Nitheesh NH

This year, Alibaba’s Singles’ Day (also known as 11.11 Global Shopping Festival) was extended with two sales windows, compared to the typical 24-hour sale in previous years. According to Alibaba, the timeline change this year aimed to enable consumers to have more time to shop, while relieving some of the logistics burden.

The first round of sales was held on November 1–3, following a pre-sale on October 21–31. During the pre-sale, consumers could put down deposits toward purchases and then pay off the rest of the amount once the official sale began.

The company has already reported solid results in its first round of sales from November 1–3. Over 100 brands hit GMV of ¥100 million ($14.9 million) on Tmall within 111 minutes of the start of the first sales period, at 12:00am on November 1.

The second round took place from midnight on November 11, with the pre-sale on November 4–10.

During the 24-hour shopping window on November 11, more than 16 million products were on sale on Tmall from over 250,000 brands. Among these goods, over three million were new offerings for the second sales phase and more than one million accounted for restocks of first-round best-selling products that got restocked as brands re-arranged inventories globally to fulfill the high demand in China.

Results Suggest Strong Demand from Chinese Consumers

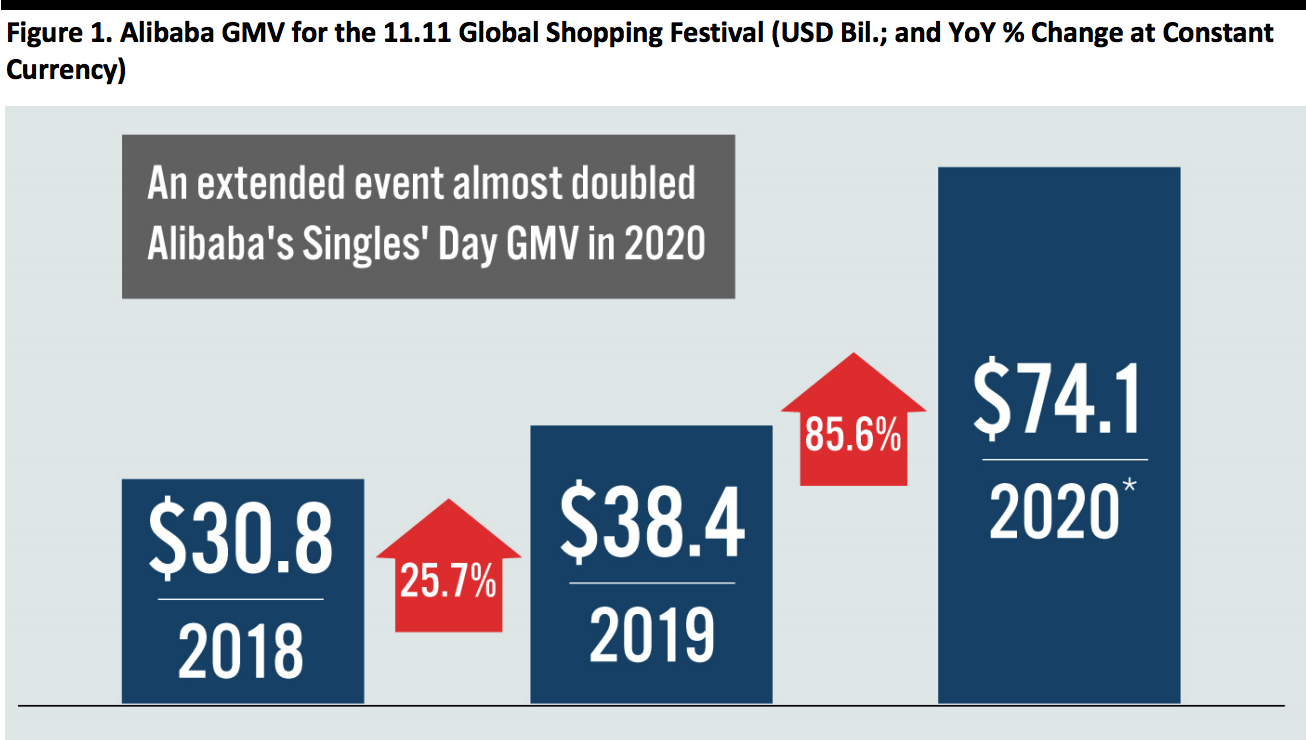

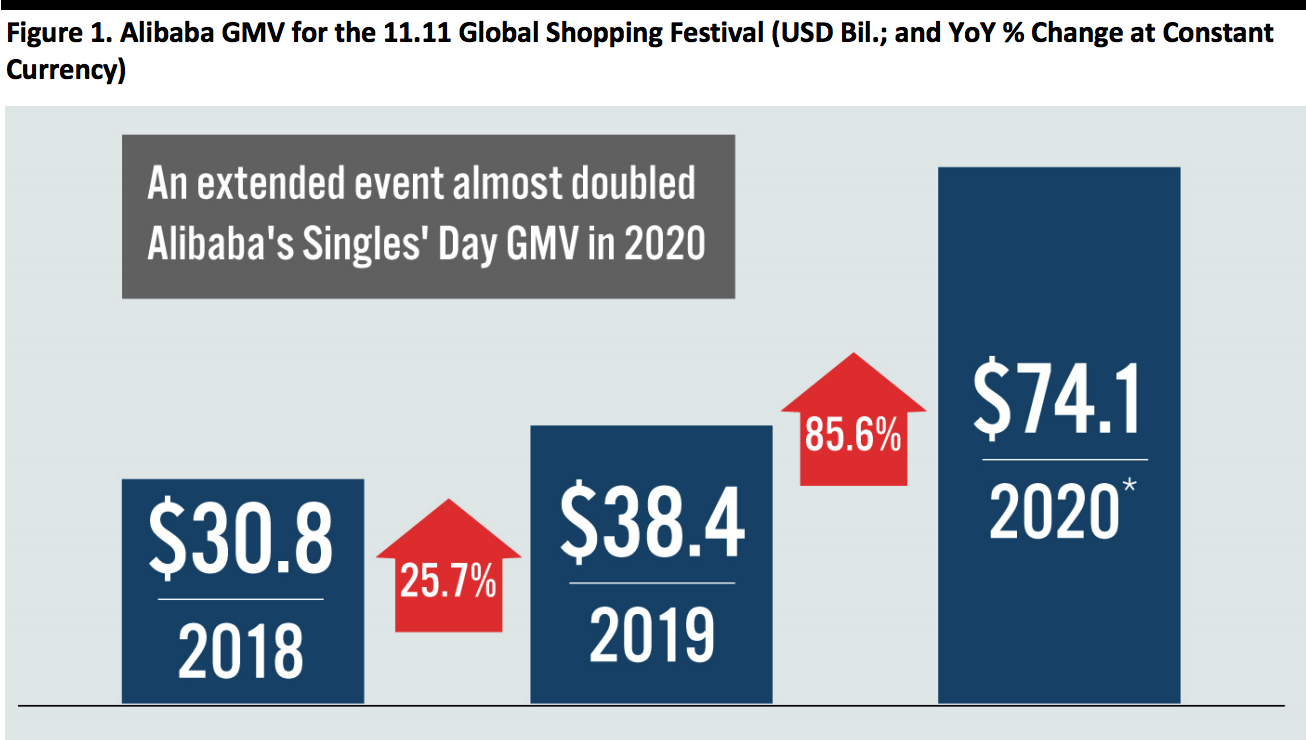

Alibaba reported total GMV of ¥498.2 billion ($74.1 billion as converted by Alibaba) for 2020’s expanded Singles’ Day event. This was up 85.6% in renminbi terms on 2019, versus 25.7% growth last year, supported by the substantial extension of the event.

