Nitheesh NH

What’s the Story?

Singles’ Day, also known by Alibaba as the 11.11 Global Shopping Festival, has become the largest and most important shopping festival in China, with consumers flocking to major Chinese e-commerce platforms such as Tmall and JD.com to take advantage of promotions. Last year, GMV on Singles’ Day reached $38.4 billion across Alibaba’s platforms, up 26% year over year. In this report, we present our 11 predictions for Singles’ Day 2020 and take a look at what’s new for this year’s event on major e-commerce platforms including Alibaba, JD.com, Pinduoduo and Suning.com.Why It Matters

This year, Singles’ Day serves an important role and growth driver for domestic and international merchants in the wake of Covid-19. China’s economy has recovered strongly from the pandemic—its GDP grew by 4.9% in the third quarter, and retail sales returned to growth in August. Chinese consumers have also shown their pent-up spending power, with a significant sales rebound seen during the 6.18 Shopping Festival and Golden Week. With businesses hit hard by the pandemic, brands and retailers can leverage Singles’ Day as a means to significantly boost sales and clear a glut of inventory.11 Predictions for Singles’ Day 2020

- Singles’ Day will maintain healthy growth: We expect Singles’ Day across all platforms to maintain double-digit growth. Last year, the shopping festival generated ¥410 billion ($58 billion) across all platforms in the 24-hour period on November 11, increasing by 30.1% year over year, according to Chinese data company Syntun.

- 900 million Chinese consumers will participate in Singles’ Day: With an increasing Internet penetration rate accelerated by Covid-19, we expect 900 million Chinese consumers to shop on at least one of the e-commerce platforms during Singles’ Day.

- There will more discounts and promotions, and they will be straightforward: More products will be on sale to stimulate purchases. Consumers will be able to view the final price on each product page (including the discount) without the need for complicated calculations.

- Livestreaming will be the key channel to boost sales: We will see more livestreaming sessions this year, hosted not only by influencers but also company executives and celebrities.

- Singles’ Day will continue to be the testing ground for product innovation: More brands will launch new products or introduce exclusive products for the shopping event.

- Travel restrictions will drive sales of imported products: As international travel remains restricted, outbound spending has shifted back to the domestic market, so e-commerce is seeing a boost in cross-border sales.

- Product delivery will be faster: Efficient delivery of online orders to consumers will be ensured this year through an extended sales period, upgraded technology and logistics infrastructure, and the use of stores as fulfillment centers.

- Consumers from lower-tier markets will be the new source of growth: We expect that the majority of new shoppers during the festival will come from lower-tier cities, driven by a wide assortment of discounted and C2M (consumer-to-manufacturer) products.

- The shopping experience will be more engaging and personalized: The use of technology such as artificial intelligence (AI) and big data will see more personalized product recommendations. Interactive games will continue to improve the shopping experience.

- The online shopping festival will increase its offline presence: More brick-and-mortar stores, especially small- and medium-sized businesses, will participate in Singles’ Day this year.

- Alibaba will maintain its leading position during Singles’ Day: The competition is becoming more intense in the e-commerce market, with a variety of platforms joining Singles’ Day this year. However, we expect that Alibaba will continue to dominate the event.

11.11 Global Shopping Festival 2020: What’s New?

Extended Shopping Period This year’s 11.11 Global Shopping Festival will have two sales windows, extending the official sales period from 24 hours to four days. The first round will take place on November 1–3, and the second round will start on the traditional November 11—resulting in two pre-sale periods as well. According to Alibaba, the additional sales window will provide opportunities for more merchants—particularly new brands and small businesses—to participate in the event. [caption id="attachment_118271" align="aligncenter" width="700"] Source: Alibaba/Coresight Research[/caption]

Expanded Offerings

Alibaba expects around 800 million consumers to shop on its platforms during the 11.11 Shopping Festival this year—300 million more than last year. More than 250,000 brands will participate in the event, with nearly 200 of those being luxury brands, including Chanel, Dior and Net-a-Porter. Many luxury brands that launched their flagship store on Tmall this year are signing up for the shopping spree for the first time, such as Balenciaga, Cartier, Chloé, Montblanc, Piaget and Prada.

To meet consumer demand in China for high-quality imported products, Tmall Global will offer more than 2,600 new overseas brands. In addition, Kaola, the cross-border e-commerce platform that Alibaba acquired in September 2019, will be a new participant of Singles’ Day this year, bringing products from 89 countries.

During the festival, 14 million products will be on sale on Tmall—40% more than last year’s event. Product offerings range from popular categories such as fashion, cosmetics and electronics to big-ticket items such as cars and even houses.

Singles’ Day has become the destination for new product launches—over 2 million new products will be unveiled on Tmall during the shopping festival, which is double the amount from the 2019 event.

Participation of Alipay and Taobao Deals

Alibaba’s mobile payment platform Alipay has evolved into a one-stop digital lifestyle app that offers a wide range of lifestyle services for its 1.2 billion users, such as food delivery, clothing dry cleaning and more. During Singles’ Day this year, to further provide support to local small businesses, Alipay will bring together nearly 2 million local service providers in over 100 Chinese cities and host special promotions to consumers. For example, consumers can redeem vouchers on Alipay in local coffee shops or grocery stores.

