albert Chan

In our monthly countdown to the 11.11 Global Shopping Festival, known as Singles’ Day, we will help brands and retailers to prepare for the event and make the most of the huge opportunities it presents. Last year, GMV on Singles’ Day reached $38.4 billion across Alibaba’s platforms, with roughly 200,000 domestic and overseas brands joining in the event. In 2020, with the retail industry globally having been hit hard by the coronavirus crisis, brands and retailers can leverage Singles’ Day as a means to recover sales and clear some inventory.

With six months to go until Singles’ Day 2020, we highlight the actions that brands and retailers can take over the coming months to get ready for the shopping event.

An Opportunity That Brands and Retailers Should Not Ignore

Given the temporary store closures and depressed demand in Western markets, Singles’ Day could help retailers to mitigate the impact of the coronavirus pandemic, including what may be a very weak holiday period. We hold a cautious outlook for European and US retail demand throughout the rest of 2020: The profound effects of the crisis on the economy and labor market are likely to inhibit consumer demand in the West over the remainder of the year, even if the coronavirus shutdown turns out to be for a relatively short period of time.

Companies selling discretionary goods could make full use of this global shopping event to clear some of their inventories from non-Western markets—as long as products still have relevance. They can also use the event to offset likely weaknesses in those Western markets through the end of 2020.

We have seen growth in some discretionary goods categories in China, such as beauty, in which sales have quickly rebounded as the nation recovers from coronavirus outbreak. Data provider ECdataway reported that sales of cosmetic and skincare products on Tmall jumped 89.5% during the International Women’s Day (March 8) promotion period. Similarly, the apparel category saw an uptick. Chinese apparel company Peace Bird reported that its GMV reached ¥120 million ($16.0 million) during the International Women’s Day sales period (March 5–8)—with average GMV per day totaling ¥30 million ($4.2 million). By comparison, the company’s average daily GMV was just ¥8 million ($1.1 million) in February, during the coronavirus outbreak.

Moreover, both beauty and apparel categories performed well during the 11.11 Global Shopping Festival in 2019. Sales of Estée Lauder products reached ¥700 million ($99 million) on Tmall—a roughly 40% year-over-year increase. Chinese apparel brand Bosideng gained ¥650 million ($92 million) in sales on Tmall, representing 58% year-over-year growth.

[caption id="attachment_109286" align="aligncenter" width="704"] Estée Lauder Singles’ Day page on Tmall

Estée Lauder Singles’ Day page on TmallSource: Alibaba[/caption]

What Brands Should Be Doing Now: Mark Down Key Dates in the Calendar

Alibaba has a timeline for the multilayered vetting process that takes place each year for brands and retailers looking to participate in the event. Brands and retailers need to mark down the key dates now. This is what we expect for 2020, based on the 2019 timeline for Alibaba’s platforms:

- From mid-September, brands can apply to the event. They must meet the requirements outlined in the “Sales Activities Standard Rules.” In essence, these criteria require merchants to show records of providing good services to customers across various areas, including product quality, logistics, query handing and post-sales services.

- Between September 23 and 30, merchants will need to start registering products for the pre-sale period, which lasts from October 21 to November 10.

- From mid- to late October, merchants can submit their application to participate in Singles’ Day itself, listing the products they plan to sell. Rules around this process vary from one year to the next, and sometimes merchants are required to sell different products on November 11 than the ones they have been selling during the pre-sale period. Merchants may be allowed to apply for an extension to sell the same products sold during the pre-sale period on Singles’ Day, subject to the rules of the year.

- During the pre-sale period of October 21 to November 10, companies participate in the preliminary round of sales and promotions.

- On November 11, the 24-hour 11.11 Global Shopping Festival officially takes place.

Action Points for Brands Now: Brands and retailers need to make sure that they fulfill the performance standard required by Alibaba. Merchants need to reach out to vendors (such as companies who offer delivery and post-sales services) to check whether they meet the requirement or not, if they outsource these services to third parties. Alibaba usually checks the performance for the 30 days prior to a set date (which usually falls in late August).