Percentage changes exclude currency effects

Percentage changes exclude currency effects

*2020 was an extended event with two sales events and two pre-sale periods

Source: Alibaba[/caption] The commentary and insights below are based on preliminary information published by Alibaba before the end of Singles’ Day. According to Alibaba, total GMV exceeded ¥372.3 billion ($55.4 billion) during the period from midnight on November 1 to 12:30am on November 11—30 minutes after the beginning of the second sales window. Source: Alibaba Cloud[/caption]

Source: Alibaba Cloud[/caption]

Source: Alibaba News[/caption]

New Technologies Improve the Shopping Experience

Singles’ Day has become the testing ground for new and innovative technologies. Coresight Research noted that parcel delivery is even faster this year, helped by advance delivery of pre-sale items to centralized locations near consumers.

Alibaba applies artificial intelligence (AI) in the supply chain and logistics system to increase efficiency. Automation has been a focal point among Chinese e-commerce giants. Alibaba unveiled its latest autonomous logistics robot, Xiaomanlv to ease some pressure on last-mile delivery. The robot can carry 50 packages and cover 100 kilometers on a single charge. The robots have been operating at China’s Zhejiang University since November 1 and are expected to deliver 30,000 packages during the shopping festival.

As livestreaming continues to gain momentum as an effective selling channel, Alibaba enriched shopping experiences by introducing virtual livestreaming hosts to interact with viewers, powered by intelligent cognitive technologies. The company also offered real-time translation during livestreaming. The technology is based on Alibaba’s self-developed speech algorithm, which can translate Chinese into English, French, Russian and Spanish.

[caption id="attachment_119152" align="aligncenter" width="700"]

Source: Alibaba News[/caption]

New Technologies Improve the Shopping Experience

Singles’ Day has become the testing ground for new and innovative technologies. Coresight Research noted that parcel delivery is even faster this year, helped by advance delivery of pre-sale items to centralized locations near consumers.

Alibaba applies artificial intelligence (AI) in the supply chain and logistics system to increase efficiency. Automation has been a focal point among Chinese e-commerce giants. Alibaba unveiled its latest autonomous logistics robot, Xiaomanlv to ease some pressure on last-mile delivery. The robot can carry 50 packages and cover 100 kilometers on a single charge. The robots have been operating at China’s Zhejiang University since November 1 and are expected to deliver 30,000 packages during the shopping festival.

As livestreaming continues to gain momentum as an effective selling channel, Alibaba enriched shopping experiences by introducing virtual livestreaming hosts to interact with viewers, powered by intelligent cognitive technologies. The company also offered real-time translation during livestreaming. The technology is based on Alibaba’s self-developed speech algorithm, which can translate Chinese into English, French, Russian and Spanish.

[caption id="attachment_119152" align="aligncenter" width="700"] Alibaba’s autonomous logistics robot

Alibaba’s autonomous logistics robot

Source: Alibaba[/caption] Alibaba’s New Digital Factory Expedites the Production Process for Merchants Alibaba first unveiled its new digital factory Xunxi in Hangzhou in September. The apparel factory is designed to enable a faster manufacturing process, taking a more user-centric approach compared to traditional factories. The factory leverages various digital solutions such as AI, cloud computing and IoT technologies to streamline the production process. As a result, the Xunxi factory can process orders from 100 pieces with a short order lead time of seven days from design to finish. The gap between the two sales windows for this year’s Singles’ Day allowed merchants to quickly restock or adjust their product offerings, based on consumer data. With its fast turnaround time and flexibility, Xunxi was able to help apparel brands such as JACK&JONES, ONLY and other domestic merchants to restock for the second sales period and boost sales. What We Think Alibaba’s reported GMV increase of 85.6% is in the context of an event that saw two sales events instead of the usual one, with each having its own pre-sale period.

- In 2019, Alibaba reported 11.11 GMV of ¥268.4 billion, or $38.4 billion at 2019 exchange rates.

- In 2018, Alibaba reported 11.11 GMV of ¥213.5 billion, or $30.8 billion at 2018 exchange rates.

Percentage changes exclude currency effects

Percentage changes exclude currency effects*2020 was an extended event with two sales events and two pre-sale periods

Source: Alibaba[/caption] The commentary and insights below are based on preliminary information published by Alibaba before the end of Singles’ Day. According to Alibaba, total GMV exceeded ¥372.3 billion ($55.4 billion) during the period from midnight on November 1 to 12:30am on November 11—30 minutes after the beginning of the second sales window.

