DIpil Das

What’s the Story?

In this report, we discuss several new product offerings on Alibaba’s Tmall e-commerce platform during Singles’ Day 2020 on November 11. We highlight selected brands’ product strategies to drive consumer excitement and purchases for this year’s shopping festival.Why It Matters

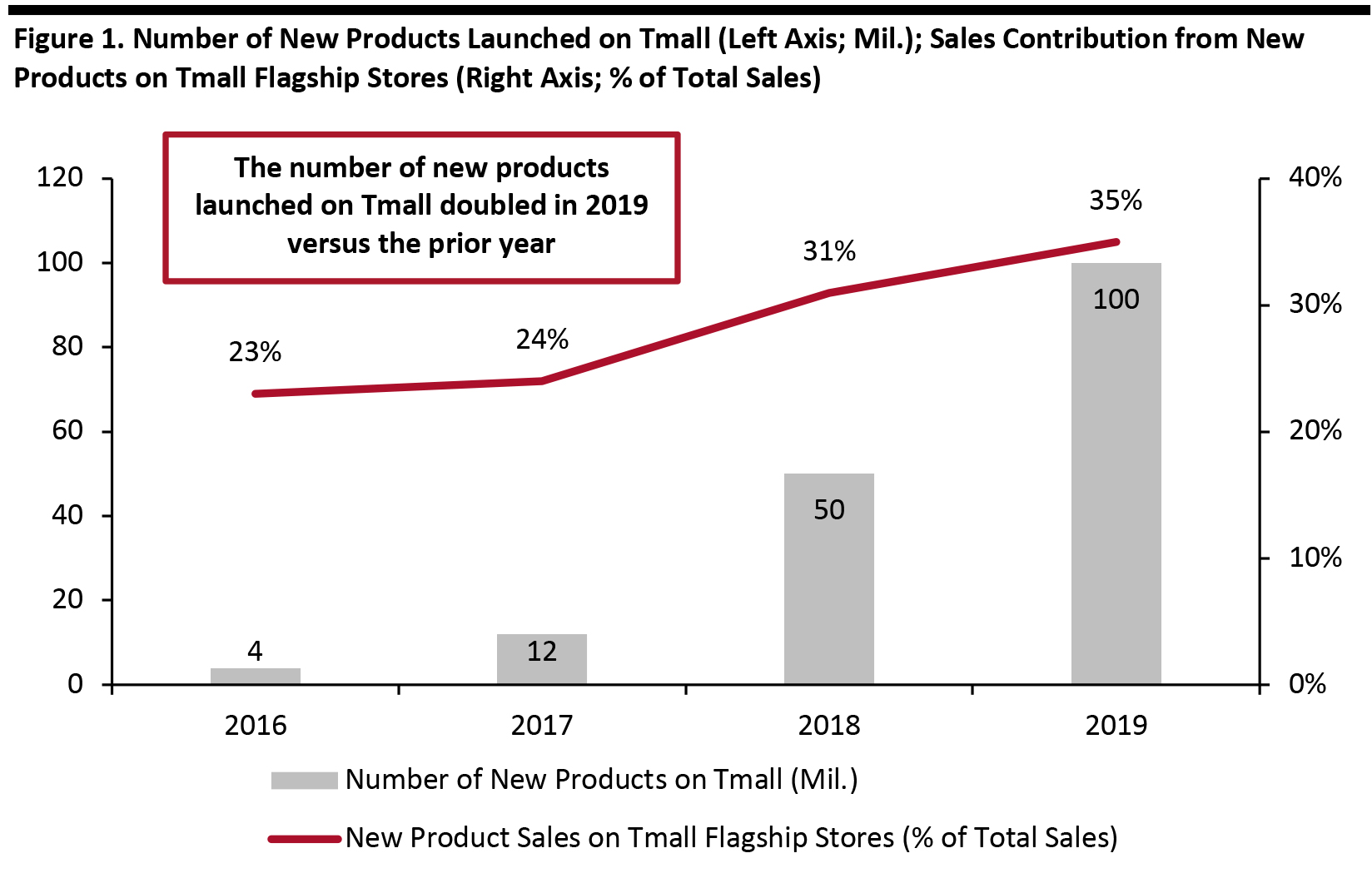

The launch of new products is a key way for brands to generate consumer excitement and boost sales on Tmall. At the start of 2020, the platform announced that new products will continue to be the core strategy this year, and its goal was to incubate over 300 new products that generate sales of over ¥100 million ($14.7 million). In 2019, the number of new products launched on the platform exceeded 100 million, according to Tmall, which was double the number from 2018. As a proportion of total sales, the sales of new products has also been creeping higher each year. In 2019, new products accounted for 35% of total sales on Tmall flagship stores (see Figure 1). [caption id="attachment_119338" align="aligncenter" width="700"] Source: AliResearch/Tmall [/caption]

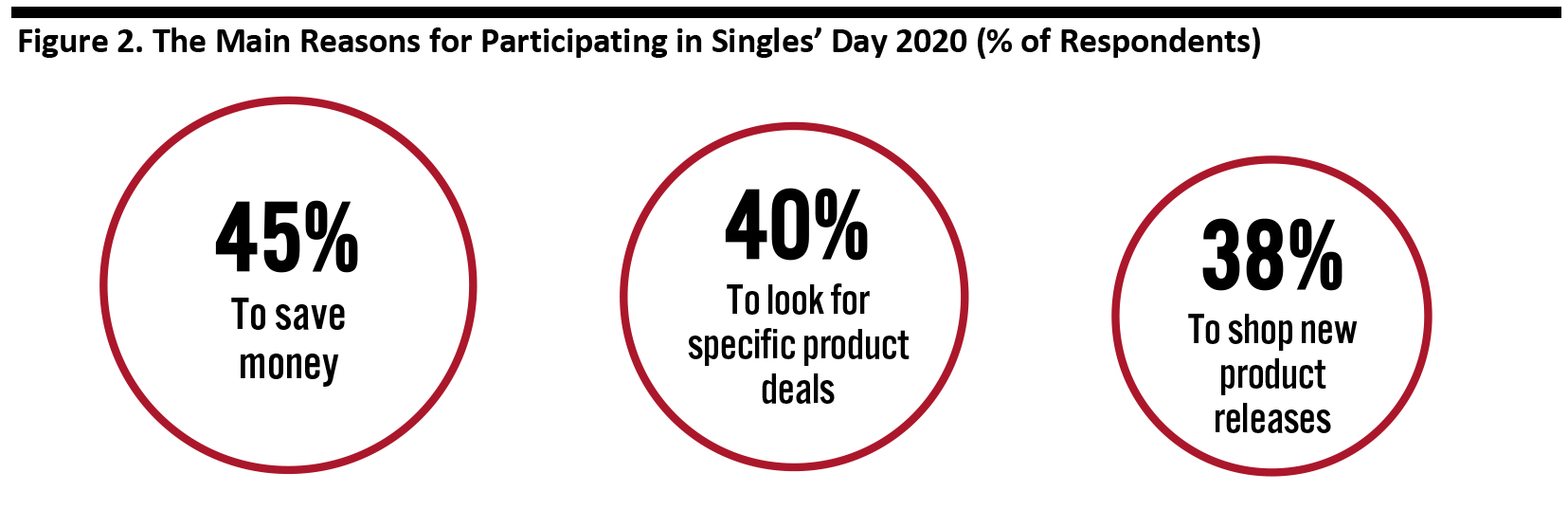

In recent years, Singles’ Day has evolved into the prime opportunity for brands to launch new products. During the festival this year, Tmall unveiled over 2 million new products, double the amount from the 2019 event, and over 50% of merchants launched new products. Although consumers are focused on discounts this year, as their spending has been affected by the Covid-19 pandemic, shopping new product releases is one of the main reasons they typically participate in Singles’ Day, according to AlixPartners.

[caption id="attachment_119339" align="aligncenter" width="700"]

Source: AliResearch/Tmall [/caption]

In recent years, Singles’ Day has evolved into the prime opportunity for brands to launch new products. During the festival this year, Tmall unveiled over 2 million new products, double the amount from the 2019 event, and over 50% of merchants launched new products. Although consumers are focused on discounts this year, as their spending has been affected by the Covid-19 pandemic, shopping new product releases is one of the main reasons they typically participate in Singles’ Day, according to AlixPartners.

