DIpil Das

Introduction

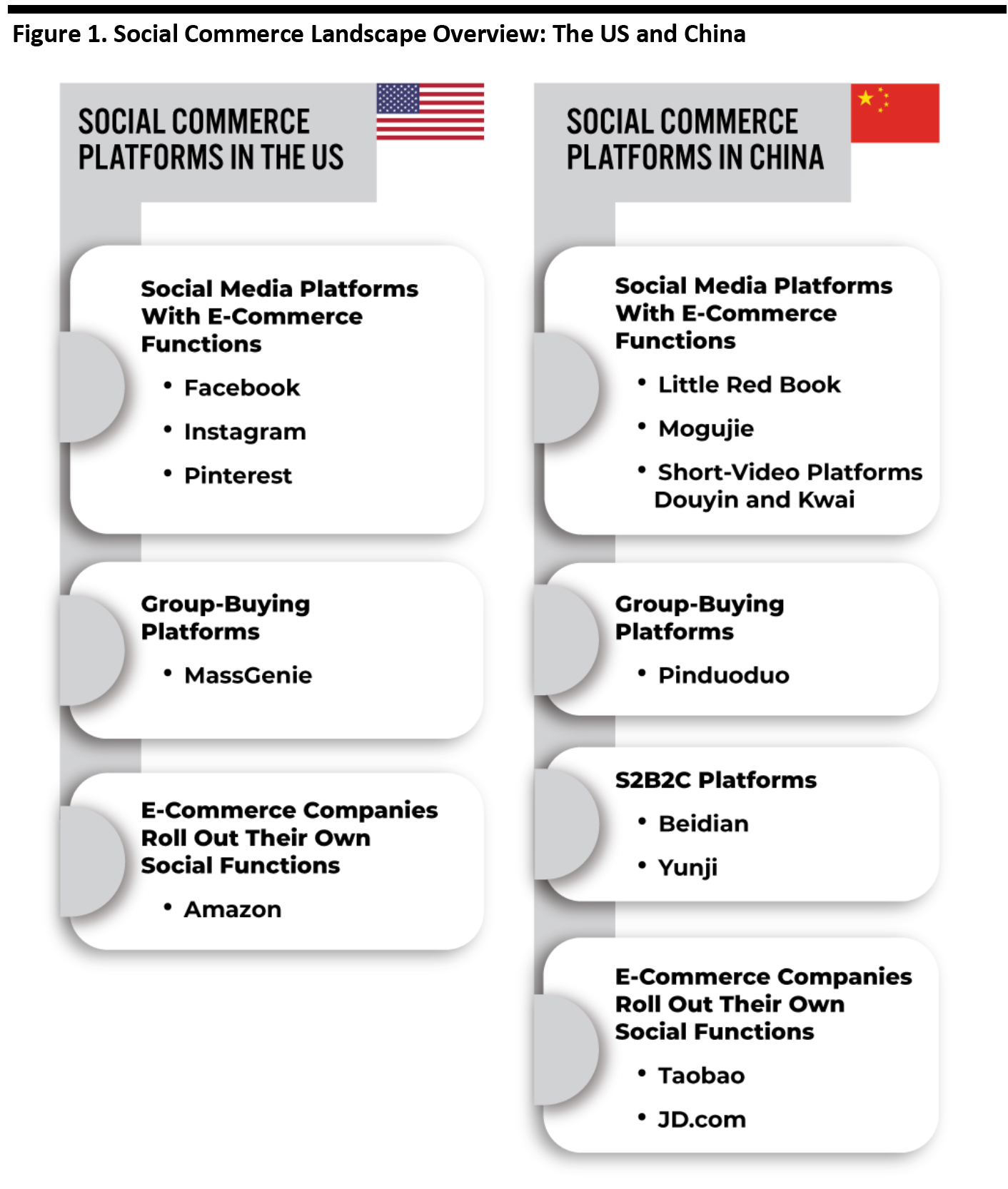

Brands and retailers skillfully use social media platforms as a marketing channel to engage with consumers and promote their products. In the US, social commerce continues to relate mainly to purchasing through social media, although we are seeing some broader models of social commerce emerge. For instance, e-commerce platform Amazon added a livestreaming service, Amazon Live, to further engage with consumers. In China, social commerce is a broader segment, encompassing other forms of social buying where social participation is prominent. For instance, group-buying platforms offer lower-priced products to consumers that form groups with their social contacts to place bulk orders. In this report, we discuss the social commerce landscapes in the US and China—including social media platforms that enable consumers to purchase, e-commerce platforms with social media functions and group-buying platforms. In addition, there are S2B2C platforms, which aim to shorten the supply chain between factories and consumers. We also highlight opportunities in the social commerce market that brands and retailers could look to leverage. [caption id="attachment_110292" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Social-Media-Dominant Social Commerce Landscape in the US

