Nitheesh NH

What’s the Story?

The Covid-19 pandemic has had grave and direct consequences on every element of people’s lives and the economy. Here, we look at some of the less immediate impacts of the crisis on US retail and its recovery, and how they will continue to affect the US retail landscape even once the health crisis is over.Why It Matters

The economic shockwaves triggered by the pandemic were of unprecedented scale in 2020: The unemployment rate rose by a factor of three over the course of one month; the economy shrunk by 31.4% in the second quarter; and retail sales declined by nearly 20% year over year in April. While the immediate consequences of these historic changes have become clear, the longer-term impacts of the current crisis on the US retail landscape remain less certain. In this report, we analyze six ways in which pandemic-driven changes to the economy, retail and consumer behavior will impact the industry moving forward.Six Ways Covid-19 Will Continue To Impact US Retailers and Consumers: A Deep Dive

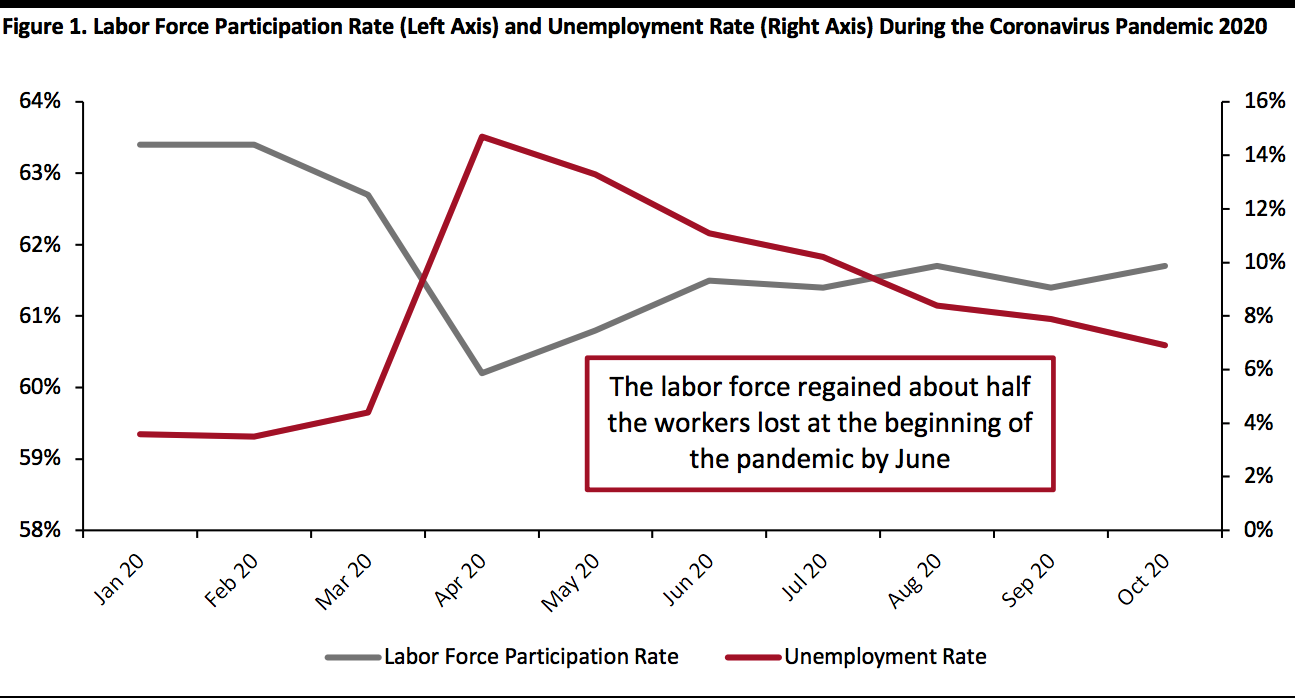

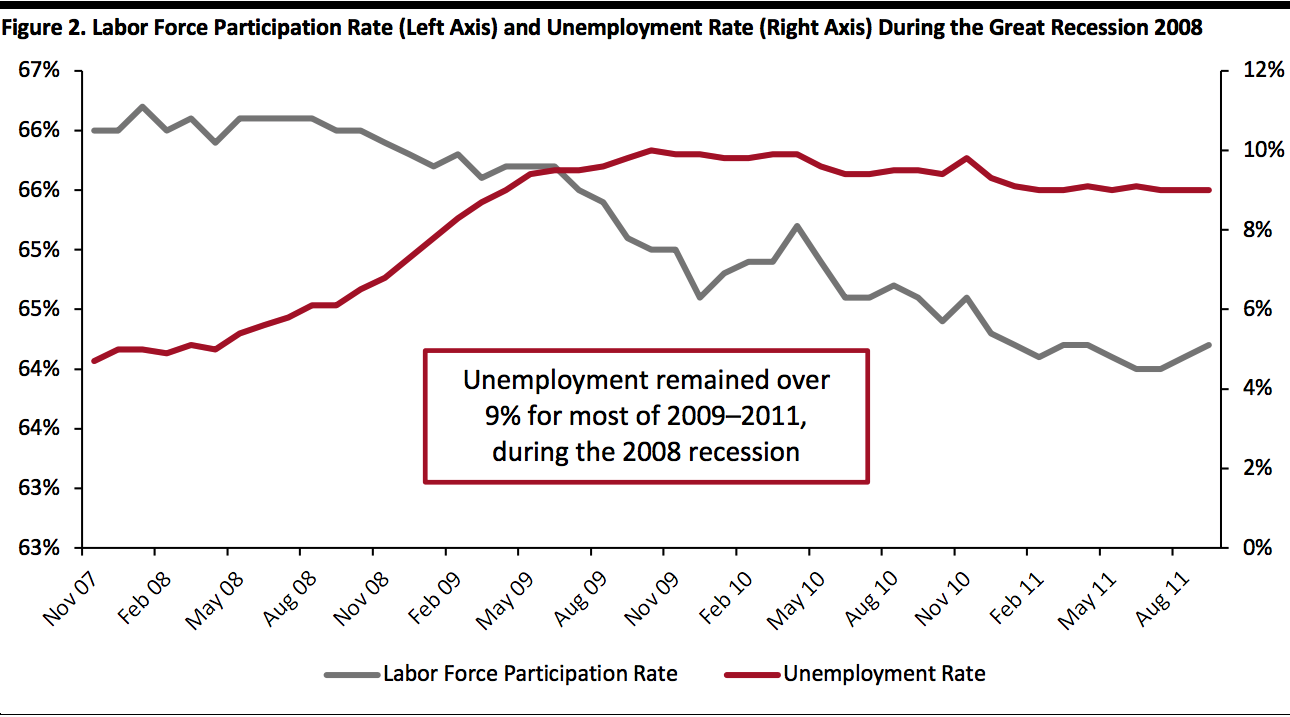

1. The Unemployment Rate Is Moving in the Right Direction, but Recovery May Slow in the Short Term The trends of the unemployment rate and labor force participation rate during the Covid-19 pandemic paint a positive picture of economic recovery when compared to previous financial crises. During the Great Recession of 2008, the unemployment rate remained at over 9% through September 2011 (see Figure 2). By contrast, the coronavirus crisis saw the unemployment rate remain at 9% or higher for only four months. The unemployment rate in the US stands at 5.9% as of October, down from a peak of 14.7% in April. Since spiking at the beginning of the pandemic, the unemployment rate has declined every month since May, at first glance signaling a strong, fast economic recovery (see Figure 1). After dropping in April, the labor force participation rate has risen substantially since the initial outbreak of the coronavirus in the US, regaining about half of the workers lost at the outset of the pandemic by October, although it did stagnate between August and October, as shown in Figure 1. The rate during the Great Recession, on the other hand, fell relatively steadily from the second half of 2009 all the way to the end of 2019. [caption id="attachment_120411" align="aligncenter" width="700"] Source: FRED[/caption]

[caption id="attachment_120412" align="aligncenter" width="700"]

Source: FRED[/caption]

[caption id="attachment_120412" align="aligncenter" width="700"] Source: FRED[/caption]

However, the current unemployment rate is not a cause for unbridled optimism, as the lack of growth in certain industries is concerning for many Americans that remain unemployed. While many professional and office workers have returned to their jobs, the stagnating recovery of travel, tourism, and food service will slow the recovery of unemployment (which we discuss further in the next section).

Sales at food-service and drinking places saw negative month-over-month growth in October (down 12.3%) for the first time since April, indicating that the swift recovery in this sector has faded and keeping many service industry workers out of a job. The tourism industry faces a similar dilemma: For example, New York City is expected to see only one-third its usual tourism volume this year, severely affecting the employment of more than 400,000 workers in the city’s tourism industry.

