DIpil Das

Alibaba Reached GMV of $38 Billion in 2019

The eleventh 24-hour Global Shopping Festival (known as Singles’ Day or Double 11) on November 11 concluded with impressive results for Alibaba. The company reported:

Source: Ebrun.com/Coresight Research[/caption]

JD.com Reached a Transaction Volume of $29 Billion for its 11-Day Sales Event

Source: Ebrun.com/Coresight Research[/caption]

JD.com Reached a Transaction Volume of $29 Billion for its 11-Day Sales Event

Source: Alizila/Coresight Research [/caption]

Fun and Innovative Consumer Shopping Experiences

Alibaba continues to enhance consumer experiences of product discovery and shopping through Tmall 2.0 and livestreaming. Tmall Flagship Store 2.0 helps brands to create a personalized storefront to engage with consumers. During Singles’ Day, cosmetics brands such as Bobbi Brown, Estée Lauder and MAC leveraged Tmall 2.0 to launch virtual experiences for customers to try-on makeup products. Tmall 2.0 was used by 1,167 brands during the shopping holiday, and their transaction conversion rate on Singles’ Day increased more than 20% year over year, according to Jiang Fan, President of Taobao and Tmall.

Chinese consumers use livestreaming platforms to discover and learn more about new products, making it the top marketing tool for brands to attract new customers. Over 100,000 brands used livestreaming during Singles’ Day. The GMV generated from livestreaming within the first hour exceeded the full-day total GMV from livestreaming last year. A variety of products were promoted through this channel in 2019, and livestreaming around fresh produce has become particularly popular—Chinese villagers sold 30,000 tonnes of agricultural goods in the first ten days of the Singles’ Day pre-sales period.

[caption id="attachment_99494" align="aligncenter" width="700"]

Source: Alizila/Coresight Research [/caption]

Fun and Innovative Consumer Shopping Experiences

Alibaba continues to enhance consumer experiences of product discovery and shopping through Tmall 2.0 and livestreaming. Tmall Flagship Store 2.0 helps brands to create a personalized storefront to engage with consumers. During Singles’ Day, cosmetics brands such as Bobbi Brown, Estée Lauder and MAC leveraged Tmall 2.0 to launch virtual experiences for customers to try-on makeup products. Tmall 2.0 was used by 1,167 brands during the shopping holiday, and their transaction conversion rate on Singles’ Day increased more than 20% year over year, according to Jiang Fan, President of Taobao and Tmall.

