Nitheesh NH

Singles’ Day Presents Opportunities for New Entrants

Alibaba’s 11.11 Global Shopping Festival, also known as Singles’ Day, is the largest online shopping festival. Every year, many new brands—both domestic and international—that have newly joined Alibaba’s e-commerce platforms use the event to promote themselves to Chinese consumers; some also achieved impressive sales in their first Singles’ Day participation this year.

Tmall Global, Alibaba’s cross-border e-commerce platform, has become an important venue for foreign brands to test the waters in China and launch their first Singles’ Day promotional campaigns. In June 2019, Tmall Global launched an English-language website to streamline the onboarding process for foreign brands, and it aims to double the number of foreign brands on its platform to 40,000 over the next three years via this initiative.

In this report, we look at some of the recently joined brands on Alibaba’s e-commerce platforms to understand how they approached the China market on Singles’ Day.

New Beauty Entrants Start with Social Media

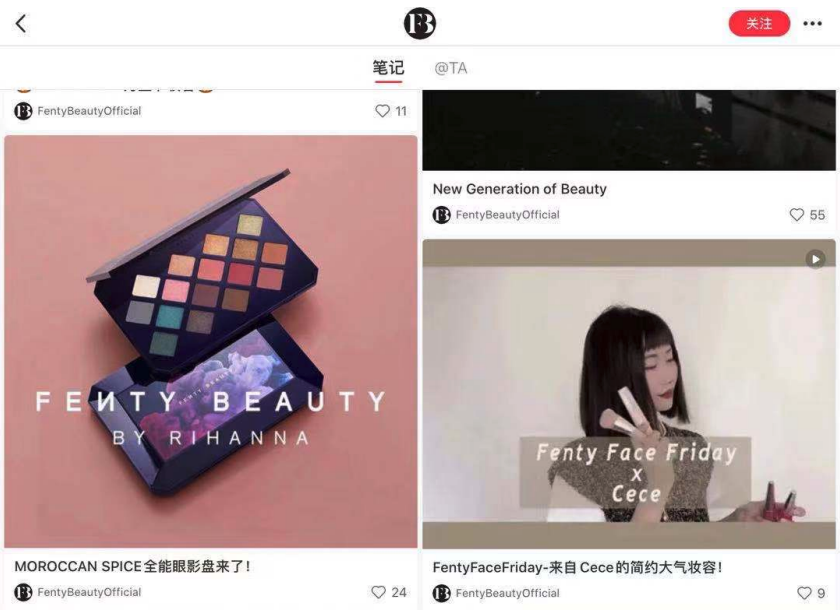

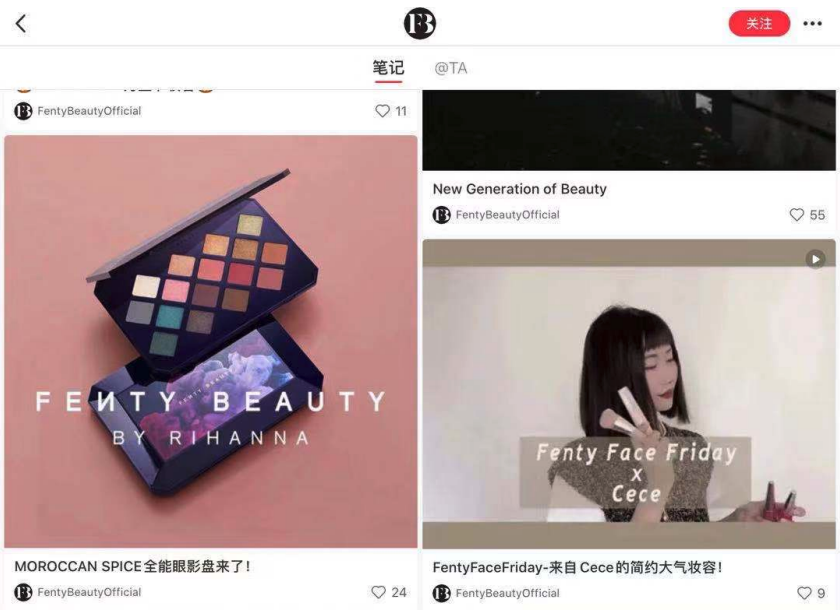

Fenty Beauty, the cosmetics brand founded by American singer Rihanna and launched under the partnership with luxury group LVMH, entered China through the launch of its Tmall Global flagship store in September. The brand had already landed on Weibo (a major social media micro-blogging site equivalent to Twitter) and online beauty community Xiaohongshu (Red) to amass brand awareness and exposure.

