Nitheesh NH

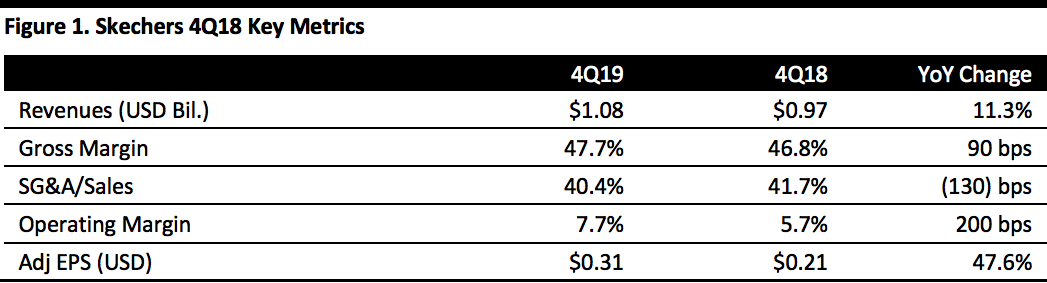

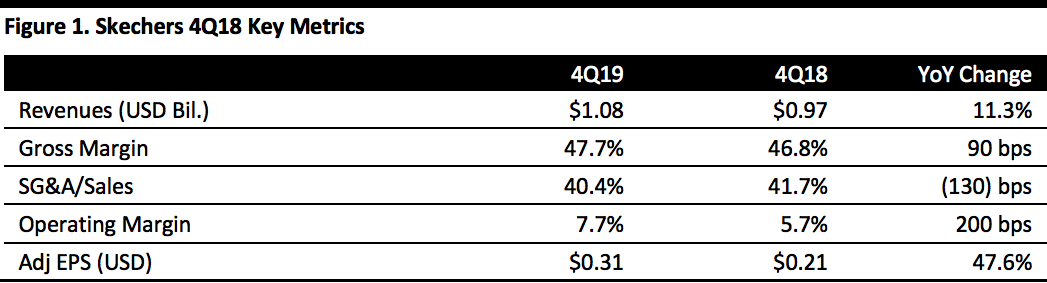

[caption id="attachment_71990" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Skechers reported 4Q18 EPS of $0.31, up 47.6% year over year and beating the $0.23 consensus estimate.

In 4Q18, the company grew sales 11.4% to $1.08 billion, missing the $1.1 billion consensus estimate. On a constant-currency basis, the company recorded $1.1 billion in sales, up 13.7% year over year, reflecting a $22.3 million currency adjustment.

The company’s international wholesale business grew 18.4%, missing the 20.2% consensus estimate. The global retail business increased 7.5%, lower than the 8.1% consensus estimate, while the domestic wholesale business grew 4.8%, missing the 9.0% consensus estimate.

Comparable same-store sales were up 1.1% in company-owned retail stores during the quarter, lower than the 2.4% consensus estimate. Comps were driven by a 3.0% increase in international stores and 0.4% increase in the U.S.

The company’s gross margin increased 90 basis points to 47.7%, beating the 46.9% consensus estimate. The increase was driven by improved retail pricing and product mix. Meanwhile, foreign currency exchange rates had a negative impact on gross margin.

SG&A expense as a percentage of sales fell 130 basis points to 40.4% compared with the year-ago period. However, SG&A expenses grew 7.9% to $436.8 million. The change in SG&A was due to the continued expansion in China and company-owned Skechers stores globally.

The company reported a 7.7% operating margin, up 200 basis points year over year and beating the consensus estimate of 5.9%.

In 2018, total inventory decreased $9.8 million to $863.3 million. Working capital increased $114.2 million to $1.62 billion from 2017.

Outlook

The company offered the following guidance for 1Q19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Skechers reported 4Q18 EPS of $0.31, up 47.6% year over year and beating the $0.23 consensus estimate.

In 4Q18, the company grew sales 11.4% to $1.08 billion, missing the $1.1 billion consensus estimate. On a constant-currency basis, the company recorded $1.1 billion in sales, up 13.7% year over year, reflecting a $22.3 million currency adjustment.

The company’s international wholesale business grew 18.4%, missing the 20.2% consensus estimate. The global retail business increased 7.5%, lower than the 8.1% consensus estimate, while the domestic wholesale business grew 4.8%, missing the 9.0% consensus estimate.