[caption id="attachment_119339" align="aligncenter" width="700"] Base: Chinese consumers aged 15+

Base: Chinese consumers aged 15+ Source: AlixPartners [/caption]

Tmall Hey Box—The Dedicated Portal for New Products

Tmall Hey Box is the platform’s dedicated gateway for consumers to discover new products and is one of Tmall’s popular suite of tools for product launches. The portal presents a variety of new products to consumers, with customized recommendations provided by Alibaba’s big data and artificial intelligence technology. Tmall Hey Box created a specific site for new products launched on Double 11. Tmall expected the site to attract 500 million users to shop and help 30 new products to achieve sales of over ¥100 million ($14.7 million) and 1,000 new products to surpass sales of over ¥10 million ($1.5 million) during the festival. From October 22 to November 11, Tmall Hey Box also partnered with brands, celebrities and key opinion leaders to promote a variety of new products on its official livestreaming channel. [caption id="attachment_119349" align="aligncenter" width="700"] Dedicated site for Singles’ Day new products (Left); Livestreaming on Tmall Hey Box official channel (Right)

Dedicated site for Singles’ Day new products (Left); Livestreaming on Tmall Hey Box official channel (Right) Source: Tmall [/caption]

Analyzing New Products: In Detail

Instead of simply launching new products, some brands are being creative on their product offerings to cultivate consumer demand. Their approaches include crossover products, Tmall-exclusive products, and value gift sets. Crossover Products Crossover products—either between brands or between brands and artists/themes—have proven successful in China. Brand mashups, especially unlikely ones, allow conventional products to be positioned as unique offerings to refresh a brand’s image and attract young shoppers. Lancôme unveiled a mystery box in partnership with “emoji – The Iconic Brand.” The box contains one of Lancôme’s bestselling toners, Tonique Confort, with the bottle cap featuring one of four different emoji expressions, as well as an emoji-branded headband. The specific bottle cap in each beauty box is random, so consumers do not know which one they will receive—creating a sense of excitement and surprise. In 11.11’s first pre-sale day on October 21, the box achieved sales of over ¥10 million ($1.5 million). [caption id="attachment_119348" align="aligncenter" width="700"] Source: Lancôme[/caption]

Crossovers between food and beauty are particularly popular in China, and unusual mashups in particular capture social media attention. French skincare brand Caudalie announced a collaboration with known Chinese beverage shop Nayuki Tea to launch a limited-edition gift box that included Caudalie’s signature Vinoperfect Radiance Serum and Nayuki tea bags. In addition, Nayuki introduced a new grape-flavored milk tea drink, inspired by Caudalie’s famous product ingredient, grape extracts. Consumers who ordered the drink in-store had the chance to receive free samples of the serum. Caudalie launched a campaign on Weibo, and its hashtag #GrapeTreasureTea had received over 91 million views on the platform as of November 9.

[caption id="attachment_119347" align="aligncenter" width="700"]

Source: Lancôme[/caption]

Crossovers between food and beauty are particularly popular in China, and unusual mashups in particular capture social media attention. French skincare brand Caudalie announced a collaboration with known Chinese beverage shop Nayuki Tea to launch a limited-edition gift box that included Caudalie’s signature Vinoperfect Radiance Serum and Nayuki tea bags. In addition, Nayuki introduced a new grape-flavored milk tea drink, inspired by Caudalie’s famous product ingredient, grape extracts. Consumers who ordered the drink in-store had the chance to receive free samples of the serum. Caudalie launched a campaign on Weibo, and its hashtag #GrapeTreasureTea had received over 91 million views on the platform as of November 9.

[caption id="attachment_119347" align="aligncenter" width="700"] Source: Caudalie[/caption]

Olay collaborated with American artist Keith Haring, who is known for his pop art and graffiti drawings, to create new packaging styles for three Olay serums and one moisturizer. Consumers who spent over ¥599 ($87.80) on Olay’s Tmall store could receive a limited-edition Keith Haring tote bag, and those who spent over ¥699 ($102.40) could get the artist’s cosmetics bag. Olay also added the hashtag #FollowYourHeartToShine on Weibo to encourage users to share their dream-chasing stories to win products. As of November 9, the hashtag had accumulated 520 million views.