Fenty Beauty promoted its products and Tmall Global store on Weibo in the Singles’ Day pre-sale period, which began on October 21. The pre-sale period is a warm-up promotional period for the shopping holiday, in which shoppers can add items to their online carts ahead of final purchase on November 11.

[caption id="attachment_99878" align="aligncenter" width="700"] Fenty Beauty promoted its products with a tag of “Tmall Double 11” on Weibo on November 1.

Fenty Beauty promoted its products with a tag of “Tmall Double 11” on Weibo on November 1.

Source: Weibo[/caption] On its account on Xiaohongshu, Fenty Beauty has received over 9,000 “notes,” a Xiaohongshu-specific term referring to user feedback, as of November 5—less than six months after the brand opened its account on the platform. [caption id="attachment_99879" align="aligncenter" width="700"] Fenty Beauty’s Xiaohongshu account

Fenty Beauty’s Xiaohongshu account

Source: Xiaohongshu[/caption] Social media channels are typically effective channels for beauty brands to showcase the merits of their products. Although Fenty Beauty emerged with a halo effect from its founder Rihanna, user-generated feedback on social platforms is still important to instill trust and create buzz for the brand. China-based emergent beauty brand Perfect Diary adopted a comprehensive social media strategy to build awareness of its identity and products, and successfully broke into the established beauty market in the past two years. It first promoted its brand on Xiaohongshu and paid attention to the post-purchase experience of consumers by continually engaging with them on WeChat, the mainstream social app in China. Perfect Diary’s customer engagement efforts led to good Singles’ Day results in 2018: The brand was among over 30 beauty and personal care brands that achieved ¥100 million ($14.3 million) in sales during Singles’ Day 2018, according to Alibaba. This year, Perfect Diary launched exclusive new products on its Tmall flagship store specifically for the shopping holiday. For example, it debuted a co-branded eyeshadow palette with Chinese National Geography magazine, showcasing the diverse colorful terrains of China. It also launched a new pink lipstick endorsed by top beauty key opinion leader Austin Li, who once sold 15,000 lipsticks in 15 minutes during a livestream show. [caption id="attachment_99880" align="aligncenter" width="700"] The Perfect Diary/Chinese National Geography co-branded eyeshadow palette (left); Perfect Diary’s new pink lipstick for this Singles’ Day, endorsed by Austin Li (right)

The Perfect Diary/Chinese National Geography co-branded eyeshadow palette (left); Perfect Diary’s new pink lipstick for this Singles’ Day, endorsed by Austin Li (right)

Source: Tmall[/caption] Parent-and-Baby Category Sees “Consumption Upgrade” Products by New Entrants The parent-and-baby category has been a popular cross-border e-commerce category in China, as parents are looking for assurance in imported products that they perceive to be of higher quality. The burgeoning middle-class population and the shift to a two-child policy (from the previous long-standing one-child policy) are fueling the demand for quality parent-and-baby products with unique benefits. Based on the products offered by new entrants on Tmall and Tmall Global on this year’s Singles’ Day, there is the trend of “consumption upgrade” in the sector. Paris-based jewelry brand Ilado sells maternity necklaces, which the brand claims “bring joy and serenity” to the mother and child in prenatal and postnatal stages. Ilado offered discounts of ¥200-500 ($29-71) during its Singles’ Day promotional campaign. [caption id="attachment_99881" align="aligncenter" width="700"] Ilado’s discounts for maternity necklaces ranged from ¥200 to ¥500 during Singles’ Day 2019.