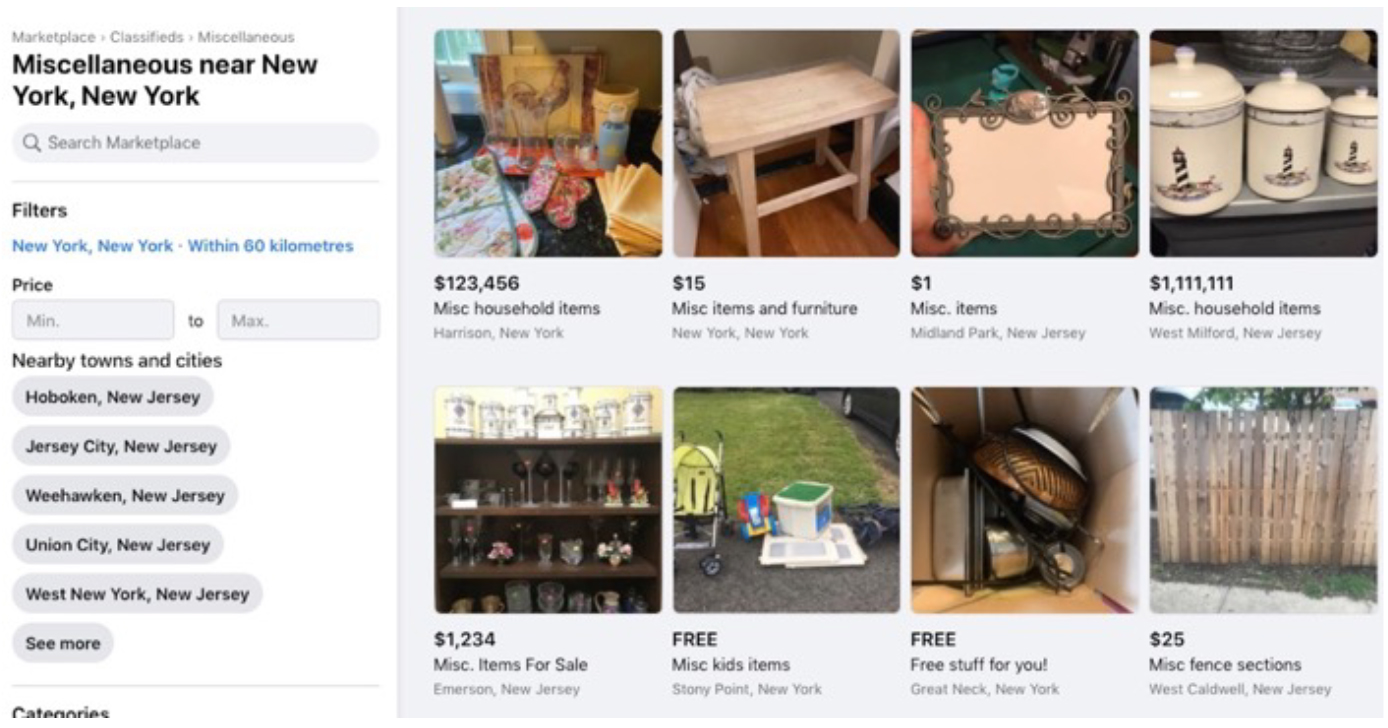

In the US, social commerce primarily involves buying through social media, although we are seeing some new formats emerge. For instance, major e-commerce platforms have added social media functions on their sites, such as Amazon launching Amazon Live to connect with individual users. Furthermore, the group-buying trend is taking hold through platforms such as MassGenie; these promote the social element of shopping by requiring consumers to form purchasing groups with their contacts in order to access low-priced products. We expect that the role of social commerce platforms is being amplified by the coronavirus crisis, as retailers face store shutdowns and depressed consumer demand. Retailers and brands have turned to social media to engage shoppers, communicate empathy, provide customer services and drive sales. Social Media Platforms with Purchasing Functionality Social media platforms usually have large numbers of users that can spend quite some time on these sites. There are around 249.7 million social media users in the US in 2020—equivalent to 75.5% of the whole population—according to Statista. On average, these users are each expected to spend an average of 80 minutes per day on social media through 2020, according to a revised estimate by market research firm eMarketer. This represents an increase of six minutes over the pre-coronavirus estimate, partly due to users spending more time at home in lockdown during the Covid-19 pandemic. Brands and retailers often use social media as a marketing channel to showcase their products. Around 49% of the 200 retail executives surveyed by content marketing platform Stackla in 2019 said that increased visibility for their products is a benefit they have realized via social commerce. The survey also found that around 63% of retailers work with key opinion leaders (KOLs), who publish posts on product experiences with details on product features. This is an important subset of social commerce, drawing interest from audiences and encouraging them to purchase the promoted items based on KOL recommendations.Figure 2. Social Media Platforms in the US That Have E-Commerce Functions [wpdatatable id=198 table_view=regular] *Business to consumer/consumer to consumer **Monthly active users Source: Company reports/Coresight Research Facebook Founded in 2004, Facebook is one of the most popular social media platforms, with roughly 2.5 billion MAUs as of December 2019. Facebook is also the most widely used social media platform for shopping. According to Coresight Research’s social media survey conducted in November 2019, Facebook is used for discovering products or making purchases by 72% of US consumers that use social media as part of the shopping process. In 2016, Facebook launched its Facebook Marketplace function, which works like classified-ads site Craigslist for Facebook users. Merchants can list products on the marketplace, through which users can contact them to negotiate prices and arrange payment and delivery. [caption id="attachment_110294" align="aligncenter" width="700"]

