Introduction: Looking Beyond the Brand Names

Amazon is not just moving into newer categories, such as apparel, home furnishings and grocery; it is also building its own suite of brands in these categories. In this report, we take an exclusive deep dive into Amazon’s US private labels, using a detailed, proprietary dataset that aggregates information on nearly 7,000 such products.

A number of studies and articles have noted the many private labels Amazon has launched over the years. However, simply taking note of its private labels does not necessarily indicate the depth (number of products) or breadth (category presence) of the offering; nor does it give any indication of consumer reception, sales volumes or pricing.

In collaboration with competitive intelligence provider DataWeave, we have aggregated a number of metrics on 74 known Amazon US private labels. In the sections that follow, we slice and dice that data to provide information on:

- Breadth and depth: We show Amazon’s private-label presence by category, including how many products it offers within categories and within the subcategories of apparel.

- Consumer reception: We feature the average star rating given by customers for Amazon’s different private labels.

- Implied consumer demand: We show the number of consumer reviews, which we think can, in many cases, be a proxy for sales volumes.

- Positioning: We discuss the average selling price of Amazon’s private-label apparel products, by category and brand.

The focus of our research is the 74 private labels identified by research firm L2 and published by tech news website Recode in April 2018. We list these 74 brands in full at the end of this report. This report focuses on summarizing key findings; specific data points are available on request.

We offer two major takeaways from our research:

- The dominance of the apparel category: Apparel is the dominant category in Amazon’s private-label offering, and one that appears to be growing, as the retailer pushes further into the clothing and footwear markets. In contrast, Amazon’s private-label offering in grocery categories such as food and household care remains limited, and in beauty and personal care, Amazon offers just two private-label products.

- Amazon is building a highly-segmented fashion offering: Our analysis in turn suggests that Amazon is building a highly-segmented fashion offering. This segmented approach is reflected in its large number of brands, range of price points and presence across clothing and footwear subcategories. This strategy is most evident in the often-limited number of products within each apparel private label: Amazon is creating specialized fashion brands that focus on a specific category or serve a specific consumer segment. The diversity of this offering dovetails with Amazon’s overall neutral positioning, as a platform that draws in shoppers from all demographics looking for brands at all price points.

