Introduction

What’s the Story?

Customer expectations and habits are ever-evolving, and retailers need to remain up to date with changes to stay agile and competitive. Increased consumer technology usage and the pandemic have accelerated the pace of technology adoption in offline shopping, with many consumers now demanding integrated tech for a seamless offline experience.

Smart shopping solutions leverage software and hardware designed for retail and e-commerce—including contactless commerce, the Internet of Things (IoT), robotics, augmented and virtual reality (AR/VR), and artificial intelligence (AI), among others. In this report, which focuses on India’s brick-and-mortar retail market, we explore how such solutions can help retailers streamline operations and keep up with consumer expectations. We also present notable examples of India-based retailers that have already implemented technology-based shopping solutions.

Coresight Research has identified physical retail renewal as a

key trend to watch in retail and a component trend of Coresight Research’s

RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details).

Why It Matters

Smart shopping solutions allow retailers to enhance overall customer experience, build loyalty and streamline operations. Even quick or fruitful shopping trips can devolve into frustration if shoppers need to wait in long checkout queues—leading to cart abandonment—while repeated long waits affect customer loyalty.

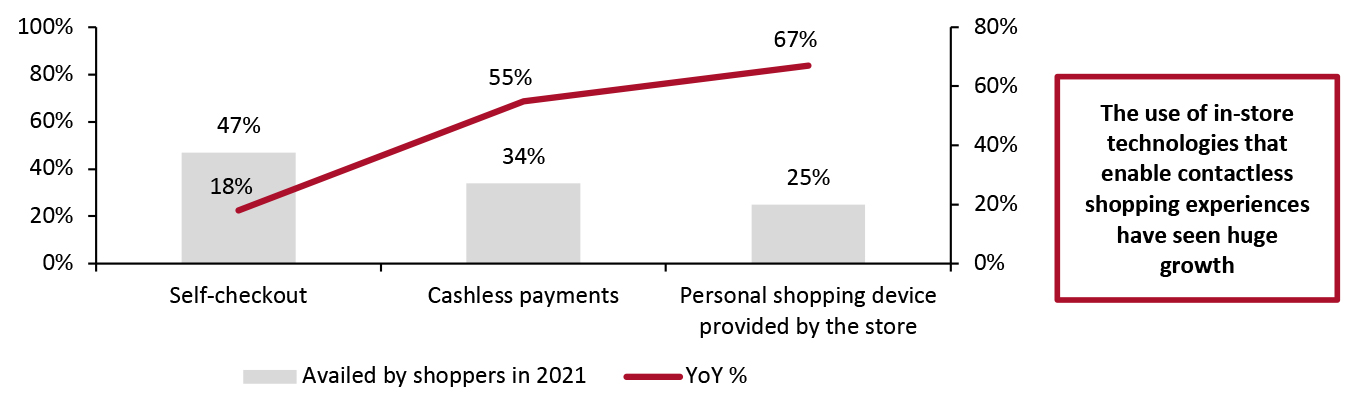

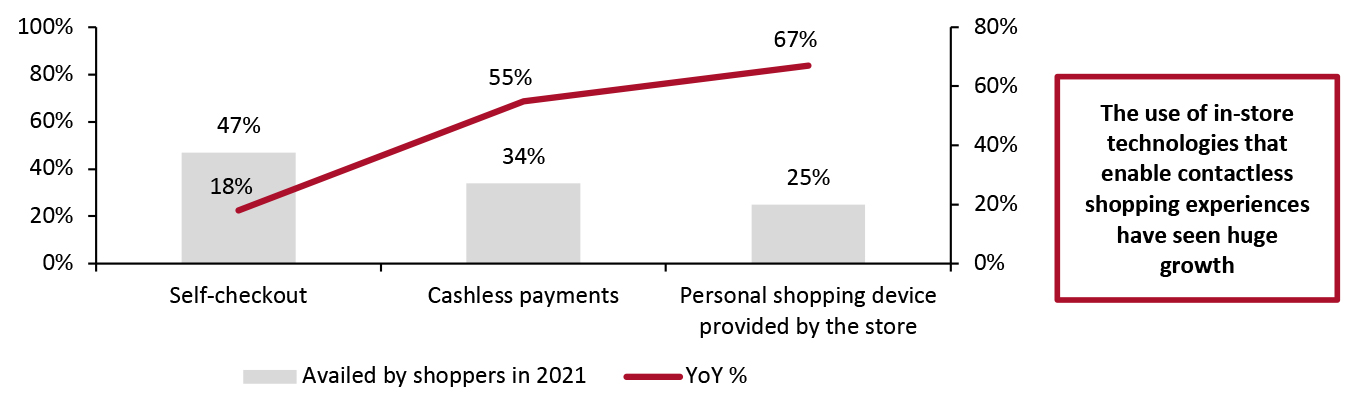

Globally, 73% of shoppers expect retailers to use the latest technology, according to consulting firm Zebra Technologies’ 14th Annual Global Shopper Survey, published in November 2021. The survey also revealed that in-store technologies enabling smart and contactless shopping—namely, self-checkout, cashless payments and in-store personal shopping devices—have seen huge year-over-year growth in usage among shoppers (see Figure 1).

Figure 1. Global Shoppers: Use of In-Store Technologies for Contactless Shopping (Left Axis: % of Respondents) and YoY Change (Right Axis; %), 2021

[caption id="attachment_147118" align="aligncenter" width="700"]

Base: 5,000 shoppers, store associates, and retail decision-makers aged 18+ across North America, Latin America, Europe and APAC, surveyed in July 2021