As discretionary brands and retailers review their lockdown-driven gluts of inventory and their options for clearing it, they should consider Singles’ Day as one those options. Alongside retaining stock for the following year (in the case of some apparel retailers), clearing via off-price channels and other wholesale routes, and discounting in domestic stores, Singles’ Day could be a further route. However, retailers and brands must ensure that any products they aim to put into the event continue to have relevance to shoppers buying in November.

Prerequisite of Joining the Event: Be a Seller on Tmall

Brands looking to participate in the event must be existing sellers on the platform, as Alibaba only allows sellers on its platforms to participate in Singles’ Day.

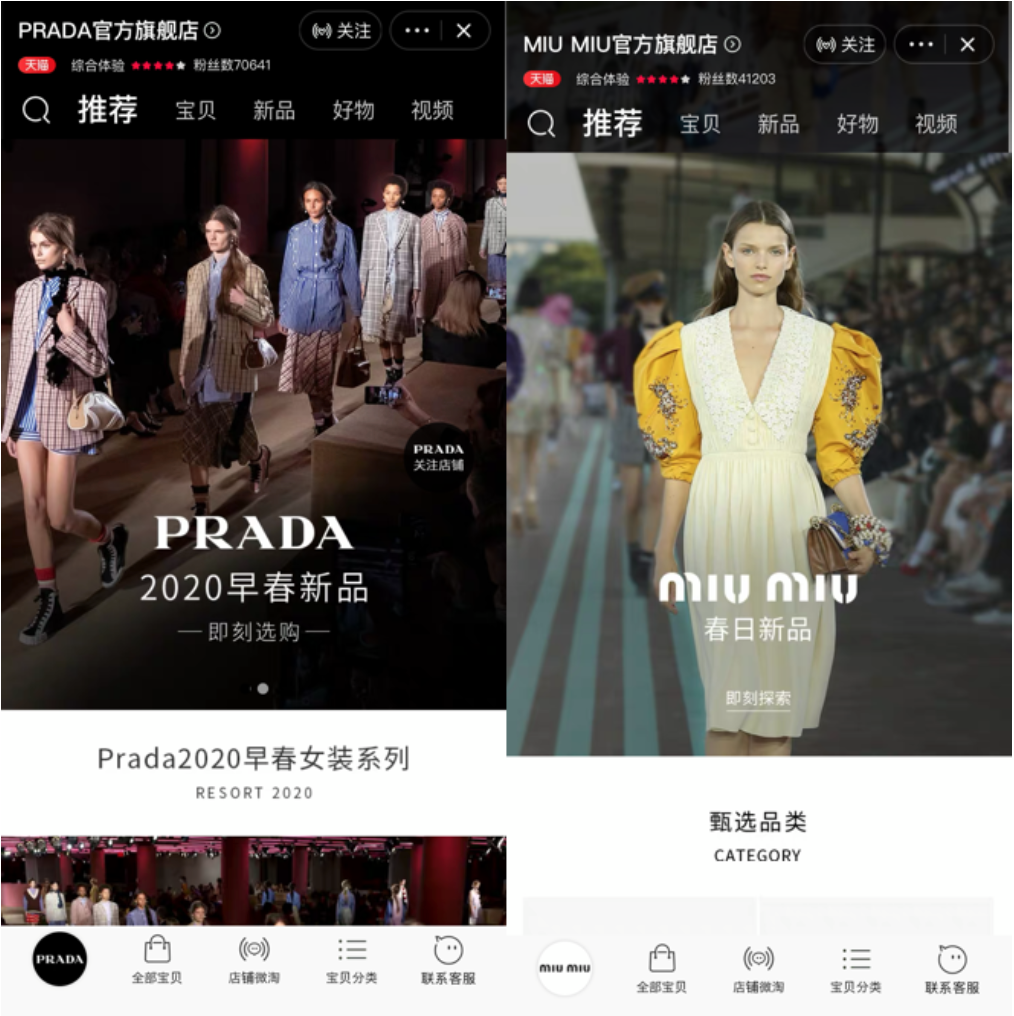

We have seen a number of international brands recently launch stores on Tmall and Tmall Global to sell products through the digital channel, due to temporary store closures during the pandemic. In March, IKEA, streetwear brand Bape, sneaker and apparel brand Undefeated and luxury brands Miu Miu and Prada all made their debuts on Tmall.