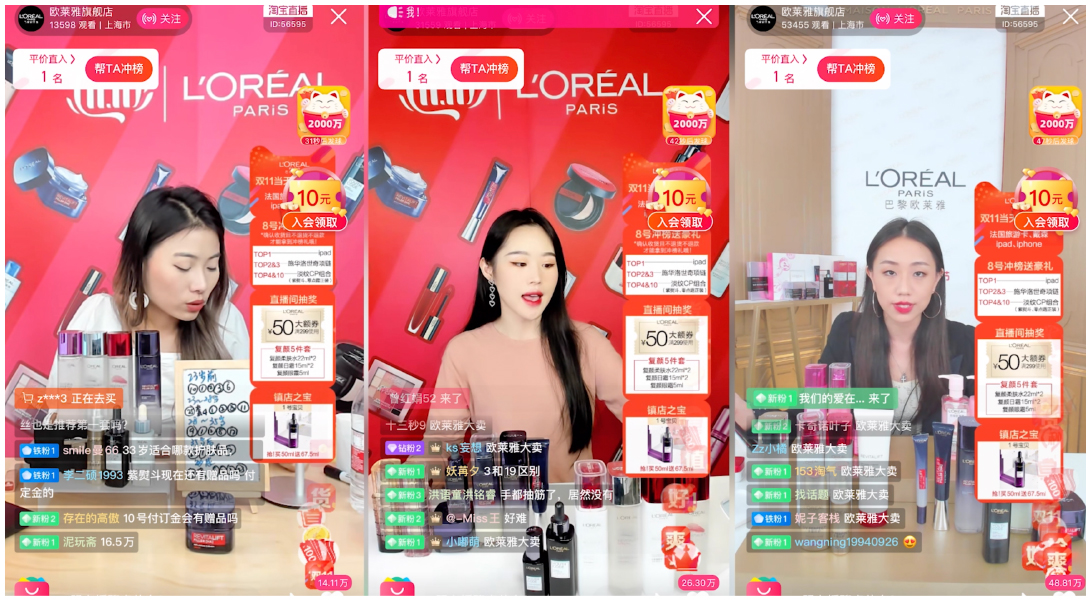

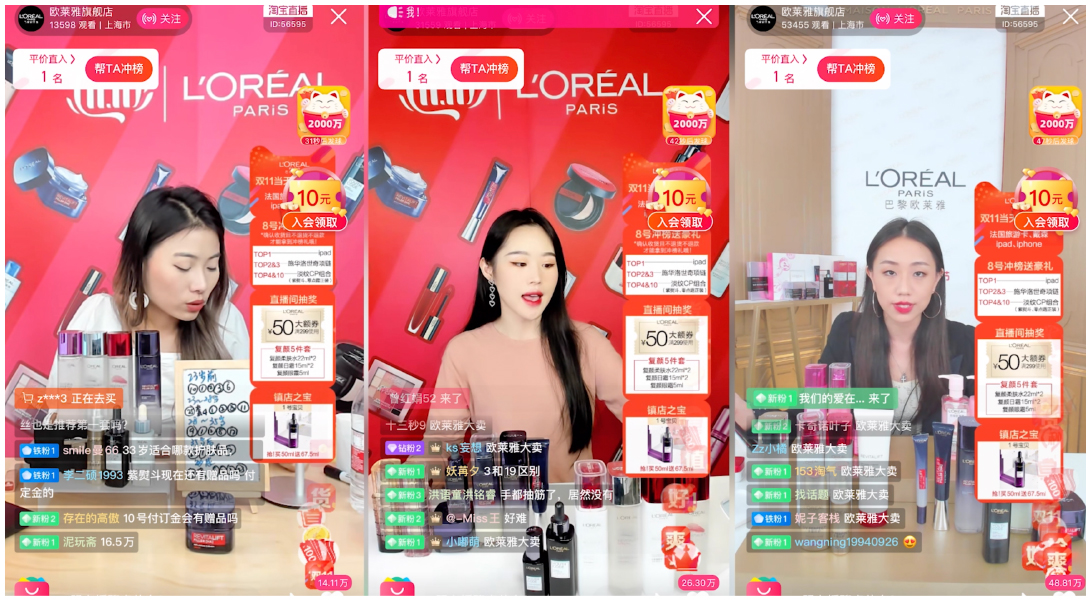

Chinese consumers use livestreaming platforms to discover and learn more about new products, making it the top marketing tool for brands to attract new customers. Over 100,000 brands used livestreaming during Singles’ Day. The GMV generated from livestreaming within the first hour exceeded the full-day total GMV from livestreaming last year. A variety of products were promoted through this channel in 2019, and livestreaming around fresh produce has become particularly popular—Chinese villagers sold 30,000 tonnes of agricultural goods in the first ten days of the Singles’ Day pre-sales period.

[caption id="attachment_99494" align="aligncenter" width="700"] Livestreaming of L’Oréal’s products by key opinion leaders during Singles’ Day.

Livestreaming of L’Oréal’s products by key opinion leaders during Singles’ Day.

