DIpil Das

What’s the Story?

We look at the recovery of small businesses in the US in the wake of the Covid-19 crisis, analyzing both their struggles at the outset of the pandemic-induced economic crash and their subsequent rebound. We compare the current small-business environment to the 2008 global financial crisis (GFC).Why It Matters

Over 99% of firms in the US are small businesses and they generate about half of all US GDP, according to the US Small Business Administration, which generally defines small businesses as privately owned companies with fewer than 1,500 employees (although specific definitions vary by industry). Understanding their recovery from the Covid-19 pandemic is therefore key to developing a clear view of what the business and retail landscape will look like through 2021 and beyond.Small Businesses in US Retail: In Detail

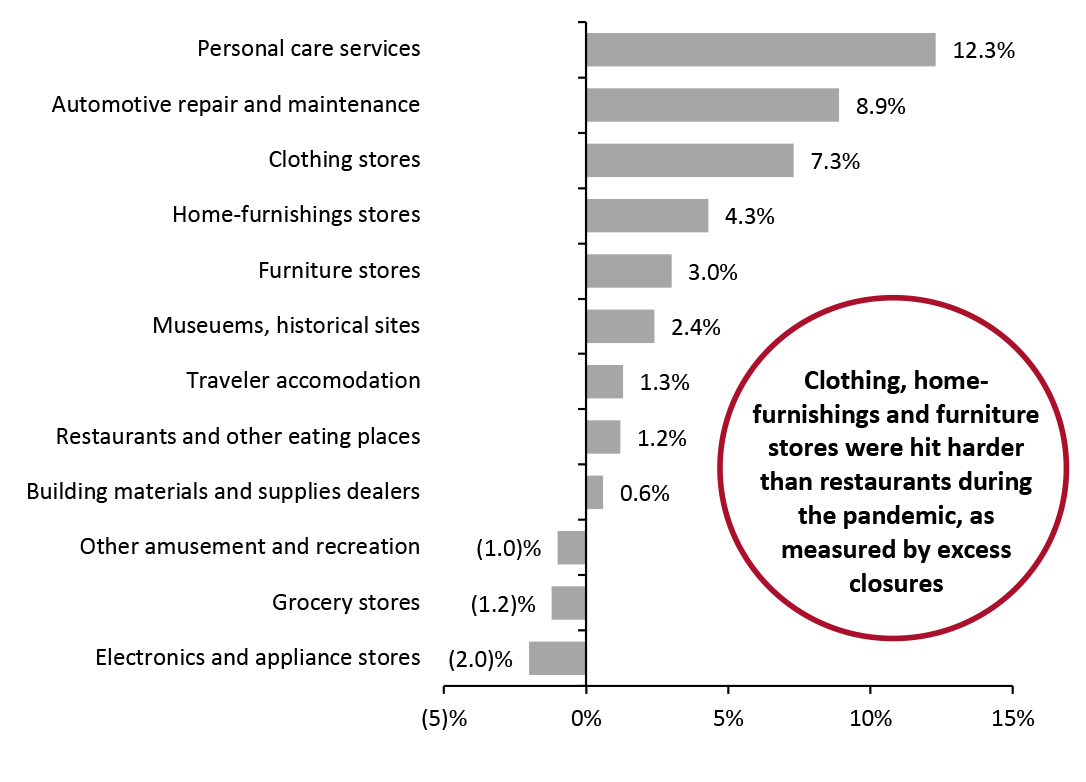

Coresight Research presents five things you need to know about the pandemic-led collapse and renaissance of small businesses in the US. 1. Small and Micro-Businesses Closed at Record Rates at the Outset of the Covid-19 Crisis, Mirroring the GFC Business closures during the pandemic took place almost exclusively among small businesses— particularly those with fewer than 50 employees. Unlike during the GFC, these businesses were disproportionately service-oriented, due to the obvious catastrophic impact that the pandemic had on the service sector during lockdowns. In May 2020, the peak of pandemic-driven business closures, the proportion of closures among companies with up to 49 employees was nearly two percentage points higher than the 2015–2019 average, according to research from the Federal Reserve. The proportion of closures for businesses with 50–499 employees rose by nearly one percentage point. By contrast, the proportion of closures among businesses with 500 employees or more remained roughly level with historical levels. Between March 2020 (the outset of the Covid-19 pandemic in the US) and February 2021, an estimated 11,000 more retailers went out of business compared to the historical exit rates of the last five years, out of a total base of just over 1 million retailers—these were highly concentrated among small businesses, particularly in the apparel sector. The service industry struggled to an even greater extent, with 128,000 excess exits across food services, entertainment/recreation and all other service