Implications for Retailers

Retail sales have been strong but buoyed by government stimulus checks, which can create a deceptively positive image of overall economic health. However, unemployment and labor force participation numbers are moving in the right direction and indicate that recovery from the current recession will be swifter than previous economic crises. Retailers should expect sales to bounce back more quickly than they did following the global financial crisis, but universal recovery across all sectors will likely require a combination of more stimulus and an effective widespread rollout of vaccines.

2. Lower-Income Consumers Will Have Their Spending Constricted in the Short Term

At the outset of the coronavirus pandemic, the economic effects of the crisis rippled across all income levels: The stock market plummeted; layoffs were abundant; and lockdowns placed severe restrictions on the lives of all consumers, regardless of wealth. As the crisis has gone on, it has become clear that the wealth of consumers has a strong correlation with Covid-19 impacts on spending habits.

Disparities in unemployment rate by income level illustrate this correlation well: By June 2020, just 4% of workers in the top quintile of earners who lost their jobs at the outset of the crisis remained unemployed, while about 20% of bottom-quintile earners who lost their jobs remained unemployed, according to data from the National Bureau of Economic Research (NBER).

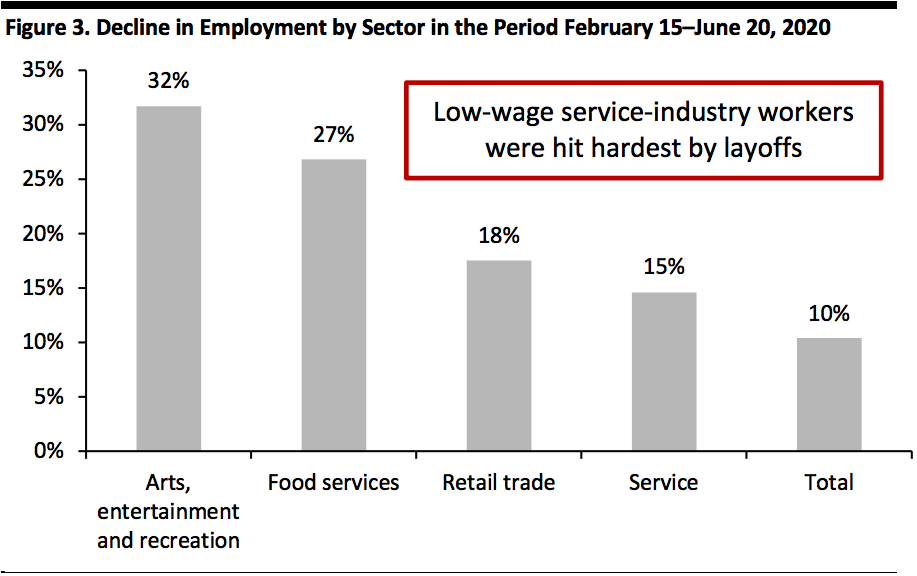

While high earners have largely been able to work from home, lower-income workers generally need to go to a physical workplace, making them more vulnerable to coronavirus-related work restrictions. Furthermore, low-income workers tend to work in areas that are more immediately responsive to changes in consumer behavior, particularly in the entertainment, services and retail industries, which have proved vulnerable amid the pandemic. Consumers remain reluctant to travel, shop in stores and eat and drink at restaurants and bars: According to our latest US consumer survey on December 1, 44.7% of respondents are currently avoiding shops in general, while 59.9% are avoiding restaurants and bars and 43.8% are avoiding leisure and entertainment venues.

The result has been a persistent high unemployment rate in these sectors. Between February 15 and June 20, paid employment in the arts, entertainment and recreation industry declined by 31.7%, accompanied by sharp decreases in the accommodation and food-service industry (down 26.8%), retail trade (down 17.5%) and service sector (down 14.6%), according to the NBER. By comparison, the overall employment level was down just 10.4% in June compared to its pre-pandemic level.

[caption id="attachment_120413" align="aligncenter" width="580"]

Source: FRED[/caption]

However, the current unemployment rate is not a cause for unbridled optimism, as the lack of growth in certain industries is concerning for many Americans that remain unemployed. While many professional and office workers have returned to their jobs, the stagnating recovery of travel, tourism, and food service will slow the recovery of unemployment (which we discuss further in the next section).

Sales at food-service and drinking places saw negative month-over-month growth in October (down 12.3%) for the first time since April, indicating that the swift recovery in this sector has faded and keeping many service industry workers out of a job. The tourism industry faces a similar dilemma: For example, New York City is expected to see only one-third its usual tourism volume this year, severely affecting the employment of more than 400,000 workers in the city’s tourism industry.

Implications for Retailers

Retail sales have been strong but buoyed by government stimulus checks, which can create a deceptively positive image of overall economic health. However, unemployment and labor force participation numbers are moving in the right direction and indicate that recovery from the current recession will be swifter than previous economic crises. Retailers should expect sales to bounce back more quickly than they did following the global financial crisis, but universal recovery across all sectors will likely require a combination of more stimulus and an effective widespread rollout of vaccines.

2. Lower-Income Consumers Will Have Their Spending Constricted in the Short Term

At the outset of the coronavirus pandemic, the economic effects of the crisis rippled across all income levels: The stock market plummeted; layoffs were abundant; and lockdowns placed severe restrictions on the lives of all consumers, regardless of wealth. As the crisis has gone on, it has become clear that the wealth of consumers has a strong correlation with Covid-19 impacts on spending habits.

Disparities in unemployment rate by income level illustrate this correlation well: By June 2020, just 4% of workers in the top quintile of earners who lost their jobs at the outset of the crisis remained unemployed, while about 20% of bottom-quintile earners who lost their jobs remained unemployed, according to data from the National Bureau of Economic Research (NBER).

While high earners have largely been able to work from home, lower-income workers generally need to go to a physical workplace, making them more vulnerable to coronavirus-related work restrictions. Furthermore, low-income workers tend to work in areas that are more immediately responsive to changes in consumer behavior, particularly in the entertainment, services and retail industries, which have proved vulnerable amid the pandemic. Consumers remain reluctant to travel, shop in stores and eat and drink at restaurants and bars: According to our latest US consumer survey on December 1, 44.7% of respondents are currently avoiding shops in general, while 59.9% are avoiding restaurants and bars and 43.8% are avoiding leisure and entertainment venues.

The result has been a persistent high unemployment rate in these sectors. Between February 15 and June 20, paid employment in the arts, entertainment and recreation industry declined by 31.7%, accompanied by sharp decreases in the accommodation and food-service industry (down 26.8%), retail trade (down 17.5%) and service sector (down 14.6%), according to the NBER. By comparison, the overall employment level was down just 10.4% in June compared to its pre-pandemic level.

[caption id="attachment_120413" align="aligncenter" width="580"] Source: NBER[/caption]

Recovery has continued since June, but it is unclear whether employment in these sectors has seen significant improvement. From June to September, sales in food and beverage services saw an average month-over-month increase of 3.6%. However, even this modest improvement has evaporated recently, with sales down 0.1% month over month, and 12.4% year over year, in October. Furthermore, 26% of small and medium-sized businesses were forced to close globally during the course of the pandemic—many of them in the service industry—according to a report joint authored by The Organisation for Economic Co-operation and Development, Facebook and the World Bank. There is no immediate cure for the poor employment prospects for lower earners, which may hamper their spending even once the crisis is over. However, as we discuss later in this report, we expect coronavirus vaccines to create better prospects for these workers in the medium-to-long term.

Implications for Retailers

Retailers that target lower-income customers will need to adapt to cope with decreased spending among blue-collar and service-industry workers. At the same time, dollar stores and other discount general merchandise and grocery stores will likely continue to see gains, as they have done throughout the pandemic. Every month since May, sales at “all other general merchandise stores,” a category that prominently includes dollar stores (and does not include department stores or superstores), have increased by more than 6% year over year, compared to year-over-year growth of 2–4% in most months of 2019, according to data from the US Census Bureau. As low-income consumers continue to have their spending constricted, retailers can expect strong growth to continue in the discount sector.

