albert Chan

What’s the Story?

The Covid-19 pandemic has shaken up consumer spending behavior across many consumer categories in the. Moreover, in response to the health pandemic, US consumers are increasingly embracing a holistic approach to wellness, both mentally and physically. Wellness is a broad and multidimensional concept, spanning a wide array of consumer sectors; we expect it to be the pre-eminent multiyear trend driving discretionary spending shifts.

In this report, we explore the traction of the wellness trend across six industries in 2020 and quantify our expectations for 2021 and beyond.

Why It Matters

We expect wellness concerns to be the number-one driver of discretionary spending growth worldwide, impacting on a broad array of retail industries—perhaps more so than any other of our global trends for 2021. In its latest estimate, the Global Wellness Institute reported that the global wellness market reached $4.5 trillion in 2018 and estimated that the market surpassed $5 trillion in 2020, driven by heightened consumer focus on good health and wellness amid the pandemic.

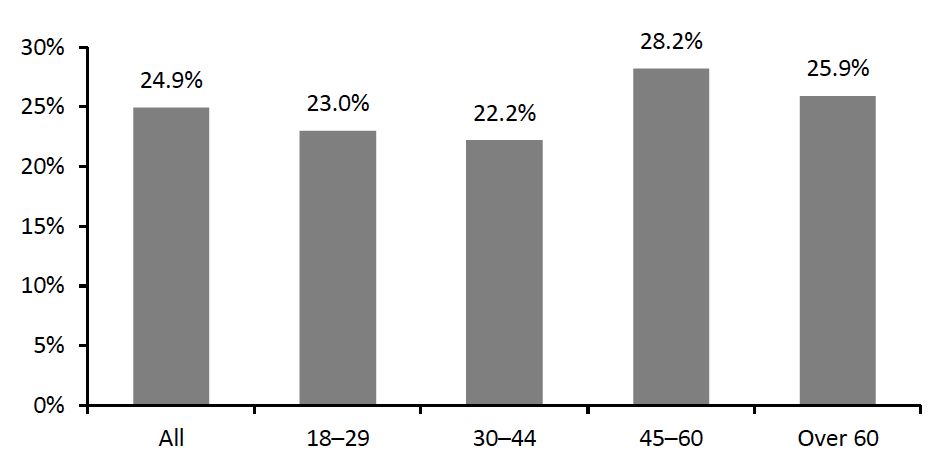

Moreover, our US consumer survey conducted on December 15, 2020, found that one-quarter of US consumers expect to retain the changed behavior of focusing more on health and wellbeing in the long term. This trend appears to be prominent across all demographics, but particularly among Gen X consumers and Baby Boomers, who are taking an increased interest in healthy living as they move toward their senior years.

Figure 1. US Consumers That Expect To Retain the Changed Behavior of Focusing More on Health and Wellbeing Post Crisis, by Age (% of Respondents)

[caption id="attachment_125833" align="aligncenter" width="550"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

How Wellness Trends Are Changing Consumer Consumption

In the following sections, we discuss how the accelerating wellness trend impacts consumer consumption across the six industries outlined in Figure 2.

Figure 2. Changes in Wellness Spending in Six Key Industries

[caption id="attachment_125834" align="aligncenter" width="550"] Source: Coresight Research[/caption]

1. Apparel

Source: Coresight Research[/caption]