[caption id="attachment_109287" align="aligncenter" width="600"] Prada’s and MiuMiu’s shops on Tmall

Prada’s and MiuMiu’s shops on TmallSource: Tmall[/caption]

Other Platforms Brands Can Consider: Although Singles’ Day was started by Alibaba, other online platforms have seen its success and jumped on board. JD.com reported that its total transaction volume exceeded ¥204.4 billion ($29 billion) in its 11-day sales event last year, from November 1 to 11—a 28% increase over 2018.

The GMV of group-buying platform Pinduoduo reached ¥25 billion ($3.5 billion) during the shopping event, according to data company Syntun. Pinduoduo’s contribution towards the total GMV of all online platforms during Singles’ Day rose to 6.1% in 2019, from 3.0% in 2018.

Leverage Chinese Livestreaming and Short-Video Apps

Brands and retailers need to familiarize themselves with popular Chinese social media apps, such as livestreaming apps (e.g., Taobao Live) and short-video platforms such as TikTok. These apps saw a surge in user numbers during the coronavirus outbreak as the forced home-quarantine measures impacted the amount and nature of screen time spent by consumers in China.

The number of daily active users on TikTok saw a 42.7 million increase between January 24 and February 2, 2020, according to data firm QuestMobile. The number of viewers on Taobao Live increased by 43.13% during the 14 days ended February 7, according to financial firm Zhongtai.

Moreover, livestreaming proved itself to be an efficient selling medium during last year’s Singles’ Day. For instance, L’Oréal saw a seven-fold increase in GMV generated in 2019 from livestreaming on Taobao Live, compared to 2018.

[caption id="attachment_109288" align="aligncenter" width="350"] A L’Oréal livestreaming session during Singles’ Day 2019

A L’Oréal livestreaming session during Singles’ Day 2019Source: Taobao Live[/caption]