Facebook Marketplace

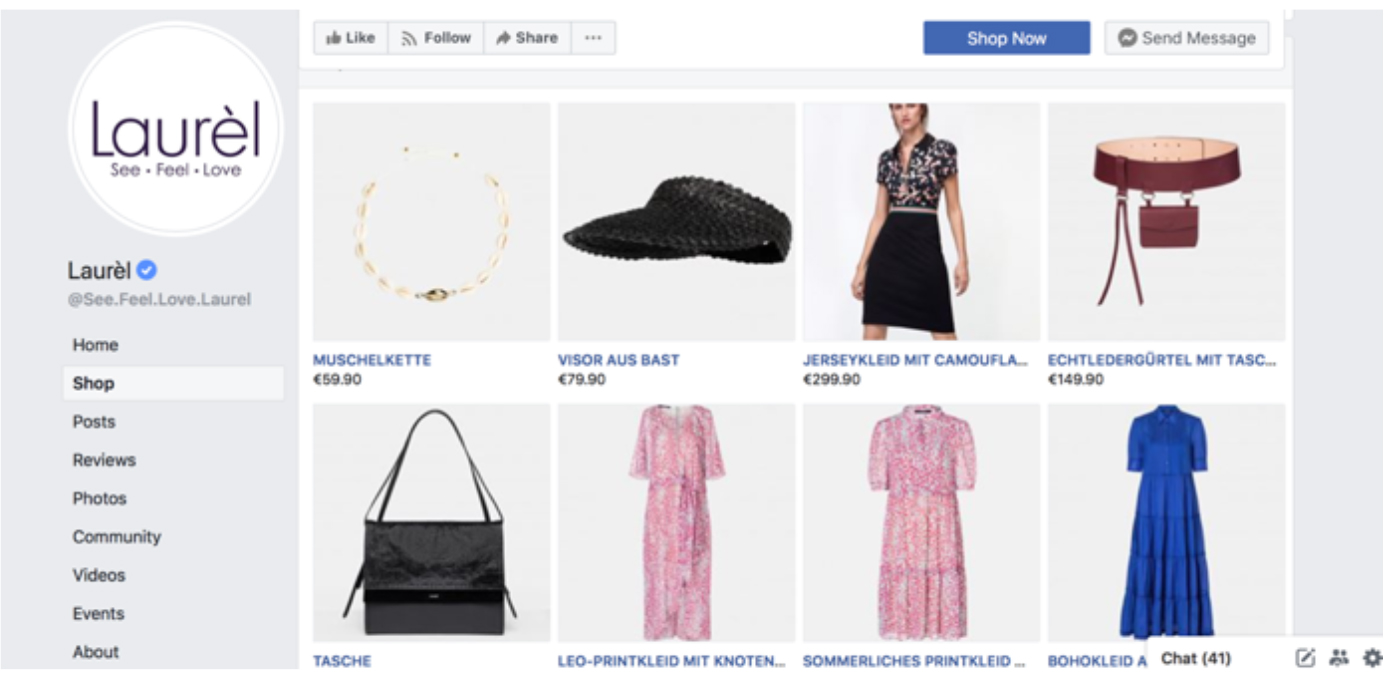

Facebook Marketplace Source: Facebook [/caption] Facebook debuted its Facebook Shop function in the same year as Facebook Marketplace. Facebook Shop works like an online store, where merchants list their products for consumers to buy without leaving the app. Users outside the US are directed to external websites—such as a merchant’s own e-commerce site—to complete transactions. [caption id="attachment_110295" align="aligncenter" width="700"]

Facebook Shop

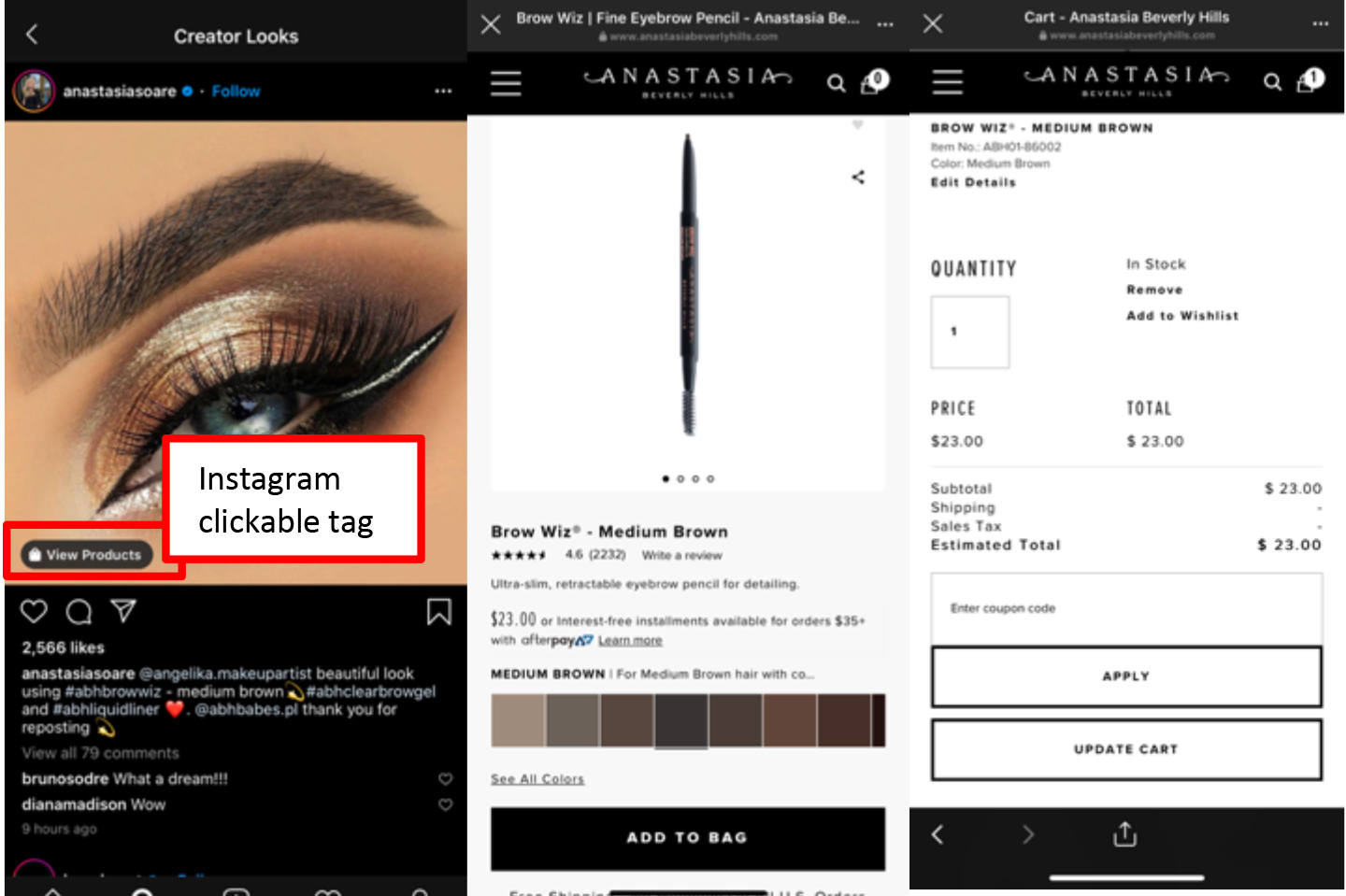

Facebook Shop Source: Facebook [/caption] Instagram Instagram is another popular platform for brands and retailers to market and sell their products. In 2018, Instagram added clickable tags that enable merchants to tag products directly in their posts, redirecting users to the retailer’s own site to make purchases. [caption id="attachment_110296" align="aligncenter" width="700"]

Source: Instagram[/caption]

