albert Chan

Introduction

What’s the Story?

Following the pandemic-led shift to e-commerce and increasing demand for authentic digital engagements from consumers, livestreaming e-commerce (shoppable live video) presents a significant opportunity for brands and retailers to retain consumer engagement online and drive sales through an entertaining and seamless format. Coresight Research has identified livestreaming e-commerce as one of the key trends to watch in retail in 2022.

In this report, we debunk six myths often heard in boardrooms about how to set up livestream events, what consumers value most when it comes to live shopping, and the impact on sales of successful digital interaction. By decoding these common myths, we present brands and retailers with critical insights into optimizing their US livestream e-commerce strategies to win in the live-shopping space.

This report is sponsored by Firework, a shoppable-video and livestreaming e-commerce solutions provider. The company is backed by IDG Capital, Lightspeed Venture Partners and GSR Ventures, with over $100 million in capital funding to date.

Why It Matters

Coresight Research estimates that the US livestream e-commerce market will total $17 billion in 2022, up 54.5% from an estimated $11 billion in 2021. We calculate that this would increase livestreaming e-commerce penetration (as a percentage of the total e-commerce market) from 1.3% to 1.9% in the same time frame—resulting in more than double the 0.8% penetration we saw in 2020 (when the US livestreaming e-commerce market totaled $6 billion).

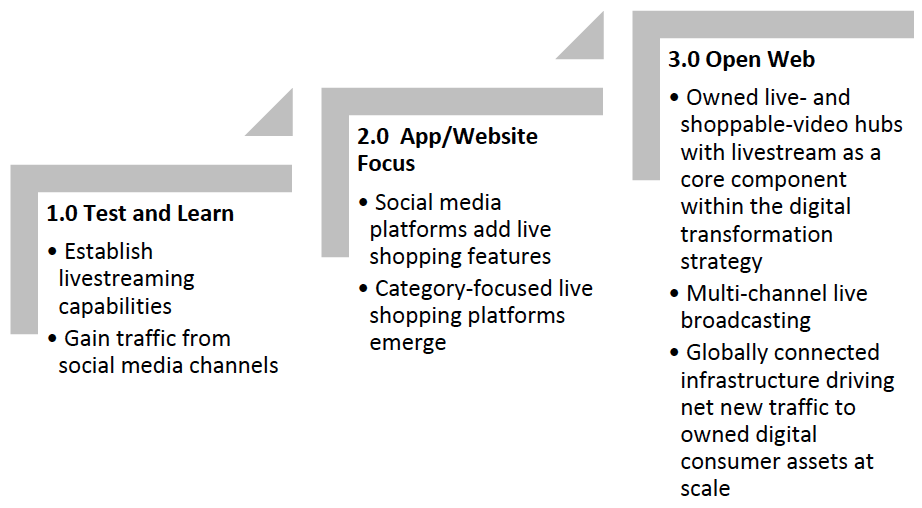

As the market grows, new players and formats are emerging online, and brands and retailers are continuing to develop their approaches. We identify three stages in the development of live shopping, as shown in Figure 1—from the “test and learn” approach when shoppable livestreams were first established to the “open web,” which sees the proliferation of owned video hubs and multi-channel livestreaming. We believe that most brands and retailers are still in stage 1.0 and 2.0, and only a few pioneering companies have entered stage 3.0.

As the market becomes more competitive, it is important that brands and retailers mature their livestreaming e-commerce strategies in order to be able to innovate and adapt to consumer preferences and shopping behaviors.

Figure 1. Livestreaming E-Commerce Development in the US

[caption id="attachment_139482" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Six Livestreaming Myths Debunked: Coresight Research x Firework Analysis

Myth #1: Live-Shopping Marketplaces Dominate the Livestreaming E-Commerce Space

Brands and retailers often consider live-shopping marketplaces, independent B2C (business-to-consumer) website/apps, as a live-shopping campaign destination. For example, Amazon Live, the live-shopping channel of e-commerce giant Amazon, is one of the most recognizable live-commerce platforms in the US. Amazon has over 300 million active users globally, presenting huge potential for livestream sales among its existing customer base.

