Web Developers

Alibaba reported record sales on Singles’ Day 2018. However, participation in the shopping festival extended to other e-commerce platforms, too. In this report, we will review the broader e-commerce market during the Singles’ Day 2018 period and review how e-commerce platforms JD.com and Suning.com performed this year.

Alibaba Took Major E-Commerce Market Share on Singles’ Day

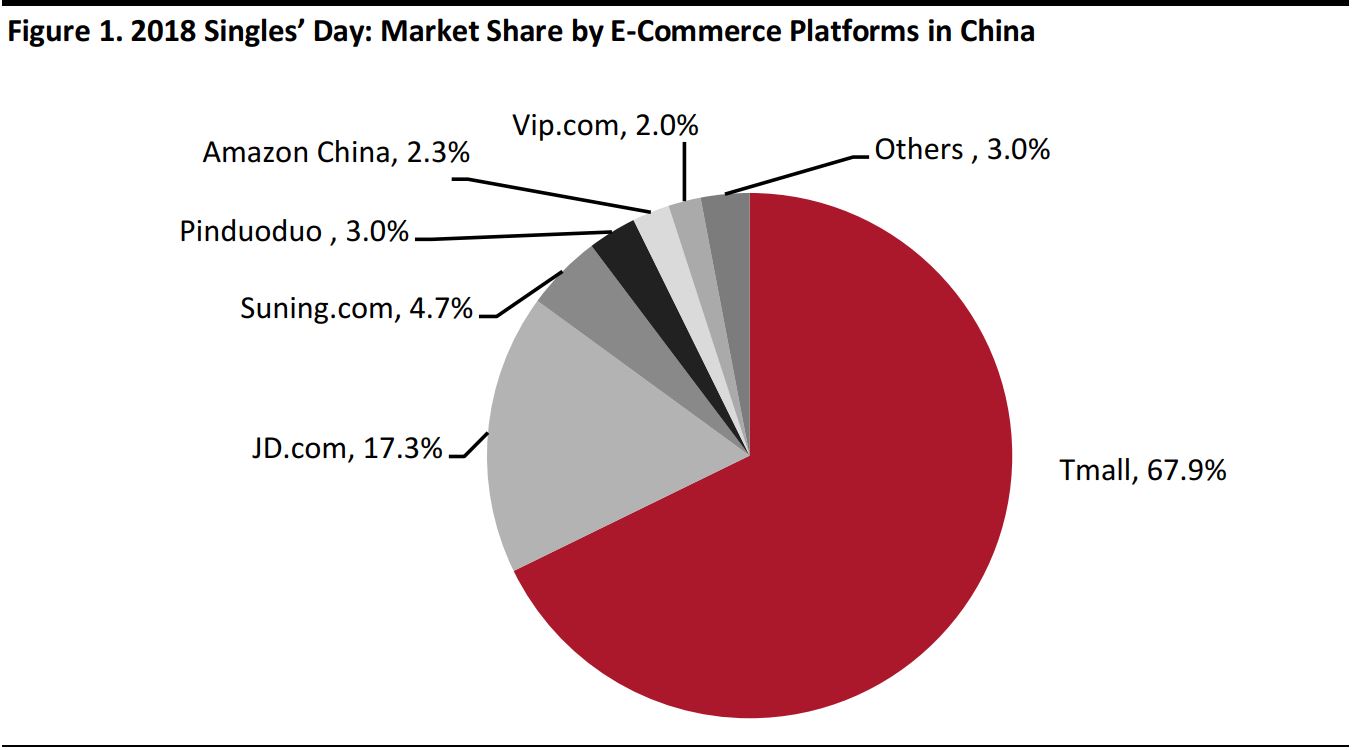

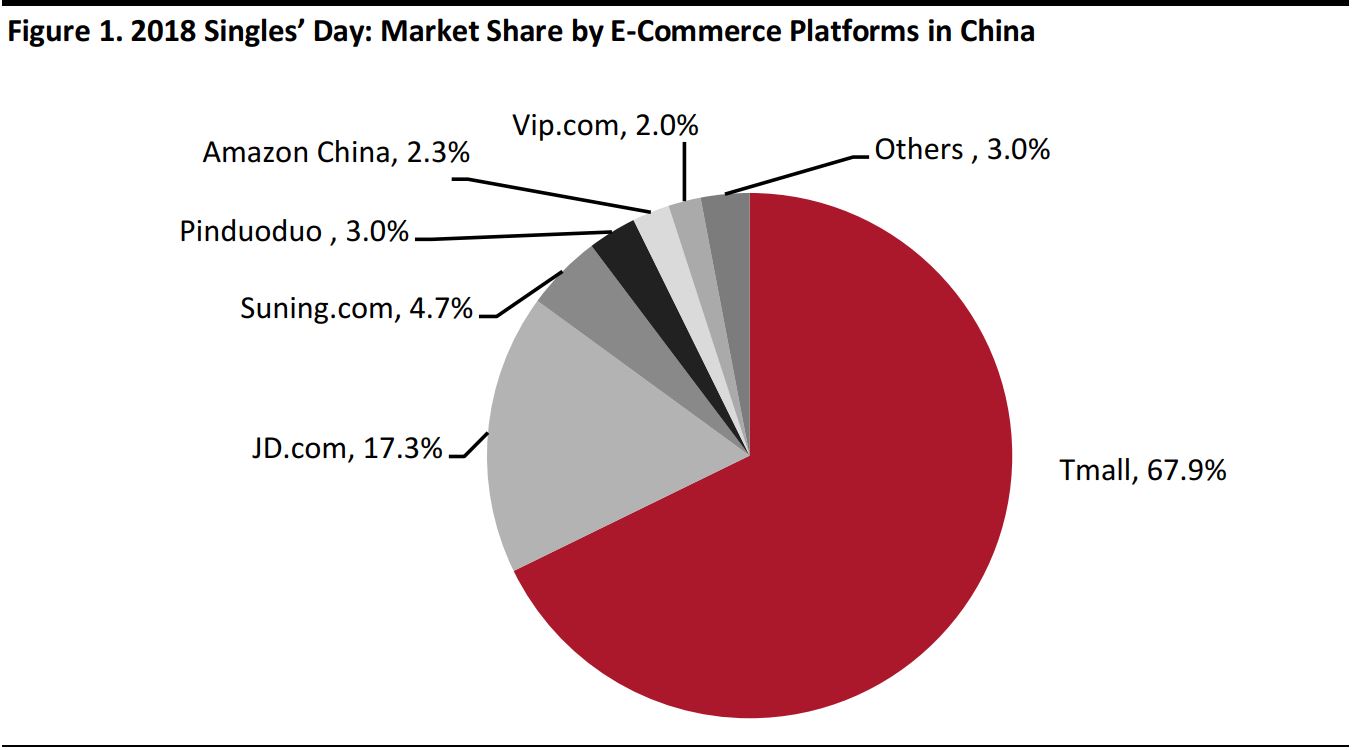

According to data from China-based data services firm Syntun, the total transacted gross merchandise value (GMV) across various platforms on Singles’ Day totaled ¥314.3 billion ($45.2 billion). Alibaba’s Tmall continued to account for the largest market share of 67.9% on Singles’ Day this year, followed by JD.com and Suning.com with 17.3% and 4.7% shares, respectively.

Source: Syntun/Coresight Research

JD.com and Suning.com Embrace Tech for Retail Change

JD.com and Suning.com recorded strong sales performances during the 2018 Singles’ Day period. JD.com achieved ¥159.8 billion ($23 billion) in sales over 11 days from November 1 to Singles’ Day; this was up 26% from ¥127.1 billion ($19.1 billion) in the same period last year. Suning.com reported a 132% year-over-year increase in omnichannel sales during this year’s Singles’ Day period, which we believe the company considers to be November 1–11. This year, JD.com and Suning.com strived to enhance the retail experience through technology. JD.com aimed for “Boundaryless Retail” and Suning.com adopted a smart retail strategy, both of which are similar to Alibaba’s New Retail concept; all ultimately lead to a seamless integration of online and offline commerce. JD.com focuses on empowering its partners and other retailers through its advanced technology such as automated fulfillment centers. During the 2018 Singles’ Day period, more than 600,000 offline stores used JD.com’s technology to attract traffic; and the number of non-JD orders covered by JD Logistics, JD.com’s logistics subsidiary, was reported more than double year over year, reflecting a broadened of partnerships.