Ilado’s discounts for maternity necklaces ranged from ¥200 to ¥500 during Singles’ Day 2019.

Source: Tmall[/caption] US parent-and-baby brand Olababy promoted its electric baby-nail trimmer on Singles’ Day this year, with the selling price dropping to ¥231 ($33) from ¥298 ($42) if customers made purchases within the first hour of November 11. [caption id="attachment_99882" align="aligncenter" width="400"] Olababy’s promotional banner for its electric baby-nail trimmer

Olababy’s promotional banner for its electric baby-nail trimmer

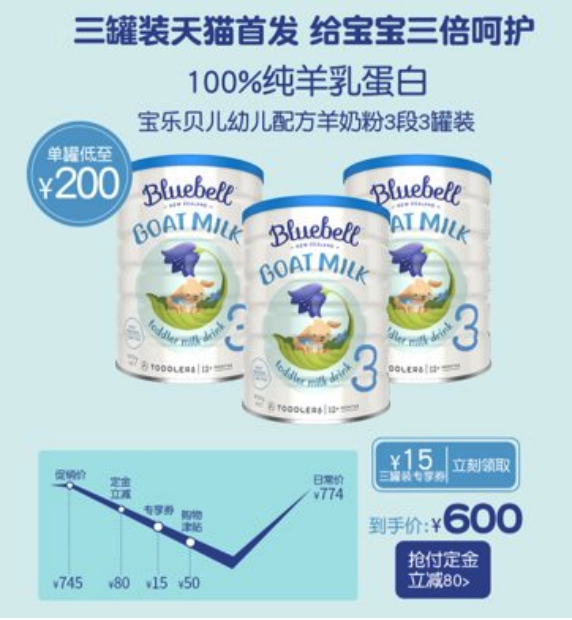

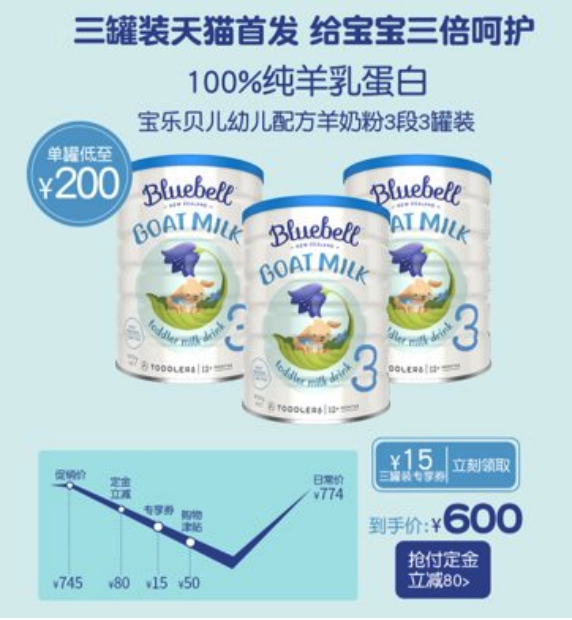

Source: Tmall Global[/caption] In 2019, New Zealand baby formula brand Bluebell introduced its organic milk formula and goat milk to China via its Tmall Global store. On its first Singles’ Day, the brand prominently promoted its hero product, “Goat Milk Toddler Milk Drink Stage 3.” Goat milk has increasingly become a popular alternative to cow milk in China, as studies have shown that it is closer to human breast milk and easier for digestion. Goat milk is generally more expensive than cow milk, representing “consumption upgrade” in China. [caption id="attachment_99883" align="aligncenter" width="400"] Bluebell promoted its Goat Milk Toddler Milk Drink Stage 3 product during Singles’ Day 2019.

Bluebell promoted its Goat Milk Toddler Milk Drink Stage 3 product during Singles’ Day 2019.