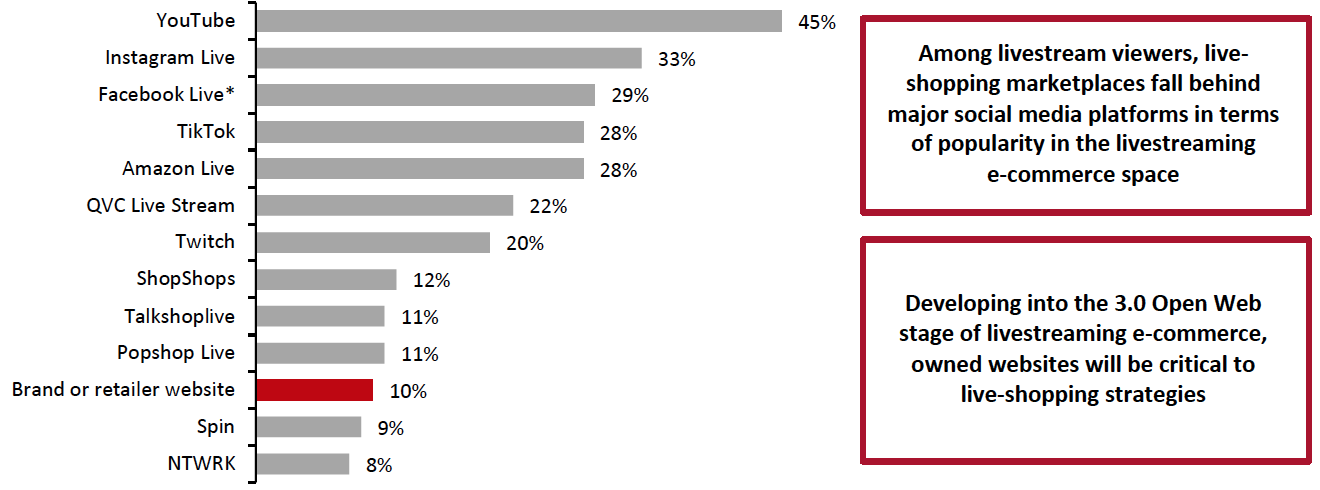

However, Amazon is faced with challenges in driving traffic into livestreams, resulting in lower engagement than social media channels. According to a Coresight Research survey of US consumers conducted in March 2021 (and additional estimates), Amazon falls behind major social media platforms YouTube, Facebook and Instagram in terms of popularity, and ties with TikTok: 28% of US livestream viewers reported that they had watched a shoppable livestream on Amazon Live, compared to 45% for YouTube (see Figure 2).

New live-shopping marketplaces are also emerging to capitalize on the popularity of shoppable video content, but they are yet to sustain high traction, according to the latest tracking data from digital intelligence provider Similarweb:

- ShopShops saw traffic drop in the fourth quarter of 2021 from the previous quarter, with a 10% decrease in time spent using the tool and a 4% increase in bounce rate, to 60%.

- Talkshoplive’s daily page views per visitor were down 19% in the fourth quarter of 2021; daily time spent on site was down 18%; and the bounce rate increased by 10% to 56.3%.

Figure 2. Platforms via Which US Livestream Viewers Have Watched Shoppable Livestreams (% of Respondents)

[caption id="attachment_139483" align="aligncenter" width="700"] *Calculated through statistical analysis

*Calculated through statistical analysisBase: 515 US respondents aged 18+ who have watched a shoppable livestream, surveyed in March 2021

Source: Coresight Research[/caption]

Myth #2: Producing Live Video Takes the Same Effort as TV Commercials

Companies commonly believe that the video quality of livestream content should be on par with television commercials—and so livestreaming requires million-dollar investments in building studios with professional audiovisual installations. However, this is not the case. Viewers prioritize content, and look to livestreaming to connect with influencers and brands—often deprioritizing production value. For example, when a host talks about a product they truly value or have real experience using, viewers can gain insight into the product as if they are getting recommendation from a trusted friend, boosting authenticity and establishing a stronger emotional connection between the host, the brand and the viewers.

