albert Chan

11.11 Promotion on Taobao app and livestreaming from KOL Li jiaqi’s store

11.11 Promotion on Taobao app and livestreaming from KOL Li jiaqi’s storeSource: Taobao[/caption]

Tmall Global

Alibaba’s cross-border online marketplace Tmall Global will feature more than 22,000 international brands from 78 countries participating in the 11.11 shopping festival. Tmall Global aims to continue incubating emerging product categories such as beauty supplements, men’s personal care, hair growth devices, oral care, baby’s skin care, pet health supplies and imported furniture. Tmall Global will also launch over 3,500 new products before 11.11, of which 3,000 are exclusive to Tmall Global.

JD.com

JD.com launched its Singles’ Day campaign on October 18 and has highlighted its focus on lower-tier cities and supply chain upgrades. JD.com expects to sell 1.2 billion products during 11.11, including 200 million C2M products developed on consumer insight analytics. JD.com is also working with celebrities and KOLs to livestream promotions, mainly in electronics, apparel, makeup and skincare.

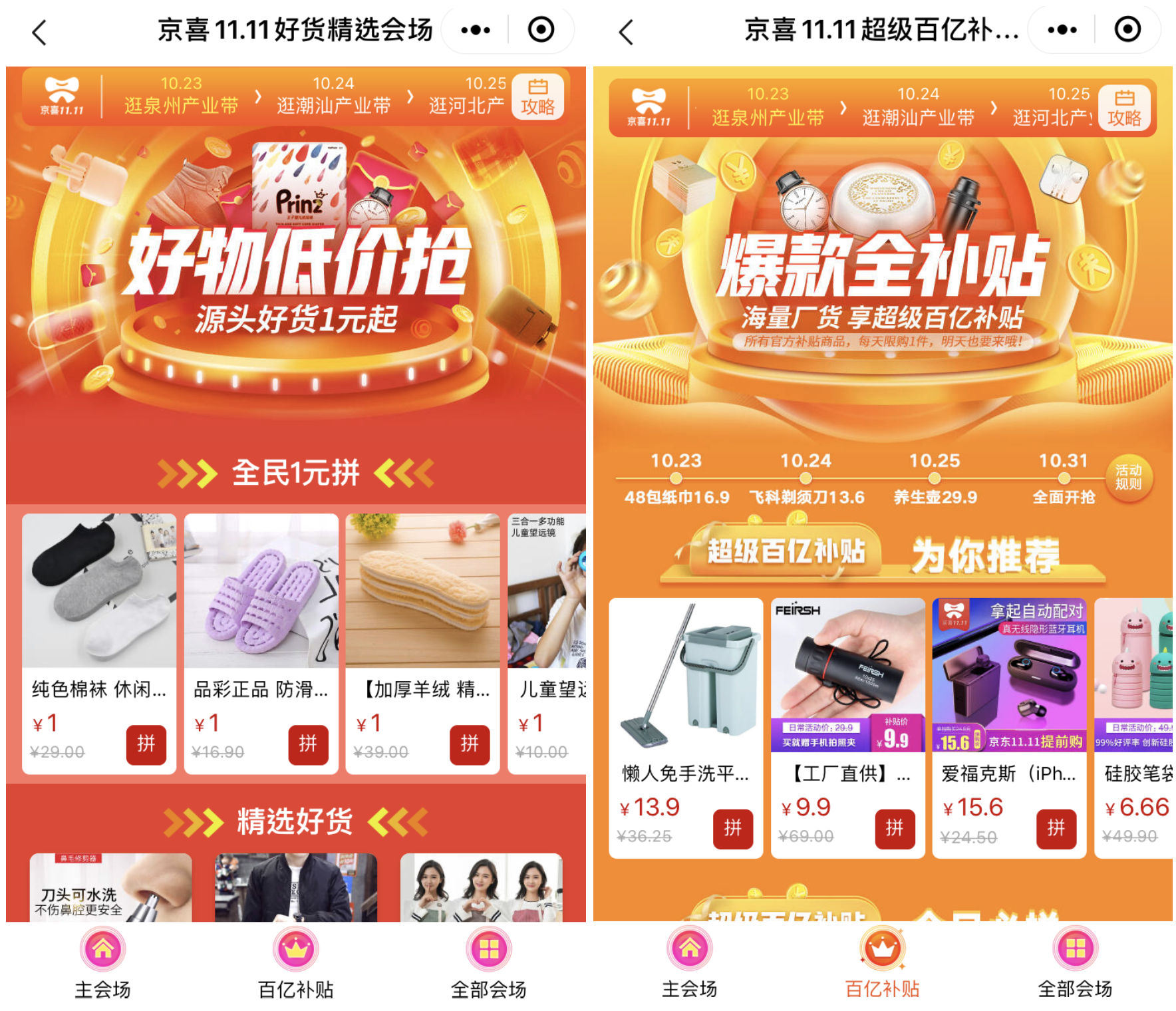

Like Alibaba, JD.com is accelerating its expansion to lower-tier markets. To better cater to residents in lower-tier cities who are more price sensitive, JD.com introduced Jingxi (formerly JD Pingou) in September, a new online group-buying marketplace similar to Pinduoduo. Jingxi has its own app and has integrated with WeChat as mini program. Jingxi’s factory-to-consumer model enables direct delivery of products at attractive price points. The company hopes to reach over 500 million consumers in this emerging market during 11.11.

JD.com has upgraded its logistics to include half-day delivery in major cities, one-day delivery in lower-tier cities, cold chain logistics, smart logistics and other steps to ensure smooth delivery during the busy shopping festival.

[caption id="attachment_98588" align="aligncenter" width="700"] Jingxi mini program on Wechat

Jingxi mini program on WechatSource: Wechat[/caption]

Suning

Suning kicked off its Singles’ Day event on October 21 with a new “one-hour solutions under all contexts” concept, aiming to solve consumer pain points under different conditions within an hour. Superior service and the shopping experience are becoming just as important to consumers as price.

Suning operates its own e-commerce platform, Suning.com, as well as a wide range of offline stores that include supermarkets, convenience stores, and electronics stores. By leveraging these physical stores, Suning can deliver products within 30 minutes within a one-kilometer (about 0.6 mile) radius of any store and provide services such as appliance repair within an hour. Suning also offers a price match guarantee, giving customers back money equal to the price difference if they find the same product cheaper somewhere else.

For merchandise, Suning emphasizes creating “S+ products” with brands, which means designating one or two hot-selling products in each category. Suning will support these products in terms of funding and logistics. To target consumers in lower tier cities, Suning also partnered with brands to launch 32 types of C2M air conditioners and continues to leverage its group-buying platform, Dajuhui, which has proven popular in lower tier cities. During 11.11, Suning plans to use Tik Tok and Kuaishou livestreaming promotions.

Key Insights

Chinese e-commerce giants have already kicked off their Singles’ Day campaigns. This year, all major online retailers are focusing on lower-tier cities. Alibaba, JD.com and Suning have already moved into lower tier cities through group-buying platforms and C2M products. Livestreaming by KOLs has also become must-have to engage with consumers – and drive sales.

Alibaba, JD.com and Suning are also going beyond coupons and discounts to focus more on enhancing the overall customer shopping experience, including storefront revamps and supply chain upgrades.