Nitheesh NH

Alibaba’s Singles’ Day shopping extravaganza began in China at 12:00am on November 11. However, brands had already begun locking in sales in the pre-sales period from October 21. According to Alibaba, over 62 brands each achieved more than ¥100 million ($14.3 million) in pre-order GMV, which is double the number of brands compared to last year. Here are some updates of Alibaba’s early Singles’ Day sales.

Alibaba’s Total GMV Reached a Record High of $12 Billion within the First Hour

Alibaba reached numerous impressive milestones in the first hour of the shopping holiday this year:

Source: Coresight Research[/caption]

As of 12:18am, the five best-selling women’s fashion brands by total GMV were Uniqlo, Bosideng, Vero Moda, ONLY and Eifini.

As of 1:00am, the top five countries selling to China during Singles’ Day by total GMV remained the same as last year’s: Japan, the US, Korea, Australia and Germany.

As of 1:00am, 84 brands had each exceeded ¥100 million ($14.3 million) in GMV, of which more than 50 were domestic brands. Some of the international brands included Adidas, Apple, Estée Lauder, Gap, H&M, Lancôme, L’Oréal, Nike, Olay, Uniqlo and Zara.

As of 6:28am, total GMV reached $20 billion.

As of 3:57pm, total GMV exceeded $30 billion.

As of 4:31pm, total GMV surpassed that of Singles’ Day 2018 ($30.8 billion).

Alibaba Focused on Everything New for Singles’ Day 2019

For Singles’ Day 2019, Alibaba emphasized new products, new shopping experiences and new consumers. The company launched 1 million new products for Double 11 this year, and thousands of brands rolled out the upgraded storefront Tmall 2.0 to offer more personalized shopping experiences to consumers. Alibaba’s sales and digital marketing platform Juhuasuan partnered with 1,000 brands to develop 1,000 products specifically for new consumers—shoppers from lower-tier cities.

Livestreaming Helped Brands To Drive Sales during Singles’ Day

Watching a livestream has become the go-to option for Chinese consumers to look for new products and learn more about the story behind a brand. Consumers are able to shop immediately for the products they see on the livestreaming platform. Taobao livestreaming generated more than $15.1 billion in GMV in 2018, an increase of almost 400% year over year.

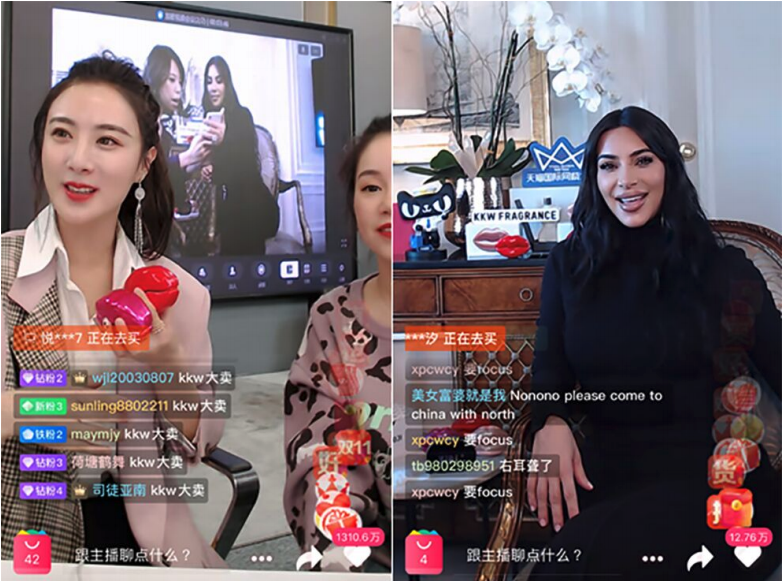

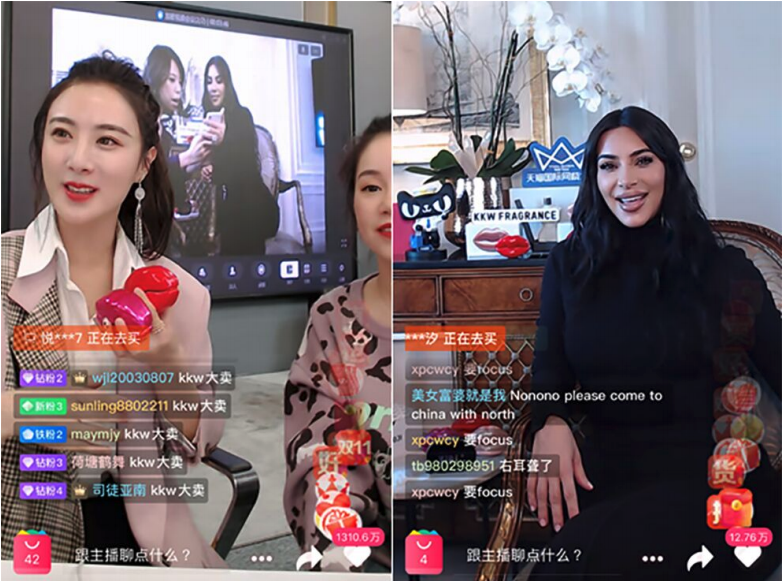

More than 17,000 brands began livestreaming on the first day of pre-sales across multiple categories—from beauty, fashion and home appliances to cars and movie tickets. The orders generated from livestreaming in the beauty category during the pre-sales period were 50 times the total from 2018. On November 6, US celebrity Kim Kardashian West conducted a livestream with Viya, one of the top key opinion leaders in China, to sell her name-brand KKW Perfume, drawing 13 million viewers and selling out the product in a few minutes.