Source: Tmall Global[/caption] New Entrants in the Personal Care Sector Adopt Diverse Strategies Two personal care brands that are new to Tmall Global this year employed different strategies to target Chinese consumers. On its Tmall Global online store, Australian haircare brand FicceCode sells a range of scientifically developed shampoos that aim to solve common problems caused by scalp ageing and sensitivity. The brands’ organic ginger shampoos are familiar to Chinese consumers because domestic haircare brands have long used ginger as an ingredient in such products to improve hair health. FicceCode also adopts medicinal tea tree and macadamia oil as raw materials for its haircare products. During Singles’ Day 2019, the brand focused on price optimization to promote its products in the China market, offering discount coupons for shampoos and hair masks, as well as an extra 10% off for purchases made in the first 30 minutes of November 11. [caption id="attachment_99884" align="aligncenter" width="700"] FicceCode offered an extra 10% off for purchases made in the first 30 minutes of Singles’ Day 2019.

FicceCode offered an extra 10% off for purchases made in the first 30 minutes of Singles’ Day 2019.

Source: Tmall Global[/caption] Niche player Compeed, whose unique blister-cure plasters are popular in Europe, launched its flagship store on Tmall Global in April. In contrast to FicceCode, Compeed is focused on increasing brand awareness among Chinese consumers rather than lowering prices. Its Tmall Global store homepage features a company timeline, in order emphasize its brand history and values. [caption id="attachment_99885" align="aligncenter" width="700"] Compeed features a company timeline on its Tmall Global store.

Compeed features a company timeline on its Tmall Global store.

Source: Tmall Global[/caption] The brand’s Tmall Global store also features videos to demonstrate the benefits and usage of its products. [caption id="attachment_99886" align="aligncenter" width="700"] Compeed features product demo videos on Tmall Global.

Compeed features product demo videos on Tmall Global.

Source: Tmall Global[/caption] Other New Entrants Focus on Consumer Engagement New foreign brands in other categories have also launched on Tmall Global this year and used Singles’ Day as an opportunity to engage more interactively with Chinese consumers. Dutch beverage brand Jacobs Douwe Egberts opened a store on Tmall Global to capitalize on Chinese consumers’ shift to coffee consumption, bringing its coffee brands Moccona and Maxwell House. The brand hosted a daily lottery from November 1 to 11, offering a year’s worth of free coffee as the grand prize. Customers could join the lottery if they visited the store, became a follower of the brand or made a purchase through the site. [caption id="attachment_99888" align="aligncenter" width="700"] Jacobs Douwe Egberts’s Singles’ Day-themed lottery activity

Jacobs Douwe Egberts’s Singles’ Day-themed lottery activity

Source: Tmall Global[/caption] Fashion brands with a unique voice have also vied for a spot in the Chinese marketplace during 2019. Korean eyewear brand Gentle Monster and US fashion brand Everlane—which advocates sustainability and cost transparency—opened stores on Tmall Global this year. Like many other merchants, both brands offered a series of perks including coupons, gifts and limited-edition items to attract customers in their first Singles’ Day campaigns. [caption id="attachment_99889" align="aligncenter" width="700"] Gentle Monster offered three promotions on Singles’ Day 2019: Gentle Monster/Huawei co-branded products (left); limited-edition Good Dog bags as gifts for designated products (middle); and interest-free instalments for designated products with Huabei, Alibaba’s credit payment product (right).

Gentle Monster offered three promotions on Singles’ Day 2019: Gentle Monster/Huawei co-branded products (left); limited-edition Good Dog bags as gifts for designated products (middle); and interest-free instalments for designated products with Huabei, Alibaba’s credit payment product (right).

Source: Tmall Global[/caption] [caption id="attachment_99890" align="aligncenter" width="700"] Everlane’s Singles’ Day promotion: 10% off plus ¥200 ($29) discounts on orders worth ¥1,000 ($143) or more

Everlane’s Singles’ Day promotion: 10% off plus ¥200 ($29) discounts on orders worth ¥1,000 ($143) or more