1. Apparel

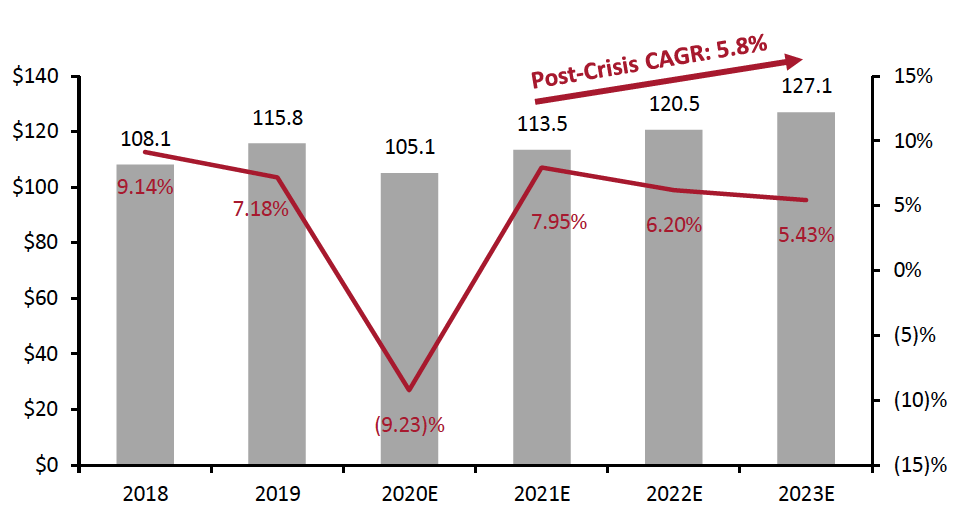

As consumers increasingly adopt athleisure for daily wear, the category is set to increase market penetration within the apparel and footwear market in 2021. We estimate that the sportswear and athleisure penetration of the total US apparel and footwear market will grow from 30% in 2018 to almost one-third in 2021, as the category continues to gain share.

The sportswear and athleisure category fared better than the overall US clothing and footwear market amid the pandemic-impacted retail environment in 2020—with sales declining by 9.2% year over year based on our estimates, compared to the overall 12% year-over-year spending drop in the sector according to Bureau of Economic Analysis (BEA) data. In 2021, we expect athleisure category sales to increase by 7.9%, outperforming the projected growth of 7.0% in total spending on clothing and footwear.

According to a survey conducted by investment bank Harrison Co. in April 2020, over 50% of US respondents are motivated to work out more, based on a renewed appreciation for their health and wellbeing amid the pandemic, and 37% of respondents expect to work out more post pandemic. This increasing focus on health and wellness builds on existing perceptions of health and wellness as a reflection of lifestyle values and is likely to translate to growth in the athleisure apparel category.

We predict a rebound of 7.9% in US sportswear and athleisure sales in 2021, and expect the market to grow at a CAGR of 5.8% from 2021 to 2023 as growth moderates in 2022 and 2023.

Figure 3. US Sportswear and Athleisure Market Size (Left Axis; USD Bil.) and YoY % Change (Right Axis)

[caption id="attachment_125835" align="aligncenter" width="550"] The market includes performance sports apparel and footwear (characterized by new fibers and fabrics as well as innovative process technologies) as well as sports-inspired apparel and footwear, which includes non-performance and outdoor items by major sports brands as well as sports-inspired products offered by general apparel brands.

The market includes performance sports apparel and footwear (characterized by new fibers and fabrics as well as innovative process technologies) as well as sports-inspired apparel and footwear, which includes non-performance and outdoor items by major sports brands as well as sports-inspired products offered by general apparel brands.Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Many fashion brands and retailers, including luxury players, are vying to capture a share of the market amid growing wellness trends. We discuss brands that have recently announced or launched athleisure lines to tap into demand for athleisure accessories that complement the increasing consumer enthusiasm for health and fitness activities.

- High-end apparel brand COS launched its first women’s activewear collection in May 2020, followed by a men’s activewear collection in August 2020. The activewear lines are designed for everyday performance and comfort and serve as an extension of the retailer’s leisure collection.

- Kohl’s has announced plans to launch a new private-label athleisure brand, FLX, in March 2021. The range features versatile activewear made with high-quality, performance fabrics. According to the company’s investor presentation in October 2020, its athleisure sales have grown at a 10% CAGR from 2016 to 2019.

- Louis Vuitton, owned by parent company LVHM, has partnered with the NBA (National Basketball Association) to create an active menswear capsule collection for the spring/summer 2021 season. LVHM-owned brand Kenzo also launched its first sportswear line, Kenzo Sport, in August 2020.