Source: Alizila [/caption] Strong Consumption from Lower-Tier Cities Alibaba expected most of the 100 million new consumers on this year’s Singles’ Day event to come from lower-tier cities. To capture the shoppers in that market, the company partnered with multinational brands including L’Oréal and P&G, as well as Chinese manufacturers, to create new products based on consumer analytics. Juhuasuan, Alibaba’s sales and marketing platform, partnered with 1,000 brands to launch 1,000 products during the pre-sales period to meet demands for lower-tier consumers. JD.com also saw strong growth in the lower-tier cities, with a 60% year-over-year increase in Singles’ Day shoppers from such locations. Over 40% of new customers shopped through Jingxi, JD’s group-buying platform. Participation from across Alibaba’s Ecosystem Businesses across the Alibaba ecosystem were once again all in for this year’s Singles’ Day. Lazada, Alibaba’s e-commerce platform for the Southeast Asia market, has tapped into livestreaming and interactive games to offer a more fun shopping experience to local consumers. The number of shoppers and merchants more than doubled during Singles’ Day, according to Lazada Co-President Yin Jing. Six Alipay e-wallet partners also allow consumers in Southeast Asia to pay seamlessly. AliExpress, which already serves more than 200 countries, supported local merchants from Italy, Russia, Spain and Turkey that participated in Singles’ Day for the first time. A Greener Double 11 Sustainability was a key focus during Singles’ Day this year. Alibaba’s logistics affiliate, Cainiao, and its express-courier partners set up 75,000 recycling stations for consumers to dispose of cardboard packaging. Tmall also hosted special trade-in programs to recycle used electronics from 250 brands. In addition, JD.com implemented recyclable packaging and slimmer tape for more sustainable logistics. Key Insights The world’s largest global shopping festival delivered impressive sales of $38 billion and higher delivery orders this year compared to 2018. The expanded scope of “new consumption”—including new brands, products and consumers—and the global reach of Singles’ Day this year was unprecedented. Alibaba’s technology, such as Tmall 2.0 and Taobao livestreaming, also provided an enhanced and interactive shopping experience for consumers, boosting the sales record.

