DIpil Das

[caption id="attachment_93222" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

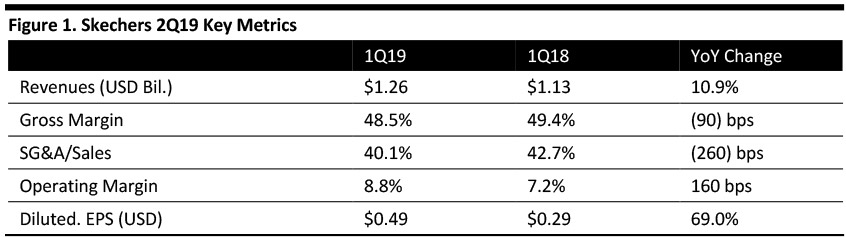

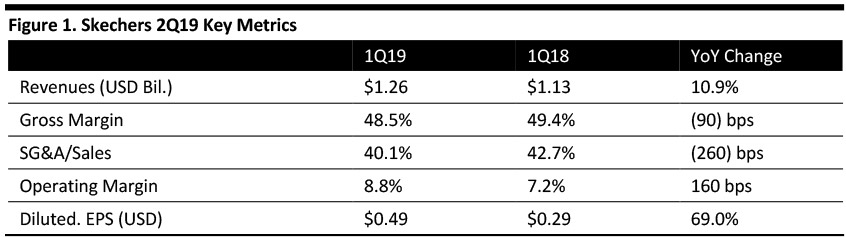

Skechers reported 2Q19 EPS of $0.49, up 69.0% year over year and beating the consensus estimate of $0.34.

2Q19 sales increased 10.9% (up 13.7% on a currency-neutral basis) to $1.26 billion, beating the $1.22 billion consensus estimate. Skechers’ company-owned global retail business grew 19.8% and its domestic business grew 1.5%. On a constant-currency basis, its international wholesale business increased 18.2%. However, its domestic wholesale business declined 3.8%.

Comparable same-store sales were up 4.9% in company-owned retail stores and e-commerce during the quarter, beating the consensus estimate of 0.5%. US comps grew 4.2% and international comps increased 6.7%.

Gross margin declined 90 basis points to 48.5%, missing the 49.5% consensus estimate. The decline is a result of clearing seasonal merchandise in select international markets, offset by higher domestic margins from improved retail pricing and product mix in its direct-to-consumer and domestic wholesale businesses.

SG&A expense as a percentage of sales fell 260 basis points to 40.1%. SG&A expenses decreased 4.2% to $505.1 million. Selling expense decreased $500,000 but general and administrative expenses increased $20.7 million. This reflects $18.5 million in spending associated with the opening of 39 new company-owned Skechers stores in the past year, including 12 that opened in 2Q19.

The company reported earnings from operations of $111.1 million, up 36.5% year over year. Operating margin expanded 160 basis points to 8.8%, beating the consensus estimate of 7.0%.

In 2Q19, total inventory increased $33.2 million to $855.6 million from 2Q18.

China growth

2Q19 sales in China grew mid-single digits, 12% at constant currency, driven by men's and women's sport and men's and women's street style. On a two-year stack, sales in China grew 52%+. Skechers has opened 69 stores in China year to date, and closed 20. A new distribution center is under construction and received $14 million in 2Q capital expenditures.

China is one of Skecher’s most exciting markets according to the CFO, as the company pursues growth with franchisees and direct-to-consumer.

Outlook

The company offered the following guidance for 3Q19:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Skechers reported 2Q19 EPS of $0.49, up 69.0% year over year and beating the consensus estimate of $0.34.

2Q19 sales increased 10.9% (up 13.7% on a currency-neutral basis) to $1.26 billion, beating the $1.22 billion consensus estimate. Skechers’ company-owned global retail business grew 19.8% and its domestic business grew 1.5%. On a constant-currency basis, its international wholesale business increased 18.2%. However, its domestic wholesale business declined 3.8%.

Comparable same-store sales were up 4.9% in company-owned retail stores and e-commerce during the quarter, beating the consensus estimate of 0.5%. US comps grew 4.2% and international comps increased 6.7%.

Gross margin declined 90 basis points to 48.5%, missing the 49.5% consensus estimate. The decline is a result of clearing seasonal merchandise in select international markets, offset by higher domestic margins from improved retail pricing and product mix in its direct-to-consumer and domestic wholesale businesses.

SG&A expense as a percentage of sales fell 260 basis points to 40.1%. SG&A expenses decreased 4.2% to $505.1 million. Selling expense decreased $500,000 but general and administrative expenses increased $20.7 million. This reflects $18.5 million in spending associated with the opening of 39 new company-owned Skechers stores in the past year, including 12 that opened in 2Q19.

