DIpil Das

What’s the Story?

The Singles’ Day 2021 pre-sale period started on October 20, followed by the first official sales period on November 1–3, the second pre-sale period on November 4–10 and the peak of the festival—the second official sales period—on November 11. We discuss early observations of sales among Chinese e-commerce companies during the festival. We explore the key initiatives they used to drive sales, including focusing on sustainability and using augmented reality (AR) and AI-driven technologies to showcase luxury goods and improve digital shopping experiences.Why It Matters

Singles’ Day is a massive shopping event that garners the attention of 900 million Chinese consumers as they flock to Chinese e-commerce websites to access product discounts, deals and other benefits. We believe that the initiatives pursued during the event (sustainability and technology-driven capabilities) signal future investment directions from Alibaba and JD.com, which will drive other retailers and merchants to achieve or facilitate similar goals to keep up.Singles’ Day 2021 Early Observations: Coresight Research Analysis

Early Numbers and Popular Product Categories Alibaba and JD.com reported $139.4 billion in combined GMV, up 15.6% year over year at constant exchange rates. In the pre-sale period alone, 290,000 brands participated on Alibaba’s platforms, and JD.com reported that nearly 60,000 brands saw sales surge by over 100% year over year on its platform—both record highs for the companies. Alibaba reported that its platforms generated ¥540.3 billion in GMV during this year’s event (equivalent to $84.7 billion using a November 12, 2021, exchange rate). This represents 8.5% growth from last year’s ¥498.2 billion, even as it Alibaba prioritized its goals of sustainability and good social equity over revenue this year amid a tougher regulatory context. Last year, Alibaba reported 26% year-over-year growth on a comparable-period basis. This Singles’ Day, the number of discount deals from all participating brands on Alibaba’s platforms totaled over 14 million, and a record 78 companies surpassed ¥100 million ($15.7 million) in GMV, according to Alibaba. The company’s livestreaming performance also supports this, as key opinion leaders (KOLs) Austin Li, Viya and Cherie alone sold record volumes of goods totaling $1.9 billion, $1.25 billion and $190 million, respectively, on the first day of the sales period, according to Alibaba. These livestreaming events especially benefited beauty brands, with beauty and cosmetics proving highly popular during the festival. For instance, beauty products comprised 70% of the 439 products that Austin Li promoted in his first livestream of the festival. [caption id="attachment_136006" align="aligncenter" width="726"] Alibaba’s opening event for the start of the official sales period

Alibaba’s opening event for the start of the official sales period Source: Alibaba [/caption] JD.com reported sales of ¥349.1 billion ($54.7 billion) as of November 11. That represents strong, 28.6% growth versus 2020. Last year, JD.com reported 34.6% year-over-year growth. JD.com said that sales of 31 brands surpassed ¥1 billion ($156.7 million) with Apple surpassing ¥10 billion ($1.6 billion) this year; over 60,000 participating brands increased sales by 100% year over year during its first presale period. In addition, the company stated that its average basket size for new products during the pre-sale period increased by 30% compared to non-festival days. The e-commerce giant offered over 400 million new products during the early sales periods, with the large appliances, phones, sport shoes and bags, and facial care products coming in as the most popular categories. This is reflected in the pre-sale sales volume for desktop computers, tablets and home theatre projectors increased by 310%, 130% and 100% year over year. Moreover, the pre-sale order volume of Xiaomi phones in the first hour of the event exceeded the sales for the entire day last year. Likewise, in the first four hours of October 20, pre-sale orders for OPPO phones increased by 227% year over year. Phone brands including Apple, Honor, Huawei, Honor and Realme also saw significant year-over-year sales increases. We attribute this partly to participation strength among digital-first consumers aged 18–35, with this demographic accounting for 70% of sales in the pre-sale window, according to JD.com. [caption id="attachment_136007" align="aligncenter" width="726"]