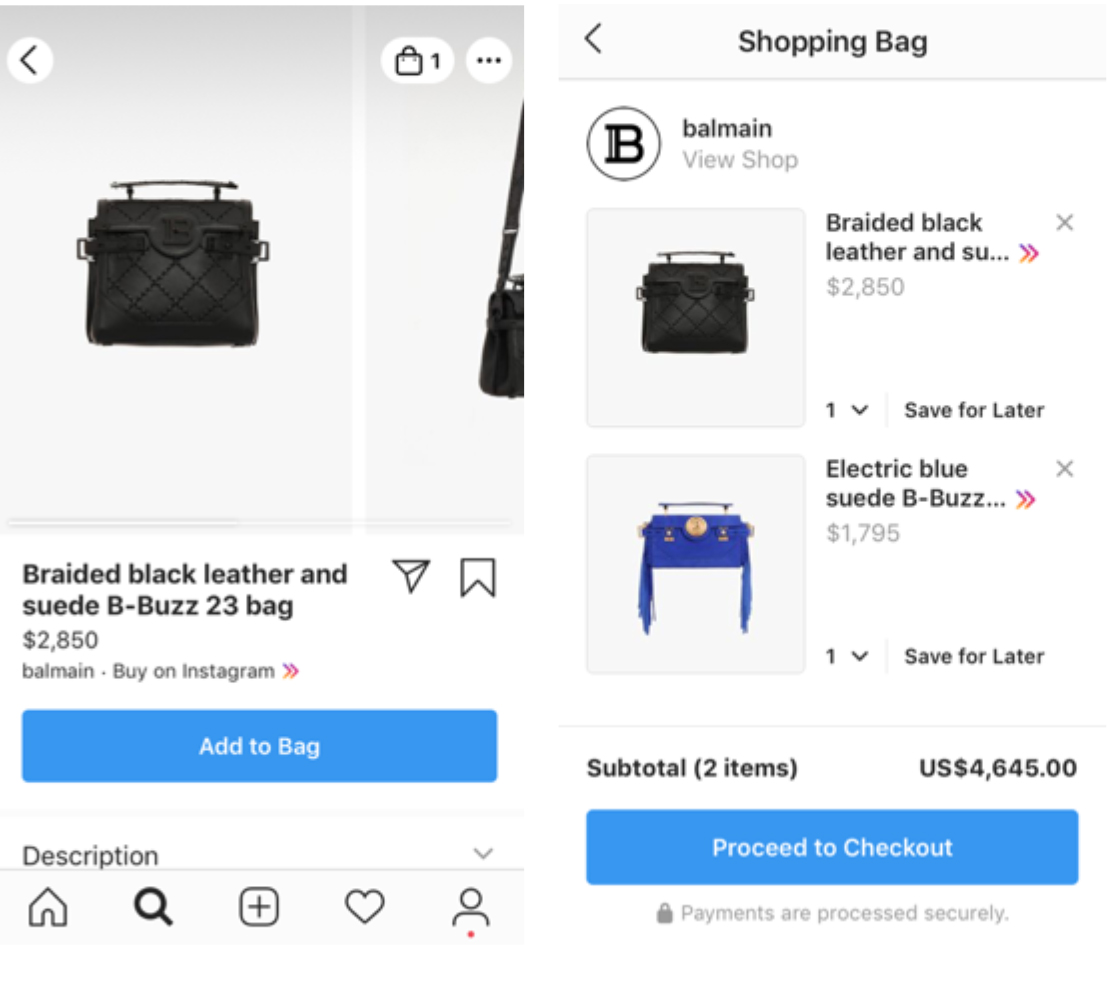

In March 2019, Instagram launched a checkout function on its platform. Users now can purchase products without leaving the platform.

[caption id="attachment_110297" align="aligncenter" width="700"]

Source: Instagram[/caption]

In March 2019, Instagram launched a checkout function on its platform. Users now can purchase products without leaving the platform.

[caption id="attachment_110297" align="aligncenter" width="700"] Instagram checkout

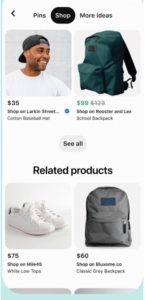

Instagram checkout Source: Instagram [/caption] Certain product categories perform especially well on Instagram, primarily clothing, footwear and accessories. According to our survey, these categories are the most popular among US shoppers on Instagram, with 64.7% of Instagram shoppers purchasing them. Pinterest Founded in 2010, Pinterest is a platform on which users exchange creative ideas, such as cooking recipes and interior design, in the format of photos. Pinterest launched its Buyable Pins feature in 2018, which enables users to buy products without leaving the platform. In April 2020, Pinterest added a “Shop” tab—an improved visual search that displays products in stock from merchants, and the results can be filtered by price and brand. [caption id="attachment_110298" align="aligncenter" width="145"]