The company reported earnings from operations of $111.1 million, up 36.5% year over year. Operating margin expanded 160 basis points to 8.8%, beating the consensus estimate of 7.0%.

In 2Q19, total inventory increased $33.2 million to $855.6 million from 2Q18.

China growth

2Q19 sales in China grew mid-single digits, 12% at constant currency, driven by men's and women's sport and men's and women's street style. On a two-year stack, sales in China grew 52%+. Skechers has opened 69 stores in China year to date, and closed 20. A new distribution center is under construction and received $14 million in 2Q capital expenditures.

China is one of Skecher’s most exciting markets according to the CFO, as the company pursues growth with franchisees and direct-to-consumer.

Outlook

The company offered the following guidance for 3Q19:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Skechers reported 2Q19 EPS of $0.49, up 69.0% year over year and beating the consensus estimate of $0.34.

2Q19 sales increased 10.9% (up 13.7% on a currency-neutral basis) to $1.26 billion, beating the $1.22 billion consensus estimate. Skechers’ company-owned global retail business grew 19.8% and its domestic business grew 1.5%. On a constant-currency basis, its international wholesale business increased 18.2%. However, its domestic wholesale business declined 3.8%.

Comparable same-store sales were up 4.9% in company-owned retail stores and e-commerce during the quarter, beating the consensus estimate of 0.5%. US comps grew 4.2% and international comps increased 6.7%.

Gross margin declined 90 basis points to 48.5%, missing the 49.5% consensus estimate. The decline is a result of clearing seasonal merchandise in select international markets, offset by higher domestic margins from improved retail pricing and product mix in its direct-to-consumer and domestic wholesale businesses.

SG&A expense as a percentage of sales fell 260 basis points to 40.1%. SG&A expenses decreased 4.2% to $505.1 million. Selling expense decreased $500,000 but general and administrative expenses increased $20.7 million. This reflects $18.5 million in spending associated with the opening of 39 new company-owned Skechers stores in the past year, including 12 that opened in 2Q19.

The company reported earnings from operations of $111.1 million, up 36.5% year over year. Operating margin expanded 160 basis points to 8.8%, beating the consensus estimate of 7.0%.

In 2Q19, total inventory increased $33.2 million to $855.6 million from 2Q18.

China growth

2Q19 sales in China grew mid-single digits, 12% at constant currency, driven by men's and women's sport and men's and women's street style. On a two-year stack, sales in China grew 52%+. Skechers has opened 69 stores in China year to date, and closed 20. A new distribution center is under construction and received $14 million in 2Q capital expenditures.

China is one of Skecher’s most exciting markets according to the CFO, as the company pursues growth with franchisees and direct-to-consumer.

Outlook

The company offered the following guidance for 3Q19:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Skechers reported 2Q19 EPS of $0.49, up 69.0% year over year and beating the consensus estimate of $0.34.

2Q19 sales increased 10.9% (up 13.7% on a currency-neutral basis) to $1.26 billion, beating the $1.22 billion consensus estimate. Skechers’ company-owned global retail business grew 19.8% and its domestic business grew 1.5%. On a constant-currency basis, its international wholesale business increased 18.2%. However, its domestic wholesale business declined 3.8%.

Comparable same-store sales were up 4.9% in company-owned retail stores and e-commerce during the quarter, beating the consensus estimate of 0.5%. US comps grew 4.2% and international comps increased 6.7%.

Gross margin declined 90 basis points to 48.5%, missing the 49.5% consensus estimate. The decline is a result of clearing seasonal merchandise in select international markets, offset by higher domestic margins from improved retail pricing and product mix in its direct-to-consumer and domestic wholesale businesses.

SG&A expense as a percentage of sales fell 260 basis points to 40.1%. SG&A expenses decreased 4.2% to $505.1 million. Selling expense decreased $500,000 but general and administrative expenses increased $20.7 million. This reflects $18.5 million in spending associated with the opening of 39 new company-owned Skechers stores in the past year, including 12 that opened in 2Q19.

The company reported earnings from operations of $111.1 million, up 36.5% year over year. Operating margin expanded 160 basis points to 8.8%, beating the consensus estimate of 7.0%.

In 2Q19, total inventory increased $33.2 million to $855.6 million from 2Q18.

China growth

2Q19 sales in China grew mid-single digits, 12% at constant currency, driven by men's and women's sport and men's and women's street style. On a two-year stack, sales in China grew 52%+. Skechers has opened 69 stores in China year to date, and closed 20. A new distribution center is under construction and received $14 million in 2Q capital expenditures.

China is one of Skecher’s most exciting markets according to the CFO, as the company pursues growth with franchisees and direct-to-consumer.

Outlook

The company offered the following guidance for 3Q19:

- Sales from $1.32 billion to $1.35 billion.

- EPS from $0.65 to $0.70.

- F2019 capital expenditures in the $150 to $175 million range.