albert Chan

Introduction

Whether measured by spectators, participants or revenues, electronic sports—esports—are quickly growing in popularity. They are expected to attract over 450 million viewers and generate over $1 billion in global revenues in 2019. In this report, we outline the scale of growth of this phenomenon, and discuss five ways in which brands and retailers can leverage esports as a platform for marketing.

What Are Esports?

Esports are online video games that involve a group of professional gamers competing in an organized league or tournament, often for prize money. Common game genres include online battle arena (such as League of Legends), first-person shooter (such as Counter-Strike: Global Offensive), fighting (such as Tekken), collectible card game (such as Hearthstone), real-time strategy (such as StarCraft) and battle royale (such as Minecraft).

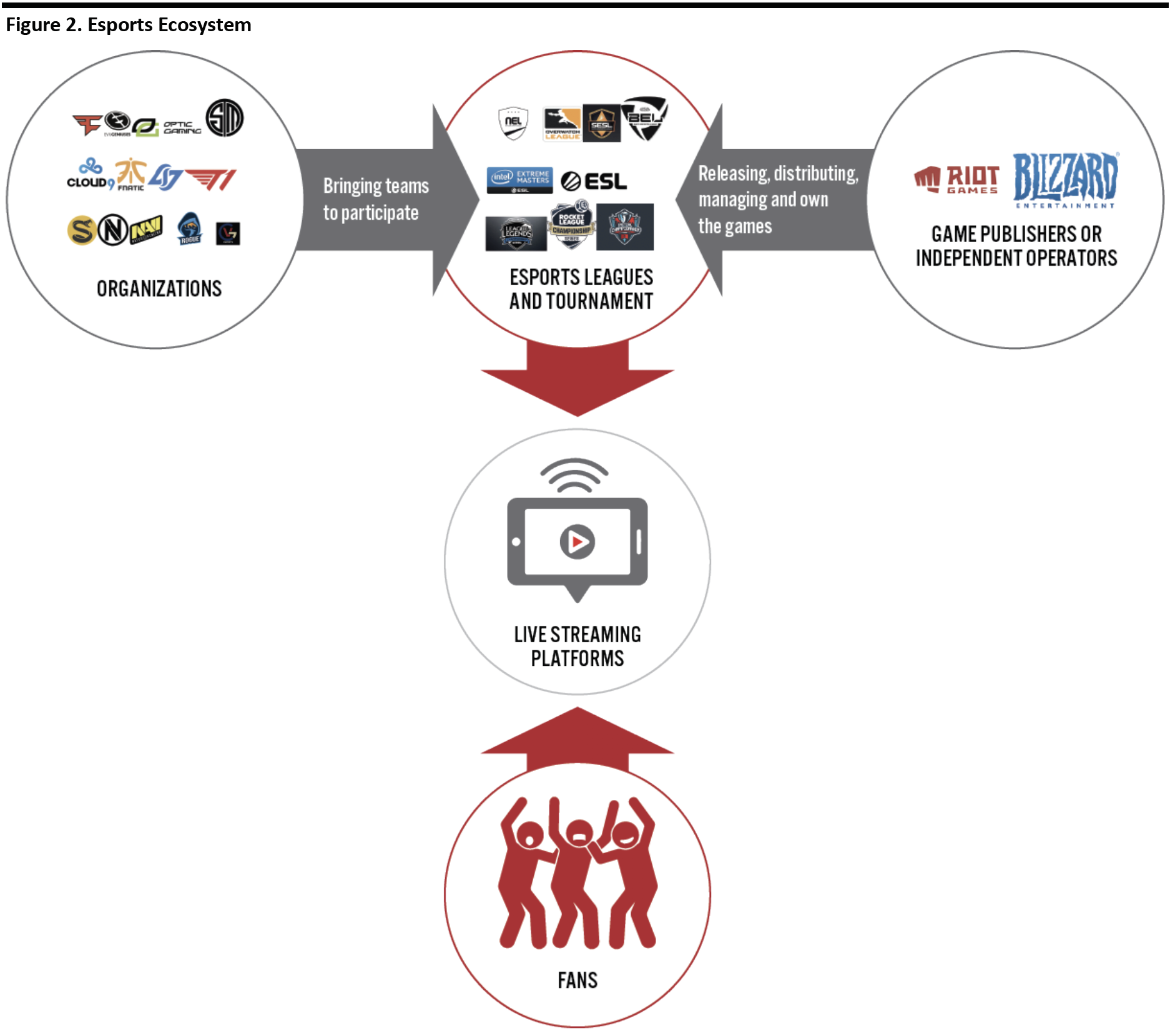