Base: 5,000 shoppers, store associates, and retail decision-makers aged 18+ across North America, Latin America, Europe and APAC, surveyed in July 2021

Source: Zebra Technologies [/caption]

Automation through smart shopping solutions provides retailers with a huge opportunity to recover sales prospects lost to digital natives and e-commerce players during the Covid-19 pandemic. As such, retailers need to augment their in-store customer experience with emerging technologies, offering consumers an end-to-end, seamless shopping journey.

Smart Shopping Solutions To Meet Consumer Expectations for Offline Retail in India: Coresight Research Analysis

Technology-Powered Smart Shopping Solutions

AI enables retailers to offer personalized experiences to their customers, including personalized product recommendations and deals, which increases upselling and cross-selling opportunities as well as driving conversion.

For example, apparel brands and retailers often use AI to provide more accurate sizing information for their customers based on data they input. Such data can also be used to compare sizes across brands more accurately and recommend other in-stock items in the consumer’s size, helping shoppers to make informed buying decisions that reduce the likelihood of returns and so save costs for retailers.

Meanwhile, as consumers often search for products online before purchasing them in physical stores, retailers that leverage AI can track prices in real time across all their channels and use that data to dynamically adjust the pricing of products to meet revenue targets.

AI can also predict demand with greater accuracy, which helps retailers optimize supply chains, manage seasonal demand and avoid out-of-stocks.

AR blends physical and digital shopping experiences, enabling retailers to showcase products in a new, engaging way.

- Fashion and beauty retailers are increasingly using AR to augment in-store fitting experiences, allowing customers to virtually try on clothes and makeup before making a purchase. This helps reduce fitting-room lines, increasing customer convenience.

- Retailers can use AR to offer virtual store tours, assisting consumers in finding what they want quickly and easily.

- Physical retailers can leverage AR technologies to offer personalized recommendations based on customer preferences and past purchases, enhancing the shopping experience and increasing sales and conversion rates.