[caption id="attachment_119346" align="aligncenter" width="700"]

Source: Caudalie[/caption]

Olay collaborated with American artist Keith Haring, who is known for his pop art and graffiti drawings, to create new packaging styles for three Olay serums and one moisturizer. Consumers who spent over ¥599 ($87.80) on Olay’s Tmall store could receive a limited-edition Keith Haring tote bag, and those who spent over ¥699 ($102.40) could get the artist’s cosmetics bag. Olay also added the hashtag #FollowYourHeartToShine on Weibo to encourage users to share their dream-chasing stories to win products. As of November 9, the hashtag had accumulated 520 million views.

[caption id="attachment_119346" align="aligncenter" width="700"] Source: Olay[/caption]

Tmall-Exclusive Products

Tmall is the largest B2C (business-to-consumer) e-commerce platform in China, and brands have designed products exclusively for shoppers on the platform. This is a win-win situation for brands and Tmall: Consumers are more inclined to shop on Tmall for its exclusivity, and brands can leverage the platform’s capability and reach to further expand its customer base.

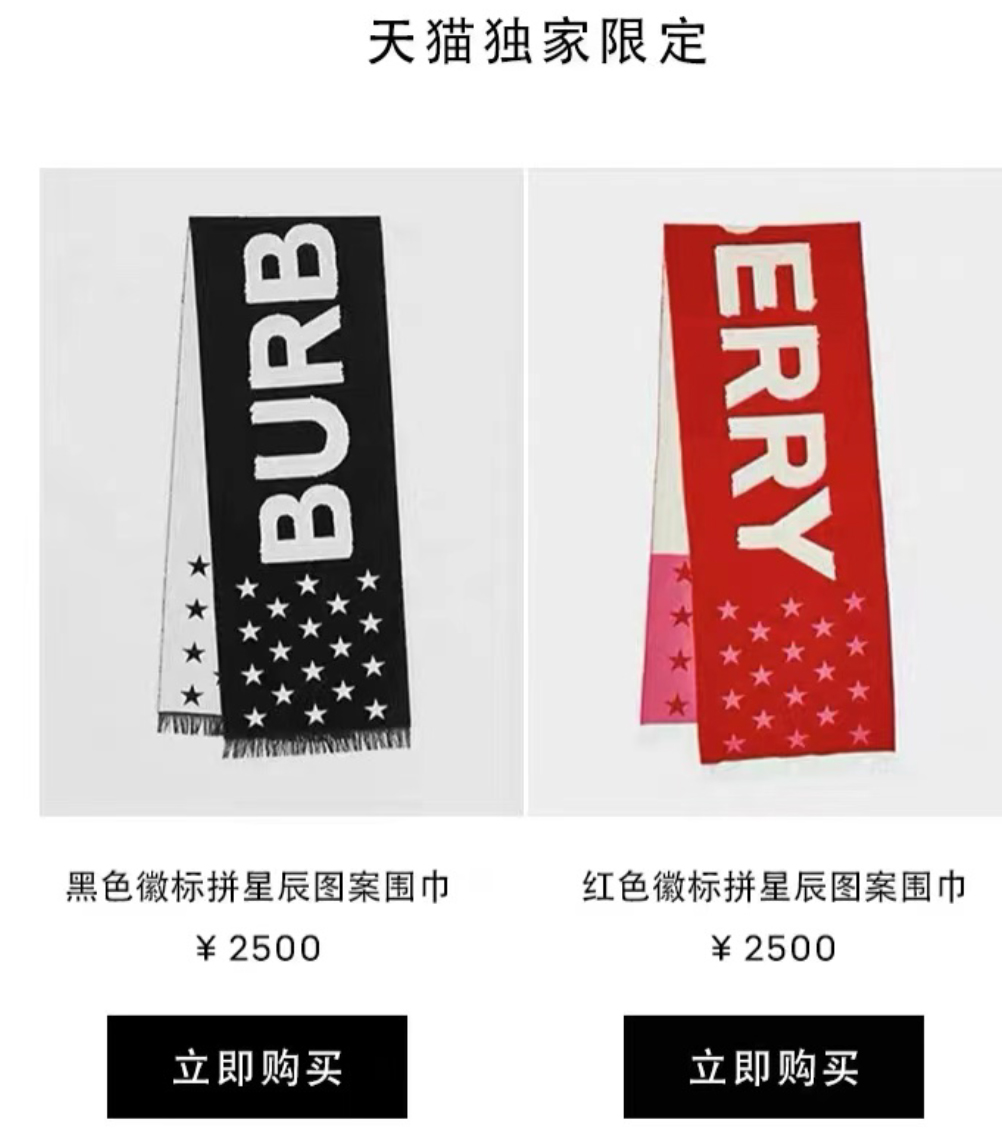

Rather than simply offering deep discounts, luxury brands are providing exclusive products for Double 11 to generate consumer interest. Burberryunveiled a Tmall-exclusive wool scarf, in black and red, priced at ¥2,500 ($366.40). The scarf sold out in the first pre-sale period of Singles’ Day and had to be restocked for the second round of sale.

[caption id="attachment_119345" align="aligncenter" width="700"]

Source: Olay[/caption]

Tmall-Exclusive Products