Professional gamers, also known as personalities, can join teams led by different organizations that participate in various games. For example, headquartered in London, Fnatic has teams for over 20 different games, including Dota 2 and League of Legends; Team SoloMid, based in the US, has more than ten teams participating in competitions around the world.

Game publishers or independent operators own the games and organize leagues and tournaments in different formats, including regional, global, amateur and professional. Each team specializes in certain tournaments and formats; they come together annually and play at a central studio where live audiences can watch. Major competitions include World Cyber Games, Electronic Sports World Cup and World e-Sports Masters.

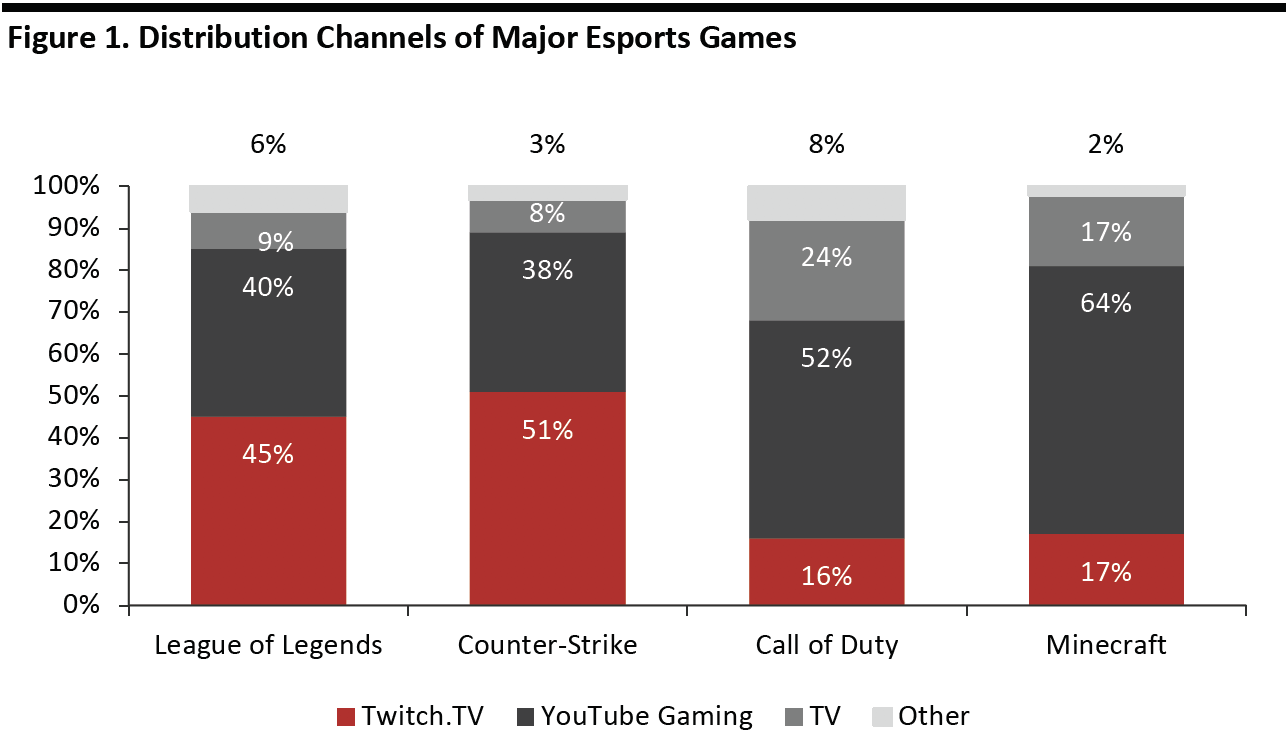

Esports are mainly distributed through online streaming media platforms, with Twitch and YouTube being the two main channels. Twitch was introduced in 2011 before being acquired by Amazon in 2014. Since then, the live-streaming video service platform has been used to host every major tournament. It also broadcasts music and creative content, and enables individual gamers to live stream while playing at home.