The technical requirements for livestreaming are therefore highly accessible, as only a smartphone, good lighting and user-friendly software are needed to get started, not a professional studio and video team.

Myth #3: Broadcasting on Social Media Will Drive Sales Conversion

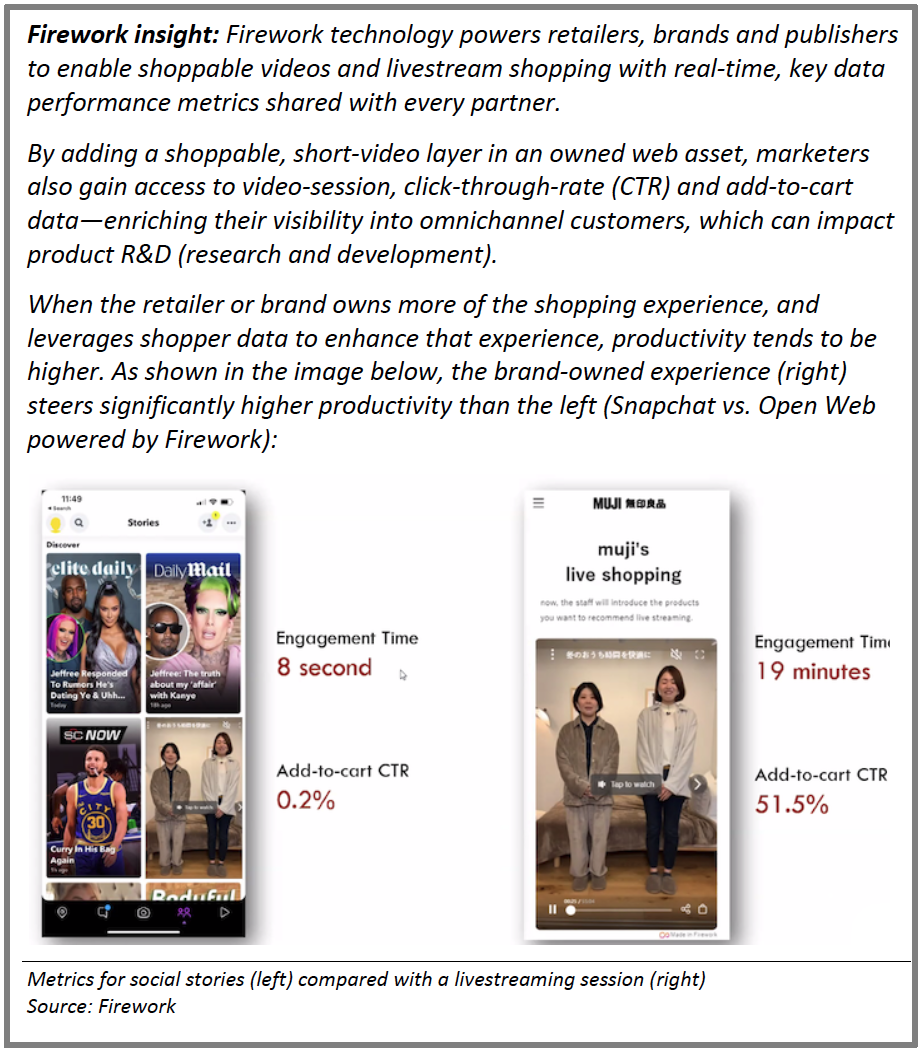

Although social media platforms are useful in attracting a broad range of viewers, we see three key challenges with using this channel to drive sales:

- Social media lacks seamless purchase functionality, leading to low add-to-cart rates. While social media platforms are popular among livestream viewers, traffic from these channels does not always translate into sales--particularly if the purchasing process is not seamless, coupled with privacy and security concerns for buying directly on social media. Coresight Research’s social commerce survey in March 2021 found that nearly nine in 10 respondents who use social media for product research or discovery give up on making a purchase at least sometimes due to a platform’s lack of in-built checkout functionality. For livestreaming specifically, streamlined in-video purchasing functionality is key to driving ultimate conversion.

