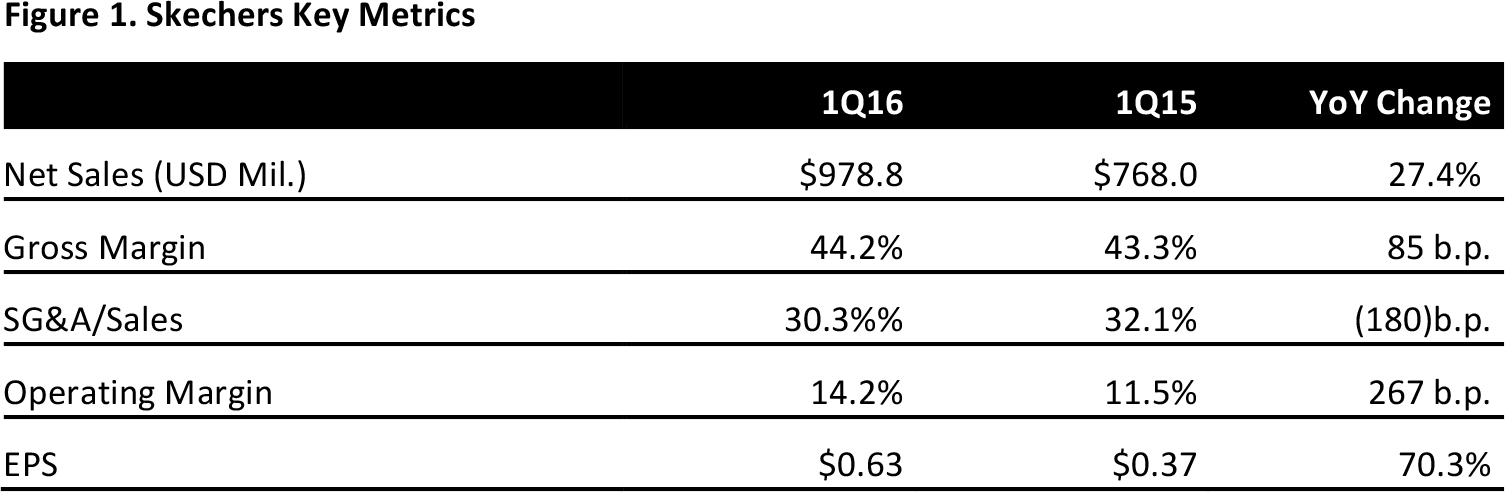

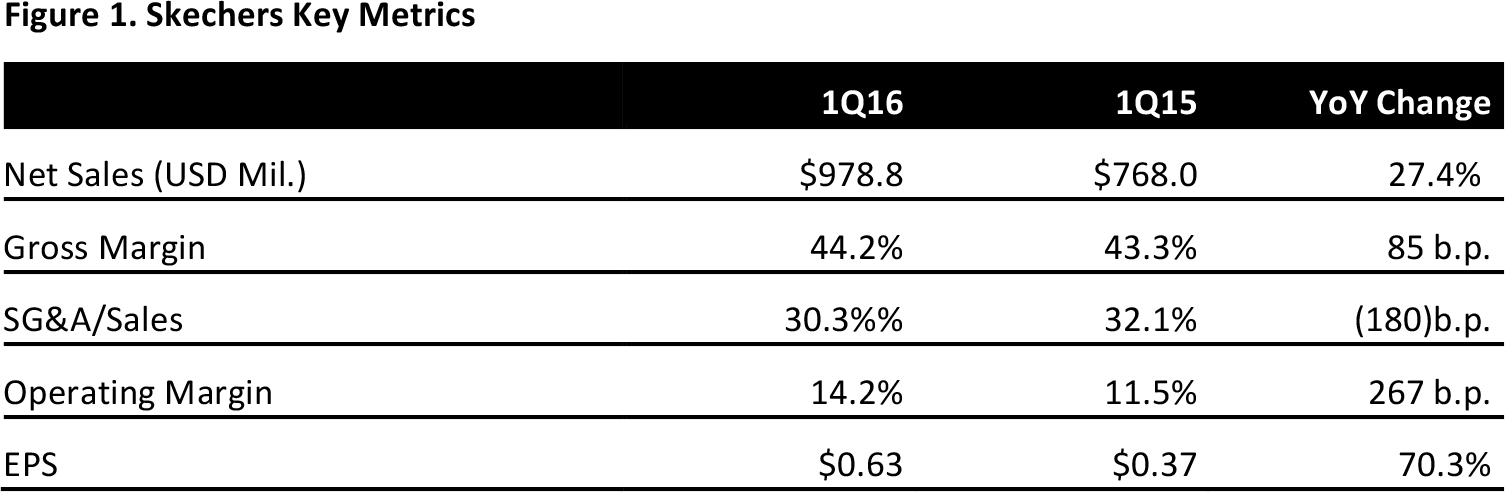

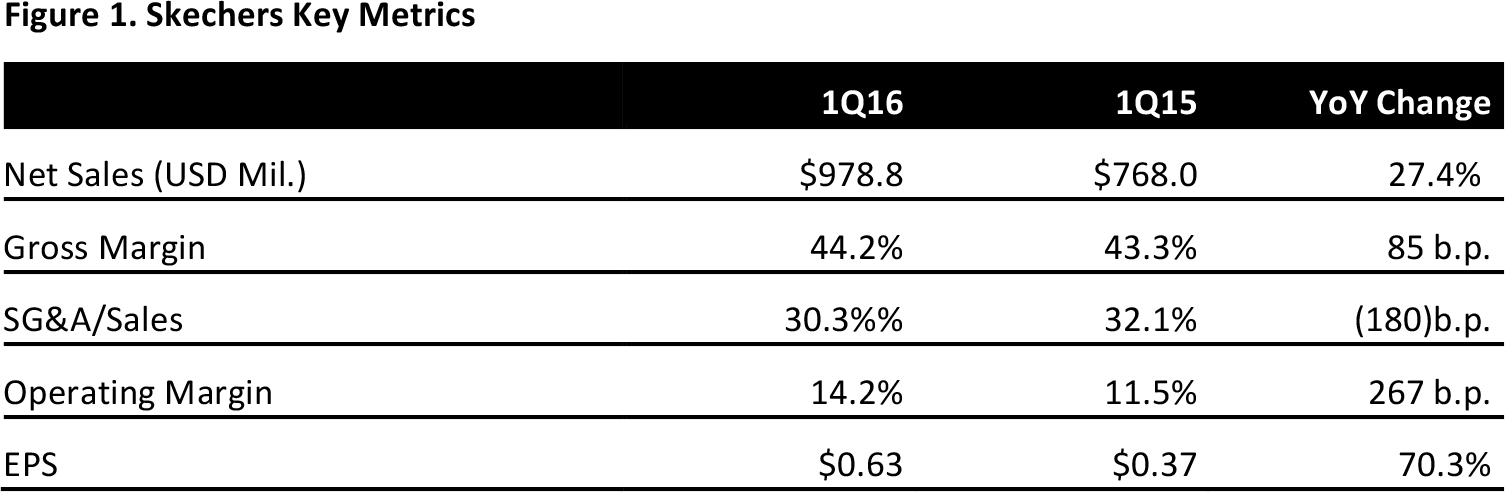

Source: Company reports

In 1Q16, Skechers reported total revenues of $978.8 million, up 27.4% from a year ago. Net earnings in the first quarter were $97.6 million, compared to $56.1 million in 1Q15. Reported EPS was $0.63, compared to $0.37 in the year-ago quarter. Both revenue and EPS results beat estimates.

The biggest contributor to the record performance was from Skechers’ international wholesale division, which reported a 47.1% increase year over year. The division became the largest business segment for the first time. Results were also boosted by the early timing of Easter this year. In addition, US domestic wholesale was up 12.1% and company-owned retail sales grew by 23.2%. Total comps were up 9.8% for the retail segment.

Management attributed the company’s success to the growing demand for its brands. The company also announced additional investments in infrastructure, including investments to improve the efficiency of its European Distribution Center, which shipped 3 million pairs of shoes during February. Management expects to be even more efficient in its largest market outside the US, namely Europe.

OUTLOOK

On the product side, the company plans to introduce new designs, including a retro sport line that global singing sensation Meghan Trainor will promote. International business will continue to be a growth driver; the company has seen substantial growth across Europe, Asia, the Middle East and the Americas.

The company provided guidance of $875–$900 million for 2Q16, below the consensus estimate of $912.9 million. This guidance assumes no significant shift of orders from the third quarter to the second quarter.