albert Chan

What’s the Story?

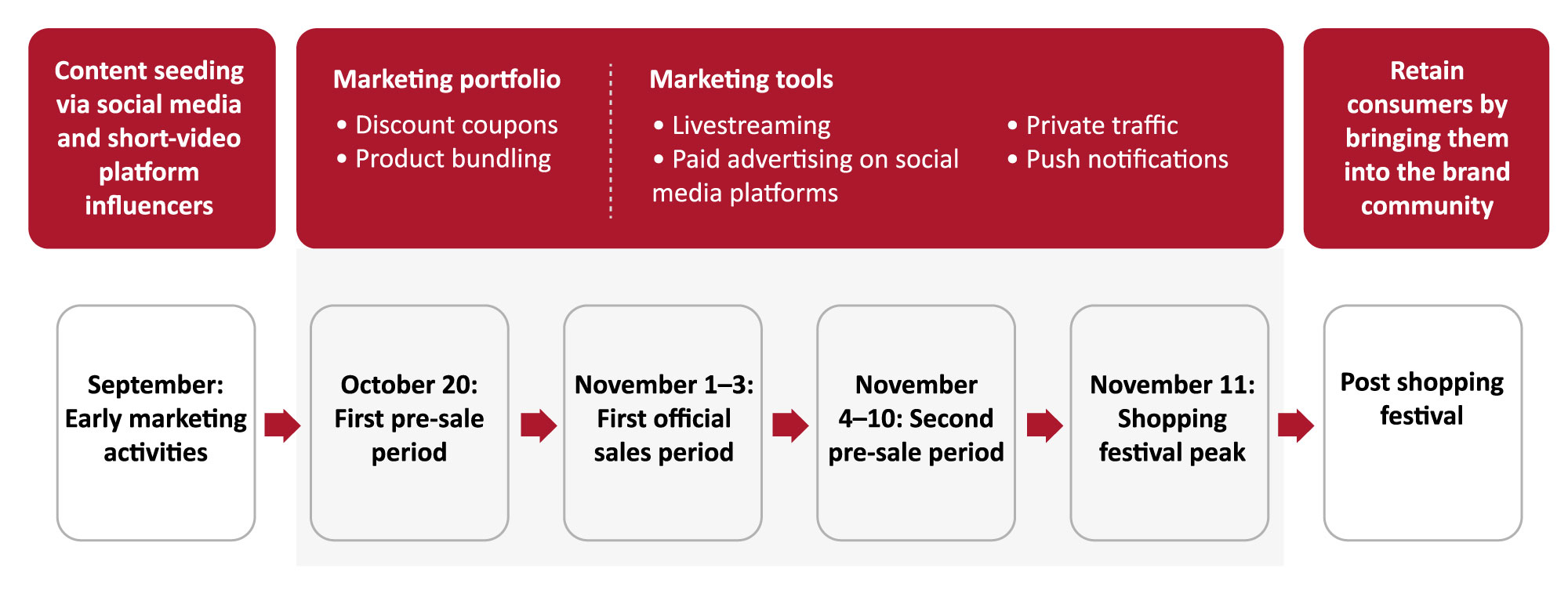

The presale period for Singles’ Day 2021 (also known as the 11.11 Global Shopping Festival) started on October 20, followed by the first official sales period on November 1–3, the second pre-sale period on November 4–10 and the peak of the festival—the second official sales period—on November 11.

We discuss four new marketing trends that we have identified among brands and retailers participating in this year’s Singles’ Day festival. Merchants can incorporate these marketing strategies for other shopping festivals in China.

Why It Matters

As the world’s largest shopping festival, Singles’ Day provides a major opportunity for brands and retailers to expand brand awareness, develop their communities and engage with their consumers to boost sales. This year, Chinese e-commerce giants Alibaba and JD.com reported GMV of $84.7 billion and $54.7 billion, respectively.

Reviewing New Marketing Trends: Coresight Research Analysis

1. Early TimelinesTo stand out to consumers, brands and retailers launched their Singles’ Day marketing activities as early as September this year.

We identified that marketing activities started with product seeding on social media platforms, such as Douyin, Little Red Book and WeChat, working with KOLs (key opinion leaders) and KOCs (key opinion consumers) to publish video content.