Source: Tmall Global[/caption] US shoe brand Allbirds opened a Tmall flagship store in April and created two color combinations for its classic Wool Runners—Fiesta Red and Sky Blue—as part of its Singles’ Day campaign. The San Francisco-based startup is known for its commitment to sustainability, and Hollywood celebrity Leonardo DiCaprio is its brand ambassador and investor. The brand’s emphasis on using natural materials instead of cheap and polluting synthetics has resonated with Chinese consumers. According to Erick Haskell, Allbirds President of International, over 80% of those who shopped through Allbirds’ Tmall store on November 11 were new customers. [caption id="attachment_99891" align="aligncenter" width="400"] Allbirds’ Singles’ Day special-edition Wool Runners: Sky Blue and Fiesta Red

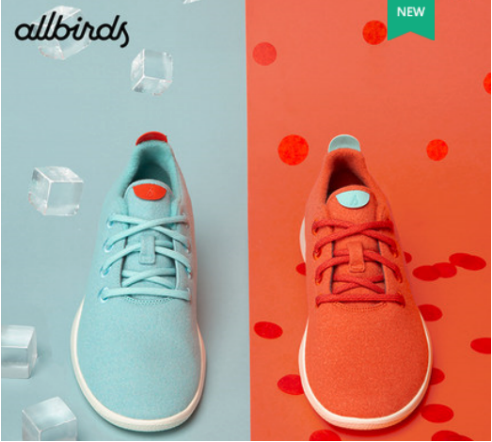

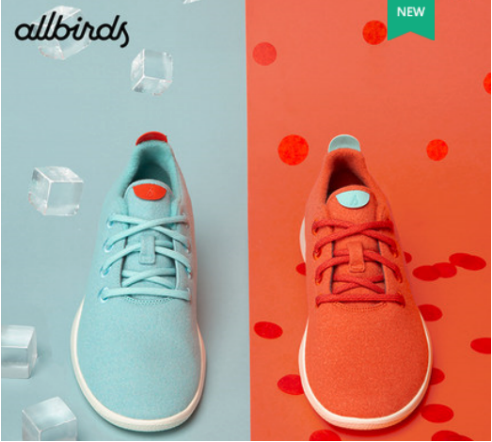

Allbirds’ Singles’ Day special-edition Wool Runners: Sky Blue and Fiesta Red

Source: Tmall[/caption] Key Insights This year, many new brands spanning a variety of categories launched their first Singles’ Day campaigns after opening stores on Alibaba’s e-commerce platforms. New entrants from around the world centered their promotional activities around the demands and preferences of Chinese consumers—such as a trend toward consumption upgrade—using social media, pricing optimization and other strategies to engage with their target markets.

Fenty Beauty promoted its products with a tag of “Tmall Double 11” on Weibo on November 1.

Fenty Beauty promoted its products with a tag of “Tmall Double 11” on Weibo on November 1.Source: Weibo[/caption] On its account on Xiaohongshu, Fenty Beauty has received over 9,000 “notes,” a Xiaohongshu-specific term referring to user feedback, as of November 5—less than six months after the brand opened its account on the platform. [caption id="attachment_99879" align="aligncenter" width="700"]

Fenty Beauty’s Xiaohongshu account

Fenty Beauty’s Xiaohongshu accountSource: Xiaohongshu[/caption] Social media channels are typically effective channels for beauty brands to showcase the merits of their products. Although Fenty Beauty emerged with a halo effect from its founder Rihanna, user-generated feedback on social platforms is still important to instill trust and create buzz for the brand. China-based emergent beauty brand Perfect Diary adopted a comprehensive social media strategy to build awareness of its identity and products, and successfully broke into the established beauty market in the past two years. It first promoted its brand on Xiaohongshu and paid attention to the post-purchase experience of consumers by continually engaging with them on WeChat, the mainstream social app in China. Perfect Diary’s customer engagement efforts led to good Singles’ Day results in 2018: The brand was among over 30 beauty and personal care brands that achieved ¥100 million ($14.3 million) in sales during Singles’ Day 2018, according to Alibaba. This year, Perfect Diary launched exclusive new products on its Tmall flagship store specifically for the shopping holiday. For example, it debuted a co-branded eyeshadow palette with Chinese National Geography magazine, showcasing the diverse colorful terrains of China. It also launched a new pink lipstick endorsed by top beauty key opinion leader Austin Li, who once sold 15,000 lipsticks in 15 minutes during a livestream show. [caption id="attachment_99880" align="aligncenter" width="700"]