[caption id="attachment_98622" align="aligncenter" width="700"] Source: Statista[/caption]

[caption id="attachment_98623" align="aligncenter" width="700"]

Source: Statista[/caption]

[caption id="attachment_98623" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Global Esports Revenue Expected To Exceed $1 Billion in 2019

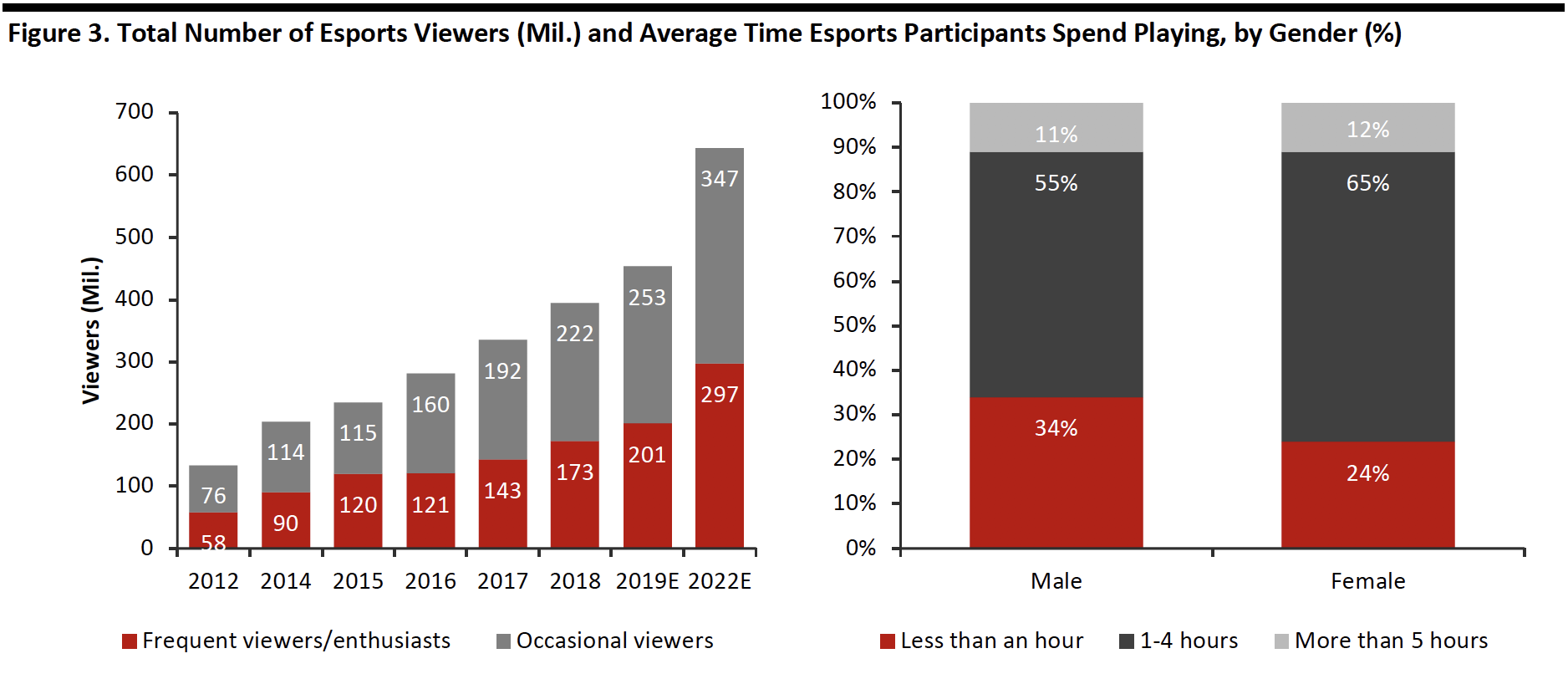

Thanks to the development of robust computing, game developers have been able to design more responsive games and better immersive experiences. Increasing high-speed internet coverage and the rise of social media also mean that players can engage with each other more easily. As a result, the total number of esports viewers reached 395 million in 2018. Market research firm Newzoo estimates that this audience will number 644 million by 2022, with 65% being enthusiasts.