Four Top Takeaways on Amazon’s Private Labels

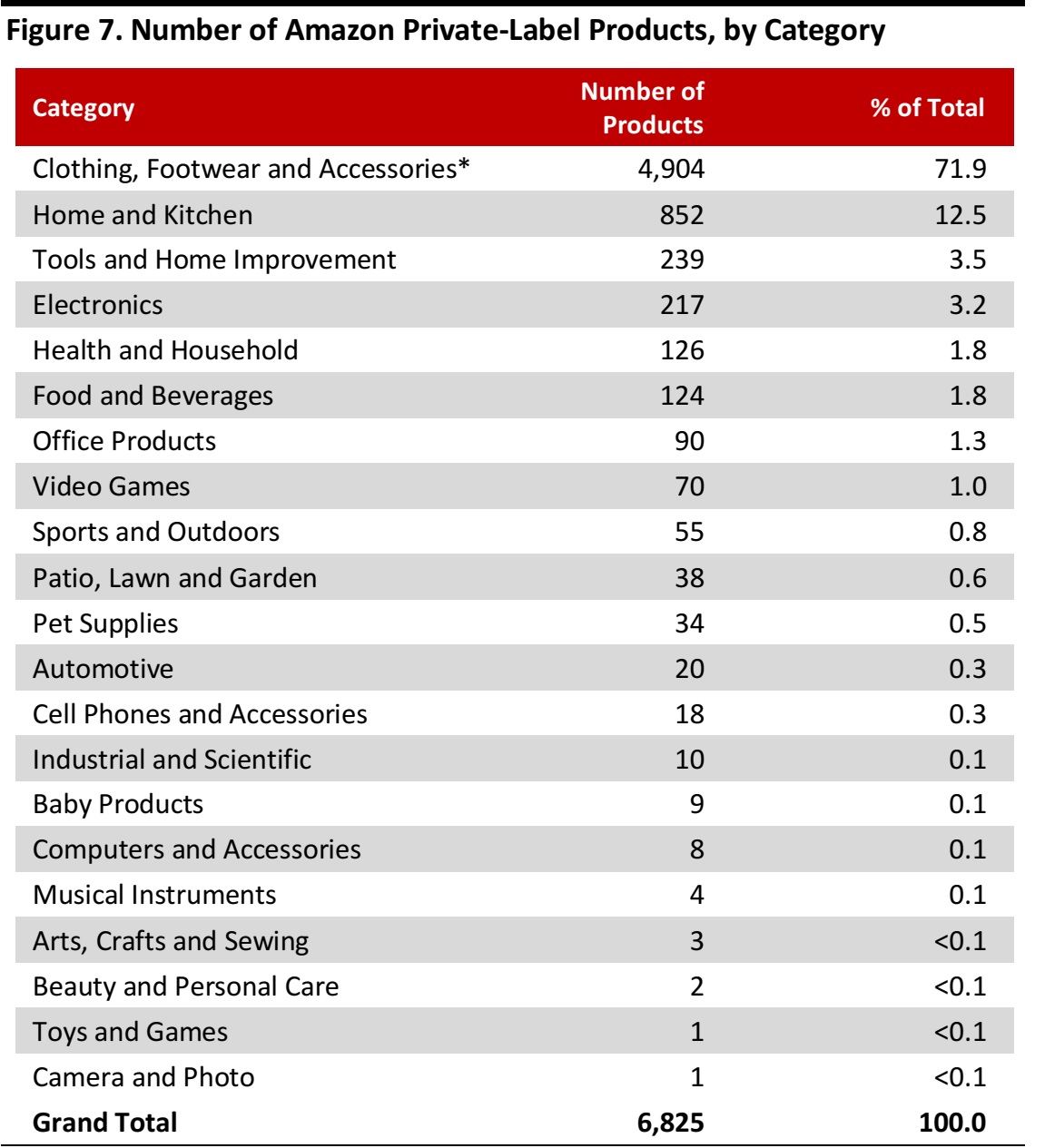

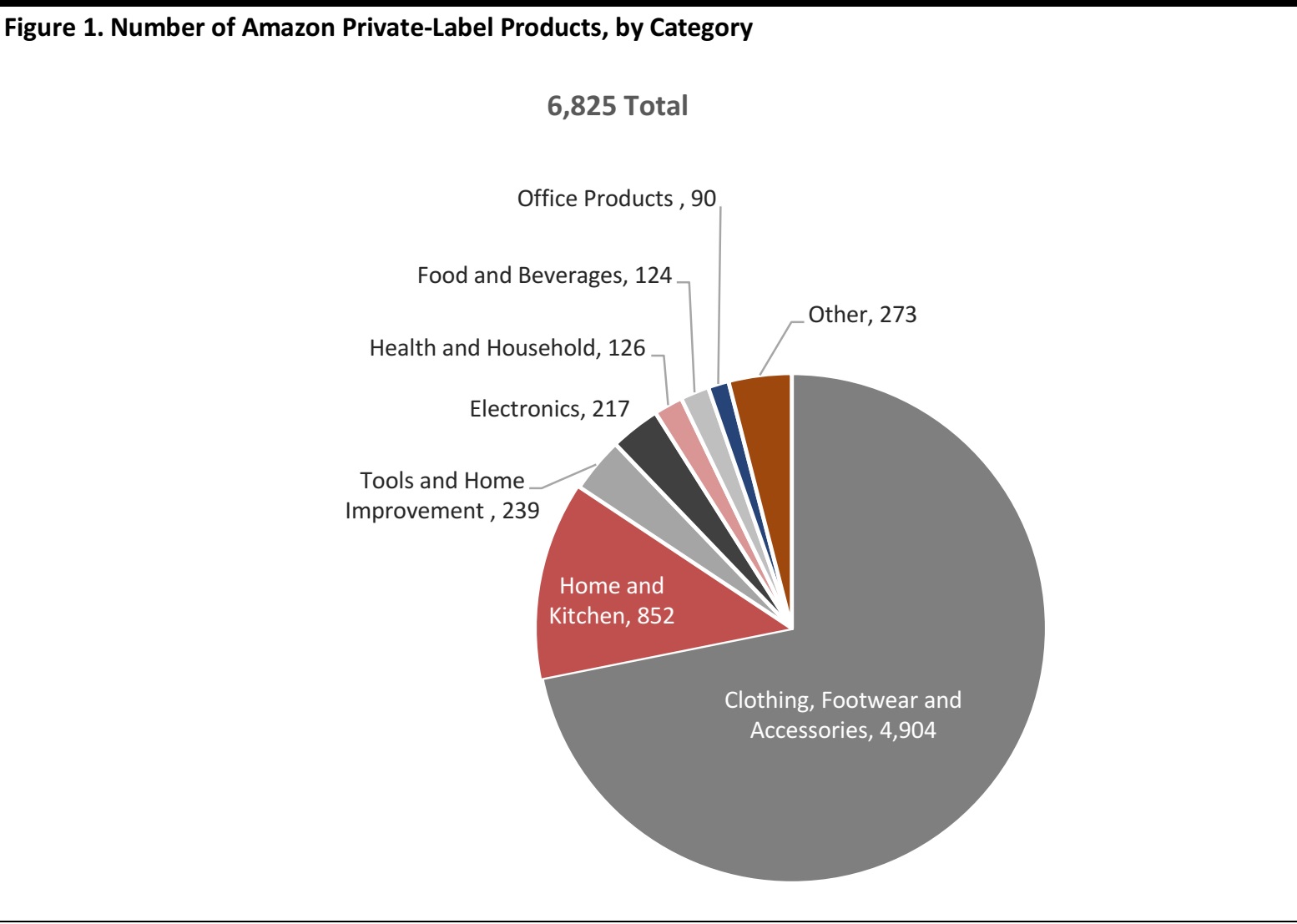

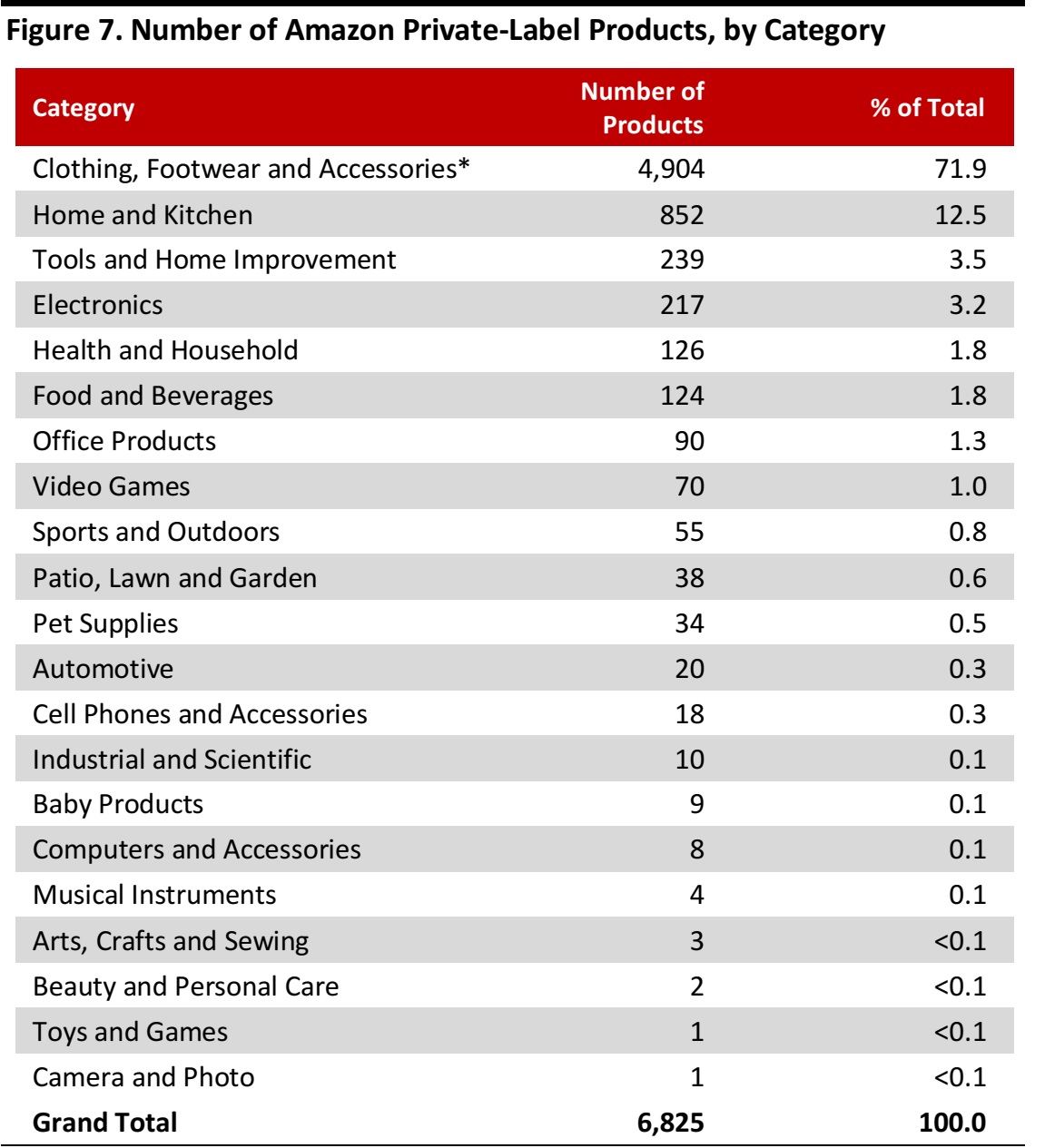

1. Amazon Offers Almost 7,000 Private-Label Products

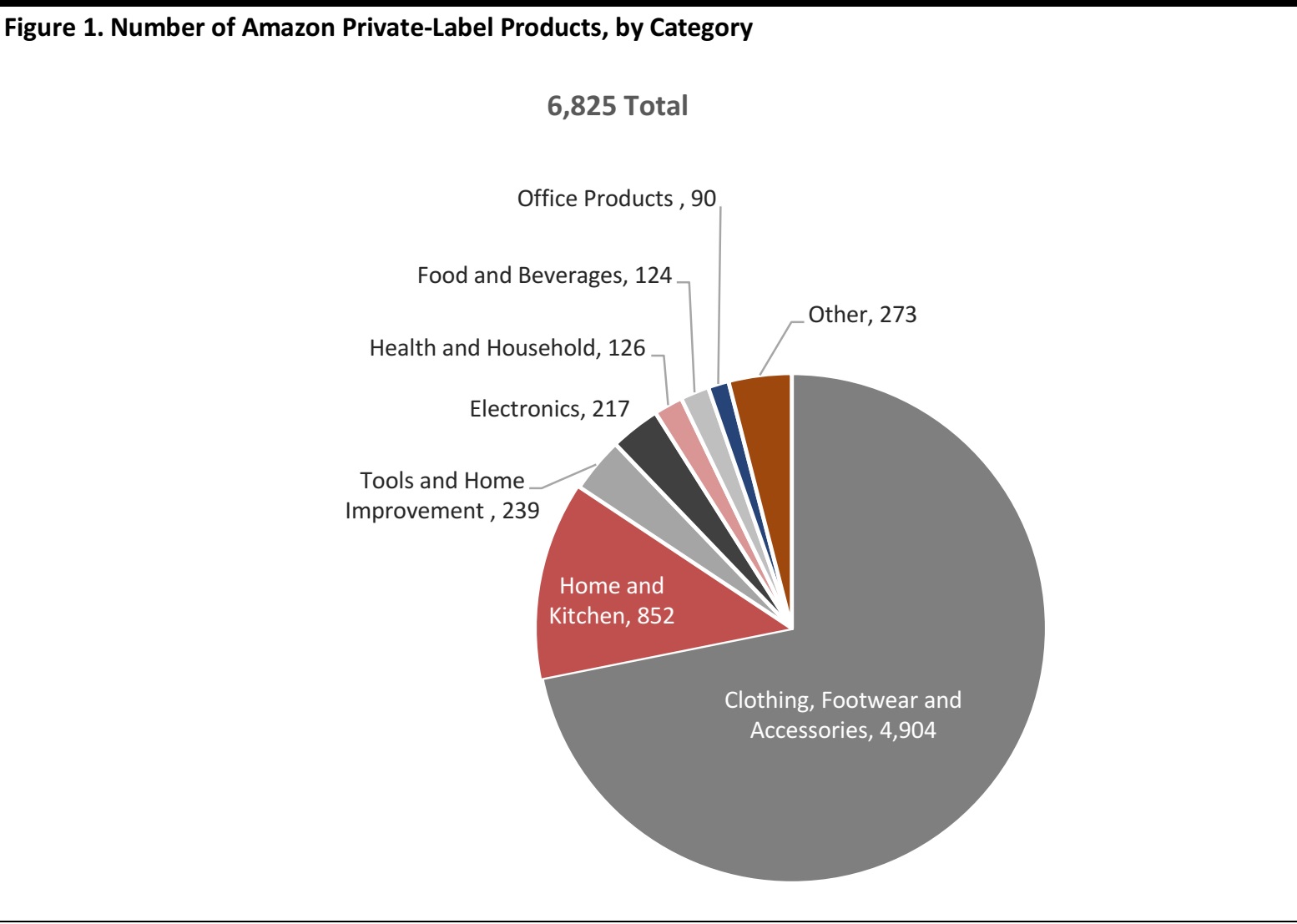

Amazon’s private-label offering spans 6,825 products across 74 identified private labels. Almost 5,000, or three-quarters, of those private-label products are in apparel—split across men’s, women’s and children’s clothing and footwear. Home and kitchen, which includes products such as towels, bedding and cookware, is the only other category with a very substantial offering.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

- Apparel: Amazon’s apparel offerings span dozens of brands, from Amazon Essentials to Wood Paper Company. In total, some 66 of Amazon’s 74 private labels include an apparel offering.

- Home and kitchen: This is another significant category, with 852 products spanning the multicategory AmazonBasics brand and three specialized private-label brands: home-textiles brand Pinzon by Amazon, and premium-positioned home-furnishings brands Rivet and Stone & Beam.

- Electronics: Amazon launched AmazonBasics in 2009 with a focus on electronics, and subsequently expanded it to other durable goods. It is notable that electronics now comprise only a small proportion of Amazon’s total private-label offering. AmazonBasics remaIns its only private-label brand in the electronics category.

- Health and household: This category includes one of Amazon’s oldest private labels—Amazon Essentials, which was launched in 2014, and spans multivitamins to baby-care products. The Presto and AmazonBasics brands offer products in health and household, too, in categories such as household cleaning products. Together with food and beverages, health and household makes up Amazon’s still-limited private-label offering in grocery-store categories.

- Food and beverages: Two private labels account for the 124 recorded food and beverage products: Wickedly Prime and Happy Belly.

Pinzon by Amazon is one of three private labels dedicated to home and kitchen goods.

Source: Amazon.com

Pinzon by Amazon is one of three private labels dedicated to home and kitchen goods.