- Social media offers limited data tracking. Hosts do not have direct access to viewer/conversion data when livestreaming through social media. Owned websites, on the other hand, give brands and retailers access to, and control of, first-party data in real time, to better understand and analyze their customers and improve future livestream sessions.

- Displayed ads and influencers offer typically lower ROI (return on investment) than targeted ads. Viewers of livestreams on social media are not necessarily engaged shoppers that would make purchases; they often simply watch content for entertainment and remain predominantly engaged to interact with friends instead of brands. Furthermore, they may not be the relevant target consumer of the brand or retailer and so would be unlikely to buy through the livestream. Additionally, social platforms inherently seek to drive any conversion to sale. When their “intent crawlers” identify a buying signal driven through an algorithm or as a result of brands running a livestream, competitive ads will often be served within a few seconds and in close proximity to the paid livestream content. This is not ideal for driving brand differentiation or if the desired outcome is creating a unique dialogue with audiences.

- Social media platforms are trying to improve their functionality to tap into the rise of livestreaming, and we saw may developments in advance of the 2021 holiday shopping season. We assess the capabilities of major US social media platforms in Figure 3, and highlight the investment required to livestream through each platform.

Figure 3. US Social Media Platforms’ Live-Shopping Features

[wpdatatable id=1616] Source: Company reports/Coresight Research

Myth #4: Livestreaming Is Primarily a Tool To Promote Deals

Consumers that have watched shoppable livestreams recognize multiple benefits of the channel, one of which is indeed looking for a good deal: Our March 2021 survey found that this was the topmost reason for watching shoppable livestreams, cited by 40% of livestream viewers.

However, discovering new products, learning more about products, excitement and convenience were also all cited by more than 30% of livestream viewers in our survey, demonstrating the varied value that the channel provides to shoppers.

Brands and retailers should diversify their livestreaming strategies to focus beyond price and connect with engaged consumers—driving repeat visits via “shoppertainment” and providing access to shopper data. Executed on a brand or retailer’s website, the blend of shoppable short-video and livestream entertainment with streamlined purchase capacity is effective in driving digital consumer engagement and conversion. Among the earliest adopters of this strategy are department stores and CPG brands such as Kraft, which we explore below.

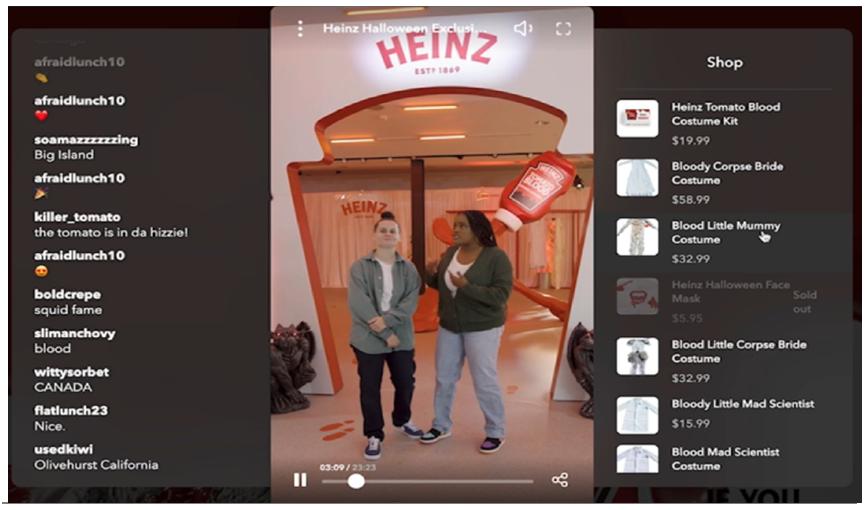

- Kraft Heinz, one of the largest CPG brand owners in the US, began hosting livestream shopping sessions on its own website in November 2021. The brand connected with parents and their children with a seasonal Heinz Halloween exclusive pop-up experience in partnership with Firework. The live campaign was amplified across social channels, as well as the Firework Publisher network. According to data provided by Firework, Kraft Heinz was able to drive over 675,000 views over the first seven days, exceeding the company’s expectations for 25,000 total videos by 27X, while producing 18X better engagement then Kraft Heinz’s 3X expectations (total of 17 million impressions across all platforms).