[caption id="attachment_98624" align="aligncenter" width="700"] Source: Newzoo/Research Now/Statista[/caption]

Source: Newzoo/Research Now/Statista[/caption]

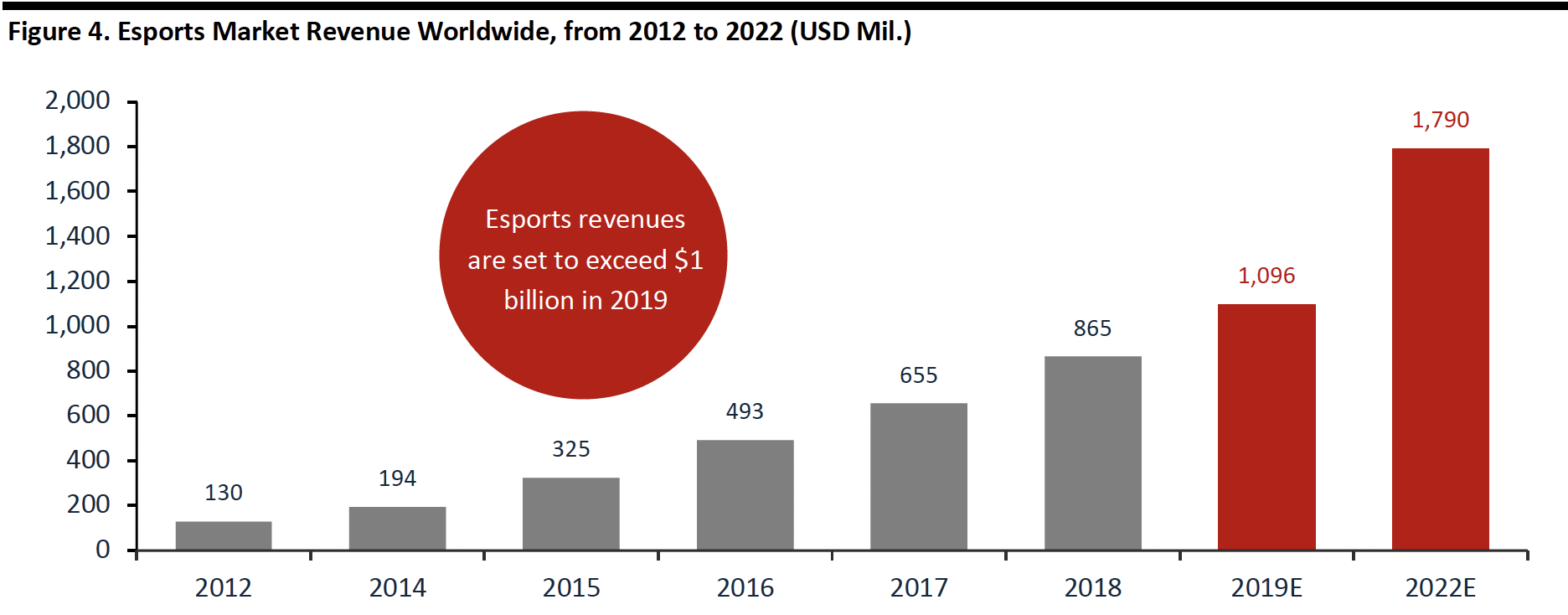

The increasing popularity of esports has driven the investment into the industry. According to Newzoo, esports revenue will reach almost $1.1 billion worldwide in 2019, with China and the US accounting for over half of that number. By 2022, the total is expected to be close to $1.8 billion. Annual combined prize pools were $121.1 million in 2017 worldwide, up 25.2% from 96.17 million in 2016.

