DIpil Das

What’s the Story?

This report reviews the campaigns that brands and retailers launched on Alibaba’s Tmall e-commerce platform from early October to Singles’ Day on November 11, 2020. We highlight the new strategies that brands and retailers adopted this year.Why It Matters

With merchants eager to facilitate a strong Singles’ Day performance, marketing campaigns were important in increasing store visibility and e-commerce sales. This year, we monitored brands’ and retailers’ marketing strategies on Tmall. In this report, we analyze how merchants engaged with consumers and explore the new strategies that were rolled out for Singles’ Day 2020. Brands and retailers can leverage these marketing strategies for upcoming shopping festivals, including Double 12 on December 12 and Chinese New Year in January 2021, to capture share of the fast-growing e-commerce market in China.Analyzing Brands and Retailers’ Marketing Campaigns: A Deep Dive

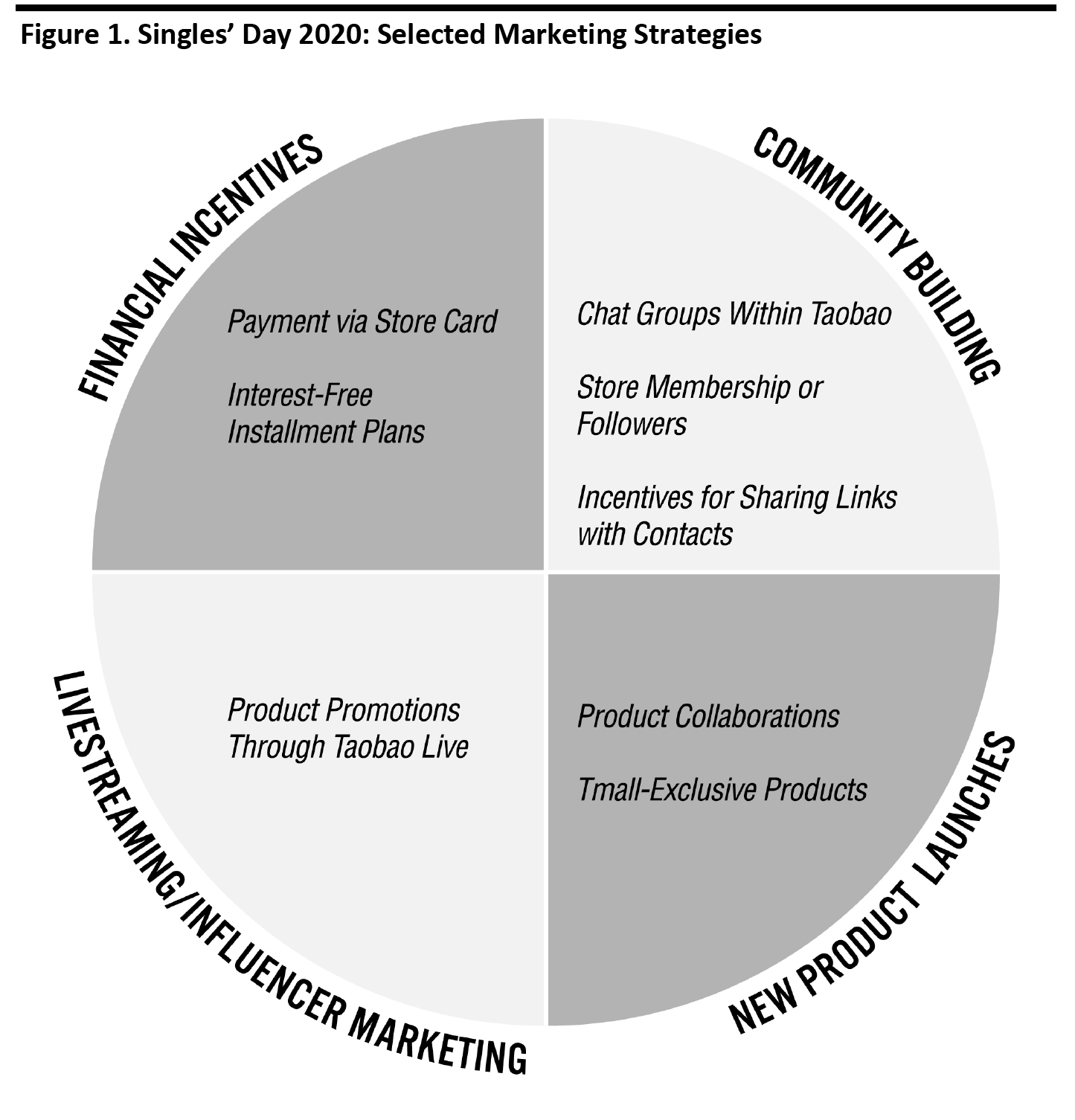

Overview of Promotion Strategies by Brands on Tmall We identified a number of common themes in the promotional strategies used by brands across different product categories on Tmall. These span gifts and coupon incentives, interest-free installment services, livestreaming, new product launches, social media networks and store membership enrollment. Brands aimed to encourage consumers to add products to their shopping carts in advance of Singles’ Day and pay a deposit for them, clearing the rest of the amount due in the first round of sales from November 1 to 3 and during the second round on November 11. To prompt customers to maintain active engagement with their brand, merchants offered benefits to shoppers for bookmarking or becoming a member of their store. Brands and retailers piloted new Singles’ Day strategies to engage with consumers and promote products this year, including the following:- Creating chat groups within Taobao to directly communicate with consumers

- Incentivizing shoppers to share products with their contacts

- Encouraging consumers to store money on shopping cards as a payment option

Source: Coresight Research[/caption]

1. Financial Incentives

Brands and retailers leveraged financial incentives to encourage spending, including store cards and interest-free installment plans.

Top-Up Store Cards

This year, Tmall introduced online shopping cards on the platform for the first time, with the top-up “stored-value cards” being accepted as a payment method by participating Tmall stores. Shoppers could add money to their card via their Alipay accounts, and merchants would provide credit rewards for shoppers when they used the cards to make purchases. However, each store required its own stored-value card, so reward credit could not be used across stores, limiting the benefit for consumers. Credit on the top-up cards remains valid for 365 days before being refunded by the retailer.

