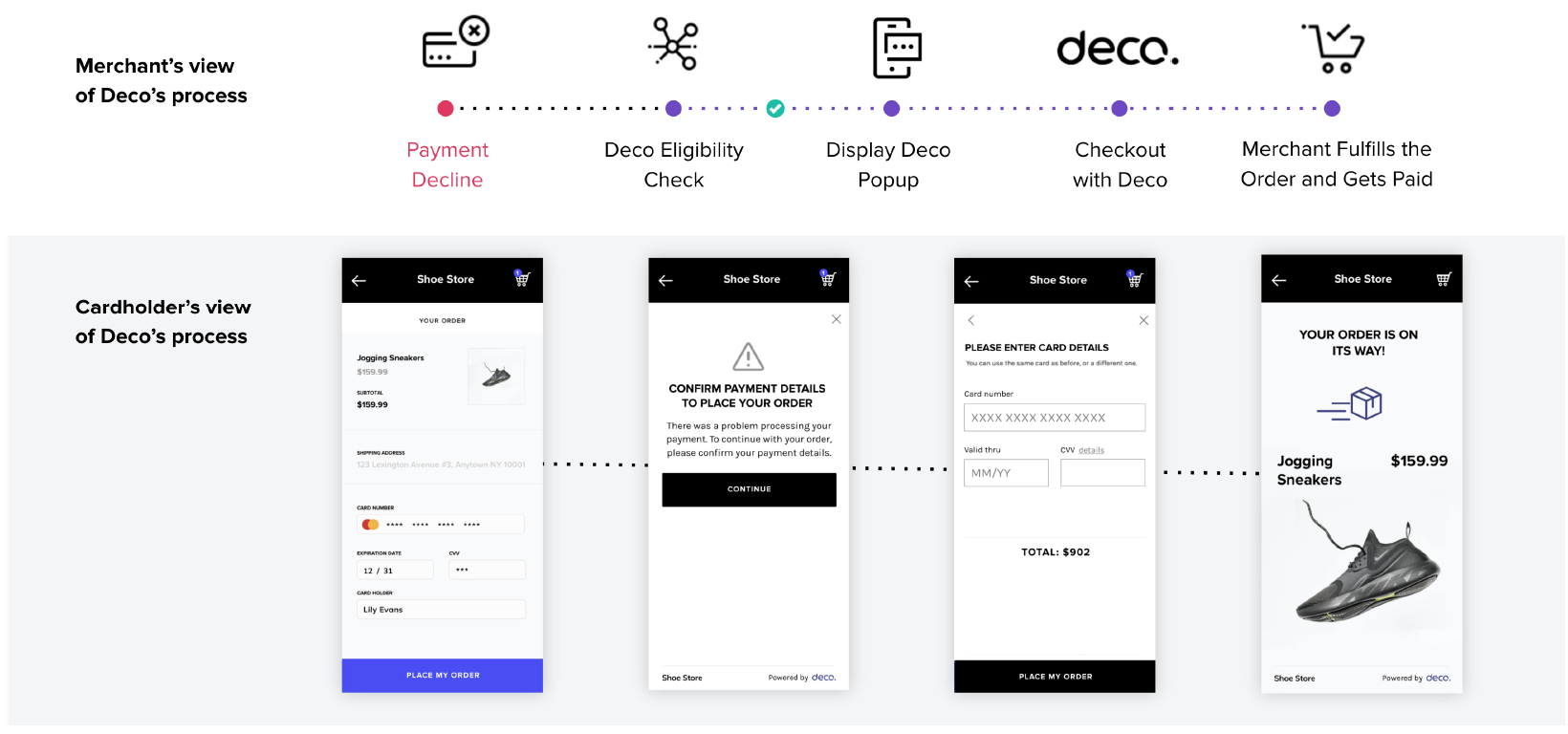

Riskified’s Deco is a real-time revenue recovery solution that assists merchants in recovering orders lost to CNP payment authorization failures at the point of decline through AI and ML technologies. It works as a frictionless website plug-in that operates at the checkout stage of the shopping journey. Once a customer experiences a payment decline, Deco identifies legitimate shoppers using ML technology and nearly simultaneously prompts the option on the checkout page to complete the payment without leaving the merchant’s site and without the need for credit checks, additional fees or applications.