3. Higher Earners May Spend More Freely

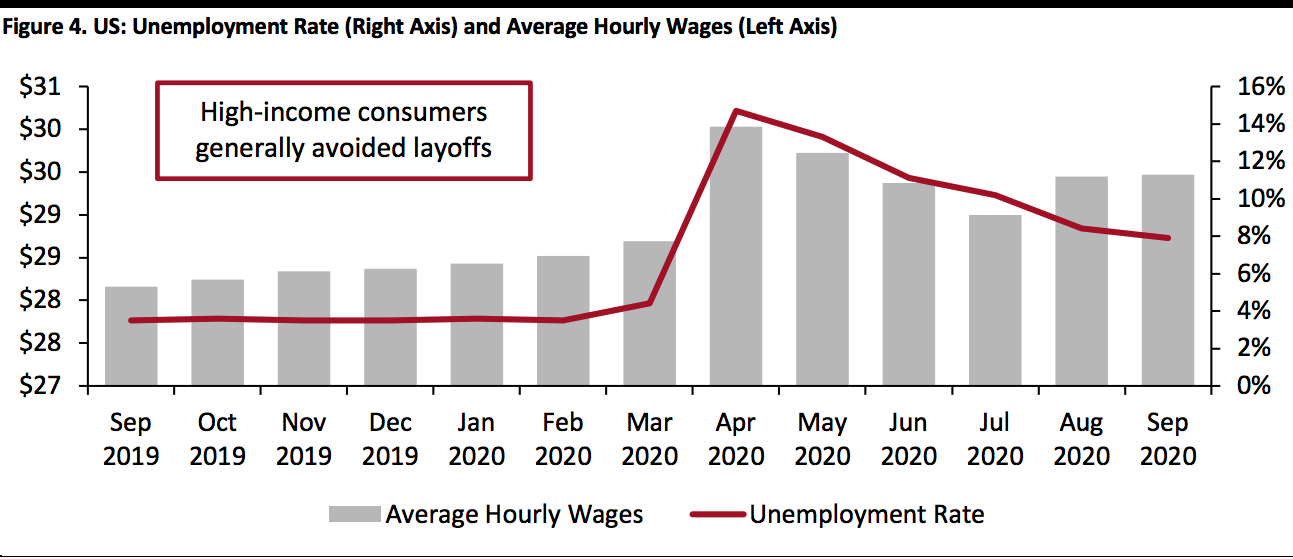

While low-income consumers will have their spending squeezed, high earners will likely have the ability to spend more freely in the medium term. Wealthy consumers generally avoided pandemic-driven layoffs: When the unemployment rate skyrocketed to 14.7% in April, so did average hourly wages, which climbed by almost 6%, reflecting that employees making a higher salary were generally spared from workforce cuts.

[caption id="attachment_120414" align="aligncenter" width="700"]

Source: NBER[/caption]

Recovery has continued since June, but it is unclear whether employment in these sectors has seen significant improvement. From June to September, sales in food and beverage services saw an average month-over-month increase of 3.6%. However, even this modest improvement has evaporated recently, with sales down 0.1% month over month, and 12.4% year over year, in October. Furthermore, 26% of small and medium-sized businesses were forced to close globally during the course of the pandemic—many of them in the service industry—according to a report joint authored by The Organisation for Economic Co-operation and Development, Facebook and the World Bank. There is no immediate cure for the poor employment prospects for lower earners, which may hamper their spending even once the crisis is over. However, as we discuss later in this report, we expect coronavirus vaccines to create better prospects for these workers in the medium-to-long term.

Implications for Retailers

Retailers that target lower-income customers will need to adapt to cope with decreased spending among blue-collar and service-industry workers. At the same time, dollar stores and other discount general merchandise and grocery stores will likely continue to see gains, as they have done throughout the pandemic. Every month since May, sales at “all other general merchandise stores,” a category that prominently includes dollar stores (and does not include department stores or superstores), have increased by more than 6% year over year, compared to year-over-year growth of 2–4% in most months of 2019, according to data from the US Census Bureau. As low-income consumers continue to have their spending constricted, retailers can expect strong growth to continue in the discount sector.

3. Higher Earners May Spend More Freely

While low-income consumers will have their spending squeezed, high earners will likely have the ability to spend more freely in the medium term. Wealthy consumers generally avoided pandemic-driven layoffs: When the unemployment rate skyrocketed to 14.7% in April, so did average hourly wages, which climbed by almost 6%, reflecting that employees making a higher salary were generally spared from workforce cuts.

[caption id="attachment_120414" align="aligncenter" width="700"] Source: FRED/Coresight Research

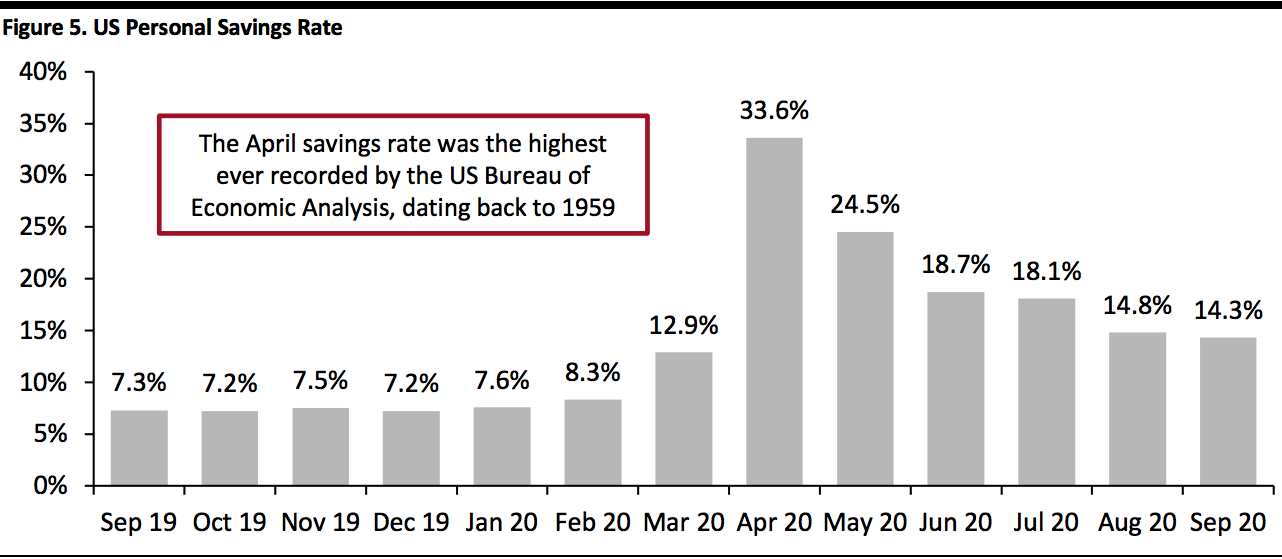

Source: FRED/Coresight ResearchPlease remove hyphens from x axis.[/caption] Unlike lower-income consumers, who rely almost exclusively on their employment for income, wealthier consumers have other streams of income and wealth that have supported them well during the pandemic. Following a brief but severe struggle at the outset of the crisis, the main sources of capital gains for high earners have done well: The S&P 500 has been strong, up 12.1% for the year as of November 24, while the median single-family home price is up 12.0% year over year—boosting feelings of wealth among stock- and property-owning consumers. This increase in capital gains is accompanied by savings accumulated during the worst days of the global health crisis. The personal savings rate spiked to 33.6% in April and remained over 14.3% as of September, as shown in Figure 5. [caption id="attachment_120415" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis[/caption]

The April savings rate was the highest ever recorded by the US Bureau of Economic Analysis, dating back to 1959. Even though October’s savings rate was less than half that in April, it was still higher than any monthly savings rate recorded between 1976 and 2019. We estimate that lost spending across 17 discretionary categories—ranging from food service to travel to apparel—over the first eight months of 2020 totals $416 billion, due to higher consumer savings.