A Detailed Look at Singles’ Day GMV

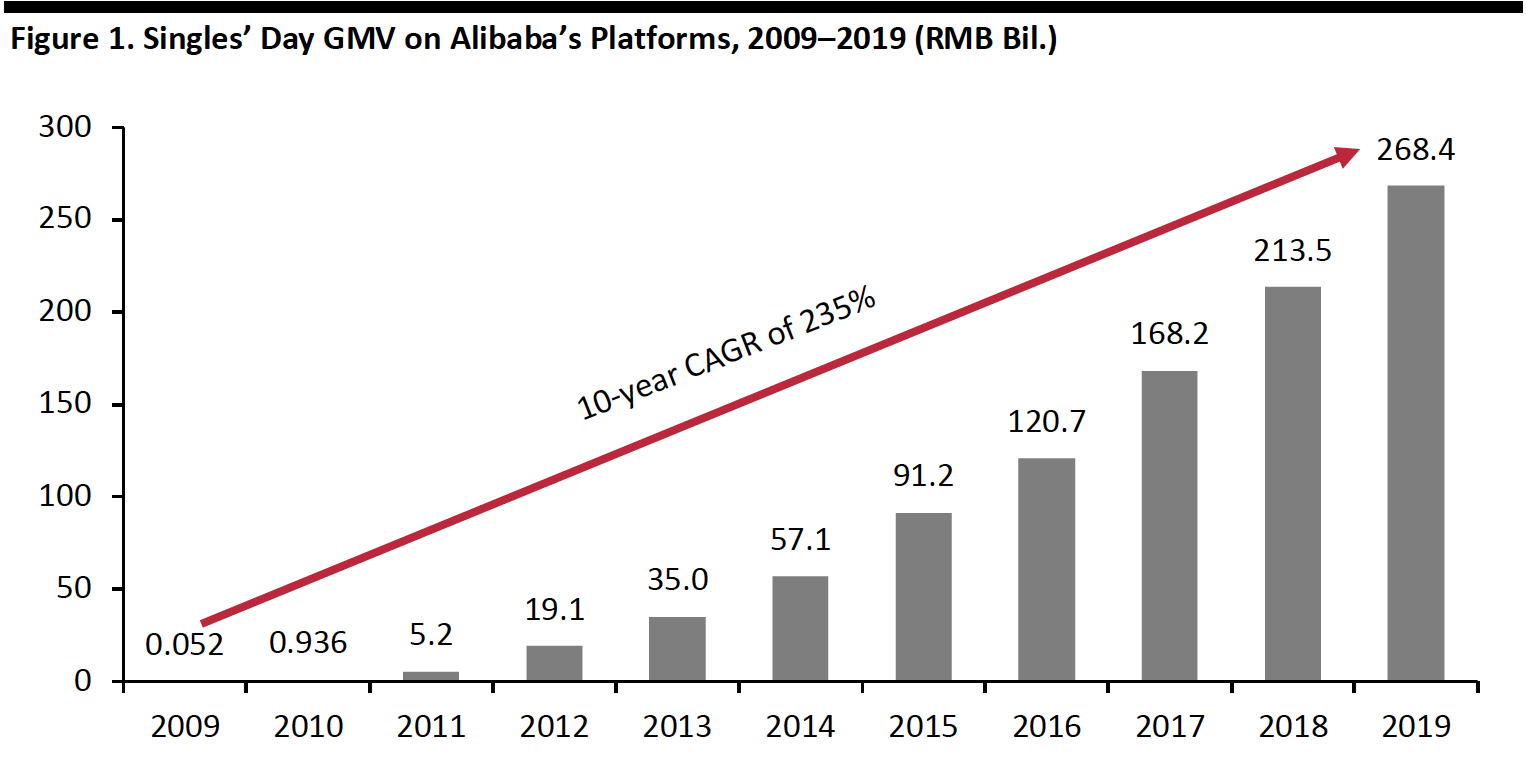

Singles’ Day began as a festival of young Chinese people celebrating their pride in being single, but Alibaba began promoting the day as a shopping in 2009. Only 29 brands participated then, with total GMV reaching ¥52 million ($7.8 million). Last year, total GMV on Alibaba’s various platforms hit ¥268.4 billion ($38.4 billion), representing 25.7% growth over the prior year and a huge 235% CAGR over the past ten years.

[caption id="attachment_109322" align="aligncenter" width="700"] Source: Alibaba/Coresight Research[/caption]

Source: Alibaba/Coresight Research[/caption]

