albert Chan

Simon Property Group

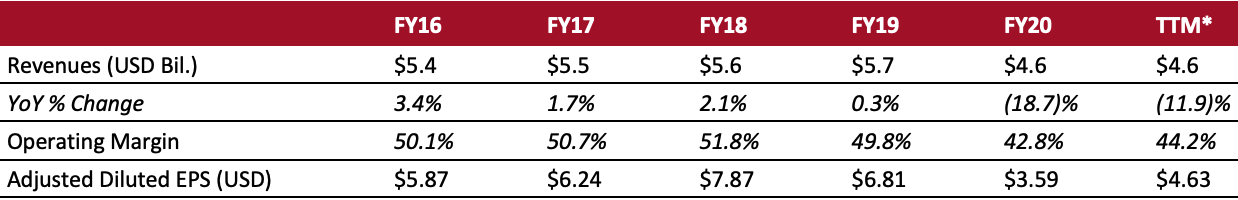

Sector: Real estate investments trusts (REITs) Countries of operation: Austria, Canada, France, Germany, Italy, Japan, Korea, Malaysia, Mexico, the Netherlands, Thailand, Spain, the UK and the US Key product categories: Lifestyle centers, premium outlets, shopping malls and other retail properties Annual Metrics [caption id="attachment_136127" align="aligncenter" width="700"] Fiscal year ends on December 31 of the calendar year