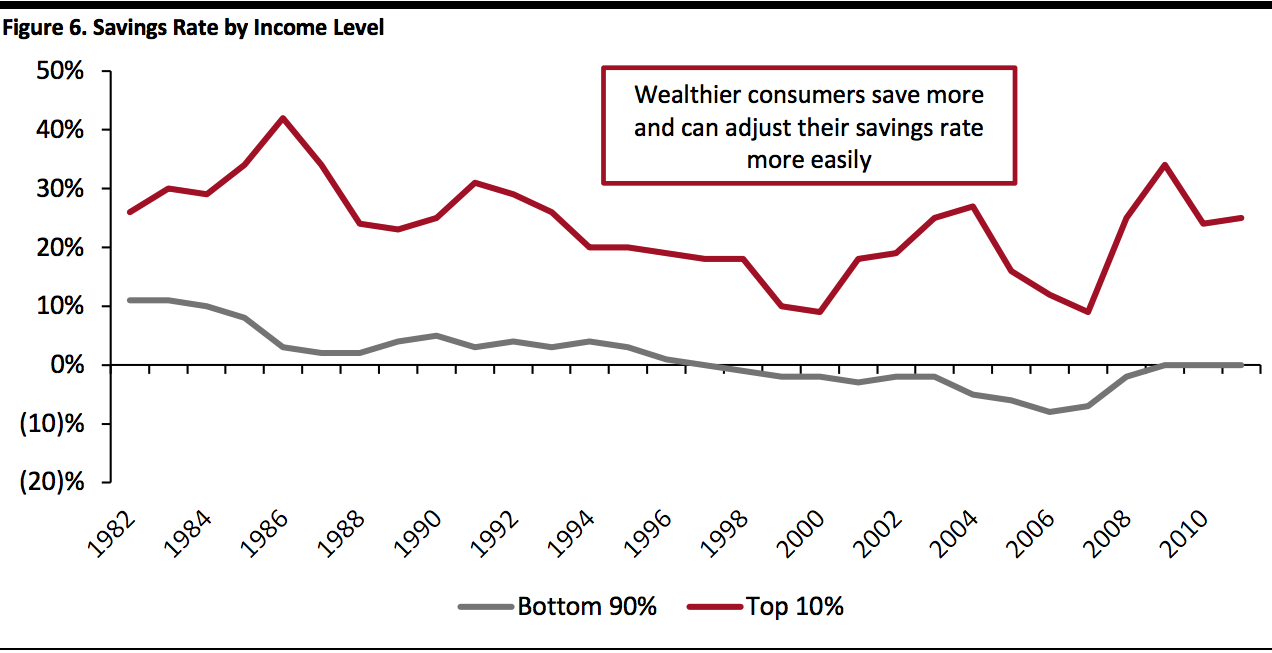

While higher savings depressed sales at the time, the lower spending may give consumers more spending power moving forward—likely concentrated among high earners who save more and have more flexibility in adjusting their savings rate. As shown in Figure 6, high-income consumers tend to save far more than low-income consumers. In 2011, the last year for which data was available, the top 10% of earners saved an average of 25% of their household income, while all others saved 0% of their household income (savings numbers can be zero and negative due to debt).

[caption id="attachment_120416" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis[/caption]

The April savings rate was the highest ever recorded by the US Bureau of Economic Analysis, dating back to 1959. Even though October’s savings rate was less than half that in April, it was still higher than any monthly savings rate recorded between 1976 and 2019. We estimate that lost spending across 17 discretionary categories—ranging from food service to travel to apparel—over the first eight months of 2020 totals $416 billion, due to higher consumer savings.

While higher savings depressed sales at the time, the lower spending may give consumers more spending power moving forward—likely concentrated among high earners who save more and have more flexibility in adjusting their savings rate. As shown in Figure 6, high-income consumers tend to save far more than low-income consumers. In 2011, the last year for which data was available, the top 10% of earners saved an average of 25% of their household income, while all others saved 0% of their household income (savings numbers can be zero and negative due to debt).

[caption id="attachment_120416" align="aligncenter" width="700"] Source: “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data,” The Quarterly Journal of Economics, May 2016[/caption]

This illustrates the greater flexibility that high earners have to adjust their savings rate depending on economic circumstances. As shown in Figure 6, during the 2008 global financial crisis, the bottom 90% of earners were only able to increase their savings rate by 5.0 percentage points, while consumers in the top 10% increased their savings rate by 16 percentage points in just one year.

The combination of these two factors, higher savings and higher flexibility, indicate that the rise in savings rates in 2020 likely concentrated savings in the hands of the wealthy. Added on top of a strong housing and stock market and low white-collar unemployment numbers, we expect that this will give wealthy consumers strong spending power for the foreseeable future.

Implications for Retailers

Retailers should take advantage of the financial security of higher-income consumers by focusing their assortment on higher-end products. We believe that shoppers are trading up to better-quality products this holiday season: In our holiday survey of US consumers, 55.5% of respondents with annual incomes of more than $100,000 reported that they plan to spend more on better-quality products this holiday season. We expect consumers who trade up during the holiday season to continue to purchase higher-price-point products moving forward.

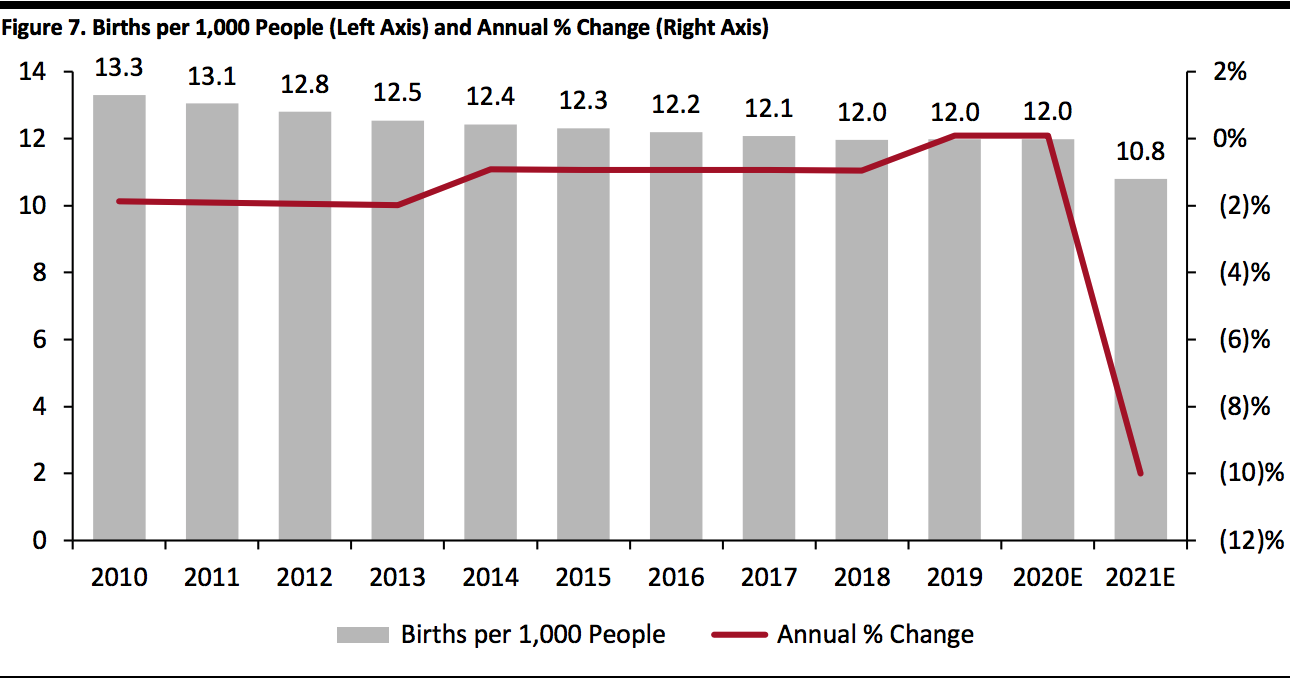

4. Birth Rates Will Drop Significantly, Impacting Childcare and Education Spending in the Long Term

In April, many news outlets speculated that the lockdowns and quarantines would result in a baby boom nine months later. However, theories like this about birth rates relating to blackouts, blizzards and other events that force individuals to remain in their homes have been generally debunked. In reality, the combination of economic uncertainty and a health crisis is likely to lead to a record drop in birth rates in late 2020 and 2021. A report from the Brookings Institute estimates that births in 2021 will likely decline by 300,000–500,000, a decline of more than 10% year over year.

[caption id="attachment_120417" align="aligncenter" width="700"]

Source: “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data,” The Quarterly Journal of Economics, May 2016[/caption]

This illustrates the greater flexibility that high earners have to adjust their savings rate depending on economic circumstances. As shown in Figure 6, during the 2008 global financial crisis, the bottom 90% of earners were only able to increase their savings rate by 5.0 percentage points, while consumers in the top 10% increased their savings rate by 16 percentage points in just one year.

The combination of these two factors, higher savings and higher flexibility, indicate that the rise in savings rates in 2020 likely concentrated savings in the hands of the wealthy. Added on top of a strong housing and stock market and low white-collar unemployment numbers, we expect that this will give wealthy consumers strong spending power for the foreseeable future.

Implications for Retailers

Retailers should take advantage of the financial security of higher-income consumers by focusing their assortment on higher-end products. We believe that shoppers are trading up to better-quality products this holiday season: In our holiday survey of US consumers, 55.5% of respondents with annual incomes of more than $100,000 reported that they plan to spend more on better-quality products this holiday season. We expect consumers who trade up during the holiday season to continue to purchase higher-price-point products moving forward.

4. Birth Rates Will Drop Significantly, Impacting Childcare and Education Spending in the Long Term

In April, many news outlets speculated that the lockdowns and quarantines would result in a baby boom nine months later. However, theories like this about birth rates relating to blackouts, blizzards and other events that force individuals to remain in their homes have been generally debunked. In reality, the combination of economic uncertainty and a health crisis is likely to lead to a record drop in birth rates in late 2020 and 2021. A report from the Brookings Institute estimates that births in 2021 will likely decline by 300,000–500,000, a decline of more than 10% year over year.