- The total GMV is the total value of orders settled through Alipay on Alibaba’s China retail marketplaces (Taobao and Tmall), as well as AliExpress, Kaola, Lazada and New Retail and consumer services platforms. All USD figures are based on the exchange rate of US$1=RMB6.7232—the central parity rate announced by the People’s Bank of China (PBOC) on October 30, 2020.

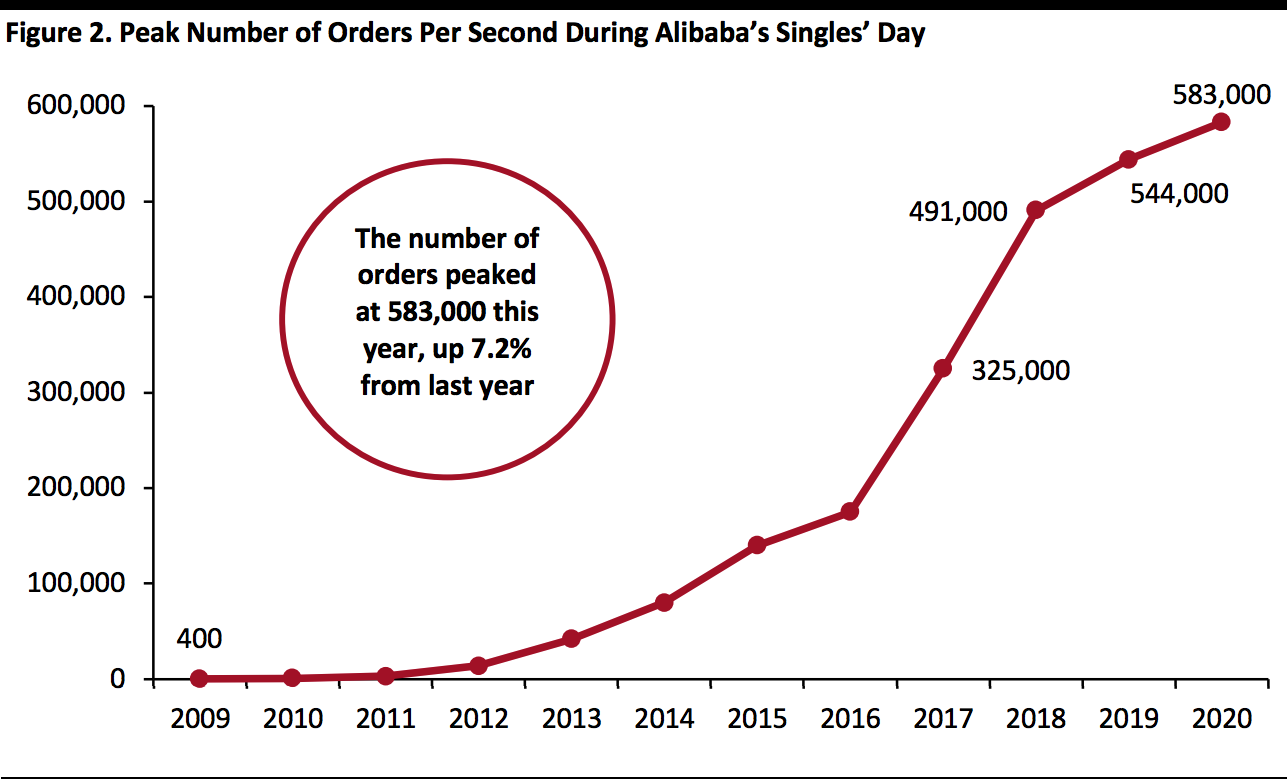

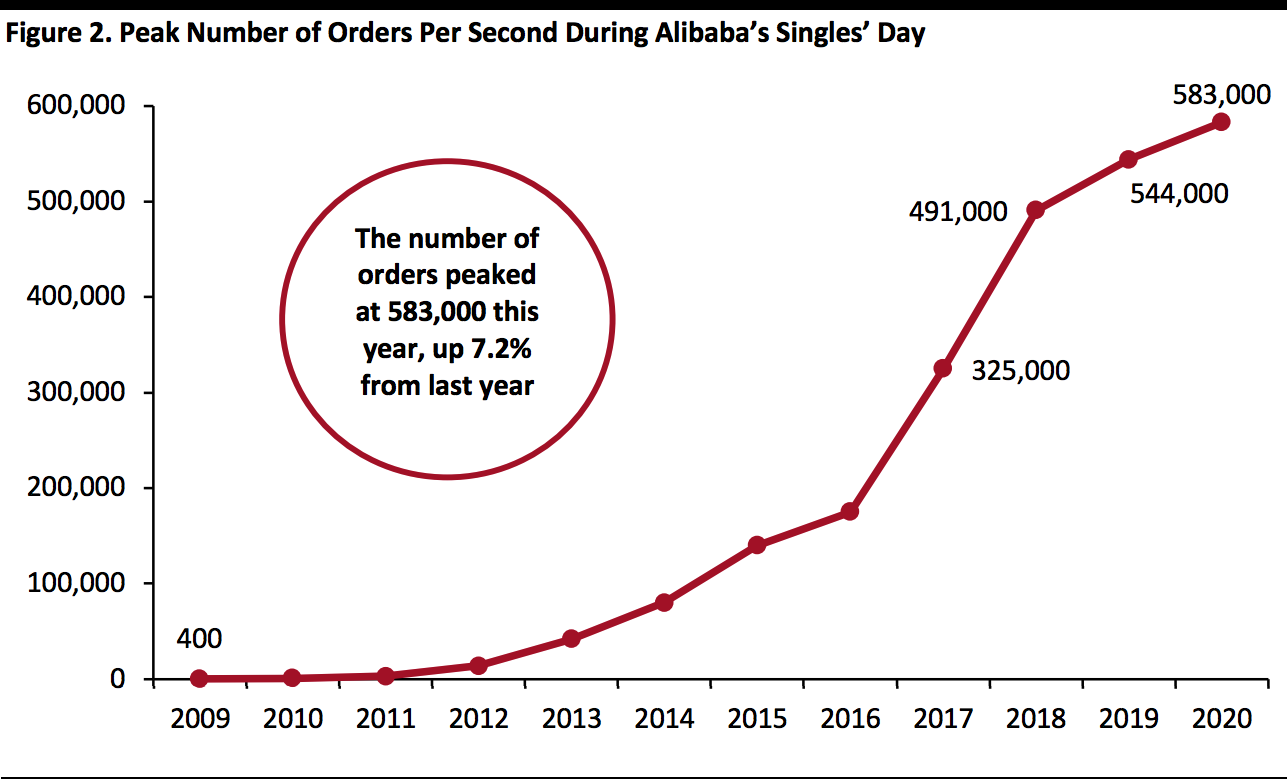

- The number of orders peaked at 583,000 orders per second, an improvement from 544,000 last year and 491,000 two years ago, thanks to the advanced capability of Alibaba Cloud.

Source: Alibaba Cloud[/caption]

Source: Alibaba Cloud[/caption]

- Based on data starting from November 1, 13 brands have each achieved ¥1 billion ($148.7 million) in GMV on Tmall, as of 12:35am on November 11. During the same period, 342 brands each surpassed GMV of ¥100 million ($14.9 million), including Adidas, Apple, Estée Lauder, Haier, Huawei, Lancôme, L’Oréal, Midea, NIKE and Xiaomi.