categories, out of a total base of about 740,000 service providers. While media coverage often focused on the plight of restaurants during the crisis, it was actually personal care services that were proportionately hit the hardest, as illustrated in Figure 1. Among retailers, clothing stores were predictably most impacted, while grocery and electronics—two sectors that saw strong demand during the pandemic—saw company closures remain below historical rates.Figure 1. Excess Exit Estimates by Industry (% of Total Establishments), March 2020–February 2021 vs. 2015–2019 Average Exit Rate [caption id="attachment_128888" align="aligncenter" width="725"]

Source: US Federal Reserve[/caption]

2. Unlike During the GFC, the Collapse Was Highly Concentrated Early in the Crisis and Subsequent Closures Have Been Rare

A closer look indicates that small businesses are in much healthier shape now than was the case following the GFC.

While the total number of small-business closures was high during the Covid-19 crisis, the damage occurred in the early months of the pandemic, and the business environment has subsequently seen gradual improvement.

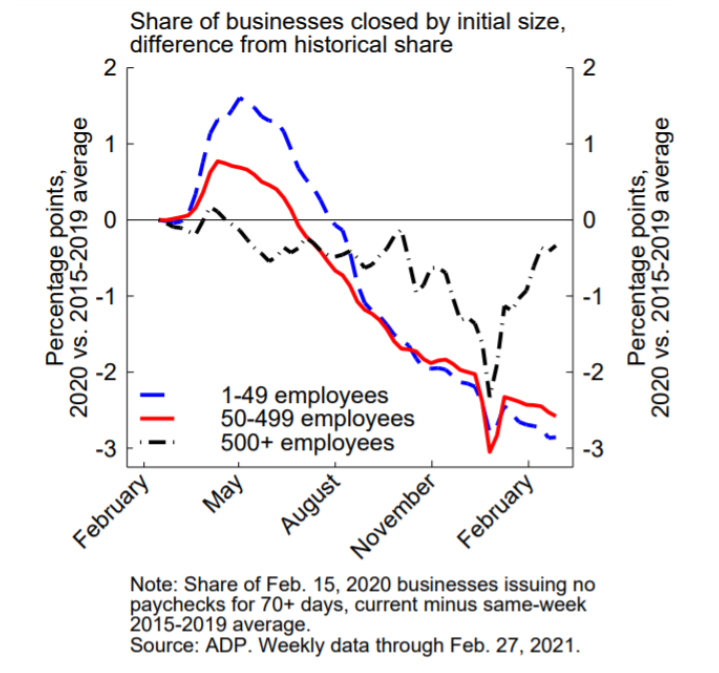

The 2008 crash was the result of structural economic issues, whereas the 2020 crisis occurred in the midst of a business boom and was sparked by exogenous factors that were unrelated to the economic environment. As a result, the small business collapse highlighted in the previous section was much more concentrated than the drawn-out stretch of business closures and steady, lower rate of new business applications during the GFC. At almost no point during the crisis did the closures of large businesses (those with 500 or more employees) surpass the historical rate. By August 2020, even businesses with fewer than 50 employees were closing at rates below historical averages, as shown in the image below.

[caption id="attachment_128889" align="aligncenter" width="719"]

Source: US Federal Reserve[/caption]

2. Unlike During the GFC, the Collapse Was Highly Concentrated Early in the Crisis and Subsequent Closures Have Been Rare

A closer look indicates that small businesses are in much healthier shape now than was the case following the GFC.

While the total number of small-business closures was high during the Covid-19 crisis, the damage occurred in the early months of the pandemic, and the business environment has subsequently seen gradual improvement.