Tmall is the largest B2C (business-to-consumer) e-commerce platform in China, and brands have designed products exclusively for shoppers on the platform. This is a win-win situation for brands and Tmall: Consumers are more inclined to shop on Tmall for its exclusivity, and brands can leverage the platform’s capability and reach to further expand its customer base.

Rather than simply offering deep discounts, luxury brands are providing exclusive products for Double 11 to generate consumer interest. Burberryunveiled a Tmall-exclusive wool scarf, in black and red, priced at ¥2,500 ($366.40). The scarf sold out in the first pre-sale period of Singles’ Day and had to be restocked for the second round of sale.

[caption id="attachment_119345" align="aligncenter" width="700"] Source: Burberry[/caption]

Italian high-end sneaker brand Golden Goose, which just opened its flagship store on Tmall in August, participated Double 11 for the first time. The brand released a new style exclusively for Tmall called PURESTAR and a new collection called Dad-Star that made its debut on Tmall. The first 100 consumers who purchased Dad-Star sneakers received a keychain for free.

[caption id="attachment_119344" align="aligncenter" width="700"]

Source: Burberry[/caption]

Italian high-end sneaker brand Golden Goose, which just opened its flagship store on Tmall in August, participated Double 11 for the first time. The brand released a new style exclusively for Tmall called PURESTAR and a new collection called Dad-Star that made its debut on Tmall. The first 100 consumers who purchased Dad-Star sneakers received a keychain for free.

[caption id="attachment_119344" align="aligncenter" width="700"] Source: Golden Goose[/caption]