Pinterest’s Shop tab

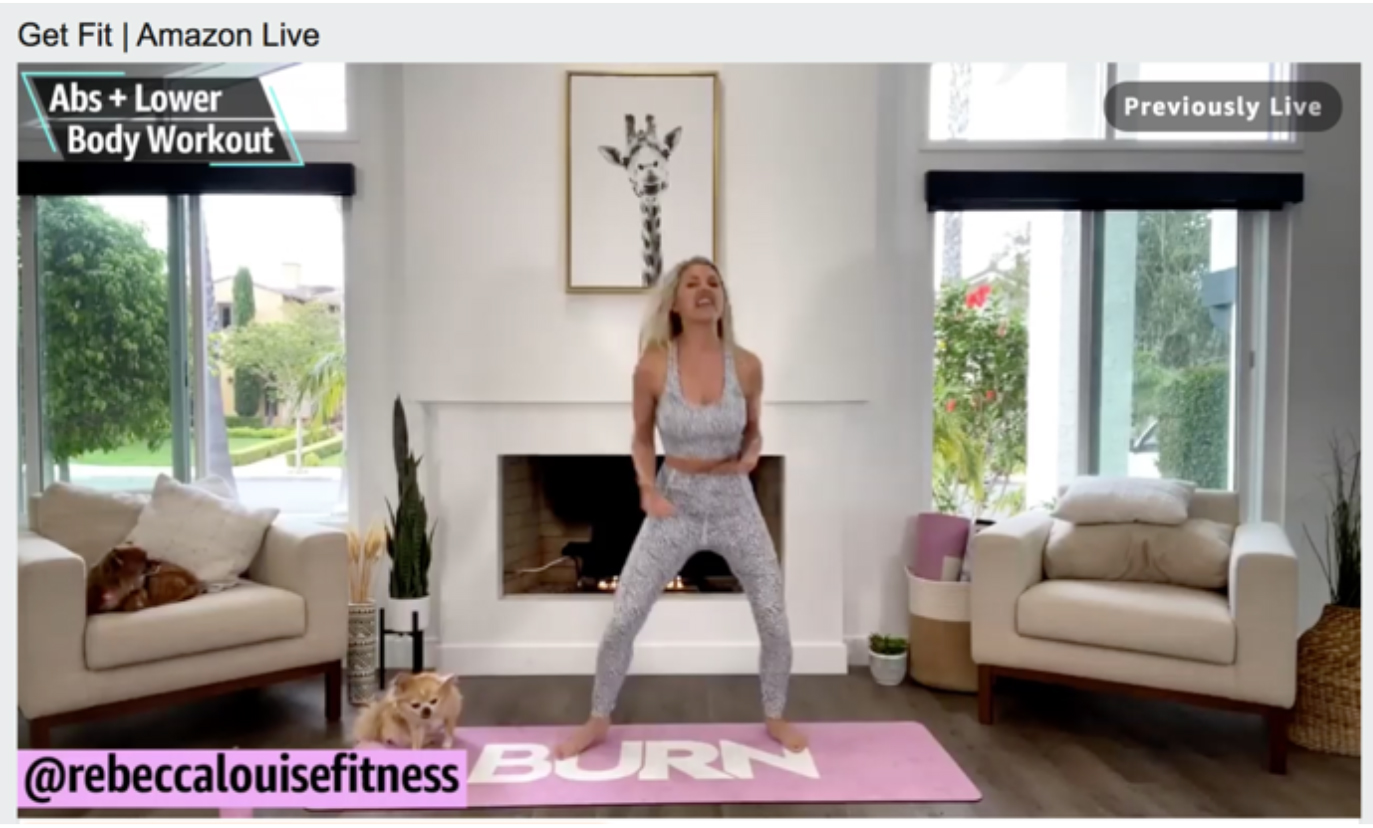

Pinterest’s Shop tab Source: Company website [/caption] Amazon Adds Social Media Functionality With users spending so much time on social media, many e-commerce platforms are adding social functions to their sites, such as livestreaming and group buying. Amazon launched its livestreaming function, Amazon Live, in February 2019, to connect with users. The company was late to the livestreaming trend compared to platforms in China—for example, Alibaba’s Taobao launched such a function in 2016. The functionality on Amazon is also less interactive than livestreaming in China, where viewers can post live comments and ask questions to the host during a session. [caption id="attachment_110299" align="aligncenter" width="700"]

Amazon Live

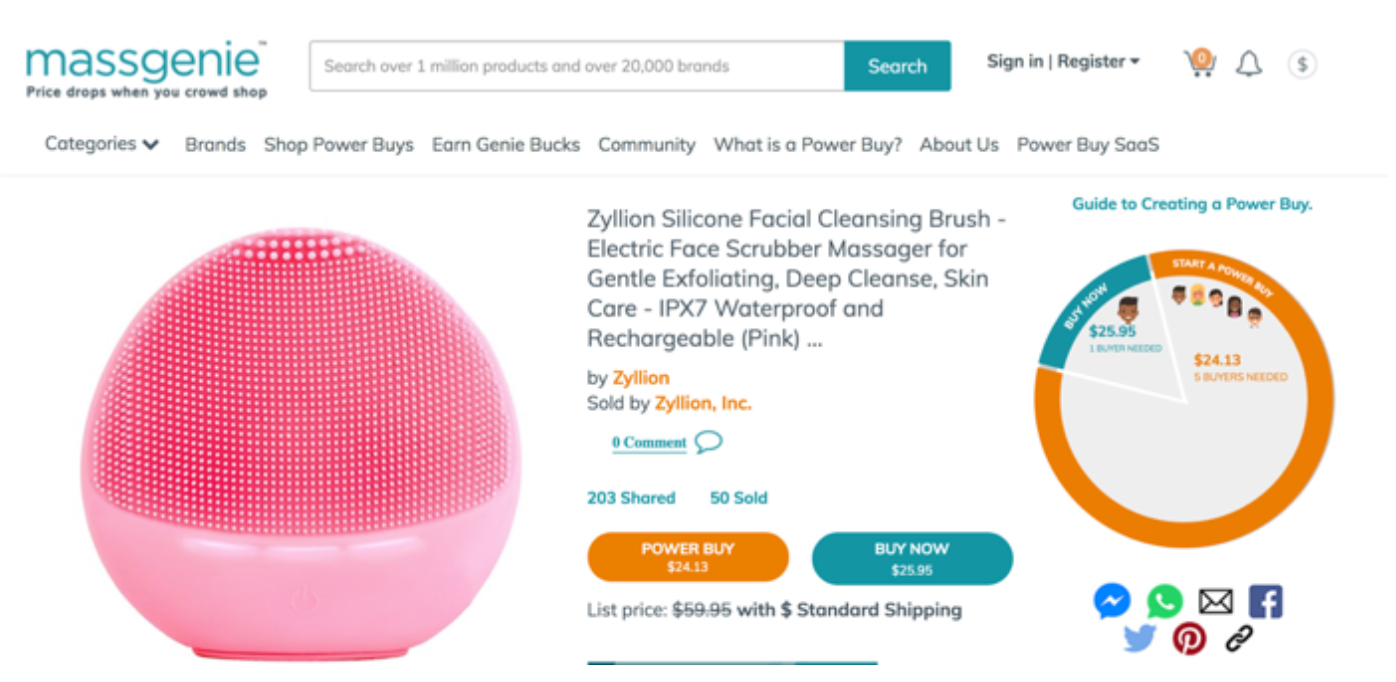

Amazon Live Source: Amazon [/caption] MassGenie, a Group-Buying Platform Launched in 2016, MassGenie sells multicategory products, including fashion, beauty, electronics and sporting goods. Although shoppers can purchase items individually, they can join together in small groups to access lower prices; users share deals with their contacts via online tools, such as over e-mail or through Facebook, Pinterest, Twitter and WhatsApp. [caption id="attachment_110300" align="aligncenter" width="700"]