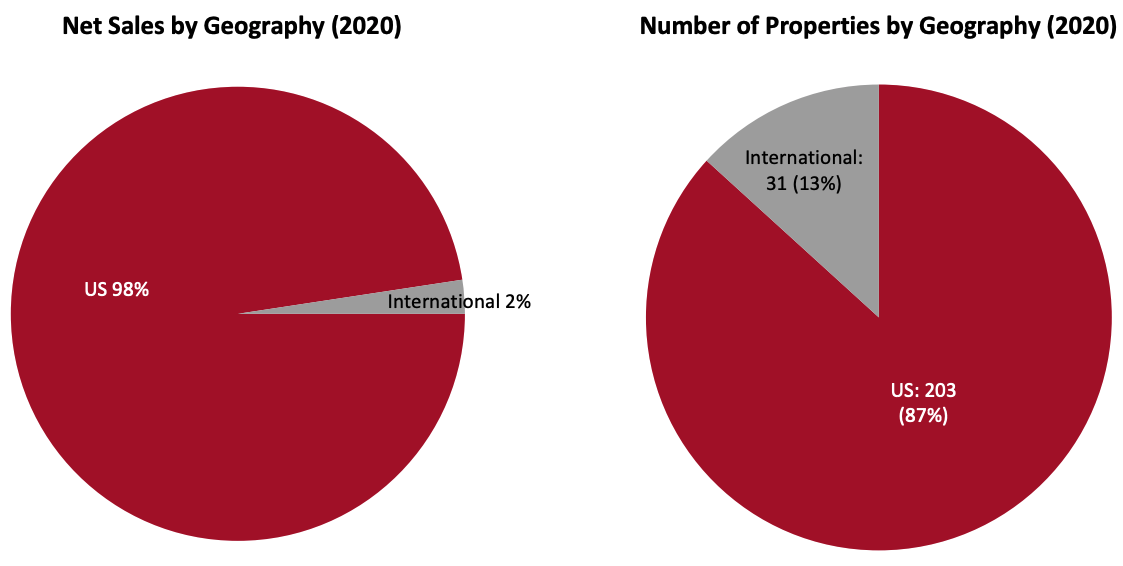

Fiscal year ends on December 31 of the calendar year*Trailing 12 months ended June 30, 2021[/caption] Summary Founded in 1993 and headquartered in Indianapolis, Indiana, Simon Property Group is a real estate investment trust (REIT) that develops, manages and owns retail real estate, with properties across Asia, Europe and North America. Its properties include premier dining, entertainment, mixed-use and shopping destinations under brands such as The Mills, Simon Malls, Simon Premium Outlets and ShopPremiumOutlets.com. The company’s properties in the US contain an aggregate of 179.9 million square feet of gross leasable area (GLA), as of June 30, 2021. As of the same date, Simon Property Group owns or holds an interest in 202 income-producing properties in the US across 37 states and Puerto Rico. This comprises 95 malls, 69 premium outlets, 14 Mills outlets, six lifestyle centers and 18 other retail properties. On December 30, 2020, Simon Property Group acquired an 80% noncontrolling stake in the Taubman Realty Group, which has an interest in 24 outlet, regional and super-regional malls in Asia and the US. As of the end of fiscal its 2020 (December 31, 2020), the company and its affiliates employ 3,300 personnel in the US, of which 900 are part-time workers. Internationally, Simon Property Group owns 32 Premium Outlets and Designer Outlet properties primarily located in Canada, Asia and Europe. Its properties outside the US are primarily owned through joint ventures. The company also holds a 22.4% equity stake in Klepierre SA—a publicly traded, Paris-based real estate company that owns, or has an interest in, shopping centers located in 15 countries in Europe. Company Analysis Coresight Research insight: In Simon Property Group’s 2021 second quarter, ended June 30, 2021, its US mall and premium outlet occupancy decreased by 1.1 percentage points to 91.8%, down from 92.9% in the same quarter last year. This was primarily due to tenant bankruptcies, but partially offset by leasing activity. Nevertheless, the company’s portfolio is well diversified and the majority of its tenants are large corporations, which has enabled Simon Property Group to weather the pandemic much more effectively than its competitors. The company recorded year-over-year revenue growth of 3.3% in its second quarter, reaching $2.49 billion—an increase from $2.41 billion in 2020. The company recorded funds from operations (FFO) of $2.1 billion, growing 24.5% year-over-year from $1.7 billion in 2020. Its portfolio net operating income (NOI) increased by 16.7% to $3.1 billion—primarily due to its acquisition of a stake in Taubman Realty Group, which added 25 million square feet of malls across Asia and the US to its portfolio. Although Simon Property Group has faced challenges in 2020, it has navigated the pandemic resiliently, promising resurgence through 2021. Its reputation and track record, diversified and superior portfolio, strong balance sheet and ability to adapt to the crisis position the company as an industry powerhouse.

| Tailwinds | Headwinds |

|

|

- Focus on redevelopment efforts, including investing in redeveloping former department store spaces

- Continue to add mixed-use components to its market-leading centers

- Expand the digitalization of its businesses. In 2019, it invested in Rue Gilt Groupe, a premier e-commerce portfolio company

- Continue strategic acquisitions and investments to expand its portfolio

- Consider dispositions of property unimportant for strategic growth

Company Developments

Company Developments

| Date | Development |

| August 10, 2021 | Simon Property Group redeems $1.65 billion of Senior Notes. The redemption date for January 2022 Notes is scheduled for August 25, 2021, and the redemption date for February 2023 Notes is scheduled for September 9, 2021. |

| July 27, 2021 | Klepierre SA sells five non-core properties in Norway to an unknown buyer for approximately €440 million ($510 million). |

| July 14, 2021 | Simon Property Group wins award “Best Place to Work for Disability Inclusion” in the 2021 Disability Equality Index (DEI). |

| July 7, 2021 | Simon Property Group signs lease with Swiss chocolate retailer Läderach for 15 stores in the former’s properties across California, Florida, Massachusetts, New York, Texas and Virginia, beginning August–September 2021. |

| December 5, 2018 | Simon Property Group and Electrify America launch California’s first 350 kW electric vehicle charging station. |

| October 18, 2018 | Simon Property Group and Nobu break ground for the mixed-use redevelopment of Phipps Plaza. |

| October 1, 2018 | Simon Property Group appoints Adam Reuille as Senior Vice President and Chief Accounting Officer and Steven Broadwater as Senior Vice President of Financial Reporting and Operations. |

| September 11, 2018 | Simon Property Group and Macerich enter into a joint venture to create Los Angeles Premium Outlets. |

- David E. Simon—Chairman, President and CEO

- Brian J. McDade—Executive VP, Treasurer and CFO

- John Rulli—Chief Administrative Officer

Source: Company reports/S&P Capital IQ