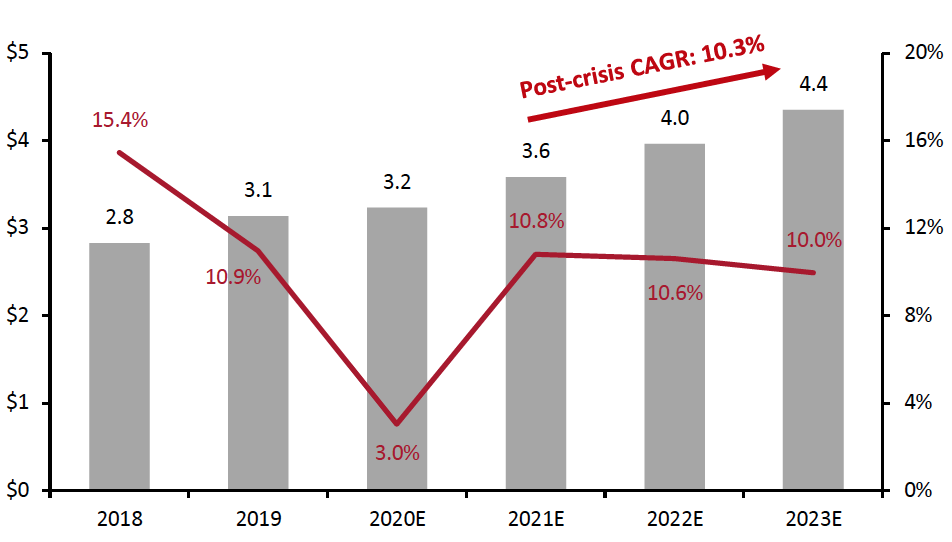

Shoppers are increasingly conscious of the ingredients in their beauty products, with the growing focus on health and wellness translating to amplified demand for natural beauty products, which are often referred to as “clean” beauty. Coresight Research estimates that sales of US natural cosmetics and skincare products, deemed to be clean beauty, reached $3.2 billion in 2020, up 3% year over year. This compared to a 3% decline in the overall US cosmetics and skincare market, based on Euromonitor International data.

While there is no official definition, “clean beauty” is generally considered as a guarantee that products do not contain harmful or toxic ingredients, both for the user’s skin and the environment. According to a 2020 survey conducted by tech company Bazaarvoice, 68% of global consumers read the ingredient labels on beauty products before buying, and 43% want clean hair, makeup and skincare products.

Moreover, the context of the health pandemic has led to a spike in consumer purchases of clean beauty products. Payment company Klarna reported an 18% increase in volume in the clean beauty category compared to pre-pandemic in the US. The category appealed the most to US millennial and Gen Z consumers—millennials accounted for 71% of the overall volume for clean beauty purchases via the platform as of August 2020, while Gen Z has shown the highest increase compared to pre-pandemic in clean beauty spending, reaching 26%.

As more beauty companies offer natural beauty products and big beauty retailers including Sephora and Ulta double down on clean beauty, we predict that the natural beauty market will see solid growth and hit $4.4 billion in 2023. This reflects a CAGR of 10.3% from 2021 to 2023. Moreover, we expect the penetration of natural beauty products within the overall US beauty market to expand from 7% in 2018 to 11% in 2023.

Figure 4. US Natural Beauty Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis)

[caption id="attachment_125836" align="aligncenter" width="550"] The natural beauty market includes natural cosmetics and skincare products.

The natural beauty market includes natural cosmetics and skincare products.Source: Coresight Research[/caption]

While the most common clean beauty products are currently skincare and cosmetics, we expect to see beauty brands and retailers continue to branch out into categories such as fragrance, haircare and nail polish, choosing to eliminate controversial ingredients from their product formulas.

- Leading haircare manufacturer John Paul Mitchell Systems launched a clean haircare line named Paul Mitchell Clean Beauty in October 2020.

- L’Oréal-owned Pureology relaunched its haircare products with a clean formula in July 2020.

Within the beauty industry, wellness-related CBD beauty products are also poised to grow exponentially, with consumers interested in CBD for its attributed calming and anti-inflammatory properties.