JD.com’s unmanned robot delivering packages Source: China News Service

Suning.com aims to refresh China’s rural retail by opening Suning Retail Cloud Stores in rural counties. These stores are designed to upgrade the operations and shopping experiences of traditional mom-and-pop stores in rural areas via franchise partnerships. Suning said that its support helped over a thousand of such Cloud Stores achieve 3,308% sales growth during the Singles’ Day period over last year.

A Suning Retail Cloud Store in China Source: Suning.com

Slower Singles’ Day E-Commerce Sales Growth

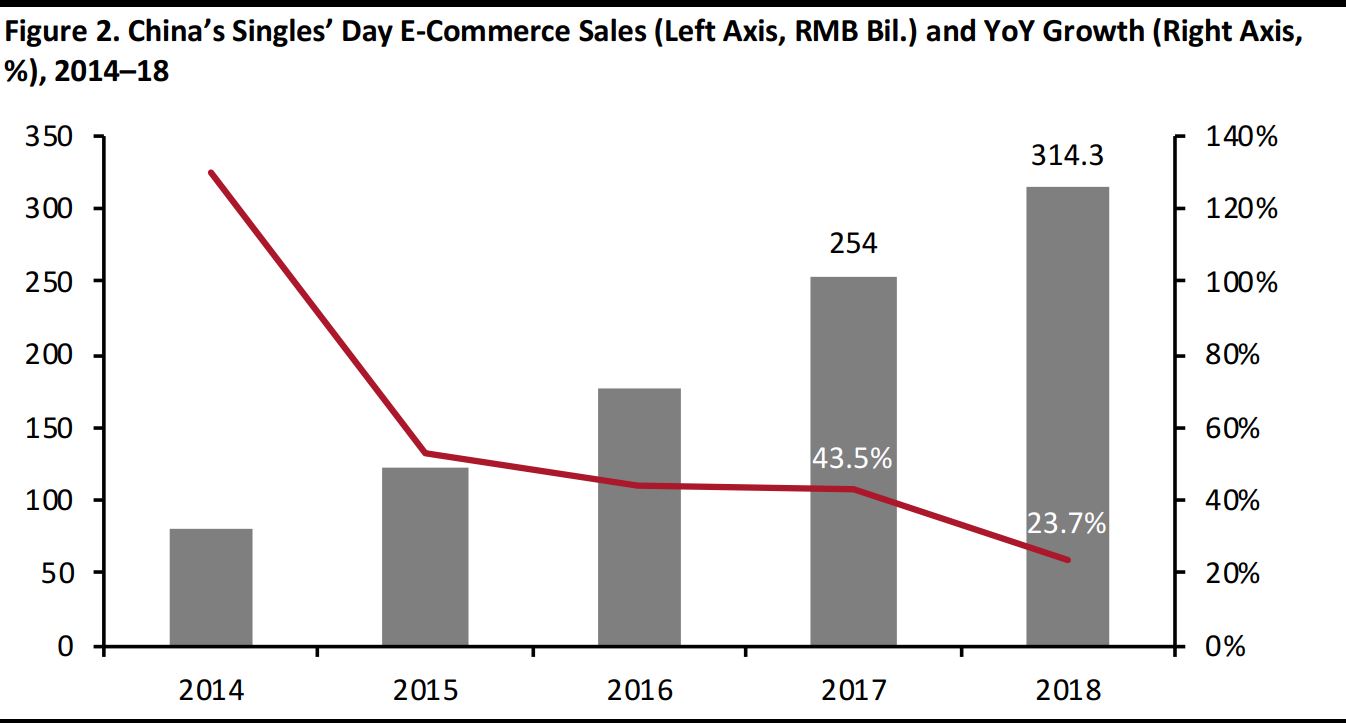

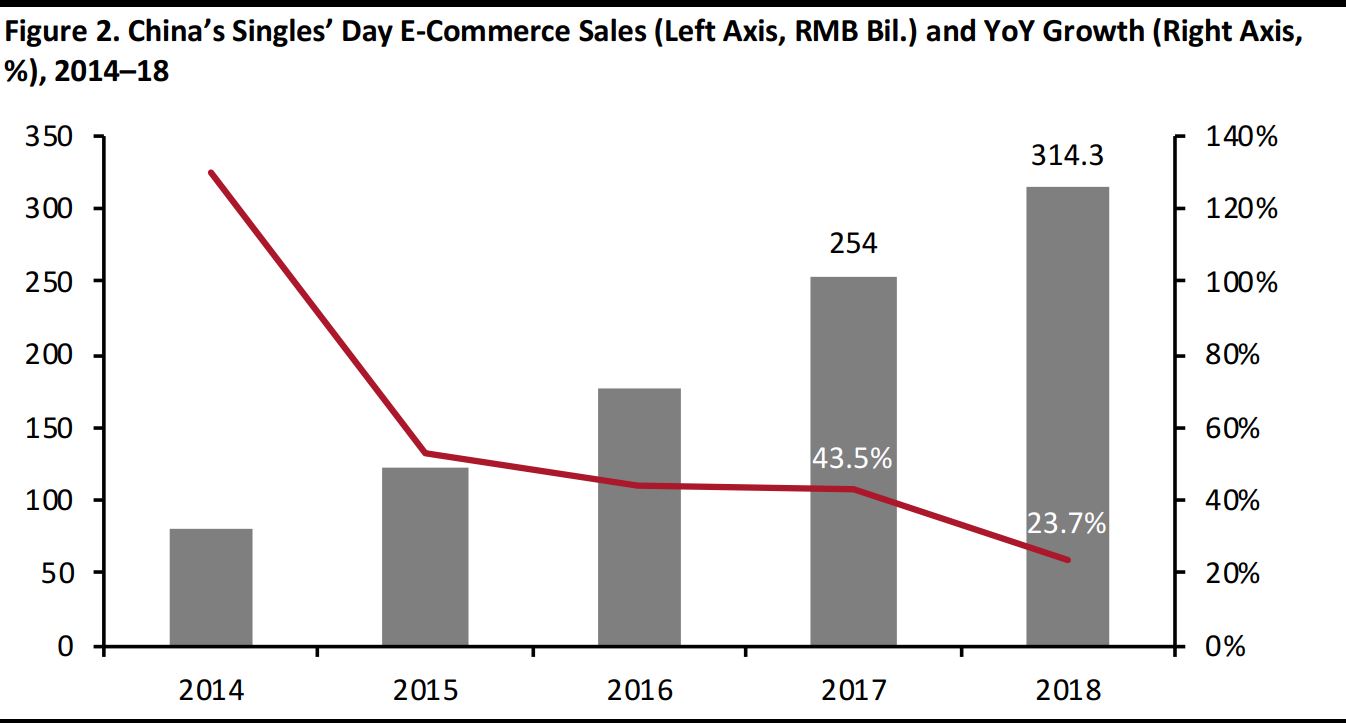

Singles’ Day reached its tenth edition this year, and this anniversary saw overall e-commerce sales growth for the day slow. The overall year-over-year sales growth across all e-commerce platforms this year stood at 23.7% this year, compared to 43.5% last year, according to data from Syntun. From 2014 to 2018, there was a downward trend in the sales growth of the event.

Source: Syntun/Coresight Research

Implications of Slower Growth

A decreasing growth rate does not necessarily reflect a declining passion for Singles’ Day or online shopping. We believe the slowing of growth can be attributed to two factors:- The overall retail sector in China is slowing. This year, China’s retail sales growth has reached its weakest in 15 years. China’s year-over-year retail growth rate was particularly sluggish in May and October 2018, when sales increased by 8.5 and 8.6%, respectively; these growth rates were the lowest since June 2003, according to China’s National Bureau of Statistics.

- Other online shopping festivals have gained traction, but Singles’ Day remains the largest one. Other e-commerce platforms have introduced their own cyber shopping festivals with discounts offered almost every quarter, meaning Singles’ Day is not the only time to find promotions. Consumers have become familiar with the promotion cadence of the various e-commerce platforms and appear to be adjusting their plans to take advantage of those multiple shopping festivals.

- The annual shopping festival has made China’s retail sector more vibrant and diversified as an increasing number of brands and retailers have joined the event. Some overseas retailers consider Singles’ Day to be the best time to build their brand in the China market.

- It provides an opportunity for e-commerce platforms and their partners to acquire new customers, boosting the number of active users and supporting future revenue growth.

- Singles’ Day has evolved with its influence extending to the offline settings. Some brick-and-mortar stores, whether they have an online presence or not, joined the festival to take advantage of the immense consumer interest. Singles’ Day has helped accelerate the pace of online-offline retail integration and it has promoted the concept of “retailtainment.”