Singles’ Day promotions on Oppo and Xiaomi brand phones

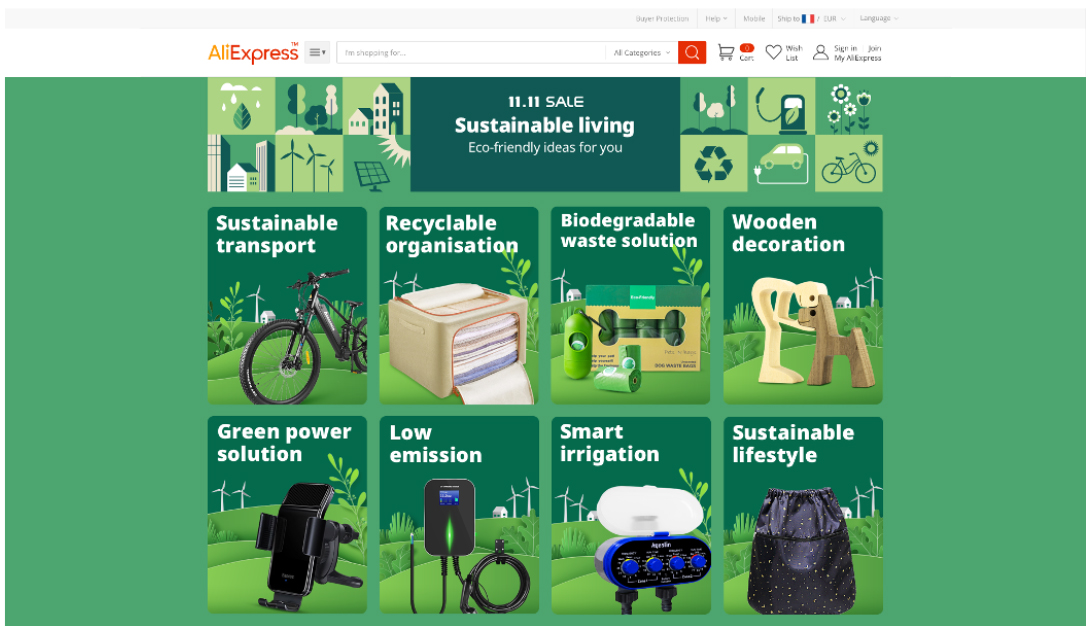

Singles’ Day promotions on Oppo and Xiaomi brand phones Source: JD.com [/caption] Sustainability Initiatives Sustainability and social responsibility are central themes in this year’s Singles’ Day festival, with Alibaba and JD.com launching varying initiatives relating to sustainable practices. Alibaba has focused on creating a minimizing the environmental impact of the festival, promoting sustainable products and reducing packaging waste. Alibaba’s online marketplace Tmall launched a “green alliance” with 14 brands to promote green products, energy and logistics networks during the festival. The company developed “green vouchers” as one of its promotional strategies, offering $15.6 million in vouchers to incentivize consumers to embrace purchases with a “green product certification”—a collection of 500,000 products produced by over 2,000 merchants. Within the first two hours of the pre-sale period on October 20, over 20,000 shoppers purchased green home appliances. Certified green product purchases also allow consumers to earn Alipay Ant Forest points that go toward supporting tree-planting initiatives in China. As well as incentivizing product choices, Alibaba’s logistics arm Cainiao partnered with 200 brands this festival to promote green packaging, using its own algorithm to optimize space in packaging boxes and reduce the amount of tape used. Cainiao also rolled out new features on Taobao and its own app, allowing customers to monitor their carbon footprint reduction through reusing shipping boxes and compiling package deliveries. [caption id="attachment_136008" align="aligncenter" width="725"]

Alibaba’s sustainability-focused products and initiatives for Singles’ Day

Alibaba’s sustainability-focused products and initiatives for Singles’ Day Source: AliExpress [/caption] JD.com has invested in a different aspect of sustainability for Singles’ Day 2021, with a focus on sustainable food sourcing and fishing practices. Through JD.com’s grocery arm JD Fresh, food purchases are popular during Singles’ Day, especially following the company’s development of cold chain logistics. On October 28, JD Fresh launched 70 new sustainable seafood products in preparation for the start of the official sales period. All products carry certification from the Marine Stewardship Council (MSC). The products were launched at MSC’s sustainable seafood event, with guest speakers including the Norwegian Seafood Council, which presented best practices for sustainable fishing and safeguarding seafood supplies for the future. JD’s investment into sustainable fishing provides a foundation for the development of sustainable fishing practices worldwide, according to a MSC China Program representative at the event. Technology Initiatives Alibaba and JD focused on leveraging AR and AI technology to best showcase high-end products during Singles’ Day. Both companies are also aiming to benefit from the rise of NFTs in the luxury space. Alibaba is addressing consumers’ desire to interact with products online through AR-powered virtual try-on products for luxury brands, accounting for the role of experiential retail in driving luxury purchases. This initiative is part of Alibaba’s engagement with the concept of the metaverse, whereby interactive experiences allow users to better understand and experience a product before purchase. Developing its virtual experiences during the festival, Alibaba launched its first “Double 11 Metaverse Art Exhibition,” which was held on the Tmall app and presented by virtual idol Ayayi. The exhibition offering eight limited NFT collections from top luxury brands, including 1,000 units of Burberry’s deer mascot NFT, which were sold with a limited edition physical scarf. Guests could interact with the deer mascot NFT through a virtual museum gallery. Although cryptocurrency is not legal in China, brands are still finding other ways to sell NFTs, such as through tokenless blockchain infrastructure developed by Baidu, Alibaba and Tencent, or through China’s new digital yuan (e-CNY), which is pegged to the national currency. [caption id="attachment_136009" align="aligncenter" width="725"]

Alibaba’s virtual idol Ayayi

Alibaba’s virtual idol Ayayi Source: Instagram [/caption] Like Alibaba, JD.com is also enhancing its e-commerce platform through technology. This year, the company has developed its smart customer service chatbots. Its AI-powered chatbots held 1.81 million consultations within the first 10 minutes of the pre-sale event, an increase of 165% year over year. The company has also launched an AR try-on function for luxury shoes purchased from brands including Berluti, Hogan and Tods. The service allows consumers to measure their foot size using their mobile phone camera and see a virtual image of what the shoes would look like.