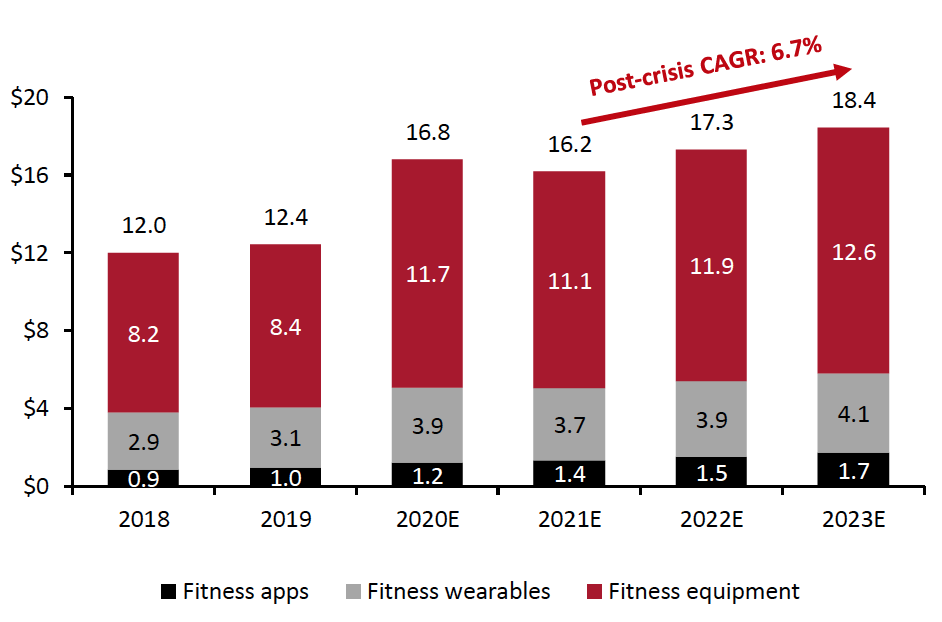

3. Home FitnessNew business models are disrupting the fitness industry, with the rise of digital fitness replicating in-studio experiences at home and providing greater convenience for customers. We estimate that the total US home fitness market, which includes fitness apps, equipment and wearables, reached $16.8 billion in 2020—a 35.2% leap year over year.

Moreover, home fitness provides a solution for consumers that are increasingly health-conscious amid the pandemic but reluctant to visit enclosed public spaces—our weekly US consumer surveys consistently record that over half of consumers are avoiding gyms or sporting centers due to the coronavirus. This is in line with BEA data for consumer spending on membership clubs and fitness centers, which tumbled by 28.3% year over year in 2020.

Breaking down the home fitness market, some 70% of total sales were driven by purchases of fitness equipment. As fitness equipment and wearables are typically a one-time purchase, we project that spending in this segment will fall slightly in 2021, given that consumers are unlikely to make repeat purchases. Contrastingly, we anticipate that fitness apps will continue to see growth from recurring subscription revenue.

Looking forward, we expect consumers to become increasingly comfortable in returning to gyms or fitness centers as vaccinations roll out across the US. With more gyms also offering digital fitness content and digital fitness experiences continually improving through technology, we are likely to see a hybrid model of online/in-person workouts in the future.

- For instance, digital fitness platforms as using artificial intelligence (AI) to personalize workout routines and adopting virtual reality (VR) technology to gamify training experiences. Fitness innovator Tonal offers wall-mounted intelligent weight training equipment. Users can choose different workout goals—the AI-enhanced equipment will automatically provide resistance and adjust the weight requirements for each exercise in real time. The company reported that its sales increased eightfold year over year in 2020.

Coresight Research expects the home fitness market to reach $18.4 billion in 2023, representing a post-crisis CAGR of 6.7% from 2021 to 2023, albeit with a dip in 2021 due to a decline in the sales of equipment and wearables.

Figure 5. US Home Fitness Market (USD Bil.)

[caption id="attachment_125837" align="aligncenter" width="550"] Source: Statista/Coresight Research[/caption]

4. Mental Wellbeing

Source: Statista/Coresight Research[/caption]

4. Mental Wellbeing

Often viewed as a public stigma, mental health and wellbeing were brought into the spotlight amid the pandemic in 2020 and into 2021.

The American Psychological Association noted in its latest Stress in America survey in January 2021 that some 84% of Americans reported feeling at least one emotion associated with prolonged stress—the most common being feelings of anger, anxiety and sadness. The survey also recorded an average stress level of 5.6 on a scale of one to 10 in January, where one represents “little to no stress” and 10 represents “a great deal of stress.” This was much higher than pre-pandemic survey findings of a 4.9 average stress level in 2019.

More consumers today are seeking products and services that offer overall emotional support, with an increased focus on the interconnected nature of mental and physical wellbeing.