[caption id="attachment_99360" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

As of 12:18am, the five best-selling women’s fashion brands by total GMV were Uniqlo, Bosideng, Vero Moda, ONLY and Eifini.

As of 1:00am, the top five countries selling to China during Singles’ Day by total GMV remained the same as last year’s: Japan, the US, Korea, Australia and Germany.

As of 1:00am, 84 brands had each exceeded ¥100 million ($14.3 million) in GMV, of which more than 50 were domestic brands. Some of the international brands included Adidas, Apple, Estée Lauder, Gap, H&M, Lancôme, L’Oréal, Nike, Olay, Uniqlo and Zara.

As of 6:28am, total GMV reached $20 billion.

As of 3:57pm, total GMV exceeded $30 billion.

As of 4:31pm, total GMV surpassed that of Singles’ Day 2018 ($30.8 billion).

Alibaba Focused on Everything New for Singles’ Day 2019

For Singles’ Day 2019, Alibaba emphasized new products, new shopping experiences and new consumers. The company launched 1 million new products for Double 11 this year, and thousands of brands rolled out the upgraded storefront Tmall 2.0 to offer more personalized shopping experiences to consumers. Alibaba’s sales and digital marketing platform Juhuasuan partnered with 1,000 brands to develop 1,000 products specifically for new consumers—shoppers from lower-tier cities.

Livestreaming Helped Brands To Drive Sales during Singles’ Day

Watching a livestream has become the go-to option for Chinese consumers to look for new products and learn more about the story behind a brand. Consumers are able to shop immediately for the products they see on the livestreaming platform. Taobao livestreaming generated more than $15.1 billion in GMV in 2018, an increase of almost 400% year over year.

More than 17,000 brands began livestreaming on the first day of pre-sales across multiple categories—from beauty, fashion and home appliances to cars and movie tickets. The orders generated from livestreaming in the beauty category during the pre-sales period were 50 times the total from 2018. On November 6, US celebrity Kim Kardashian West conducted a livestream with Viya, one of the top key opinion leaders in China, to sell her name-brand KKW Perfume, drawing 13 million viewers and selling out the product in a few minutes.

[caption id="attachment_99360" align="aligncenter" width="700"] Source: Alizila[/caption]

Singles’ Day Shopping through Online and Offline Channels

Although Singles’ Day started as an online-only festival on Alibaba’s Tmall e-commerce platform, the shopping holiday was adopted by many offline stores this year. For example, China-based department-store chain Intime transformed into a digitalized store using Alibaba’s New Retail approach, and 60% of its customers made purchases through the Intime app to pick up in store, according to Xiaodong Chen, the company’s CEO. The Coresight Research team visited one of the Intime malls in Hangzhou on November 10, and the store was packed with crowds of customers shopping for Singles’ Day.

All 65 Intime stores in China adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of the cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

[caption id="attachment_99361" align="aligncenter" width="700"]

Source: Alizila[/caption]

Singles’ Day Shopping through Online and Offline Channels

Although Singles’ Day started as an online-only festival on Alibaba’s Tmall e-commerce platform, the shopping holiday was adopted by many offline stores this year. For example, China-based department-store chain Intime transformed into a digitalized store using Alibaba’s New Retail approach, and 60% of its customers made purchases through the Intime app to pick up in store, according to Xiaodong Chen, the company’s CEO. The Coresight Research team visited one of the Intime malls in Hangzhou on November 10, and the store was packed with crowds of customers shopping for Singles’ Day.

All 65 Intime stores in China adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of the cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

[caption id="attachment_99361" align="aligncenter" width="700"] The crowd in Hangzhou’s Intime department store.

The crowd in Hangzhou’s Intime department store.

Source: Coresight Research[/caption]

- Total GMV surpassed $1 billion within one minute and eight seconds.

- Total GMV exceeded $10 billion within 29 minutes and 45 seconds.

- Total GMV hit $12 billion within the first hour.

Source: Coresight Research[/caption]

As of 12:18am, the five best-selling women’s fashion brands by total GMV were Uniqlo, Bosideng, Vero Moda, ONLY and Eifini.

As of 1:00am, the top five countries selling to China during Singles’ Day by total GMV remained the same as last year’s: Japan, the US, Korea, Australia and Germany.

As of 1:00am, 84 brands had each exceeded ¥100 million ($14.3 million) in GMV, of which more than 50 were domestic brands. Some of the international brands included Adidas, Apple, Estée Lauder, Gap, H&M, Lancôme, L’Oréal, Nike, Olay, Uniqlo and Zara.

As of 6:28am, total GMV reached $20 billion.