- From November 1 to 12:00pm on November 11:

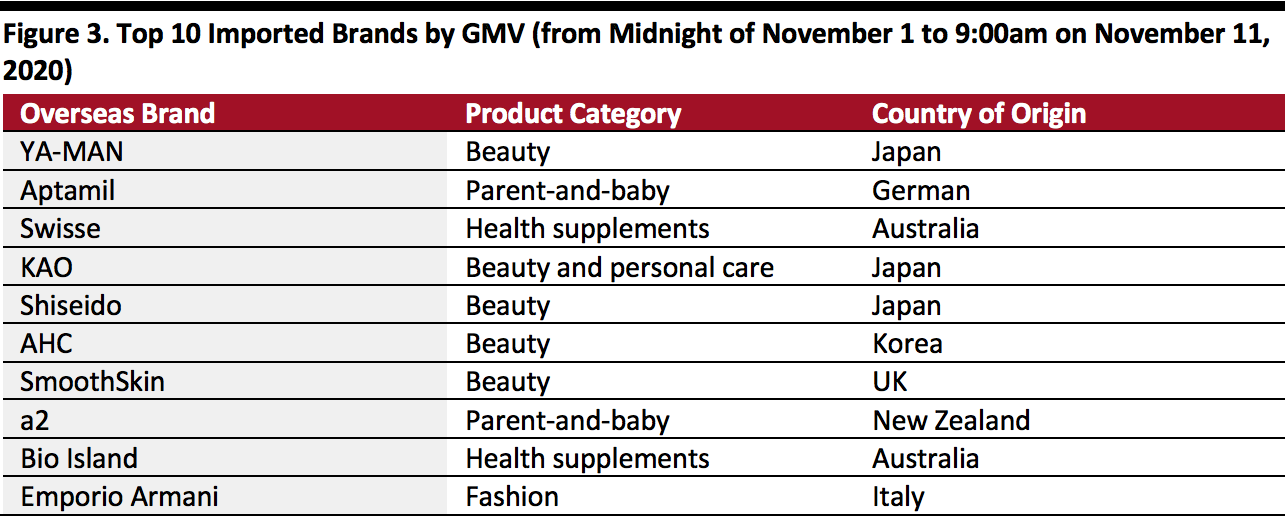

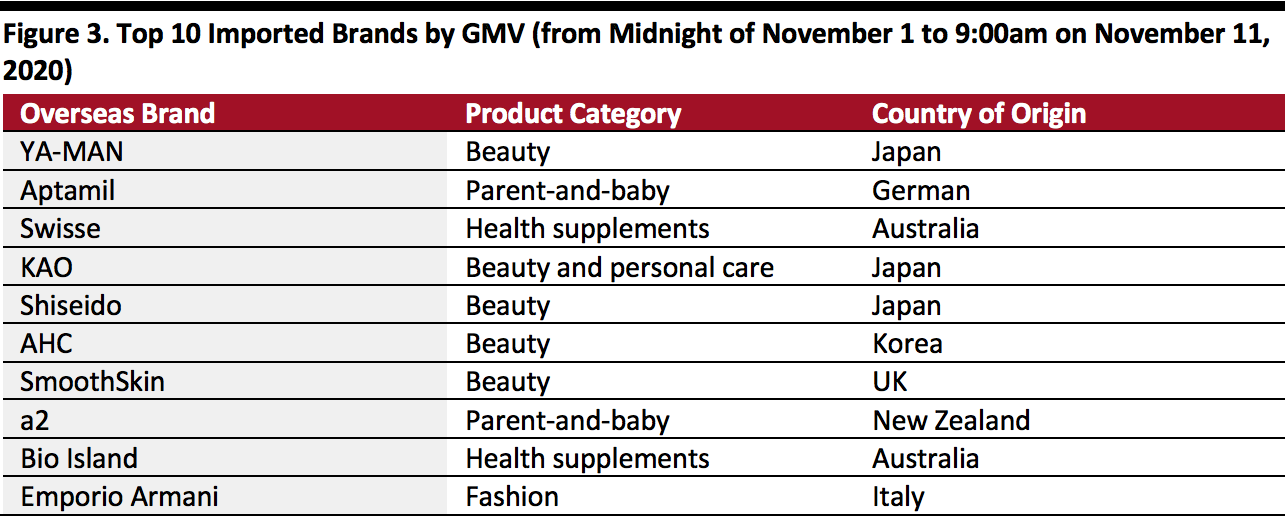

- Imported products on Tmall Global saw year over year growth of 47.3% in GMV, of which 180 overseas brands each recorded GMV of over ¥10 million ($1.5 million). Beauty was the most popular imported product category—as of 9:00am on November 11, half of the top 10 imported brands by GMV were in the beauty category, as shown in Figure 2.