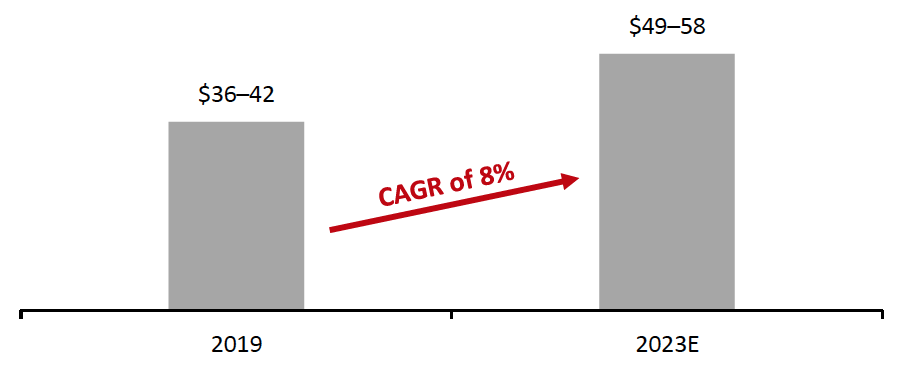

The Global Wellness Institution reported that the global mental wellness industry was worth an estimated $120.8 billion in 2019. Breaking down the global estimate, we calculate that the US accounted for 30–35% of the mental wellness market, translating to roughly $36–42 billion in 2019. Coresight Research expects to see the market grow at a CAGR of 8% through 2023, reaching approximately $49–58 billion.

According to the Global Wellness Institution’s definition, the market includes:

- Brain-boosting nutraceuticals: Spending on ingestible products with the specific aim of improving mental health, including functional foods and beverages that claim to have brain health and sleep benefits, herbal and botanical products, over-the-counter supplements and traditional remedies for better brain health and energy.

- Meditation and mindfulness: Spending on meditation and mindfulness practices, and related products and services such as apps, accessories and equipment, and wearable gadgets and trackers.

- Self-improvement: Spending on products and activities associated with self-help and personal development, including brain training and cognitive enhancement apps, and self-help classes and workshops.

- Senses, spaces, and sleep: Spending on products and services related to senses, including aromatherapy, circadian lighting, home fragrances, sound healing, stress toys, weighted blankets, wellness music and white noise.

As mental wellbeing relates to sleep health, the sector includes products and services that overlap with the sleep economy, which we discuss in more detail in the below section.

Figure 6. US Mental Wellness Market (USD Bil.)

[caption id="attachment_125838" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Besides traditional sleep-aiding and mood-enhancing ingestible products, such as melatonin, valerian root and Omega-3 fatty acids, we see opportunities in virtual therapy services and products that foster a comfortable and relaxing environment at home.

- For example, meditation app Calm topped 3.9 million global downloads in April 2020, followed by 1.5 million downloads worldwide of competitor app Headspace in the month, according to app intelligence firm Sensor Tower. Consumers are also finding comfort in home fragrances that claim to promote relaxation, with the segment seeing sales growth of 13% during the first nine months of 2020, according to research firm NPD Group.

Poor quality or insufficient sleep is an issue for many US consumers. According to the Centers for Disease Control and Prevention (CDC), one-third of Americans usually get less than the recommended amount of sleep.

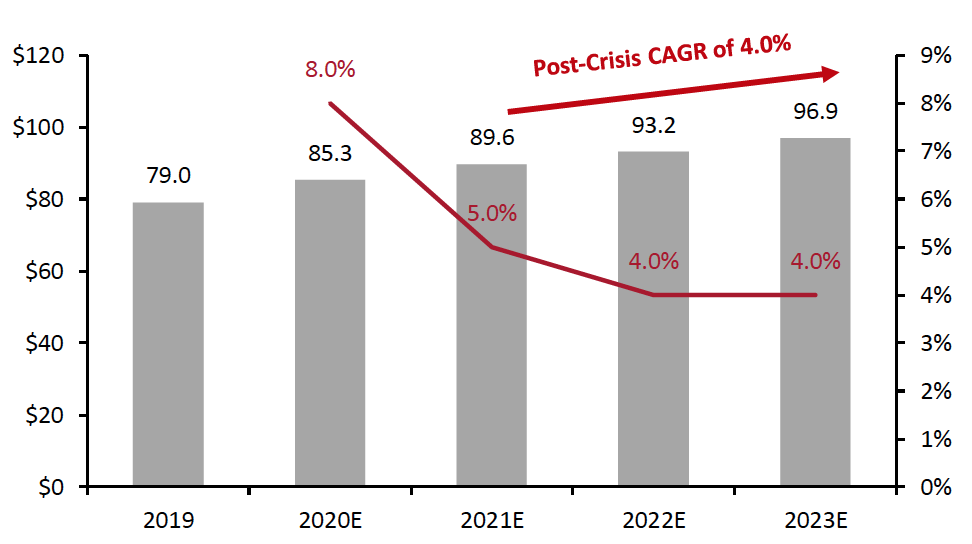

In 2020, the issue was exacerbated by the pandemic, resulting in the coinage of the term “Covid-somnia” by sleep neurologists. We estimate that the market grew by 8.0% to $85.3 billion in 2020, and will go on to reach $96.9 in 2023—at a CAGR of 4.0% from 2021 to 2023.