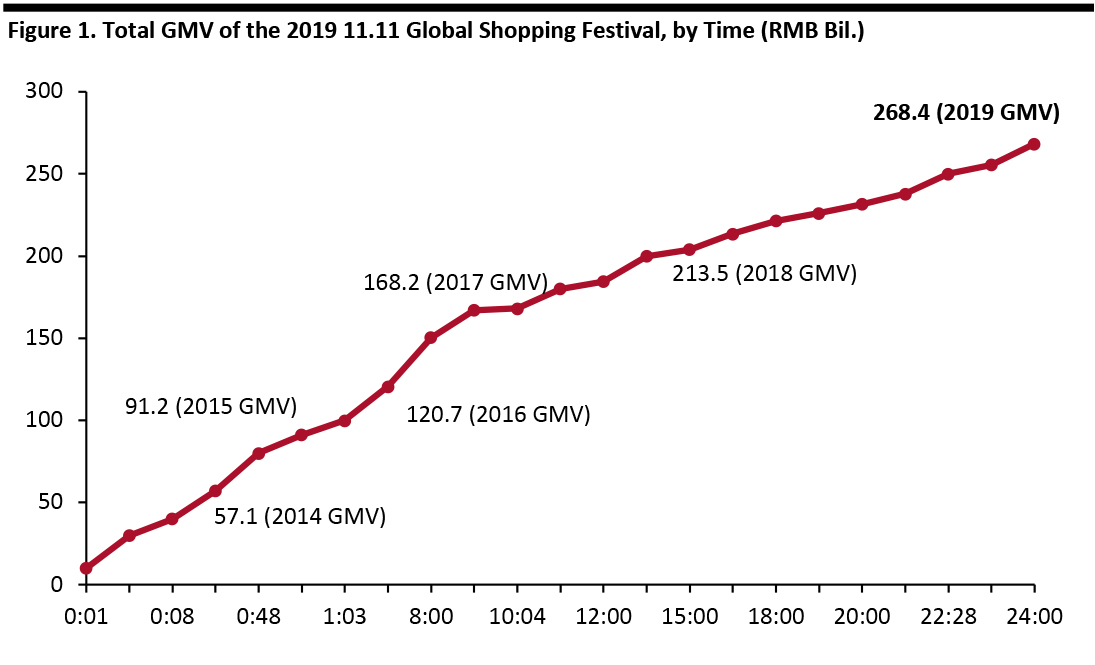

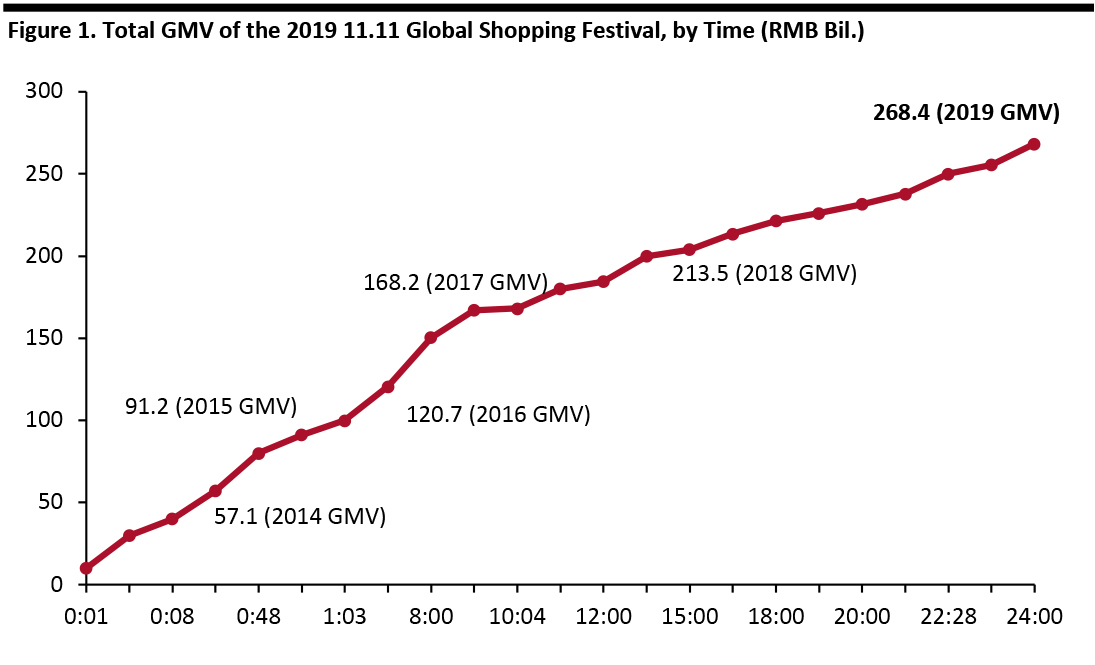

- Total GMV reached ¥268.4 billion ($38.4 billion), an increase of 26% in renminbi terms, from ¥213.5 billion ($30.8 billion) in 2018. This compared to 27% growth in 2018.

- Alibaba’s Cainiao Network processed a record high of 1.3 billion delivery orders, compared to “over 1 billion” orders in 2018.

- Alibaba achieved the goal of attracting 100 million new consumers to shop on Taobao and Tmall.

- Over 200,000 brands from 78 countries participated in Singles’ Day 2019, up from last year’s 180,000.

- 299 brands surpassed ¥100 million ($14.3 million) in GMV compared to 237 brands last year, and 15 of those exceeded ¥1 billion ($143 million) in GMV. Some of the top-selling brands include Apple, Estée Launder, Gap, H&M, Levi’s, L’Oréal, Nike, Under Armour and Uniqlo.