A MassGenie product page

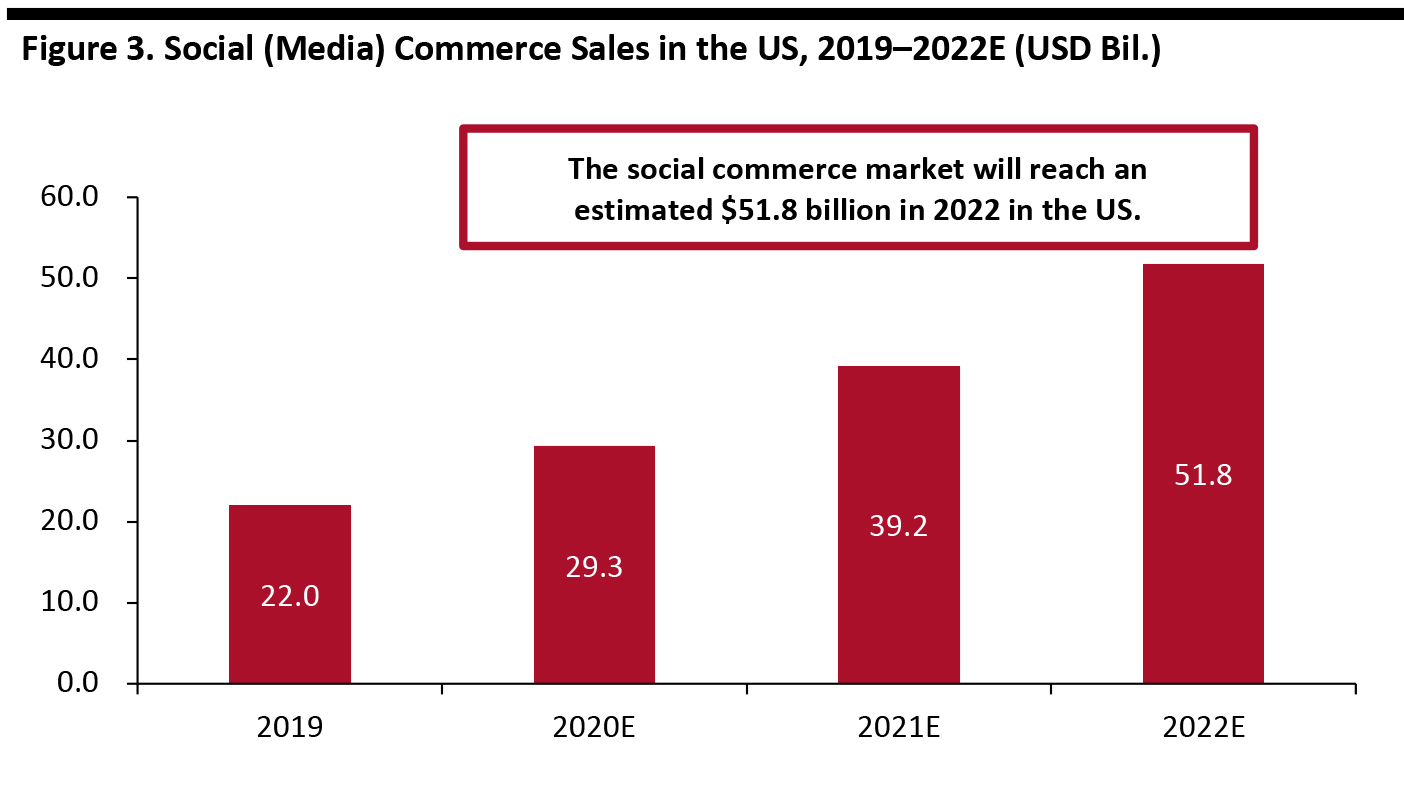

A MassGenie product page Source: MassGenie [/caption] The Growing Social Commerce Market in the US Although new forms of social commerce are emerging in the US, purchasing through social media is still the main form of social commerce. The market is projected to increase from $22.0 billion to $51.8 billion from 2019 to 2022, according to research company Technavio. [caption id="attachment_110301" align="aligncenter" width="700"]

Source: Technavio [/caption]

Source: Technavio [/caption]