As of 3:57pm, total GMV exceeded $30 billion.

As of 4:31pm, total GMV surpassed that of Singles’ Day 2018 ($30.8 billion).

Alibaba Focused on Everything New for Singles’ Day 2019

For Singles’ Day 2019, Alibaba emphasized new products, new shopping experiences and new consumers. The company launched 1 million new products for Double 11 this year, and thousands of brands rolled out the upgraded storefront Tmall 2.0 to offer more personalized shopping experiences to consumers. Alibaba’s sales and digital marketing platform Juhuasuan partnered with 1,000 brands to develop 1,000 products specifically for new consumers—shoppers from lower-tier cities.

Livestreaming Helped Brands To Drive Sales during Singles’ Day

Watching a livestream has become the go-to option for Chinese consumers to look for new products and learn more about the story behind a brand. Consumers are able to shop immediately for the products they see on the livestreaming platform. Taobao livestreaming generated more than $15.1 billion in GMV in 2018, an increase of almost 400% year over year.

More than 17,000 brands began livestreaming on the first day of pre-sales across multiple categories—from beauty, fashion and home appliances to cars and movie tickets. The orders generated from livestreaming in the beauty category during the pre-sales period were 50 times the total from 2018. On November 6, US celebrity Kim Kardashian West conducted a livestream with Viya, one of the top key opinion leaders in China, to sell her name-brand KKW Perfume, drawing 13 million viewers and selling out the product in a few minutes.

[caption id="attachment_99360" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

As of 12:18am, the five best-selling women’s fashion brands by total GMV were Uniqlo, Bosideng, Vero Moda, ONLY and Eifini.

As of 1:00am, the top five countries selling to China during Singles’ Day by total GMV remained the same as last year’s: Japan, the US, Korea, Australia and Germany.

As of 1:00am, 84 brands had each exceeded ¥100 million ($14.3 million) in GMV, of which more than 50 were domestic brands. Some of the international brands included Adidas, Apple, Estée Lauder, Gap, H&M, Lancôme, L’Oréal, Nike, Olay, Uniqlo and Zara.

As of 6:28am, total GMV reached $20 billion.

As of 3:57pm, total GMV exceeded $30 billion.

As of 4:31pm, total GMV surpassed that of Singles’ Day 2018 ($30.8 billion).

Alibaba Focused on Everything New for Singles’ Day 2019

For Singles’ Day 2019, Alibaba emphasized new products, new shopping experiences and new consumers. The company launched 1 million new products for Double 11 this year, and thousands of brands rolled out the upgraded storefront Tmall 2.0 to offer more personalized shopping experiences to consumers. Alibaba’s sales and digital marketing platform Juhuasuan partnered with 1,000 brands to develop 1,000 products specifically for new consumers—shoppers from lower-tier cities.

Livestreaming Helped Brands To Drive Sales during Singles’ Day

Watching a livestream has become the go-to option for Chinese consumers to look for new products and learn more about the story behind a brand. Consumers are able to shop immediately for the products they see on the livestreaming platform. Taobao livestreaming generated more than $15.1 billion in GMV in 2018, an increase of almost 400% year over year.

More than 17,000 brands began livestreaming on the first day of pre-sales across multiple categories—from beauty, fashion and home appliances to cars and movie tickets. The orders generated from livestreaming in the beauty category during the pre-sales period were 50 times the total from 2018. On November 6, US celebrity Kim Kardashian West conducted a livestream with Viya, one of the top key opinion leaders in China, to sell her name-brand KKW Perfume, drawing 13 million viewers and selling out the product in a few minutes.

[caption id="attachment_99360" align="aligncenter" width="700"] Source: Alizila[/caption]

Singles’ Day Shopping through Online and Offline Channels

Although Singles’ Day started as an online-only festival on Alibaba’s Tmall e-commerce platform, the shopping holiday was adopted by many offline stores this year. For example, China-based department-store chain Intime transformed into a digitalized store using Alibaba’s New Retail approach, and 60% of its customers made purchases through the Intime app to pick up in store, according to Xiaodong Chen, the company’s CEO. The Coresight Research team visited one of the Intime malls in Hangzhou on November 10, and the store was packed with crowds of customers shopping for Singles’ Day.

All 65 Intime stores in China adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of the cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

[caption id="attachment_99361" align="aligncenter" width="700"]

Source: Alizila[/caption]

Singles’ Day Shopping through Online and Offline Channels

Although Singles’ Day started as an online-only festival on Alibaba’s Tmall e-commerce platform, the shopping holiday was adopted by many offline stores this year. For example, China-based department-store chain Intime transformed into a digitalized store using Alibaba’s New Retail approach, and 60% of its customers made purchases through the Intime app to pick up in store, according to Xiaodong Chen, the company’s CEO. The Coresight Research team visited one of the Intime malls in Hangzhou on November 10, and the store was packed with crowds of customers shopping for Singles’ Day.

All 65 Intime stores in China adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of the cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

[caption id="attachment_99361" align="aligncenter" width="700"] The crowd in Hangzhou’s Intime department store.

The crowd in Hangzhou’s Intime department store.Source: Coresight Research[/caption]