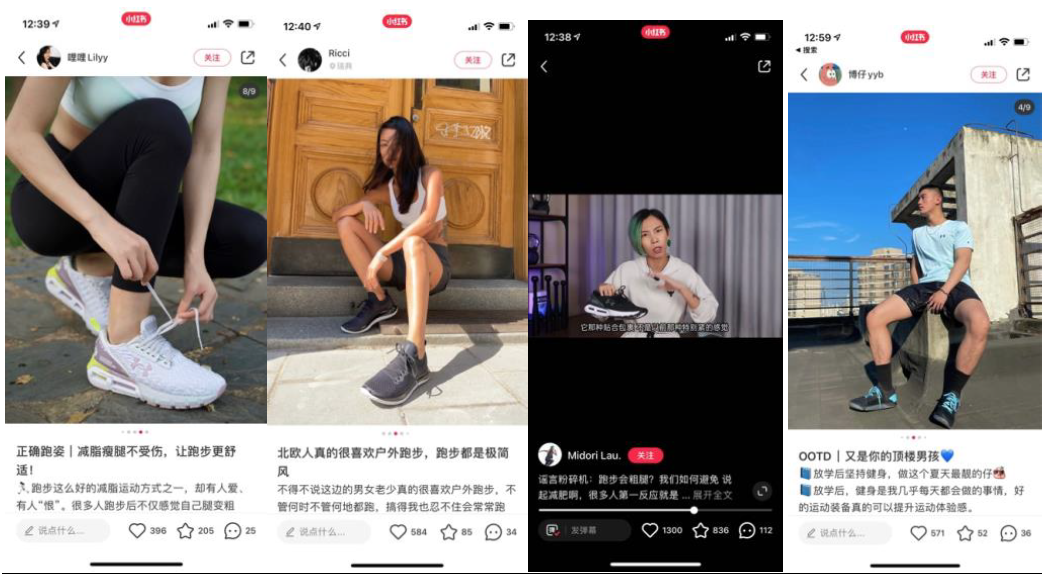

The influencers share personal stories, testimonials and reviews related to brands’ and retailers’ products. For example, sportswear retailer Under Amour worked with several influencers to promote its popular sneaker lines via Little Red Book in early September.

[caption id="attachment_136452" align="aligncenter" width="550"] Influencers promoting Under Armour sneakers on Little Red Book in September 2021

Influencers promoting Under Armour sneakers on Little Red Book in September 2021Source: Little Red Book[/caption]

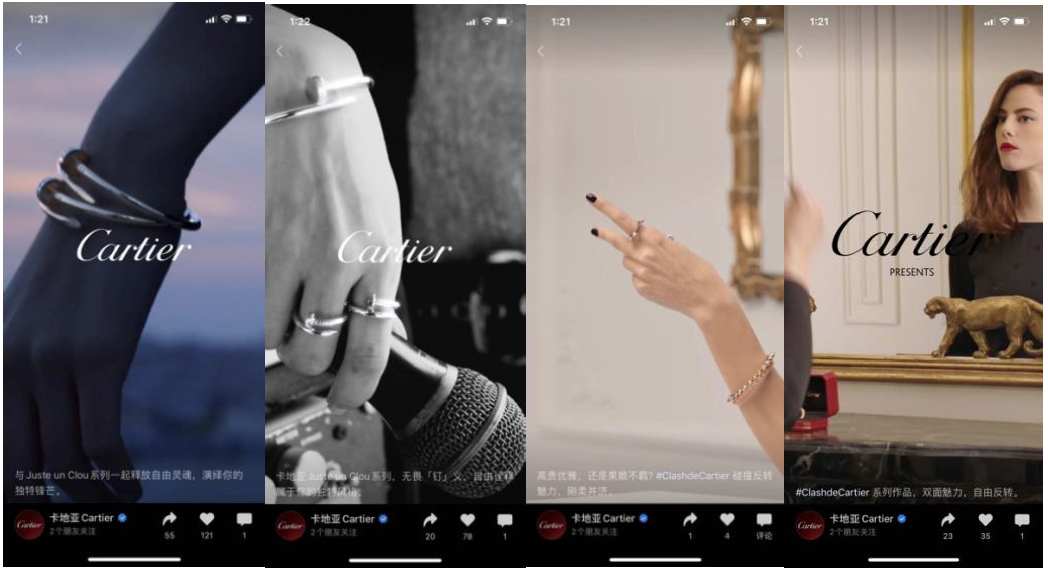

Brands also use video content to seed products before the shopping festival, such as WeChat Channel. For example, luxury jewelry brand Cartier launched several videos to promote its collections on the short-video platform in September.

[caption id="attachment_136453" align="aligncenter" width="550"] Cartier’s short-video content published on WeChat Channel

Cartier’s short-video content published on WeChat ChannelSource: WeChat Channel[/caption]

Figure 1 presents a timeline of marketing activities for Singles’ Day, starting from early engagement with product seeding in September this year. We discuss the key marketing tools in the figure below.