Consumers are sleeping worse than before—43% of Americans described their sleep as poor or fair, based on Better Sleep Council’s 2020 State of America’s Sleep Survey, compared to 38% in 2019. Concerns over the economy and individual’s health amid the pandemic also likely contributed to poor sleep. As a result, consumers are increasingly encompassing sleep within the wellness movement, benefiting a wide range of products that aid sleep.

Frost & Sullivan forecasted the US sleep economy stood at $79 billion in 2019. The market is made up of 11 categories and services with products that are marketed as improving sleep: ambience optimization (including lighting, sound, scents, temperature and humidity), bedding, bedroom furniture, pajamas, pet sleeping products, airplane sleep accessories, tracking devices, sleep supplements, sleep-apnea-treatment devices, sleep services and medical diagnostic services.

Figure 7. US Sleep Economy Market (Left Axis; USD Bil.) and YoY % Change (Right Axis)

[caption id="attachment_125839" align="aligncenter" width="550"] Source: Frost & Sullivan/Coresight Research[/caption]

Source: Frost & Sullivan/Coresight Research[/caption]

Direct-to-consumer (DTC) brands, in particular, are launching innovative and customizable versions of conventional sleep products, which are marketed as specifically aiding better sleep. We expect these brands to capture share from traditional brands and retailers in 2021 and beyond.

- Casper, the pioneer of DTC bedding, launched a weighted blanket in late 2019, which is a therapeutic product designed to calm anxiety. Casper has also been expanding its product portfolio, offering 40 products as of the end of 2020. The company reported a 13.1% year-over-year revenue rise in 2020.

- Casper’s nearest rival Purple also saw solid sales growth in 2020, spiking by 51.4% year over year.

We also could see sustained popularity in other adjacent verticals, such as lighting, scents, sleep apps, and tracking devices. More wearables are integrating sleep monitoring functions and tools for detecting sleep disorders. Most popular devices such as Apple Watch and Fitbit all have sleep tracking features. In a March 2020 survey conducted by GlobalWebIndex, 40% of US and UK wearable owners said they use wearable devices to track their sleep.

- Sleep solutions and skincare brand, This Works, reported that consumers’ attention on sleep influenced sales of its products, with sales of sleep candles sales rising by 200% between March and May 2020.

Health supplements, especially immunity-positioned ones have seen unprecedented and sustained interest throughout 2020, as consumers look for products that bolster overall health as a precaution against illness. Supplements such as vitamin B, C, D and zinc, which are generally known for their immunity-boosting potential saw a surge in usage, including many new consumers.

According to the Natural Marketing Institute, one in five Americans started taking vitamins in the wake of Covid-19, and adding that to the current users, who comprise 70% of respondents, roughly 90% of the US population are taking supplements. Our US consumer survey undertaken on March 8, 2021, found that almost 30% of respondents reported buying more health products because of the pandemic.