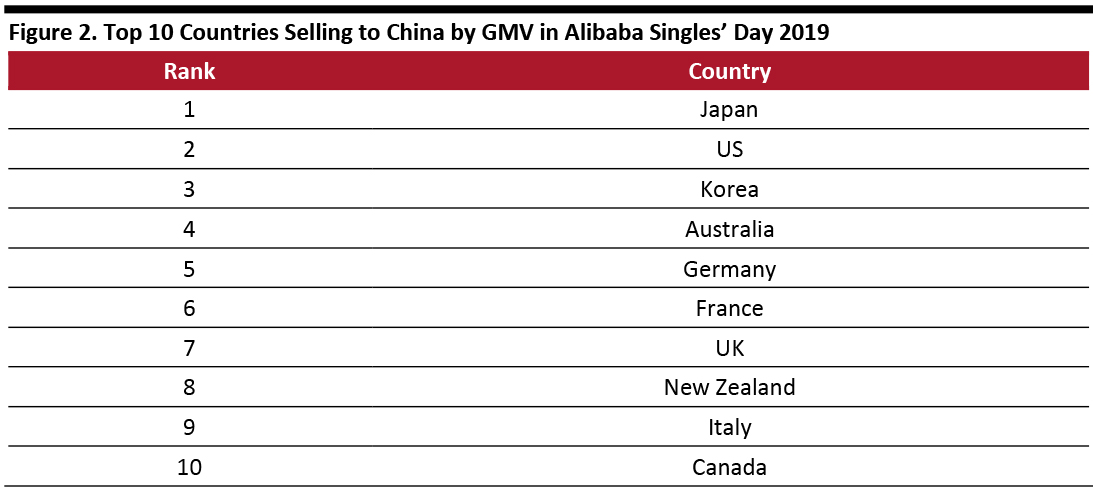

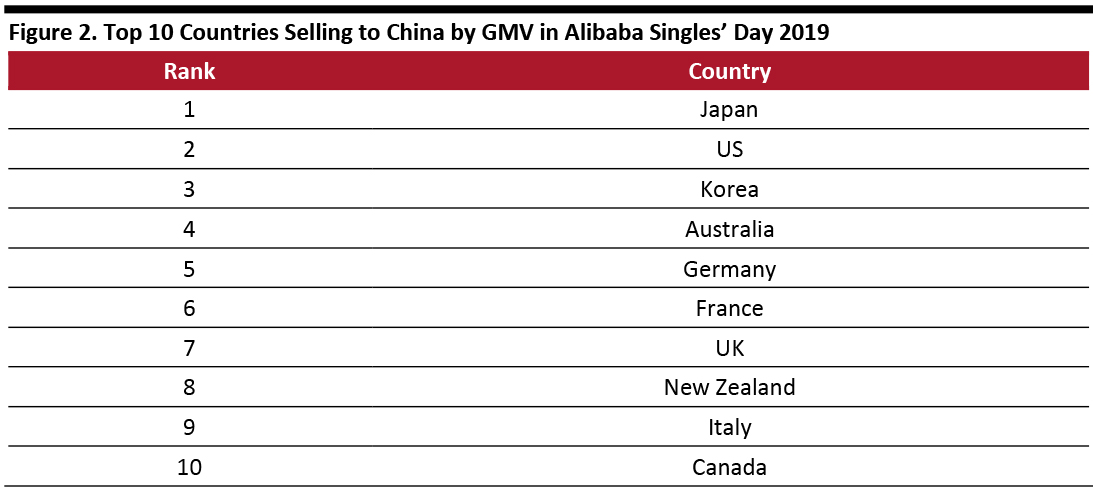

- Reflecting the same trend as last year, Japan, the US, South Korea, Australia and Germany (ordered by total GMV) were the top five countries selling to China through Alibaba’s cross-border platforms.

Source: Ebrun.com/Coresight Research[/caption]

JD.com Reached a Transaction Volume of $29 Billion for its 11-Day Sales Event

Source: Ebrun.com/Coresight Research[/caption]

JD.com Reached a Transaction Volume of $29 Billion for its 11-Day Sales Event

- Total transaction volume exceeded ¥204.4 billion ($29 billion) in the 11-day sales event from November 1 to 11, an increase of 28% year over year in renminbi terms.

- The US, Japan, Germany, Netherlands and Italy (ordered by total GMV) were the top five countries selling to China on JD.com.

- Lower-tier cities drove growth for JD.com during the Singles’ Day period, with over 70% of new users on the website coming from lower-tier cities. Best-selling categories included home appliances, mobile phones, desktops, sports and parent-and-baby products.

- The average consumption volume by JD Plus members (JD’s premium membership program) was ten times that of non-PLUS members during the 11-day sales period.

Source: Alizila/Coresight Research [/caption]

Fun and Innovative Consumer Shopping Experiences

Alibaba continues to enhance consumer experiences of product discovery and shopping through Tmall 2.0 and livestreaming. Tmall Flagship Store 2.0 helps brands to create a personalized storefront to engage with consumers. During Singles’ Day, cosmetics brands such as Bobbi Brown, Estée Lauder and MAC leveraged Tmall 2.0 to launch virtual experiences for customers to try-on makeup products. Tmall 2.0 was used by 1,167 brands during the shopping holiday, and their transaction conversion rate on Singles’ Day increased more than 20% year over year, according to Jiang Fan, President of Taobao and Tmall.