Figure 1. Singles’ Day 2021: Major Marketing Activities Timeline [caption id="attachment_136454" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2. Alternative Livestreaming Strategies

Source: Coresight Research[/caption]

2. Alternative Livestreaming Strategies

Livestreaming is a highly efficient tool for brands to engage with consumers and generate sales. To facilitate authentic communication this year, many brands chose to develop their own teams of livestream hosts from internal staff with insightful product knowledge, as opposed to hiring external hosts or influencers for all events. Brands also worked with livestream providers and multi-channel networks to set up their own livestream events.

By setting up and hosting their own livestream sessions, brands have more control over scheduling and content, plus they can choose exactly how to introduce their products and engage with viewers.

For example, NIKE built its own livestream team for Singles’ Day with its own employees as hosts. The company also invited Olympic athlete Su Bingtian as a special guest for one of its livestream events, which attracted over 4 million viewers.

[caption id="attachment_136455" align="aligncenter" width="350"] NIKE’s employee-hosted livestream sessions

NIKE’s employee-hosted livestream sessionsSource: Taobao Live[/caption]

Having brand-run livestreaming allows brands and retailers to broadcast sessions via several social media channels at the same time, which helps to reach more consumers. China-based skincare brand Home Facial Pro ran 40 livestream events between October 2 and November 6, streamed on Douyin, Taobao Live and WeChat Channel simultaneously.

[caption id="attachment_136456" align="aligncenter" width="550"] Home Facial Pro’s livestream sessions during the Singles’ Day festival

Home Facial Pro’s livestream sessions during the Singles’ Day festivalSource: Douyin, Taobao Live and WeChat Channel[/caption] 3. Private Traffic Channels

As a marketing method, driving customer acquisition through private traffic gives brands greater control over communication and reduces third-party costs. Private traffic comprises brand-led online communication with customers via private groups, often hosted on WeChat in China as the country’s primary communication tool. For Singles’ Day, merchants created different WeChat groups to funnel customer communication.

Estée Lauder uses its WeChat mini program as a channel to communicate with its deal-seeking consumers, offering exclusive promotions within the group as well as product information and reviews. Consumers can also watch livestreams directly through the group.

[caption id="attachment_136457" align="aligncenter" width="550"] Estée Lauder’s product deals promoted in WeChat groups

Estée Lauder’s product deals promoted in WeChat groupsSource: WeChat[/caption]

Domestic cosmetic brands Little Ondine and Zeesea also shared their sales and deals within WeChat groups, which they created prior to the launch of Singles’ Day to drive excitement. Consumers within the group could shop for the products directly by clicking the links provided.

[caption id="attachment_136458" align="aligncenter" width="350"] Little Ondine and Zeesea’s Singles’ Day WeChat groups

Little Ondine and Zeesea’s Singles’ Day WeChat groupsSource: WeChat[/caption] 4. Community Building

Brands and retails sought to retain consumers through community building around the Singles’ Day shopping festival, taking different approaches to bolster brand loyalty.

For example, high-end cycling brand ASSOS included a post-sale services card in packages it delivered to customers. The card featured a QR code link to the brand’s customer service WeChat contact. The brand encourages consumers to scan the QR code and join the customer service group to access post-purchase support, share stories and discover new products.

[caption id="attachment_136459" align="aligncenter" width="200"] Source: ASSOS[/caption]

Source: ASSOS[/caption]

Brands and retailers also offered exclusive privileges to shoppers during Singles’ Day to build their communities through loyalty programs. For example, Spanish fashion retailer Massimo Dutti offered double loyalty program points on every purchase between October 21 and November 11 and domestic underwear brand Bananain offered a cash coupon to loyalty members who signed up during the festival. To build long-term relationships with consumers, the two brands also offer additional loyalty points on a monthly basis, and Bananain gives its loyalty members cash coupons during their birth month.

[caption id="attachment_136460" align="aligncenter" width="550"] Bananain’s loyalty program offers for Singles’ Day

Bananain’s loyalty program offers for Singles’ DaySource: Tmall[/caption]

What We Think

Singles’ Day has gone from strength to strength as a shopping festival since its inception in 2009. Brands and retailers are looking to new marketing strategies to stand out to consumers, build strong communities and drive sales.

Implications for Brands/Retailers

Brands and retailers can apply similar marketing strategies for upcoming shopping festivals in China, such as Alibaba’s 12.12, Christmas and Chinese New Year. We also recommend that merchants take the following steps to stay ahead in today’s digital retail environment:

- Increase digital marketing spend, with a focus on personalization and driving customer loyalty in the long term

- Introduce livestreaming and short-video content through several channels to interact with a wide range of consumers