Diverse Social Commerce Landscape in China

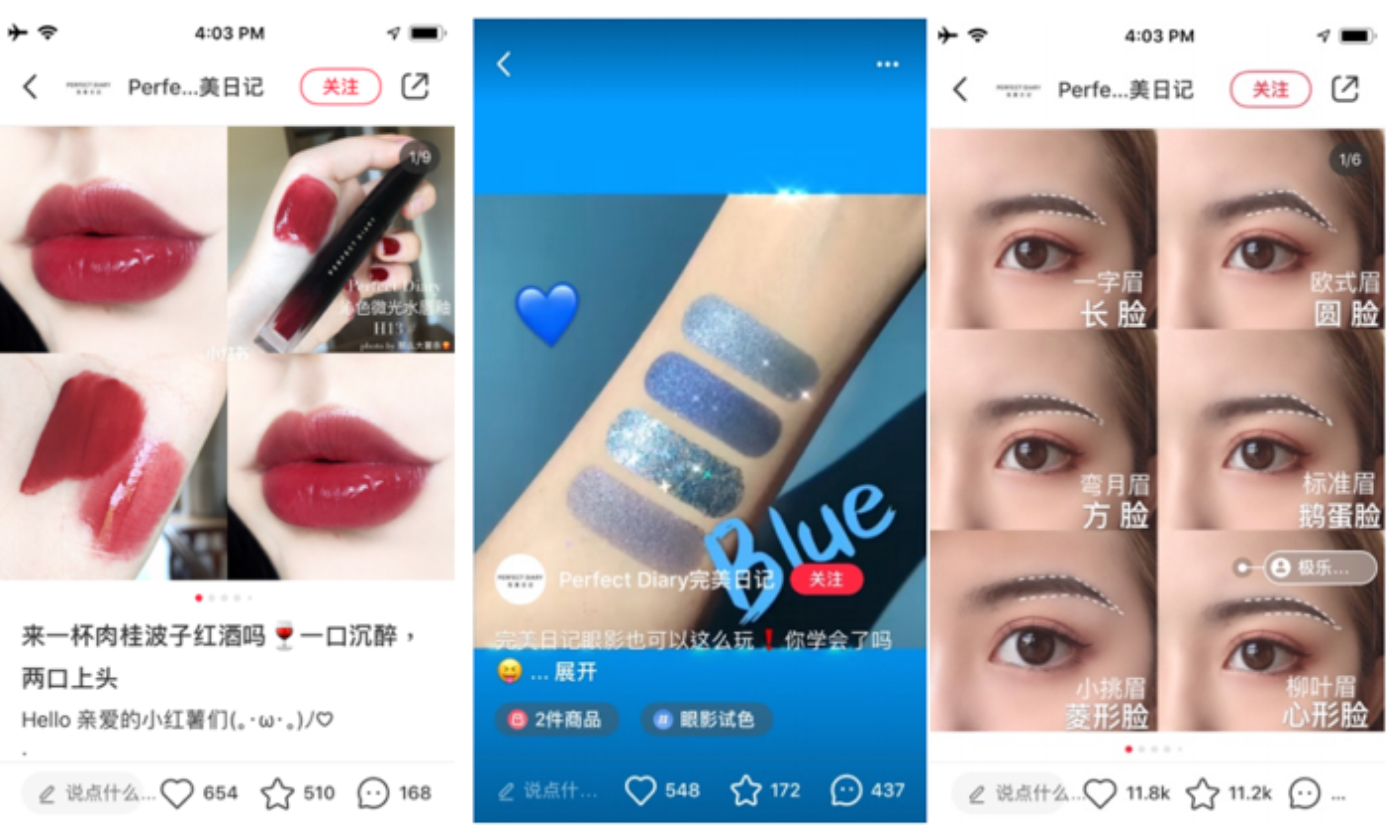

Social commerce is a broader segment in China than in the US, encompassing other forms of social buying beyond social media—such as online participation (e.g., consumers sharing products with contacts) to facilitate the process of selling. Both group-buying and S2B2C platforms leverage the social interaction element. Below, we outline social media platforms that allow consumers to make purchases, sites that require users sharing products with their contacts, and e-commerce platforms that are embracing social media functionalities in China. As e-commerce and social commerce mature in Western markets such as the US, we could see companies adopt more elements of China’s broadly defined social commerce landscape. Social Media Platforms with Purchasing Functionality Chinese social media sites, including short-video platforms, have been very active in adding e-commerce functions to their sites.Figure 4. Content-Based Social Media Platforms in China [wpdatatable id=199 table_view=regular] Source: Company reports/Coresight Research Little Red Book Little Red Book was launched in 2013 as a social sharing site for Chinese tourists to share their experiences of discovering and buying luxury products from overseas and exchange fashion ideas. The platform integrated e-commerce functionality in December 2014, and it has now become one of the most popular social commerce sites for users to find and buy products from overseas markets. The layout and design of Little Red Book posts make the platform particularly suitable for cosmetics brands to showcase their products—colourful pictures with short and concise text. For instance, KOLs and users can post pictures of product trials and comparisons of different makeup color shades. [caption id="attachment_110303" align="aligncenter" width="701"]

Posts of product trials and comparisons of different makeup color shades on Little Red Book

Posts of product trials and comparisons of different makeup color shades on Little Red Book Source: Little Red Book [/caption] In addition, Little Red Book is very popular among fashion and beauty bands due to its user base, the majority of whom are young women. Little Red Book had 72.9 million MAUs as of September 2019, according to data firm QuestMobile. Around 86% of users are female, and 52% are 25–35 years old, according to research firm iResearch. Mogujie Founded in 2011 in Hangzhou, Mogujie is an online sharing community focused around fashion products. The platform was listed on the Nasdaq Stock Exchange in 2018. It covers major fashion categories, ranging from apparel and accessories to cosmetics. KOLs post product reviews and styling tips on the platform to encourage people to make purchases; they usually post their outfit stylings and tag the brands featured. Users can also purchase items through livestreaming, in which KOLs showcase the products and consumers can interact via online chat rooms. The platform started broadcasting e-commerce livestreaming in 2016, and the GMV of Mogujie’s livestreaming business grew 99.5% year over year to ¥3.4 billion (around $478.9 million) for the third quarter of fiscal year 2020. Short-Video Platforms Douyin and Kwai Popular short-video platforms Kwai and Douyin were launched in 2011 and 2016 respectively, and both added e-commerce functions to their sites in 2018. The two platforms then upgraded this functionality in 2019:

- In November 2019, Douyin extended its restrictions to allow all users to sell products through the platform. Previously, the social app had stipulated a minimum requirement of 3,000 followers for a user to access the e-commerce function. Douyin sees 320 million daily active users, and this move could help the platform to gain traction as a video-based e-commerce site.

- In June 2019, Kwai integrated with JD.com and Pinduoduo to boost its e-commerce capabilities, after a similar integration with Tmall and Taobao previously. The added functionality allows users to sell goods to other users and lets them demonstrate products listed on these sites via a channel called Kuaishou Small Store.

Figure 5. An Overview of S2B2C Platforms [wpdatatable id=200 table_view=regular] Source: Company reports/Coresight Research Beidian Founded in August 2017, Beidian is a membership-based social commerce platform. Each member needs to first place an order worth of ¥398 (around $56.10) to become a store owner on the platform. The store owner can find suppliers via the platform as well as receiving support, such as in marketing, delivery and post-sales services. Store owners are also incentivised to invite their contacts to join Beidian and open stores, as they earn commission based on the performance of their own stores plus the stores of those they introduced to the platform. Beidian sells a wide range of products, including home supplies, apparel, food, beauty and baby products. The main user group is aged 15–44, and 60% of the platform’s users are from Tier-3 and Tier-4 cities and below, according to the company. Latest company data show that MAUs rose 549.6% year over year to 13.3 million in March 2019. [caption id="attachment_110305" align="aligncenter" width="169"]