[caption id="attachment_98625" align="aligncenter" width="700"] Source: Newzoo[/caption]

Source: Newzoo[/caption]

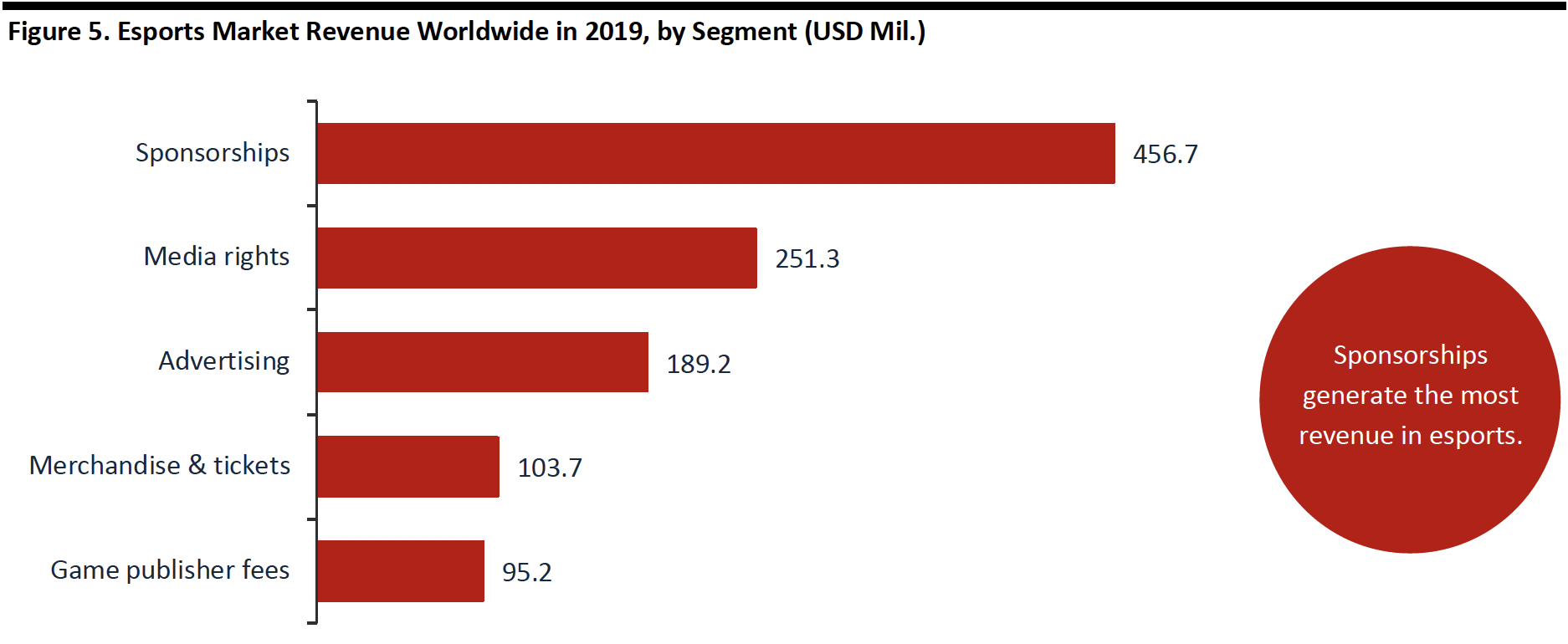

Sponsorship currently accounts for 41% of earnings in esports. Similar to traditional sports, sponsorship creates a win-win deal for brand owners and organizations, leagues and tournaments. Media rights make up about 23% of industry revenue, with some of the leading broadcasting networks investing in esports. In July 2018, ESPN signed a multi-year deal to televise the Overwatch League.