Source: Coresight Research[/caption]

1. Financial Incentives

Brands and retailers leveraged financial incentives to encourage spending, including store cards and interest-free installment plans.

Top-Up Store Cards

This year, Tmall introduced online shopping cards on the platform for the first time, with the top-up “stored-value cards” being accepted as a payment method by participating Tmall stores. Shoppers could add money to their card via their Alipay accounts, and merchants would provide credit rewards for shoppers when they used the cards to make purchases. However, each store required its own stored-value card, so reward credit could not be used across stores, limiting the benefit for consumers. Credit on the top-up cards remains valid for 365 days before being refunded by the retailer.

- Purcotton, a Chinese brand focused on ecofriendlycotton apparel and home products, provided four types of rewards for shoppers using stored-value cards, increasing in correlation to the top-up amount:

- Adding ¥600 ($90) earns a reward of ¥30 ($4.5).

- Adding ¥800 ($119) earns a reward of ¥50 ($7).

- Adding ¥1,200 ($179)reward of ¥150 ($22).

- Adding ¥2,000 ($298) earns a reward of ¥300 ($45).

- US beauty brand Elizabeth Arden also provided four types of top-up rewards:

- Adding ¥1,000 ($149) earns a reward of ¥50 ($7).

- Adding ¥3,000 ($447) earns a reward of ¥180 ($27).

- Adding ¥5,000 ($746) earns a reward of ¥400 ($60).

- Adding ¥10,000 ($1,492) earns a reward of ¥1,000 ($149).

Online shopping card top-up page for Purcotton (left) and Elizabeth Arden (right)

Online shopping card top-up page for Purcotton (left) and Elizabeth Arden (right) Source: Tmall [/caption] Interest-Free Installment Plans To encourage consumers to purchase expensive products, brands and retailers offered interest-free installment payment options, as many did for last year’s Singles’ Day. To be eligible for this service, consumers were required to have sufficient credit on Ant Credit Pay in their Alipay account, a virtual credit card offered by Ant Group. The interest-free installment service proved popular among electronics retailers.

- Microsoft offered an interest-free installment plan of up to 24 months for its laptops, such as Surface Laptop Go, Surface Go 2 and Surface Pro 7. Shoppers were required to pay a deposit of ¥100 ($15) and choose Ant Credit Pay as the payment method for the rest of the payment.

- Samsung also provided a 24-month interest-free installment plan for its mobile phones, including the Galaxy Z Fold2 5G, and laptops such as the Galaxy Book S.

Interest-free product plans from Microsoft (left) and Samsung (right)

Interest-free product plans from Microsoft (left) and Samsung (right) Source: Tmall [/caption] Brands also offered interest-free installment plans for luxury and beauty products to facilitate high-end purchases.

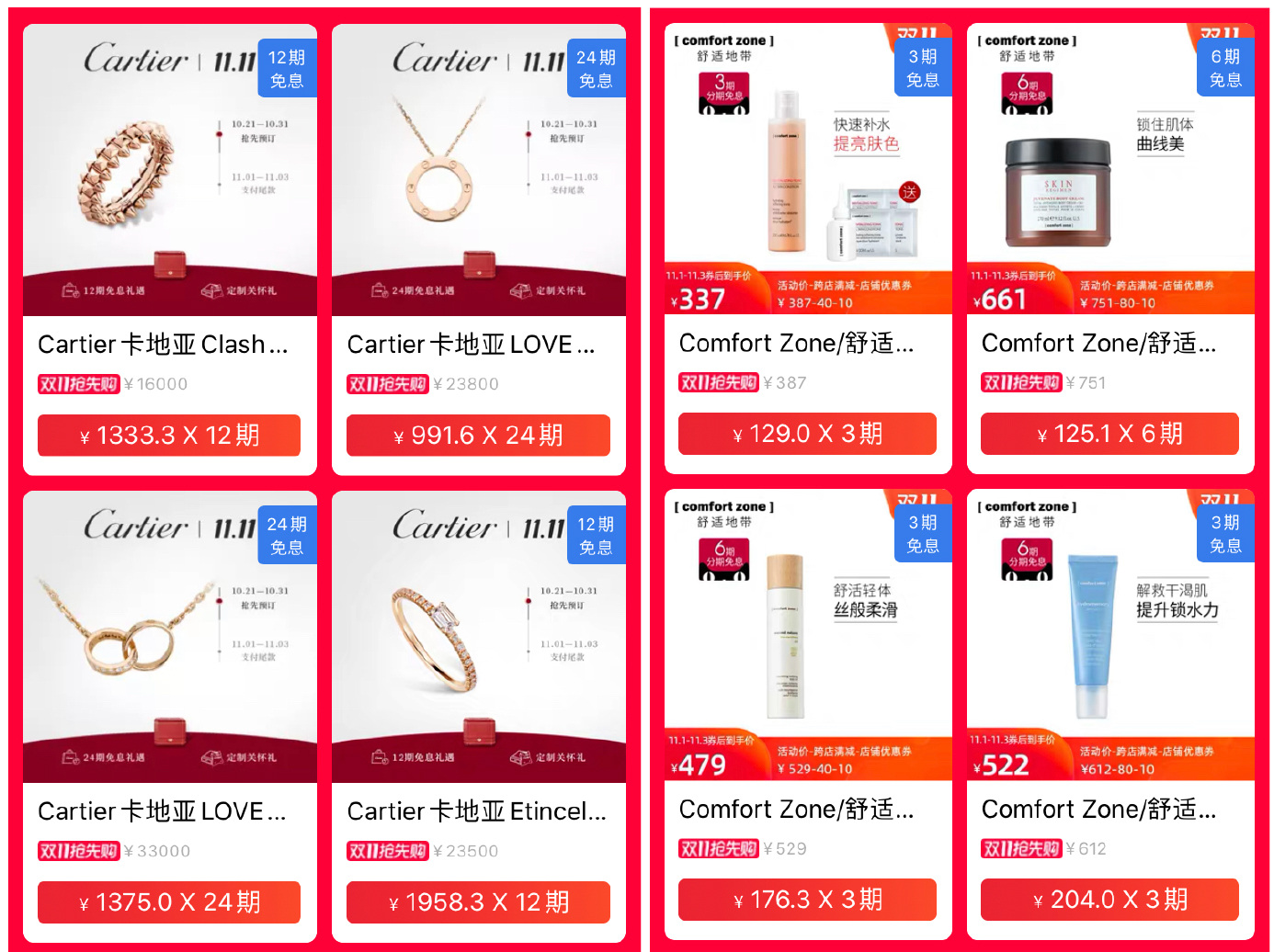

- Through Cartier’s Tmall store, customers could purchase the brand’s Clash de Cartier ring, priced at ¥16,000 ($2,387), for a deposit of ¥520 ($78). Shoppers then committed to a monthly payment of ¥1,290 ($192) over the next 12 months via Ant Credit Pay.

- Skincare brand Comfort Zone, a banner of the high-end parent company Davines Group, also offered interest-free installment plans to provide access to luxury goods.

Interest-free installment plans offered by Cartier (left) and Comfort Zone (right)

Interest-free installment plans offered by Cartier (left) and Comfort Zone (right) Source: Tmall [/caption] 2 Community Building Building a sense of community around a brand or retailer can help to build visibility, establish a loyal customer base and ultimately improve sales conversion. Tactics for this year’s Singles’ Day included creating chat groups within the Taobao e-commerce platform, inviting customers to share product links with their contacts, as well as asking shoppers to become store members or followers. Taobao Chat Groups Brands created chat groups on Taobao to directly communicate and engage with consumers, emulating a community feel. Shoppers who joined the chat groups were able to access product information and discounts.

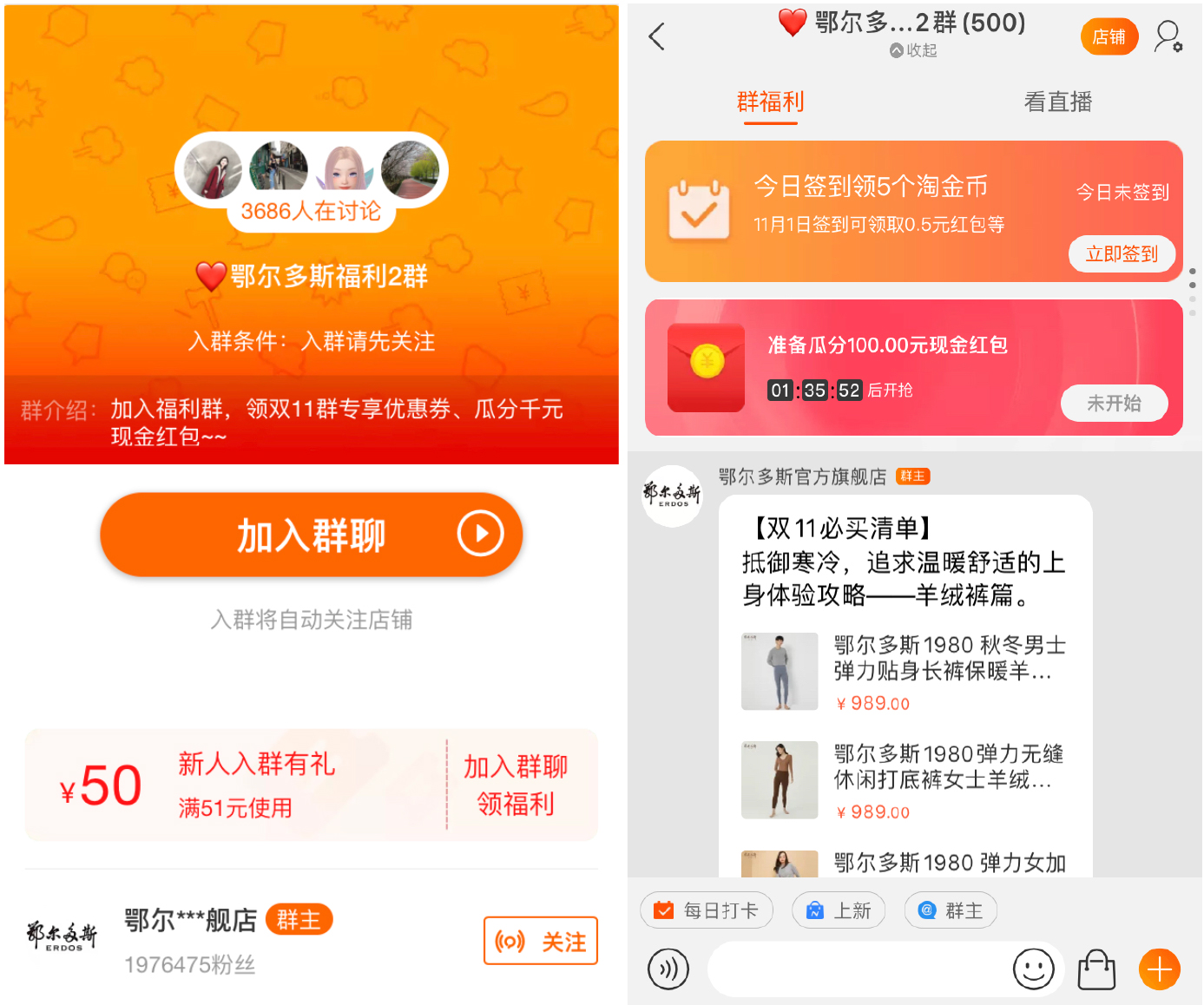

- Chinese fashion brand ERDOS offered a coupon worth ¥50 ($7.50) toward purchases of its cashmere apparel products for those who joined the brand’s group chat, as well as enabling them to automatically become store followers. Within the group chat, customers could ask questions about products and share any problems they experienced in the shopping process. There were 500 members in one of ERDOS’s chat groups, as of October 31.

ERDOS’s chat group invitation (left) and chat group (right)

ERDOS’s chat group invitation (left) and chat group (right) Source: Taobao [/caption]

- Quaker Oats invited customers to join its chat groups, with newcomers automatically enrolled as store followers. Customers could share their orders in the group chat, giving them the chance to win their order for free. Quaker also released discount information in the chat groups from time to time, which was not made available elsewhere.

Quaker’s chat group invitation (left) and chat group (right)

Quaker’s chat group invitation (left) and chat group (right) Source: Taobao [/caption] Incentives for Sharing Products with Contacts Brands incentivized shoppers to share products and coupon links with people in their contacts list on Taobao, WeChat or Weibo as a way to expand consumer reach.

- New Balance offered coupons worth ¥120 ($18) for orders above ¥800 ($119). To access the reward, customers were required to share the link with three contacts on Taobao, WeChat or Weibo. These contacts could then access the same coupon by opening the link in Taobao or Tmall. All three contacts had to open the link for the sharer to use the coupon.

- Similarly, Bally offered coupons worth ¥200 ($30) for orders above ¥3,000 ($446) for customers whoshared links with five contacts. The five contacts would also each receive a coupon worth ¥100 ($15) to spend on orders above ¥1,000 ($150).

Coupons to share with contacts from New Balance (left) and Bally (right)

Coupons to share with contacts from New Balance (left) and Bally (right) Source: Tmall [/caption] Store Membership As in previous years, brands continued to encourage customers to join their store communities as members or followers, providing engagement opportunities for Singles’ Day and beyond. Shoppers were able to interact with stores on Tmall by bookmarking and following a store or by enrolling in a store’s membership scheme to enjoy more benefits. When shoppers search products on Taobao, related products from the stores they follow show up in the first search results. Brands competed intensely to cultivate a loyal customer base and offer different perks for store members in the run-up to, and during, Singles’ Day.

- Shiseido offered store members a discount on cosmetics—including reductions on cosmetic samples from ¥470 ($70) to ¥200 ($30) during the pre-sale period, as well as a coupon worth ¥200 ($30), which was valid on November 1–3 for orders above ¥1,400 ($208). Store members could also participate in flash-sale activities, accessing cosmetics samples worth ¥183 ($27) for ¥9.90 ($1.50)—up to a limit of 200 products per day.

- L'Occitane incentivized store members to order two sets of L'Occitane products by offering a customized mini suitcase as a gift. The number of suitcases was limited to 50,000 and given out on a first-come, first-served basis.

Membership benefits from Shiseido (left) and L'Occitane (right)

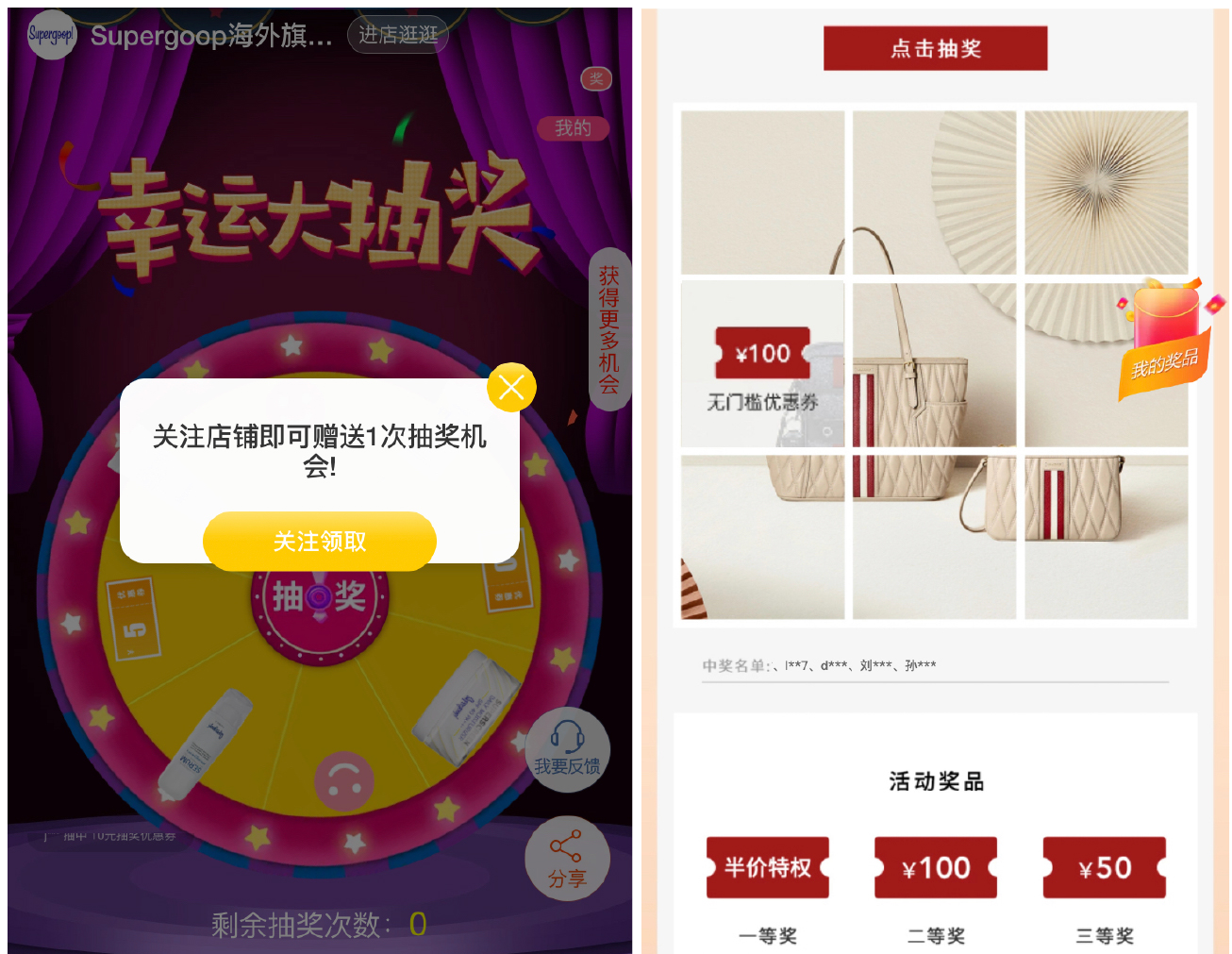

Membership benefits from Shiseido (left) and L'Occitane (right) Source: Tmall [/caption] Both Bally and Supergoop hosted lucky draw activities for their store followers: In Supergoop’s event, customers could win products worth up to ¥378 ($56); and in Bally’s lucky draw, customers could win a “half-price” discount on any store product. [caption id="attachment_119425" align="aligncenter" width="700"]

Lucky draw activities hosted by Supergoop (left) and Bally (right)

Lucky draw activities hosted by Supergoop (left) and Bally (right) Source: Tmall [/caption] 3. Livestreaming and Influencer Marketing This year, livestreaming continued to be an effective way for brands and retailers to engage with consumers to promote products and drive sales. On the first day of the pre-sale period, October 21, the number of views on Taobao Live—Alibaba’s designated livestreaming channel—reached 709 million, according to Zhigua Data, Taobao Live’s data service agency. On the same day, the number of live broadcasters reached 66,700 and the number of products promoted during livestreaming sessions exceeded 2 million. Influencers have become a driver of purchasing behavior, especially among young consumers in China. Influencers claim that they are connected to their audiences and give honest opinions and reviews about product traits, which demonstrates authenticity and drives conversion rates. Brands are increasingly working with celebrity and social media influencers to attract Gen Z consumers in the China market—generally defined as those born after 1996 and up to the mid-2010s—a demographic group that is perceived to be the most influenced by social media endorsements. Around 44% of Gen Z consumers have made a shopping decision based on a recommendation from a social influencer, versus 26% of the general population, according to market research company Kantar. During Singles’ Day 2020, top KOL Viya generated ¥5.32 billion ($797.5 million) in GMV during a six-hour livestream on October 21, during which she promoted 149 products from different brands. Among them, South Korean high-end skincare brand The History of Whoo’s seven-piece skincare kit was the bestseller, with 433,400 items sold during the session. [caption id="attachment_119424" align="aligncenter" width="700"]

The History of Whoo worked with Viya, a popular KOL, to promote its products through livestreaming

The History of Whoo worked with Viya, a popular KOL, to promote its products through livestreaming Source: Tmall and Taobao [/caption]

- Estée Lauder hosted 41 livestreaming sessions in October 2020—amounting to at least one livestreaming session per day. The brand invited celebrities to promote its products for some of the sessions: Actress Yang Mi hosted a livestreaming session for the brand on October 21, which acheivedalmost 3.6 million views.

Estée Lauder’s livestreaming list (left) and KOL livestreaming session on Taobao (right)

Estée Lauder’s livestreaming list (left) and KOL livestreaming session on Taobao (right) Source: Taobao [/caption] Brands also leveraged technology to design virtual hosts for their livestreaming sessions. Chinese snack brand Three Squirrels and jacket brand BOSIDENG broadcast some livestreaming sessions with animated host characters, although these attracted far fewer views than those with human hosts. [caption id="attachment_119422" align="aligncenter" width="700"]

Livestreams with virtual hosts broadcasted by Three Squirrels’ (left) and BOSIDENG (right)

Livestreams with virtual hosts broadcasted by Three Squirrels’ (left) and BOSIDENG (right) Source: Taobao [/caption]

What We Think

Brands adopted a number of different promotional methods ahead of Singles’ Day this year, including financial incentives, building merchant communities through group chats and store memberships and influencer marketing through livestreaming. While the promotion methods and combinations of benefits varied according to each brand’s campaign, the underlying strategy is based on an assumption that consumers would be more likely to transact with the store if they were offered as many perks as possible or if people they knew and trusted provided recommendations or introductions to brands. Implications for Brands/Retailers The learnings from Singles’ Day 2020 can be carried beyond the event into online retailing in China in 2021:- Merchants can deploy these marketing strategies during upcoming festivals and holidays, including Black Friday, Double 12 on December 12, Christmas, Chinese New Year and International Women’s Day.

- Brands and retailers need to begin building followers ahead of Singles’ Day next year to be able to reach consumers effectively.

- Brands and retailers can implement technology to enable effective marketing, such as using algorithms to promote relevant products to customers.

- E-commerce presents a greater opportunity than ever in China. While the coronavirus crisis has accelerated structural shifts to e-commerce, it is also redirecting shopping that would have taken place on overseas trips by Chinese travelers to domestic purchases. Through the rest of 2020 and into 2021, we expect this to boost domestic online demand for alcohol, beauty, clothing, footwear and accessories, electronics, fragrances, health supplements and vitamins, and jewelry and watches—highly popular categories for overseas shopping.

- Such are the tailwinds that we expect e-commerce to account for more than one-quarter of China’s retail sales for the first time in 2020: We expect e-commerce sales to amount to approximately $1.35 trillion of China’s $5 trillion retail industry this year.

- This shift to e-commerce will support the consolidation of a fragmented Chinese retail market, driving structural changes that go beyond channel shifts. Brands and retailers should ensure that they are prepared to take advantage of these opportunities, including through marketing campaigns that resonate with China’s online shoppers.