Source: Amazon.com

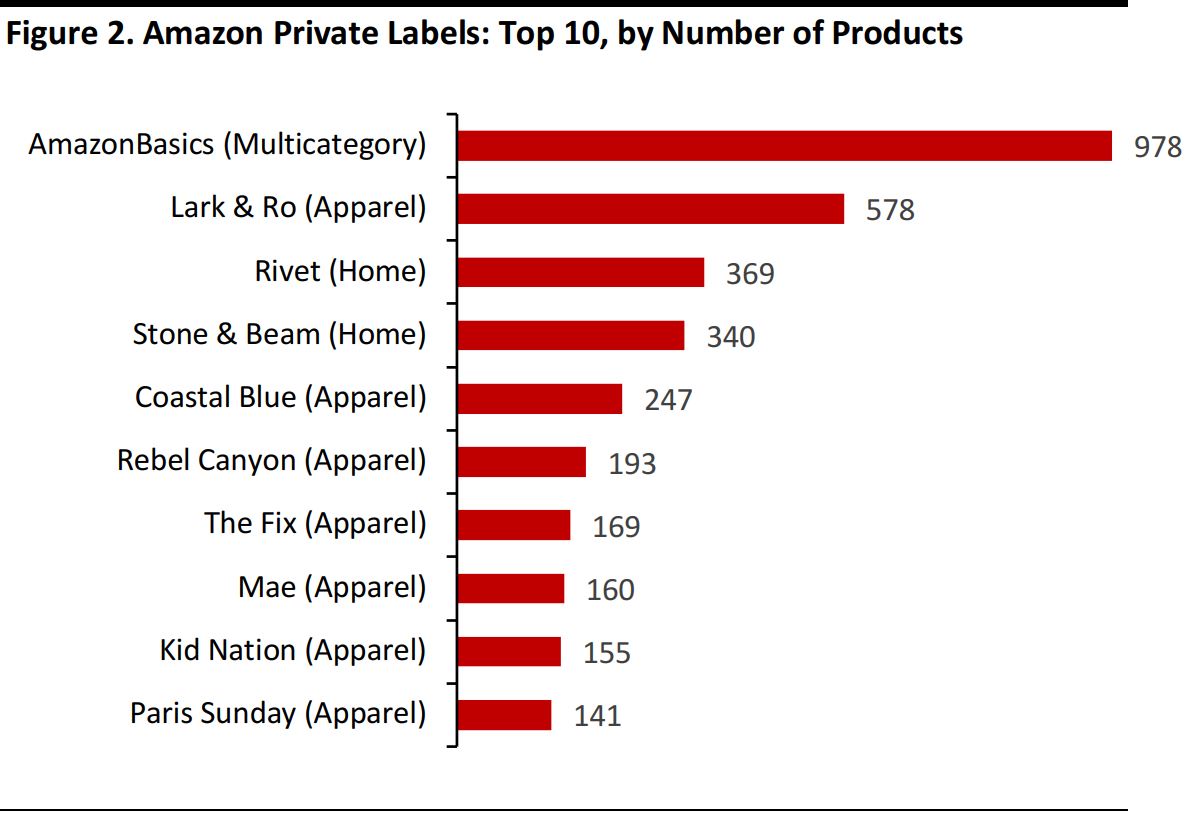

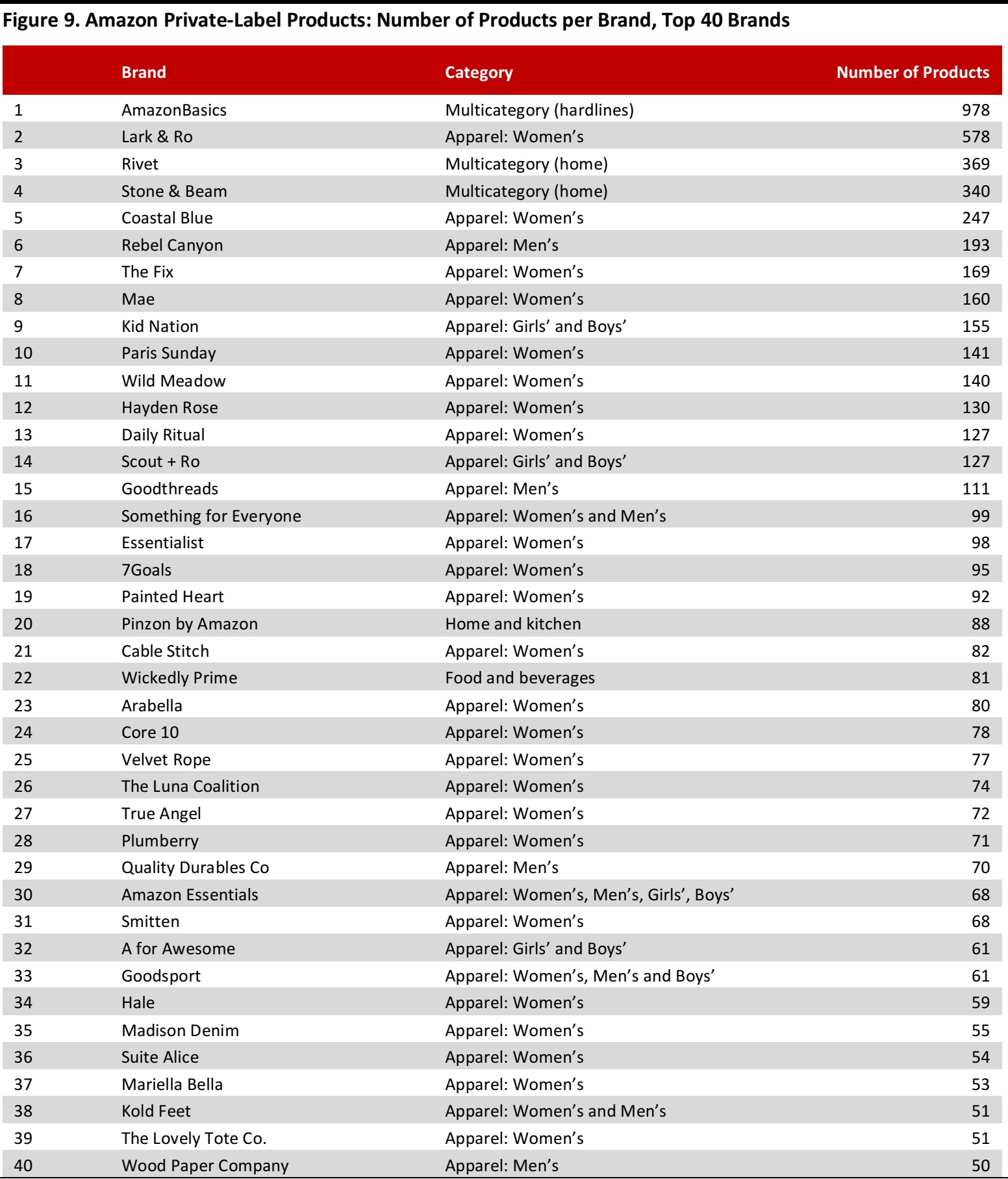

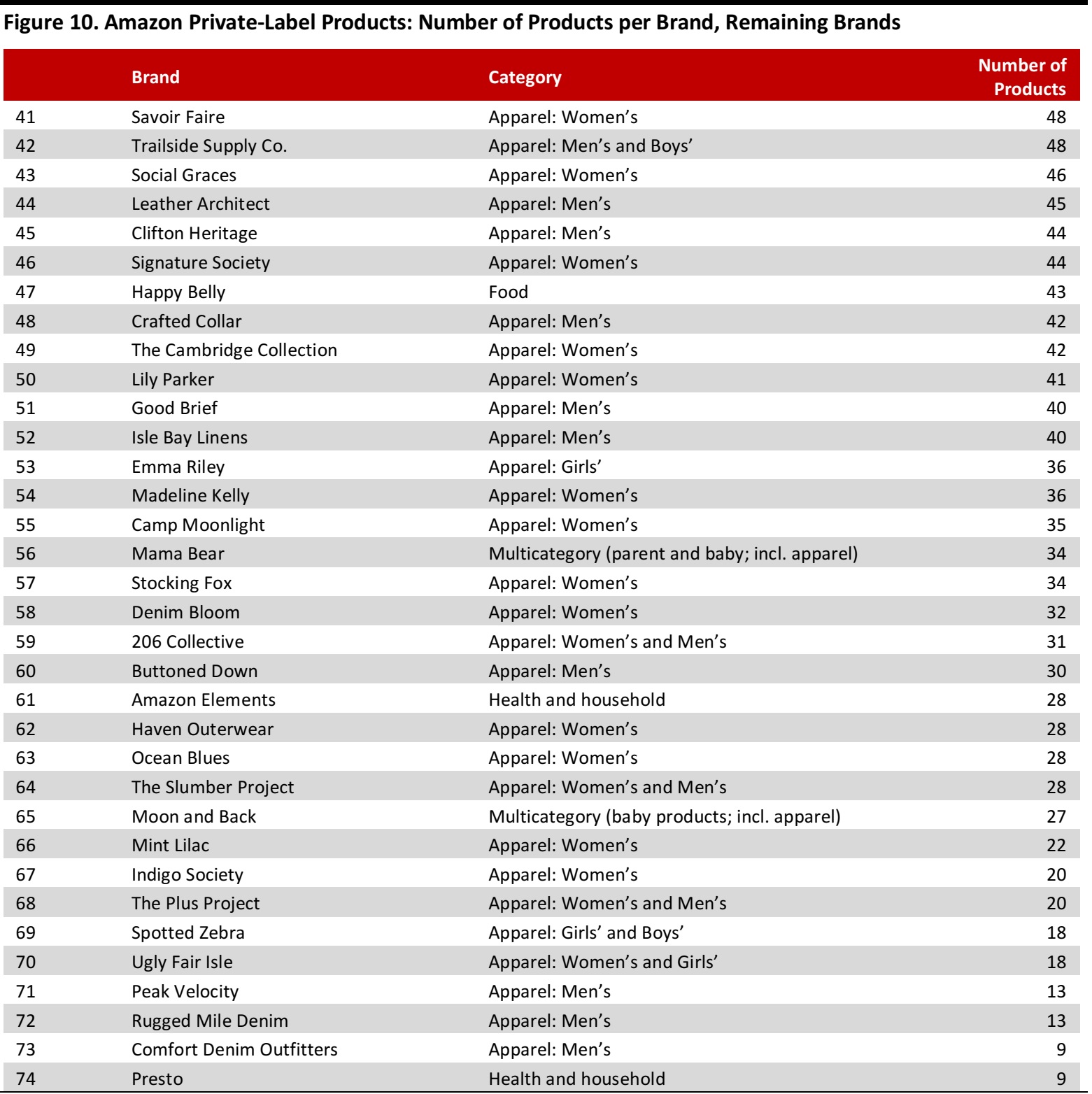

2. Most of Amazon’s Private Labels Offer Fewer than 100 Products

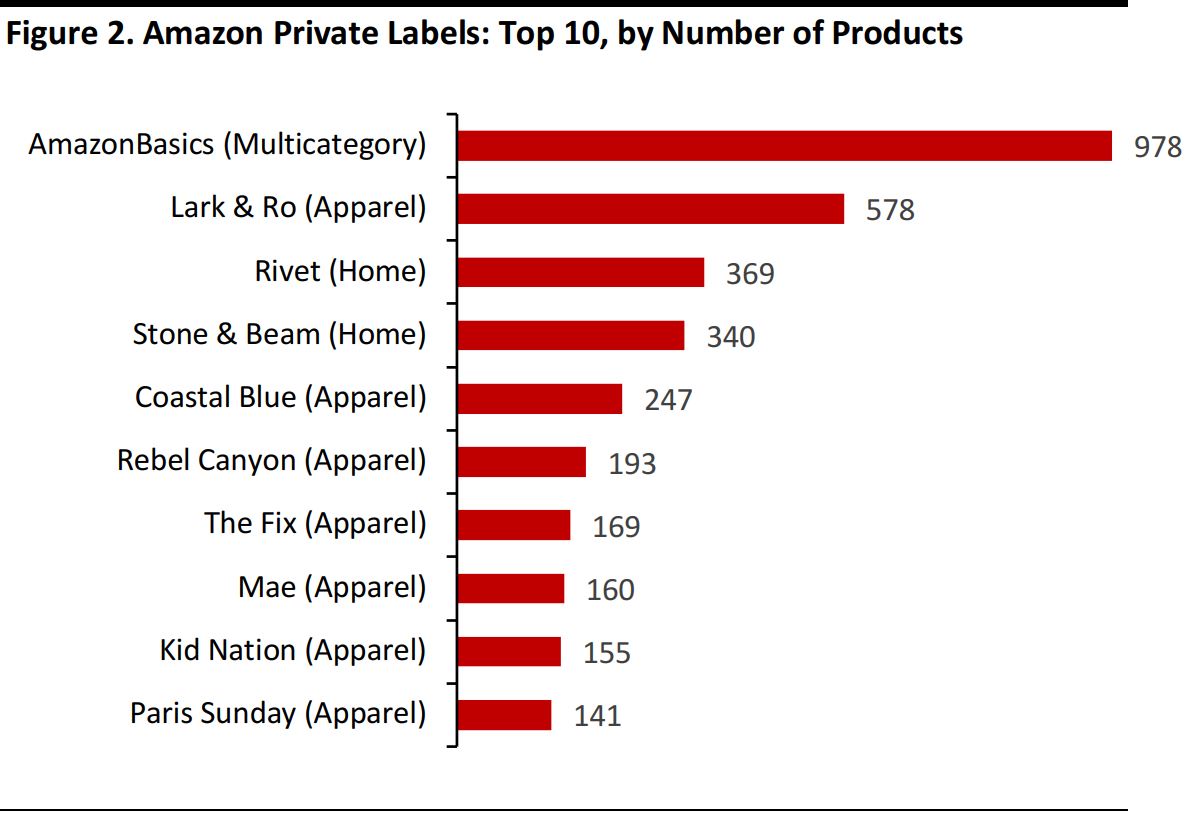

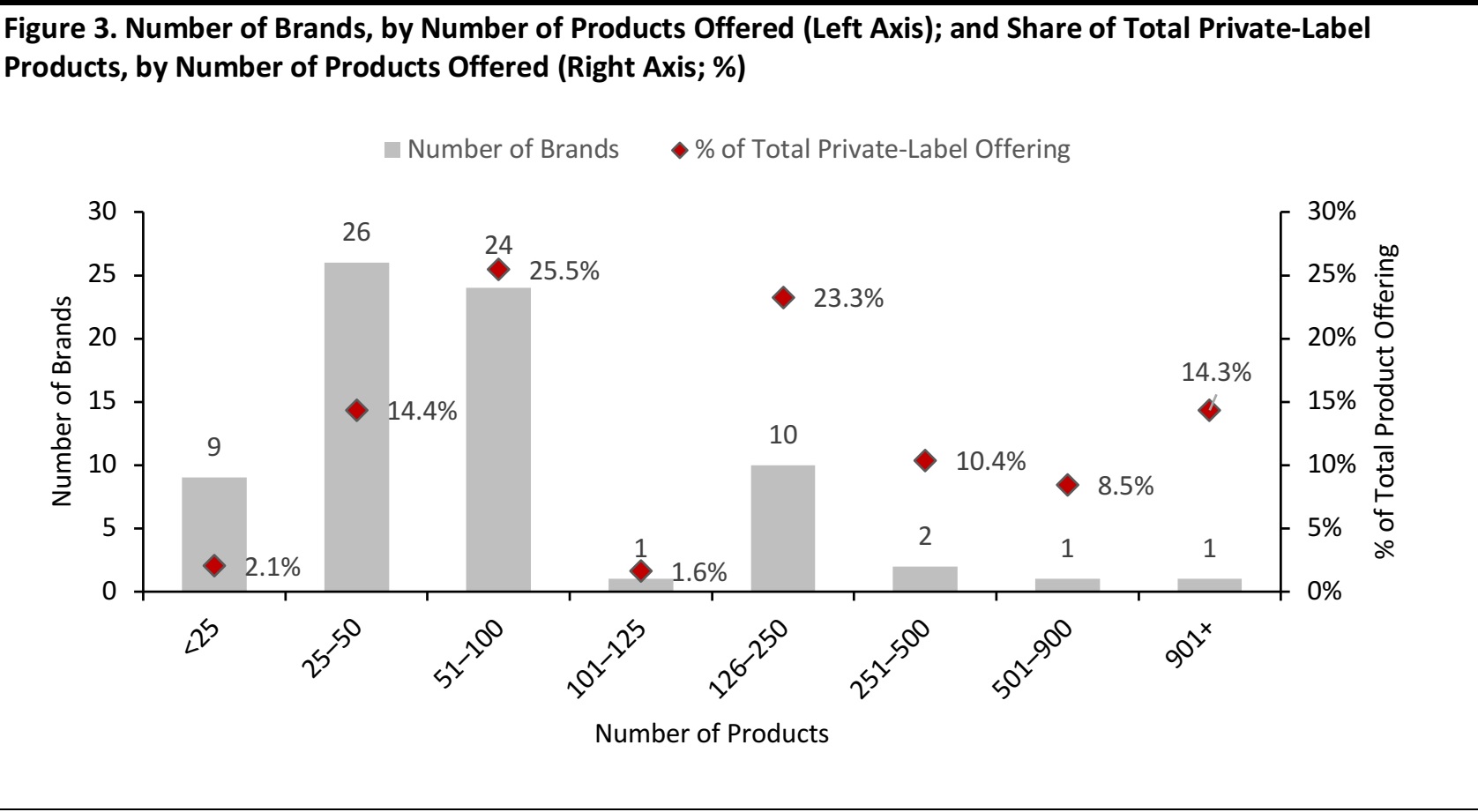

The majority of Amazon’s private labels offer fewer than 100 products. We think this underlines the segmented strategy that Amazon is pursuing in apparel: most of its fashion brands are designed to target a specific type of consumer or serve demand for a particular product type.

As measured by number of products, seven of the 10 biggest private labels are apparel brands, and this reflects the overall strength of that category in Amazon’s private-label offering. Yet, only one of the biggest four brands is an apparel brand—Lark & Ro. This implies that Amazon’s strategy in fashion is to build smaller, more specialized ranges than it does in categories such as home or electronics, where brands such as AmazonBasics and Rivet include a large number of products.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Rivet is an aspirational home-furnishings brand.

Source: Amazon.com

Rivet is an aspirational home-furnishings brand.