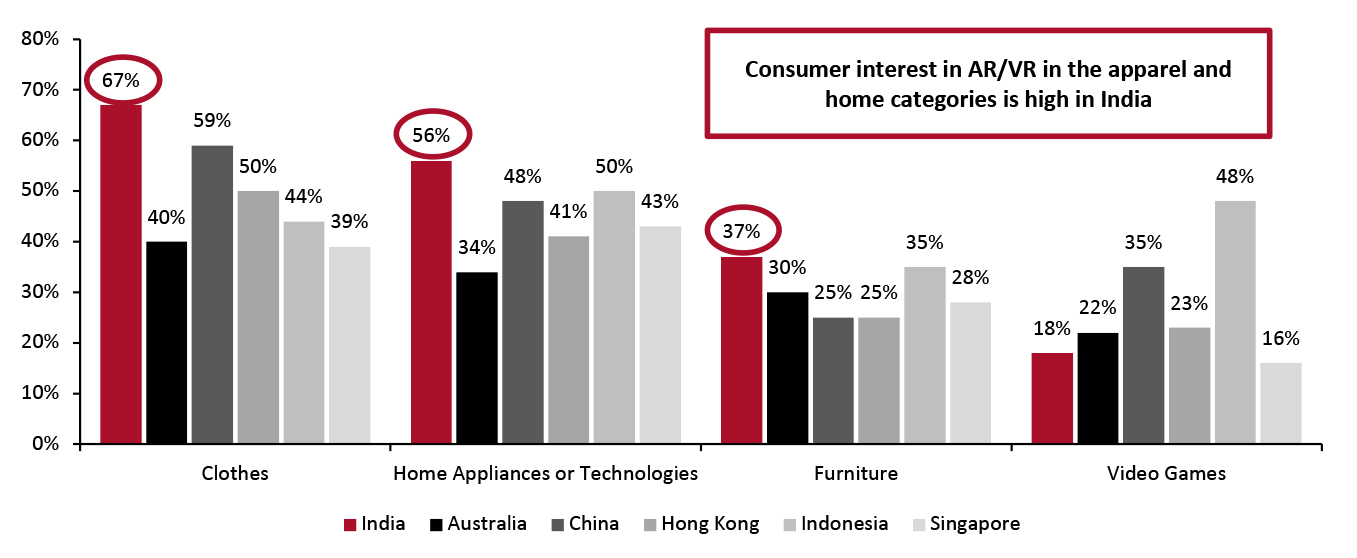

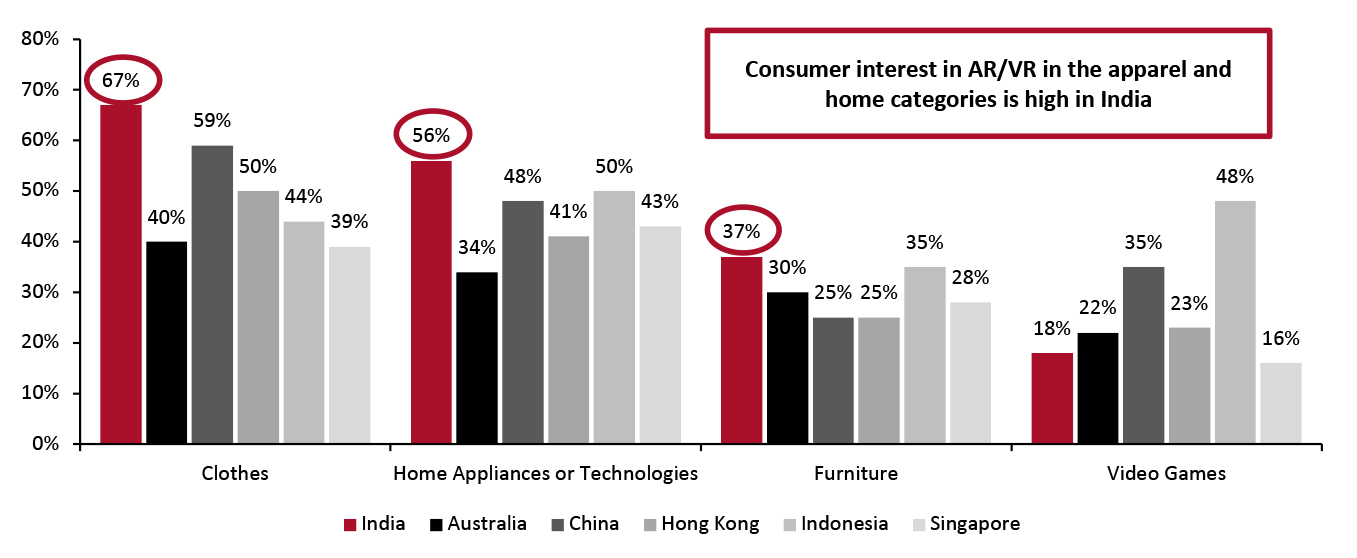

Indian consumers are ready and willing to embrace AR in their shopping journey, particularly in retail categories such as apparel and furniture, with consumer interest in AR/VR exceeding rates in other countries in the Asia-Pacific region, according to a global survey conducted by UK-based market research firm YouGov (see Figure 2).