Beidian homepage

Beidian homepage Source: Beidian [/caption] Yunji Yunji is a S2B2C social commerce platform that was founded in 2015. There are two types of membership: Diamond and VIP. Diamond members need to pay an annual fee of ¥398 (around $56.10) and have access to benefits such as member-exclusive discounts and training events. VIP members join the platform via Diamond members' invitation; they do not need to pay any fees but do not receive any benefits. Yunji members can receive monetary rewards if they share products and related content with their contacts—such as through WeChat groups, official accounts and moments. Yunji got listed on the Nasdaq Stock Exchange in 2019, raising $121 million in its initial public offering. According to the company’s financial report, the number of Yunji transacting members (those who generate at least one order by promoting products) increased from 4.2 million to 9.4 million in the 12 months ended September 30, 2019—an increase of 122.7% year over year. E-Commerce Platforms Add Social Media Functionality Chinese e-commerce platforms—including Taobao and JD.com—are responding to social media trends by adding social functions on their sites. Taobao Taobao added Weitao in 2013, to facilitate interaction and communication among consumers. It then added Taobao Livestreaming in 2016, which allows KOLs to broadcast live, interactive video sessions of themselves trying on new products. Consumers can interact with the hosts and ask questions in real time. Livestreaming accounted for 7.5% of the company’s $38.4 billion total sales on Singles’ Day 2019. The platform has also started to implement 5G technology to improve the user experience. Weitao allows merchants and KOLs post product-related content in various forms, such as short videos or general posts with photos. Consumers can like and post comments to interact with merchants/KOLs on the platform. [caption id="attachment_110306" align="aligncenter" width="173"]

KOLs share products on Weitao feeds

KOLs share products on Weitao feeds Source: Weitao [/caption] JD.com JD.com started its group-buying mini program on WeChat in June 2018, before launching its group-buying app Jingxi in April 2019. Users on the platform can enjoy high discounts on products in the form of group buying. Consumers are encouraged to share product-related content on WeChat and invite their contacts to form a group to purchase products at lower prices. During Jingxi's Singles’ Day 2019 promotion period (October 18 to November 10), the overall order volume on the platform increased by 274% month over month. [caption id="attachment_110307" align="aligncenter" width="175"]

Jingxi homepage

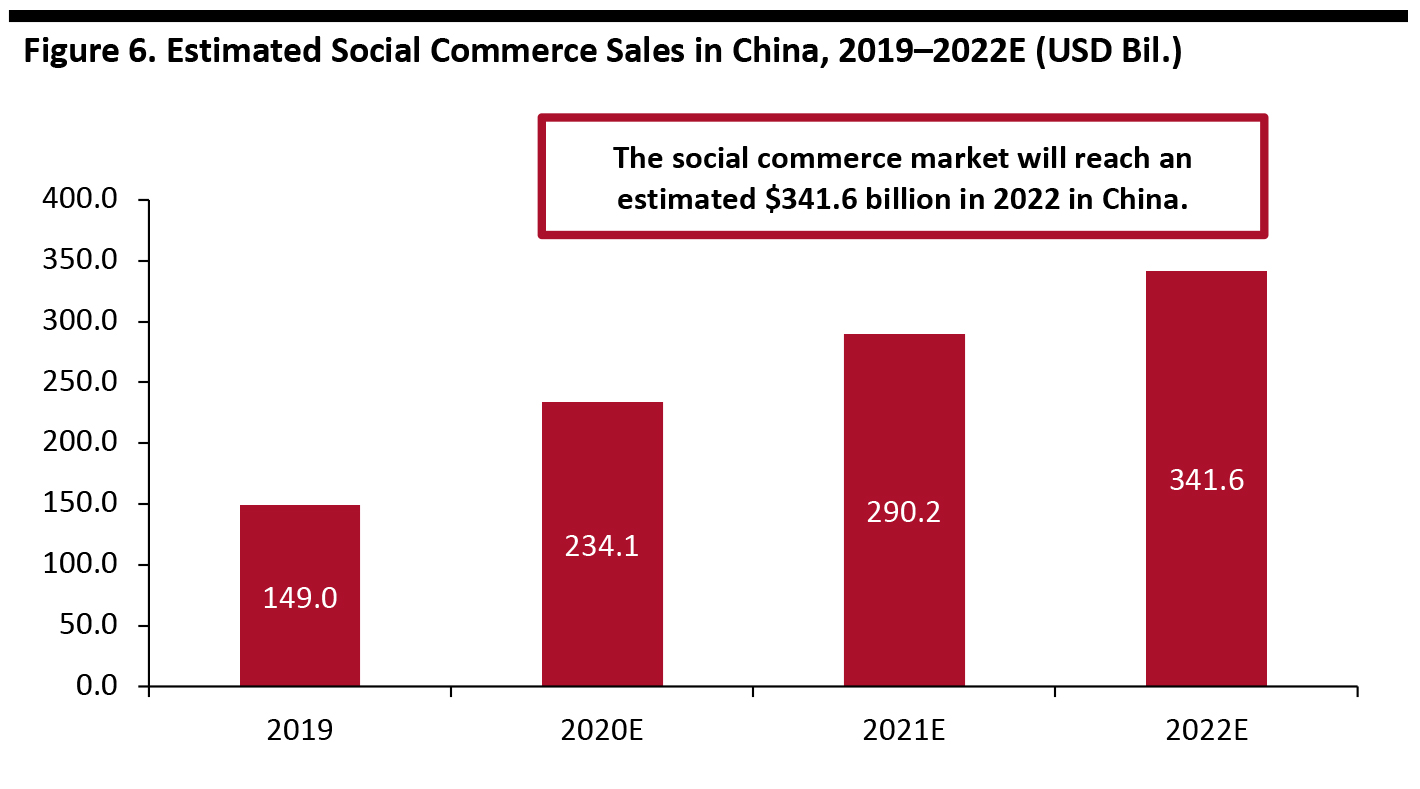

Jingxi homepage Source: Jingxi [/caption] The Thriving Social Commerce Market in China With social commerce representing a broad range of platforms in China, the market is estimated to grow from $149.0 billion in 2019 to $341.6 billion in 2022, representing 129% growth, according to financial firm Tianfeng. This partly reflects the huge number of Internet users in China, amounting to 904 million as of March 2020—close to 64.6% of the nation’s population. [caption id="attachment_110308" align="aligncenter" width="700"]

Source: Tianfeng[/caption]

Source: Tianfeng[/caption]