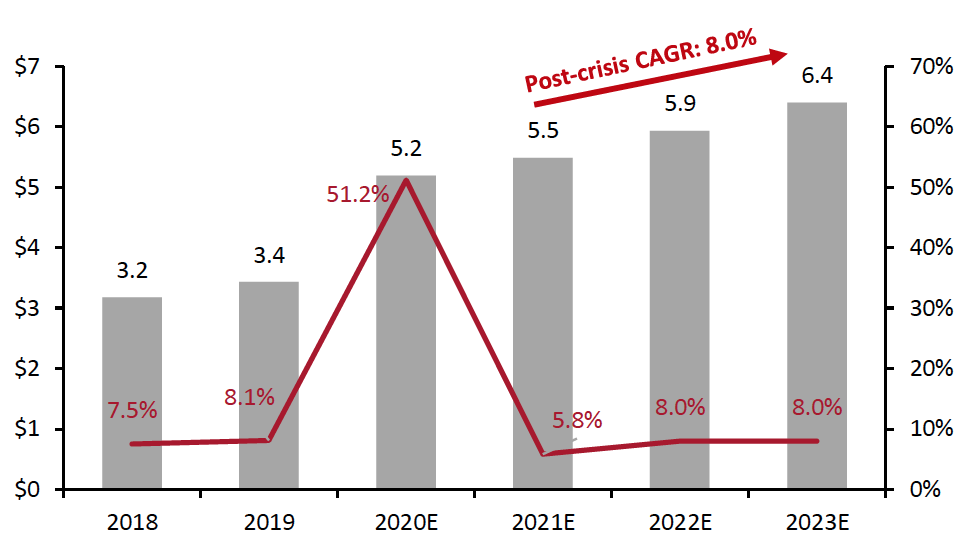

Strong consumer demand drove significant sales gains for immunity supplements last year—in July 2020, the Nutrition Business Journal projected 51.2% year-over-year growth for 2020 in this segment, amounting to $5.2 billion. This estimate would account for 9.5% of total US supplement sales.

We expect the growth of immunity supplements to moderate this year and revert to pre-pandemic levels of around 8.0% in the next two years. The immunity supplement market will reach $6.4 in 2023, representing a post-crisis CAGR of 8.0%, and 10% of the total US supplement market.

In addition to immunity supplements, we see strong potential in beauty and CBD supplements, supported by the wellness trend. Beauty supplements commonly contain collagen, co-enzymes and vitamins that can be beneficial to hair, nails and skin. CBD supplements are cited to help relieve anxiety and sleep issues.

- Hair growth supplement brand Nutrafol reported 61% growth in its new customer sales of its women’s supplement between March and May 2020.

- Beauty supplement brand Moon Juice saw significant interest in its sleep supplements Dream Dust and Magnesi-Om, with sales increasing by 70% and 50%, respectively, between mid-March and May 2020. The brand also launched SuperBeauty supplements in May 2020, which combine glutathione, an antioxidant ingredient with vitamins C and E. The product claims to diminish signs of aging and promote collagen production.

Figure 8. US Cold, Flu and Immunity Supplement Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis)

[caption id="attachment_125840" align="aligncenter" width="550"] Source: Nutrition Business Journal/Coresight Research[/caption]

Source: Nutrition Business Journal/Coresight Research[/caption]

What We Think

Covid-19 has transformed most consumers’ ways of living and shopping, leading to major spending shifts in the retail industry. Health and wellness has become increasingly significant for many consumers, resulting in a spike in demand for products and services positioned toward both physical and mental wellness during the pandemic. We believe that the wellness trend will sustain over the coming years, and remain a top driver of discretionary spending growth.

Implications for Brands/Retailers

- As consumers continue to look to athleisure for casual daily wear as well as fitness activities, we expect US sportswear and athleisure sales to account for one-third of the total apparel and footwear market in 2021. As the boundaries of athleisure, sportswear and casualwear continue to blur, traditional brands and retailers can leverage technology innovations to enhance the comfort and functionality of all their apparel offerings across the three categories. Retailers should also look to partner with leading sportswear brands on co-branded collections to generate consumer interest and expand their customer base.

- To capitalize on the home fitness trend and strengthen brand communities, brands and retailers should create more fitness content, including informative posts and free fitness classes, whether on their own platforms, social media accounts or through collaboration with online fitness innovators.

- As consumers become increasingly conscious of the ingredients contained in their cosmetics, beauty brands and retailers should commit to greater transparency and sustainability in their offerings to resonate with shoppers. While “clean beauty” may still seem a somewhat vague term, it is important for brands to provide knowledgeable information and content on beauty product ingredients. For example, beauty brand Biossance recently launched an online resource named The Clean Academy within its website, defining itself as the go-to destination on the clean beauty topic.

- Beauty and food brands and retailers should look to incorporate immunity-boosting or sleep-aiding benefits into new products or develop product ranges positioned to improve general wellness. To capitalize on this trend, Pepsi launched a water drink called Driftwell in December 2020. The drink is infused with herbal ingredients and minerals, such as L-theanine, an amino acid that reportedly promotes calmness and aids sleep.

- Home brands and retailers should look to partner with wellness-focused platforms or apps, such as Calm, to co-produce content on sleep, relaxation and mediation that will boost brand awareness. Brands and retailers can also look to emphasize wellness-related benefits in new product launches, particularly those that address specific needs that consumers might have, such as insomnia or stress.

Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved