Nitheesh NH

What’s the Story?

In this report, we analyze new entrants on Tmall to understand their approach to China market entry or expansion on Singles’ Day.Why It Matters

Singles’ Day (also termed Alibaba’s 11.11 Global Shopping Festival) is China’s biggest online shopping festival—with consumers flocking to Taobao and Tmall to take advantage of promotions. Every year, new brands on Alibaba’s e-commerce platforms—both domestic and international—use the event to increase brand exposure and promote their products in the China market. This year, the Covid-19 pandemic has caused disruption across the global retail industry. The importance of online shopping channels for retailers has increased throughout temporary store closures and lockdowns. China’s $5 trillion retail market remains attractive to international retailers, and many international brands made their Tmall Global debuts during the coronavirus outbreak in March 2020, including streetwear brand Bape, luxury brands Miu Miu and Prada and apparel brand Undefeated. China’s retail industry is likely to return to strong, positive growth in 2021, according to Coresight Research estimations. We discuss new entrants’ marketing and sales strategies during the Singles’ Day shopping festival this year.Analyzing New Entrants: In Detail

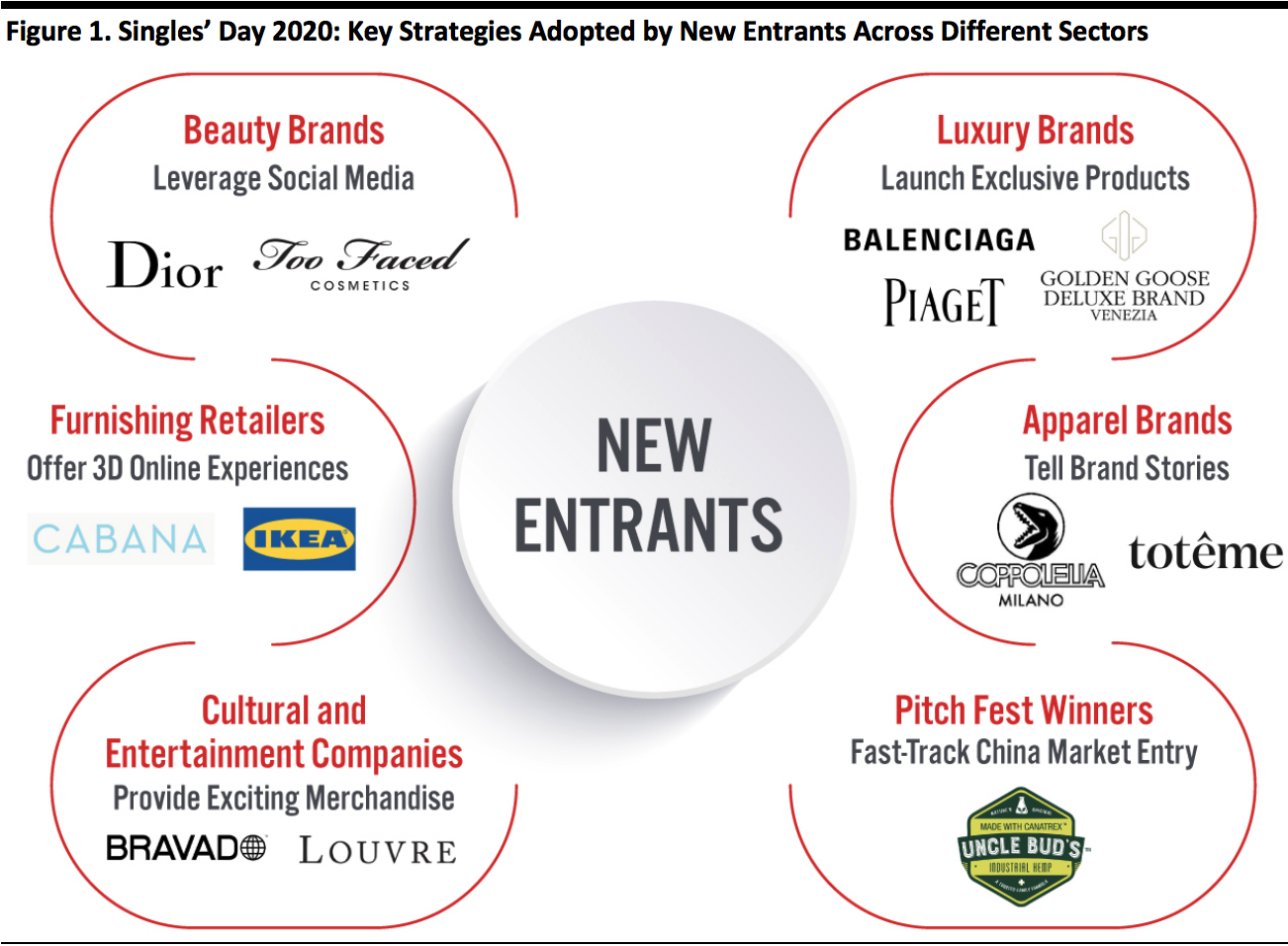

New entrants from different sectors adopted a number of strategies to market their products and engage with consumers during Singles’ Day 2020. We summarize the six components of the festival’s “new entrants” landscape in Figure 1 and discuss each strategy below. [caption id="attachment_119490" align="aligncenter" width="700"] Source: Coresight Research[/caption]

1. New Beauty Entrants Continue To Leverage Social Media

Beauty retailers are increasingly making use of social media to engage consumers, remaining active on social channels through lockdown and focusing on makeup looks and tutorials for facial features not covered up by masks: Eyeshadow sales on Tmall increased by 40% year over year between January and March 2020, according to the platform.

Dior Beauty, the cosmetics brand of Christian Dior, launched its Tmall flagship store in June. The brand has run an account on social micro-blogging site Weibo since 2011 and has 3.7 million followers as of October 31, 2020.

Dior Beauty promoted its products and Tmall store on Weibo in the Singles’ Day pre-sale period, which began on October 21. The brand appointed famous actress Angela Wing, known by her stage name Angelababy, as its ambassador for China to promote the brand’s beauty products on Weibo.

[caption id="attachment_119491" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

1. New Beauty Entrants Continue To Leverage Social Media

Beauty retailers are increasingly making use of social media to engage consumers, remaining active on social channels through lockdown and focusing on makeup looks and tutorials for facial features not covered up by masks: Eyeshadow sales on Tmall increased by 40% year over year between January and March 2020, according to the platform.

Dior Beauty, the cosmetics brand of Christian Dior, launched its Tmall flagship store in June. The brand has run an account on social micro-blogging site Weibo since 2011 and has 3.7 million followers as of October 31, 2020.

Dior Beauty promoted its products and Tmall store on Weibo in the Singles’ Day pre-sale period, which began on October 21. The brand appointed famous actress Angela Wing, known by her stage name Angelababy, as its ambassador for China to promote the brand’s beauty products on Weibo.

[caption id="attachment_119491" align="aligncenter" width="580"] Angelababy featured on Dior Beauty’s Weibo account

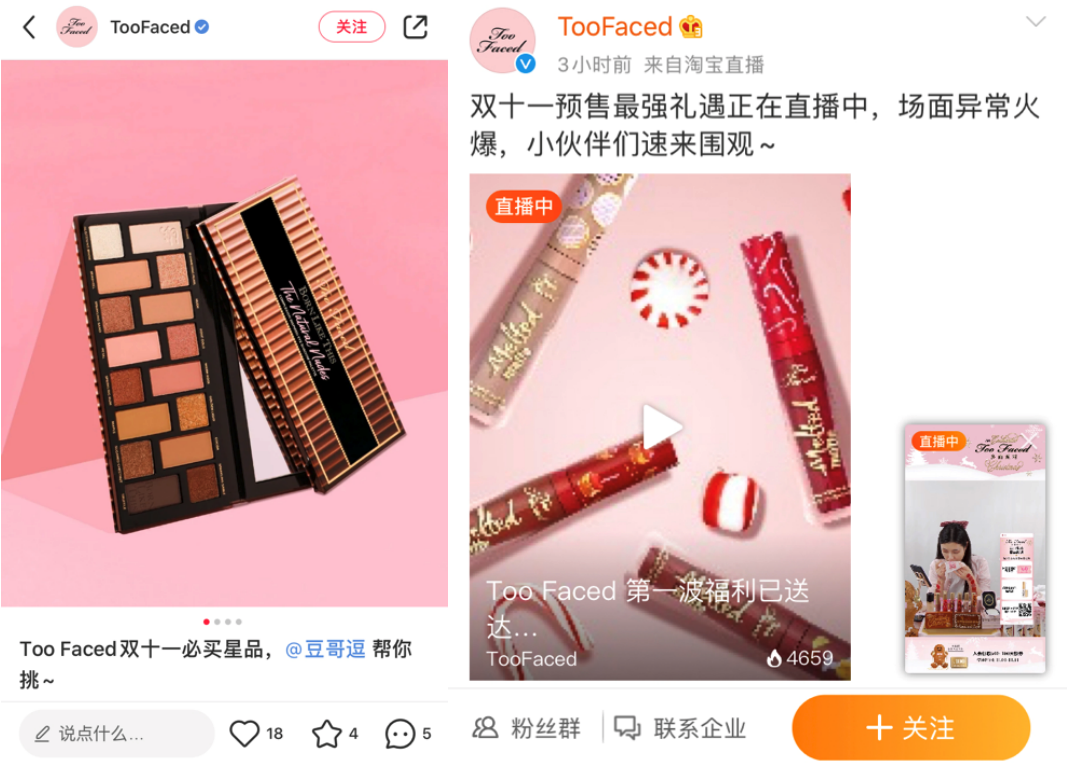

Angelababy featured on Dior Beauty’s Weibo accountSource: Weibo[/caption] Part of the Estée Lauder family, American cosmetics brand Too Faced Cosmetics entered the China market through the launch of its Tmall flagship store in April. The brand launched several campaigns on Weibo and Little Red Book—a social lifestyle platform, also known as Xiaohongshu, that blends user-generated content and e-commerce to amass brand exposure and generate sales. It may be likened to a combination of Instagram and Pinterest. During the Singles’ Day pre-sale period, Too Faced Cosmetics shared a list of its “must-buy” products on Little Red Book, written by KOLs. The brand shared links for its Taobao livestreaming sessions on its Weibo account to expand its audience. As of the end of October, Too Faced had 26,000 followers on Weibo and 10,000 followers on Little Red Book, as well as 350,000 fans on its Tmall store. [caption id="attachment_119492" align="aligncenter" width="580"]

Posts from Too Faced accounts on Little Red Book (left) and Weibo (right).

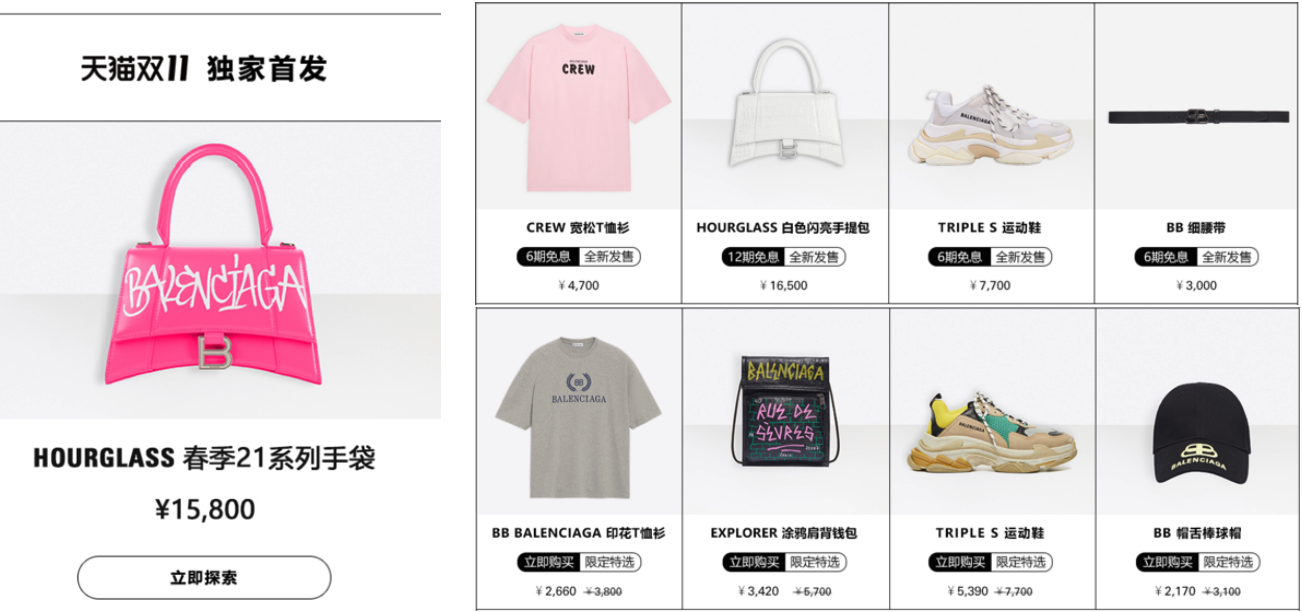

Posts from Too Faced accounts on Little Red Book (left) and Weibo (right).Source: Little Red Book/Weibo[/caption] 2. Luxury Brands Launch Exclusive Products for Singles’ Day We saw luxury brands launch exclusive products to attract consumers and generate a sense of excitement around products perceived as unique. This year, eight brands owned by Richemont, a Switzerland-based luxury goods company, opened flagship stores on Tmall. We outline promotions by two Richemont brands—Balenciaga and Piaget—below. Read about more new product launches for Singles’ Day in our separate report, which includes highlights from luxury brands Golden Goose and Tory Burch. Balenciaga opened its flagship Tmall store in May. During the Singles’ Day pre-sale period, the brand launched its Hourglass handbag exclusively on Tmall Customers—offering customers a 12-month interest-free installment plan on this product. The brand promoted other new arrivals by offering six- or 12-month interest-free installment plans and discounts worth over ¥1,000 ($150) across accessories, apparel and shoes. [caption id="attachment_119493" align="aligncenter" width="700"]

Balenciaga’s promotions on Tmall

Balenciaga’s promotions on TmallSource: Tmall[/caption] Piaget used Singles’ Day to promote exclusive products¬ on its Tmall store, including its Limelight diamond watches and Possession earrings—as well as 12- or 24-month interest-free installment payment plans. Piaget also provided extras such as card wallets, gift boxes and promotional gifts to the shopper that placed the first order during the event and to customers that spent above ¥20,000 ($3,000). [caption id="attachment_119494" align="aligncenter" width="700"]

Piaget’s promotions on Tmall

Piaget’s promotions on TmallSource: Tmall[/caption] 3. Furnishing Retailers Offer 3D Online Experiences Branching out from traditional reliance on offline distribution, furnishing brands and retailers offered 3D online shopping experiences to e-commerce consumers. Cabana, a Chinese furnishing retailer focused on luxury home goods, opened its flagship Tmall store in May. The retailer sells home furnishings from international brands, such as Carl Hansen & Son, Thonet, USM and Vitra. Cabana invited shoppers to explore USM products in a 3D setting within the Tmall store. The retailer also organized livestreaming sessions during the Singles’ Day pre-sale period, hosting renowned Japanese architect Shuhei Aoyama to talk about his design concepts. [caption id="attachment_119495" align="aligncenter" width="580"]

Cabana’s livestreaming poster (left) and 3D showroom (right) on Tmall

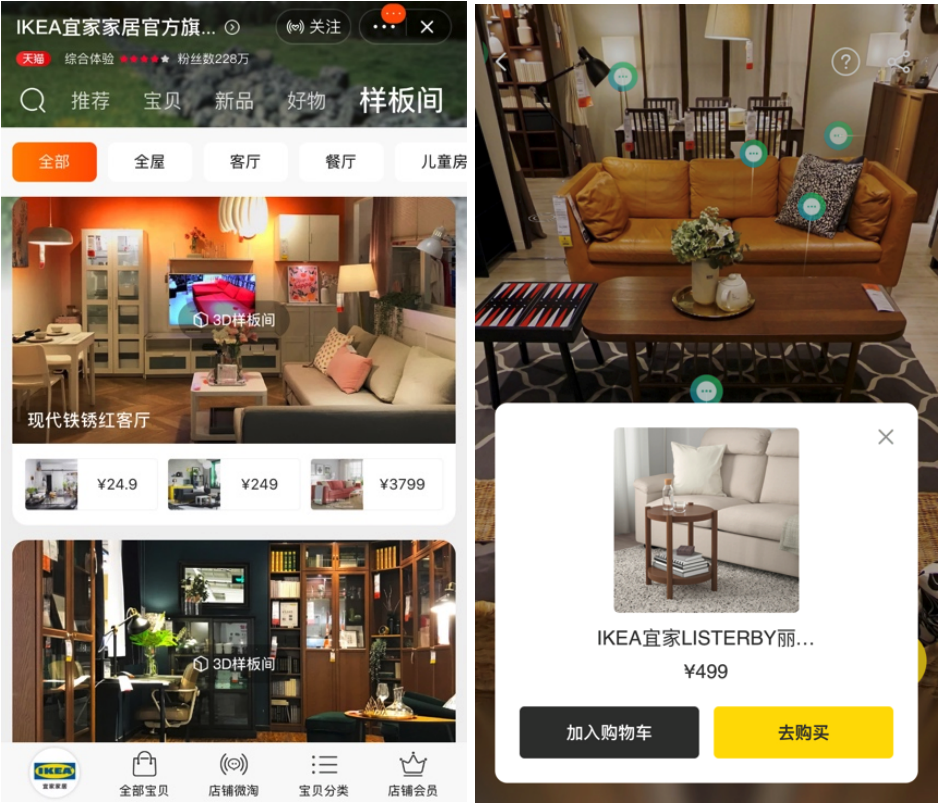

Cabana’s livestreaming poster (left) and 3D showroom (right) on TmallSource: Tmall[/caption] IKEA, the world’s largest furniture retailer, opened a Tmall flagship store in March—the brand’s first online flagship store on a third-party platform. As of the end of October, it has almost 2.3 million store fans on Tmall. IKEA uses 3D showrooms categorized by dining room, kitchen and living room to showcase its products on its Tmall store. Browsing from mobile phones, customers can click to move around the virtual showroom, swipe the screen to rotate the viewing angle or adjust the zoom. During the Singles’ Day pre-sale period, IKEA organized several livestreaming sessions on Tmall to promote its products. On October 23, the company organized a Halloween-themed livestream for kids to make Halloween cookies, promoting kitchen products such as rolling pins and storage jars. [caption id="attachment_119496" align="aligncenter" width="580"]

IKEA’s 3D showrooms on Tmall

IKEA’s 3D showrooms on TmallSource: Tmall[/caption] 4. New Entrants in Apparel Focus on Telling Brand Stories New apparel entrants used their Tmall stores as a platform to share their brand stories and invite shoppers to engage more deeply with brands on Singles’ Day. Italian streetwear and skateboarding apparel brand Coppolella opened its flagship store on Tmall in January this year. The brand offers relatively low prices compared to other international brands, ranging from ¥29.90 (around $4.50) to ¥1,229 (around $184). Instead of providing discounts and offers, Coppolella’s approach to Singles’ Day focused more on its brand stories and design concepts. On its Tmall store homepage, the brand features a video about young shoppers skateboarding and shares its brand concept on simplistic fashion. Coppolella also provides detailed information on the design concepts for its clothing. The brand sold approximately 7,500 units of its dinosaur hoodie between November 1 and 13. [caption id="attachment_119497" align="aligncenter" width="700"]

Coppolella’s homepage (left) and design concept introduction (right) on Tmall

Coppolella’s homepage (left) and design concept introduction (right) on TmallSource: Tmall[/caption] Totême, a Stockholm-based apparel band, opened its flagship Tmall store on October 10. The store provides a wide range of products, including accessories, ready-to-wear apparel and swimsuits. On its store page, the brand shares the design features of its minimalistic and uniform-like product styles. The brand also highlights its offline store in Stockholm, which is designed by its founder and famous architect, Christian Halleröd. Just over a month after opening its Tmall store, the brand had grown its store followers to 57,271, as of November 13. [caption id="attachment_119498" align="aligncenter" width="700"]

Images of Totême’s brick-and-mortar store in Stockholm displayed on its Tmall storefront

Images of Totême’s brick-and-mortar store in Stockholm displayed on its Tmall storefrontSource: Tmall[/caption] 5. Cultural and Entertainment Companies Offer Exciting Merchandise Cultural and entertainment companies opened flagship stores on Tmall this year, offering shoppers a diverse range of merchandise. Bravado, the Universal Music Group’s global merchandising and brand management division, launched an online store on Alibaba’s cross-border platform Tmall Global on October 28. The brand collaborated with Taylor Swift to bring the singer’s new merchandise for her recent album Folkelore to Chinese fans two weeks ahead of the official release date, giving fans exclusive early access to official T-shirts, hoodies and cardigans from Bravado’s Tmall Global store on Singles’ Day. Bravado encouraged consumers to purchase merchandise by providing special benefits according to sales volumes between October 28 and November 11, and giving customers a chance to win an album signed by Taylor Swift. [caption id="attachment_119499" align="aligncenter" width="580"]

Bravado’s Tmall store (left) and promotion of Singles’ Day (right)

Bravado’s Tmall store (left) and promotion of Singles’ Day (right)Source: Tmall[/caption] France’s Louvre Museum opened its flagship store on Tmall on September 29, ahead of Singles’ Day. During the shopping festival, the organization promoted its eyeshadow and lipstick products from its collaboration with Chinese beauty brand MarieDalgar, as well as handbags from its partnership with A.Cloud, a Chinese accessories brand. The Louvre Tmall store offered a 50% discount on its products on November 1–3. [caption id="attachment_119500" align="aligncenter" width="700"]

Products from the Louvre Museum’s collaborations (left) and Singles’ Day promotions on its Tmall store (right)

Products from the Louvre Museum’s collaborations (left) and Singles’ Day promotions on its Tmall store (right)Source: Tmall[/caption] 6. Pitch Fest Winners Debut on Tmall Global On September 15, Alibaba’s cross-border e-commerce platform Tmall Global hosted its first Go Global 11.11 Pitch Fest, allowing US brands to pitch their businesses to a panel of industry experts for a chance to sell on Tmall this Singles’ Day and fast-track China market entry. Uncle Bud’s, a hemp and cannabidiol (CBD) brand, was one of the nine Pitch Fest winners. The brand opened its Tmall Global flagship store on October 28, just over a month after the Pitch Fest event. It now offers 20 different products on its Tmall store, from face masks to lip balm. Brand ambassador and NBA legend Earvin “Magic” Johnson attended the Tmall Global Walk of Fame event on November 7, which supported brands in introducing their international, high-quality products to Chinese consumers. [caption id="attachment_119501" align="aligncenter" width="580"]

Poster for brand’s Tmall Global Walk of Fame event (left) and Uncle Bud’s Tmall store (right)

Poster for brand’s Tmall Global Walk of Fame event (left) and Uncle Bud’s Tmall store (right)Source: Weibo and Tmall[/caption]

What We Think

Many new brands spanning a variety of categories launched their first Singles’ Day campaigns this year after opening stores on Alibaba’s e-commerce platforms. New entrants from around the world centered their promotional activities around the demands and preferences of Chinese consumers, using social media, discounts and promotions to engage with their target consumers. Implications for Brands/Retailers- Brands and retailers can leverage upcoming festivals and holidays—such as Black Friday, Double 12, Chinese New Year and International Women’s Day—to launch online stores on Tmall.

- Social media continues to be an important tool for brands and retailers to promote products and engage with consumers; brands and retailers can leverage Chinese social media platforms such as Little Red Book and Weibo.

- Singles’ Day is a good channel for brands and retailers to trial new product rollouts.

- Sharing brand stories with consumers can help to increase engagement.

- More than ever, Chinese e-commerce presents a substantial opportunity. The coronavirus crisis has accelerated structural shifts toward e-commerce in the country, and limited travel is redirecting shopping that would have taken place overseas into domestic purchases. We expect this to boost domestic online demand for alcoholic drinks, beauty, clothing, electronics, fragrances, footwear and accessories, health supplements and vitamins, and jewelry and watches—highly popular categories for overseas shopping.

- We expect e-commerce to account for more than one-quarter of China’s retail sales for the first time in 2020, accounting for around $1.35 trillion in purchases.

- This shift to e-commerce will support the consolidation of a still-fragmented Chinese retail market, driving structural changes that go beyond channel shifts. Global brands and retailers should stand equipped to take advantage of these opportunities, including through market entry and expansion.