Kraft Heinz hosts themed livestream shopping sessions

Kraft Heinz hosts themed livestream shopping sessionsSource: Firework[/caption]

Myth #5: Investing in Celebrities Translates to Sales

Working with celebrities or influencers to host livestream sessions can boost sales for brands and retailers. However, it is not as simple as that. Brands and retailers must look to engage with influencers that bring an appropriate fanbase; as we mentioned earlier in relation to social media, many celebrities’ followers may simply watch livestreams for the entertainment, rather than be engaged shoppers. Celebrity livestream endorsement is also developing a perception of anti-authenticity within younger skewing demographics; product experts, employees and passionate fans are preferred as primary livestream participants.

Coresight Research’s March 2021 social commerce survey found that 32% of US social media shoppers who follow celebrities/influencers reported that their shopping behaviors are “often/always” affected by influencers/celebrities, demonstrating that influencers offer definite potential to steer conversion, but not guaranteeing sales. In order to ensure that celebrities’ followers do lead to high sales through livestreaming, brands and retailers must look to create an authentic connection with consumers and build trust in their brand and products. This can be accomplished by communicating with the digital consumer audience within a brand or retailers’ website.

The livestreaming ecosystem in China provides a model for working with influencers, with top livestreaming hosts Viya and Austin Li having built success by gaining audience trust: Shoppers believe that these influencers are working on their behalf to find the best products and deals. Store employees can also make valuable hosts, as they can help online shoppers find products, explain options and features, and order out-of-stock items. Shoppers view virtual video assistance—particularly in fashion and large-format stores—as enhancing the shopping experience, underlining the need for retailers to find and train motivated, well-prepared and well-equipped employees.

- AT&T provides a live-video service on its website for inquires and placing shopping orders. Users can receive recommendations on a new phone or advise and expertise on choosing a phone plan for their family. The expert can demonstrate product features and offer the best deal for switching from another cellphone provider.

A live-video service from an AT&T representative presenting a TV package deal

A live-video service from an AT&T representative presenting a TV package dealSource: Company website[/caption]

Myth #6: Sales Conversion Is the Only Metric That Matters

Although a high sales volume is every seller’s ultimate goal, livestreaming provides opportunities for brands and retailers to learn about their customers and improve their offerings, through live viewer feedback.

Brands should implement data-tracking capabilities to gain deep and accurate insights into consumers, and acquire more leads from livestreaming channels: Tailored promotions can drive both revenue and profitability. For example, merchants on Chinese livestreaming e-commerce platform Taobao Live have been leveraging real-time data monitoring to reward live audiences with instant deals when their interaction reaches a certain level, such as free delivery when viewers respond to a quiz. By recommending items to the customer with a suitable promotional cadence, brands’ livestreaming will meet pre-defined promotional goals.

Firework: A Next-Generation Digital Experience Solution Designed for the Open Web

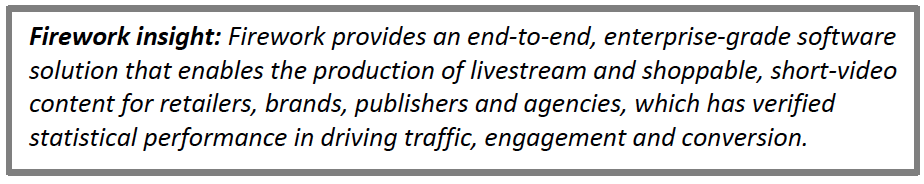

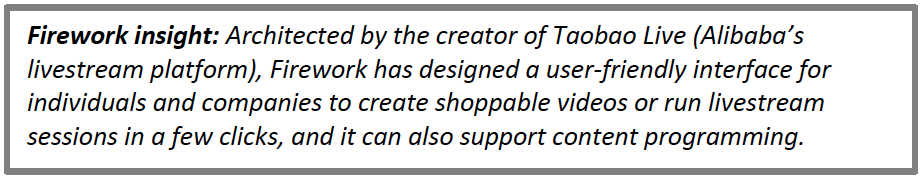

Firework offers an end-to-end digital experience platform designed to help businesses engage and grow in the emerging “open web” era. Firework enables its customers to create and host native, shoppable video content for engaging product discovery, seamless shopping experiences and, ultimately, a meaningful connection with the end consumers. Its technology is also designed to connect the entire open web with short, shoppable video and livestream infrastructure, creating a powerful traffic driving and audience targeting suite, according to the company.