The 2008 crash was the result of structural economic issues, whereas the 2020 crisis occurred in the midst of a business boom and was sparked by exogenous factors that were unrelated to the economic environment. As a result, the small business collapse highlighted in the previous section was much more concentrated than the drawn-out stretch of business closures and steady, lower rate of new business applications during the GFC. At almost no point during the crisis did the closures of large businesses (those with 500 or more employees) surpass the historical rate. By August 2020, even businesses with fewer than 50 employees were closing at rates below historical averages, as shown in the image below.

[caption id="attachment_128889" align="aligncenter" width="719"] Source: US Federal Reserve[/caption]

3. Technology and Stimulus Have Enabled Small Businesses To Spring Up at Record Rates

Small businesses have not just stopped closing at high rates; they have actually been opening at very high rates for the past 12 months, in sharp contrast to the slow pace of new business openings following the GFC.

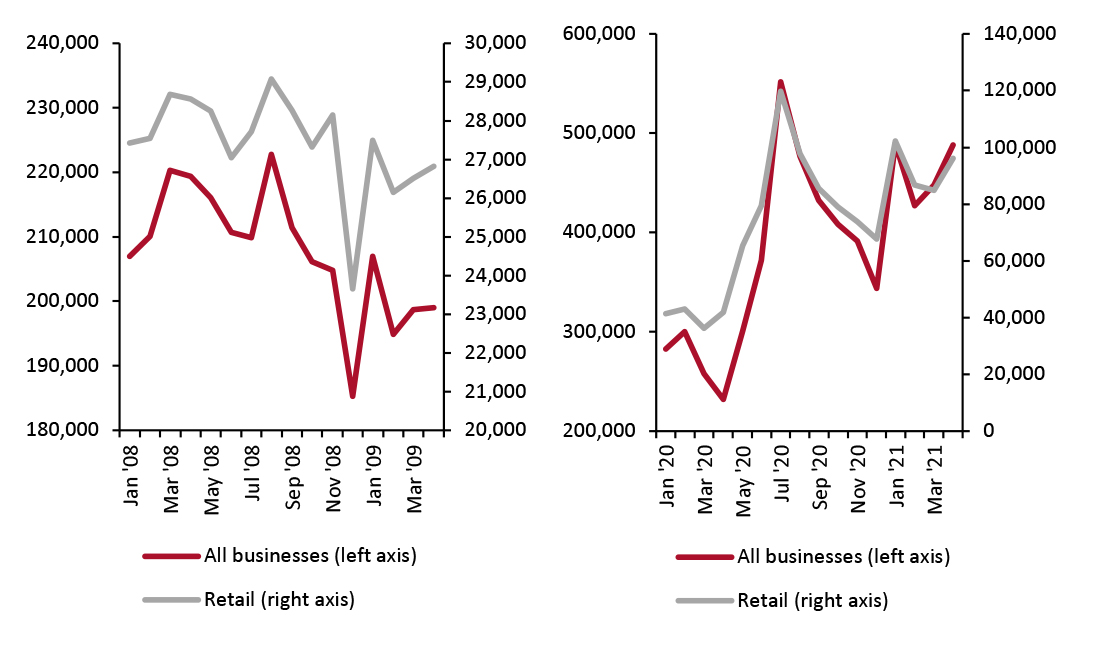

New business applications more than doubled during May 2020 to April 2021 compared to the prior 12 months—for both businesses as a whole and for retailers specifically. Figure 2 shows how new business applications stagnated and fell slightly during the GFC but rose amid the Covid-19 pandemic.

Source: US Federal Reserve[/caption]

3. Technology and Stimulus Have Enabled Small Businesses To Spring Up at Record Rates

Small businesses have not just stopped closing at high rates; they have actually been opening at very high rates for the past 12 months, in sharp contrast to the slow pace of new business openings following the GFC.

New business applications more than doubled during May 2020 to April 2021 compared to the prior 12 months—for both businesses as a whole and for retailers specifically. Figure 2 shows how new business applications stagnated and fell slightly during the GFC but rose amid the Covid-19 pandemic.

Figure 2. Seasonally Adjusted New Business Applications, January 2008–April 2009 (Left) and January 2020–April 2021 (Right) [caption id="attachment_128893" align="aligncenter" width="725"]

Source: US Census Bureau[/caption]

The recent increase in new business applications has been driven by two key factors:

Source: US Census Bureau[/caption]

The recent increase in new business applications has been driven by two key factors:

- Stimulus and high unemployment rates: Consumers received three rounds of stimulus checks during the pandemic, which, along with high savings rates over the course of the crisis, gave many some of the capital they needed to start their own businesses. Widespread unemployment for much of the crisis also caused many consumers to turn to founding their own businesses due to a lack of full-time employment—although that is now shifting as the unemployment rate has fallen below 6% for the first time since the crisis began (although last week, new jobless claims did rise), and there are hiring shortages across industries.

- Technology and the shift to working from home: New business communications technologies and a cultural shift toward working from home has lowered the barrier to entry in many industries. Entrepreneurs can now even more easily run businesses from their homes and can even pursue “side hustles” while they have a full-time job, using technologies such as Microsoft Teams and Zoom to save on office and travel costs.

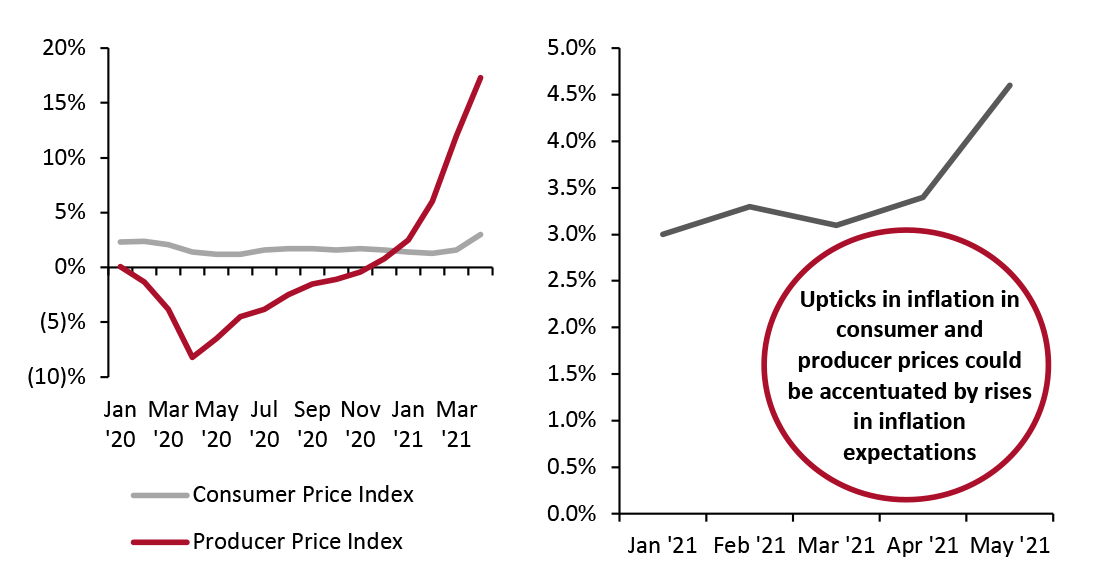

Figure 3. Producer Price Index and Consumer Price Index for All Urban Consumers: All Items Less Food and Energy, US City Average (YoY % Change; Left) and University of Michigan One-Year Inflation Expectations (Right) [caption id="attachment_128891" align="aligncenter" width="725"]

Source: University of Michigan/US Bureau of Labor Statistics[/caption]

Small businesses and their smaller budgets are often particularly vulnerable to spikes in inflation. Business owners expect this year to be no different: 67% of small business owners fear that inflation will hurt their recovery from the crisis, according to a poll conducted in April and May by small business networking company Alignable. Some 80% of respondents to that same survey said that the cost of supplies is increasing compared to pre-pandemic levels, with nearly one in four small business owners reporting that these costs have increased by 25% or more. The Producer Price Index has already begun to spike, a potential harbinger of difficult times ahead for small businesses.

Equally worrisome is the difficulty that small businesses are having finding workers. The Alignable survey found that 50% of small businesses are having trouble filling all of their job vacancies, partially due to the continuation of more generous unemployment benefits. In response to these increased benefits, certain large companies such as Amazon, Kroger and Under Armour have raised their minimum wage to $15 per hour. Many small businesses may struggle to find room in their budgets amid rising supply costs to afford to keep pace with these rises in wages, and as a result could continue to struggle to fill vacancies moving forward.

Clamping down on inflation is also not a solution that will benefit small businesses. If the Federal Reserve decides to adopt a more aggressive posture against inflation, small businesses will feel the adverse effects of a rise in interest rates that will hamper their ability to access capital. In the months ahead, the success of small businesses will reflect their ability to cope with inflationary pressures and the depth and duration of those pressures.

5. Small Retailers and Brands That Create Seamless, Convenient, Curated Experiences Are Best Positioned To Thrive

Small businesses can no longer compete with the sheer quantity of selection provided by giant retailers such as Amazon and Walmart, but in a post-pandemic world, they can still carve out niches that cater to the contemporary consumer.

Furthermore, although they do not have the same deep pockets as their larger counterparts, small retailers can prioritize investments in several key areas to attract the attention and dollars of the new consumer. In our recent report in partnership with strategic consulting and media firm January Digital, we highlighted three key features that consumers look for when choosing what retailer or brand to shop: Free, fast delivery, free easy returns and the ability to shop both online and offline for the same products.

Source: University of Michigan/US Bureau of Labor Statistics[/caption]

Small businesses and their smaller budgets are often particularly vulnerable to spikes in inflation. Business owners expect this year to be no different: 67% of small business owners fear that inflation will hurt their recovery from the crisis, according to a poll conducted in April and May by small business networking company Alignable. Some 80% of respondents to that same survey said that the cost of supplies is increasing compared to pre-pandemic levels, with nearly one in four small business owners reporting that these costs have increased by 25% or more. The Producer Price Index has already begun to spike, a potential harbinger of difficult times ahead for small businesses.

Equally worrisome is the difficulty that small businesses are having finding workers. The Alignable survey found that 50% of small businesses are having trouble filling all of their job vacancies, partially due to the continuation of more generous unemployment benefits. In response to these increased benefits, certain large companies such as Amazon, Kroger and Under Armour have raised their minimum wage to $15 per hour. Many small businesses may struggle to find room in their budgets amid rising supply costs to afford to keep pace with these rises in wages, and as a result could continue to struggle to fill vacancies moving forward.

Clamping down on inflation is also not a solution that will benefit small businesses. If the Federal Reserve decides to adopt a more aggressive posture against inflation, small businesses will feel the adverse effects of a rise in interest rates that will hamper their ability to access capital. In the months ahead, the success of small businesses will reflect their ability to cope with inflationary pressures and the depth and duration of those pressures.

5. Small Retailers and Brands That Create Seamless, Convenient, Curated Experiences Are Best Positioned To Thrive

Small businesses can no longer compete with the sheer quantity of selection provided by giant retailers such as Amazon and Walmart, but in a post-pandemic world, they can still carve out niches that cater to the contemporary consumer.

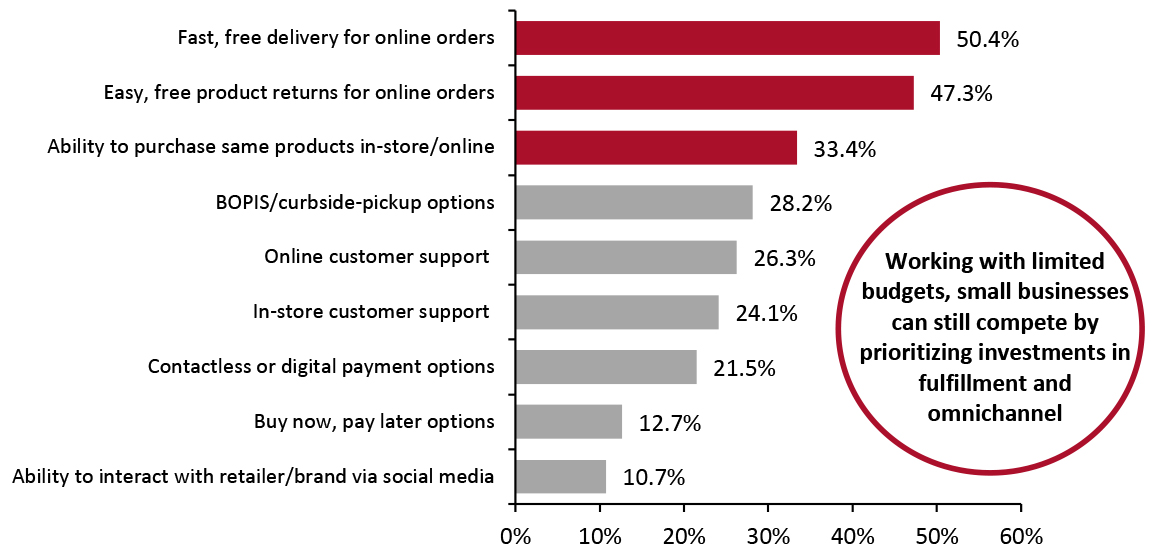

Furthermore, although they do not have the same deep pockets as their larger counterparts, small retailers can prioritize investments in several key areas to attract the attention and dollars of the new consumer. In our recent report in partnership with strategic consulting and media firm January Digital, we highlighted three key features that consumers look for when choosing what retailer or brand to shop: Free, fast delivery, free easy returns and the ability to shop both online and offline for the same products.

Figure 4. Features That Are “Very Important” to US Consumers When Choosing a Retailer or Brand To Shop With (% of Respondents) [caption id="attachment_128892" align="aligncenter" width="725"]

Base: 419 US respondents aged 18+, surveyed on May 3, 2021

Base: 419 US respondents aged 18+, surveyed on May 3, 2021 Source: Coresight Research/January Digital [/caption] Small businesses must ensure that, despite their size, they have a strong e-commerce presence across marketplaces such as Amazon as well as social platforms and owned websites. To complete the seamless experience for customers, small businesses must also ensure they have the logistics capacity to provide delivery and returns services that are competitive with larger companies—an effort that may require partnering with third-party solutions providers such as Project Verte.

What We Think

The pandemic-related outlook for small businesses is very strong, with consumers avoiding public places at record-low rates and widespread vaccinations likely to prevent further flare-ups of the virus. The bounceback of these businesses has been and will continue to be much stronger and quicker than during the GFC, when less aggressive stimulus and deeper structural economic issues delayed recovery and prolonged the period of abnormally high numbers of small business closures. Moving forward, small business fears will shift away from the virus and toward inflation. Whether or not the Federal Reserve takes action to curb rising prices, small businesses will see a more negative impact than their larger counterparts and could struggle to maintain inventory and staff. A rise in new jobless claims, while an indicator that recovery may be slowing somewhat, could also prove beneficial in fighting inflation. Historically, a very tight labor market has been a prerequisite for surges in inflation, so continued slack could help curb rising prices. Overall, strong consumer demand and record numbers of new business applications are creating a positive environment for small businesses that can effectively curate and execute within a niche. Implications for Brands/Retailers- Small retailers and brands can best appeal to consumers by ensuring seamless omnichannel shopping experiences, which may often mean partnering with third-party solutions providers.

- These retailers can also succeed by curating their store selection and experiences to suit the local communities they are in, demonstrating a connection with their locale that larger retailers can find difficult to replicate.

- Small businesses may once again be more viable tenants, but an eventual raising of interest rates by the Federal Reserve to prevent the economy from overheating could reduce these businesses’ abilities to secure loans and liquidity in the medium term.

- As more people launch small businesses out of their home, technology is playing a particularly vital role in their development. In retail, there remains significant room for technology vendors to assist digitally native small brands and retailers, from inventory management, to customer service to returns.