[caption id="attachment_98626" align="aligncenter" width="700"] Source: Newzoo[/caption]

Source: Newzoo[/caption]

How Brands Can Be Involved

An increasing number of brands and retailers are looking to leverage the continued growth of esports to tap into wider demographics. By collaborating and becoming esports sponsors, brands and retailers can attract young consumers through various channels, as well as increase brand recognition.

We have identified six major ways in which brand owners and retailers can leverage esports.

[caption id="attachment_98627" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Forming partnerships with organizations

Brand owners and retailers can team up with organizations by becoming the official sponsor of a particular team. Team members wear jerseys that feature their sponsor’s brand logos. As players participate in games around the world, sponsors benefit from increased brand exposure.

In January 2019, athletic apparel retailer Puma teamed up with Cloud9, a leading esports organization. Under the agreement, Puma became the official apparel and game-day pants and shoes supplier for the Cloud9 League of Legends Championship Series team. In May 2019, Cloud9 expanded the partnership into a multi-year deal, with the two parties working together on a full apparel collection for all of Cloud9’s teams. It has been reported that the collaborative apparel will also be made available to the public, further increasing Puma’s brand exposure.

[caption id="attachment_98628" align="aligncenter" width="305"] Cloud9 team jersey

Cloud9 team jerseySource: Cloud9.com[/caption]

2. Forming partnerships with leagues or tournaments

In 2018, 60 million people around the world watched Mid-Season Invitational, an annual League of Legends tournament. In the same year, Electronic Sports League (ESL) attracted up to 15,000 daily visitors to 10 mega-events.

As the number of viewers of leagues and tournament keeps growing, brand owners and retailers can partner with competitions to become the event sponsor, creating tournament-themed contest and providing equipment to participants. Live streaming, television broadcasting and media coverage of leagues and tournaments can increase brand engagements.

In December 2018, Intel extended its existing partnership with ESL, committing to invest $100 million over the following three years. In addition to being the title sponsor of ESL’s longest-running esports tour, Intel Extreme Masters, the company also supports the $1 million award at Intel Grand Slam.

[caption id="attachment_98629" align="aligncenter" width="700"] Winners at 2018 Intel Extreme Masters

Winners at 2018 Intel Extreme MastersSource: eslgaming.com[/caption]

In 2018, DHL partnered with ESL to create promotional events as part of DHL’s plans to reach to younger consumers and build an emotional connection with them. For example, the partnership held a contest in which participants had to share a picture of a DHL vehicle on social media to win tickets to watch ESL One in New York.

Doritos, producer of flavored tortilla chips, partnered with Twitch to host a gaming event called Doritos Bowl. The company invited leading gamers to showcase their skills, and fans could follow Doritos’ social media accounts (such as Facebook, Instagram and Twitter) to get the latest news from the event. As a result, the brand’s exposure increased through multiple channels.