Chinese consumers use livestreaming platforms to discover and learn more about new products, making it the top marketing tool for brands to attract new customers. Over 100,000 brands used livestreaming during Singles’ Day. The GMV generated from livestreaming within the first hour exceeded the full-day total GMV from livestreaming last year. A variety of products were promoted through this channel in 2019, and livestreaming around fresh produce has become particularly popular—Chinese villagers sold 30,000 tonnes of agricultural goods in the first ten days of the Singles’ Day pre-sales period.

[caption id="attachment_99494" align="aligncenter" width="700"]

Source: Alizila/Coresight Research [/caption]

Fun and Innovative Consumer Shopping Experiences

Alibaba continues to enhance consumer experiences of product discovery and shopping through Tmall 2.0 and livestreaming. Tmall Flagship Store 2.0 helps brands to create a personalized storefront to engage with consumers. During Singles’ Day, cosmetics brands such as Bobbi Brown, Estée Lauder and MAC leveraged Tmall 2.0 to launch virtual experiences for customers to try-on makeup products. Tmall 2.0 was used by 1,167 brands during the shopping holiday, and their transaction conversion rate on Singles’ Day increased more than 20% year over year, according to Jiang Fan, President of Taobao and Tmall.

Chinese consumers use livestreaming platforms to discover and learn more about new products, making it the top marketing tool for brands to attract new customers. Over 100,000 brands used livestreaming during Singles’ Day. The GMV generated from livestreaming within the first hour exceeded the full-day total GMV from livestreaming last year. A variety of products were promoted through this channel in 2019, and livestreaming around fresh produce has become particularly popular—Chinese villagers sold 30,000 tonnes of agricultural goods in the first ten days of the Singles’ Day pre-sales period.

[caption id="attachment_99494" align="aligncenter" width="700"] Livestreaming of L’Oréal’s products by key opinion leaders during Singles’ Day.

Livestreaming of L’Oréal’s products by key opinion leaders during Singles’ Day. Source: Alizila [/caption] Strong Consumption from Lower-Tier Cities Alibaba expected most of the 100 million new consumers on this year’s Singles’ Day event to come from lower-tier cities. To capture the shoppers in that market, the company partnered with multinational brands including L’Oréal and P&G, as well as Chinese manufacturers, to create new products based on consumer analytics. Juhuasuan, Alibaba’s sales and marketing platform, partnered with 1,000 brands to launch 1,000 products during the pre-sales period to meet demands for lower-tier consumers. JD.com also saw strong growth in the lower-tier cities, with a 60% year-over-year increase in Singles’ Day shoppers from such locations. Over 40% of new customers shopped through Jingxi, JD’s group-buying platform. Participation from across Alibaba’s Ecosystem Businesses across the Alibaba ecosystem were once again all in for this year’s Singles’ Day. Lazada, Alibaba’s e-commerce platform for the Southeast Asia market, has tapped into livestreaming and interactive games to offer a more fun shopping experience to local consumers. The number of shoppers and merchants more than doubled during Singles’ Day, according to Lazada Co-President Yin Jing. Six Alipay e-wallet partners also allow consumers in Southeast Asia to pay seamlessly. AliExpress, which already serves more than 200 countries, supported local merchants from Italy, Russia, Spain and Turkey that participated in Singles’ Day for the first time. A Greener Double 11 Sustainability was a key focus during Singles’ Day this year. Alibaba’s logistics affiliate, Cainiao, and its express-courier partners set up 75,000 recycling stations for consumers to dispose of cardboard packaging. Tmall also hosted special trade-in programs to recycle used electronics from 250 brands. In addition, JD.com implemented recyclable packaging and slimmer tape for more sustainable logistics. Key Insights The world’s largest global shopping festival delivered impressive sales of $38 billion and higher delivery orders this year compared to 2018. The expanded scope of “new consumption”—including new brands, products and consumers—and the global reach of Singles’ Day this year was unprecedented. Alibaba’s technology, such as Tmall 2.0 and Taobao livestreaming, also provided an enhanced and interactive shopping experience for consumers, boosting the sales record.