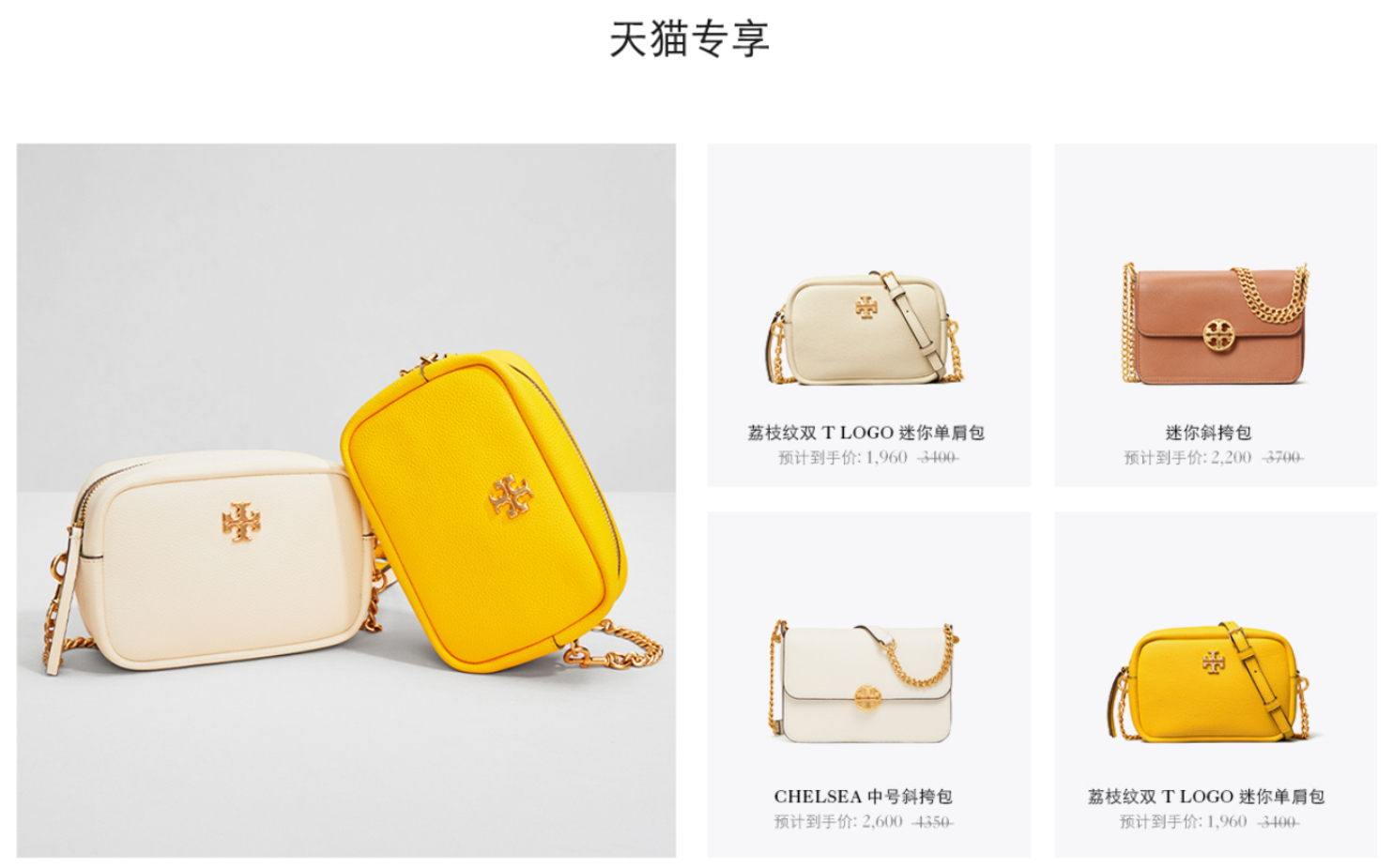

American designer brand Tory Burch designed three exclusive handbag styles for Tmall, with prices ranging from ¥1,960 to ¥2,600 ($287–$381). During the first pre-sale period (October 21–31), these three products contributed 13.1% of the company’s pre-sale GMV, according to CBNData.

[caption id="attachment_119343" align="aligncenter" width="700"]

Source: Golden Goose[/caption]

American designer brand Tory Burch designed three exclusive handbag styles for Tmall, with prices ranging from ¥1,960 to ¥2,600 ($287–$381). During the first pre-sale period (October 21–31), these three products contributed 13.1% of the company’s pre-sale GMV, according to CBNData.

[caption id="attachment_119343" align="aligncenter" width="700"] Source: Tory Burch[/caption]

New, Value Gift Sets

Product bundling is an effective way to market products, increase average order value and reduce inventory. Consumers are more likely to buy product sets as the total value of the bundle is typically lower than buying the items separately. New gift sets for Double 11 were made available in limited quantities, urging consumers to purchase quickly to avoid missing out.

South Korean high-end skincare brand The History of Whoo launched a seven-piece set of its Radiance Rejuvenating products, priced at ¥1,590 ($233)—a roughly 70% discount. The set was one of the top 10 bestselling products in the first hour of November 1, and the only beauty product that exceeded sales of ¥600 million ($87.9 million) during the first round of sale (November 1–3) in this year’s Singles’ Day festival.