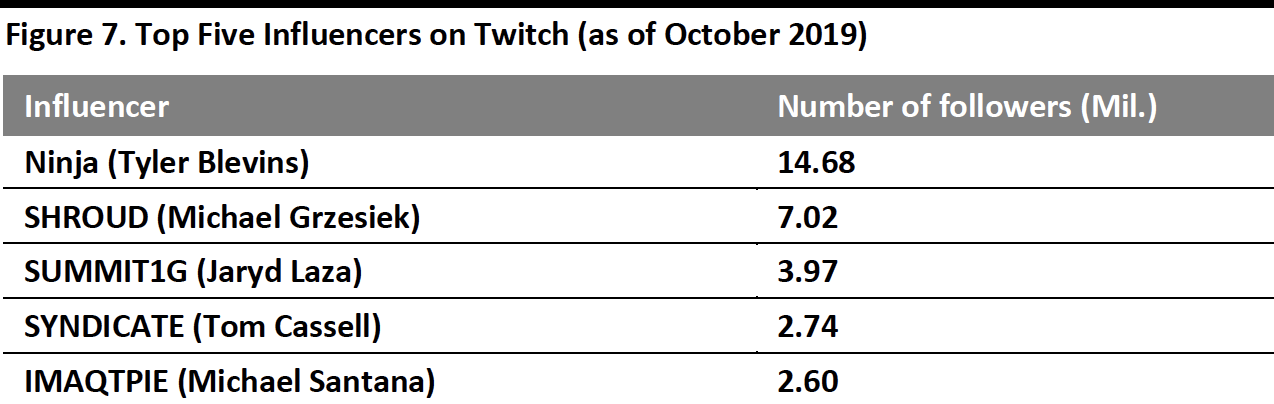

3. Teaming up with influencers on live-streaming platforms

According to Twitchtracker, an online data analytic company that tracks Twitch’s statistics, the number of Twitch streamers totaled 2.9 million in September 2019, and the total number of average concurrent viewers was over 1.2 million in the same month. Top influencers on Twitch have millions of followers. By forming a partnership with these influencers on esports live-streaming platforms, brand owners and retailers can reach people that share the same interests, taste and opinions as the influencers.

[caption id="attachment_98630" align="aligncenter" width="700"] Source: Twitch/Coresight Research[/caption]

Source: Twitch/Coresight Research[/caption]

Japanese food manufacturer Nissin Foods formed a partnership with Twitch in 2018 and collaborated with leading influencers on the platform. The company recently worked with Pokemani, a top influencer with 3.4 million followers on Twitch. During one of her live-streaming videos, she ate Nissin cup noodles. There was a ‘Slurp Meter’ logo on screen, which measured the noise level when she was eating. The video gained 11,453 viewership.

[caption id="attachment_98631" align="aligncenter" width="701"] Pokemani’s live stream showed her eating Nissin noodles.

Pokemani’s live stream showed her eating Nissin noodles.Source: Twitch[/caption]

4. Sponsoring gaming personalities

Similar to having traditional sports stars as brand ambassadors, brand owners can form partnerships with professional esports personalities who can then publicly endorse the brands.

Energy drink company Red Bull has been actively engaging with esports for many years. As well as hosting numerous esports events around the world, the company has sponsored several leading gamers, creating video content with them on social media platforms, such as Instagram, Twitter and YouTube. One video showcases the streaming room of Tyler “Ninja” Blevins, one of the top esports athletes; the video gained over 14 million viewers. Red Bull also launched a headband and a special energy drink can under Ninja’s name and offers consumers a chance to meet and play with him. To be eligible for selection, consumers have to visit Ninja.RedBull.com and upload picture or video that creatively showcases how they game.

[caption id="attachment_98632" align="aligncenter" width="200"] Red Bull’s Ninja can

Red Bull’s Ninja can Source: Red Bull[/caption]

5. Launching merchandise

Brand owners can obtain exclusive merchandise deals in the esports sector, particularly in selling event merchandise, such as jerseys, footwear and souvenirs. This enables brands to secure their market position in the electronics and sports sectors, as well as bringing in extra revenue.

In July 2019, Misfits Gaming formed a global esports apparel venture with Outerstuff, a youth sports apparel manufacturer. Outerstuff will run the day-to-day operations of the joint venture’s business and oversee apparel design, sales, marketing and distribution. The venture will launch a new line of licensed apparel for both Misfits Gaming and its Overwatch League franchise Florida Mayhem.

6. Assigning dedicated areas for esports events

According to Nielsen, around 75% of esports fans in the US are aged between 18 and 35. To promote brand awareness with these targeted consumers—as well as increase foot traffic—retailers can arrange in-house esports events where fans are able to watch and participate in the games.

In October 2019, Five Below, a discount retailer that targets the teenage demographic, teamed up with Nerd Street Gamers, which hosts esports leagues, tournaments and training camps. Through the partnership, the two companies will build 3,000-square-foot esports facilities at selected Five Below stores, beginning with a multi-store pilot in 2020. The retailer plans to engage with the growing gaming community across the US.

Outlook

Esports has been growing continuously with no signs of slowing down. The International Olympic Committee is reportedly open for further discussions about possible future cooperation between the Olympic and esports communities; the Paris Olympic bid committee is open to esports on the 2024 Olympic program.

As esports continues to gain recognition as a real sport among key associations worldwide, we expect to see an increasing number of brands and retailers tap into this industry as part of their marketing campaigns.