The Perfect Diary/Chinese National Geography co-branded eyeshadow palette (left); Perfect Diary’s new pink lipstick for this Singles’ Day, endorsed by Austin Li (right)

The Perfect Diary/Chinese National Geography co-branded eyeshadow palette (left); Perfect Diary’s new pink lipstick for this Singles’ Day, endorsed by Austin Li (right)Source: Tmall[/caption] Parent-and-Baby Category Sees “Consumption Upgrade” Products by New Entrants The parent-and-baby category has been a popular cross-border e-commerce category in China, as parents are looking for assurance in imported products that they perceive to be of higher quality. The burgeoning middle-class population and the shift to a two-child policy (from the previous long-standing one-child policy) are fueling the demand for quality parent-and-baby products with unique benefits. Based on the products offered by new entrants on Tmall and Tmall Global on this year’s Singles’ Day, there is the trend of “consumption upgrade” in the sector. Paris-based jewelry brand Ilado sells maternity necklaces, which the brand claims “bring joy and serenity” to the mother and child in prenatal and postnatal stages. Ilado offered discounts of ¥200-500 ($29-71) during its Singles’ Day promotional campaign. [caption id="attachment_99881" align="aligncenter" width="700"]

Ilado’s discounts for maternity necklaces ranged from ¥200 to ¥500 during Singles’ Day 2019.

Ilado’s discounts for maternity necklaces ranged from ¥200 to ¥500 during Singles’ Day 2019.Source: Tmall[/caption] US parent-and-baby brand Olababy promoted its electric baby-nail trimmer on Singles’ Day this year, with the selling price dropping to ¥231 ($33) from ¥298 ($42) if customers made purchases within the first hour of November 11. [caption id="attachment_99882" align="aligncenter" width="400"]

Olababy’s promotional banner for its electric baby-nail trimmer

Olababy’s promotional banner for its electric baby-nail trimmerSource: Tmall Global[/caption] In 2019, New Zealand baby formula brand Bluebell introduced its organic milk formula and goat milk to China via its Tmall Global store. On its first Singles’ Day, the brand prominently promoted its hero product, “Goat Milk Toddler Milk Drink Stage 3.” Goat milk has increasingly become a popular alternative to cow milk in China, as studies have shown that it is closer to human breast milk and easier for digestion. Goat milk is generally more expensive than cow milk, representing “consumption upgrade” in China. [caption id="attachment_99883" align="aligncenter" width="400"]

Bluebell promoted its Goat Milk Toddler Milk Drink Stage 3 product during Singles’ Day 2019.

Bluebell promoted its Goat Milk Toddler Milk Drink Stage 3 product during Singles’ Day 2019.Source: Tmall Global[/caption] New Entrants in the Personal Care Sector Adopt Diverse Strategies Two personal care brands that are new to Tmall Global this year employed different strategies to target Chinese consumers. On its Tmall Global online store, Australian haircare brand FicceCode sells a range of scientifically developed shampoos that aim to solve common problems caused by scalp ageing and sensitivity. The brands’ organic ginger shampoos are familiar to Chinese consumers because domestic haircare brands have long used ginger as an ingredient in such products to improve hair health. FicceCode also adopts medicinal tea tree and macadamia oil as raw materials for its haircare products. During Singles’ Day 2019, the brand focused on price optimization to promote its products in the China market, offering discount coupons for shampoos and hair masks, as well as an extra 10% off for purchases made in the first 30 minutes of November 11. [caption id="attachment_99884" align="aligncenter" width="700"]

FicceCode offered an extra 10% off for purchases made in the first 30 minutes of Singles’ Day 2019.