Source: Amazon.com

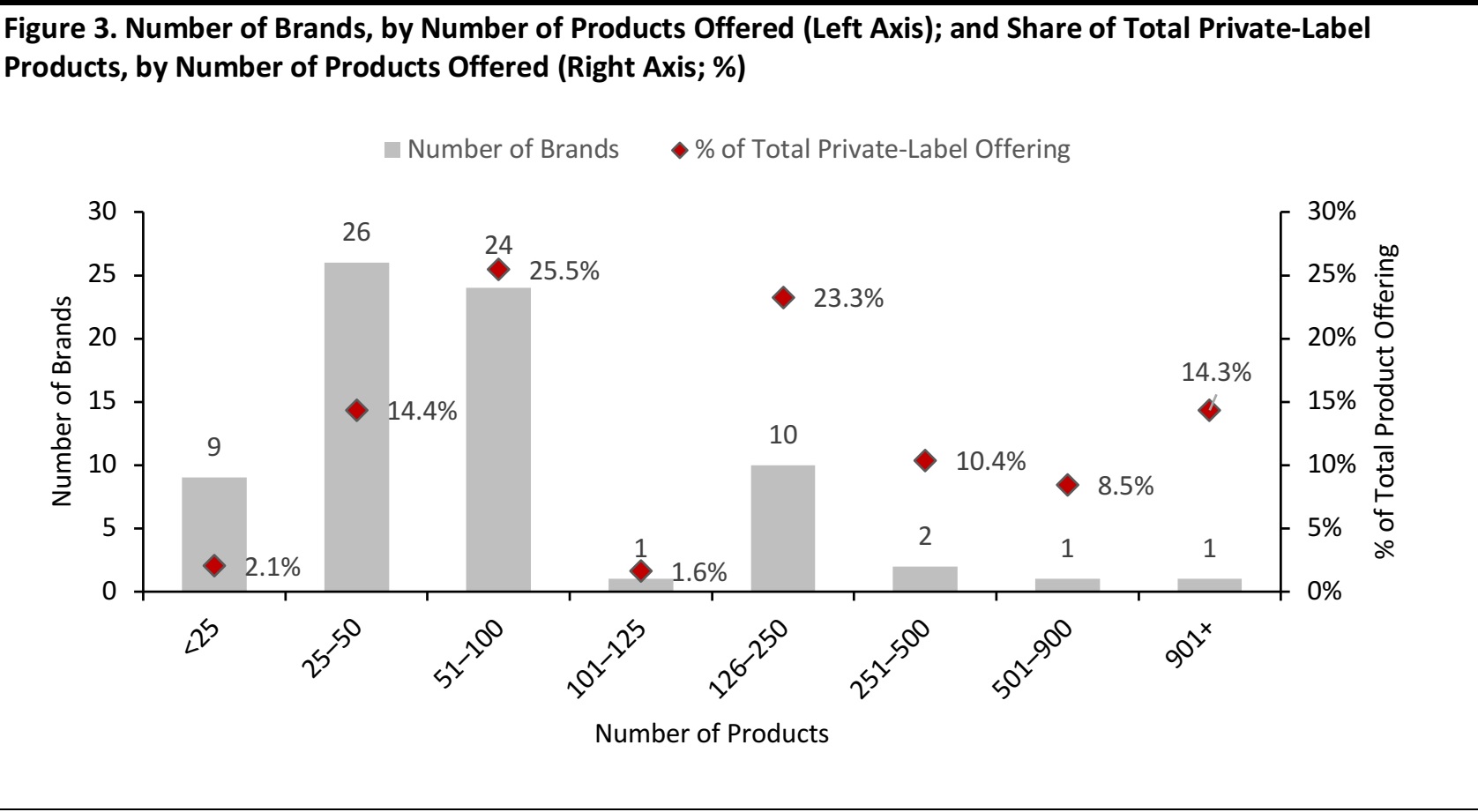

Below, we chart the number of brands by the number of products offered within each brand; we also show what proportion of the total private-label offering each range comprises (so, for example, the nine brands that offer fewer than 25 products contribute 2.1% of all Amazon’s private-label product offering, while the 26 brands offering 25–50 products contribute 14.4% of the total private-label offering).

- Some 59 of Amazon’s 74 identified private labels offer 100 or fewer products. In fact, each Amazon private label offers an average of 92 products.

- One brand offers over 900 products: AmazonBasics, with 978 products, alone contributes over 14% of all Amazon private-label products.

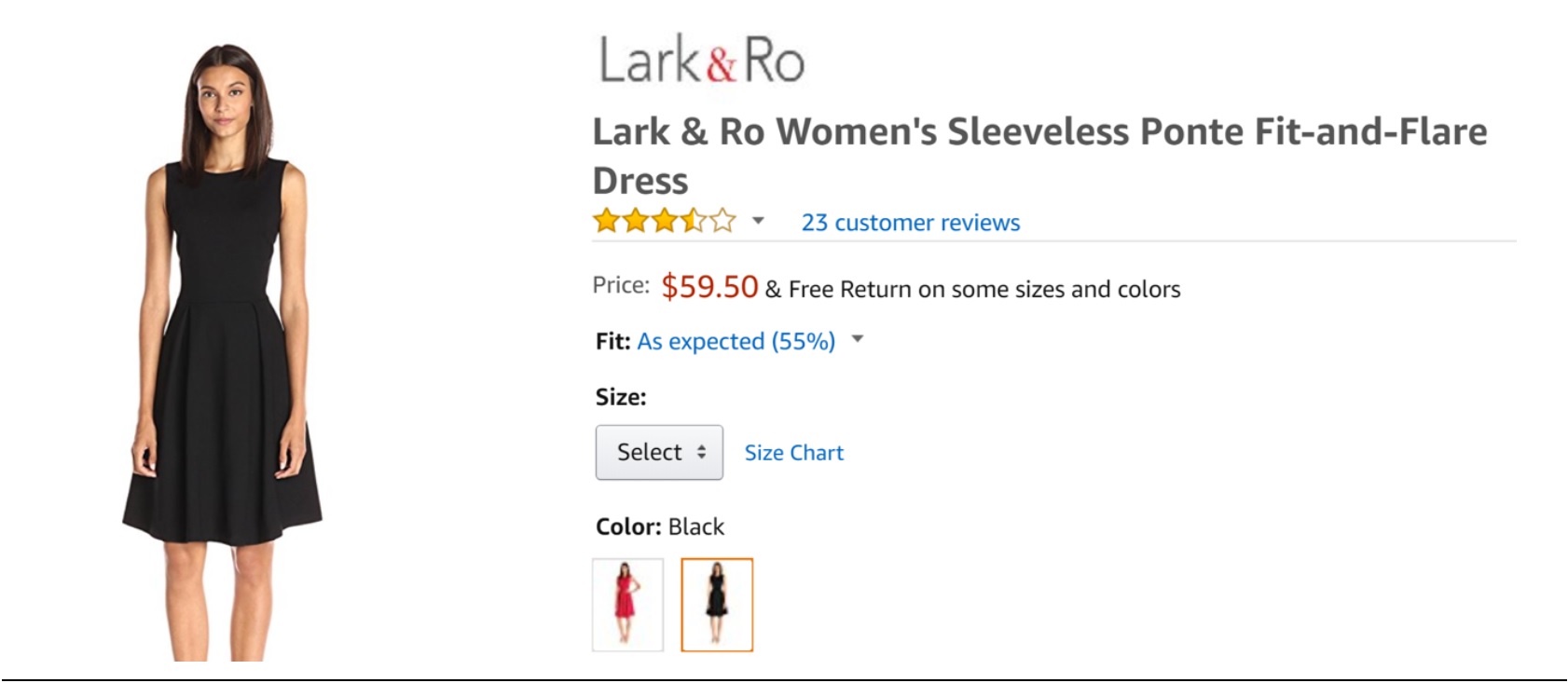

- One brand offers between 500 and 900 products: this is Amazon’s core womenswear brand Lark & Ro, whose 578 products are equivalent to 8.5% of Amazon’s total private-label offering.

- Two brands offer between 250 and 500 products each: these are the home-goods brands Rivet, with 369 products, and Stone & Beam, with 340 products.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

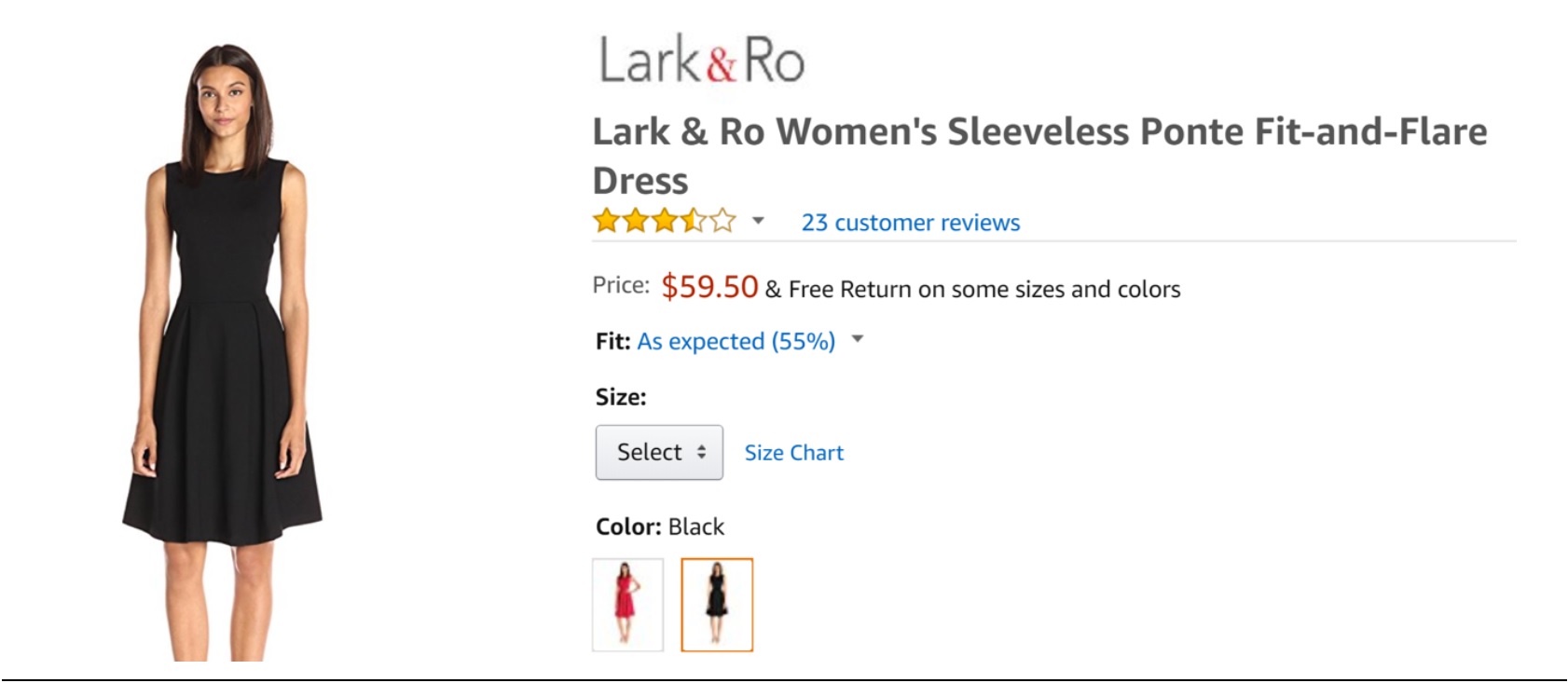

Womenswear brand Lark & Ro is Amazon’s second-biggest private label, behind AmazonBasics.

Source: Amazon.com

Womenswear brand Lark & Ro is Amazon’s second-biggest private label, behind AmazonBasics.

Source: Amazon.com

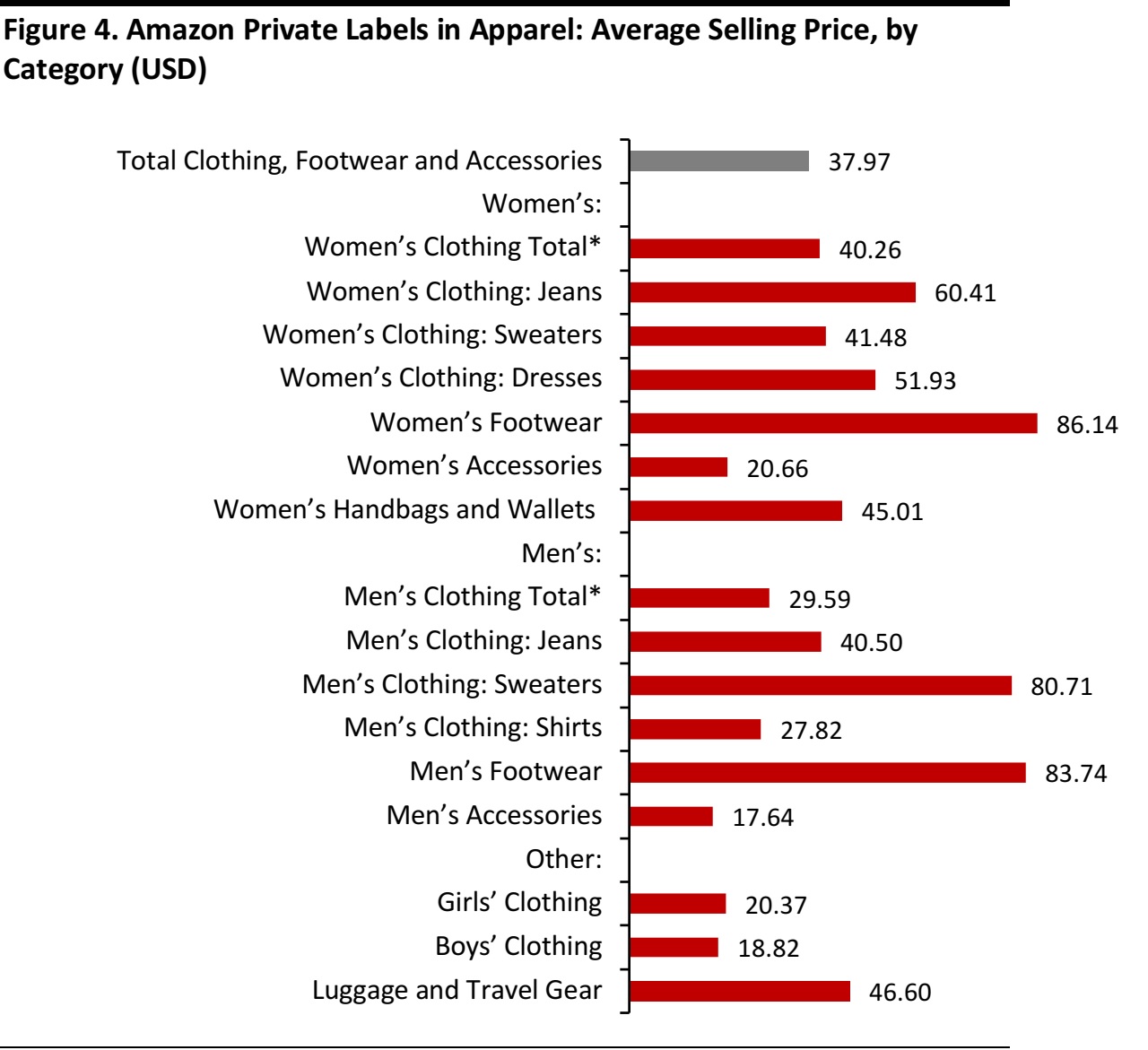

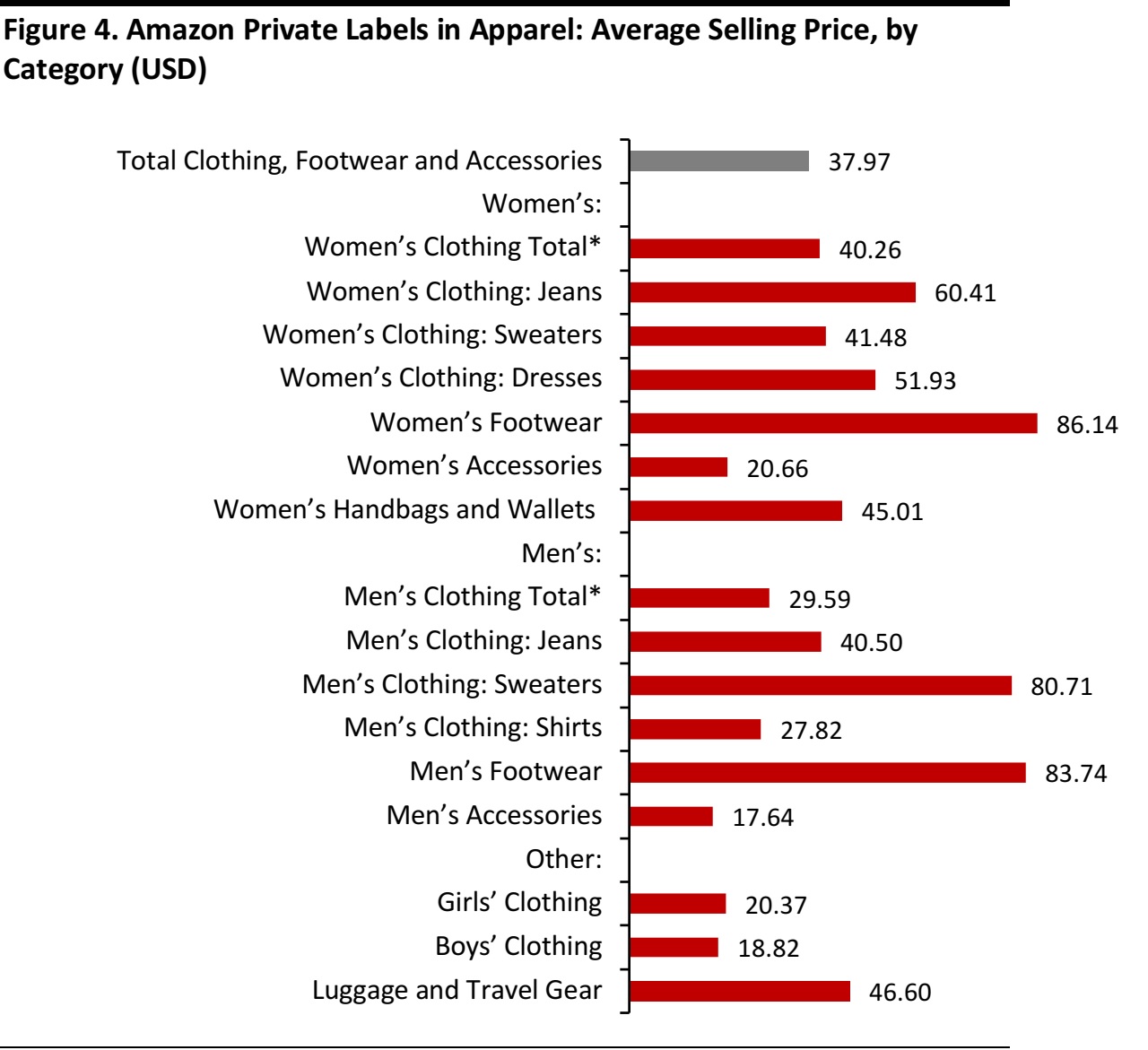

3. Amazon’s Average Apparel Product Sells for $38

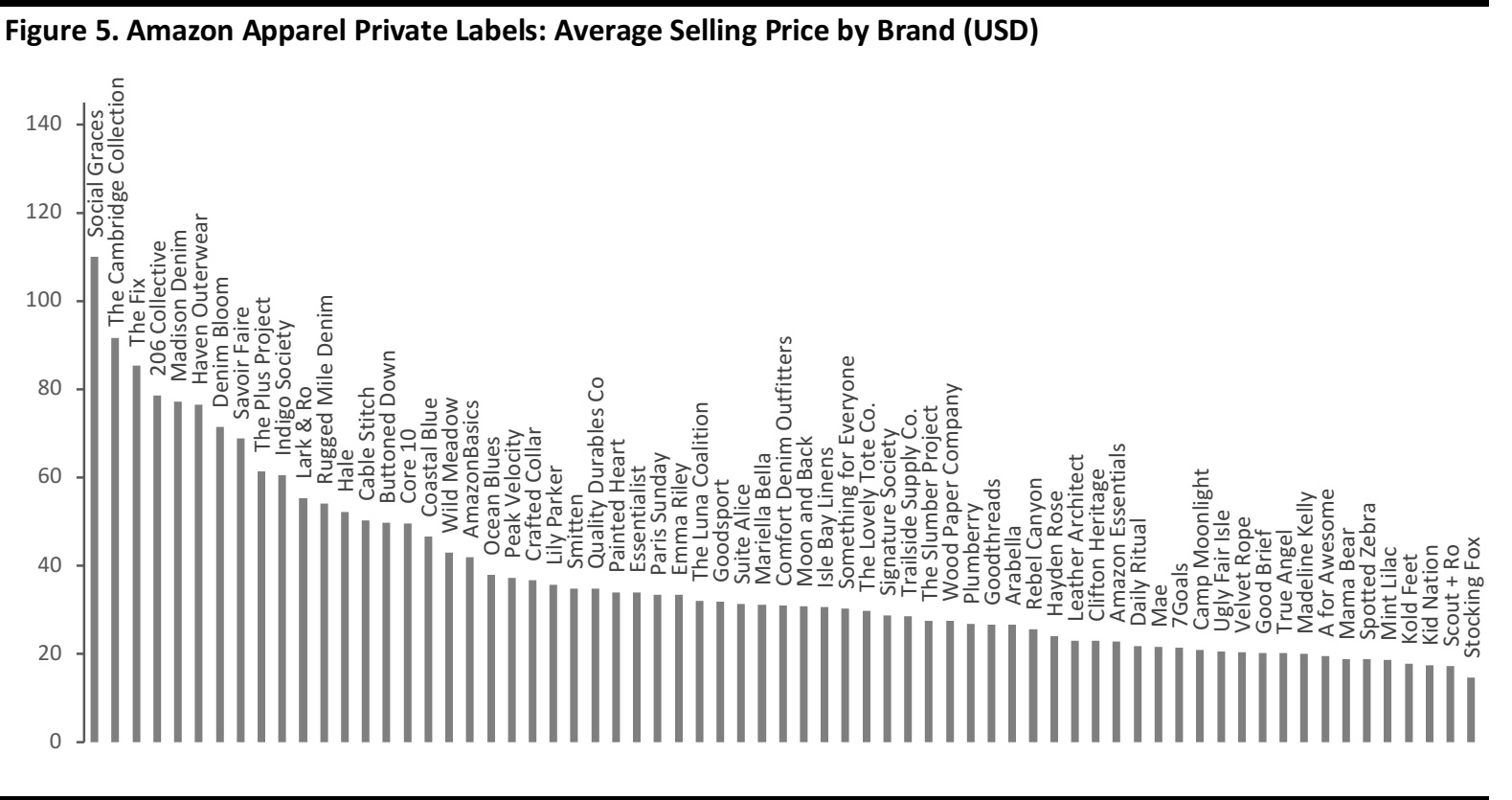

The average item of Amazon private-label apparel sells for $38, a price that implies a midmarket positioning. However, that average conceals a wide range of price points that reflect Amazon’s tiered proposition spanning budget to high-end; see the second graph below for average price per brand.

Moreover, childrenswear and accessories depress the average apparel price, while adult footwear pushes it up. For the core categories of women’s and men’s clothing, the average private-label item is sold for around $40 and $30, respectively. We show selected women’s and men’s clothing subcategories in the chart below.

*Selected subcategories shown.

Source: DataWeave/Coresight Research

*Selected subcategories shown.

Source: DataWeave/Coresight Research

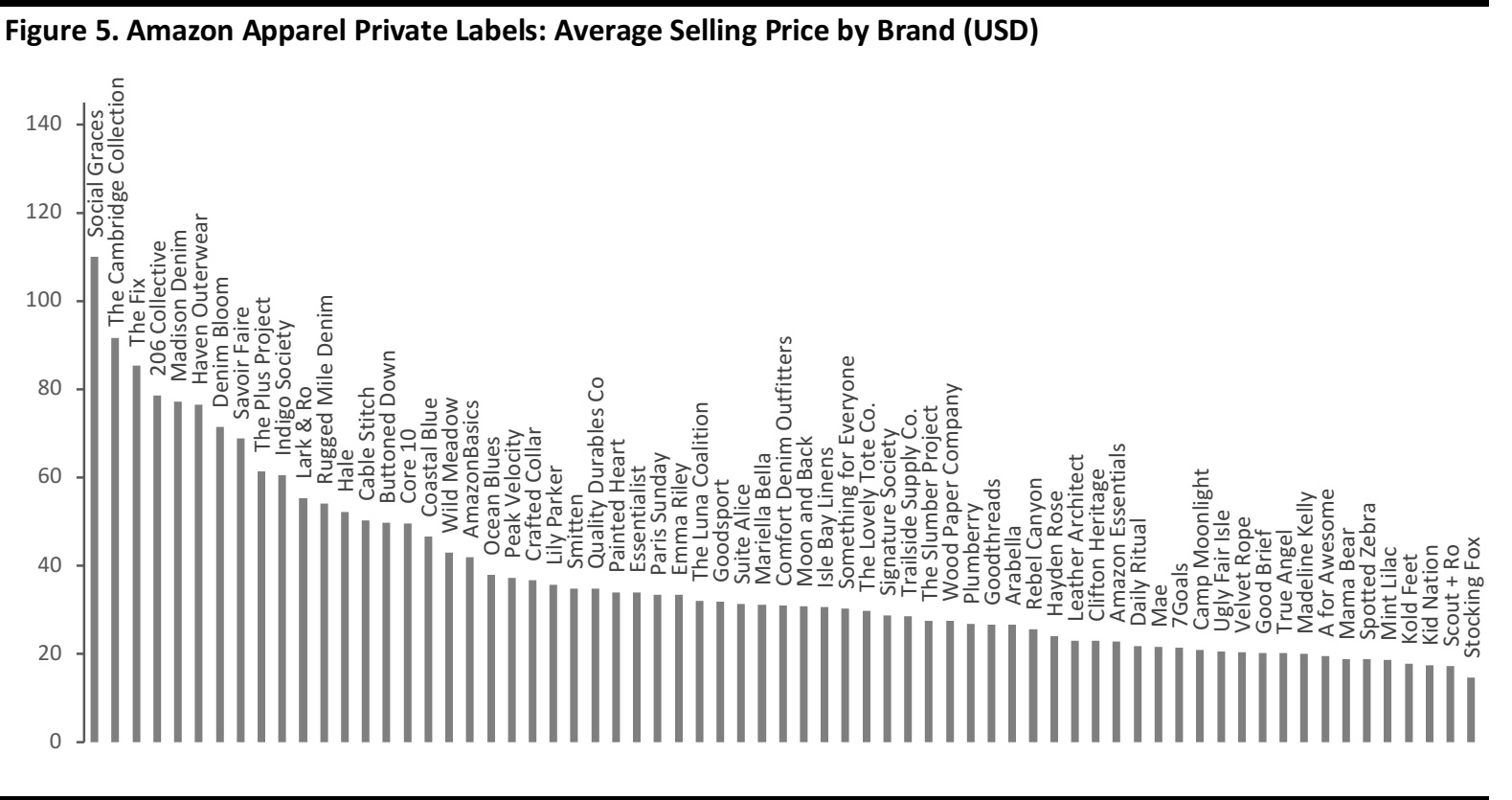

Underlining the stratified nature of Amazon’s fashion offering, we recorded substantial differences in average selling prices between its private labels:

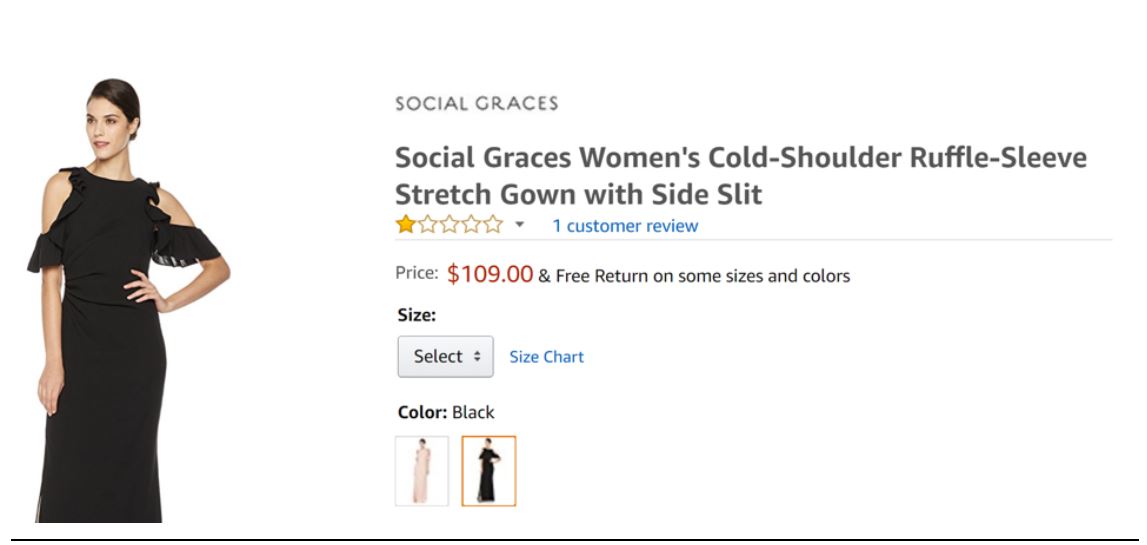

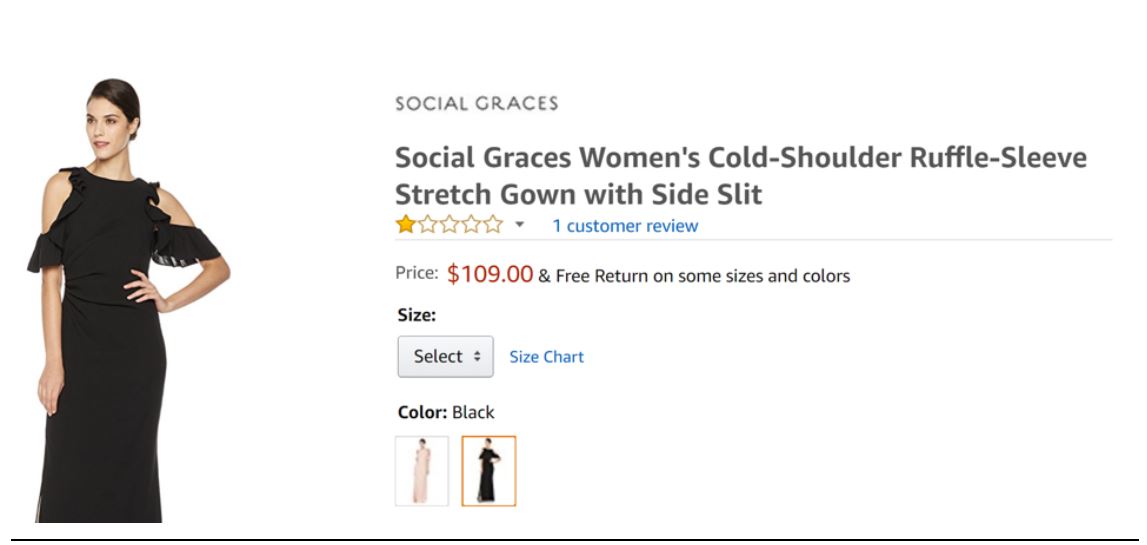

- Social Graces: At $110, formal-dress brand Social Graces had the highest average price of all Amazon’s apparel private labels.

- The Cambridge Collection: Also focusing on formal dresses, the Cambridge Collection was the second-most-expensive brand, with an average selling price of $92.

- Lark & Ro: Amazon’s core womenswear brand Lark & Ro registered an average item price of $55.

- Amazon Essentials: Budget-friendly Amazon Essentials recorded an average selling price of just under $23.

- Scout + Ro: Products in the flagship kidswear brand Scout + Ro sell for an average $17.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Social Graces is Amazon’s most expensive private label.

Source: DataWeave/Coresight Research

Social Graces is Amazon’s most expensive private label.

Source: DataWeave/Coresight Research

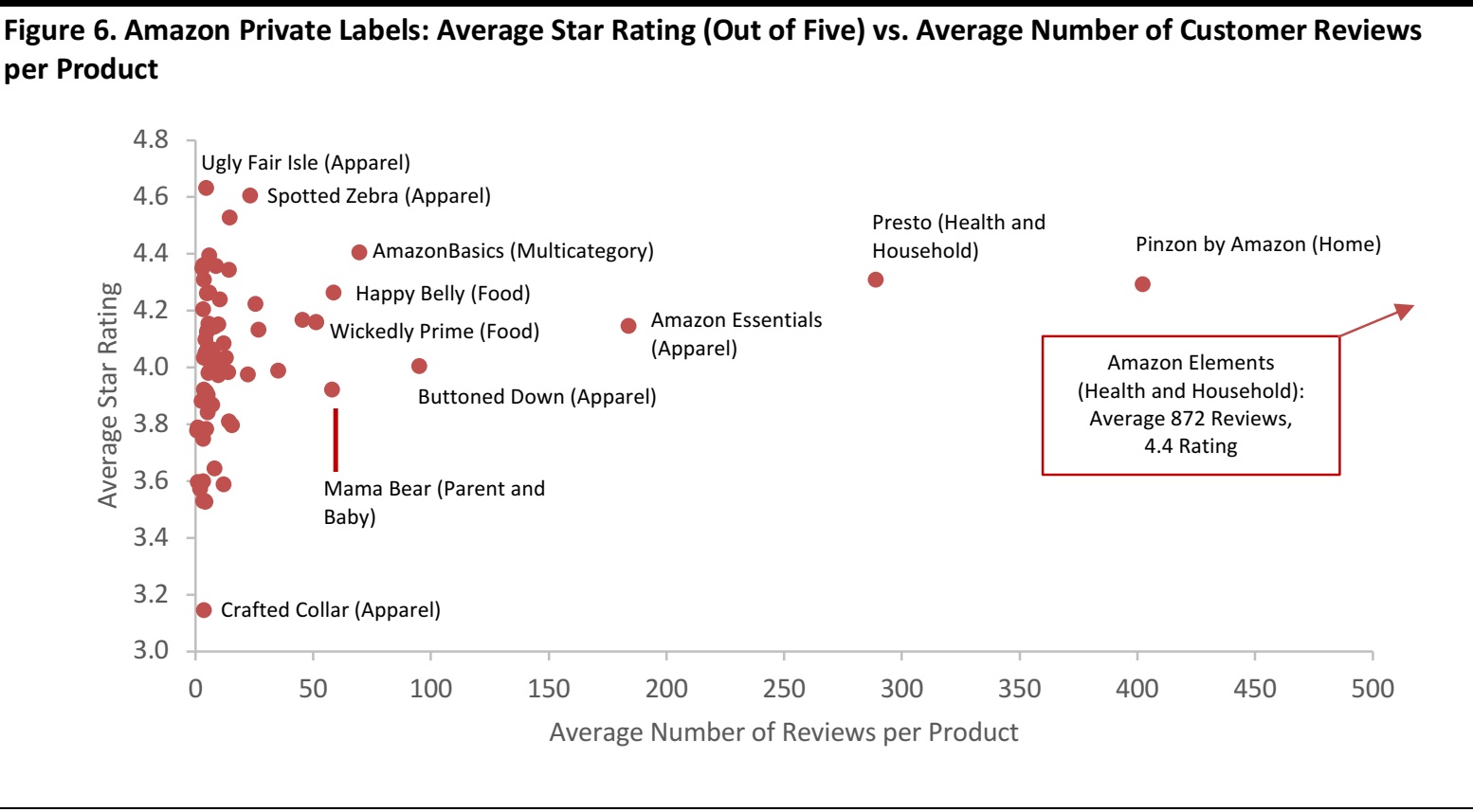

4. Customers Give Amazon Private Labels Four Stars Out of Five

The data so far have illustrated what Amazon offers. But what are customers buying and how do they view Amazon’s private labels?

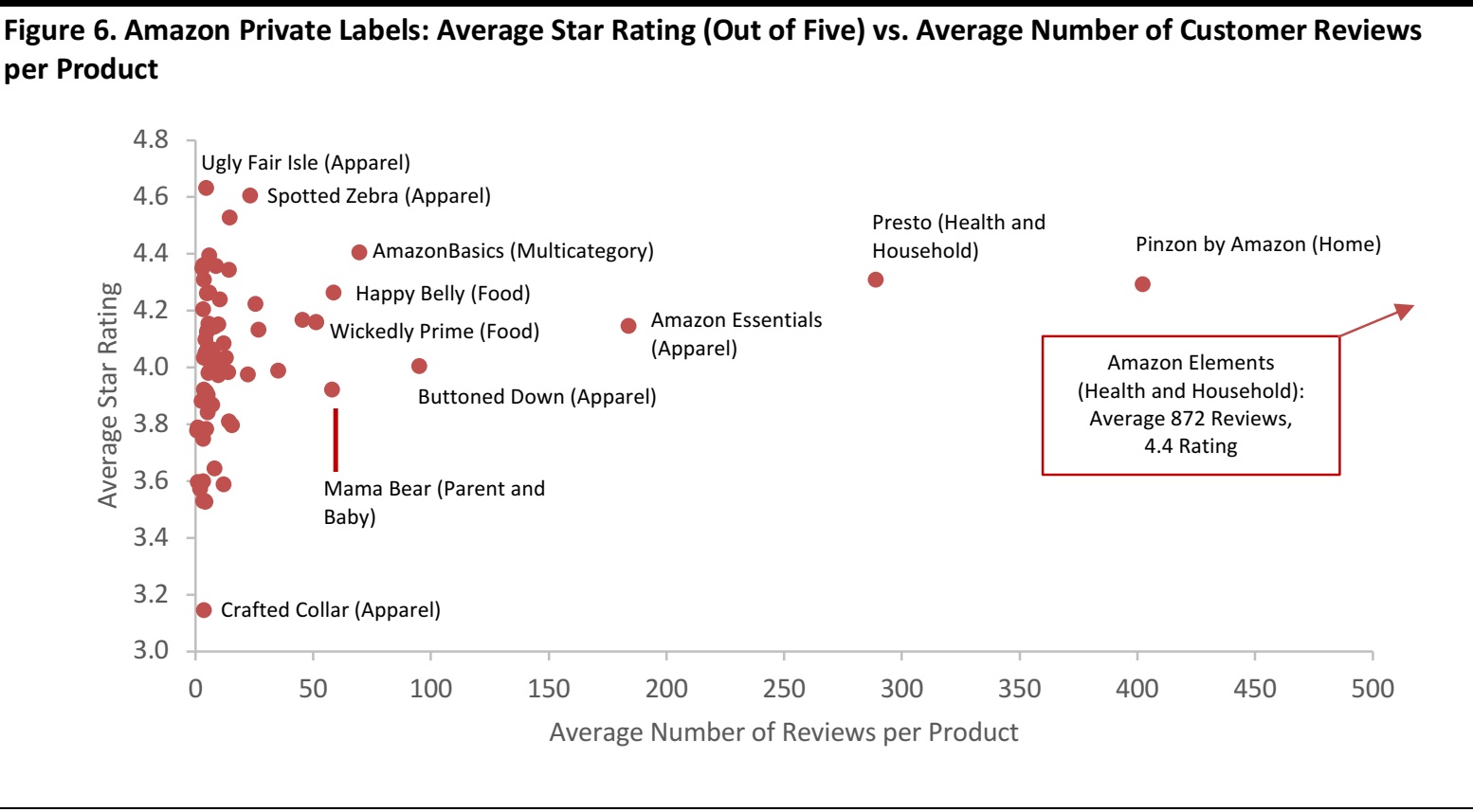

In the absence of hard sales data from Amazon, one potential indication of unit sales is the number of customer reviews each product and brand receives: a greater number of reviews implies higher unit sales. We recognize that this could be skewed by the type of product: for example, parents may be passionate about providing reviews of baby products; although, as we show below, boring products such as batteries generate a lot of reviews.

At the same time, customer satisfaction with Amazon’s private labels can be measured by the average star rating customers leave in those reviews. We chart both sets of data in the graph below.

- The data show a handful of brands generating very high volumes of reviews and this is often driven by a few products with a very high number of reviews.

- The average Amazon private-label product generates a customer rating of four stars out of five, suggesting overall solid customer satisfaction levels. However, this average conceals a range from 3.1 for menswear brand Crafted Collar to 4.6 for boys’ and girls’ apparel brand Spotted Zebra, and for womenswear and girls’ clothing brand Ugly Fair Isle.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

High-volume grocery-store items are among the most-reviewed of Amazon’s private labels, though the ranges are often very limited:

- Amazon Elements is Amazon’s most-reviewed private-label brand, per product. It also sees a relatively high star rating of 4.4 out of 5. The number of customer reviews is boosted by two baby-wipe products, which have each garnered over 10,000 customer reviews. Launched in 2014, Amazon Elements baby wipes were among Amazon’s first private-label products in nondurable, grocery-store categories. The brand offers only 28 products in total.

- Presto offers just nine products across detergents and household paper products, and a number of these have generated several hundred reviews, implying substantial consumer trial of the brand.

- Wickedly Prime is Amazon’s core food brand, with 81 products. Its products have each generated an average 51 reviews and a score of 4.2. Amazon’s second food brand, Happy Belly, scores an average of 4.3 from 58 reviews per product; it offers just 43 products.

High numbers of reviews for Pinzon by Amazon and AmazonBasics suggest that consumers are trying Amazon’s brands for selected nongrocery, nonapparel categories:

- Pinzon by Amazon, a home-textiles brand, sees a high number of reviews and a relatively high average score of 4.3. Its average review count is boosted by two items: a six-piece towel set attracts more than 6,000 customer reviews and a hypoallergenic mattress topper has garnered more than 7,000 customer opinions.

- AmazonBasics is highly reviewed, although it is also Amazon’s oldest private label. Like Amazon Elements, it registers an average rating of 4.4 stars out of 5. Two AmazonBasics products have generated an exceptionally large number of reviews: a USB charging cable has prompted more than 57,000 shoppers to post a review, making it the most-reviewed private-label product on Amazon. Meanwhile, a pack of 48 AA AmazonBasics batteries has got more than 20,000 customers excited enough to share their thoughts.

An AmazonBasics USB charging cable is the most-reviewed private-label product on Amazon.com.

Source: Amazon.com

An AmazonBasics USB charging cable is the most-reviewed private-label product on Amazon.com.

Source: Amazon.com

- Lark & Ro is Amazon’s biggest apparel private label, with 578 products, but it sees only an average number of reviews by product. Lark & Ro’s average rating is just 3.8.

These Amazon baby wipes have attracted more than 10,000 customer reviews.

Source: Amazon.com

These Amazon baby wipes have attracted more than 10,000 customer reviews.

Source: Amazon.com

In More Detail

Number of Products per Category: Apparel and Home Products Dominate the Offering

We have already noted the prominence of apparel and home goods in Amazon’s own-branded offering. We provide a full breakdown of categories below, and this shows the long tail of Amazon’s category presence.

- Beauty and personal care: Amazon’s private-label offering in this category is negligible. The two products offered are durable goods—washcloths and a toiletries bag—both from AmazonBasics.

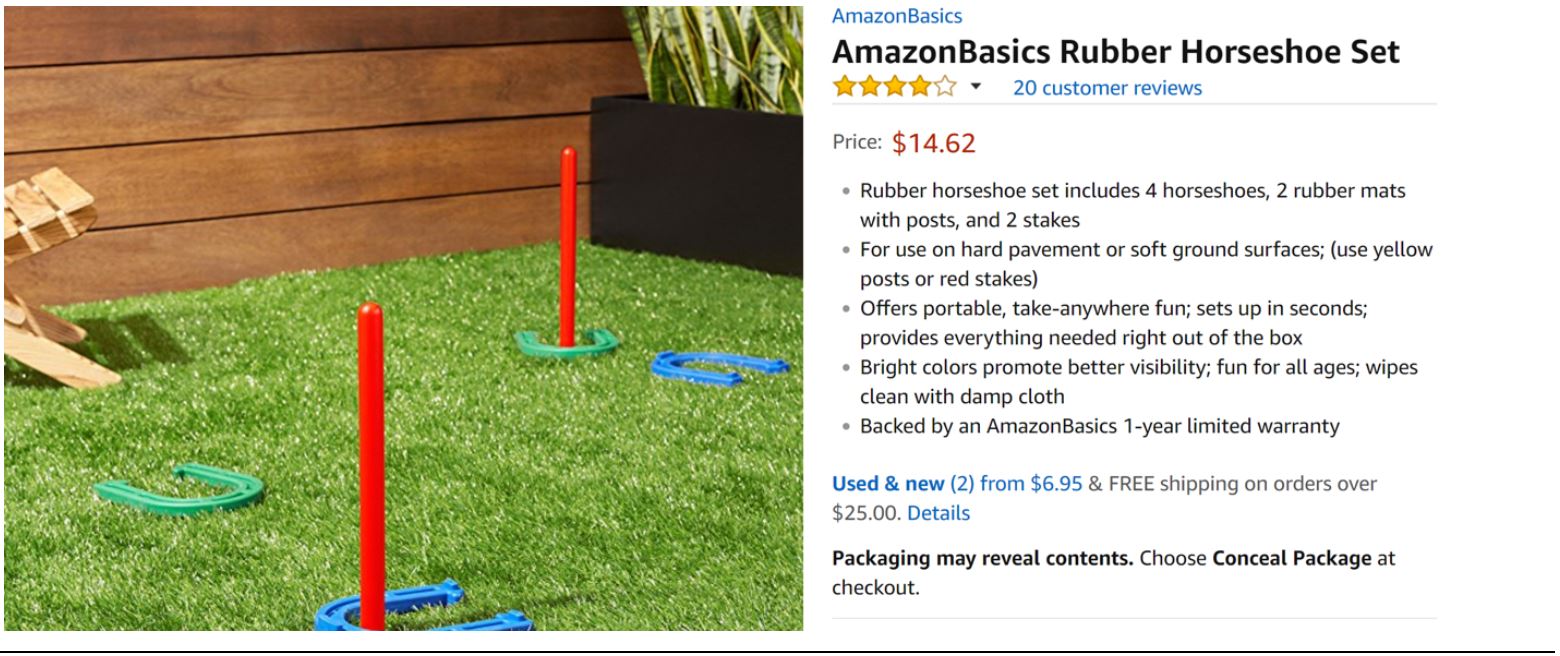

- Toys and games: Amazon offers just one private-label product in toys and games: a horseshoe-throwing game from AmazonBasics. Toys and games already see a high e-commerce penetration rate, suggesting opportunities for Amazon to build its own brands in the category.

*Includes luggage.

Source: DataWeave/Coresight Research

*Includes luggage.

Source: DataWeave/Coresight Research

An AmazonBasics Rubber Horseshoe Set is the only private-label product in toys and games.

Source: Amazon.com

An AmazonBasics Rubber Horseshoe Set is the only private-label product in toys and games.