Taobao Deals, a dedicated app launched in March 2020 catering to price-conscious consumers in lower-tier markets, will also take part in 11.11. Shoppers will be able to purchase C2M products at deep discounts, with some priced at ¥1 ($0.15).

Focus on Livestreaming

Livestreaming has become the most popular medium to engage with consumers and drive sales in China. In just 10 minutes on October 21, the first day of pre-sale, the transaction volume on Taobao Live surpassed the total from the entire day last year. According to Alibaba, 400 company executives and 300 celebrities, in addition to top KOLs (key opinion leaders), will host individual livestream sessions during the shopping festival.

[caption id="attachment_118272" align="aligncenter" width="580"]

Source: Alibaba/Coresight Research[/caption]

Expanded Offerings

Alibaba expects around 800 million consumers to shop on its platforms during the 11.11 Shopping Festival this year—300 million more than last year. More than 250,000 brands will participate in the event, with nearly 200 of those being luxury brands, including Chanel, Dior and Net-a-Porter. Many luxury brands that launched their flagship store on Tmall this year are signing up for the shopping spree for the first time, such as Balenciaga, Cartier, Chloé, Montblanc, Piaget and Prada.

To meet consumer demand in China for high-quality imported products, Tmall Global will offer more than 2,600 new overseas brands. In addition, Kaola, the cross-border e-commerce platform that Alibaba acquired in September 2019, will be a new participant of Singles’ Day this year, bringing products from 89 countries.

During the festival, 14 million products will be on sale on Tmall—40% more than last year’s event. Product offerings range from popular categories such as fashion, cosmetics and electronics to big-ticket items such as cars and even houses.

Singles’ Day has become the destination for new product launches—over 2 million new products will be unveiled on Tmall during the shopping festival, which is double the amount from the 2019 event.

Participation of Alipay and Taobao Deals

Alibaba’s mobile payment platform Alipay has evolved into a one-stop digital lifestyle app that offers a wide range of lifestyle services for its 1.2 billion users, such as food delivery, clothing dry cleaning and more. During Singles’ Day this year, to further provide support to local small businesses, Alipay will bring together nearly 2 million local service providers in over 100 Chinese cities and host special promotions to consumers. For example, consumers can redeem vouchers on Alipay in local coffee shops or grocery stores.

Taobao Deals, a dedicated app launched in March 2020 catering to price-conscious consumers in lower-tier markets, will also take part in 11.11. Shoppers will be able to purchase C2M products at deep discounts, with some priced at ¥1 ($0.15).

Focus on Livestreaming

Livestreaming has become the most popular medium to engage with consumers and drive sales in China. In just 10 minutes on October 21, the first day of pre-sale, the transaction volume on Taobao Live surpassed the total from the entire day last year. According to Alibaba, 400 company executives and 300 celebrities, in addition to top KOLs (key opinion leaders), will host individual livestream sessions during the shopping festival.

[caption id="attachment_118272" align="aligncenter" width="580"] Top KOLs Viya (left) and Li Jiaqi (also known as Austin Li; right) each conducted a 7.5-hour livestream session on Taobao Live in the evening of October 20, 2020 to kick off Singles’ Day.

Top KOLs Viya (left) and Li Jiaqi (also known as Austin Li; right) each conducted a 7.5-hour livestream session on Taobao Live in the evening of October 20, 2020 to kick off Singles’ Day.Source: Taobao Live[/caption]