FicceCode offered an extra 10% off for purchases made in the first 30 minutes of Singles’ Day 2019.Source: Tmall Global[/caption] Niche player Compeed, whose unique blister-cure plasters are popular in Europe, launched its flagship store on Tmall Global in April. In contrast to FicceCode, Compeed is focused on increasing brand awareness among Chinese consumers rather than lowering prices. Its Tmall Global store homepage features a company timeline, in order emphasize its brand history and values. [caption id="attachment_99885" align="aligncenter" width="700"]

Compeed features a company timeline on its Tmall Global store.

Compeed features a company timeline on its Tmall Global store.Source: Tmall Global[/caption] The brand’s Tmall Global store also features videos to demonstrate the benefits and usage of its products. [caption id="attachment_99886" align="aligncenter" width="700"]

Compeed features product demo videos on Tmall Global.

Compeed features product demo videos on Tmall Global.Source: Tmall Global[/caption] Other New Entrants Focus on Consumer Engagement New foreign brands in other categories have also launched on Tmall Global this year and used Singles’ Day as an opportunity to engage more interactively with Chinese consumers. Dutch beverage brand Jacobs Douwe Egberts opened a store on Tmall Global to capitalize on Chinese consumers’ shift to coffee consumption, bringing its coffee brands Moccona and Maxwell House. The brand hosted a daily lottery from November 1 to 11, offering a year’s worth of free coffee as the grand prize. Customers could join the lottery if they visited the store, became a follower of the brand or made a purchase through the site. [caption id="attachment_99888" align="aligncenter" width="700"]

Jacobs Douwe Egberts’s Singles’ Day-themed lottery activity

Jacobs Douwe Egberts’s Singles’ Day-themed lottery activitySource: Tmall Global[/caption] Fashion brands with a unique voice have also vied for a spot in the Chinese marketplace during 2019. Korean eyewear brand Gentle Monster and US fashion brand Everlane—which advocates sustainability and cost transparency—opened stores on Tmall Global this year. Like many other merchants, both brands offered a series of perks including coupons, gifts and limited-edition items to attract customers in their first Singles’ Day campaigns. [caption id="attachment_99889" align="aligncenter" width="700"]

Gentle Monster offered three promotions on Singles’ Day 2019: Gentle Monster/Huawei co-branded products (left); limited-edition Good Dog bags as gifts for designated products (middle); and interest-free instalments for designated products with Huabei, Alibaba’s credit payment product (right).

Gentle Monster offered three promotions on Singles’ Day 2019: Gentle Monster/Huawei co-branded products (left); limited-edition Good Dog bags as gifts for designated products (middle); and interest-free instalments for designated products with Huabei, Alibaba’s credit payment product (right).Source: Tmall Global[/caption] [caption id="attachment_99890" align="aligncenter" width="700"]

Everlane’s Singles’ Day promotion: 10% off plus ¥200 ($29) discounts on orders worth ¥1,000 ($143) or more

Everlane’s Singles’ Day promotion: 10% off plus ¥200 ($29) discounts on orders worth ¥1,000 ($143) or moreSource: Tmall Global[/caption] US shoe brand Allbirds opened a Tmall flagship store in April and created two color combinations for its classic Wool Runners—Fiesta Red and Sky Blue—as part of its Singles’ Day campaign. The San Francisco-based startup is known for its commitment to sustainability, and Hollywood celebrity Leonardo DiCaprio is its brand ambassador and investor. The brand’s emphasis on using natural materials instead of cheap and polluting synthetics has resonated with Chinese consumers. According to Erick Haskell, Allbirds President of International, over 80% of those who shopped through Allbirds’ Tmall store on November 11 were new customers. [caption id="attachment_99891" align="aligncenter" width="400"]

Allbirds’ Singles’ Day special-edition Wool Runners: Sky Blue and Fiesta Red

Allbirds’ Singles’ Day special-edition Wool Runners: Sky Blue and Fiesta RedSource: Tmall[/caption] Key Insights This year, many new brands spanning a variety of categories launched their first Singles’ Day campaigns after opening stores on Alibaba’s e-commerce platforms. New entrants from around the world centered their promotional activities around the demands and preferences of Chinese consumers—such as a trend toward consumption upgrade—using social media, pricing optimization and other strategies to engage with their target markets.