[caption id="attachment_133990" align="aligncenter" width="700"] Source: Riskified[/caption]

Source: Riskified[/caption]

- Selected Case Studies

A European luxury fashion brand working with The Level Group

The Level Group, an e-commerce partner responsible for the online businesses of a portfolio of fashion and luxury brands, found that many non-US brands with significant US sales volumes suffer from high decline rates due to inefficiencies in the payment authorization process. The company also found that merchants were struggling to proactively convert the authorization failures at the point of decline and to deliver a great customer experience during checkout.

A European luxury fashion brand that partners with The Level Group and has a high US sales volume and high average order value partnered with Deco. As a result of the partnership, the brand recovered 9.62% of Deco-eligible US credit card payments annually. Nearly 60% of Deco users of the brand were first-time users, and these shoppers have returned on average 2.5 more times to shop, spending double the amount per purchase than they had spent on their initial purchases. “Deco leverages AI, ML and analytics to serve good customers who have unfortunately been declined—all without friction,” said Andrea Ciccoli, Co-Founder of The Level Group.

Revolve

Los Angeles-based online apparel retailer Revolve has always monitored its payment authorization performance. However, a significant proportion of potential customers fail authorization due to declines by the payment processor, payment gateway or banks. Even some existing Revolve customers with excellent credit were experiencing the costly friction of retrying checkout with another payment method. Another source of customer friction Revolve faced was having no clarity on the reasons for the authorization declines. Revolve’s US credit card transactions were especially vulnerable, with millions of dollars of Deco-eligible transactions failing authorization annually.

Revolve sought a solution to recapture lost revenue and reduce customer friction throughout the payment process to further enhance customer loyalty and lifetime value. Through partnering with Deco, Revolve recovered 18% of its failed US credit card payments, and Deco users who were first-time Revolve shoppers completed an average of five return-to-site visits. Ultimately, Deco helped Revolve maximize its revenue and improve the customer experience. “Our payments offering and optimization strategy would not be complete without Deco,” said David Pujades, Chief Operating Officer at Revolve.

For more information, visit riskified.com.

What We Think

Payment authorization failure is not an issue that can be fixed by metrics alone. Merchants need to adopt a holistic perspective that also takes into account revenue optimization and the customer experience—both of which are foundational factors to retail success and why merchants should prioritize the issue of payment authorization failure.

Implications for Merchants

- While payment authorization failure is likely to be more prevalent in certain retail sectors, it is a sizable problem occurring sector-wide in US retail.

- It is not sufficient for merchants to be merely aware of the issue of authorization failures. They need to prioritize it and track, benchmark and optimize payment authorization performance to stop revenue loss, protect brand reputation and boost customer lifetime value.

- Merchants need to use the right metrics to track/monitor payment authorization performance—covering a mix of customer-related and payment-related metrics.

- Working with PSPs is one way in which merchants can optimize payment authorization performance by increasing data visibility.

- Merchants should also explore working with solutions providers to tackle payment authorization failures at the point of a payment decline. Riskified’s Deco solution helps shoppers complete payments on a merchant’s site without the need for any credit checks, additional fees or applications.

Survey Methodology

This study is based on the analysis of data from an online survey of 209 retailers conducted in June 2021. We selected respondents based on the following criteria:

- The company’s target consumers are mainly in the US or Canada

- Retailers selling physical goods across six sectors—big-box, cosmetics/beauty products, electronics/auto parts, fashion, grocery and home goods/furnishings

- Online credit card sales from US consumers in 2020 reached at least $30 million

- Holding senior positions (owners, directors, heads, managers)

- From customer care, e-commerce and digital, fraud and risk, finance and payments functions