Firework’s enterprise clients include Albertsons, Kraft Heinz, Marie Claire and Unilever. Firework’s C-Suite includes the creator of Taobao Live for Alibaba (CTO), the creator of LinkedIn Mobile (Co-Founder, President), the founder of Everstring (Co-Founder, CEO), the Global Head of Ad Sales for Snapchat (CRO), plus C-Suite executives from the publishing and media spaces (chief customer officers and chief business officers, respectively).

[caption id="attachment_139492" align="aligncenter" width="500"] Firework’s digital ecosystem

Firework’s digital ecosystemSource: Firework[/caption]

We present two case studies from Firework that showcase how companies can deepen digital customer engagement, increase brand awareness and improve retail sales through the use of shoppable videos and livestream shopping.

Shoppable videos

As retailers compete for consumers’ attention online, swipeable short videos offer an immersive experience to engage existing and prospective customers. Firework offers businesses, brands and publishers the solution to create immersive, mobile-optimized, swipeable short videos on their own website, with a simple setup, according to the company. Firework’s embedded call-to-action link also give businesses the ability to further customize the customer experience.

The Firework end-to-end shoppertainment suite accelerates retailers’ ROI. According to Firework data, across the global enterprise retail portfolio, Firework is enabling video engagement increases of more than 4–5X and 5%+ CTR. Nearly half (45%) of audiences who view Firework short videos click on the “Shop Now” button, according to the company.

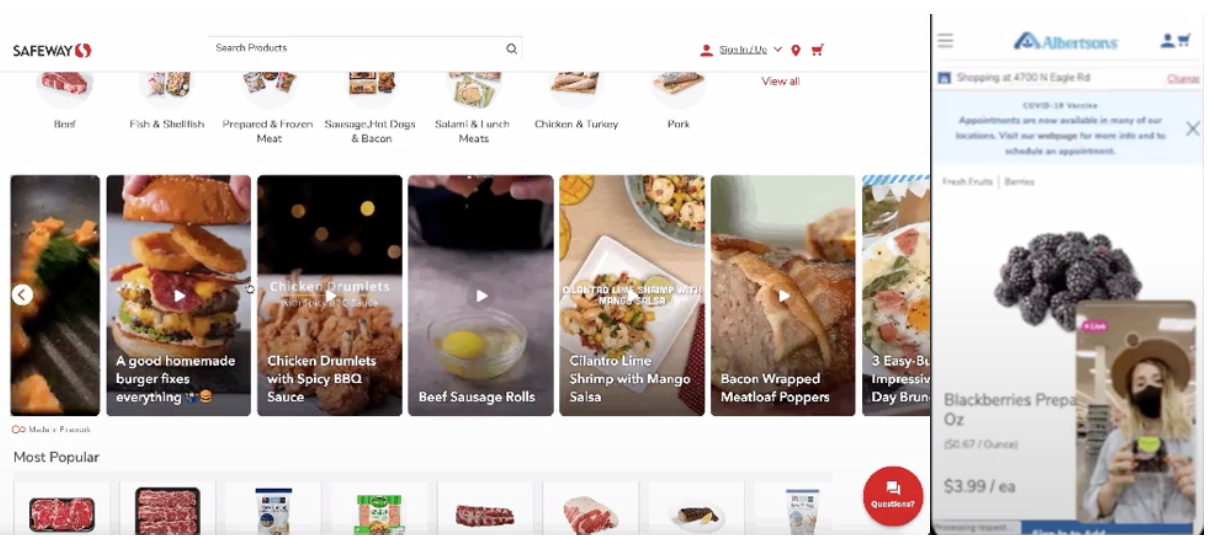

- Albertsons, one of the largest food retailers in the US, partnered with Firework in September 2021 to develop short-form videos and livestream content on both the retailer’s site and Firework’s platform. The shoppable videos are 30 seconds long and optimized for mobile devices. They feature food-related content such as recipes and preparation tips, designed to re-envision the digital grocery shopping experience.