- 16 new brands (that have been on Tmall for less than three years) each hit GMV of ¥100 million ($14.9 million).

- Shanghai, Beijing and Hangzhou were the three cities that generated the highest GMV.

Source: Alibaba News[/caption]

New Technologies Improve the Shopping Experience

Singles’ Day has become the testing ground for new and innovative technologies. Coresight Research noted that parcel delivery is even faster this year, helped by advance delivery of pre-sale items to centralized locations near consumers.

Alibaba applies artificial intelligence (AI) in the supply chain and logistics system to increase efficiency. Automation has been a focal point among Chinese e-commerce giants. Alibaba unveiled its latest autonomous logistics robot, Xiaomanlv to ease some pressure on last-mile delivery. The robot can carry 50 packages and cover 100 kilometers on a single charge. The robots have been operating at China’s Zhejiang University since November 1 and are expected to deliver 30,000 packages during the shopping festival.

As livestreaming continues to gain momentum as an effective selling channel, Alibaba enriched shopping experiences by introducing virtual livestreaming hosts to interact with viewers, powered by intelligent cognitive technologies. The company also offered real-time translation during livestreaming. The technology is based on Alibaba’s self-developed speech algorithm, which can translate Chinese into English, French, Russian and Spanish.

[caption id="attachment_119152" align="aligncenter" width="700"]

Source: Alibaba News[/caption]

New Technologies Improve the Shopping Experience

Singles’ Day has become the testing ground for new and innovative technologies. Coresight Research noted that parcel delivery is even faster this year, helped by advance delivery of pre-sale items to centralized locations near consumers.

Alibaba applies artificial intelligence (AI) in the supply chain and logistics system to increase efficiency. Automation has been a focal point among Chinese e-commerce giants. Alibaba unveiled its latest autonomous logistics robot, Xiaomanlv to ease some pressure on last-mile delivery. The robot can carry 50 packages and cover 100 kilometers on a single charge. The robots have been operating at China’s Zhejiang University since November 1 and are expected to deliver 30,000 packages during the shopping festival.

As livestreaming continues to gain momentum as an effective selling channel, Alibaba enriched shopping experiences by introducing virtual livestreaming hosts to interact with viewers, powered by intelligent cognitive technologies. The company also offered real-time translation during livestreaming. The technology is based on Alibaba’s self-developed speech algorithm, which can translate Chinese into English, French, Russian and Spanish.

[caption id="attachment_119152" align="aligncenter" width="700"] Alibaba’s autonomous logistics robot

Alibaba’s autonomous logistics robotSource: Alibaba[/caption] Alibaba’s New Digital Factory Expedites the Production Process for Merchants Alibaba first unveiled its new digital factory Xunxi in Hangzhou in September. The apparel factory is designed to enable a faster manufacturing process, taking a more user-centric approach compared to traditional factories. The factory leverages various digital solutions such as AI, cloud computing and IoT technologies to streamline the production process. As a result, the Xunxi factory can process orders from 100 pieces with a short order lead time of seven days from design to finish. The gap between the two sales windows for this year’s Singles’ Day allowed merchants to quickly restock or adjust their product offerings, based on consumer data. With its fast turnaround time and flexibility, Xunxi was able to help apparel brands such as JACK&JONES, ONLY and other domestic merchants to restock for the second sales period and boost sales. What We Think Alibaba’s reported GMV increase of 85.6% is in the context of an event that saw two sales events instead of the usual one, with each having its own pre-sale period.

- The number of orders created at peak was up by 7.2% year over year, compared to a 10.8% rise in 2019. A slowdown in peak growth is to be expected with an extended event and the easing of peak-capacity challenges was likely one factor behind the decision to extend Singles’ Day this year.

- Imported products on Tmall Global saw year over year growth of 47.3% in GMV by midday on November 11, although this was over a longer period than last year. Depressed rates of international travel look set to redirect some shopping from overseas to domestic, and this is likely to have been one factor behind solid demand for imported products this year.