[caption id="attachment_120417" align="aligncenter" width="700"] Source: Brookings Institute/United Nations World Population Prospects[/caption]

This will have a significant impact on the economy that will outlast the Covid-19 pandemic. Health-care spending for newborns, toddlers and pre-school children is significantly higher than it is for older children and young adults: In 2016, Americans spent an average of $2,765 on health care for children aged under five, compared to just $1,921 on health care for children between the ages of six and 17, according to data from the US Department of Health and Human Services. If birth rates in 2021 decline by 10%, we estimate it could conservatively result in around $560 million in lost health-care spending in 2021.

The retail industry will also feel the impact of decreasing birth rates. In 2019, baby and toddler wear accounted for $9.9 billion in retail sales, according to data from Euromonitor International. A reduction in birth rates by 10% could cause a $300 million decrease in spending in this category, independent of other factors, in 2021, 2022 and 2023.

Implications for Retailers

Spending on children’s health-care and products will suffer over the next several years as a result of declining birth rates. Brands and retailers who focus on childcare-related products must plan for a sustained period of decreased spending in these areas.

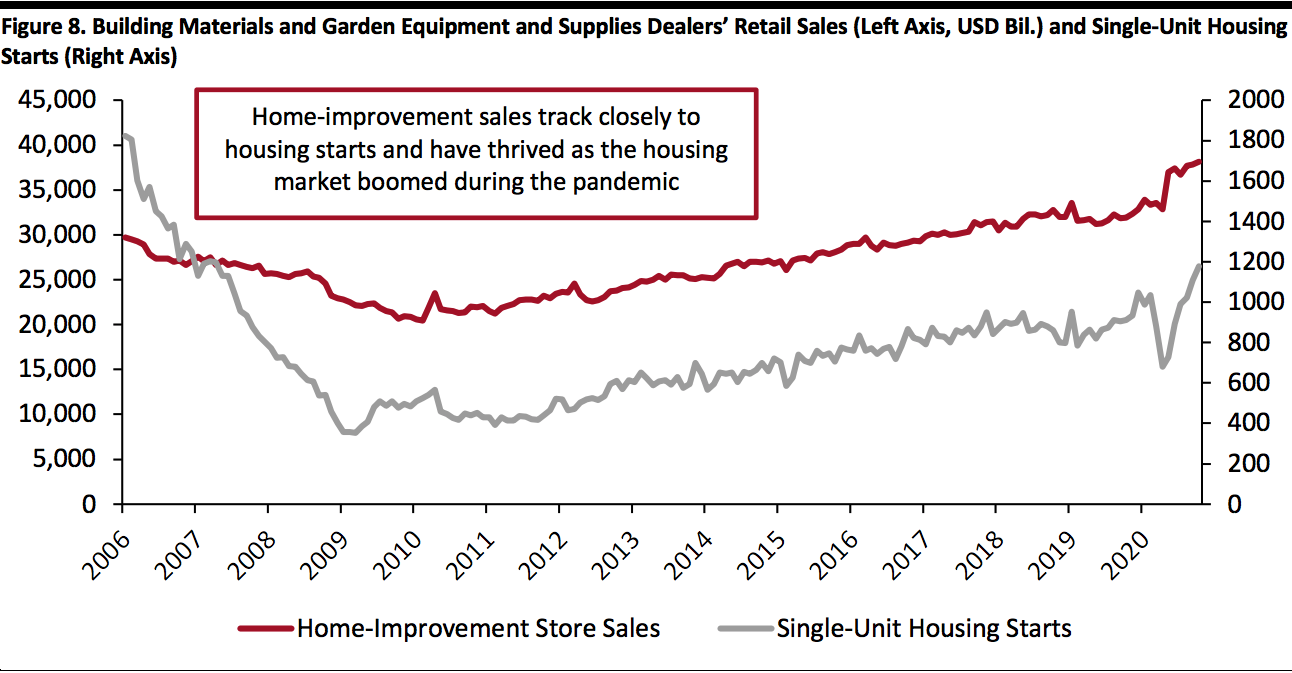

5. The Surge in Homebuying Will Drive Retail Sales but Should Wane in the Medium Term

Despite the pandemic-driven recession, home prices have risen substantially, and housing starts have recovered to pre-pandemic levels. As of September, the median existing single-family home price was up 12.0% year over year, and all four major US regions saw double-digit year-over-year price gains (13.7% in the West, 13.3% in the Northeast, 11.4% in the South, 11.1% in the Midwest), according to the National Association of Realtors.

This rise in prices has correlated with strong growth in housing starts, particularly in single-unit homes (standalone houses). While the amount of new apartment unit starts declined by 19.9% year over year in October 2020, housing starts for single-unit homes, which account for 78% of all housing starts, saw a staggering 29.4% year-over-year increase. Sales were driven in part to people relocating to non-urban locations in the midst of the pandemic, along with homebuyers looking to take advantage of record-low mortgage rates; the effective 30-year fixed mortgage rate averaged 3.01% in the third quarter of 2020, down from 3.71% the prior year and 3.29% the prior quarter. The homebuying surge will remain strong at least until the end of the year: As of September, pending home sales across the US were up 20.5% compared to the year-ago period, according to the National Association of Realtors.

Increases in housing starts correlate strongly with an increase in retail sales, particularly in building materials and gardening equipment supplies dealer sales, as shown in Figure 8.

[caption id="attachment_120418" align="aligncenter" width="700"]

Source: Brookings Institute/United Nations World Population Prospects[/caption]

This will have a significant impact on the economy that will outlast the Covid-19 pandemic. Health-care spending for newborns, toddlers and pre-school children is significantly higher than it is for older children and young adults: In 2016, Americans spent an average of $2,765 on health care for children aged under five, compared to just $1,921 on health care for children between the ages of six and 17, according to data from the US Department of Health and Human Services. If birth rates in 2021 decline by 10%, we estimate it could conservatively result in around $560 million in lost health-care spending in 2021.

The retail industry will also feel the impact of decreasing birth rates. In 2019, baby and toddler wear accounted for $9.9 billion in retail sales, according to data from Euromonitor International. A reduction in birth rates by 10% could cause a $300 million decrease in spending in this category, independent of other factors, in 2021, 2022 and 2023.

Implications for Retailers

Spending on children’s health-care and products will suffer over the next several years as a result of declining birth rates. Brands and retailers who focus on childcare-related products must plan for a sustained period of decreased spending in these areas.

5. The Surge in Homebuying Will Drive Retail Sales but Should Wane in the Medium Term

Despite the pandemic-driven recession, home prices have risen substantially, and housing starts have recovered to pre-pandemic levels. As of September, the median existing single-family home price was up 12.0% year over year, and all four major US regions saw double-digit year-over-year price gains (13.7% in the West, 13.3% in the Northeast, 11.4% in the South, 11.1% in the Midwest), according to the National Association of Realtors.

This rise in prices has correlated with strong growth in housing starts, particularly in single-unit homes (standalone houses). While the amount of new apartment unit starts declined by 19.9% year over year in October 2020, housing starts for single-unit homes, which account for 78% of all housing starts, saw a staggering 29.4% year-over-year increase. Sales were driven in part to people relocating to non-urban locations in the midst of the pandemic, along with homebuyers looking to take advantage of record-low mortgage rates; the effective 30-year fixed mortgage rate averaged 3.01% in the third quarter of 2020, down from 3.71% the prior year and 3.29% the prior quarter. The homebuying surge will remain strong at least until the end of the year: As of September, pending home sales across the US were up 20.5% compared to the year-ago period, according to the National Association of Realtors.

Increases in housing starts correlate strongly with an increase in retail sales, particularly in building materials and gardening equipment supplies dealer sales, as shown in Figure 8.

[caption id="attachment_120418" align="aligncenter" width="700"] Source: FRED/US Census Bureau[/caption]

During the Great Recession, which resulted in a collapse of home sales, home-improvement sales bottomed out at $20.5 billion in February 2010, a 31.1% decline compared to February 2006 (pre-crisis). It was not until January 2017 that sales in this sector reached their pre-recession values again.

Conversely, the recession in 2020 has seen housing starts grow, particularly in single-unit homes where most home-improvement spending occurs. As a result, home-improvement sales were up 17.0% year over year in October and have posted double-digit sales growth every month since May. This has played a major role in keeping retail sales high even as the recession continues. In October 2020, home-improvement sales accounted for 9.5% of all retail sales ex automobiles and gasoline, and were a major driver of overall retail sales and economic growth.