Comparable same-store sales were up 1.1% in company-owned retail stores during the quarter, lower than the 2.4% consensus estimate. Comps were driven by a 3.0% increase in international stores and 0.4% increase in the U.S.

The company’s gross margin increased 90 basis points to 47.7%, beating the 46.9% consensus estimate. The increase was driven by improved retail pricing and product mix. Meanwhile, foreign currency exchange rates had a negative impact on gross margin.

SG&A expense as a percentage of sales fell 130 basis points to 40.4% compared with the year-ago period. However, SG&A expenses grew 7.9% to $436.8 million. The change in SG&A was due to the continued expansion in China and company-owned Skechers stores globally.

The company reported a 7.7% operating margin, up 200 basis points year over year and beating the consensus estimate of 5.9%.

In 2018, total inventory decreased $9.8 million to $863.3 million. Working capital increased $114.2 million to $1.62 billion from 2017.

Outlook

The company offered the following guidance for 1Q19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Skechers reported 4Q18 EPS of $0.31, up 47.6% year over year and beating the $0.23 consensus estimate.

In 4Q18, the company grew sales 11.4% to $1.08 billion, missing the $1.1 billion consensus estimate. On a constant-currency basis, the company recorded $1.1 billion in sales, up 13.7% year over year, reflecting a $22.3 million currency adjustment.

The company’s international wholesale business grew 18.4%, missing the 20.2% consensus estimate. The global retail business increased 7.5%, lower than the 8.1% consensus estimate, while the domestic wholesale business grew 4.8%, missing the 9.0% consensus estimate.

Comparable same-store sales were up 1.1% in company-owned retail stores during the quarter, lower than the 2.4% consensus estimate. Comps were driven by a 3.0% increase in international stores and 0.4% increase in the U.S.

The company’s gross margin increased 90 basis points to 47.7%, beating the 46.9% consensus estimate. The increase was driven by improved retail pricing and product mix. Meanwhile, foreign currency exchange rates had a negative impact on gross margin.

SG&A expense as a percentage of sales fell 130 basis points to 40.4% compared with the year-ago period. However, SG&A expenses grew 7.9% to $436.8 million. The change in SG&A was due to the continued expansion in China and company-owned Skechers stores globally.

The company reported a 7.7% operating margin, up 200 basis points year over year and beating the consensus estimate of 5.9%.

In 2018, total inventory decreased $9.8 million to $863.3 million. Working capital increased $114.2 million to $1.62 billion from 2017.

Outlook

The company offered the following guidance for 1Q19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Skechers reported 4Q18 EPS of $0.31, up 47.6% year over year and beating the $0.23 consensus estimate.

In 4Q18, the company grew sales 11.4% to $1.08 billion, missing the $1.1 billion consensus estimate. On a constant-currency basis, the company recorded $1.1 billion in sales, up 13.7% year over year, reflecting a $22.3 million currency adjustment.

The company’s international wholesale business grew 18.4%, missing the 20.2% consensus estimate. The global retail business increased 7.5%, lower than the 8.1% consensus estimate, while the domestic wholesale business grew 4.8%, missing the 9.0% consensus estimate.

Comparable same-store sales were up 1.1% in company-owned retail stores during the quarter, lower than the 2.4% consensus estimate. Comps were driven by a 3.0% increase in international stores and 0.4% increase in the U.S.

The company’s gross margin increased 90 basis points to 47.7%, beating the 46.9% consensus estimate. The increase was driven by improved retail pricing and product mix. Meanwhile, foreign currency exchange rates had a negative impact on gross margin.

SG&A expense as a percentage of sales fell 130 basis points to 40.4% compared with the year-ago period. However, SG&A expenses grew 7.9% to $436.8 million. The change in SG&A was due to the continued expansion in China and company-owned Skechers stores globally.

The company reported a 7.7% operating margin, up 200 basis points year over year and beating the consensus estimate of 5.9%.

In 2018, total inventory decreased $9.8 million to $863.3 million. Working capital increased $114.2 million to $1.62 billion from 2017.

Outlook

The company offered the following guidance for 1Q19:

- Sales of between $1.275 billion and $1.3 billion.

- EPS in the range of $0.70 to $0.75.