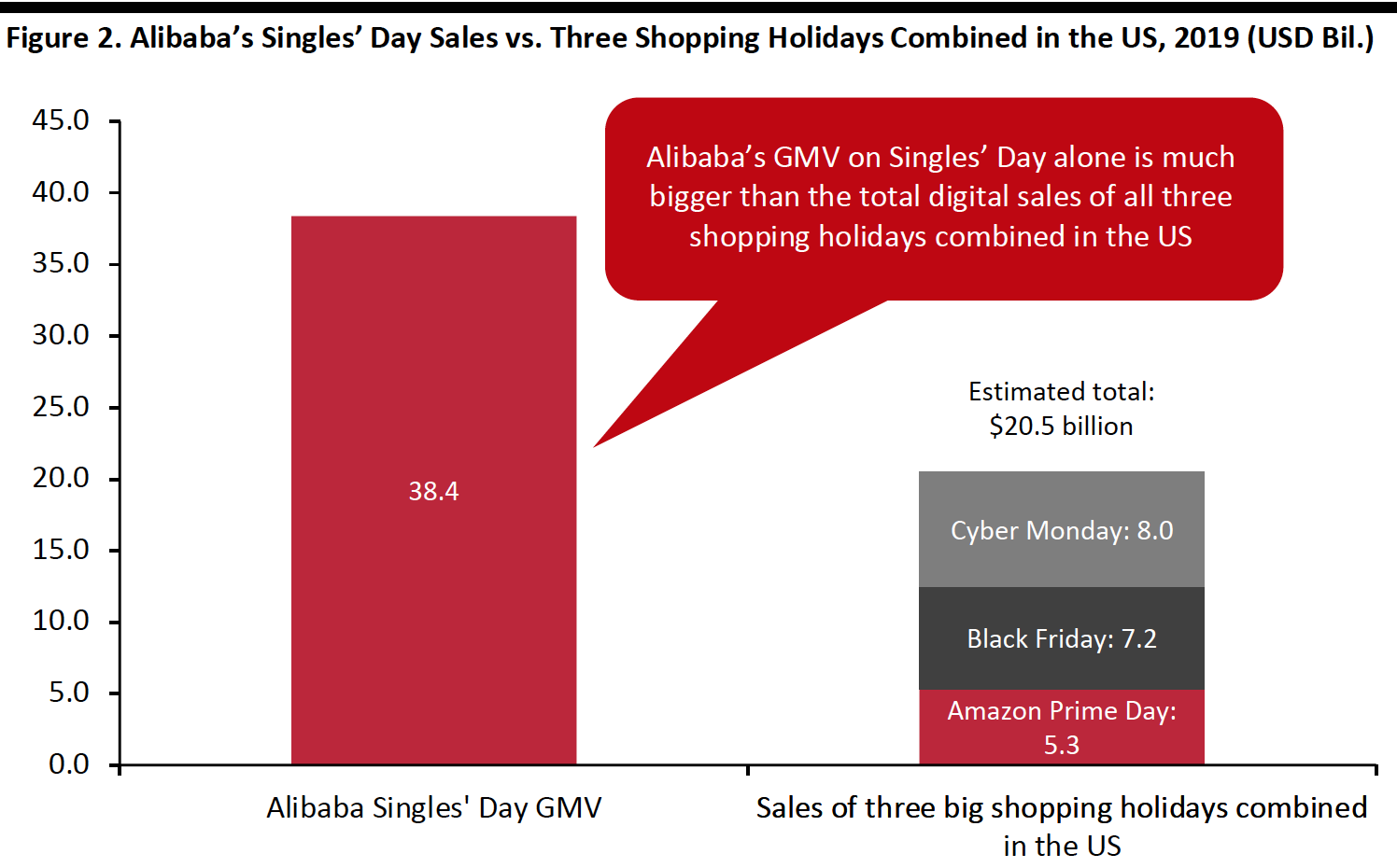

The scale of China’s Singles’ Day compared to three major US shopping holidays—Amazon Prime Day, Black Friday and Cyber Monday—shows how important it should be for brands and retailers. Amazon launched its first 24-hour Prime Day shopping festival in 2015 to commemorate its 20th anniversary. The e-commerce giant extended the shopping extravaganza to two full days in 2019 from 36 hours in 2018. We estimate that the event, which took place on July 15 and 16, generated global sales in the region of $5.3 billion for Amazon.

For Black Friday last year, Salesforce estimated that online sales reached $7.2 billion, with Cyber Monday collecting $8.0 billion.

[caption id="attachment_109290" align="aligncenter" width="700"] Source: Company reports/ Coresight Research[/caption]

Source: Company reports/ Coresight Research[/caption]

Key Insights

Singles’ Day has emerged as the world’s largest shopping festival in terms of GMV—much bigger than the total digital sales of Amazon Prime Day, Black Friday and Cyber Monday combined. With temporary store closures and depressed consumer demand in the West due to the coronavirus, Singles’ Day represents a key opportunity for brands and retailers to clear some of their inventory of discretionary products.

Preparation for Singles’ Day is important: Western brands and retailers need to know the timeline (such as when to submit product listings for the pre-sales period) and mark down key dates. Companies should launch a shop on Tmall if they have not yet done so, because this is a requirement for brands and retailers to join the event.

Companies could also leverage popular online apps (e.g., Taobao Live and TikTok) to boost product sales. These apps have become even more popular among consumers during the coronavirus outbreak, and livestreaming is taking hold as a strong sales channel, particularly in beauty.