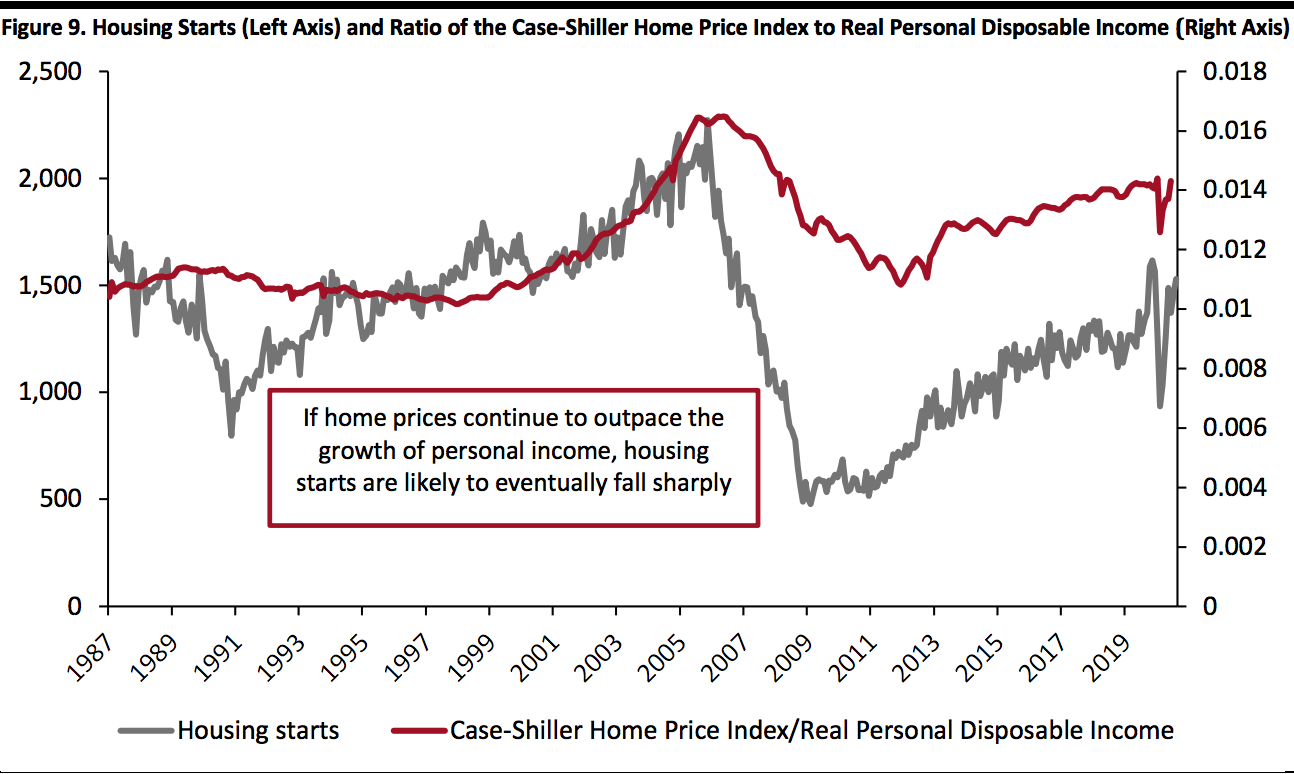

Despite these positive numbers, the outlook for retail and the economy based on housing sales is not universally rosy. Housing prices are rising significantly faster than real disposable income, making it unclear how long a fast-moving, high-priced housing market can be sustained. The last time that housing starts and the ratio of housing prices to personal disposable income rose at their current rates, the result was the greatest housing crash in US history, as shown in Figure 9. While there were myriad other factors that contributed to the housing crisis of 2007/8, it is worrisome that even as house affordability falls, housing starts continue to rise.

[caption id="attachment_120419" align="aligncenter" width="700"]

Source: FRED/US Census Bureau[/caption]

During the Great Recession, which resulted in a collapse of home sales, home-improvement sales bottomed out at $20.5 billion in February 2010, a 31.1% decline compared to February 2006 (pre-crisis). It was not until January 2017 that sales in this sector reached their pre-recession values again.

Conversely, the recession in 2020 has seen housing starts grow, particularly in single-unit homes where most home-improvement spending occurs. As a result, home-improvement sales were up 17.0% year over year in October and have posted double-digit sales growth every month since May. This has played a major role in keeping retail sales high even as the recession continues. In October 2020, home-improvement sales accounted for 9.5% of all retail sales ex automobiles and gasoline, and were a major driver of overall retail sales and economic growth.

Despite these positive numbers, the outlook for retail and the economy based on housing sales is not universally rosy. Housing prices are rising significantly faster than real disposable income, making it unclear how long a fast-moving, high-priced housing market can be sustained. The last time that housing starts and the ratio of housing prices to personal disposable income rose at their current rates, the result was the greatest housing crash in US history, as shown in Figure 9. While there were myriad other factors that contributed to the housing crisis of 2007/8, it is worrisome that even as house affordability falls, housing starts continue to rise.

[caption id="attachment_120419" align="aligncenter" width="700"] Source: FRED[/caption]

We anticipate that the housing boom will continue in the short term but will likely fade as fewer consumers are able to afford houses. Similarly, we expect that the shift towards single-unit homes from apartments is far from guaranteed to remain a trend in the long term. Much has been made of the exodus from urban centers in the US during the pandemic: In New York City in September, closed sales jumped 12.2% from the previous year, while pending sales grew a staggering 49.3% year over year, according to data from the National Association of Realtors. Many people wary of crowded cities and unsure of their benefit while working from home have chosen to move elsewhere. However, for every home sale, there is a buyer as well as a seller—clearly a large subset of consumers are willing to invest in a potentially undervalued New York housing market.

Furthermore, tech giants Amazon, Apple, Facebook and Google have all pursued acquiring new office space in New York City this year. Facebook acquired enough New York office space to enable the company to triple the amount of workers it can have in the city, according to The New York Times, while Amazon paid around $1 billion to acquire the Lord & Taylor flagship building in Midtown from WeWork, according to Forbes.

Implications for Retailers

Home-improvement retailers will continue to grow as the housing market grows. However, as the growth of house prices continues to outpace the growth of disposable income, we expect that the end of the house buying craze is within sight. Retailers would do well to avoid overcommitting resources based on the assumption that housing starts will experience untampered growth in the medium and long term. Likewise, assumptions that urban real estate will continue to decline in value may be unfounded, as tech giants with the ability to plan for the long run are snatching up underpriced New York office space.

6. A Vaccine Will Prompt a Switch Back to Services in the Medium and Long Term

The service industry has been hit perhaps the hardest by the pandemic. In the second quarter of 2020, personal consumption expenditures on services declined by 14.5% year over year. During the pandemic, consumers have been wary of traveling, eating and drinking out, and going to places like salons and gyms—and this avoidance of public places has continued: Our December 1 survey found that 59.9% of consumers are avoiding restaurants, bars and coffee shops, while 56.0% are avoiding gyms.

However, with several promising vaccines now in production, we expect consumers may begin to spend more on services and get more adventurous in the relatively near future, if not in the immediate short term. Our consumer surveys indicate that consumers’ habits have been responsive to virus infection rates. For instance, on September 9, 9.1% of consumers that we surveyed indicated that in the past two weeks they had visited a leisure/cultural attraction. On that same date, the seven-day rolling average of newly reported Covid-19 cases was 11% lower than the week prior, according to data from the Centers of Disease Control and Prevention (CDC). Conversely, on November 17, when the CDC reported seven-day average of new cases was 34% higher than the week prior, just 5.9% of consumers reported visiting a leisure/cultural attraction.

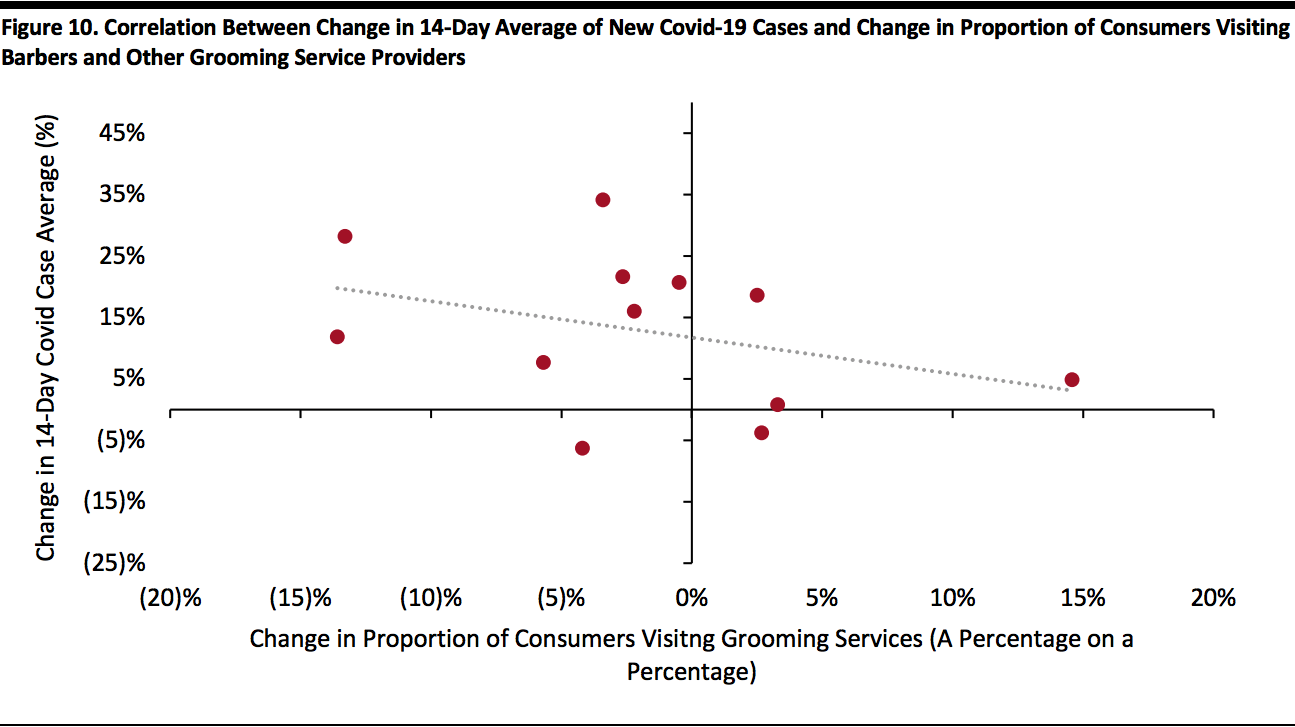

This responsiveness holds true for other service providers as well. Figure 10 illustrates how changes in 14-day Covid-19 case averages correlates with changes in consumer propensity to go to barbers, salons and other grooming service providers.

[caption id="attachment_120420" align="aligncenter" width="700"]

Source: FRED[/caption]

We anticipate that the housing boom will continue in the short term but will likely fade as fewer consumers are able to afford houses. Similarly, we expect that the shift towards single-unit homes from apartments is far from guaranteed to remain a trend in the long term. Much has been made of the exodus from urban centers in the US during the pandemic: In New York City in September, closed sales jumped 12.2% from the previous year, while pending sales grew a staggering 49.3% year over year, according to data from the National Association of Realtors. Many people wary of crowded cities and unsure of their benefit while working from home have chosen to move elsewhere. However, for every home sale, there is a buyer as well as a seller—clearly a large subset of consumers are willing to invest in a potentially undervalued New York housing market.

Furthermore, tech giants Amazon, Apple, Facebook and Google have all pursued acquiring new office space in New York City this year. Facebook acquired enough New York office space to enable the company to triple the amount of workers it can have in the city, according to The New York Times, while Amazon paid around $1 billion to acquire the Lord & Taylor flagship building in Midtown from WeWork, according to Forbes.

Implications for Retailers

Home-improvement retailers will continue to grow as the housing market grows. However, as the growth of house prices continues to outpace the growth of disposable income, we expect that the end of the house buying craze is within sight. Retailers would do well to avoid overcommitting resources based on the assumption that housing starts will experience untampered growth in the medium and long term. Likewise, assumptions that urban real estate will continue to decline in value may be unfounded, as tech giants with the ability to plan for the long run are snatching up underpriced New York office space.

6. A Vaccine Will Prompt a Switch Back to Services in the Medium and Long Term

The service industry has been hit perhaps the hardest by the pandemic. In the second quarter of 2020, personal consumption expenditures on services declined by 14.5% year over year. During the pandemic, consumers have been wary of traveling, eating and drinking out, and going to places like salons and gyms—and this avoidance of public places has continued: Our December 1 survey found that 59.9% of consumers are avoiding restaurants, bars and coffee shops, while 56.0% are avoiding gyms.

However, with several promising vaccines now in production, we expect consumers may begin to spend more on services and get more adventurous in the relatively near future, if not in the immediate short term. Our consumer surveys indicate that consumers’ habits have been responsive to virus infection rates. For instance, on September 9, 9.1% of consumers that we surveyed indicated that in the past two weeks they had visited a leisure/cultural attraction. On that same date, the seven-day rolling average of newly reported Covid-19 cases was 11% lower than the week prior, according to data from the Centers of Disease Control and Prevention (CDC). Conversely, on November 17, when the CDC reported seven-day average of new cases was 34% higher than the week prior, just 5.9% of consumers reported visiting a leisure/cultural attraction.

This responsiveness holds true for other service providers as well. Figure 10 illustrates how changes in 14-day Covid-19 case averages correlates with changes in consumer propensity to go to barbers, salons and other grooming service providers.

[caption id="attachment_120420" align="aligncenter" width="700"] Source: Coresight Research/CDC[/caption]

On average, a 1% increase in the 14-day rolling average of new Covid-19 cases correlates with a 0.23% decline in the percentage of consumers visiting grooming service providers (a percentage on a percentage), although there is a high degree of variation in this relationship. Consumers will respond to reduced virus risks quickly, making monitoring the distribution of vaccines key for retailers and service industry providers.

Data from China, which offers a look to a post-crisis future as the virus is widely reported to have been brought almost entirely under control in the country, also suggests that the recovery of the service industry will be fast and strong once virus fears subside. In October 2020, Chinese service industry production grew 7.4% year over year, even faster than the reported 4.3% year-over-year growth in consumer goods sales that same month, according to the Chinese National Bureau of Statistics.

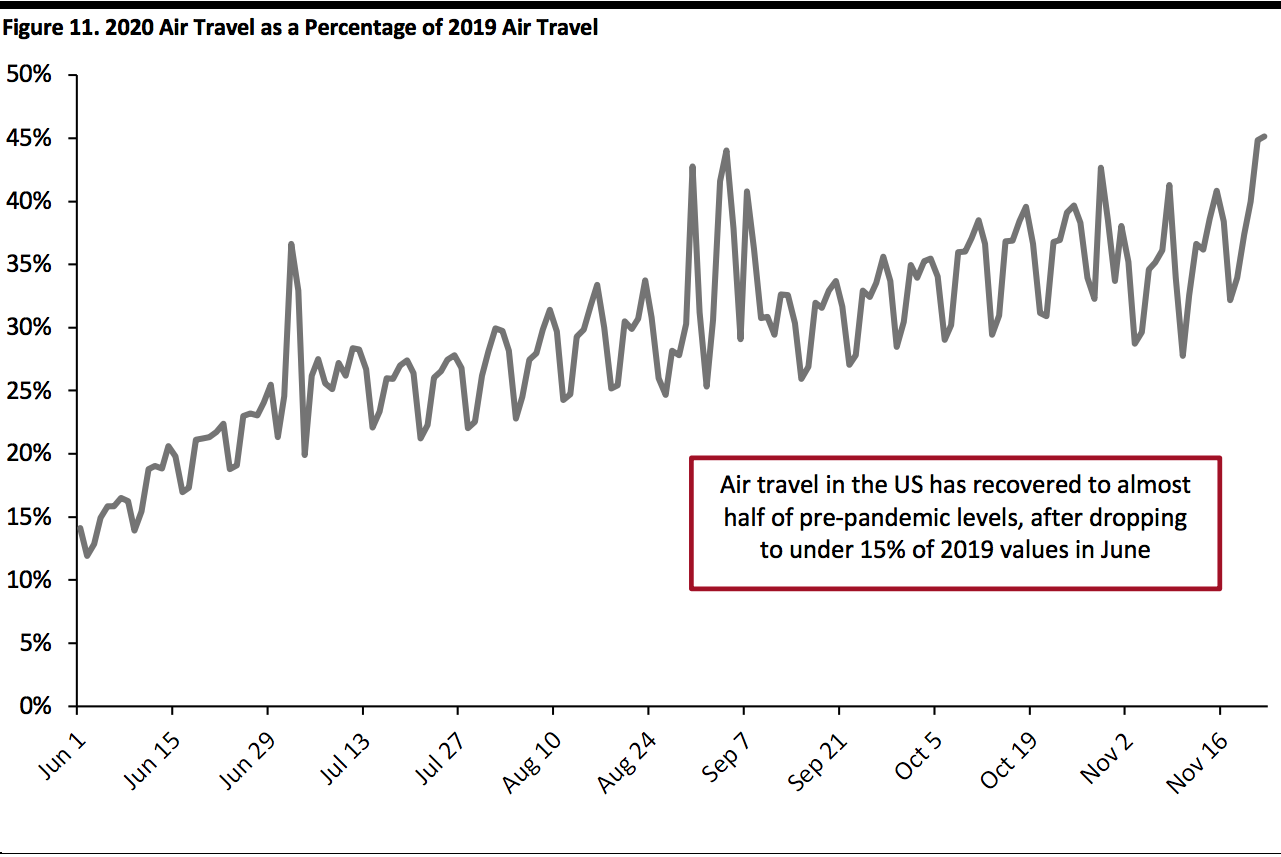

Even prior to a vaccine being distributed, there are certain indications that consumers are restless to return to normal life. In the US, airline travel has picked up substantially in recent months. Figure 11 illustrates the steady recovery of travel, even as the pandemic continues.

[caption id="attachment_120421" align="aligncenter" width="700"]

Source: Coresight Research/CDC[/caption]

On average, a 1% increase in the 14-day rolling average of new Covid-19 cases correlates with a 0.23% decline in the percentage of consumers visiting grooming service providers (a percentage on a percentage), although there is a high degree of variation in this relationship. Consumers will respond to reduced virus risks quickly, making monitoring the distribution of vaccines key for retailers and service industry providers.

Data from China, which offers a look to a post-crisis future as the virus is widely reported to have been brought almost entirely under control in the country, also suggests that the recovery of the service industry will be fast and strong once virus fears subside. In October 2020, Chinese service industry production grew 7.4% year over year, even faster than the reported 4.3% year-over-year growth in consumer goods sales that same month, according to the Chinese National Bureau of Statistics.

Even prior to a vaccine being distributed, there are certain indications that consumers are restless to return to normal life. In the US, airline travel has picked up substantially in recent months. Figure 11 illustrates the steady recovery of travel, even as the pandemic continues.

[caption id="attachment_120421" align="aligncenter" width="700"] Source: TSA[/caption]

On June 1, 2020, Transportation Security Administration (TSA) checkpoint data reveals that there were 86% fewer daily airline passengers in the US than that same day the year prior. By November 22, that number was 55%—still an unprecedented dip but clearly trending back toward normalcy.

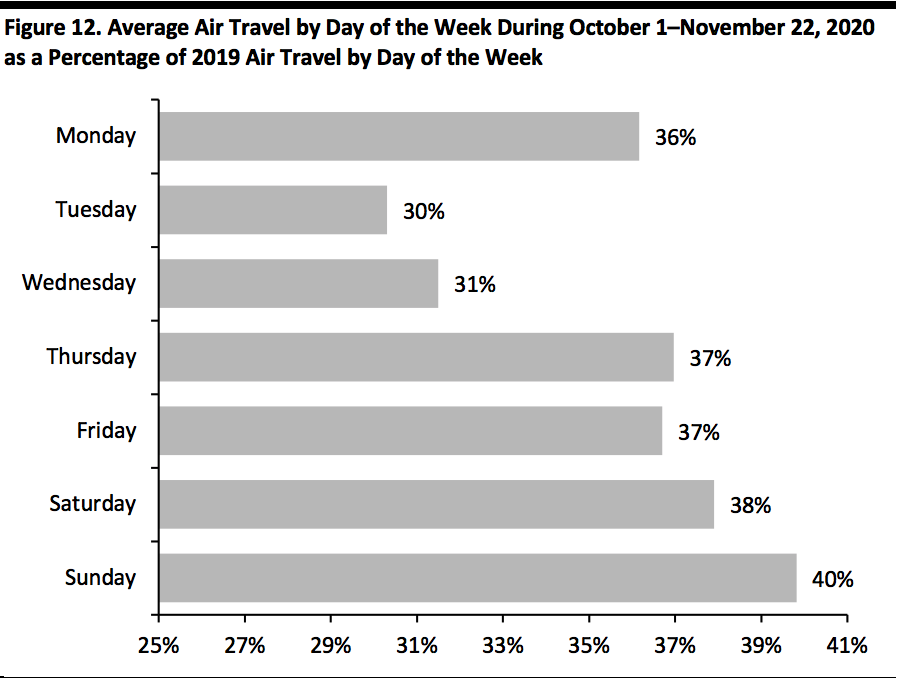

This recovery in travel will not be uniform: As many businesses continue to utilize work-from-home models, and even transitioning to permanent work-from-home operations, business travel is unlikely to ever reach the same levels it did prior to the pandemic. TSA data reveals that midweek travel (Tuesday and Wednesday) has recovered far more slowly than Thursday through Monday. Between October 1 and November 22, average daily travelers on Tuesdays and Wednesdays were only 30% and 31% of their 2019 values, while Sunday travel had rebounded to 40% of its 2019 value, as shown in Figure 12.

[caption id="attachment_120422" align="aligncenter" width="580"]

Source: TSA[/caption]

On June 1, 2020, Transportation Security Administration (TSA) checkpoint data reveals that there were 86% fewer daily airline passengers in the US than that same day the year prior. By November 22, that number was 55%—still an unprecedented dip but clearly trending back toward normalcy.

This recovery in travel will not be uniform: As many businesses continue to utilize work-from-home models, and even transitioning to permanent work-from-home operations, business travel is unlikely to ever reach the same levels it did prior to the pandemic. TSA data reveals that midweek travel (Tuesday and Wednesday) has recovered far more slowly than Thursday through Monday. Between October 1 and November 22, average daily travelers on Tuesdays and Wednesdays were only 30% and 31% of their 2019 values, while Sunday travel had rebounded to 40% of its 2019 value, as shown in Figure 12.

[caption id="attachment_120422" align="aligncenter" width="580"] Source: TSA[/caption]

Likewise, consumer expenditures on services have already recovered swiftly (if not completely) from their drop at the beginning of the pandemic. Third-quarter consumer service expenditures were down just 7.2% year over year, less than half of the decline seen in the prior quarter. We expect consumers to continue to switch their spending back to experiences as they grow weary of virus restrictions, particularly as vaccines become available for the general public.

Implications for Retailers

When the virus is under control, consumers will be more comfortable spending on experiences. Even now, during times when cases are high, consumers are becoming increasingly weary of virus restrictions and are more inclined to travel and resume other aspects of normal life. Retailers that have pivoted to appeal to consumers looking for products rather than experiences may want to consider adapting to the return to experience spending. However, as businesses cut down on travel and time in the office, retailers and service providers that cater to business travelers may never again see pre-pandemic sales volumes.

Source: TSA[/caption]

Likewise, consumer expenditures on services have already recovered swiftly (if not completely) from their drop at the beginning of the pandemic. Third-quarter consumer service expenditures were down just 7.2% year over year, less than half of the decline seen in the prior quarter. We expect consumers to continue to switch their spending back to experiences as they grow weary of virus restrictions, particularly as vaccines become available for the general public.

Implications for Retailers

When the virus is under control, consumers will be more comfortable spending on experiences. Even now, during times when cases are high, consumers are becoming increasingly weary of virus restrictions and are more inclined to travel and resume other aspects of normal life. Retailers that have pivoted to appeal to consumers looking for products rather than experiences may want to consider adapting to the return to experience spending. However, as businesses cut down on travel and time in the office, retailers and service providers that cater to business travelers may never again see pre-pandemic sales volumes.

What We Think

Implications for Brands/Retailers- Most macroeconomic indicators have rebounded more rapidly than in previous recessions, indicating that recovery from the current recession will be swifter than in the past.

- However, retailers need to be wary of assuming the pandemic’s impact on sales is complete: Many low-income individuals remain out of work and will continue to spend less.

- Higher-income consumers may spend more freely thanks to booming stock and housing markets. Retailers should target wealthier consumers and promote better-quality, higher-price-point products.

- Retailers specializing in children’s products must brace for the impact of a double-digit decrease in birth rates in 2021.

- Home-improvement retailers should expect a continued surge in sales in short run as the housing market continues to thrive. However, as people stop fleeing cities and house prices continue to outgrow income, these retailers should plan ahead for a slowdown in the market that is beginning to appear on the horizon.

- Retailers that profit from consumer spending on experiences and services will see their sales recover in the medium-to-long term as travel and service spending trends upward, and will respond well to the beginning of vaccination efforts.

- Real estate firms should be cautious about divesting from cities; while workers are fleeing cities during the pandemic, tech giants planning for the long run have given urban centers like New York City a vote of confidence.