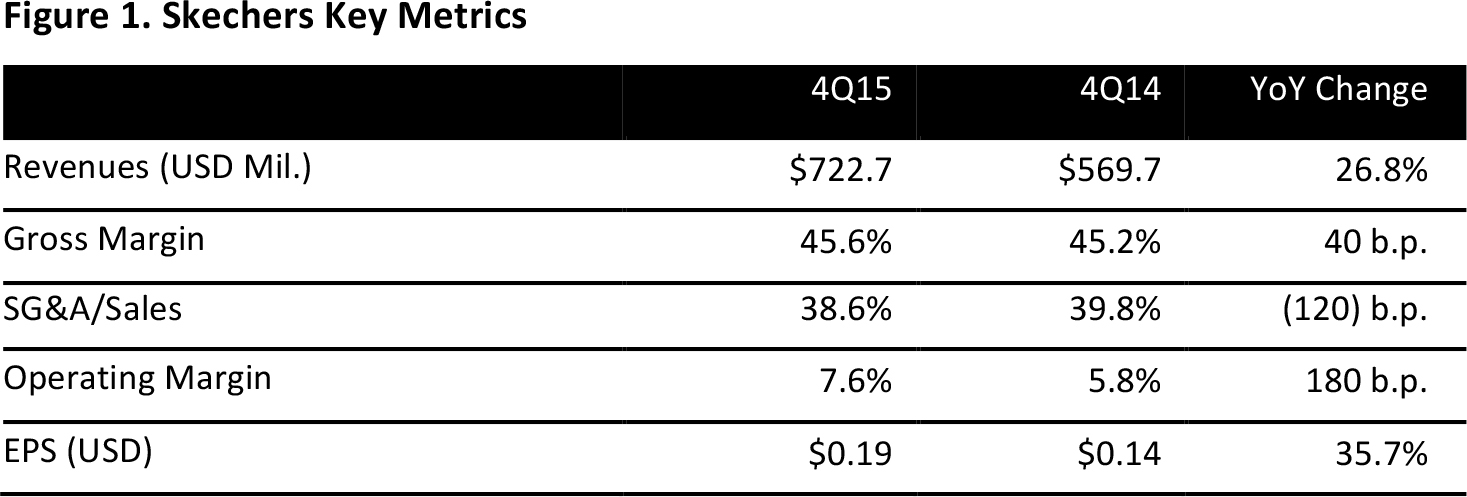

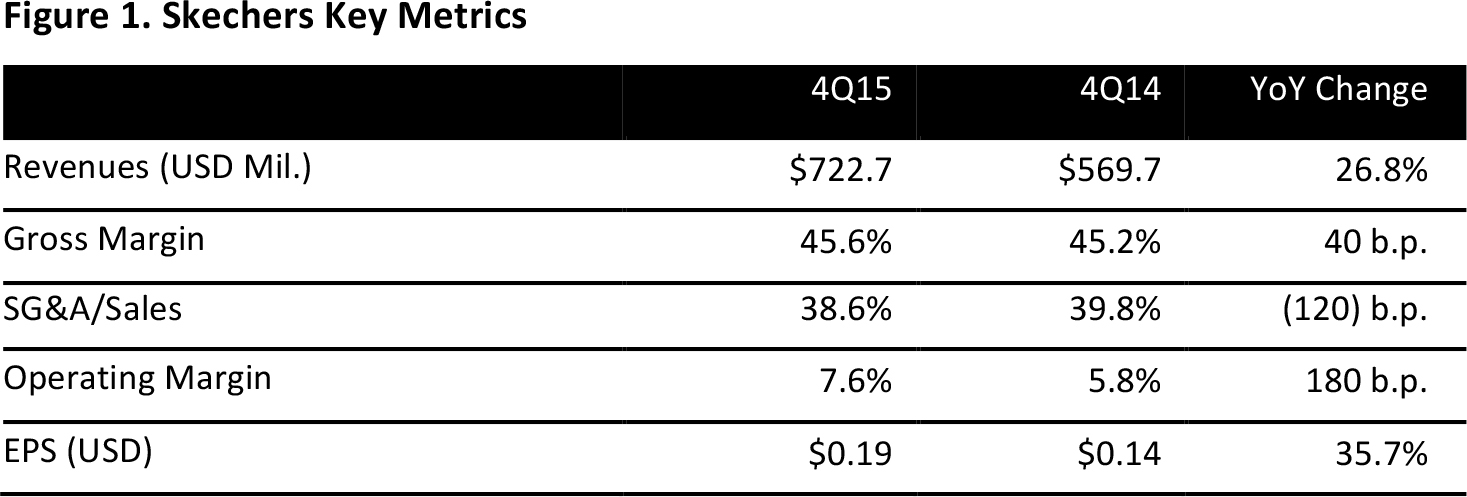

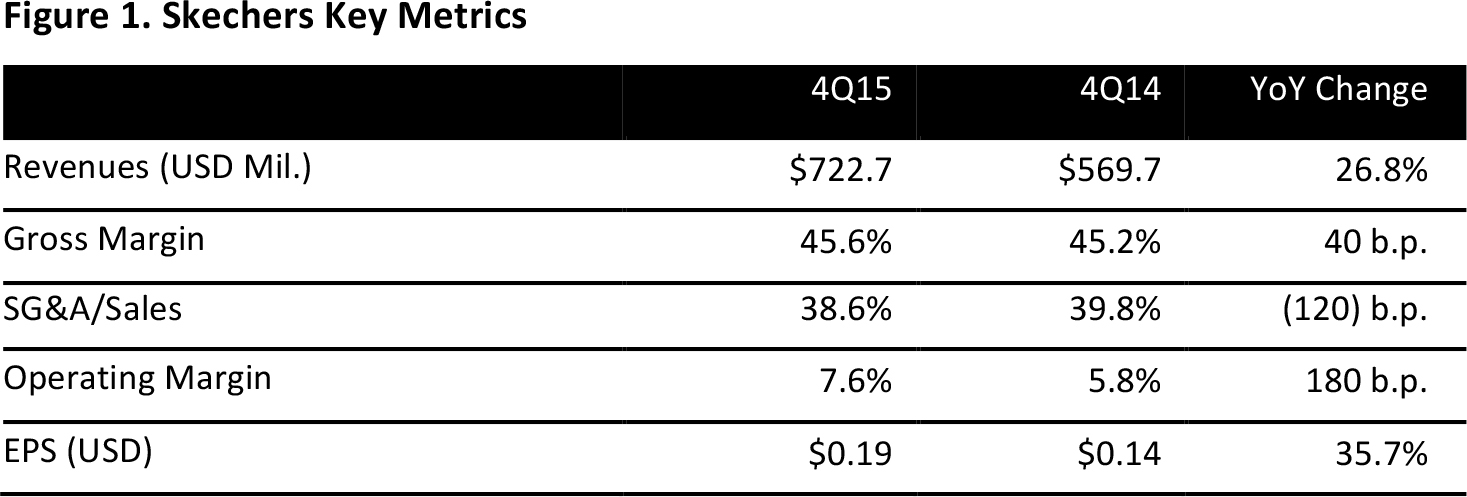

Source: Company reports

Skechers reported 4Q15 EPS of $0.19 versus the consensus estimate of $0.20.

Total revenue was $722.7 million, an increase of 26.8% year over year, versus expectations of $693.5 million. Domestic wholesale sales increased at a high-single-digit rate, while international wholesale sales and retail segment sales both increased at a double-digit rate. Growth was driven by sales across men’s, women’s and kids’ categories. During the period, international sales represented 41% of total sales. The figure edged the company closer to its goal of international accounting for half its business over the next two to three years.

Sales have been driven by increased shelf space at existing retailers and growth in the retail channel to 1,300 stores, which are a combination of company-owned and third-party-owned outlets. The company’s strategy has centered on continued product innovation and expansion into new categories. Skechers believes it will have 1,650 stores by the end of 2016.

Backlog orders were up 9.5% as of the end of December, and were impacted by some distributors pulling forward orders from January to December.

Management provided 1Q16 guidance for EPS of $0.50–$0.55 versus consensus of $0.52. Total revenue is expected to be $885–$920 million versus consensus of $895.7 million. According to the company, 1Q16 started off strong; January sales were up 35% and the first week of February was also strong. Company-owned retail stores are on track to achieve mid- to high-single-digit comps in January.