Source: Amazon.com

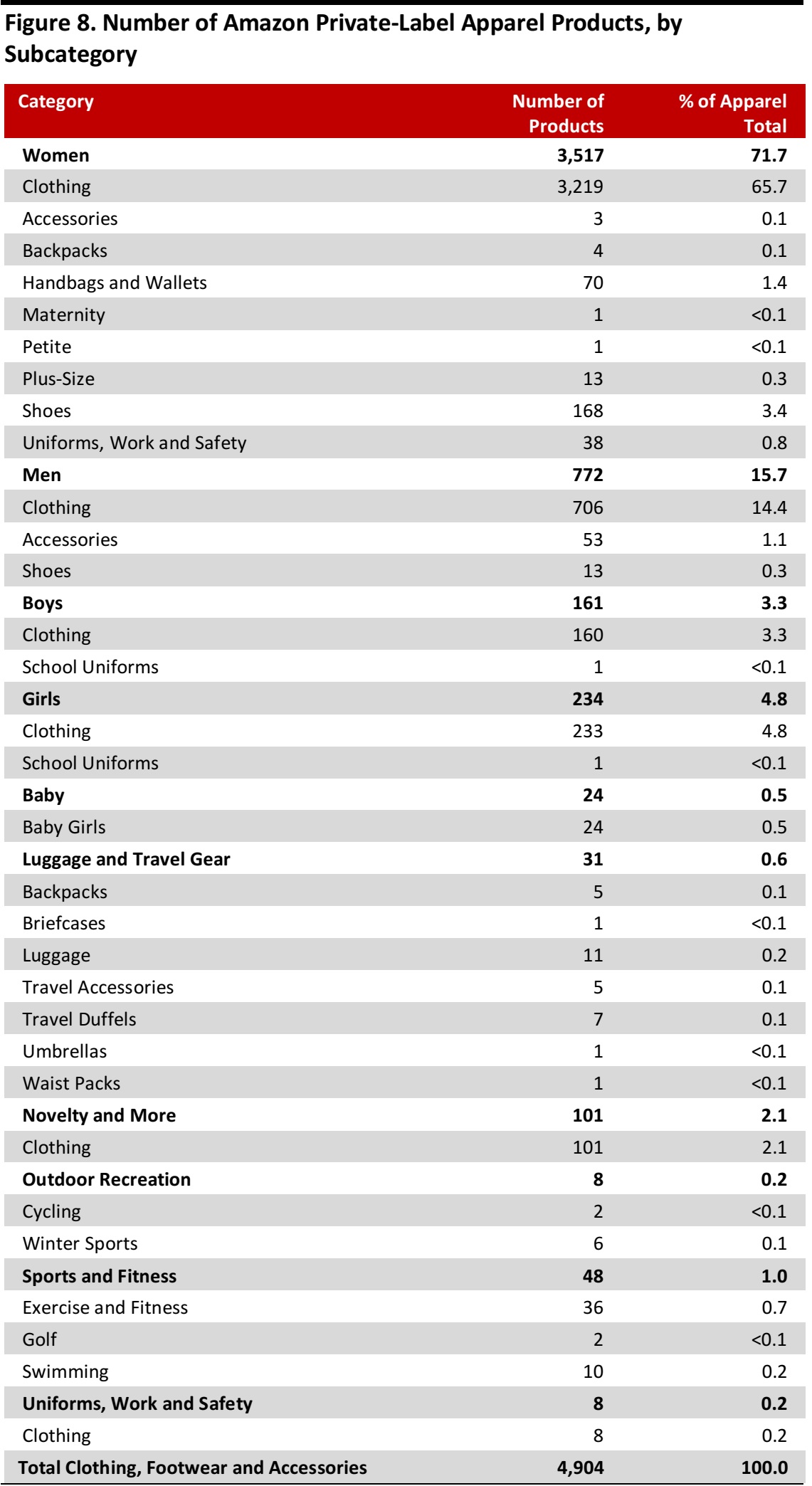

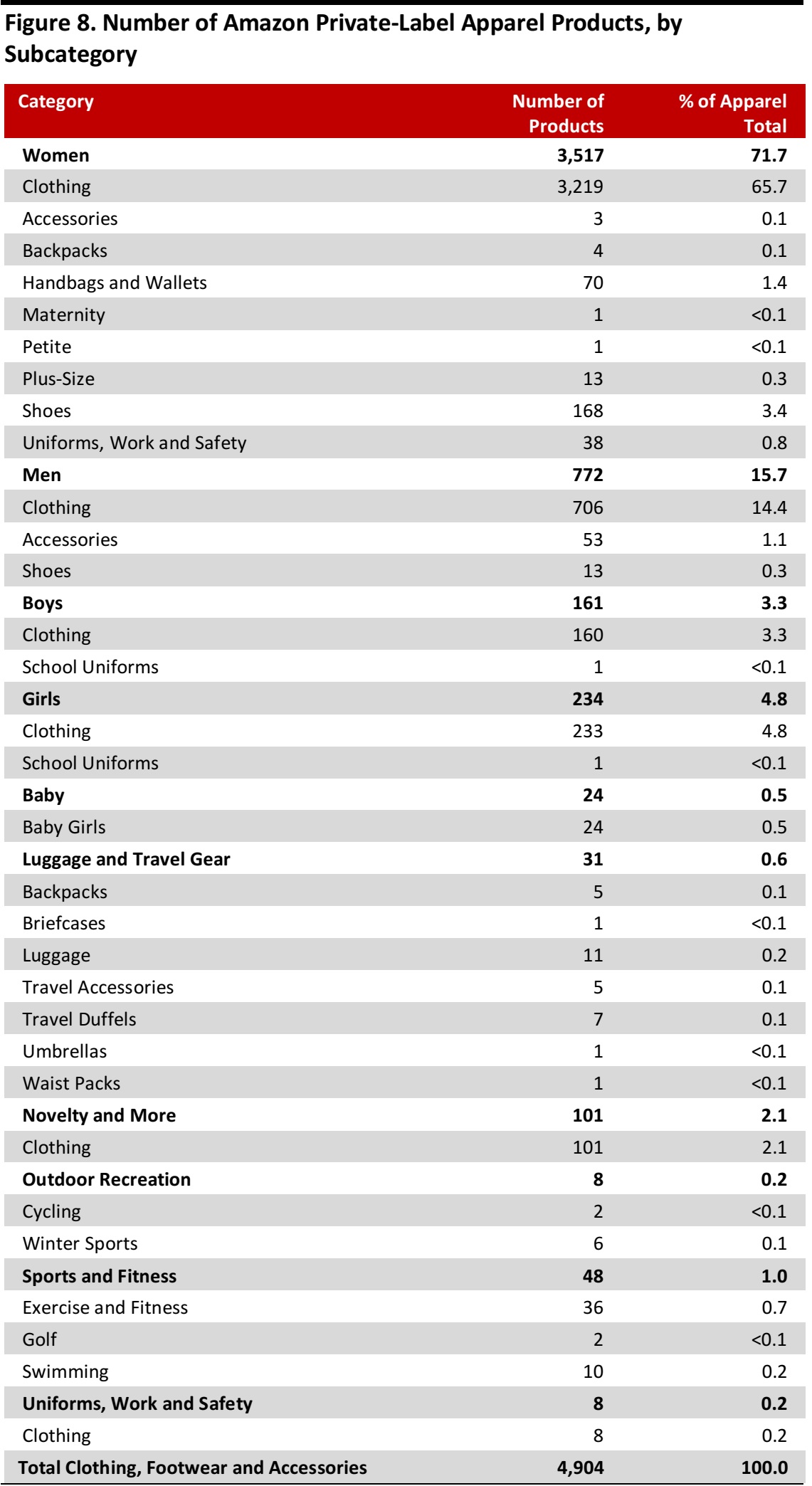

Amazon’s Private-Label Offering in Clothing, Footwear and Accessories

Apparel is the cornerstone of Amazon’s private-label ranges. Below, we break down this apparel offering by subcategory.

Womenswear accounts for almost 72% of all Amazon’s apparel private-label products, a far greater proportion than its approximate 50% share of the total clothing market.

Source: iStockphoto

Source: iStockphoto

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

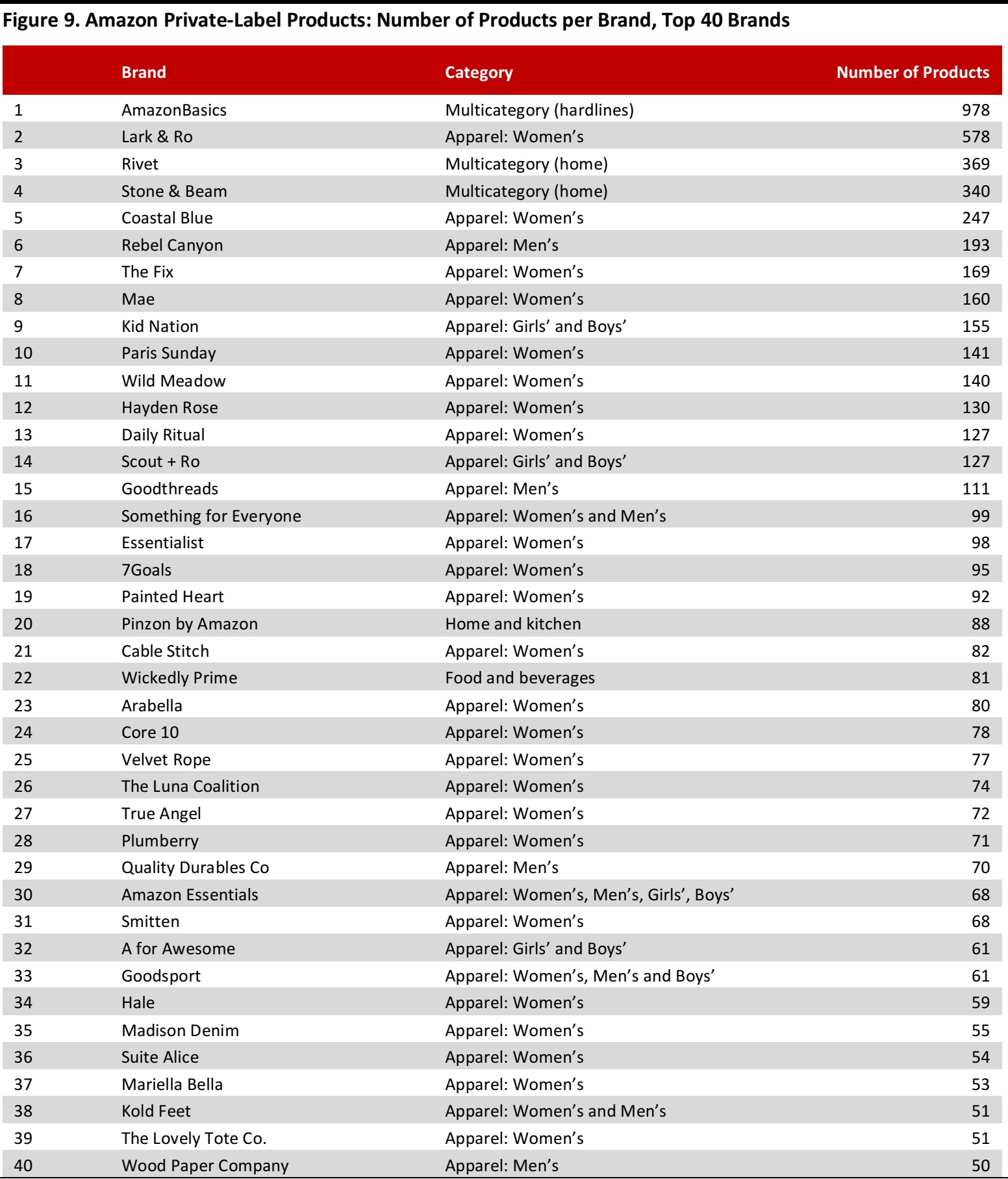

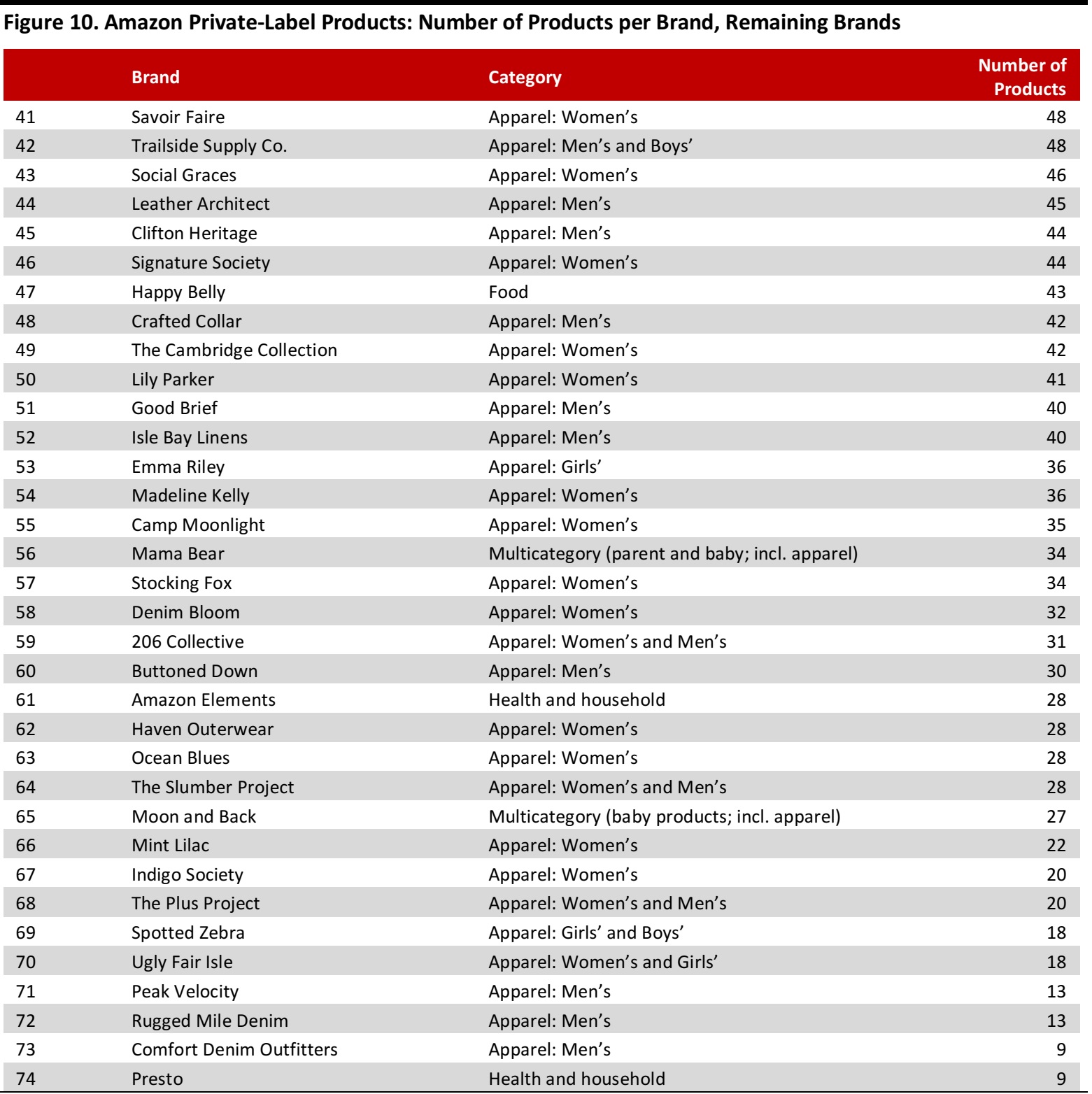

Number of Products per Brand: AmazonBasics and Lark & Ro Lead the Pack

Finally, we offer a roundup of all 74 identified private labels, ranked by number of products and noting their category presence.

- AmazonBasics is by far the biggest of those labels, by number of products, at 978 items. AmazonBasics is sold in a number of categories that include computers, electronics, home and kitchen, automotive accessories and luggage.

- Lark & Ro is Amazon’s biggest category-specific private label, with nearly 600 apparel products.

- As we noted earlier, some 66 of the 74 brands have some apparel offering.

- Amazon’s private-label offering in grocery categories such as food and household care, as represented by brands such as Wickedly Prime, Happy Belly, Amazon Elements and Presto, remains limited.

We conclude by emphasizing that the dominance of apparel brands reflects Amazon’s segmented approach to fashion: it has launched brands that are designed to focus on particular subcategories, such as sleepwear or denim, or resonate with a particular consumer segment.

We break down the brands into two tables, below.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

About DataWeave

Powered by proprietary artificial intelligence (AI), DataWeave provides actionable competitive-intelligence-as-a-service to retailers and consumer brands in near real time by aggregating and analyzing data from the web. While retailers use DataWeave’s Retail Intelligence product to make smarter pricing and merchandising decisions and drive profitable growth, consumer brands use DataWeave’s Brand Analytics product to protect their brand equity online and optimize the experience delivered to shoppers on e-commerce websites. For more information, visit

www.dataweave.com.

Notes

The data in this report reflect products listed on Amazon.com in early May 2018. Our analysis generally uses the multilevel category definitions associated with each product on Amazon.com, with corrections to minor discrepancies in categorization. Further data and analysis are available on request.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Pinzon by Amazon is one of three private labels dedicated to home and kitchen goods.

Source: Amazon.com

Pinzon by Amazon is one of three private labels dedicated to home and kitchen goods.

Source: Amazon.com Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Rivet is an aspirational home-furnishings brand.

Source: Amazon.com

Rivet is an aspirational home-furnishings brand.

Source: Amazon.com

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Womenswear brand Lark & Ro is Amazon’s second-biggest private label, behind AmazonBasics.

Source: Amazon.com

Womenswear brand Lark & Ro is Amazon’s second-biggest private label, behind AmazonBasics.

Source: Amazon.com *Selected subcategories shown.

Source: DataWeave/Coresight Research

*Selected subcategories shown.

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Social Graces is Amazon’s most expensive private label.

Source: DataWeave/Coresight Research

Social Graces is Amazon’s most expensive private label.

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research An AmazonBasics USB charging cable is the most-reviewed private-label product on Amazon.com.

Source: Amazon.com

An AmazonBasics USB charging cable is the most-reviewed private-label product on Amazon.com.

Source: Amazon.com These Amazon baby wipes have attracted more than 10,000 customer reviews.

Source: Amazon.com

These Amazon baby wipes have attracted more than 10,000 customer reviews.

Source: Amazon.com *Includes luggage.

Source: DataWeave/Coresight Research

*Includes luggage.

Source: DataWeave/Coresight Research An AmazonBasics Rubber Horseshoe Set is the only private-label product in toys and games.

Source: Amazon.com

An AmazonBasics Rubber Horseshoe Set is the only private-label product in toys and games.

Source: Amazon.com Source: iStockphoto

Source: iStockphoto Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research