Physical retail stores must look to adopt digitalization and immersive technologies to remain competitive with their online counterparts.

Figure 2. Asia-Pacific Region: Consumer Interest in AR/VR Across Categories, by Country (% of Respondents)

[caption id="attachment_147119" align="aligncenter" width="700"]

Categories as published in the survey

Categories as published in the survey

Base: 1,000+ consumers per country (except Hong Kong, with 504 consumers), surveyed January–February 2021

Source: YouGov [/caption]

Indian retailers plan to invest in emerging technologies such as IoT to drive customer engagement and improve efficiency, according to an August 2021 report from India-based telecommunication service provider Airtel’s B2B arm, Airtel Business. In fact, over 50% of large Indian retailers have started piloting IoT or plan to test IoT in 2022 or 2023, according to research and advisory firm Greyhound Research’s Retail Priorities 2021 survey.

IoT enables retailers to connect various electronic devices—including appliances, mobile phones, signage, cameras, laptops and more—to track in-store consumer behavior. The result is a wealth of real-time data about in-store merchandise, such as when products sell, average time spent in-store by shoppers, customer engagement levels with products, and conversion and abandonment rates. Combined with traditional retail analytics, IoT-derived data offers deep insights into customers’ habits and shopping journeys.

In addition, retailers can use IoT technology to manage inventories and optimize supply chains. IoT solutions provide inventory visibility across what is on shelves, in transportation and at warehouses, helping retailers become more efficient and reduce costs. IoT-powered devices such as smart shelves also provide information about the exact location of an item in a physical store and track its movement from shelf to sale. Such data provides retailers with current stock levels, informs accurate predictions about the items that are likely to see higher conversion and when, and enables timely replenishment. IoT solutions can even allow retailers to keep track of store assets such as shopping carts and store hardware.

Finally, IoT sensors that monitor in-store customer traffic enable retailers to optimize store layouts and make future customer visits more fruitful, increasing customer retention.

- MPoS systems and contactless checkout/payment

Mobile point-of-sale (mPoS) systems enable store associates to assist and checkout customers from anywhere in the store, helping to avoid long checkout lines. Shoppers are more likely to make a return visit to a store if their experience was convenient, so retailers that increase the speed of checkout will increase customer loyalty. Contactless checkout and payments likewise enable retailers to offer a smooth customer journey and avoid frustration, leading to repeat visits.

In April 2020, Amazon India launched its contactless payment service, Amazon Pay, in over 10,000 shops, from small neighborhood stores to retail giants. Amazon said that the service enables customers to maintain social distancing while shopping and spend less time in the store in the pandemic-impacted environment. Amazon Pay has become one of the preferred modes of payment among consumers: as of November 2021, Amazon Pay has 50 million users in India, leveraging India’s Unified Payments Interface (UPI) in its platform.

How Smart Shopping Solutions Can Address Consumer Expectations

- A personalized shopping experience

Customers want brands and retailers to understand who they are and what they want. To stand out from the competition and online counterparts, physical retailers should identify the actual needs of consumers and leverage real-time data to personalize customer engagement, product offerings and in-store experiences. They should also anticipate customer wants and proactively solve their problems to foster relationships and build loyalty.

Smart shopping solutions help create a personalized shopping experience by offering consumers product recommendations based on their past purchases. Retailers can also engage in-store shoppers in real time by sending push notifications about new products, in-store offers and promotions to their smart devices.

- Face-to-face customer service

While in stores, customers want assistance from knowledgeable store associates; this is one of the main differences between shopping in-store and online. Brands and retailers need to provide ample training to store associates to ensure they know products inside and out.

Smart retail solutions such as IoT sensors can help retailers gain insights into high-performing traffic areas and customer behavior inside stores. They can then use this information to manage and train store associates, organize traffic inside the store and improve store operations. By implementing store automation, retailers can free up staff to focus on important face-to-face tasks, including answering questions and building relationships with customers.

- Safe and convenient shopping

While the world continues to open up, many consumers still fear new the emergence of new Covid-19 variants and want retailers to make them feel safe and secure while shopping. Retailers can communicate their health and safety measures in-store through technologies such as digital signage and QR code decals, in order to build trust and increase customer retention.

Consumers also expect a seamless and convenient shopping experience in the brick-and-mortar channel—particularly now, as they have become accustomed to the ease of online shopping.

Contactless payment technology is a smart shopping solution that minimizes the need for physical interactions in stores, making customers feel more confident and increasing convenience while shopping.

E-commerce giant Amazon launched “Smart Stores” in India in June 2020, software that allows in-store customers to explore available products and make contactless payments by scanning a QR code. The initiative helped small neighborhood stores and retail giants offer a contactless shopping experience to their customers, increase store footfall and improve the shopping journey—all of which lead to more sales—according to Amazon.

[caption id="attachment_147120" align="aligncenter" width="699"]

Amazon’s QR-code-based display offering a smart digital storefront

Amazon’s QR-code-based display offering a smart digital storefront

Source: Amazon [/caption]

- Omnichannel shopping experiences

Shoppers usually browse product categories such as consumer electronics, apparel, furniture and home décor online before purchasing from a physical store. Retailers need to facilitate customer shopping journeys as they switch channels from online to offline to make a purchase. They should also focus on offering in-store fulfillment of online orders, such as BOPIS (buy online, pick up in-store) and curbside pickup.

Smart retail solutions can help retailers further their omnichannel shopping experience by tracking customers’ interests and then sending personalized offers and discounts when they approach certain in-store aisles.

Benefits of Smart Shopping Solutions for Retailers

Below, we look at some of the key benefits associated with deploying smart retail solutions and technologies.

- Efficient supply chains and waste reduction

Efficient supply chains, something lacking in pre-pandemic India, require investments in technology, logistics and skilled workers. The pandemic-led shift to online shopping and increased demand for short delivery times prompted many Indian retailers to scale up their supply chain investments.

To cater to the growing demands of omnichannel consumers and to avoid delays and disruptions, retailers need real-time and predictive data on their entire supply chain—including demand forecasting, inventory management and goods movement. Using technologies that optimize logistics and leverage AI, predictive analytics and computer vision provides supply chain visibility.

Warehouse automation technologies such as order-picking robots can improve the efficiency of order fulfillment and support product quality checks.

Smart shopping solutions also help retailers track demand for specific items, and they can use this information to optimize stock levels and better manage their inventory—reducing waste and increasing revenue per square foot.

- Optimized store layout and processes

Physical retailers do not have the same store visibility and metrics that online retailers do, making it difficult to understand their customers’ wants and in-store journeys. IoT-enabled devices allow physical retailers to gain in-depth visibility of their customers’ journeys. These devices provide insights into customers’ in-store merchandise engagement levels and which store areas tend to see higher sales. Retailers can then use this data to optimize the store layout.

IoT-enabled devices also help track store inventory in real time and optimize merchandising decisions, thus providing retailers with real-time in-store data with the same level of detail and accuracy that e-commerce players achieve.

- Improved customer retention levels

Consumer concerns related to safety will likely linger post pandemic, especially when new variants arise. Retailers’ use of innovative shopping solutions will instill confidence in consumers during their in-store shopping journey, improving customer retention levels.

Smart retail solutions help retailers to manage inventory and understand stock levels in real time, allowing retailers to streamline alternative fulfillment options—such as BOPIS, curbside pickup and ship-from-store for online orders—creating omnichannel synergies to cater to growing omnichannel adoption.

In India, BOPIS and curbside pickup have gained popularity since the onset of the pandemic, as retailers adopted these services to meet demand for convenience and contact-light fulfillment. According to Shopify’s “Future of Commerce 2021” report, more than half of surveyed retailers provided alternative pickup and delivery options more often from March to August 2020 than before the pandemic. Furthermore, 69% of Indian consumers used BOPIS or curbside-pickup options more frequently than before the pandemic.

We expect demand for these services to remain high moving forward, as consumers have come to expect an easy and frictionless shopping journey.

Examples of Retailers Using Smart Shopping Solutions

Below, we look at how major Indian retailers are currently leveraging smart shopping solutions in their stores.

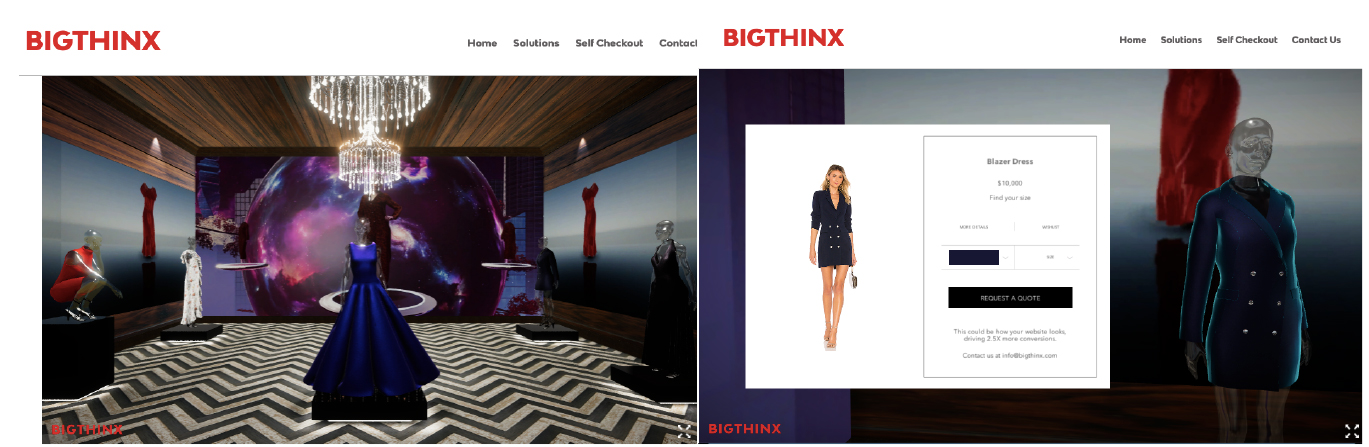

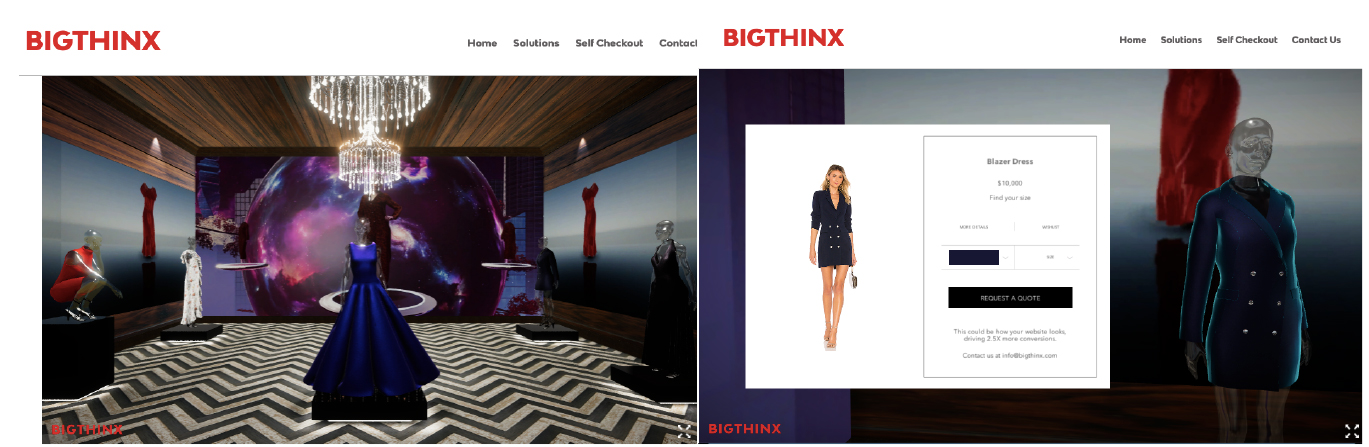

- BigThinx, an Indian fashion-tech company, created “Lyflike,” an AI visualization platform that enables fashion brands to digitize human avatars for online and in-store shopping. The tool renders 3D body scans and body measurements from 2D images to accurately predict sizes for mass customization and made-to-measure fashion.

[caption id="attachment_147121" align="aligncenter" width="701"]

BigThinx’s virtual showroom for physical brands and retailers (left); product description using virtual models (right)

BigThinx’s virtual showroom for physical brands and retailers (left); product description using virtual models (right)

Source: Company website [/caption]

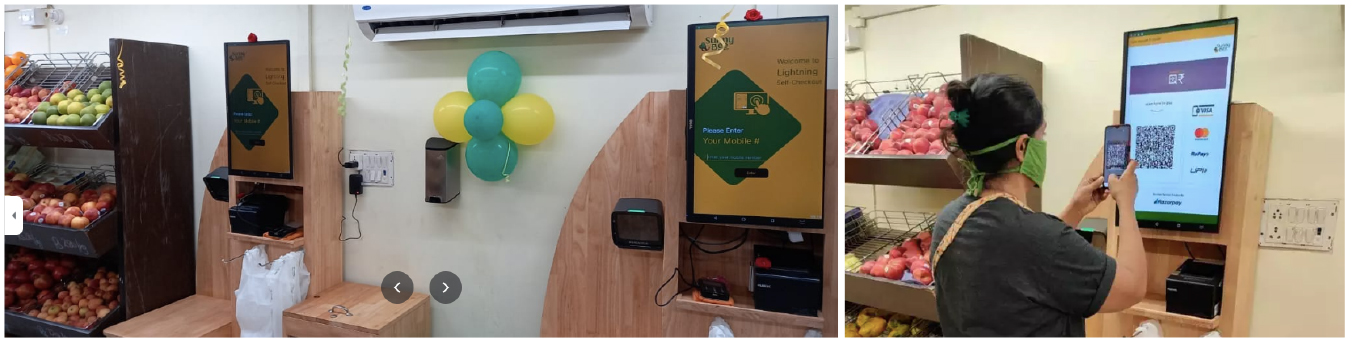

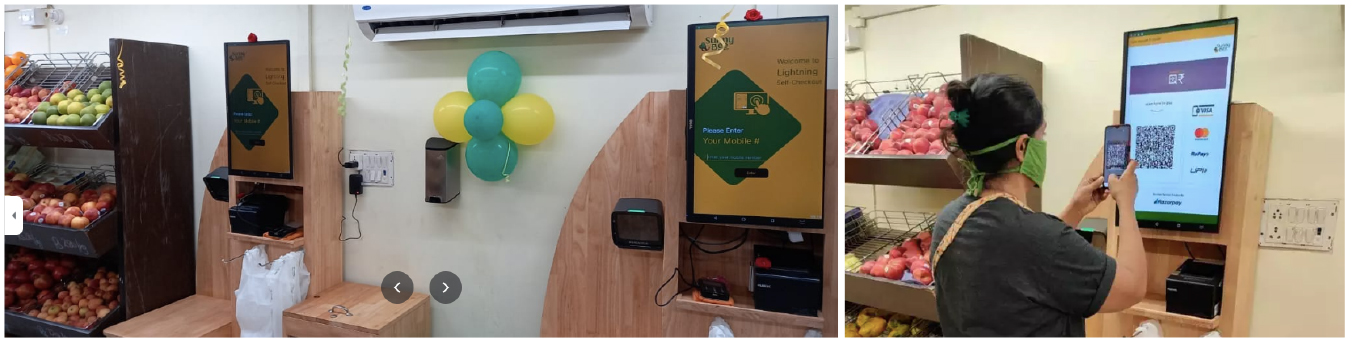

- In July 2020, SunnyBee Market, a Chennai-based premium food and grocery startup, introduced a self-checkout store in Besant Nagar, Chennai—the first of its kind in India. The self-checkout counter, powered by WayCool Labs, comes with a built-in high-speed scanner, touchscreen panel and receipt printer. After shoppers scan their purchases, the screen displays a QR code that allows shoppers to pay for their groceries via their mobile device using any UPI payment method. This solution frees up staff to focus their time on managing store operations and improving customer service.

[caption id="attachment_147122" align="aligncenter" width="700"]

SunnyBee’s self-checkout kiosk (left); a customer performing contactless checkout at SunnyBee’s store in Besant Nagar, Chennai (right)

SunnyBee’s self-checkout kiosk (left); a customer performing contactless checkout at SunnyBee’s store in Besant Nagar, Chennai (right)

Source: Company website [/caption]

- Indian jewelry brand Tanishq, part of the Tata Group, uses AR at airport kiosks in Bangalore and Delhi to enable travelers try on jewelry virtually. Customers can select the jewelry they wish to try on from a screen and then turn to an AR mirror that virtually shows them wearing the jewelry. The jewelry also moves with the person, giving a realistic effect.

[caption id="attachment_147123" align="aligncenter" width="700"]

A customer trying on jewelry using AR at Tanishq Delhi Airport kiosk

A customer trying on jewelry using AR at Tanishq Delhi Airport kiosk

Source: Facebook [/caption]

- Kochi-based startup Watasale operates unstaffed and fully autonomous stores that sell ready-to-eat snacks and beverages, packaged items and personal care products. The stores feature self-checkout functionality through the company’s mobile app. At Watasale locations, customers generate a QR code in the company’s app to enter the store, pick the items they want and leave, paying through the app (similar to Amazon’s “Just Walk Out” technology). The company claims that its store is an enhanced version of a vending machine and leverages AI, computer vision and sensors to power this technology.

[caption id="attachment_147124" align="aligncenter" width="700"]

Watasale’s self-checkout store in Kochi (left); a customer using QR-code to enter the store to buy products (right)

Watasale’s self-checkout store in Kochi (left); a customer using QR-code to enter the store to buy products (right)

Source: Company website/newspaper reports [/caption]

What We Think

We believe that technology-powered convenience will be a crucial driver for physical retailers. We anticipate that retailer investments in deep tech such as IoT, AR/VR and robotic solutions will surge in 2022, 2023 and beyond as retailers attempt to bring customers back to stores, address evolving consumer needs and gain an edge over the competition.

We expect brands and retailers to leverage AI and real-time customer data to offer hyper-personalization for more relevant product and service recommendations. We also anticipate that retailers in the apparel, beauty and furniture categories will soon equip their stores with AR-powered try-on solutions like those found on their online storefronts.

Finally, we believe that brands and retailers will leverage technologies to empower their online storefronts and physical stores alike to bring in omnichannel synergies to cater to “omnipresent” consumers.

Implications for Brands and Retailers

- Retailers can use IoT and computer vision to empower store associates with real-time information about in-store products, specifications, alternatives, pricing, offers and deals, enabling them to add value and upsell to customers, strengthening their relationships.

- Brands and retailers that plan to install contactless checkouts should also check the costs involved in deploying such technologies on a mass scale.

- Brands and retailers should streamline their back-end operations with technology-powered solutions to increase alternative fulfillment offerings.

- Personalized shopping experiences leveraging real-time data will be a key differentiator for brands and retailers in a post-pandemic world as consumers set higher benchmarks for the personalization they expect from stores.

Implications for Technology Vendors

- Brands that begin offering more personalization need AI and predictive analytics systems for data-driven insights, providing growth avenues for AI technology vendors.

- Brands and retailers investing in technologies to provide virtual try-on solutions for their products will provide opportunities for AR and VR application providers.

- Retailers investing in deep technologies will benefit tech companies offering IoT tags and technologies.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework

[caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research [/caption]

Base: 5,000 shoppers, store associates, and retail decision-makers aged 18+ across North America, Latin America, Europe and APAC, surveyed in July 2021

Base: 5,000 shoppers, store associates, and retail decision-makers aged 18+ across North America, Latin America, Europe and APAC, surveyed in July 2021  Categories as published in the survey

Categories as published in the survey  Amazon’s QR-code-based display offering a smart digital storefront

Amazon’s QR-code-based display offering a smart digital storefront  BigThinx’s virtual showroom for physical brands and retailers (left); product description using virtual models (right)

BigThinx’s virtual showroom for physical brands and retailers (left); product description using virtual models (right)  SunnyBee’s self-checkout kiosk (left); a customer performing contactless checkout at SunnyBee’s store in Besant Nagar, Chennai (right)

SunnyBee’s self-checkout kiosk (left); a customer performing contactless checkout at SunnyBee’s store in Besant Nagar, Chennai (right)  A customer trying on jewelry using AR at Tanishq Delhi Airport kiosk

A customer trying on jewelry using AR at Tanishq Delhi Airport kiosk  Watasale’s self-checkout store in Kochi (left); a customer using QR-code to enter the store to buy products (right)

Watasale’s self-checkout store in Kochi (left); a customer using QR-code to enter the store to buy products (right)  Source: Coresight Research [/caption]

Source: Coresight Research [/caption]