Shoppable videos on Albertsons’ website (left) and a live-shopping session on the company’s app (right)

Shoppable videos on Albertsons’ website (left) and a live-shopping session on the company’s app (right)Source: Albertsons[/caption]

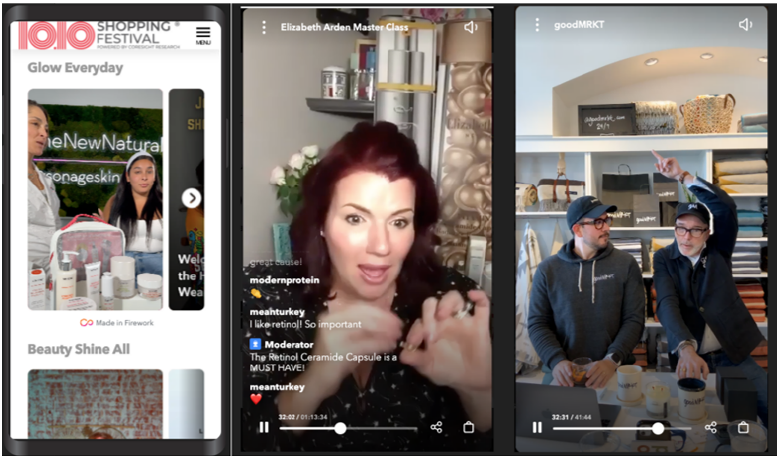

Livestream shopping

Firework’s livestream e-commerce solution allows businesses and brands to engage with existing and prospective customers, promote products through shoppable live videos on their own websites as well as driving traffic with high purchase intent through publisher amplifications and into social feeds with simulcast technology.

- On October 10, 2021, Coresight Research held its second annual 10.10 Shopping Festival, a 12-hour livestream shopping experience that was powered by Firework’s shoppable livestream platform. The event featured 25 retailers and brands, and attracted 350,000 livestream viewers as retailers showcased apparel, accessories, home goods and more. A harbinger of the future of online shopping in the US, 10.10 spurred new levels of consumer engagement, with 45% of viewers actively interacting with shoppable livestreams. A purpose-driven event, the 10.10 Shopping Festival required that participants donated at least 5% of sales to partner charities, including American Heart Association, Delivering Good and St. Jude Children’s Research Hospital.

Coresight Research partnered with Firework for the 10.10 Shopping Festival, a 12-hour livestream shopping experience

Coresight Research partnered with Firework for the 10.10 Shopping Festival, a 12-hour livestream shopping experienceSource: Coresight Research[/caption]

What We Think

Livestreaming e-commerce has become a fixture for successful companies in China and is expanding quickly in the US. The proliferation of livestream shopping offerings on e-commerce platforms, apps and social media underlines the channel’s effectiveness as an engagement tool for connecting with consumers. While a walled-gardens landscape—a closed-loop user experience for engagement, product navigating, payment and data—is forming, brands and retailers should differentiate themselves with an adaptive marketing strategy to win in the live-shopping space.

Implications for Brands/Retailers

- To evolve in the livestreaming e-commerce market, brands and retailers should host live-shopping sessions on their owned websites. Bringing the eyes of social followers to a brand's proprietary live shopping page bridges the gap between social media and brands’ e-commerce platforms, turning passive followers into active shoppers.

- We recommend that brands and retailers use store associates or a brand team with comprehensive product knowledge to answer questions from viewers, and thus develop trust among shoppers.

- Companies should look beyond price to use livestreaming as a tool to drive brand awareness, sales, trust, and, ultimately, customer loyalty. Diversifying livestream formats to incorporate personalized services is one way to achieve this.

- During the shift from the mass livestreaming adoption model to walled-garden operations, brands and retailers need to understand how to leverage data to better understand the consumer. Brands and retailers can work with technology vendors to develop customer-centric livestream strategies through their owned websites.