[caption id="attachment_119342" align="aligncenter" width="700"]

Source: Tory Burch[/caption]

New, Value Gift Sets

Product bundling is an effective way to market products, increase average order value and reduce inventory. Consumers are more likely to buy product sets as the total value of the bundle is typically lower than buying the items separately. New gift sets for Double 11 were made available in limited quantities, urging consumers to purchase quickly to avoid missing out.

South Korean high-end skincare brand The History of Whoo launched a seven-piece set of its Radiance Rejuvenating products, priced at ¥1,590 ($233)—a roughly 70% discount. The set was one of the top 10 bestselling products in the first hour of November 1, and the only beauty product that exceeded sales of ¥600 million ($87.9 million) during the first round of sale (November 1–3) in this year’s Singles’ Day festival.

[caption id="attachment_119342" align="aligncenter" width="700"] Source: The History of Whoo[/caption]

Skincare and body-care brand L'Occitane introduced a limited-edition hand-cream set containing four city-themed hand creams. Shoppers who ordered the set could also receive complimentary products worth ¥320 ($47). As a result, the total value of the gift set was ¥680 ($100), while consumers paid only ¥360 ($53).

[caption id="attachment_119341" align="aligncenter" width="700"]

Source: The History of Whoo[/caption]

Skincare and body-care brand L'Occitane introduced a limited-edition hand-cream set containing four city-themed hand creams. Shoppers who ordered the set could also receive complimentary products worth ¥320 ($47). As a result, the total value of the gift set was ¥680 ($100), while consumers paid only ¥360 ($53).

[caption id="attachment_119341" align="aligncenter" width="700"] Source: L'Occitane[/caption]

Kate Spade unveiled an exclusive gift set that included a limited-edition Nicola Twistlock handbag and a leather bracelet. The price of the bundle was the same as that of the handbag alone, at ¥2,610 ($382.50).

[caption id="attachment_119340" align="aligncenter" width="700"]

Source: L'Occitane[/caption]

Kate Spade unveiled an exclusive gift set that included a limited-edition Nicola Twistlock handbag and a leather bracelet. The price of the bundle was the same as that of the handbag alone, at ¥2,610 ($382.50).

[caption id="attachment_119340" align="aligncenter" width="700"] Source: Kate Spade[/caption]

Source: Kate Spade[/caption]

What We Think

In addition to offering deep discounts, Singles’ Day also presents an opportunity for brands and retailers to launch new products. This year, Tmall unveiled over 2 million new products, double the amount from the event in 2019. Brands need to be innovative in creating new products to meet consumer demand. Implications for Brands/Retailers- Crossover products are a popular phenomenon in China, and such brand mashups are particularly appealing to young consumers. Successful collaboration can help brands to expand their reach and refresh their image.

- Exclusive and limited-edition products create a sense of urgency to drive conversion. During shopping festivals, such as the upcoming Double 12 and Chinese New Year, luxury brands that are reluctant to provide deep discounts can choose to launch Tmall-exclusive products to generate excitement.

- Product bundling is an effective way to boost sales during shopping festivals, as the total value of the set is typically lower than the combined price of individual items. Brands can group their bestselling products with some less popular ones to reduce inventory.

- More than ever, e-commerce presents a major opportunity in China. While the coronavirus crisis has accelerated structural shifts to e-commerce, it is also redirecting shopping by Chinese travelers, that would have taken place on overseas trips, to domestic purchases. We expect this to boost domestic online demand for fragrances and beauty, clothing, footwear and accessories, health supplements and vitamins, electronics, alcoholic drinks, and jewelry and watches—highly popular categories for overseas shopping.

- Such are the tailwinds that we expect e-commerce to account for more than one-quarter of China’s retail sales for the first time in 2020: In a $5 trillion total retail market, we expect e-commerce to account for around $1.35 trillion of purchases.

- As we recently discussed in detail, this shift to e-commerce will support the consolidation of a still-fragmented Chinese retail market, driving structural changes that go beyond channel shifts. Brands and retailers should stand ready to take advantage of these opportunities, including by driving consumer excitement with new and innovative products.