Singles’ Day on Other E-Commerce Platforms

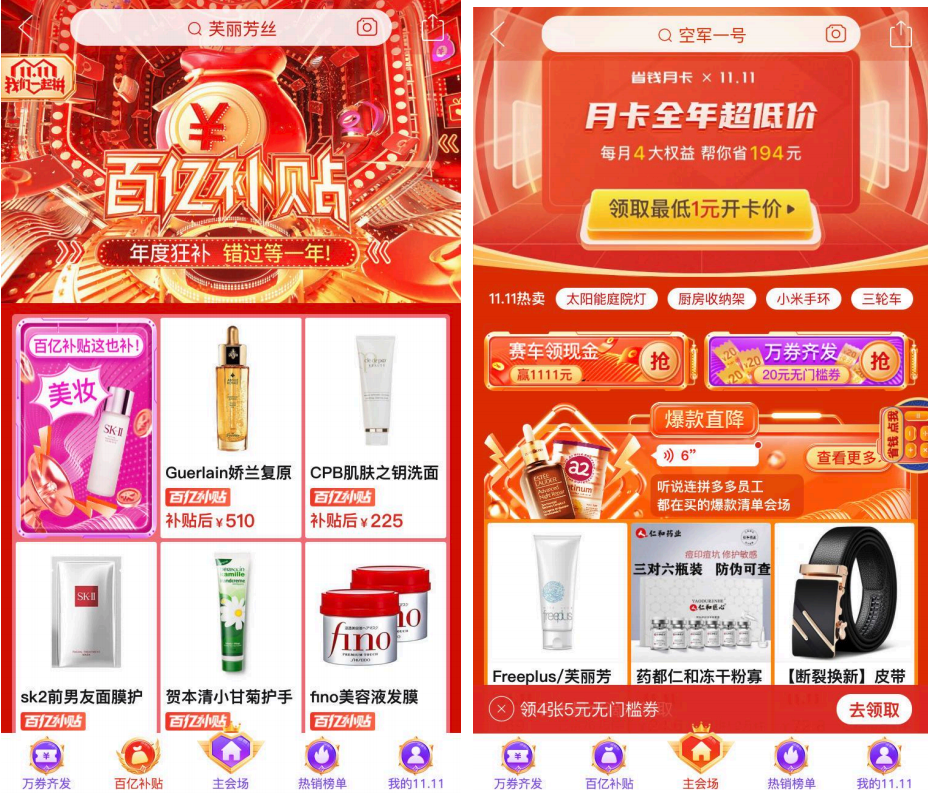

JD.com JD.com kicked off its Singles’ Day on October 21 with a pre-sale, with the official sale period set to begin on November 1. According to the platform, providing deep discounts and new products are the highlights of the event this year. JD.com will give out subsidies worth more than ¥20 billion (around $3 billion) in total for online purchases and cash coupons for offline redemption. More than 200 million goods will have 50% discounts, and a total of 300 million new products will be offered for sale (individual items, not SKUs) during the entire festival period. Jingxi, JD.com’s group-buying app targeting lower-tier cities, will also unveil over 100 million C2M products with discounts such as ¥9 (around $1.30) off every ¥99 ($14.80), as well as products priced as low as ¥1 ($0.15). JD.com has also stated that livestreaming will be a key element for its Singles’ Day; its own livestreaming platform has just started to take off. Over 500 executives and 300 celebrities have been invited to participate in livestreaming sessions during the event. JD.com is extending the online shopping festival to offline as well: It has partnered with over 1 million offline stores, including JD’s own electronics and grocery stores, to provide an omnichannel shopping experience. Members of the JD Plus premium and paid membership program are able to enjoy more exclusive discounts and benefits during the event. For these 20 million Plus members, JD.com launched a limited-edition lifestyle card, allowing them to gain benefits from local services platform Meituan, ride-hailing platform Didi and numerous restaurant chains. Members can also receive additional 5% discounts at over 730 Plus-affiliated brands. Pinduoduo Pinduoduo has not held a press conference about Single’s Day, but it did launch a dedicated site for the event on October 21. Promotions on the platform will run until November 14. Pinduoduo’s group-buying business model allows users to purchase products at discounted prices regardless of big promotional events. Unlike other platforms, Pinduoduo is not holding a pre-sale, but the company said it will provide more subsidies for consumers to enjoy the highest discounts. Promotion will be straightforward, with no coupons needed; the price shown will be the lowest price. In categories such as electronics, beauty and parent-and-baby, subsidies on certain products will increase from 10–20% to 50–60% of product prices. [caption id="attachment_118273" align="aligncenter" width="580"] Source: Pinduoduo[/caption]

Suning.com

Suning.com launched an early Singles’ Day promotion during Golden Week, from September 28 to October 8. Those who bought during that period can enjoy a price guarantee: The platform will pay back the difference if the price drops further before November 12, the last day of the official Singles’ Day event.

Suning.com has kicked off its pre-sale period; consumers can browse and put down deposits on over 100,000 products. Subsidies in the form of coupons or cash vouchers, worth ¥10 billion (around $1.5 billion) in total, will be distributed to consumers for use both online and offline. This includes an average subsidy of ¥500 ($74.60) on each mobile phone, and even subsidies on cars and houses.

According to Suning.com, its livestreaming platform will host over 55,000 sessions during the festival, including two night galas that will be broadcasted on a national TV channel on October 31 and November 10. During 13 livestreaming sessions hosted by celebrities, there will be 1,000 bestselling products on offer, priced at 10% lower than market prices.

Source: Pinduoduo[/caption]

Suning.com

Suning.com launched an early Singles’ Day promotion during Golden Week, from September 28 to October 8. Those who bought during that period can enjoy a price guarantee: The platform will pay back the difference if the price drops further before November 12, the last day of the official Singles’ Day event.

Suning.com has kicked off its pre-sale period; consumers can browse and put down deposits on over 100,000 products. Subsidies in the form of coupons or cash vouchers, worth ¥10 billion (around $1.5 billion) in total, will be distributed to consumers for use both online and offline. This includes an average subsidy of ¥500 ($74.60) on each mobile phone, and even subsidies on cars and houses.

According to Suning.com, its livestreaming platform will host over 55,000 sessions during the festival, including two night galas that will be broadcasted on a national TV channel on October 31 and November 10. During 13 livestreaming sessions hosted by celebrities, there will be 1,000 bestselling products on offer, priced at 10% lower than market prices.